A Wire Transfer Form is essential for securely transferring funds between banks or financial institutions. This complete guide offers examples, detailed explanations, and the Wire Transfer Instruction Form to ensure a smooth and hassle-free process. Understanding the Transfer Form helps ensure all information, like sender and recipient details, is accurate for a successful transaction. Learn how to fill out the form, follow the necessary instructions, and avoid common mistakes when completing wire transfers. Our guide will help you streamline your process and ensure a smooth, safe transfer every time.

What Is Wire Transfer Form?

A Wire Transfer Form is a document used to facilitate the secure transfer of money from one bank account to another. It includes important information such as the sender’s account details, recipient’s banking information, and the amount to be transferred. This form is essential for ensuring accurate and timely money transfers between institutions or individuals across various locations.

Wire Transfer Format

Wire Transfer Request Form

- Request Date: _________________________

- Sender’s Full Name: _________________________

- Sender’s Address:

- Sender’s Bank Information:

Bank Name: _______________________________________

Bank Address: _____________________________________

Account Number: ___________________________________

SWIFT/BIC Code (for international transfers): __________________________ - Recipient’s Full Name: _________________________

- Recipient’s Address:

- Recipient’s Bank Information:

Bank Name: _______________________________________

Bank Address: _____________________________________

Account Number/IBAN: ___________________________

Routing Number (Domestic): ___________________________

SWIFT/BIC Code (International): ___________________________ - Transfer Amount: _________________________

- Currency: ? USD ? EUR ? Other: _________________

- Purpose of Transfer:

- Fee Deduction (if applicable): ? From Sender ? From Recipient

- Contact Information for Sender:

Phone Number: ____________________

Email: _________________________ - Approval (For Office Use Only):

Authorized Signature: ____________________

Date of Approval: _________________________ - Notes/Additional Instructions:

