A Warranty Deed Form is a legal document used to transfer property ownership with guaranteed rights. It assures the buyer that the seller holds a clear title free of liens or claims. This form ensures peace of mind during real estate transactions by offering protection against potential disputes. Whether you’re buying, selling, or refinancing, a properly executed Warranty Form and Deed Form is essential. This comprehensive guide provides practical examples, detailed steps, and expert advice to help you navigate the complexities of property ownership transfers smoothly and confidently.

Download Warranty Deed Form Bundle

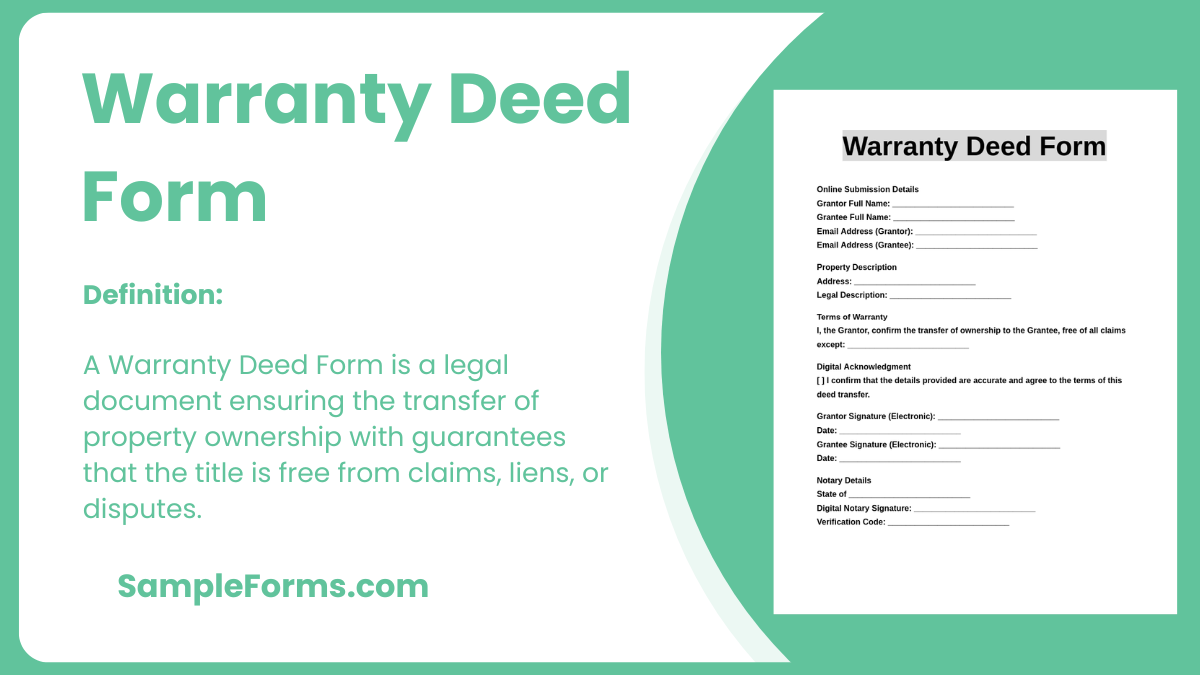

What is Warranty Deed Form?

A Warranty Deed Form is a legally binding document used in real estate transactions to transfer property ownership while guaranteeing the title’s validity. It includes assurances from the seller that there are no encumbrances, liens, or claims on the property. By using this form, buyers can protect their investment and avoid future disputes. This deed is vital for establishing trust in property transfers and is often accompanied by a title insurance policy to provide additional security.

Warranty Deed Format

Grantor Information

Name: __________

Address: __________

Grantee Information

Name: __________

Address: __________

Property Description

Legal Description of Property: __________

Property Address: __________

Transfer Details

Purchase Price: __________

Date of Transfer: __________

Guarantee Statement

The Grantor guarantees that the property is free from liens, claims, or encumbrances, except as listed below: __________

