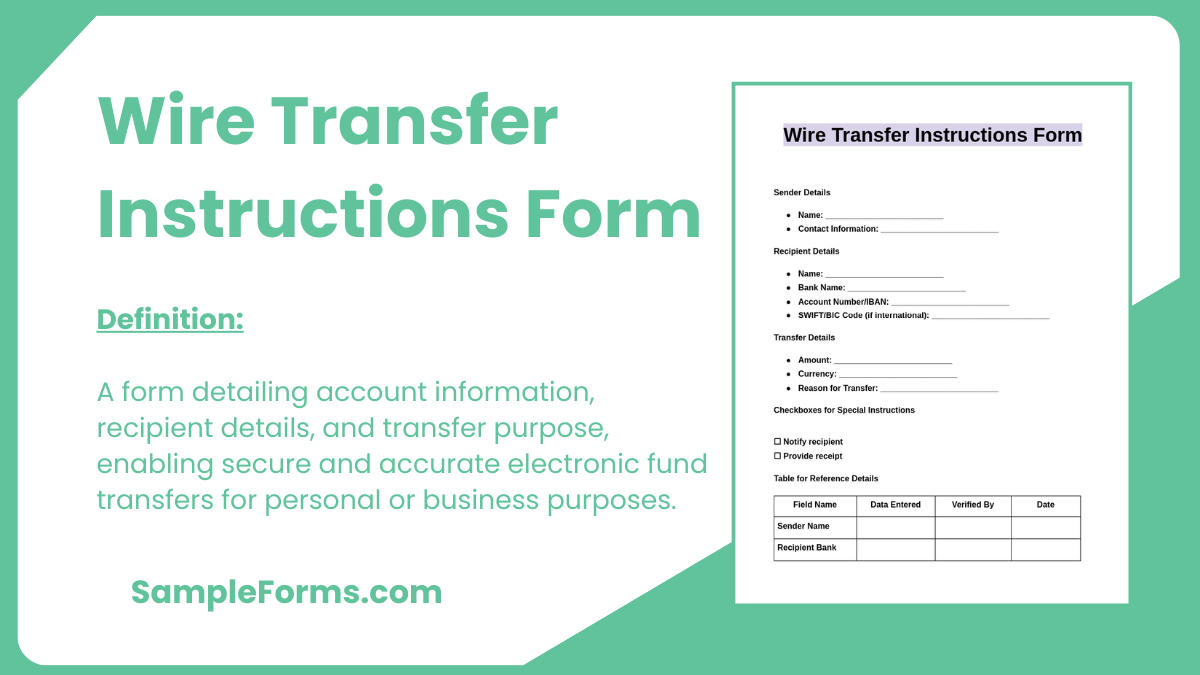

A Wire Transfer Instructions Form ensures secure and accurate financial transactions between parties. It captures essential details such as account numbers, bank codes, and recipient information. This guide provides step-by-step instructions and examples, helping you navigate the process confidently. Whether you’re handling a Wire Transfer Form or any other Transfer Form, this resource ensures precision and compliance for seamless money transfers.

Download Wire Transfer Instructions Form Bundle

What Is a Wire Transfer Instructions Form?

A wire transfer instructions form is a document which should be filled out by an individual who wants to begin a wire transfer transaction, regardless if it is inbound or an outbound wire transfer. The form will allow the bank or financial institution to obtain the information which will be used for the transaction such as the details of the accounts of both the sender and the receiver of the money.

Wire Transfer Instructions Format

Sender Information

Full Name: ________________________

Address: ________________________

Phone Number: ________________________

Email Address: ________________________

Recipient Information

Full Name/Company Name: ________________________

Bank Name: ________________________

Bank Address: ________________________

Account Number: ________________________

SWIFT/BIC Code: ________________________

IBAN (if applicable): ________________________

Routing Number (Domestic Transfers): ________________________

Transfer Details

Amount to Transfer: ________________________

Currency: ________________________

Purpose of Transfer: ________________________

Additional Information (if required)

