A worker form is a critical document used to gather information from employees within an organization. It serves various purposes, including payroll processing, record-keeping, and compliance with labor regulations. Worker forms come in different types, such as W-4 for tax withholding and I-9 for employment eligibility verification. Examples of information collected include personal details, tax-related data, and job-related specifics. Creating an effective worker form involves ensuring it complies with legal requirements and company needs. Here, we’ll explore worker forms in-depth, covering their types, examples, creation, and essential tips for designing an efficient printable form.

What is the Worker Form ? – Definition

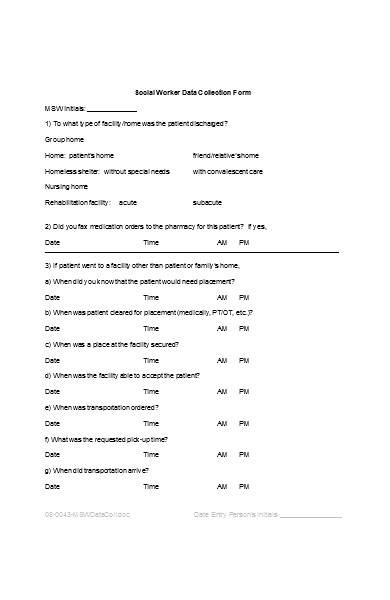

A worker form is a document used by employers to collect essential information from their employees. It serves various administrative and legal purposes, such as tax withholding, employment eligibility verification, and record-keeping. Worker forms typically gather details related to an employee’s personal information form, tax-related data, and job-specific information. These forms are crucial for ensuring compliance with labor regulations and maintaining accurate employee records, contributing to the smooth operation of an organization.

What is the Meaning of the Worker Form?

The meaning of a worker form lies in its purpose as a vital tool for employers to collect and manage crucial information about their employees. These forms serve several functions, including tax-related documentation, verification of employment eligibility, and the maintenance of essential personnel records. The meaning of a worker form is deeply rooted in its role as a key component of human resources and administrative processes, ensuring compliance with legal regulations and facilitating effective workforce management within an organization.

What is the best Sample Worker Form?

Creating a sample worker form involves several steps to collect important information from employees. Here’s a simplified outline to guide you in the process:

Step 1: Identify the Form’s Purpose

- Determine the specific purpose of the worker form. Is it for tax withholding (e.g., W-4), employment eligibility (e.g., I-9), or general employee information?

Step 2: Choose the Form Type

- Select the appropriate worker form type based on the purpose identified in Step 1.

Step 3: Gather Required Information

- Identify the essential information to collect. This may include personal details (name, address, SSN), tax-related data (dependents, filing status), and job-specific information (position, start date).

Step 4: Design the Form

- Create a clear and organized layout for the form. Use sections and fields to capture different types of information, and provide clear instructions for employees.

Step 5: Include Legal Compliance

- Ensure your form complies with relevant employment laws, such as anti-discrimination and data protection regulations.

Step 6: Test the Form

- Test the sample worker form to make sure it functions correctly. Verify that it’s easy for employees to complete and that the collected data is accurate.

Step 7: Customize if Necessary

- Tailor the form to your specific organization’s needs. Add or remove fields based on your unique requirements.

Step 8: Seek Feedback

- After employees complete the form, gather feedback to identify any areas for improvement in the process.

Creating a sample worker form involves careful consideration of its purpose and the information you need to collect, ensuring that it is user-friendly and legally compliant. Customization to your organization’s specific needs is key to its effectiveness. You also browse our Sample Employee Forms.

