A type of lease agreement that can be considered as a common lease structure mostly used in commercial real estate is termed as a triple net lease. This type of lease agreement is mostly misunderstood by many commercial real estate professionals. With this lease structure, almost all the responsibilities fall on the tenant compared to the landlord. As the tenant will be responsible for paying the rent as well as the landlord’s part of taxes.

- Sample Lease Agreement Forms

- Sample Rent Lease Agreements in PDF

What is a Triple Net (NNN) Lease Agreement?

A lease agreement on a property in which the tenant or the lessee promises to pay all the expenses of the property including the real estate taxes, building insurance, and maintenance is known as a triple net lease agreement. All these payments are in added to the fees for rent and the utilities along with all payments are the responsibility of the landlord on the absence of a triple, double, or a single net lease.

Key Features of a Triple Net (NNN) Lease

- Mostly, triple net lease agreements are used for self-governing commercial buildings, and this usually happens with a single tenant. It can also be used for other property types as well.

- Typically, a triple net lease has an initial term of 10 years or more than that, and often have built-in rent increases.

- A triple net lease is generally liked by landlords and investors as they help to create a steady and predictable income course. As the tenant is responsible for paying the building insurance and property taxes, the tables are on the landlord’s side, hence making him enjoy the profits of not paying for these extra expenses.

- The tenants can also benefit from a triple net lease is some ways. As the landlord does not have to worry about most of the extra costs of owning the property, a triple net lease has a lower rental rate than a standard lease. The cost of the property taxes, insurance, and maintenance costs will be provided in the lease term and the total cost savings are provided to the tenant.

3+ Triple-Net (NNN) Lease Agreement Samples in PDF | DOC

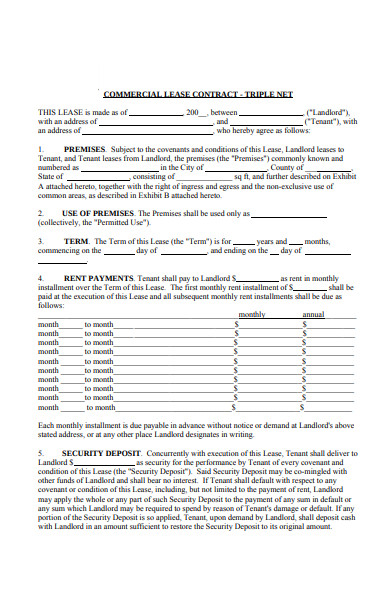

1. Commercial Triple-Net Lease Agreement

A real estate contract that is used for non-residential property and is made between landlords and a business tenant is known as a triple net commercial lease agreement. This agreement typically states that the landlord must cover most of the expenses on the property and that the monthly rent shall include all fees that are related to property taxes, insurance, and maintenance on the property. This agreement will declare that the tenant will only be responsible for the utility and services on the property like electricity, water, internet, etc. This agreement portrays various terms and conditions that have to be followed after signing the document.

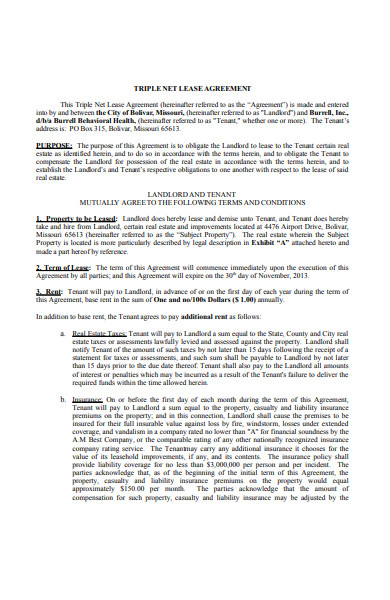

2. Sample Triple Net Lease Agreement

This is a sample triple net lease agreement for your reference purpose. It lays out the terms and conditions along with the tenant’s covenants that have to be read out thoroughly before signing. The purpose of this agreement is to obligate the landlord to lease to the tenant certain real estate as identified in this document. To do so as per the terms provided here and to establish the landlord’s and tenant’s respective obligations to one another concerning the lease of the given real estate, this agreement is employed. It also mentions the indemnification including liabilities f e and losses and other important provisions.

