A Tuition Reimbursement Form simplifies the process of reclaiming educational expenses covered by employers. Whether you’re advancing your career or upgrading skills, submitting a Reimbursement Request Form ensures that your costs are properly documented and approved. This guide walks you through the step-by-step process of filling out the form, attaching necessary documents, and ensuring a smooth approval process. Learn how to maximize your benefits, meet eligibility requirements, and avoid common mistakes when submitting your reimbursement request.

Download Tuition Reimbursement Form Bundle

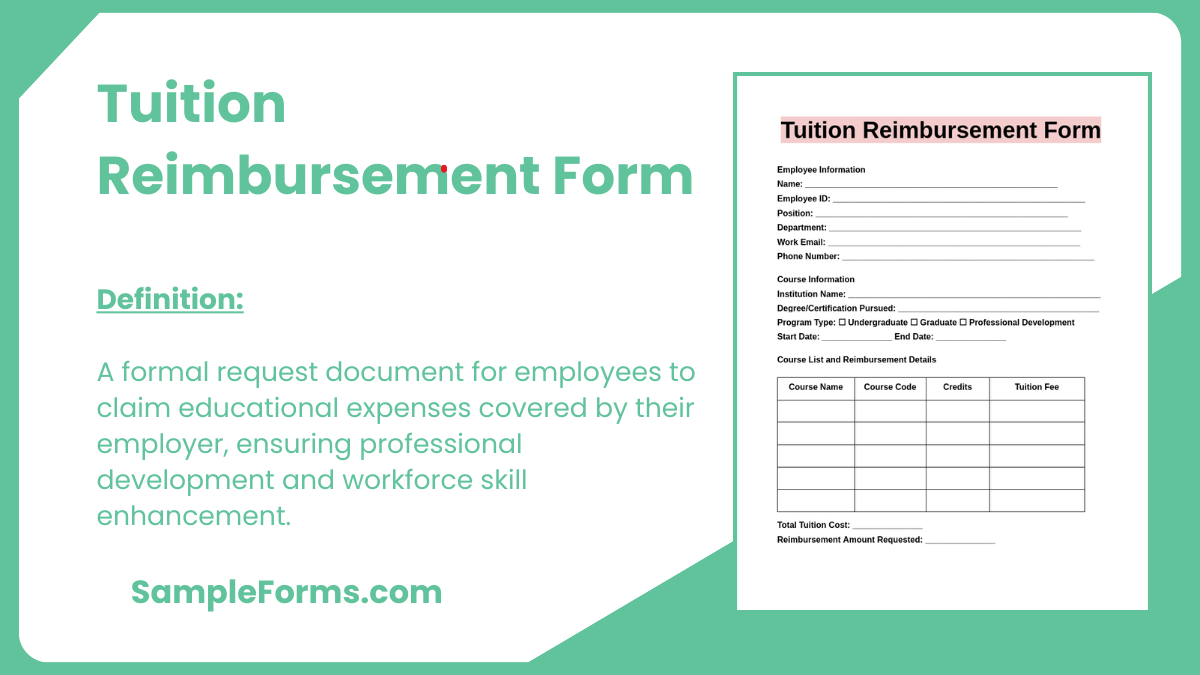

What is Tuition Reimbursement Form?

A Tuition Reimbursement Form is an official document employees use to request repayment for educational expenses covered by their employer. It outlines tuition costs, course details, and eligibility requirements. Employers use this form to validate expenses and ensure the course aligns with company policies. Once submitted, the reimbursement process includes approval from HR or management before the employee receives financial reimbursement.

Tuition Reimbursement Format

Employee Information

Full Name: _______________________________

Employee ID: _______________________________

Department: _______________________________

Position: _______________________________

Contact Number: _______________________________

Email Address: _______________________________

Educational Program Details

Institution Name: _______________________________

Course Title: _______________________________

Degree/Certification Pursued: _______________________________

Course Duration: _______________________________

Total Credit Hours: _______________________________

Expense Details

Tuition Cost: $_______________________________

Books and Supplies Cost: $_______________________________

Total Amount Requested: $_______________________________

Reason for Reimbursement

Professional Development Goal:

Relevance to Current Role:

Employer Benefit:

Required Documentation

☐ Proof of Enrollment

☐ Tuition Payment Receipt

☐ Course Completion Certificate

Approval & Authorization

Supervisor’s Name: _______________________________

Supervisor’s Signature: _______________________________

HR Representative Name: _______________________________

HR Signature: _______________________________

Date: _______________________________

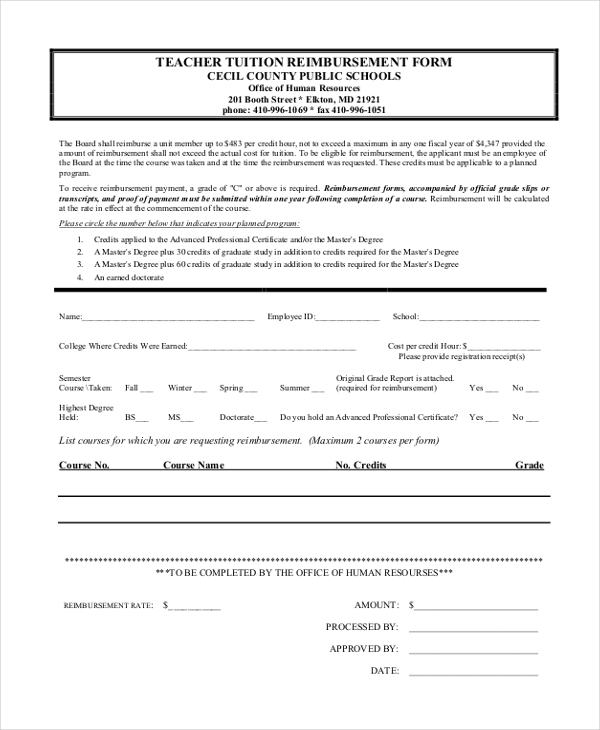

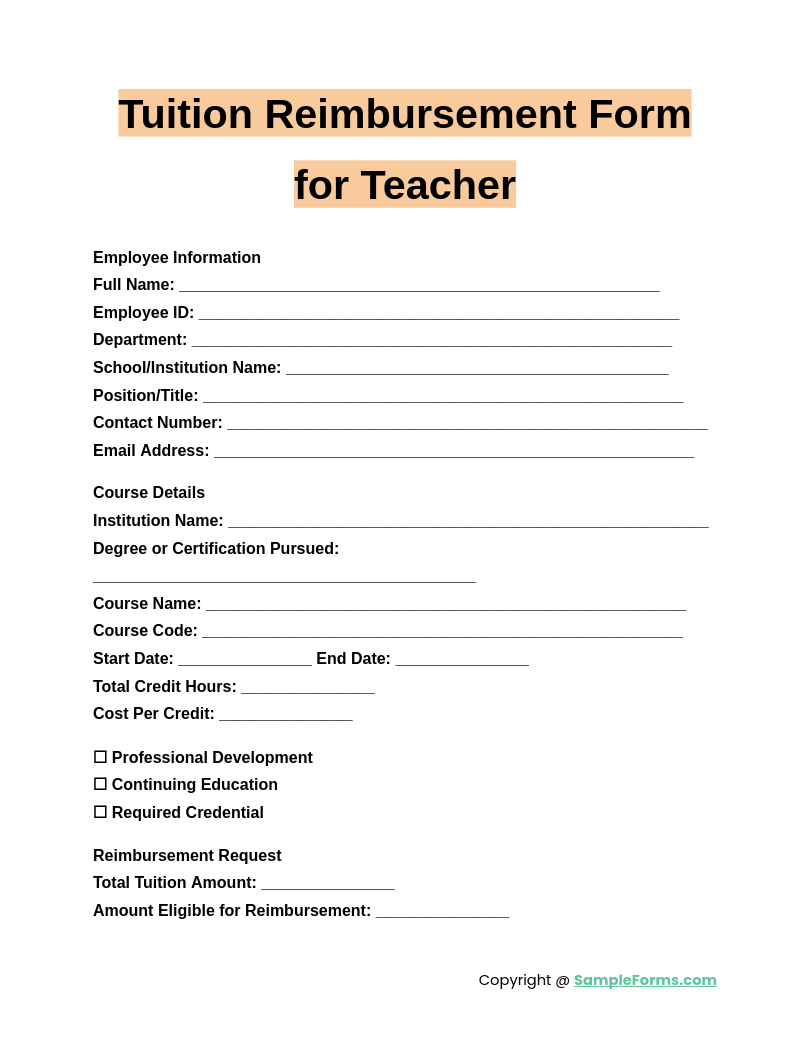

Tuition Reimbursement Form for Teacher

A Tuition Reimbursement Form for Teacher helps educators claim professional development expenses. Similar to an Expense Reimbursement Form, it ensures accurate reporting of tuition costs, course details, and employer approvals, promoting continuous learning and career advancement in the education sector.