Special Instructions: ________________________

Authorization

Signature: ________________________

Date: ________________________

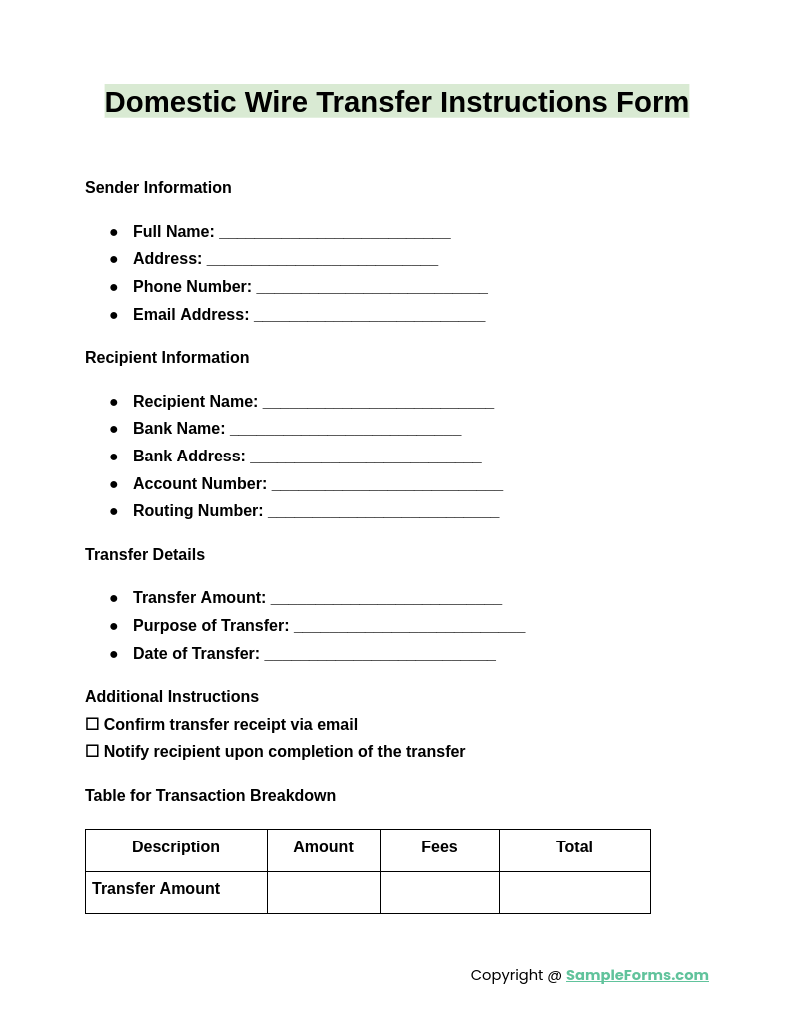

Domestic Wire Transfer Instructions Form

A Domestic Wire Transfer Instructions Form is used for transferring money within the same country, ensuring accuracy and security. Its process resembles a School Transfer Form, simplifying domestic financial transactions efficiently.

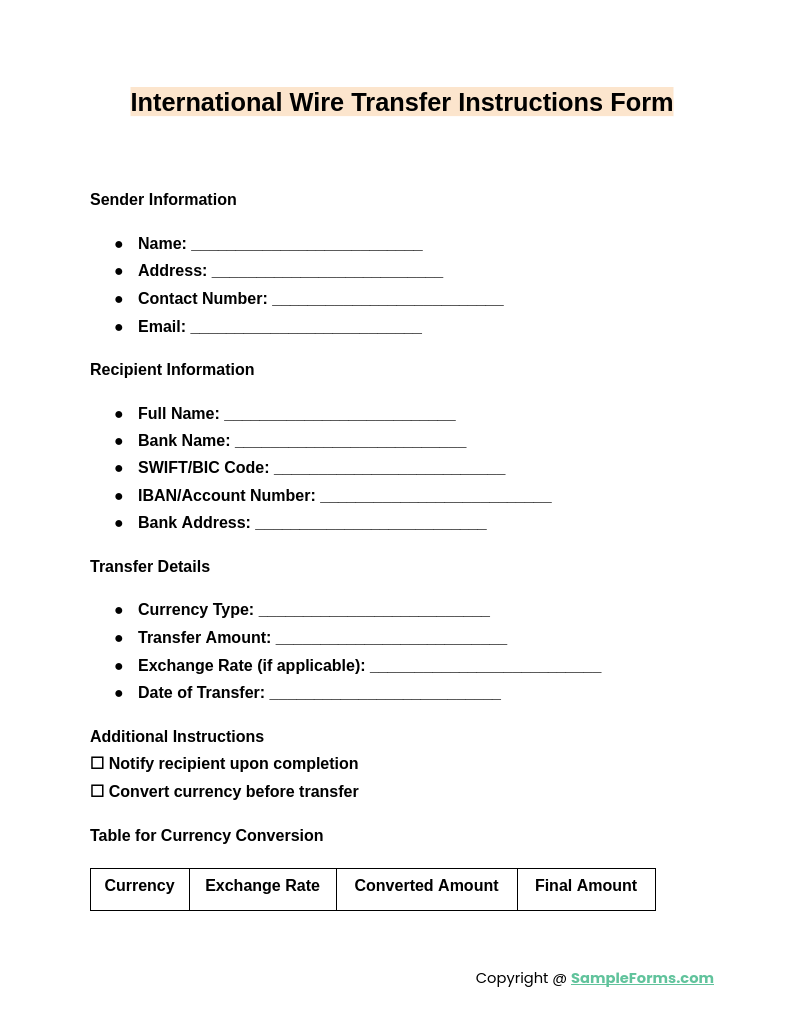

International Wire Transfer Instructions Form

An International Wire Transfer Instructions Form facilitates global transactions. It includes SWIFT codes and IBANs, akin to a Vehicle Transfer Form, ensuring seamless cross-border payments while maintaining compliance with international banking standards.