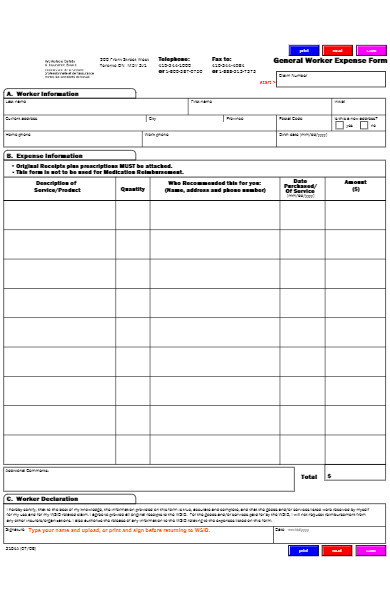

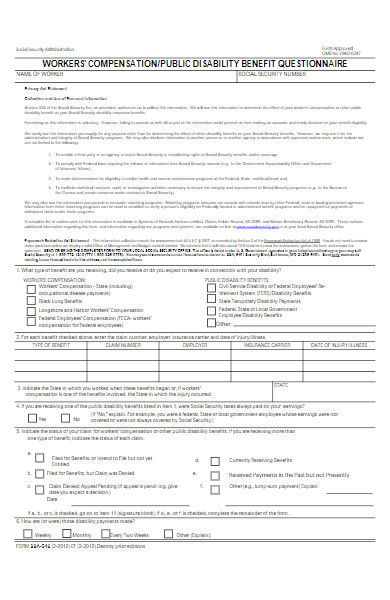

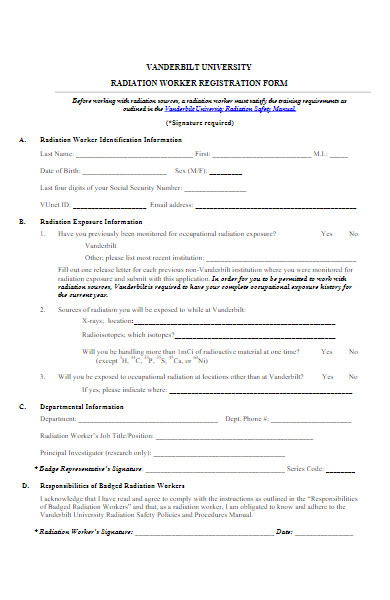

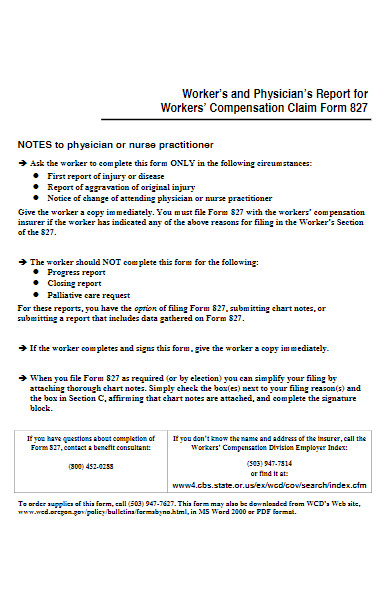

FREE 50+ Worker Forms

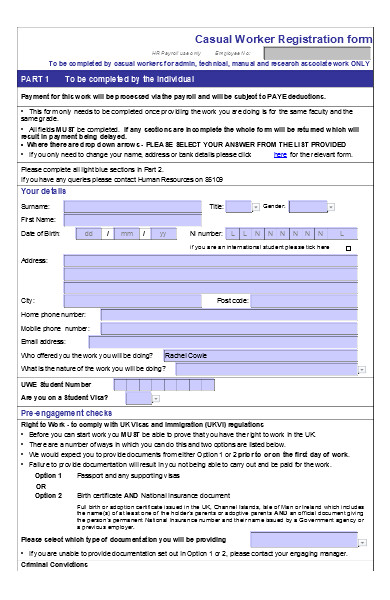

51. Casual Worker Registration Form

What form is used for employees?

The form used for employees varies depending on the specific purpose. Common forms used for employees include:

- W-4 Form: This is used for tax withholding. Employees use it to specify how much federal income tax should be withheld from their paychecks.

- I-9 Form: This form is for employment eligibility verification. Employers use it to confirm that employees are legally eligible to work in the United States.

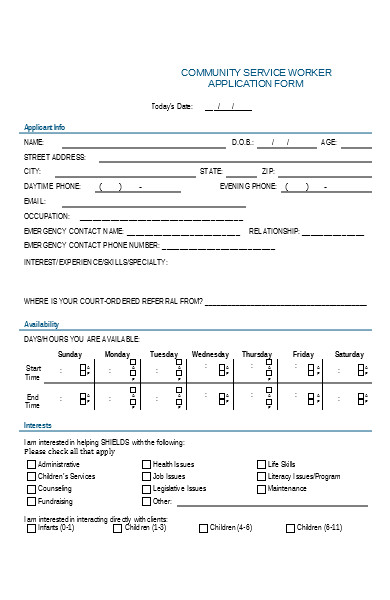

- Employee Information Form: This is a general form used to collect basic employee information, such as contact details, emergency contacts, and job-related information.

- Direct Deposit Authorization Form: Employees use this form to set up direct deposit for their paychecks, specifying the bank account where their wages will be deposited.

- Employee Benefits Enrollment Form: This form is used to enroll employees in various company benefits, such as health insurance, retirement plans, and other perks.

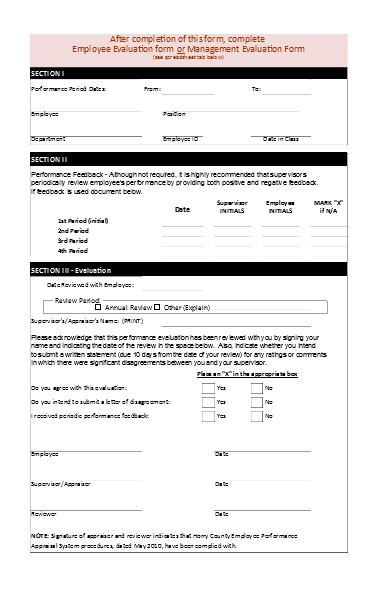

- Employee Performance Evaluation Form: Employers use this form to assess and document an employee’s performance, set goals, and provide feedback.