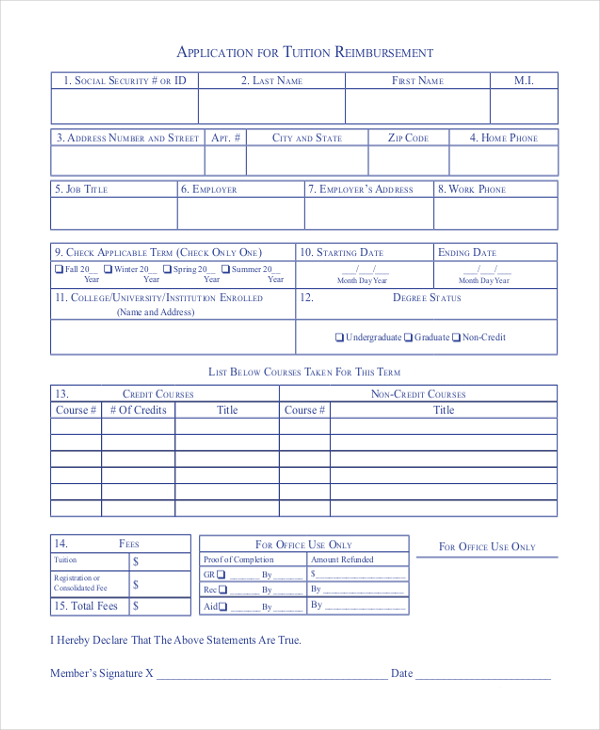

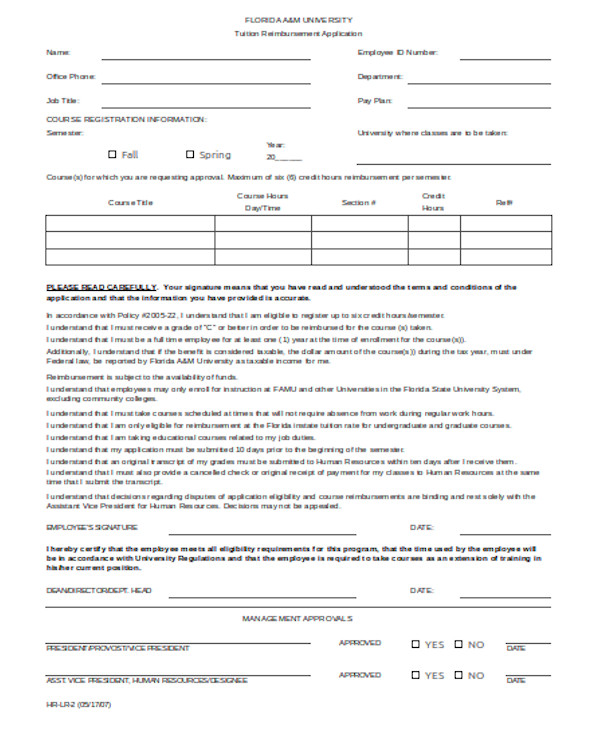

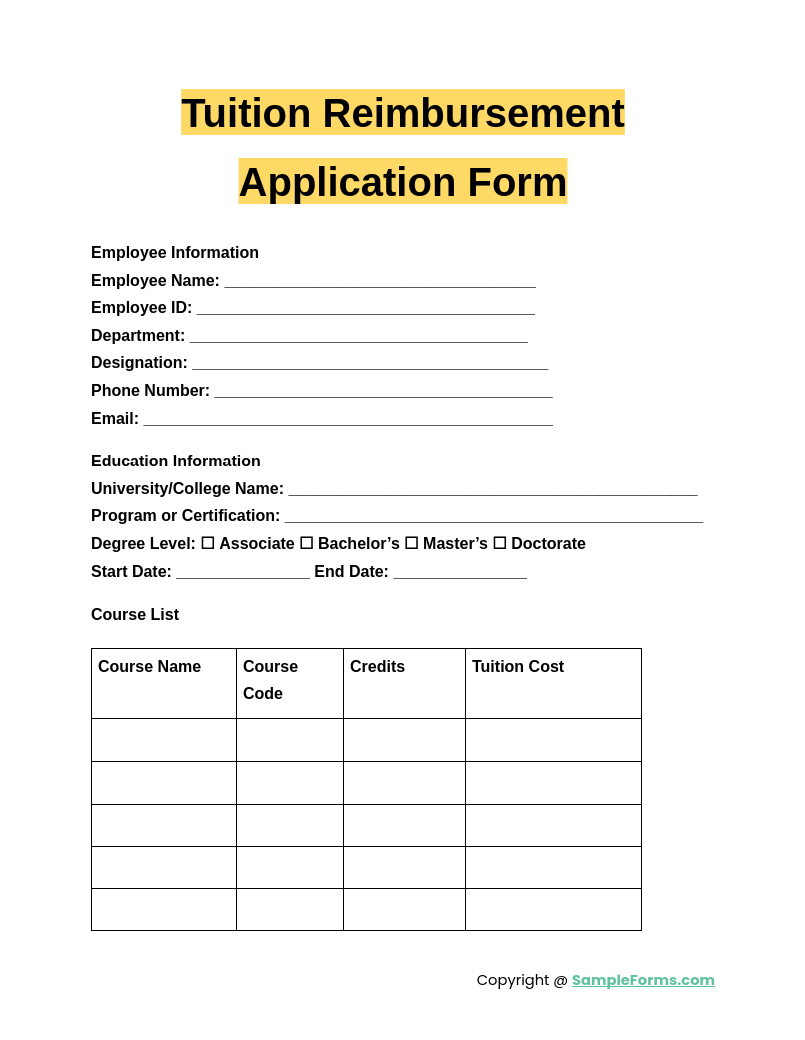

Tuition Reimbursement Application Form

A Tuition Reimbursement Application Form is essential for employees seeking financial assistance for approved courses. Like a Medical Reimbursement Form, it verifies expenses, eligibility, and policy compliance, ensuring smooth processing of educational reimbursements through employer-sponsored programs.