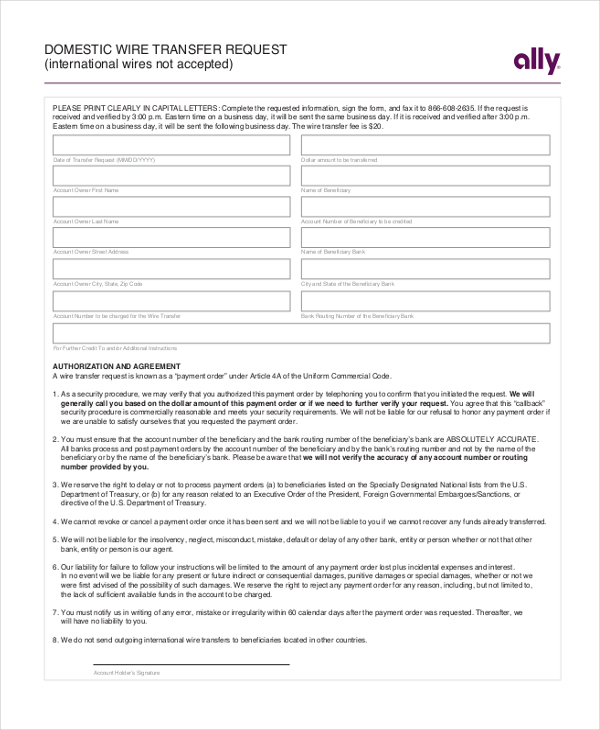

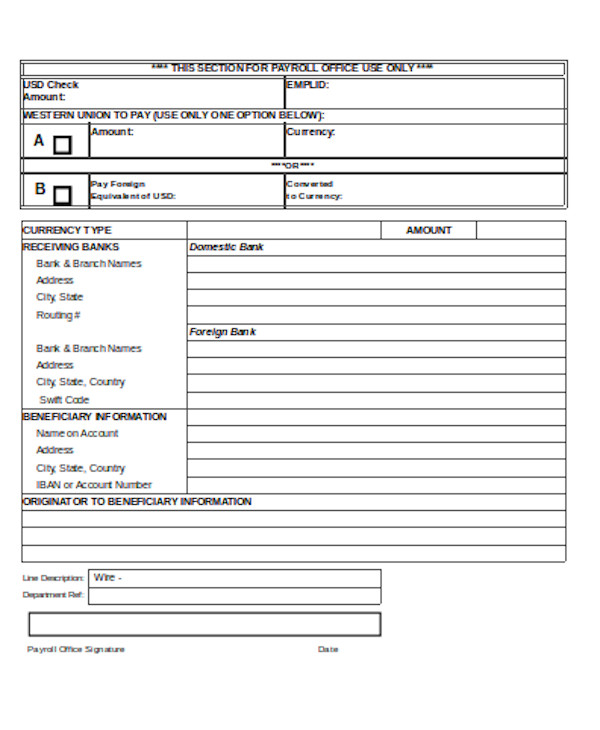

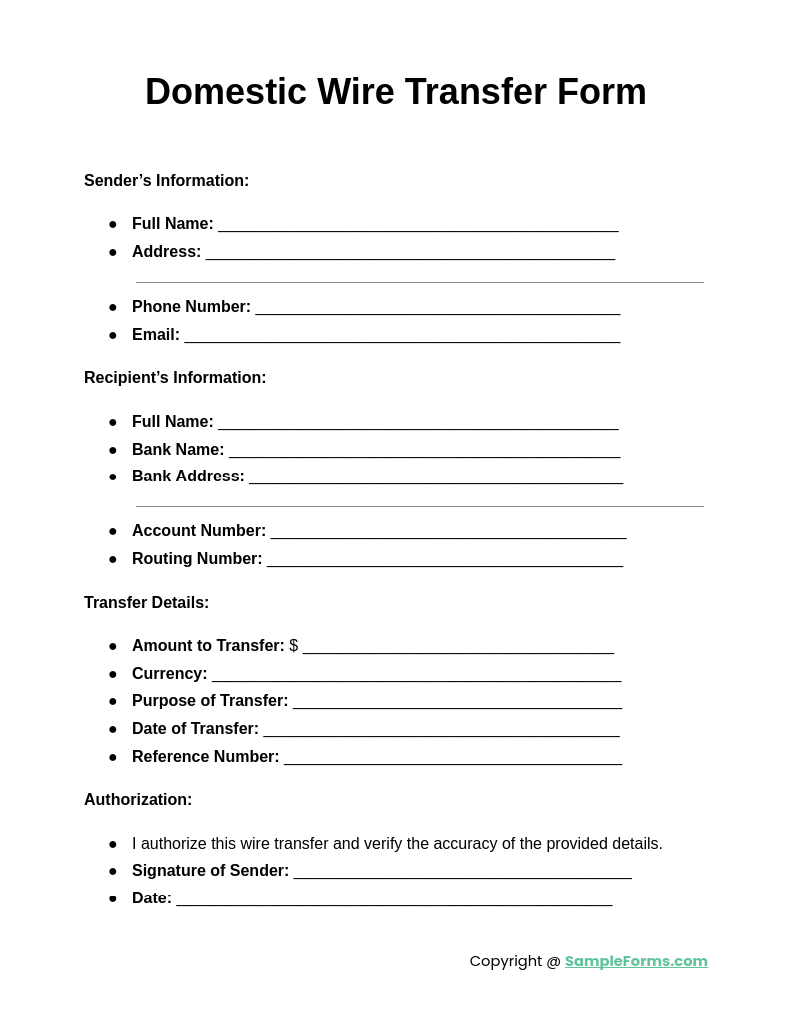

Domestic Wire Transfer Form

A Domestic Wire Transfer Form is used for transferring funds between banks within the same country. It ensures secure and quick transactions, requiring details such as account numbers, routing codes, and personal identification. Similar to a School Transfer Form, it needs accuracy.