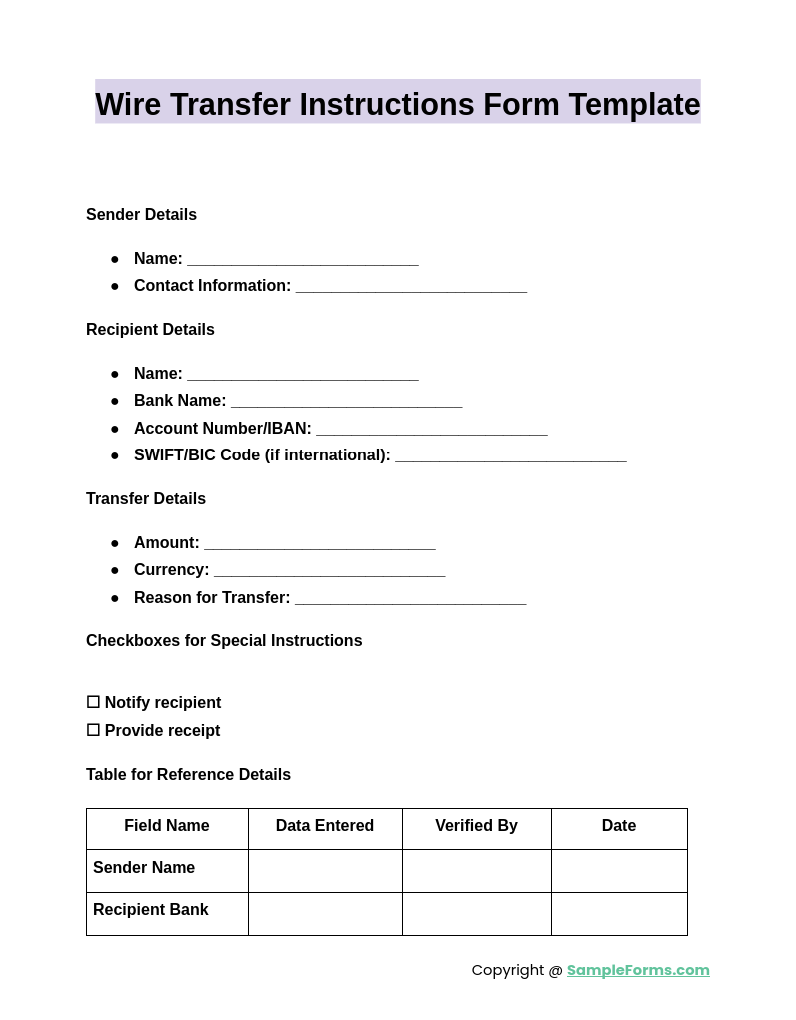

Wire Transfer Instructions Form Template

A Wire Transfer Instructions Form Template provides a preformatted structure for inputting transfer details. Like a Transfer of Ownership Form, it ensures consistency and minimizes errors during the transfer process, enhancing reliability.