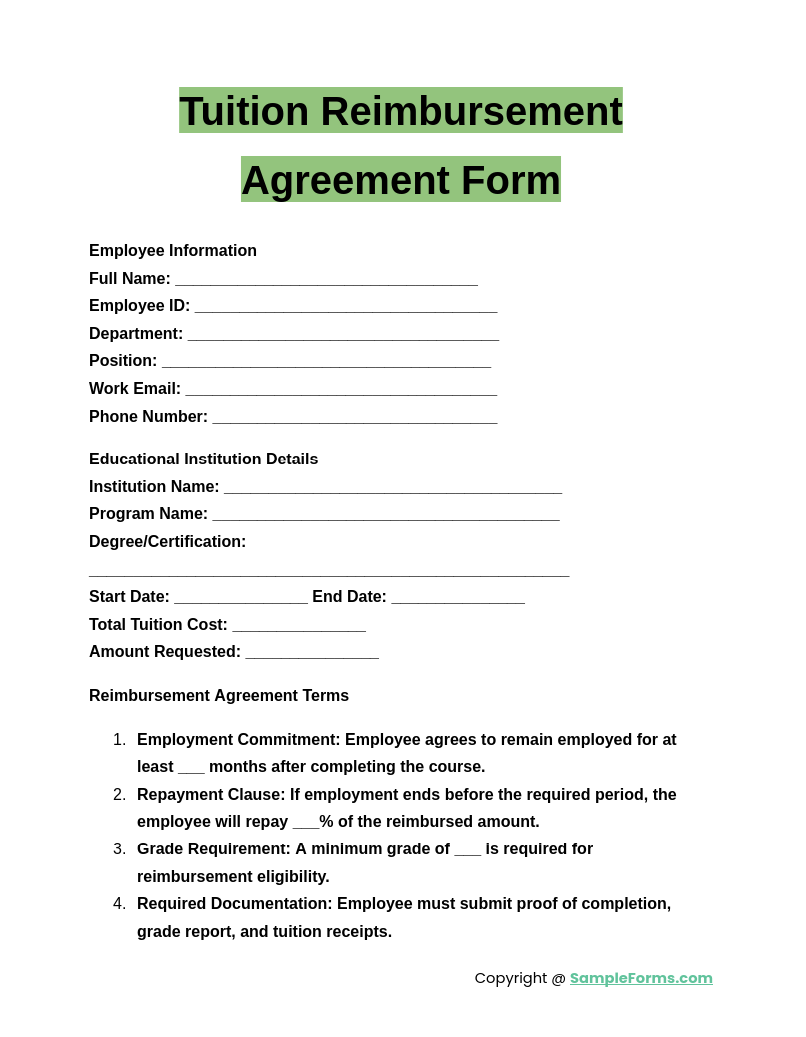

Tuition Reimbursement Agreement Form

A Tuition Reimbursement Agreement Form outlines employer and employee obligations regarding tuition reimbursement. Similar to a Travel Reimbursement Form, it formalizes repayment terms, eligibility criteria, and course relevance, ensuring compliance with corporate learning support policies.