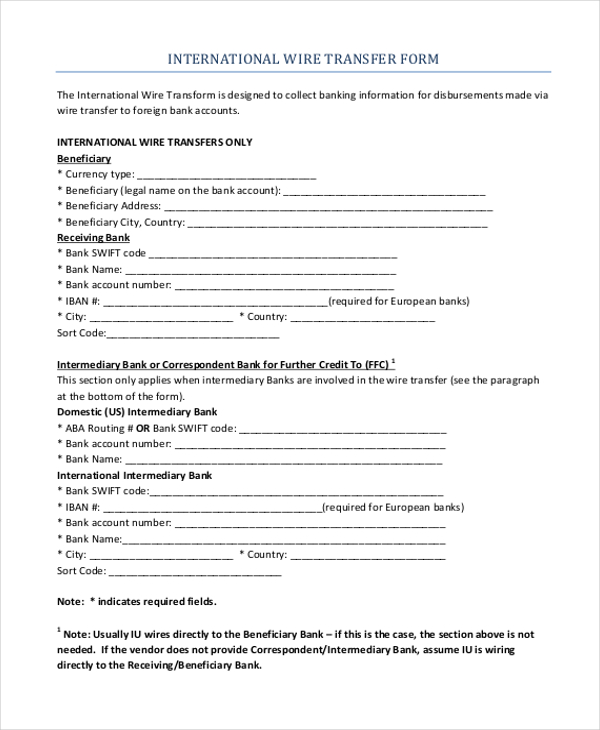

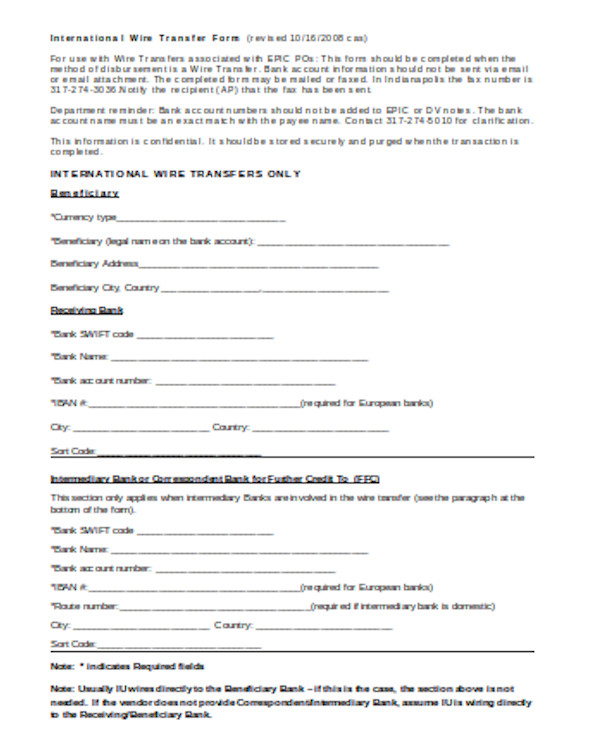

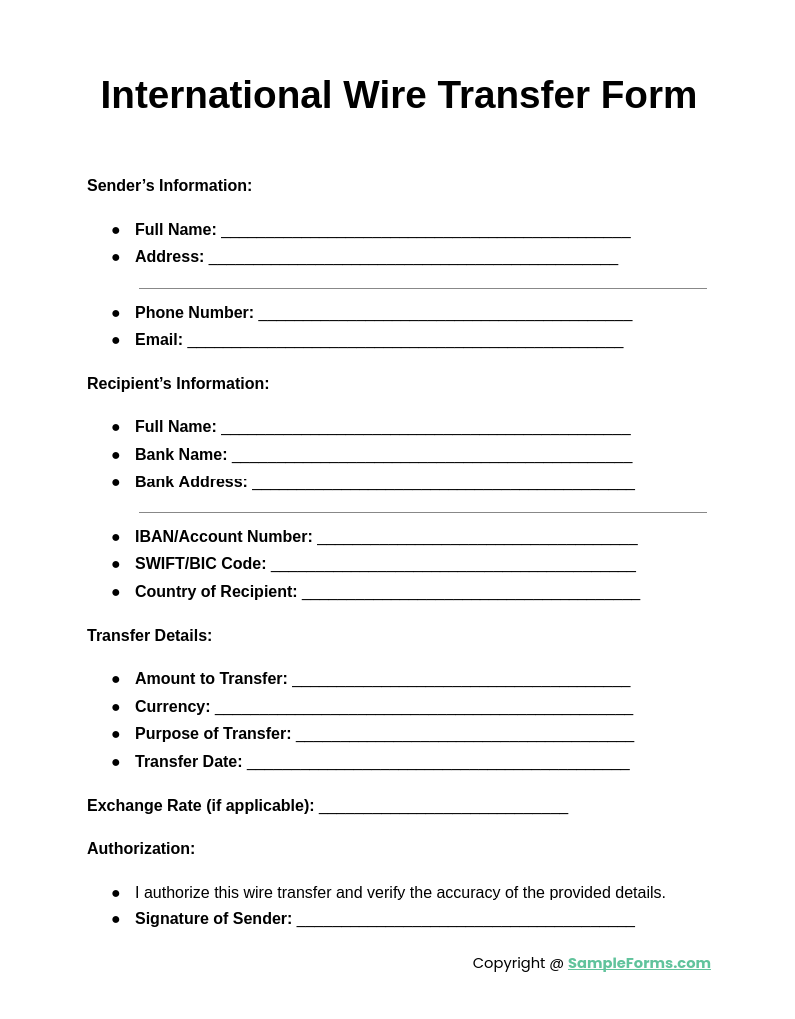

International Wire Transfer Form

An International Wire Transfer Form facilitates money transfers between different countries. It requires additional details like SWIFT codes or IBAN for secure global transactions. Just as in a Motor Vehicle Transfer Form, all information must be correct for successful processing.

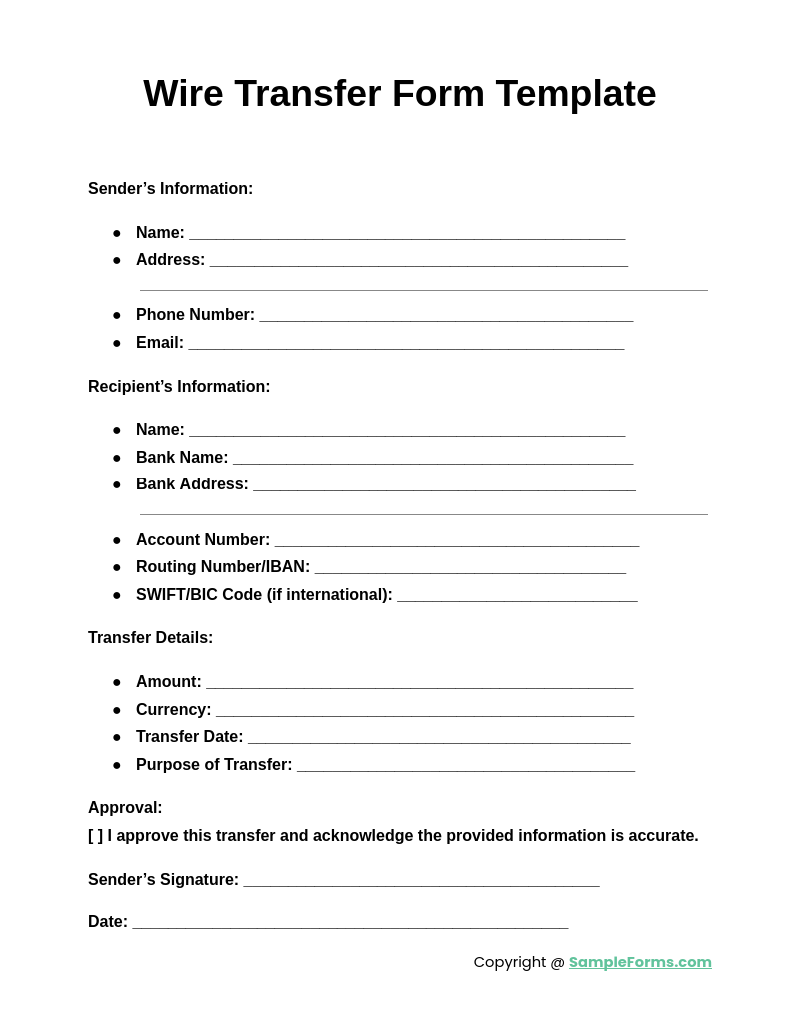

Wire Transfer Form Template

A Wire Transfer Form Template offers a ready-to-use structure for initiating money transfers. This template includes necessary fields for personal and bank information. Like a Vehicle Transfer Form, it ensures smooth and error-free processing when properly filled out.