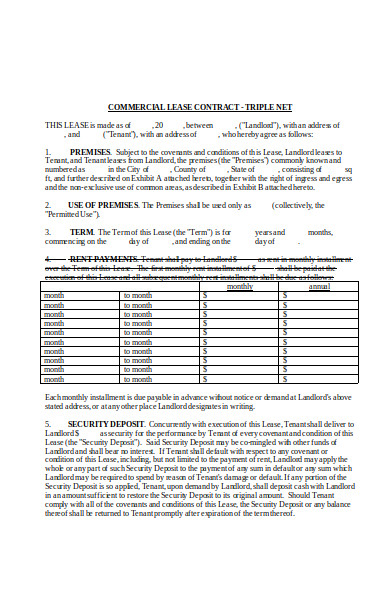

3. Triple Net Commercial Lease Contract

This is a triple net commercial agreement that is a land contract for non-private property among owners and a business occupant. This term triple-net implies to the owner covering a large portion of the costs on the property, and that the month-to-month lease integrates all charges that are related to property duties, protection, and normal territory support on the property.

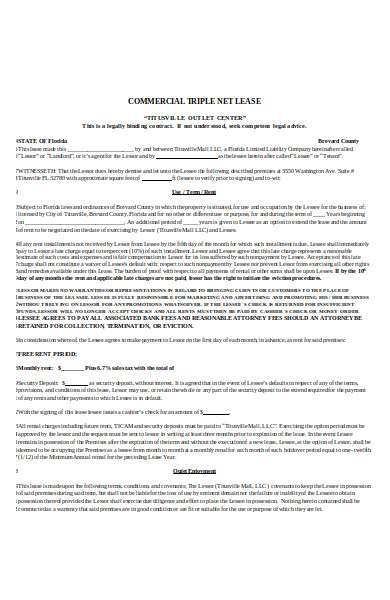

4. Commercial Triple Net Lease Agreement

In case a property owner puts their building out for a lease using a triple net lease, the tenant is responsible for paying the building’s property taxes, building insurance, and other maintenance costs or repairs that the building may require. Typically, it is the landlord who has to be responsible for these costs, but in this case, the tenant is covering these costs, therefore the rent that is extracted in the triple net lease is lower than the rent extracted in a standard lease. The capitalization rate is determined by the creditworthiness of the tenant which is used to calculate the lease amount.

Related Posts

-

FREE 5+ Commercial Sublease Agreement Forms in PDF | MS Word

-

FREE 7+ Office Lease Agreement Forms in PDF | MS Word

-

FREE 5+ Real Estate Lease Guarantee Co-Signer Agreement Forms in PDF | MS Word

-

FREE 5+ Lease with an Option to Purchase Agreement Forms in PDF | MS Word

-

FREE 7+ Realtors Lease Agreement Forms in PDF

-

FREE 10+ Condominium Lease Agreement Forms in PDF | MS Word

-

FREE 5+ Hunting Lease Agreement Forms in PDF | MS Word

-

FREE 9+ Sample Release Agreement Forms in PDF | MS Word

-

FREE 60+ Lease Agreement Forms in PDF | MS Word

-

FREE 9+ Sample Residential Lease Agreement Forms in PDF | MS Word

-

FREE 9+ Sample Sublease Agreement Forms in PDF | MS Word

-

FREE 9+ Sample Rental Lease Agreement Forms in MS Word | PDF

-

FREE 7+ Garage (Parking) Rental Agreement Forms in PDF | MS Word

-

FREE 4+ Salon Booth Rental Agreement Forms in PDF | MS Word

-

FREE 5+ Roommate Rental Agreement Forms in PDF | MS Word