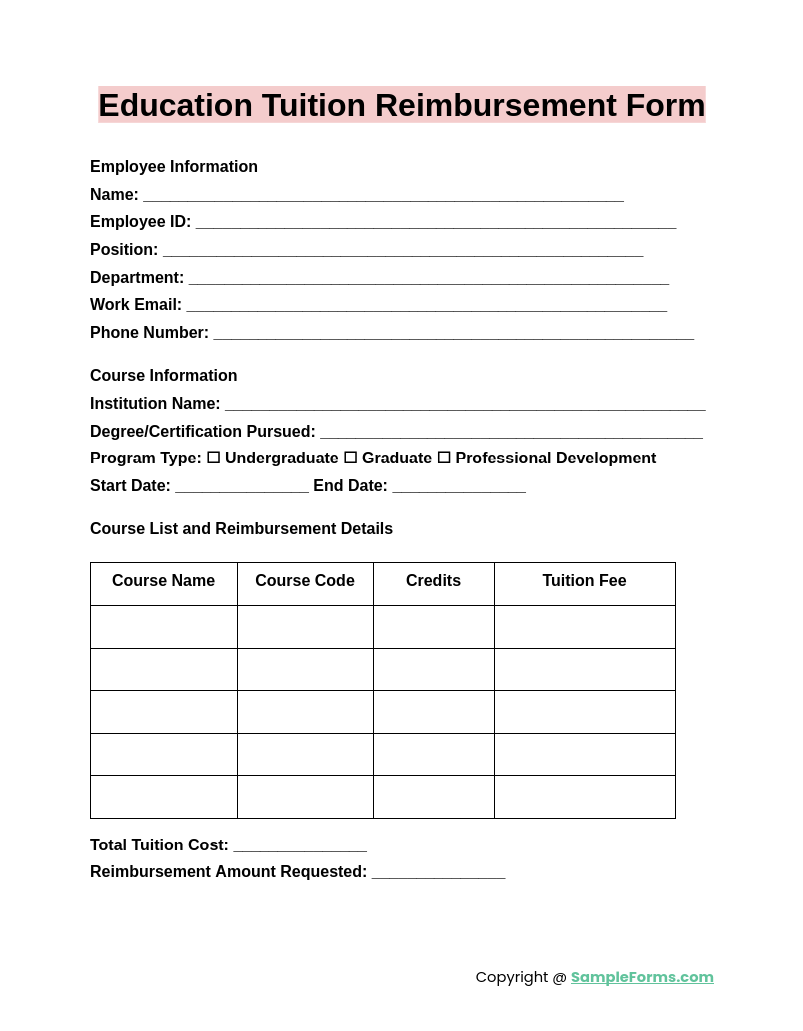

Education Tuition Reimbursement Form

An Education Tuition Reimbursement Form is used to request reimbursement for tuition-related expenses. Like a Mileage Reimbursement Form, it documents financial details, course verification, and approval processes, ensuring transparency and structured reimbursement for education costs.