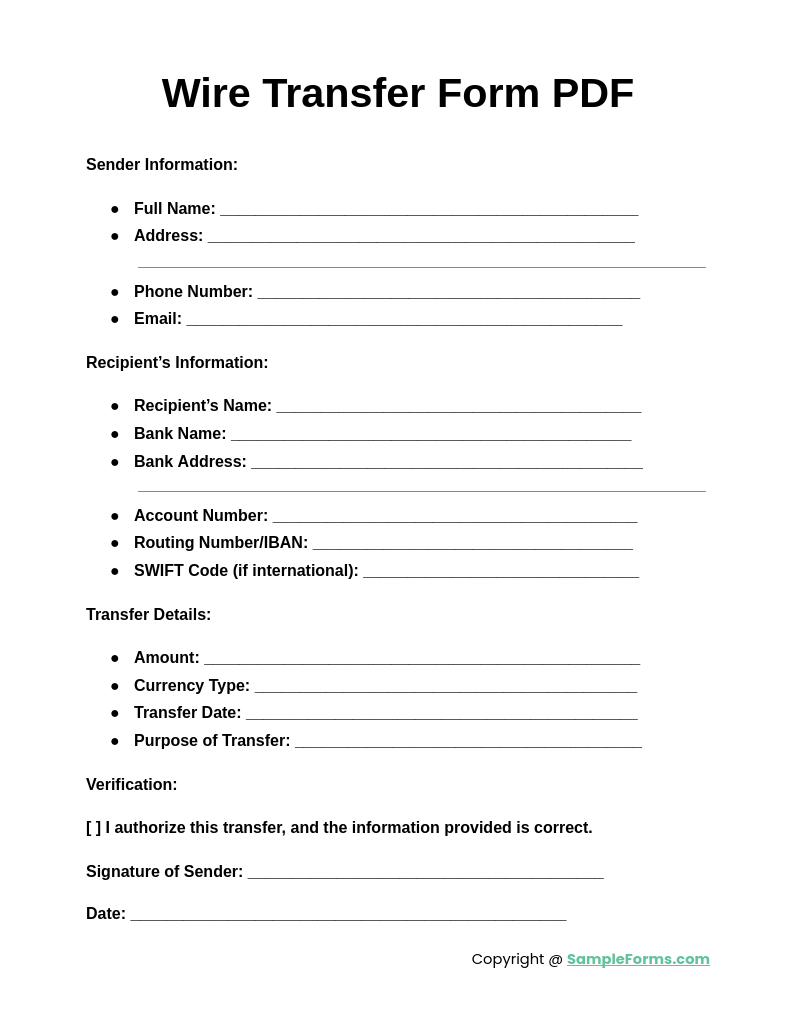

Wire Transfer Form PDF

A Wire Transfer Form PDF allows easy downloading and printing for offline use. It ensures secure documentation of fund transfers, much like completing a Registration Transfer Form, where correct information is crucial for successful transactions.

Browse More Wire Transfer Forms

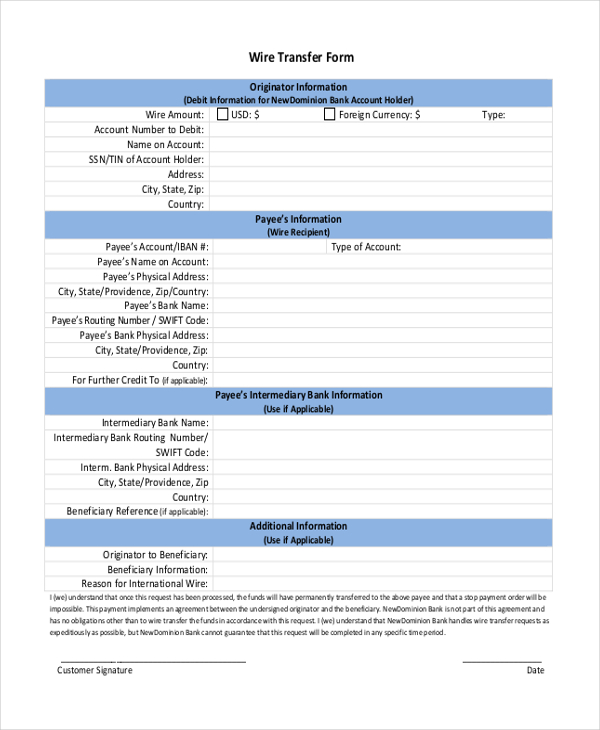

Sample Wire Transfer Request Form

When a person intends to transfer money from his account to the account of another beneficiary, he is required to fill in this form to request his bank to make the transfer.

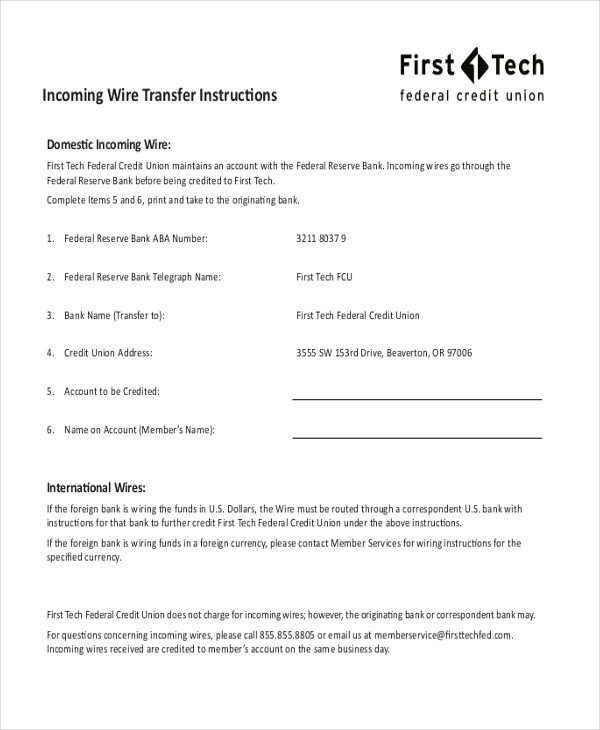

Wire Transfer Instructions Form

A person who wants to transfer certain funds to another account on a regular basis can use this form to instruct his bank about the process. He can give directions about how this is to be done.