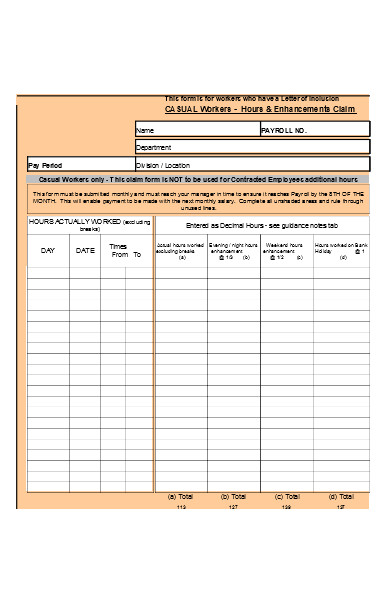

- Time Sheets or Time Cards: These are used by employees to record their hours worked, which is essential for tracking attendance and calculating wages.

- Leave Request Forms: Employees use these forms to request time off, including vacation days, sick leave, or other types of leave.

- Employee Exit Interview Form: This form is used when an employee leaves the organization to gather feedback about their experience and reasons for departure.

- Employee Self-Assessment Form: Some organizations use this form to allow employees to evaluate their own performance and provide input on their career development.

The specific fillable form used can vary based on the company’s policies, legal requirements, and the employee’s needs or status within the organization.

What Are the different types of worker forms?

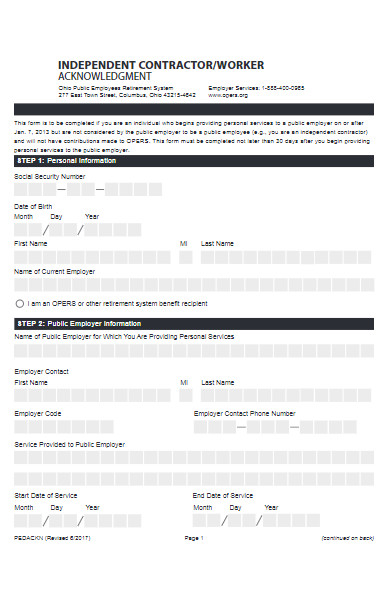

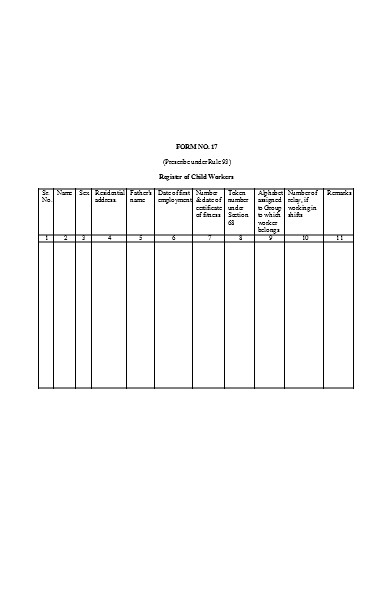

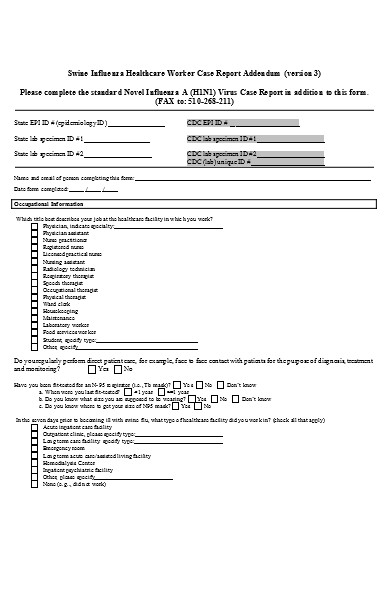

There are several different types of worker forms, each serving a specific purpose within the context of employment and human resources. Here are some common types of worker forms:

- W-4 Form: Used for tax withholding, employees use this form to specify their federal income tax withholding preferences.

- I-9 Form: This is for verifying an employee’s eligibility to work in the United States. Employers use it to ensure that employees are legally authorized to work in the country.

- Employee Information Form: A general form used to collect personal and job-related information from employees, including contact details and employment history.

- Direct Deposit Authorization Form: Employees use this form to set up direct deposit for their paychecks, providing bank account information for electronic payments.

- Employee Benefits Enrollment Form: Used for enrolling employees in various company benefits, such as health insurance, retirement plans, and other workplace perks.

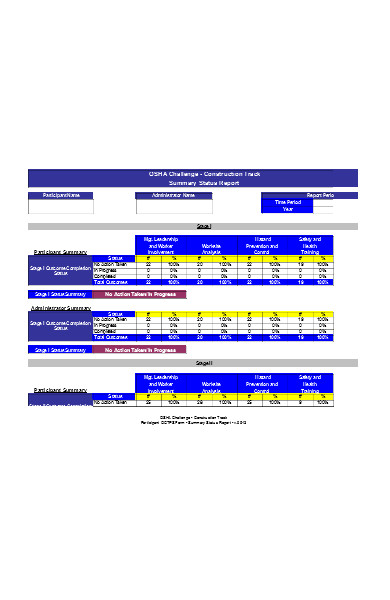

- Employee Performance Evaluation Form: Employers use this form to assess and document employee performance, set goals, and provide feedback.