Browse More Tuition Reimbursement Forms

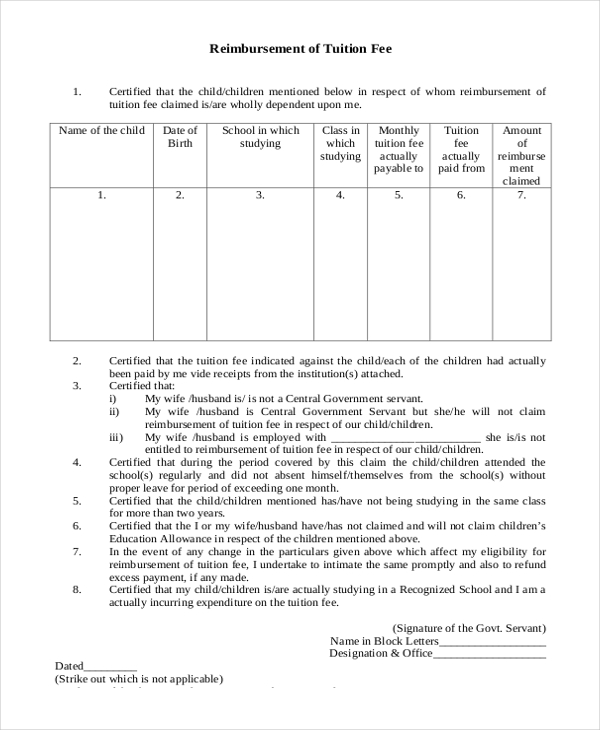

Sample Tuition Fee Reimbursement Form

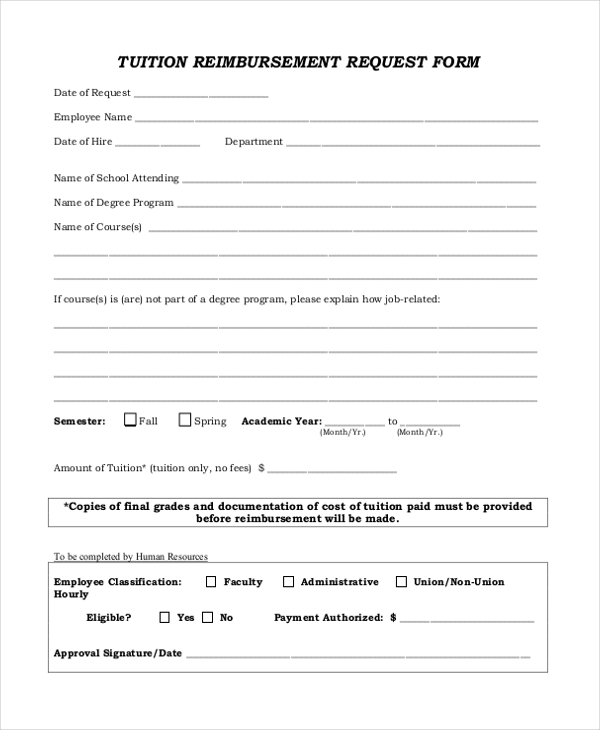

Tuition Reimbursement Request Form

Tuition Reimbursement Application Form

Sample Tuition Reimbursement Approval Form

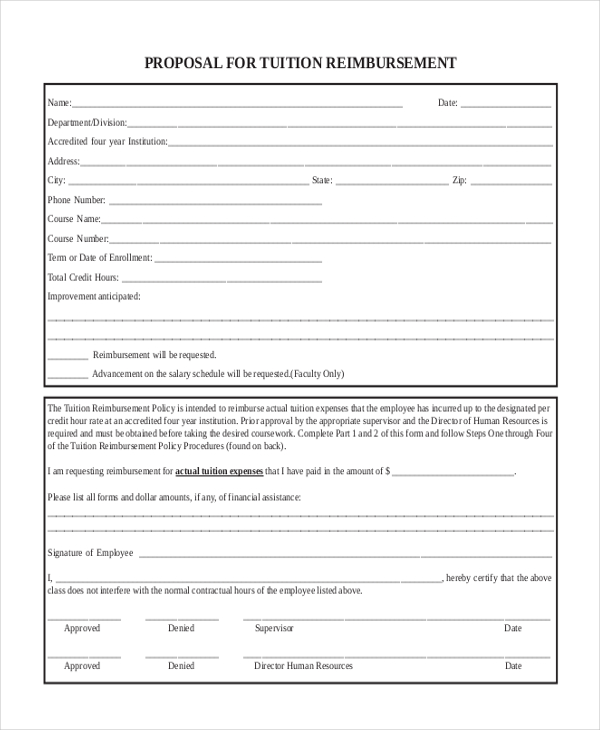

Tuition Reimbursement Proposal Form

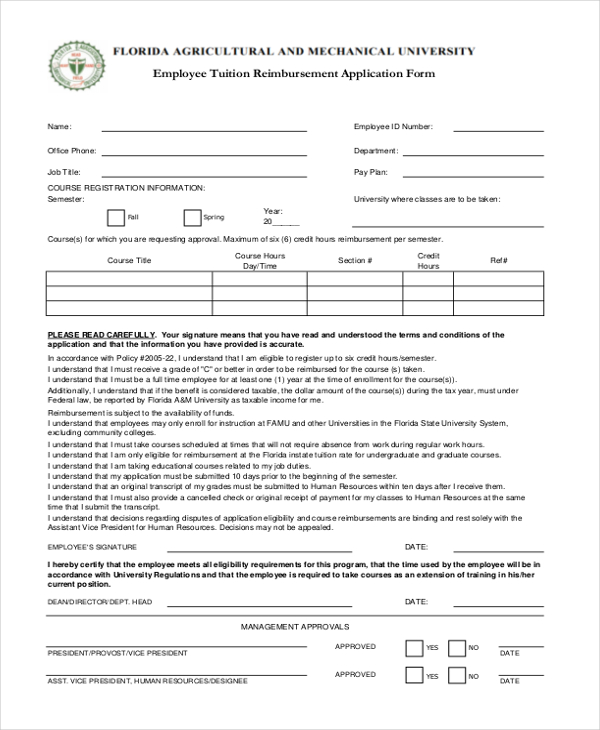

Sample Employee Tuition Reimbursement Form

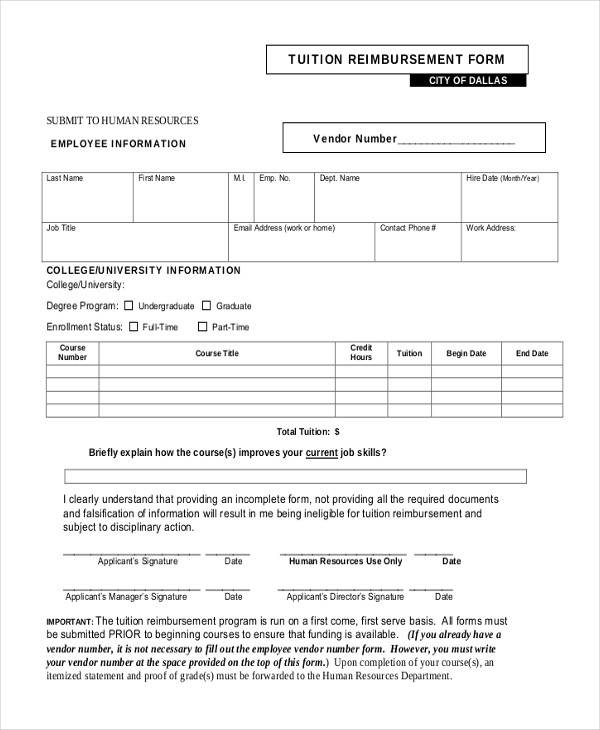

Vendor Tuition Reimbursement Form

Teacher Tuition Reimbursement Form

Sample Tuition Reimbursement Request Form

University Tuition Reimbursement Form

What is the purpose of a reimbursement form?

A reimbursement form helps employees request repayment for eligible expenses covered by their employer. Similar to a Nextcare Reimbursement Form, it ensures financial accuracy, accountability, and policy compliance for tuition and other costs.

- Expense Verification: Confirms that tuition costs meet employer reimbursement policies.

- Financial Accountability: Tracks educational expenses to prevent fraud or misuse.

- Approval Process: Ensures the company authorizes and validates the reimbursement request.

- Record Keeping: Maintains documentation for tax and audit purposes.

- Compliance Assurance: Aligns with employer and legal reimbursement policies.