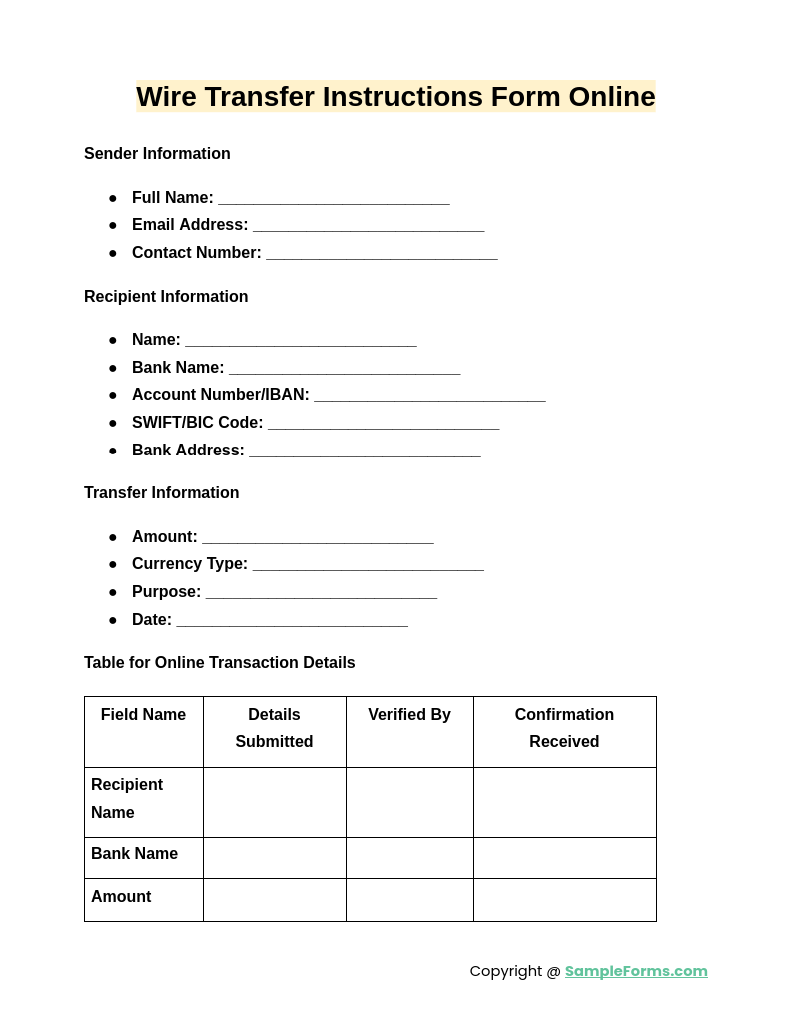

Wire Transfer Instructions Form Online

A Wire Transfer Instructions Form Online offers a digital solution for submitting transfer requests. Similar to a Deed Transfer Form, it streamlines processes, enabling users to manage their transactions conveniently from anywhere.