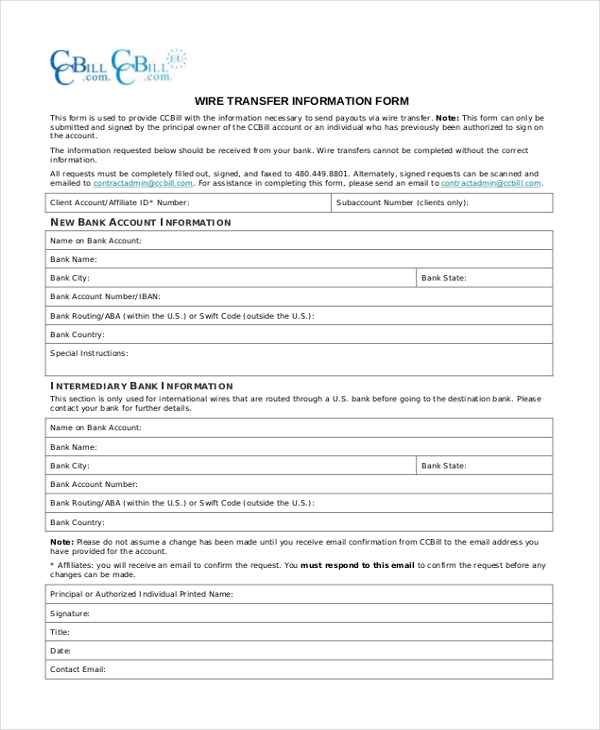

Wire Transfer Information Form

When an account holder requests his bank to provide him with a statement of all the wire transfers made by him during a specific period, the bank uses this form to provide him the details.

Wire Transfer Form Sample

This is a sample of how a wire transfer form should actually look. The user can use this form just as it is or make necessary changes to it.

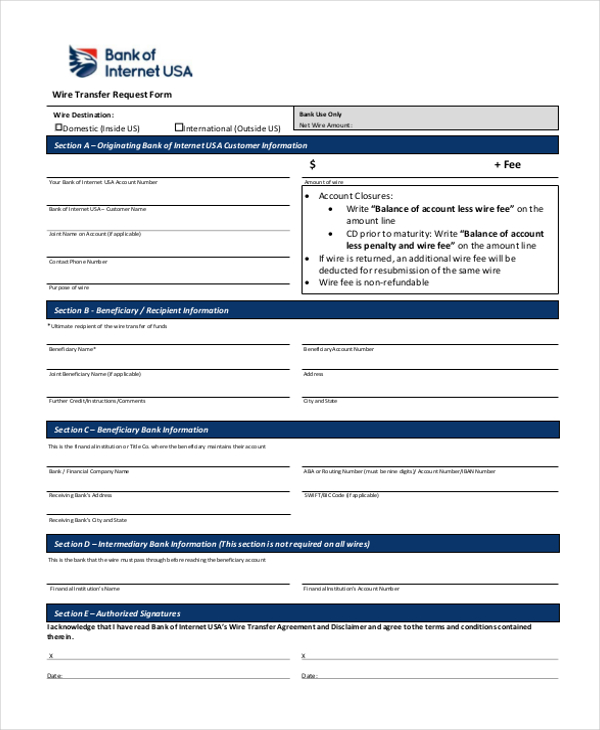

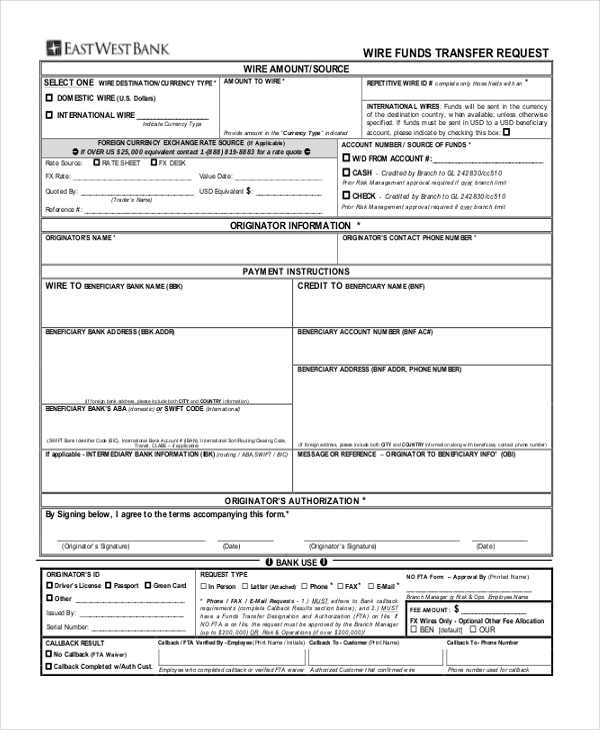

Wire Transfer Bank Form

This form is used by banks to allow their account holders to make wire transfers to other accounts. The account holders can use these forms to leave specific instructions for the wire transfers.