- Time Sheets or Time Cards: Employees use these forms to record their working hours, which is essential for tracking attendance and calculating wages.

- Leave Request Forms: Employees use these forms to request time off, including vacation days, sick leave, or other types of leave.

- Employee Exit Interview Form: Conducted when an employee leaves the organization, this form gathers feedback about their experience and reasons for departure.

- Employee Self-Assessment Form: Some organizations use this form to allow employees to evaluate their own performance and provide input on their career development.

- Payroll Deduction Authorization Form: Employees may use this form to authorize specific deductions from their paychecks, such as for charitable contributions or loan repayments.

- Employee Emergency Contact Form: Used to collect emergency contact information for employees, which can be crucial in case of unforeseen circumstances.

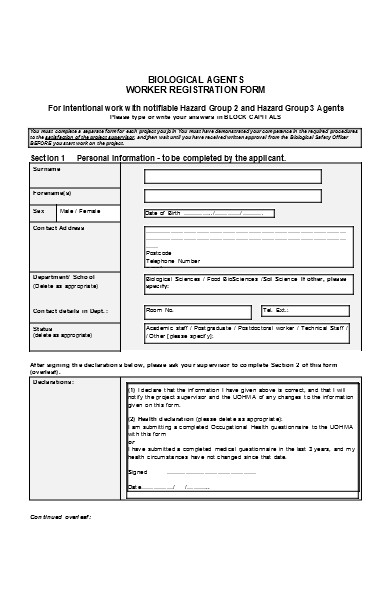

- Employee Health Declaration Form: Some workplaces use this form to collect health-related information, especially in jobs that involve potential health risks.