Browse More Wire Transfer Instructions Forms

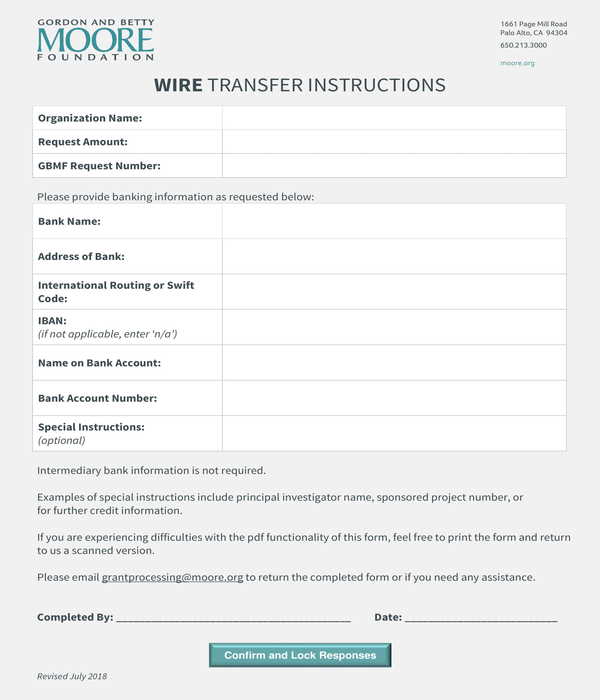

Wire Transfer Instructions Form Sample

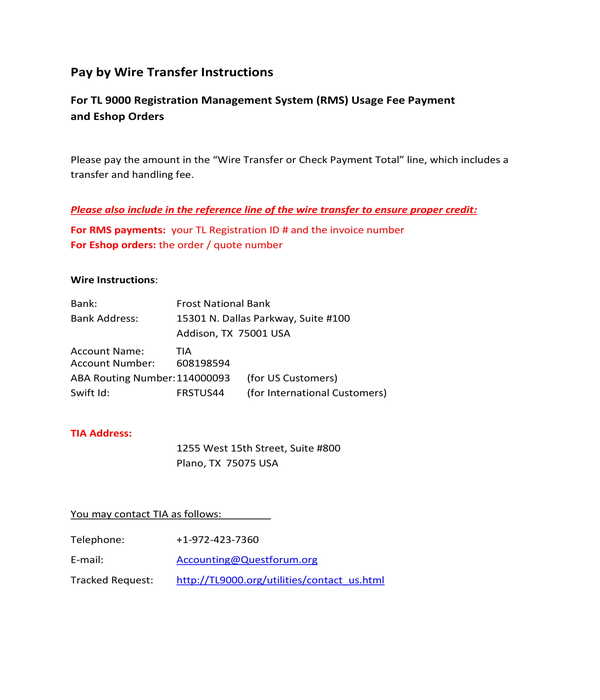

Pay by Wire Transfer Instructions Form

Wire Transfer Instructions and Disclosures Form

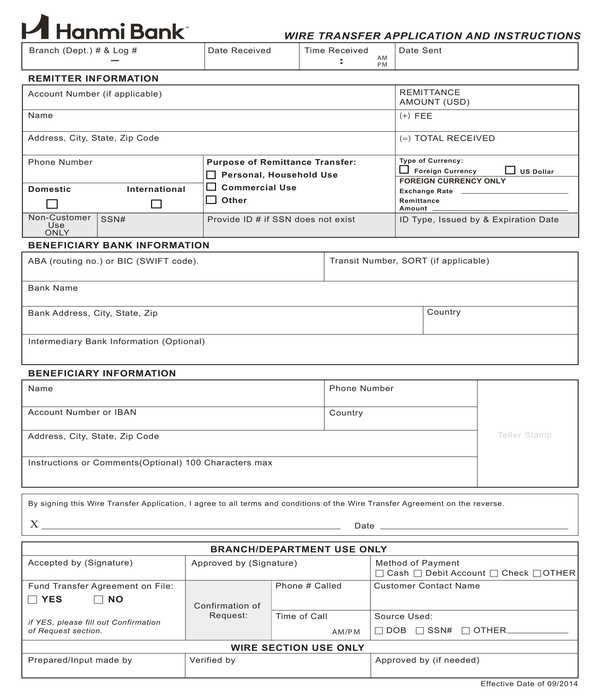

Wire Transfer Application and Instructions Form

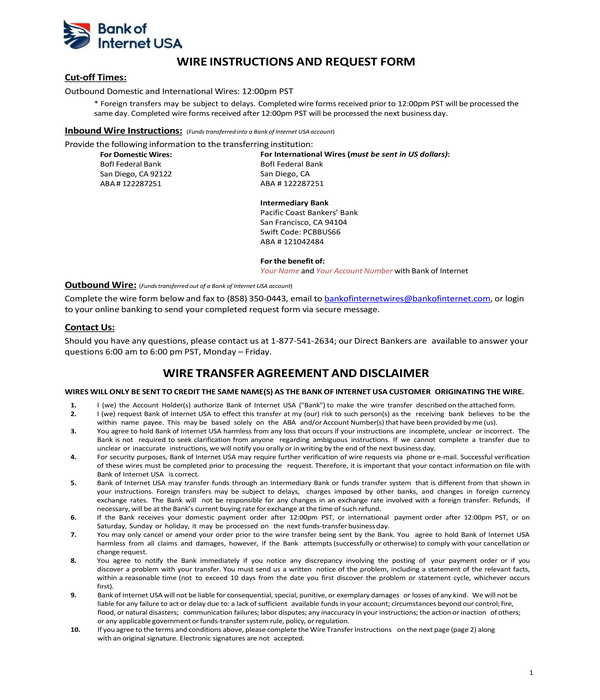

Wire Transfer Instructions and Request Form

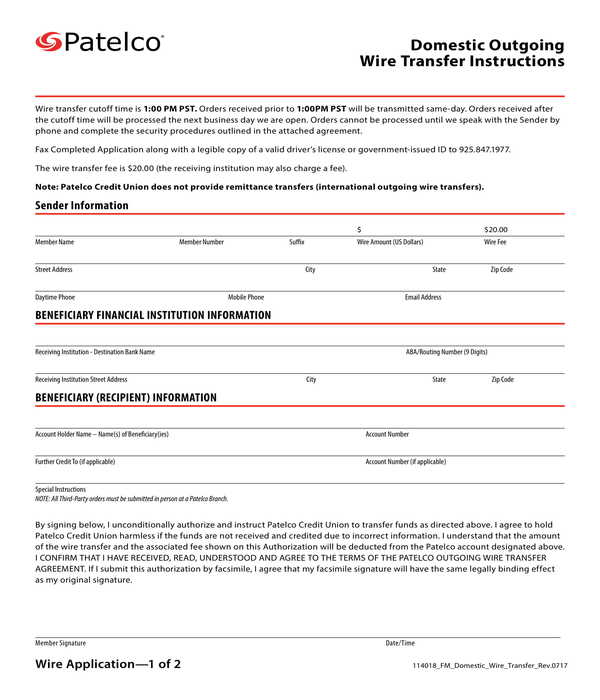

Domestic Outgoing Wire Transfer Instructions Form

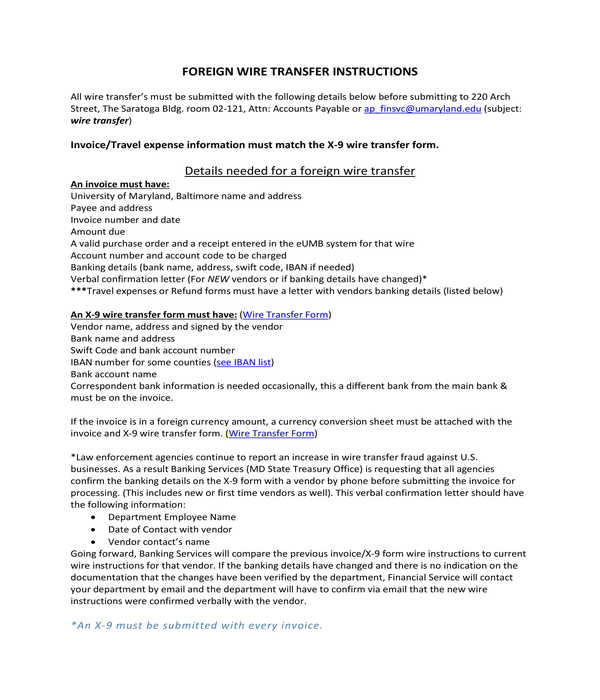

Foreign Wire Transfer Instructions Form – Contrary to the aforementioned domestic outgoing wire transfer instructions form, a foreign wire transfer instructions form is only to be used for sending and receiving funds to and from a foreign or international bank.