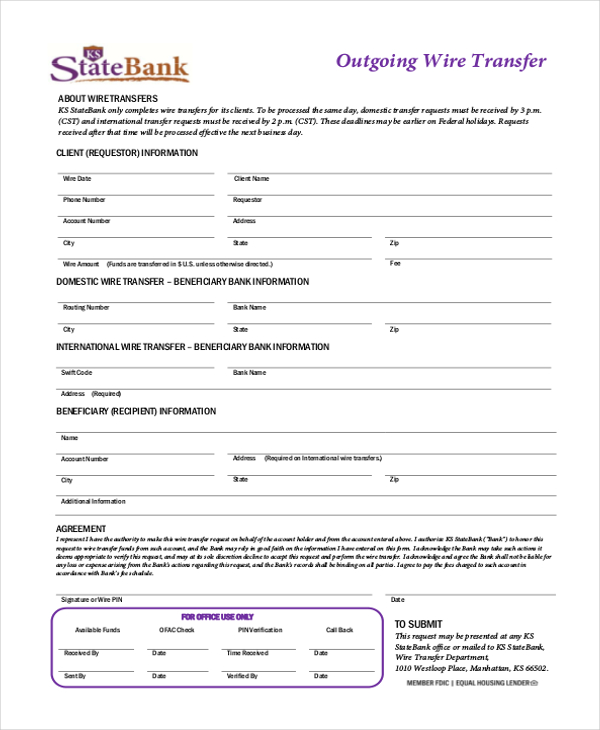

Outgoing Wire Transfer Form

This form is used by banks to allow its patrons to make a wire transfer to an account with another bank or which might be on international shores.

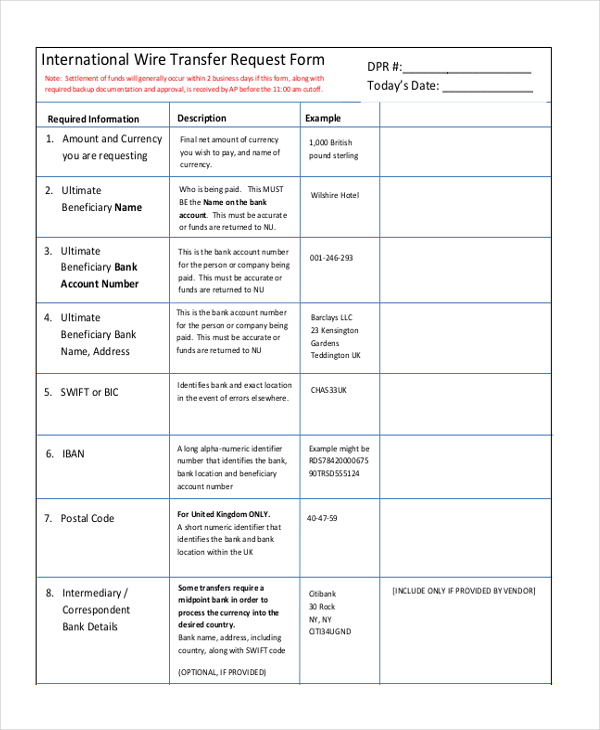

Sample International Wire Transfer Form

When a person intends to transfer funds into an international account, he is required to fill in this form with relevant details like account number, amount etc.

Domestic Wire Transfer Request Form

Banks use this form to allow their account holders to raise a request to transfer funds from their account to a domestic account.

Sample Request to Wire Transfer Funds

When a person wishes to transfer money from his account to another account, his bank expects him to fill in this request form with all the relevant details.

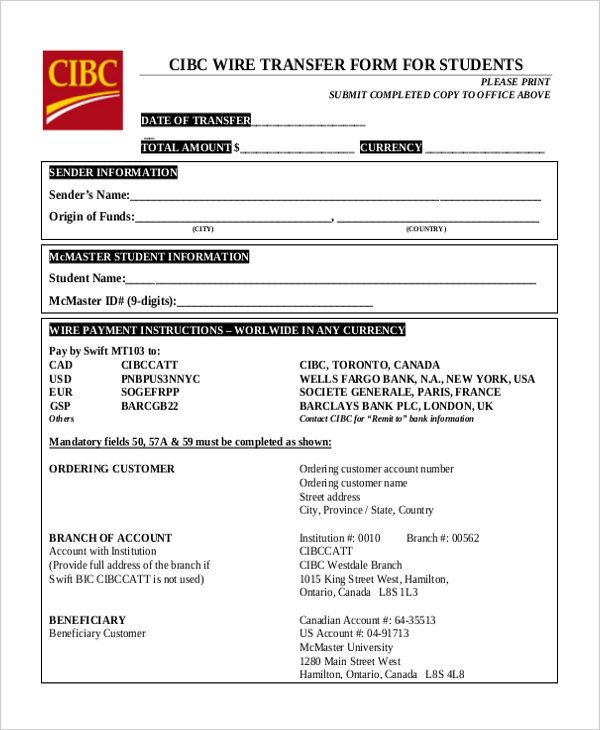

CIBC Wire Transfer Form for Students

Colleges and universities use this form to enable the parents or guardians of their students to transfer funds to the student account through the university.