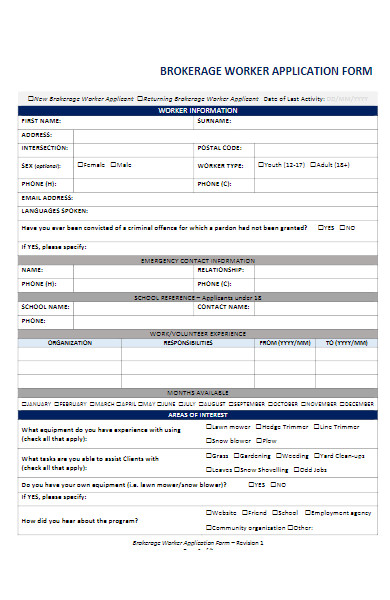

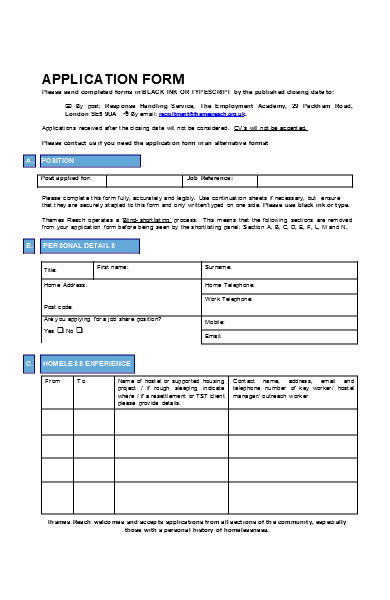

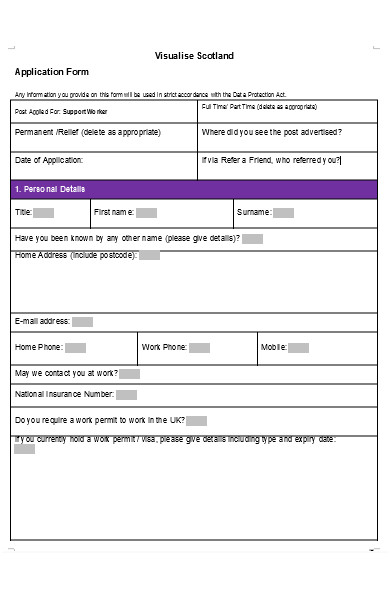

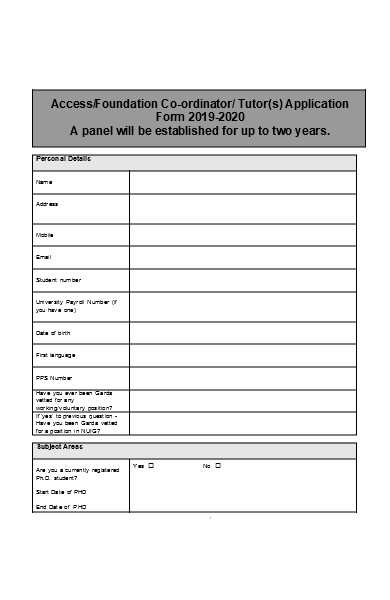

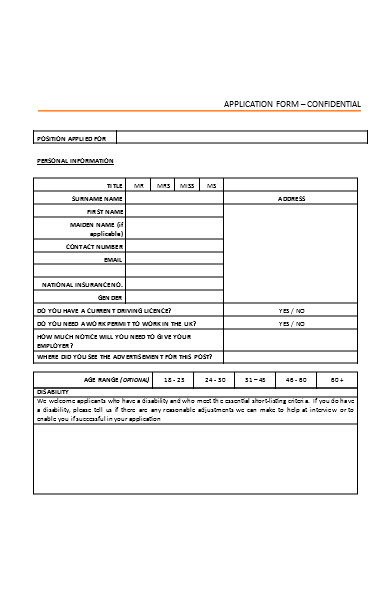

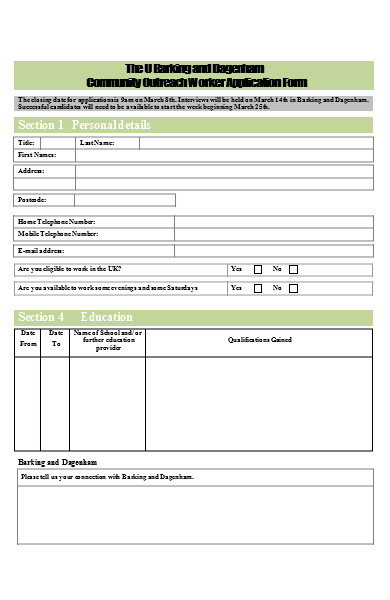

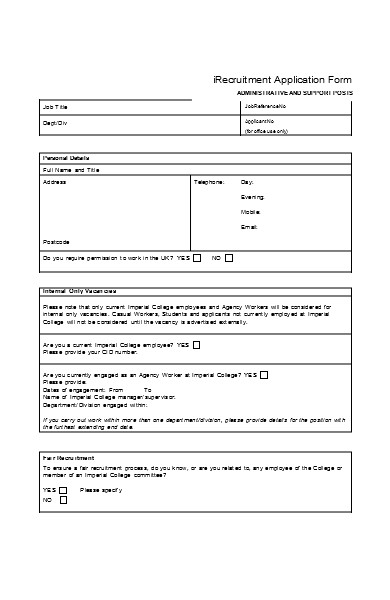

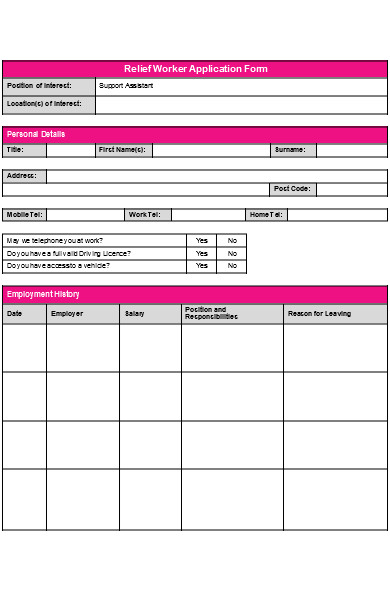

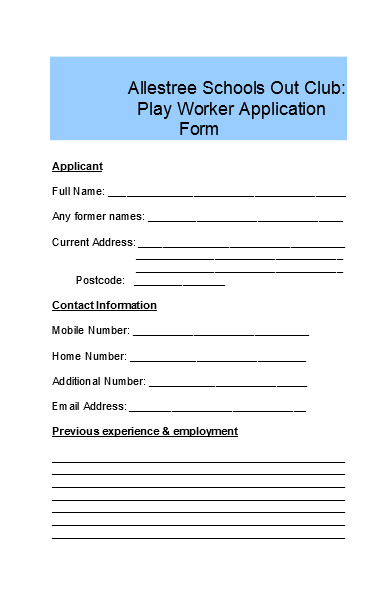

- Job Application Form: A form that prospective employees complete as part of the application process, providing detailed information about their qualifications and work history.

The specific worker form used can vary based on the organization’s needs, legal requirements, and the stage of the employee’s journey within the company. You should also take a look at our Work Forms.

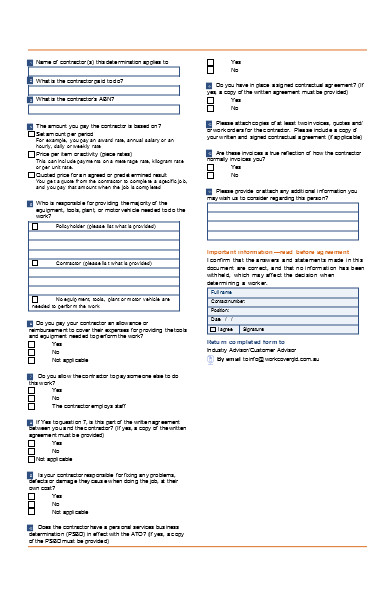

Where and how are worker forms submitted?

Worker forms are typically submitted to the employer, often to the Human Resources (HR) department, and the submission process can vary depending on the organization’s practices. Here are common methods for submitting worker forms:

- Physical Submission: In some cases, employees may be required to fill out paper forms, which they can then submit in person to their HR department or supervisor. The HR department may provide specific drop-off locations or instructions for where to submit the forms.