Foreign Wire Transfer Instructions Form

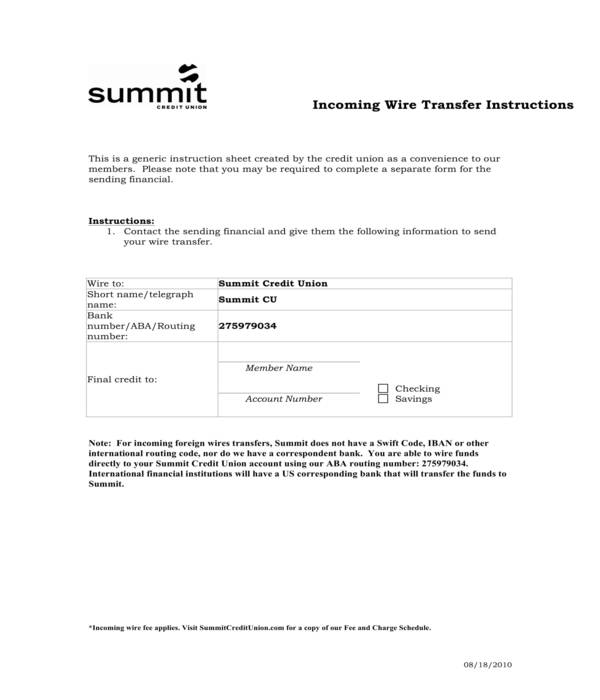

Incoming Wire Transfer Instructions Form

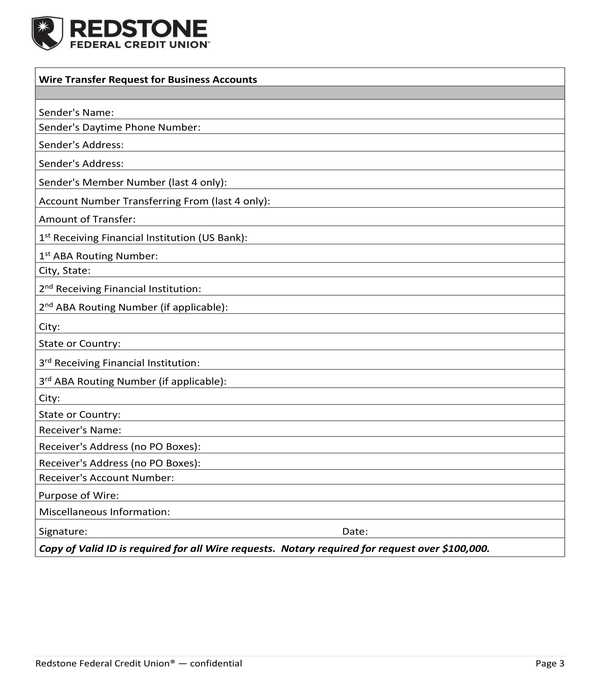

Outgoing Wire Transfer Instructions for Business Accounts Form – This form variety is solely intended for transferring funds from one business account to another. In the form, the sender of the funds will need to disclose his name, daytime phone number, address, membership number, as well as the account number that he is transferring from. Additionally, the amount of the funds to be transferred, the name of the bank and financial institution where the funds will be received, and their routing numbers will also have to be stated in the form along with the name of the receiver and the purpose of the wire transfer.