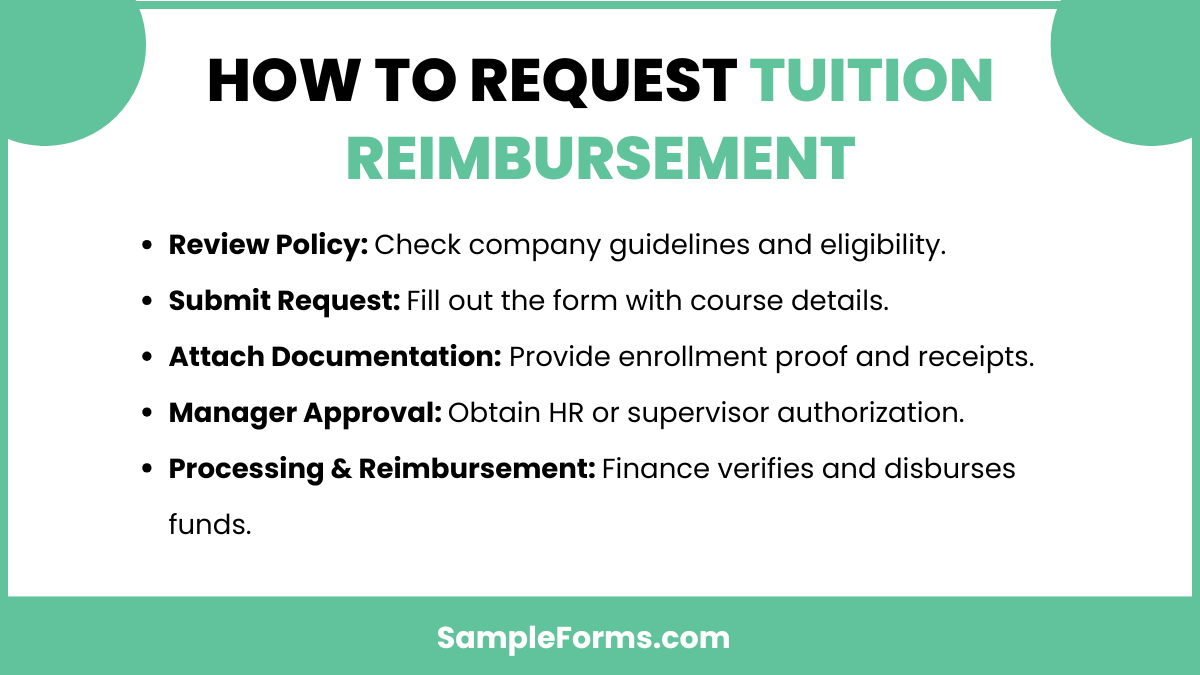

How to request tuition reimbursement?

Requesting tuition reimbursement requires following company guidelines and submitting necessary documentation. Like a Request Reimbursement Form, the process involves structured steps for approval and fund disbursement.

- Review Policy: Understand company reimbursement policies, eligibility, and course requirements.

- Submit Request: Complete the reimbursement form, including course details and tuition costs.

- Attach Documentation: Provide proof of enrollment, payment receipts, and approval letters.

- Manager Approval: Get authorization from HR or a supervisor.

- Processing & Reimbursement: Finance reviews and disburses the approved amount.

How to ask for tuition reimbursement?

Professionally requesting tuition reimbursement involves clear communication and justification. Similar to a Petty Cash Reimbursement Form, it requires detailing expenses and demonstrating benefits to the organization.

- Understand Employer Policy: Check reimbursement limits and eligibility criteria.

- Draft a Request Letter: Clearly explain course relevance and expected benefits.

- Attach Supporting Documents: Provide course details, tuition receipts, and academic approvals.

- Meet with HR or Manager: Discuss the request formally before submission.

- Follow Up: Ensure processing and track reimbursement status.

What are the cons of tuition reimbursement?

While beneficial, tuition reimbursement has potential downsides. Like a Claim Reimbursement Form, employees must adhere to conditions, policies, and restrictions before receiving funds.

- Upfront Costs: Employees pay tuition first and wait for reimbursement.

- Eligibility Restrictions: Not all courses or employees qualify for reimbursement.

- Repayment Obligations: Leaving the company early may require repayment of reimbursed funds.

- Approval Complexity: Multiple authorizations and documentation are often required.

- Processing Delays: Reimbursement may take weeks or months to finalize.