Signatures

Grantor’s Signature: __________

Date: __________

Notary Public Signature: __________

Date: __________

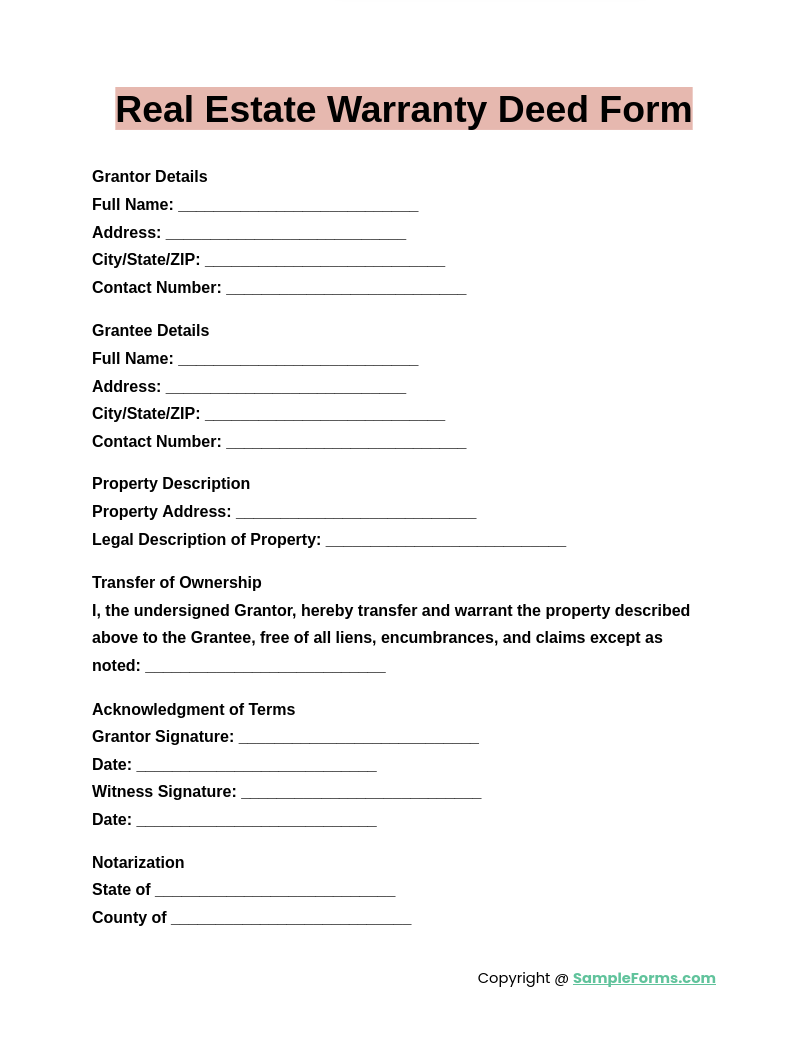

Real Estate Warranty Deed Form

A Real Estate Warranty Deed Form is essential for secure property transfers in real estate. It guarantees a clear title free of encumbrances, protecting both buyers and sellers. Similar to a Warranty Claim Form, it ensures legal clarity and reliable property ownership. This form is indispensable in safeguarding investments and fostering trust in real estate transactions.