- Digital Submission: Many organizations have moved to digital methods. Employees can complete electronic forms, often provided through the company’s intranet or HR software. These digital forms may be submitted through the same system, typically by clicking a “Submit” or “Send” button.

- Email Submission: Some organizations may accept completed forms via email. In this case, employees fill out the form and attach it to an email, sending it to a designated HR or departmental email address.

- Online Portals: Larger companies may have online portals or employee self-service systems where workers can log in and submit their forms directly. The process is typically user-friendly and secure.

- Mail or Postal Submission: For remote employees or cases where digital options are unavailable, mailing the completed form to a specified address, often the company’s HR department, may be an option.

- Fax Submission: While less common in the digital age, some organizations still accept faxed forms. Employees fill out the form and send it via fax to the designated fax number.

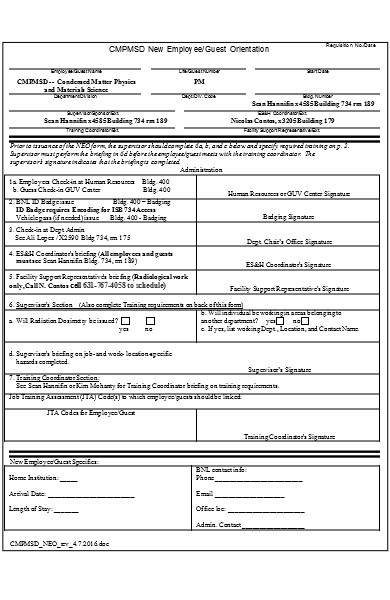

- Submission during Onboarding or Orientation: In many cases, worker forms are completed and submitted during the employee onboarding process, where HR personnel guide new hires through the required paperwork.

The exact method of submission can vary from one organization to another. It’s essential for employees to follow their employer’s specific instructions regarding how to submit worker forms to ensure that the process is completed accurately and in a timely manner. Our Work Request Forms is also worth a look at

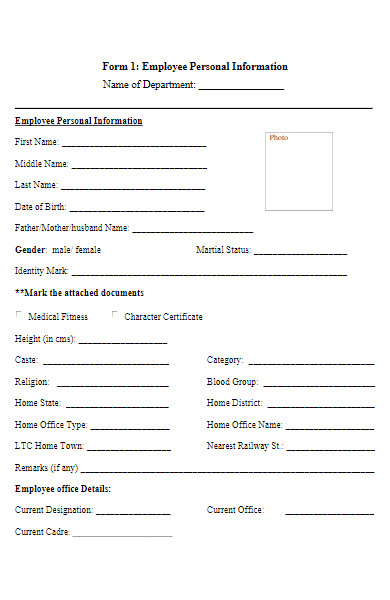

What information does an Employee Details Forms Includes?

An employee details form is a document or form used by employers to collect specific information about their employees. The form typically includes a variety of fields and sections that allow employees to provide essential personal and job-related information. Here are some common details that an employee details form may collect:

- Personal Information: This includes the employee’s full name, address, contact details (phone number and email), date of birth, and Social Security number.

- Emergency Contacts: Information about individuals to contact in case of emergencies, such as names, relationships, and contact numbers.

- Employment Information: Details related to the employee’s position, including job title, department, date of hire, work schedule, and supervisor’s name.

- Tax Information: Information related to tax withholding, such as the number of dependents, filing status, and any additional withholding allowances claimed on a W-4 form.

- Banking Information: If the employer offers direct deposit, the form may include a section for the employee to provide their bank account details for payroll purposes.

- Beneficiary Information: Some forms ask for information about beneficiaries for life insurance or retirement benefits.

- Emergency Health Information: In some cases, employees may be asked to provide information about allergies, medical conditions, or special medical considerations.

- Acknowledgments and Agreements: Employees may be asked to acknowledge that they have received specific policies, employee handbooks, or other documents, and that they understand and agree to abide by company policies.

The specific details collected on an employee details form can vary between organizations, depending on their needs and legal requirements. These best form is typically part of the onboarding process for new employees, and it’s also used to update information for current employees when necessary. It helps employers maintain accurate records and ensure effective communication with their workforce.

What is form 16 of employee?

Form 16 is a document in India that is provided by employers to their employees. It serves as a certificate of tax deducted at source (TDS) and provides details of the salary earned by the employee and the TDS that has been deducted by the employer on behalf of the government. Form 16 is an essential document for income tax purposes, as it helps employees file their income tax returns accurately. It includes information about the employee’s income, tax deductions, and other financial details for a specific financial year.

What is form 16A for salary?

Form 16A is a certificate in India issued under the Income Tax Act, 1961. It is not specifically related to salary but is a certificate for tax deducted at source (TDS) on income sources other than salary. Form 16A is primarily used for TDS on payments other than salaries, such as payments made to contractors, freelance professionals, or interest income.

Employers issue Form 16 for salary income, while other entities making payments subject to TDS, such as banks or businesses, provide Blank Form 16A to recipients of these payments. The form provides details about the income received and the TDS deducted on that income. It is important for individuals and businesses to accurately report their income and tax deductions for income tax purposes.