Standard Wire Transfer Form

International Wire Transfer Form

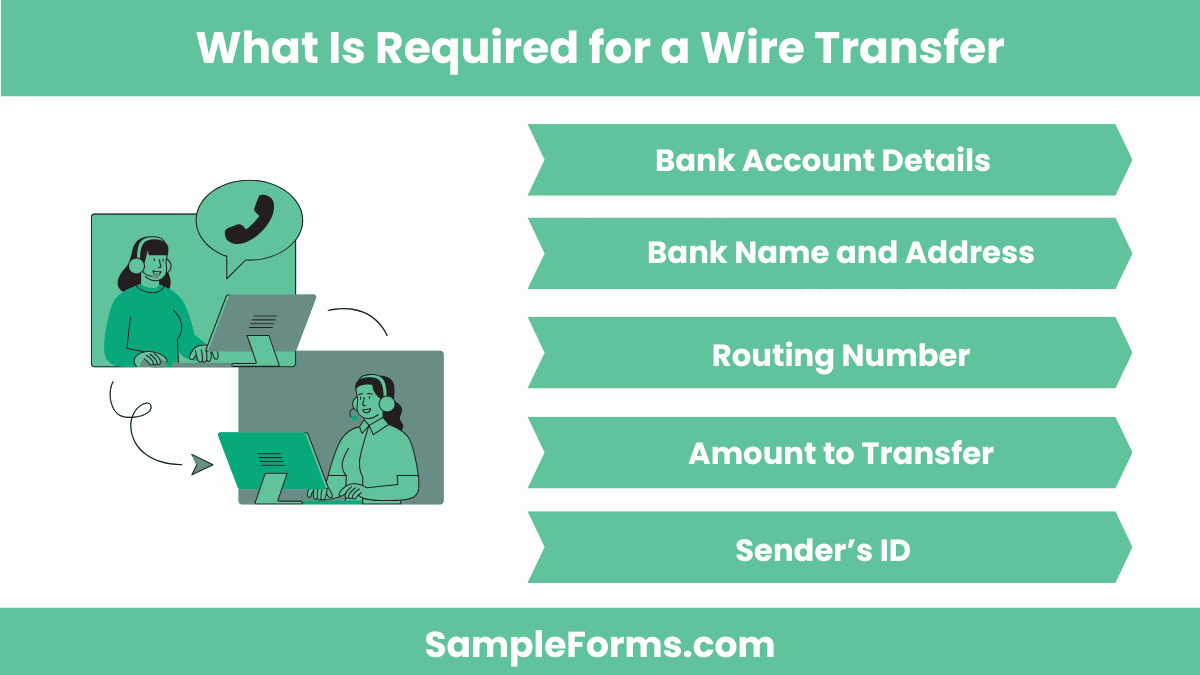

What Is Required for a Wire Transfer?

To complete a wire transfer, certain information is needed to ensure successful processing and secure transaction:

- Bank Account Details: Provide accurate bank account numbers for both sender and recipient.

- Bank Name and Address: Include the name and address of both banks involved in the transaction.

- Routing Number: A routing or SWIFT number is essential for identifying the bank.

- Amount to Transfer: Specify the exact amount being transferred.

- Sender’s ID: Proper identification must be provided, similar to submitting a Land Transfer Form for property transfers.

How Is Wire Transfer Done?

A wire transfer is done by electronically sending funds from one bank to another. Follow these essential steps:

- Initiate the Transfer: Contact your bank and request a wire transfer.

- Provide Recipient Details: Give the recipient’s name, bank details, and account number.

- Specify Transfer Amount: Ensure the correct amount is entered for transfer.

- Confirm with Bank: Verify all details with your bank before finalizing the transaction.

- Complete the Transfer: The funds are transferred within a few hours or days, similar to an Assets Transfer Form submission.

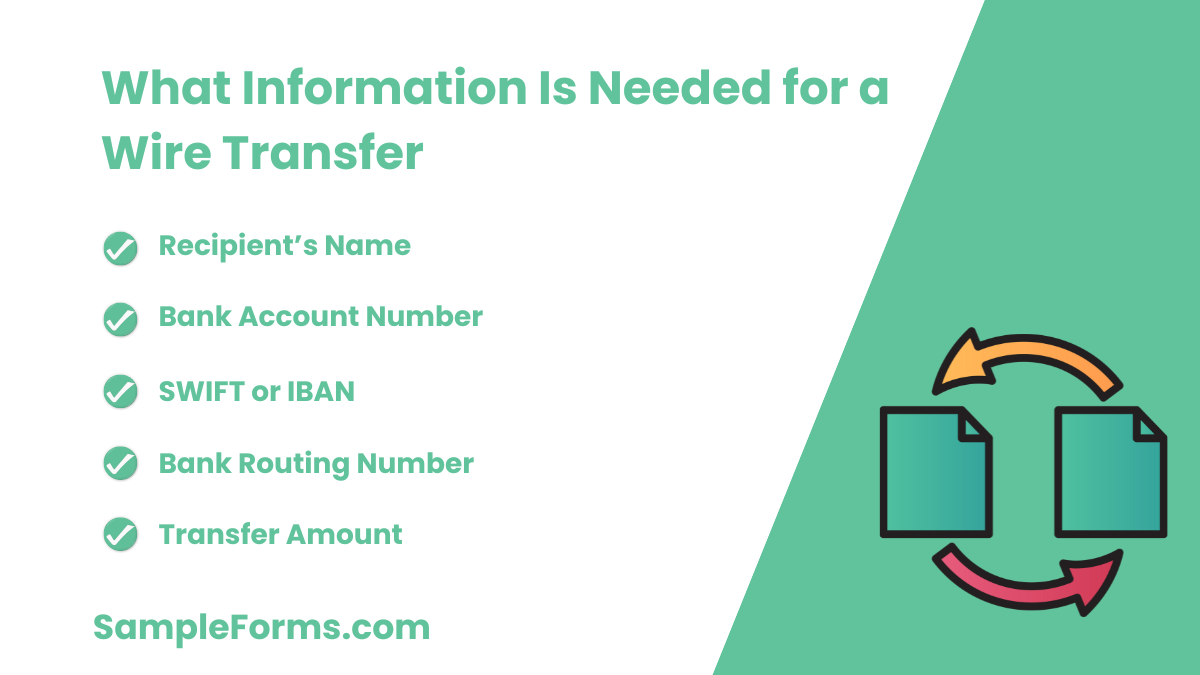

What Information Is Needed for a Wire Transfer?