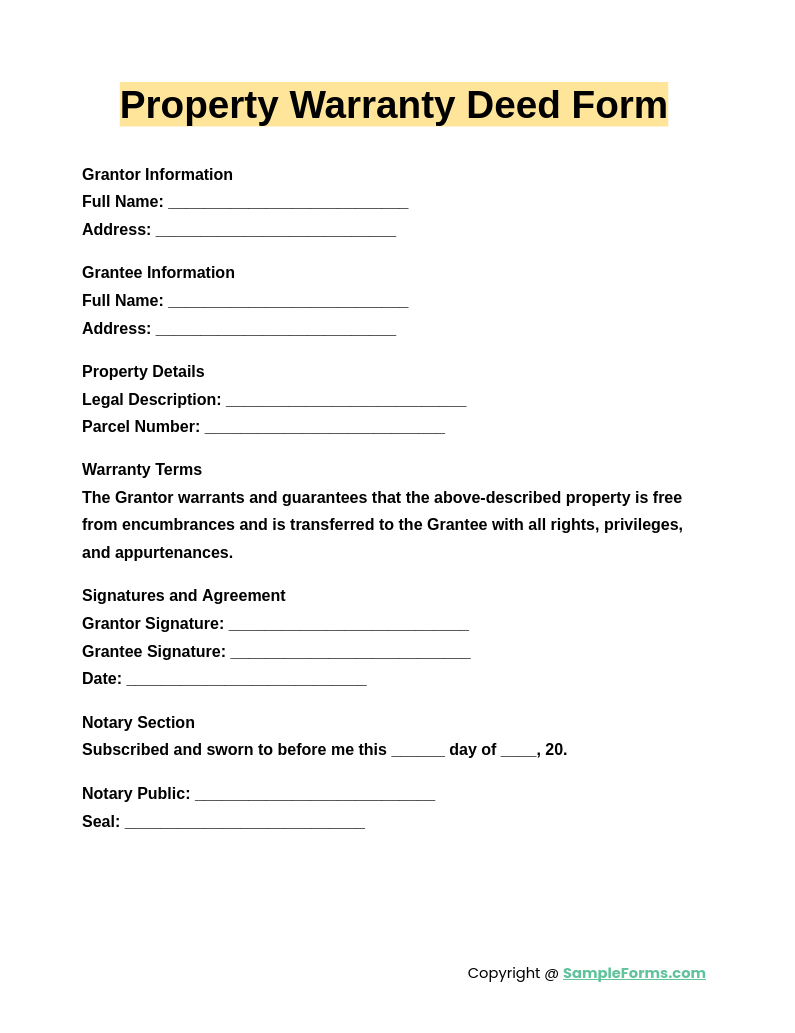

Property Warranty Deed Form

A Property Warranty Deed Form transfers ownership while guaranteeing the title’s validity. It eliminates risks associated with claims or liens, providing peace of mind to buyers. Like a Contract for Deed Form, this form ensures transparency in property transactions, making it a cornerstone document for secure property ownership.

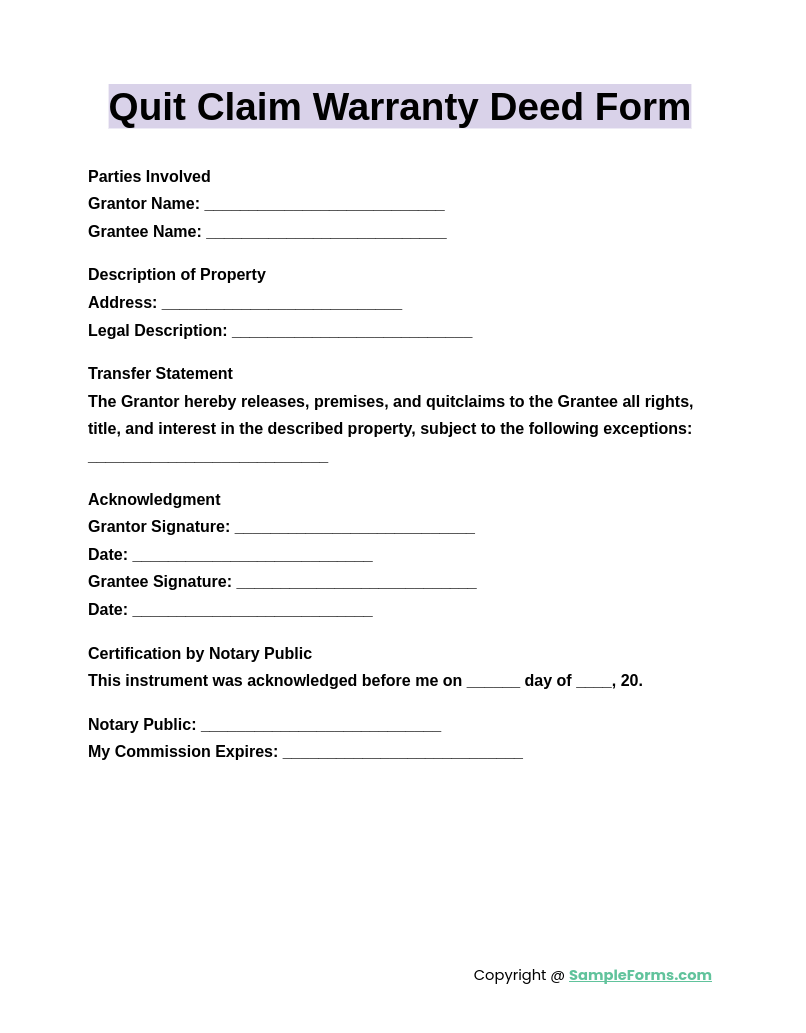

Quit Claim Warranty Deed Form

A Quit Claim Warranty Deed Form is used to transfer property ownership without guaranteeing the title’s history. It’s ideal for transfers between family members or trusted parties. Similar to a Deed Transfer Form, it simplifies ownership transitions while ensuring legal compliance.