How do employees fill out worker forms?

Employees typically fill out worker forms by following a few key steps, which can vary depending on the organization’s procedures and the form’s specific requirements. Here’s a general outline of how employees typically complete worker forms:

- Obtain the Form: Employees receive the worker form from their employer or HR department. This can be in the form of a physical paper document, a digital form, or an online form, depending on the organization’s practices.

- Read the Instructions: Employees should carefully read any instructions provided with the form to understand the purpose of the form and how to complete it correctly.

- Provide Personal Information: Start by filling in personal details, such as your full legal name, address, contact number, and Social Security number or employee identification number. Ensure that this information is accurate and up to date.

- Complete Relevant Sections: Depending on the type of worker form, there may be sections for different types of information. For example, a tax-related form may require details about dependents and tax withholding preferences, while an employment eligibility form may ask for identity and employment authorization details.

- Fill in Required Fields: Complete all fields and sections marked as mandatory or required. Ensure that the information is accurate, and be especially careful with numerical data and identification numbers.

- Review for Accuracy: Before submitting the form, carefully review all the information provided to ensure there are no errors or omissions.

- Sign and Date: If required, sign and date the form to certify that the information is accurate and that you understand the contents of the form.

- Submit the Form: Depending on the organization’s procedures, submit the completed form by the specified method. This could involve handing it in to the HR department, sending it electronically through an online portal, or mailing it to the designated address.

- Retain a Copy: Always keep a copy of the completed form for your records. This can be valuable for reference and in case there are any questions or discrepancies in the future.

- Seek Clarification: If there are any questions or uncertainties about how to fill out the form, employees should reach out to their HR department for assistance. It’s important to complete the form accurately to avoid any issues related to payroll, taxes, or employment eligibility.

The specific process may vary from one organization to another, so it’s crucial for employees to follow their employer’s instructions carefully when filling out worker forms.In addition, you should review our Workers Compensation forms.

What information should I have ready before starting to fill out a Worker Form?

Before you begin filling out a worker form, it’s essential to gather all the necessary information and documents to ensure a smooth and accurate process. Here’s a checklist of the information you should have ready:

1. Personal Information:

- Your full legal name: Ensure it matches your official identification.

- Contact information: Include your current address, phone number, and email address.

- Employee identification or Social Security number (if required).

2. Tax Information (if applicable):

- If the form is related to tax, you might need details about your tax filing status, the number of dependents, and any additional withholding allowances.

3. Employment Information:

- Details about your job, such as your job title, department, start date, and supervisor’s name.

4. Identity Documents (if needed):

- Some worker forms, especially for employment eligibility verification, may require you to provide identity documents, such as a passport or driver’s license.

5. Bank Information (if required):

- If you’re setting up direct deposit for your salary, you may need to provide your bank account details.

6. Beneficiary Information (if applicable):

- For forms related to insurance or benefits, be prepared to provide information about beneficiaries, such as their names and relationships.

7. Tax Forms (if relevant):

- Some forms might require information from your tax returns, such as the previous year’s income details.

8. Relevant Documentation (if any):

- Check if the form requires any specific documentation, such as proof of identity or eligibility.

9. Emergency Contact Information:

- In some cases, you may need to provide names and contact information for emergency contacts.

10. Acknowledgments and Agreements:

- Be prepared to acknowledge and agree to certain terms, policies, or legal statements, if required.

11. Personal Records (if needed):

- Some forms may ask for personal history information, such as previous addresses or educational history.

12. Employment History:

- Details about your previous employers, including company names, addresses, job titles, and dates of employment.

13. Professional References:

- Contact information for professional references, typically including their names, titles, phone numbers, and email addresses.

14. Legal Documents (if applicable):

- For forms related to legal matters, you may need to provide specific legal documents, such as court orders or licenses.

15. Copy of Previous Forms (if relevant):

- If you’re updating information on a recurring form, it’s helpful to have a copy of the previous form for reference.

Having this information ready before you start filling out the worker form will streamline the process and ensure that you provide accurate and complete details as required by your employer or organization. Tailor your responses to the specific requirements of the form you are filling out. You may also be interested in our Work Release Forms.

How to Create the Worker Form? – a Step by Step Guide

Creating a worker form is a structured process that involves designing a document to collect essential information from employees. Here’s a step-by-step guide on how to create a worker form:

Step 1: Define the Form’s Purpose:

- Determine the specific purpose of the worker form. Is it for tax-related information, employment eligibility verification, or general employee details?

Step 2: Identify Required Information:

- Determine what information you need to collect from employees to meet your organization’s needs and legal requirements.

Step 3: Choose the Format:

- Decide whether the form will be in a physical paper format, a digital document, or an online form.

Step 4: Create a Clear Layout:

- Design the form with a clear and organized layout. Use sections and fields to capture different types of information.

Step 5: Include Legal Compliance:

- Ensure that your form complies with all relevant employment laws and regulations, including data privacy and anti-discrimination laws.