Outgoing Wire Transfer Instructions for Business Accounts Form

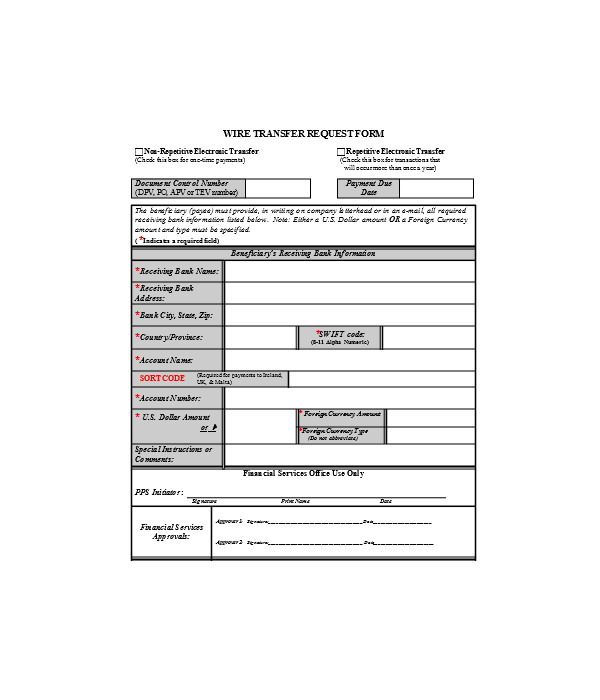

Wire Transfer Request Instruction Form

How to write wire transfer instructions?

Writing wire transfer instructions ensures accurate and secure transactions. Follow these steps for a precise process:

- Include Sender Details: Provide the sender’s name, account number, and bank name, similar to completing a Student Transfer Form.

- Recipient Information: Add the recipient’s full name, account number, and bank details.

- Routing Codes: Specify the routing number or SWIFT/IBAN codes for accurate processing.

- Transfer Amount: Mention the exact amount to be transferred.

- Purpose of Transfer: Clearly state the reason for the wire transfer in the instructions.

How to fill a wire transfer form?

Filling out a wire transfer form accurately ensures seamless processing. Use the following steps:

- Fill in Sender Information: Enter personal and banking details like on a Material Transfer Form.

- Add Beneficiary Details: Include recipient’s name, bank name, and account number.

- Provide Bank Codes: Enter the required SWIFT, IBAN, or routing numbers.

- Specify the Amount: Clearly mention the transfer amount in the designated field.

- Confirm Transfer Details: Review all details for accuracy before submission.

What are the disadvantages of wire transfer?

Wire transfers, while efficient, have limitations. Here are some common disadvantages:

- High Fees: Transfers can be costly compared to other methods, much like processing an Employee Transfer Form.

- Irreversibility: Transactions are usually final once processed.

- Security Concerns: Scams and fraud are possible if not careful.

- Time Delays: International transfers may take a few days to process.

- Limited Documentation: Not all wire transfers provide detailed transaction receipts.