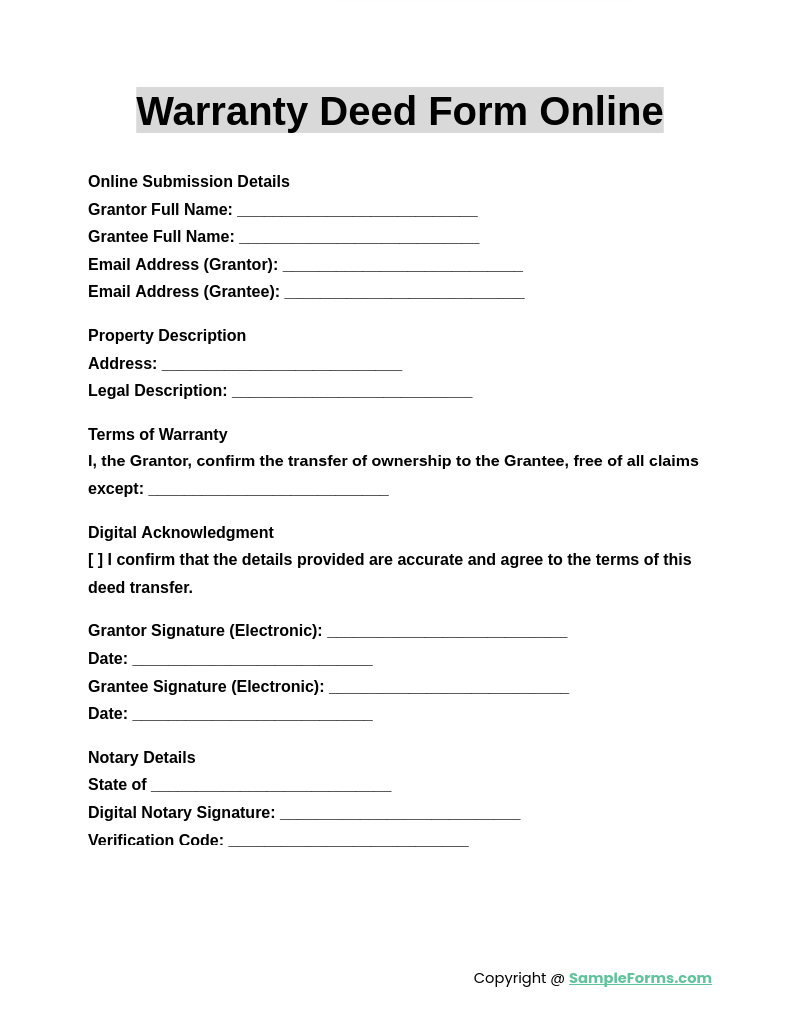

Warranty Deed Form Online

A Warranty Deed Form Online offers a digital solution for secure and efficient property ownership transfers. It combines convenience with legal validity, ensuring clear titles for buyers. Like a Grant Deed Form, it is tailored for modern, hassle-free real estate transactions, providing the assurance of title protection in a user-friendly format.