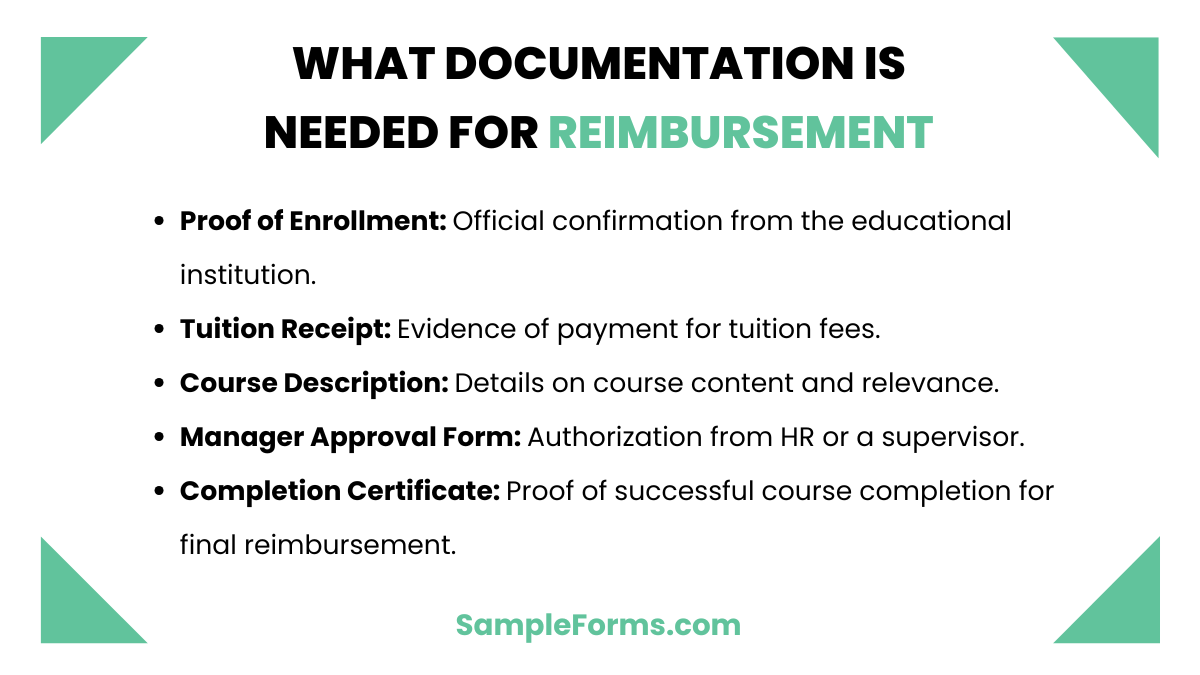

What documentation is needed for reimbursement?

Submitting tuition reimbursement requires specific documents for verification. Similar to a Student Reimbursement Form, these ensure eligibility and compliance with reimbursement policies.

- Proof of Enrollment: Official confirmation from the educational institution.

- Tuition Receipt: Evidence of payment for tuition fees.

- Course Description: Details on course content and relevance.

- Manager Approval Form: Authorization from HR or a supervisor.

- Completion Certificate: Proof of successful course completion for final reimbursement.

Does tuition reimbursement count as income?

Tuition reimbursement is generally not taxable if it meets IRS guidelines. Similar to an Employee Expense Reimbursement Form, amounts exceeding limits may be considered taxable income by the IRS.

What can I use my tuition refund for?

Tuition refunds can cover education-related expenses. Like an Employee Reimbursement Form, approved expenses may include tuition fees, books, and eligible coursework costs but not unrelated personal expenses.

Who is eligible for tuition reimbursement?

Employees pursuing employer-approved education may qualify. Like a Travel Allowance Form, eligibility depends on tenure, course relevance, and employer policies ensuring career growth and skills development.

What is the IRS rule for tuition reimbursement?

The IRS allows up to $5,250 in tax-free tuition assistance. Similar to a House Rent Allowance Form, exceeding this amount may require tax reporting as additional income.

How do you justify tuition reimbursement?

Employees must prove the course benefits their job. Like an Allowance Form, tuition reimbursement supports career advancement, improving skills that align with company goals and professional growth.

Does reimbursement count as income?

Reimbursements are generally non-taxable if job-related. Like a Disability Allowance Application Form, they are subject to IRS policies, and excess reimbursements beyond permitted limits may be considered taxable income.

Is tuition reimbursement worth it?

Tuition reimbursement reduces education costs while boosting career prospects. Like a Travel Expense Claim Form, it provides financial relief, making professional development more accessible without significant out-of-pocket expenses.

What qualifies for tuition reimbursement?

Eligible programs typically include job-related courses. Like a Travel Insurance Claim Form, documentation proving course relevance, expenses, and employer approval is required for successful reimbursement.

What is the tax form for tuition refund?

IRS Form 1098-T reports qualified education expenses. Like a Travel Claim Form, it helps taxpayers claim deductions, credits, or adjustments related to tuition and education costs.

How do I report tuition reimbursement on my taxes?

Report taxable tuition assistance on your W-2. Similar to a Claim Reimbursement Form, any non-qualified reimbursement should be declared as additional income on your tax return.

A Tuition Reimbursement Form is a crucial tool for employees looking to advance their education while benefiting from employer-sponsored tuition programs. Properly filling out this document ensures timely approval and reimbursement. Whether submitting for a single course or an entire degree, using the correct format guarantees a smooth process. Employers benefit by retaining skilled employees while supporting professional development.