For a wire transfer, accurate and complete information is necessary to avoid delays:

- Recipient’s Name: Full legal name of the person receiving the funds.

- Bank Account Number: Correct bank account number to ensure the money reaches the right destination.

- SWIFT or IBAN: International transfers require a SWIFT code or IBAN for identification.

- Bank Routing Number: Used for domestic transfers, similar to using a Student Transfer Form for school.

- Transfer Amount: Clearly state the amount to be transferred to avoid discrepancies.

What Are the Disadvantages of Wire Transfer?

While wire transfers are quick and secure, they have certain drawbacks:

- Fees: Wire transfers can incur significant fees, particularly for international transfers.

- Irreversibility: Once initiated, wire transfers cannot be reversed, unlike a Material Transfer Form that may allow cancellation.

- Processing Time: International transfers can take a few days to process.

- Exchange Rates: For international transfers, exchange rates can affect the total amount received.

- Limited Information: There’s often no detailed explanation attached to the transfer

How Do I Show Proof of a Wire Transfer?

Proof of a wire transfer is essential for both legal and transaction tracking purposes:

- Transaction Receipt: Your bank provides a receipt once the wire transfer is completed.

- Bank Statement: The wire transfer appears in your bank statement, similar to an entry on an Employee Transfer Form.

- Confirmation Email: Banks may send a confirmation email upon successful transfer.

- Tracking Number: Many banks provide a reference number for tracking purposes.

- Recipient’s Confirmation: The recipient may provide acknowledgment of receipt, similar to proving a Deed Transfer Form has been processed

Why Would Someone Use a Wire Transfer?

Wire transfers are used for fast, secure fund transfers between banks. They are ideal for large transactions, like completing a Property Transfer Form for purchasing real estate.

Is There a Limit on Wire Transfers?

Yes, banks may set daily or transaction limits for wire transfers, especially internationally. Large transfers, such as an Asset Transfer Form, may require approval.

Does a Wire Transfer Happen Immediately?

Domestic wire transfers are usually processed within hours, while international transfers may take a few days, much like a Fund Transfer Form.

How Much Does a Wire Transfer Cost?

Wire transfer fees range from $15 to $50, depending on the bank and whether it’s domestic or international, similar to filing a Stock Transfer Form.

What Is an Illegal Wire Transfer?

An illegal wire transfer involves unauthorized or fraudulent funds movement, often flagged for financial crimes, like in fraudulent Title Transfer Form cases.

What Is the Cheapest Way to Send a Wire Transfer?

The cheapest way is using banks offering low fees or online platforms, similar to using a free Inventory Transfer Form for simpler transactions.

How Do I Avoid a Wire Transfer Fee?

To avoid fees, choose banks with no-cost wire transfer options or use online services, similar to avoiding charges for a Gun Transfer Form.

Are Wire Transfers Taxed?

Wire transfers themselves are not taxed, but the funds being transferred may be subject to taxes, like in the sale of property using an Ownership Transfer Form.

How Much Does a Wire Transfer Cost?

A wire transfer typically costs $15 to $50, depending on the transaction type, akin to processing a Medical Records Transfer Form.

How Can I Get Proof of Wire Transfer?

You can obtain proof via a transaction receipt or confirmation email, much like receiving confirmation for completing a Gun Owners Transfer Form

The Wire Transfer Form is an essential tool for securely transferring funds between accounts. Our guide offers samples, forms, and letters to help you navigate this process effectively. Whether you’re sending money domestically or internationally, following the correct procedure outlined in the Budget Transfer Form ensures a successful transaction. Understanding the basics of the form helps avoid errors and delays, providing a smooth experience for both sender and recipient. Use our comprehensive guide to master the process of wire transfers and manage your financial transactions with ease.

Related Posts

-

FREE 8+ Stock Transfer Forms in PDF | Ms Word

-

FREE 7+ Change in Custodian Forms in MS Word | PDF | Excel

-

FREE 6+ Sample Residence Questionnaire Forms in PDF

-

FREE 7+ Inventory Transfer Forms in MS Word | PDF | Excel

-

FREE 7+ Ownership Transfer Forms in PDF

-

FREE 9+ Asset Transfer Forms in PDF | Ms Word | Excel

-

FREE 10+ Transfer Form Samples in PDF | MS Word | Excel

-

FREE 8+ Sample Transfer Verification Forms in PDF | MS Word

-

FREE 7+ Sample Assets Transfer Forms in MS Excel | PDF

-

FREE 8+ Deed Transfer Form Samples in PDF | MS Word

-

Transfer of Ownership Form

-

FREE 9+ Sample Firearm Transfer Forms in PDF | MS Word

-

Gun Ownership Transfer Form

-

FREE 9+ Sample Title Transfer Forms in PDF | Word

-

School Transfer Form