Browse More Warranty Deed Forms

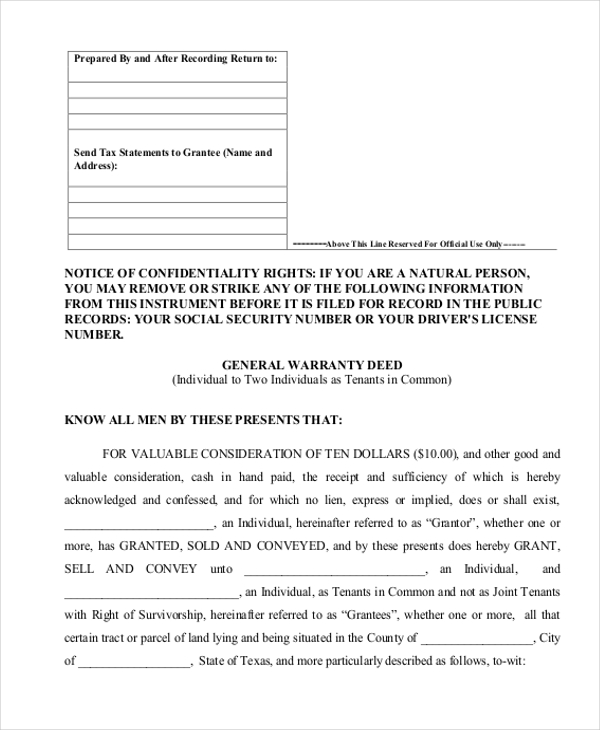

Texas General Warranty Deed Form

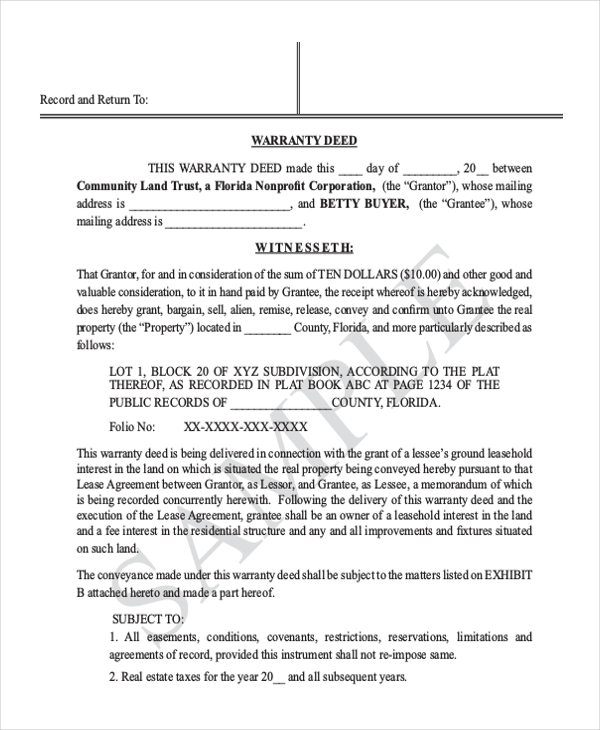

Sample Florida Warranty Deed Form

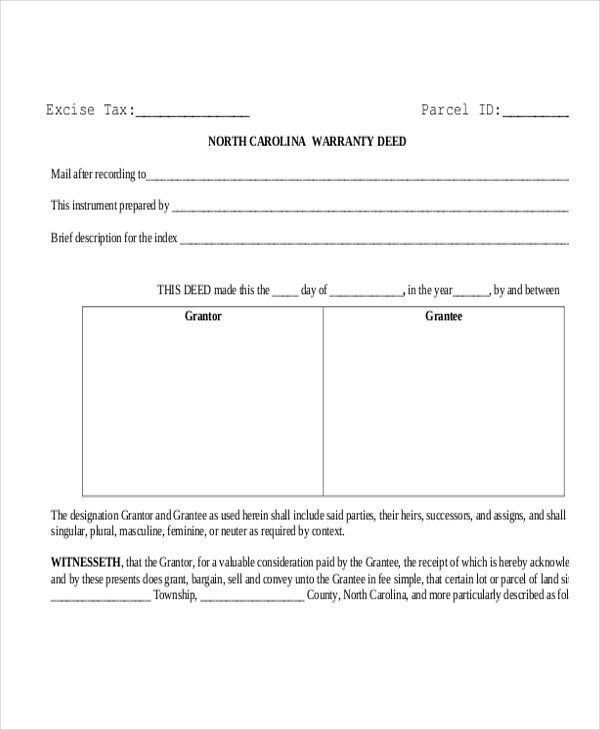

Example of North Carolina Warranty Deed Form

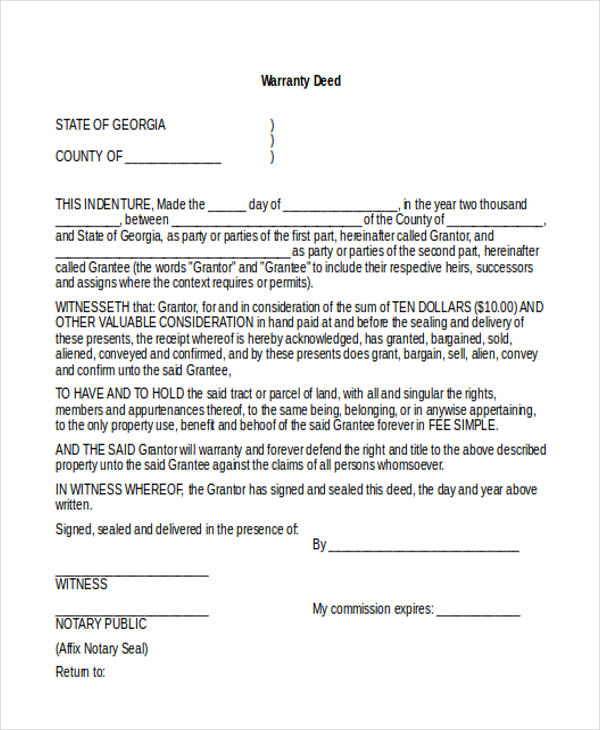

Downloadable Georgia Warranty Deed Form

Free Missouri Warranty Deed Form

This Missouri warranty deed form presents the date of deed execution, Grantor name and address, Grantee name and address, property description and address. It also obtains the signature of the notary public.