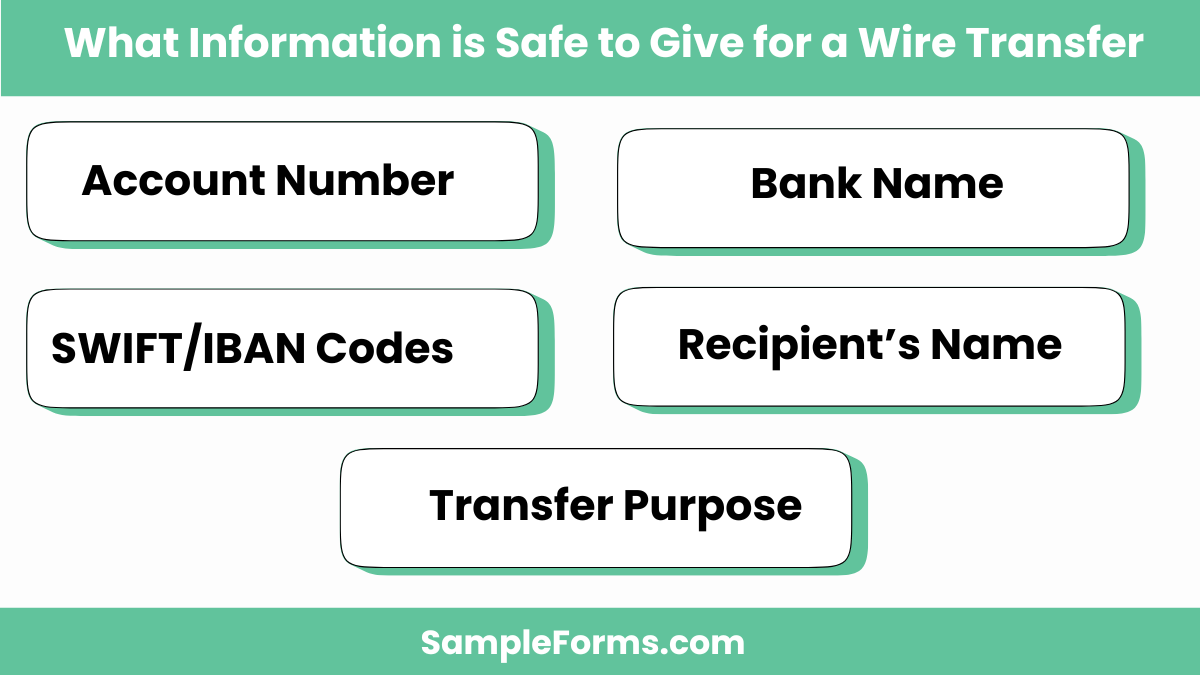

What information is safe to give for a wire transfer?

Sharing limited but essential details ensures a secure wire transfer. Follow these steps:

- Account Number: Provide only the necessary account details, similar to a Gun Transfer Form.

- Bank Name: Include the bank name and branch details.

- SWIFT/IBAN Codes: Share required routing or identification numbers securely.

- Recipient’s Name: Use only the official name matching the account.

- Transfer Purpose: Limit shared details to the purpose of the transfer.

How to confirm wire instructions?

Confirming wire instructions ensures accuracy and prevents errors. Here’s how:

- Verify Bank Details: Double-check routing numbers and account details, as you would with a Fund Transfer Form.

- Contact the Bank: Speak directly with your bank to confirm instructions.

- Review Documentation: Cross-check the provided wire instructions against official records.

- Authenticate Recipient Details: Ensure the recipient’s name matches their bank account.

- Secure Confirmation: Use two-factor authentication or confirmation emails for added security.

Is a beneficiary address required for wire transfer?

Yes, a beneficiary address is often required, similar to the detailed requirements of an Inventory Transfer Form, to ensure accuracy.

How to securely send wire instructions?

Use encrypted communication channels, verify recipient details, and follow protocols like those for an Asset Transfer Form for safe transactions.

What address should I use for wire transfer?

Use the recipient’s registered banking address, as accuracy is critical, similar to completing a Stock Transfer Form.

What are the red flags for wire transfers?

Red flags include mismatched names, excessive urgency, or unverified accounts, akin to risks identified in a Title Transfer Form.

What is the document for a bank wire transfer?

A wire transfer requires a completed bank-provided form, similar to a Motor Vehicle Transfer Form, detailing sender and recipient information.

What does FFC mean for wire instructions?

FFC stands for “For Further Credit,” directing funds to a specific account, much like clarifications in a Gun Owners Transfer Form.

How do you write a wire transfer account number?

Write it without spaces, ensuring precision like documenting an Ownership Transfer Form, to prevent transaction errors.

Does account name matter for wire transfer?

Yes, matching the account name ensures proper processing, just as it is crucial in a Medical Records Transfer Form.

Are wire transfers monitored by IRS?

Yes, large transfers are monitored to ensure compliance, similar to audits conducted for a Property Transfer Form.

How do I document a wire transfer?

Record sender, recipient, amount, and transaction details in official records, similar to maintaining an Insurance Transfer Form.

The Wire Transfer Instructions Form use provides clarity on executing secure transfers. This guide helps you understand the process while integrating elements like a Budget Transfer Form to manage finances effectively, enhancing transaction accuracy and efficiency.

Related Posts

-

FREE 8+ Stock Transfer Forms in PDF | Ms Word

-

FREE 7+ Change in Custodian Forms in MS Word | PDF | Excel

-

FREE 6+ Sample Residence Questionnaire Forms in PDF

-

FREE 7+ Inventory Transfer Forms in MS Word | PDF | Excel

-

FREE 7+ Ownership Transfer Forms in PDF

-

FREE 9+ Asset Transfer Forms in PDF | Ms Word | Excel

-

FREE 10+ Transfer Form Samples in PDF | MS Word | Excel

-

FREE 8+ Sample Transfer Verification Forms in PDF | MS Word

-

FREE 7+ Sample Assets Transfer Forms in MS Excel | PDF

-

FREE 8+ Deed Transfer Form Samples in PDF | MS Word

-

Transfer of Ownership Form

-

FREE 9+ Sample Firearm Transfer Forms in PDF | MS Word

-

Gun Ownership Transfer Form

-

FREE 9+ Sample Title Transfer Forms in PDF | Word

-

School Transfer Form