Step 6: Customize for Your Organization:

- Customize the form to your organization’s specific requirements. Add or remove fields based on your unique needs.

Step 7: Provide Clear Instructions:

- Include step-by-step instructions for employees on how to fill out the form, making it as user-friendly as possible.

Step 8: Test the Form:

- Test the worker form to make sure it functions correctly. Ensure that it’s easy for employees to complete, whether in a physical format or online.

Step 9: Seek Feedback:

- After employees complete the form, gather feedback to identify any areas for improvement in the process.

Step 10: Implement the Form:

- Once you are satisfied with the worker form, make it accessible to your employees. If it’s an online form, ensure it’s available through a secure portal.

Step 11: Train HR Staff:

- If necessary, train your HR department or relevant personnel on how to assist employees in filling out the form and processing the collected data.

Step 12: Communicate the Process:

- Clearly communicate the process for completing the worker form to all employees, including deadlines and submission instructions.

Step 13: Monitor and Update:

- Regularly review the form and gather feedback from employees and your HR team. Update it as needed to improve the employee experience and ensure you collect the right information.

Creating a worker form that is clear, legally compliant, and user-friendly is crucial for maintaining accurate employee records and facilitating effective communication and processes within your organization. Tailor the form to your specific needs, and ensure it meets all legal requirements. You may also be interested to browse through our other Return to Work Forms.

Tips for creating an Effective Worker Form

Creating an effective worker form is essential for collecting accurate and necessary information from employees while ensuring a positive user experience. Here are some tips to help you design an efficient worker form:

1. Clarify the Form’s Purpose:

- Clearly state the purpose of the form at the beginning so that employees understand why they are filling it out.

2. Keep It Simple:

- Avoid overwhelming employees with too many fields or complex language. Keep the form concise and straightforward.

3. Use Clear and Simple Language:

- Write clear and concise instructions and questions. Avoid jargon or technical terms that might confuse employees.

4. Prioritize Key Information:

- Place the most critical information at the beginning of the form, such as personal details and employment information.

5. Provide Clear Instructions:

- Include step-by-step instructions on how to complete the form, making it easy for employees to follow.

6. Standardize Formats:

- Use standardized formats for data input, such as drop-down menus, checkboxes, and text fields, to maintain consistency.

7. Mobile-Friendly Design:

- Ensure that the form is mobile-responsive, as many employees may access it from smartphones or tablets.

8. Customize for Different Roles:

- Tailor the form to different employee roles or departments, collecting only the information relevant to their positions.

9. Avoid Redundancy:

- Don’t ask for the same information multiple times. For example, if you request a resume, don’t duplicate the resume’s content on the form.

10. Include Privacy and Security Information:

- Assure employees that their data will be handled securely and in compliance with privacy laws.

11. Consider Accessibility:

- Ensure that the form is accessible to employees with disabilities, following accessibility guidelines.

12. Test the Form:

- Test the form from an employee’s perspective to ensure that it functions smoothly and there are no technical issues.

13. Legal Compliance:

- Ensure that your form complies with all relevant employment laws and regulations, including data protection and anti-discrimination laws.

14. Encourage Feedback:

- Provide a way for employees to offer feedback on the form’s usability and content. Use their input to make improvements.

15. Regularly Update the Form:

- Keep the form up to date with changing requirements, technologies, and best practices.

Creating an effective worker form helps streamline data collection, ensures legal compliance, and contributes to a positive employee experience. By following these tips, you can design a form that serves its purpose efficiently and provides a smooth experience for both employees and HR personnel.

In conclusion, a worker form is a critical document used to gather essential information from employees, serving various purposes such as tax compliance and employment eligibility verification. It comes in various types, including tax-related forms and general employee details forms. Examples encompass tax withholding forms like W-4, among others. Creating an effective worker form demands simplicity, clarity, and adherence to legal requirements. This guide underscores the importance of user-friendliness and legal compliance in form design. You can also browse our Functional Work Forms.

Related Posts

FREE 6+ Sample Employee Shift Change Forms in PDF MS Word

FREE 50+ Return to Work Forms in PDF MS Word

FREE 11+ Sample Leave Request Forms in PDF MS Word | Excel

FREE 10+ Sample Volunteer Application Forms in MS Word PDF ...

FREE 10+ Sample Construction Contract Forms in MS Word PDF ...

FREE 51+ Volunteer Application Forms in PDF MS Word | Excel

FREE 9+ Sample Certified Payroll Forms in MS Word PDF | Excel

FREE 23+ Employee Contact Forms in PDF MS Word

FREE 10+ Sample Construction Application Forms in PDF MS Word

FREE 7+ Compensation and Benefits Forms in PDF

FREE 21+ Sample Payroll Forms in MS Word PDF | Excel

FREE 20+ Bio Data Forms in PDF MS Word | Excel

FREE 30+ Sample Medical Clearance Forms in PDF MS Word

FREE 2+ Unpaid Work Experience Request Forms in PDF MS Word

FREE 13+ Sample Workers Compensation Forms in PDF XLS | Word