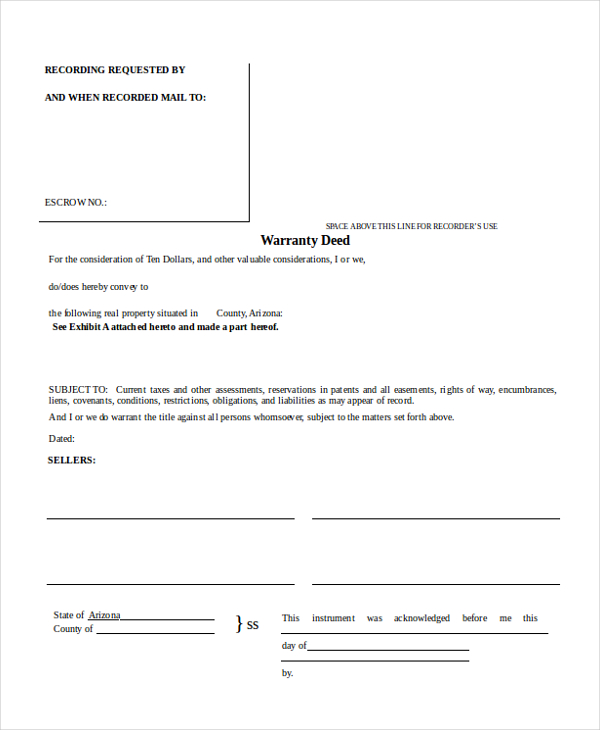

Arizona Warranty Deed Form

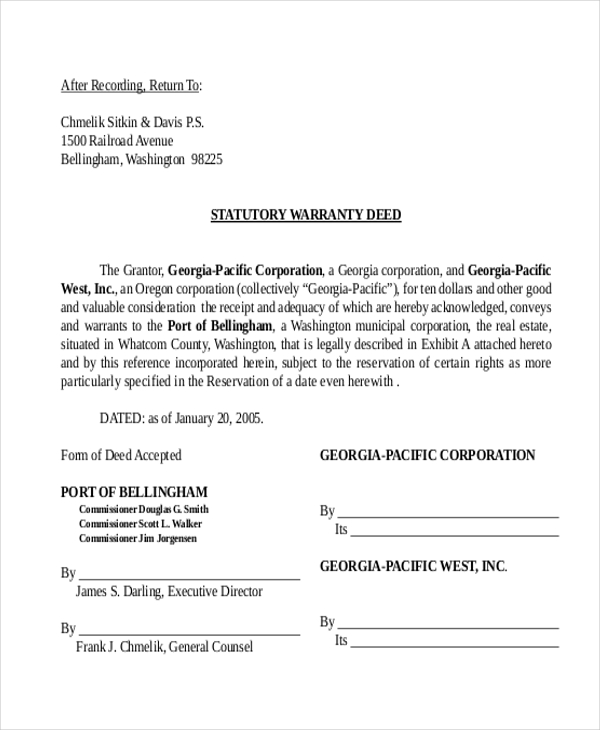

Statutory Warranty Deed Form Format

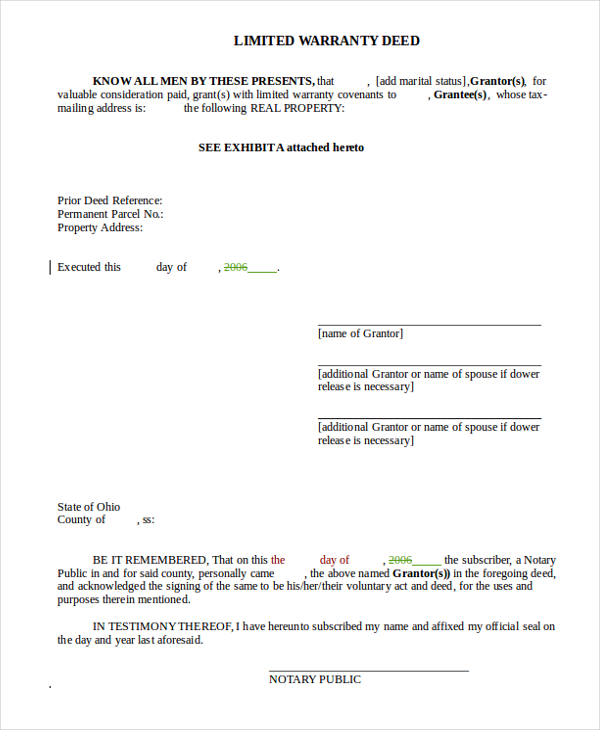

Limited Warranty Deed Form in Word

Why is a warranty deed necessary?

A warranty deed is necessary to ensure clear property ownership, provide legal protection, and instill trust in real estate transactions.

Adhering to specific rules ensures reliability:

- Title Clarity: Guarantees clear ownership for the buyer.

- Legal Security: Protects against future claims.

- Standard Compliance: Meets property transfer regulations.

- Financial Assurance: Builds confidence for lenders and buyers.

- Smooth Transactions: Prevents disputes, unlike a Deed Release Form, which serves a narrower purpose.

Who benefits the most from a warranty deed?

The buyer benefits most from a warranty deed as it guarantees clear ownership and protects against future claims on the property.

Adhering to specific rules ensures optimal use:

- Title Assurance: The buyer gets a clear title free from liens or encumbrances.

- Legal Protection: Provides recourse if title defects arise later.

- Increased Trust: Builds confidence in real estate transactions.

- Smooth Transfers: Facilitates seamless property transfers.

- Enhanced Investment Security: Ensures risk-free property ownership, unlike a Quit Claim Deed Form, which lacks guarantees.

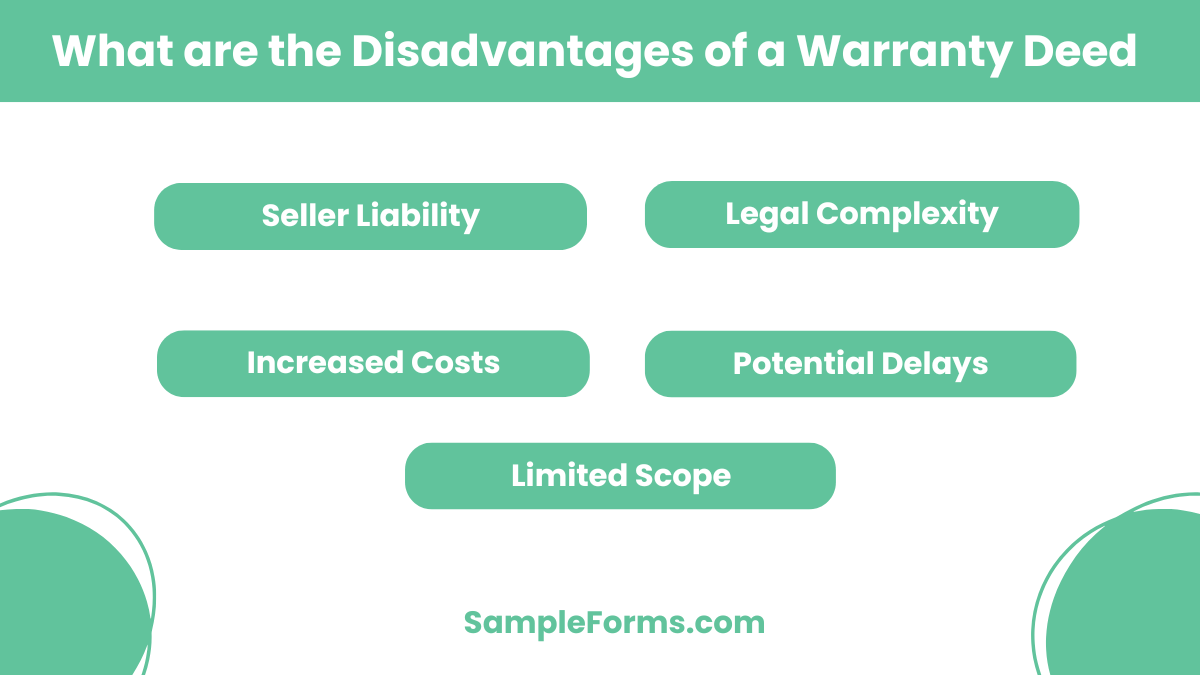

What are the disadvantages of a warranty deed?

Warranty deeds can increase seller liability for title defects and may involve higher legal costs due to the extensive guarantees they provide.

Adhering to specific rules mitigates risks:

- Seller Liability: Responsibility for title issues extends post-sale.

- Legal Complexity: Requires thorough title searches.

- Increased Costs: Higher legal fees compared to other deeds.

- Potential Delays: Longer processing times.

- Limited Scope: Not ideal for all transfers, such as those needing a Deed of Trust Form.

How do I fill out a warranty deed?

Filling out a warranty deed involves including accurate property details, parties involved, and the notarization process to validate the transaction.

Adhering to specific steps ensures accuracy:

- Identify Parties: Clearly state the grantor and grantee.

- Describe the Property: Include the legal description from the title.

- State Consideration: Mention the value exchanged.

- Sign and Notarize: Both parties must sign before a notary.

- File the Deed: Submit it to the county recorder, unlike a Real Estate Deed Form, which may have differing requirements.

How many types of property deeds are there?

There are several types of property deeds, including warranty, quitclaim, grant, and special warranty deeds, each serving unique purposes in real estate.

Adhering to specific rules categorizes deeds:

- Warranty Deed: Offers the most protection to the buyer.

- Quitclaim Deed: Transfers ownership without guarantees.

- Grant Deed: Confirms the seller hasn’t transferred the title to anyone else.

- Deed of Trust: Used as security for loans.

- Quitclaim Deed: Quitclaim Deed Form ownership transfers without warranties.

What is the most common type of warranty deed?

The general warranty deed is the most common, offering complete protection to buyers. It ensures clear title, unlike a Warranty Claim Form, which addresses specific claims.

Who can prepare a deed in Mississippi?

In Mississippi, a licensed attorney or the property owner can prepare a deed. Legal accuracy ensures reliability, unlike a Quit Deed Form, which provides limited guarantees.

What is the safest type of deed?

A general warranty deed is the safest, offering complete protection to the grantee against past claims, unlike a Quit Claim Deed Form, which lacks assurances.

What is the best deed to transfer property?

The general warranty deed is the best for transferring property, providing full guarantees. It’s more comprehensive than an Insurance Claim Form focused on insurance-related claims.

What is the weakest form of deed?

The quitclaim deed is the weakest, as it transfers ownership without guarantees or warranties, similar in simplicity to a Small Claim Form used in disputes.

What is the rule of warranty?

The rule of warranty ensures that the seller guarantees clear property title to the buyer, unlike a Travel Expense Claim Form, which deals with travel reimbursements.

Is Will better than gift deed?

A will ensures inheritance after death, while a gift deed transfers ownership immediately. Each has specific uses, unlike a Travel Insurance Claim Form tailored to travel scenarios.

What is the best warranty deed?

The general warranty deed is the best, offering maximum protection to buyers. It provides more security than a basic Travel Claim Form for incidental claims.

Which deed provides the best warranty for the grantee?

The general warranty deed provides the best warranty, ensuring full legal protection for the grantee, unlike a Statement of Claim Form, which serves other purposes.

Which deed is most preferred by the seller?

Sellers prefer a special warranty deed, limiting liability to their ownership period. It’s less comprehensive than a Claim Reimbursement Form, which handles monetary compensation.

The Warranty Deed Form serves as a cornerstone for secure property ownership transfers. By ensuring a clear title, it protects buyers from future disputes and legal challenges. This guide provides actionable insights and examples to streamline your property transactions. Whether it’s drafting a custom deed or understanding the nuances of a Contractor Warranty Form, this resource empowers buyers and sellers with clarity and confidence in their real estate dealings. Use this form to simplify property transfers and safeguard your investments effectively.

Related Posts Here

-

Waiting List Form

-

Restaurant Schedule Form

-

Mobile Home Bill of Sale

-

Landlord Consent Form

-

60-Day Notice to Vacate Form

-

Financial Statement Form

-

Product Evaluation Form

-

Construction Contract

-

School Receipt Form

-

Restaurant Training Form

-

Daily Cash Log

-

Volleyball Evaluation Form

-

Holding Deposit Agreement Form

-

License Agreement Short Form

-

Fund Transfer Form