A Travel Expense Form is essential for tracking and reimbursing costs incurred during business or personal travel. Whether used for corporate trips, employee travel, or personal record-keeping, this form ensures clear documentation of expenses, including transportation, lodging, meals, and miscellaneous costs. A well-structured Expense Form and Travel Form simplifies financial tracking, prevents discrepancies, and ensures compliance with reimbursement policies. By maintaining detailed records, individuals and businesses can streamline expense management and enhance budget accuracy. This guide explores the key components of a travel expense form, best practices, and sample templates for seamless financial reporting.

Download Travel Expense Form Bundle

What is Travel Expense Form?

A Travel Expense Form is a document used to record and categorize expenses incurred during travel for business, work, or personal purposes. It includes essential details such as date, purpose, and amount spent on airfare, accommodations, meals, and incidentals. This form helps employees and organizations track expenses, ensure accurate reimbursements, and maintain financial transparency. By documenting expenditures systematically, individuals can claim tax deductions, companies can monitor spending, and finance teams can verify costs before approval. A travel expense form ensures accountability and prevents financial discrepancies, making expense management efficient and organized.

Travel Expense Format

Traveler Information

Full Name: __________

Employee ID: __________

Department: __________

Contact Information: __________

Trip Details

Destination: __________

Purpose of Travel: __________

Departure Date: __________

Return Date: __________

Transportation Expenses

Airfare Cost: __________

Train/Bus Fare: __________

Car Rental Charges: __________

Mileage Reimbursement: __________

Accommodation and Meals

Hotel Expenses: __________

Meal Reimbursement (Breakfast, Lunch, Dinner): __________

Daily Allowance: __________

Miscellaneous Expenses

Conference/Registration Fees: __________

Business Communication (Internet, Calls, Fax): __________

Other Expenses (Explain): __________

Expense Authorization and Approval

Total Amount Claimed: __________

Employee Signature: __________

Supervisor Approval: __________

Finance Department Approval: __________

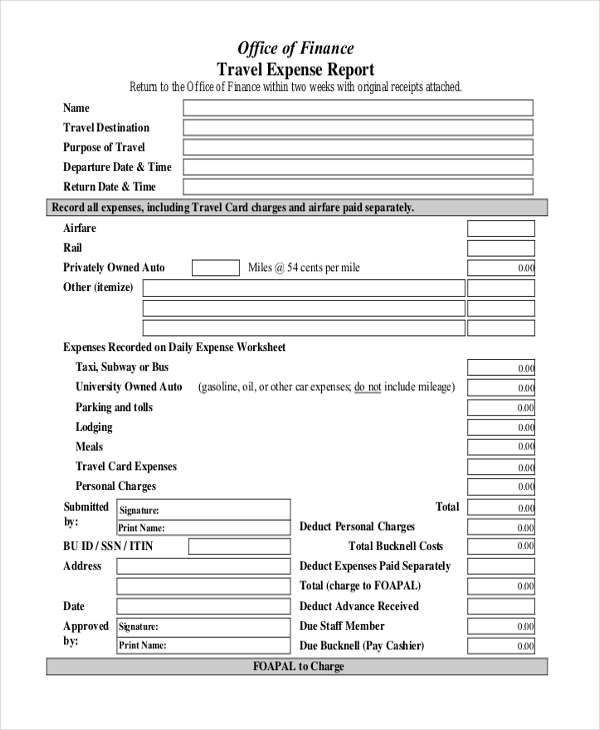

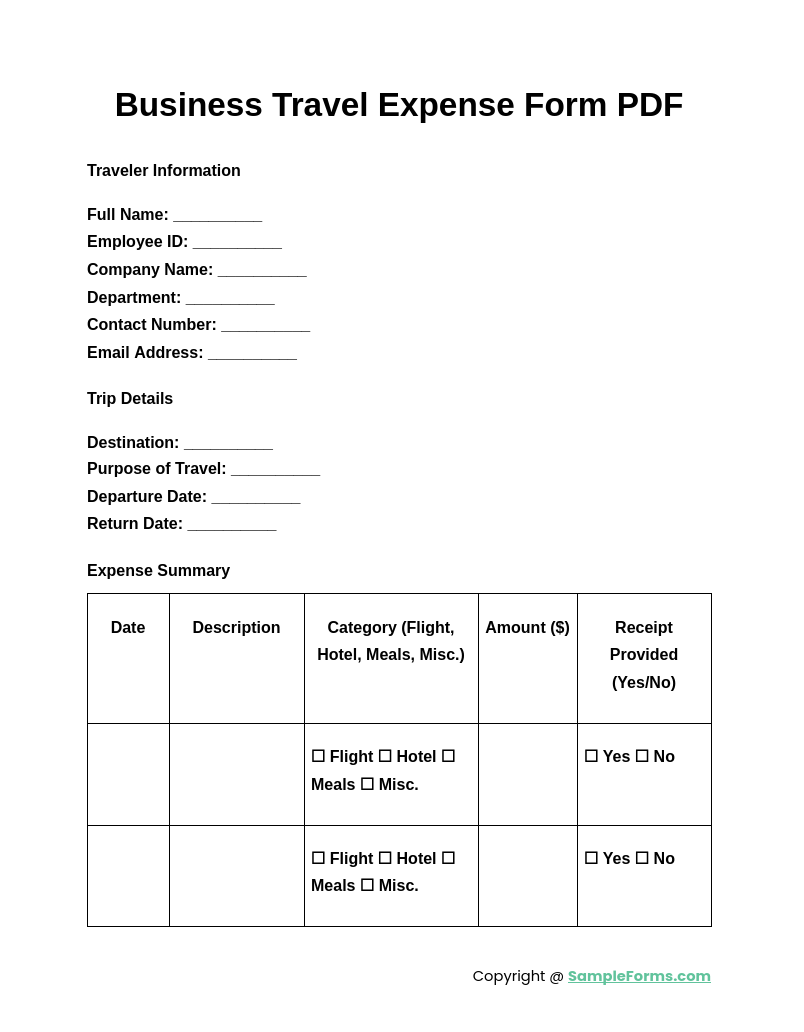

Business Travel Expense Form PDF

A Business Travel Expense Form PDF helps professionals document travel-related expenses for accurate reimbursement. Similar to an Expense Reimbursement Form, it records transportation, lodging, and meals, ensuring financial transparency and compliance with company policies for smooth reimbursement processing.

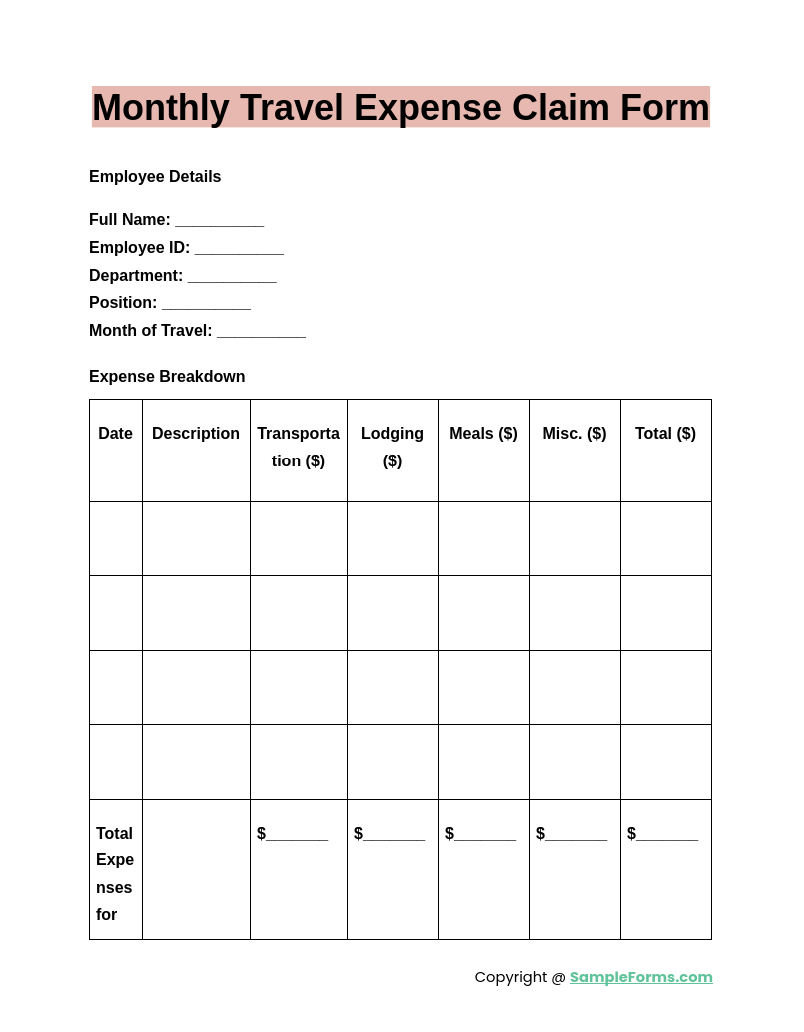

Monthly Travel Expense Claim Form

A Monthly Travel Expense Claim Form simplifies recurring travel reimbursements for employees. Like an Expense Report Form, it categorizes expenses by date and type, ensuring organized record-keeping, timely approvals, and efficient financial tracking for business or corporate travel management.

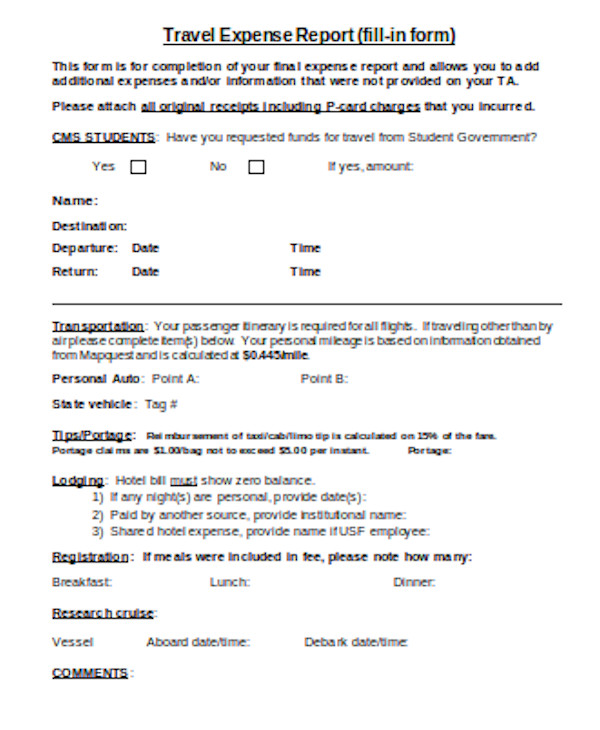

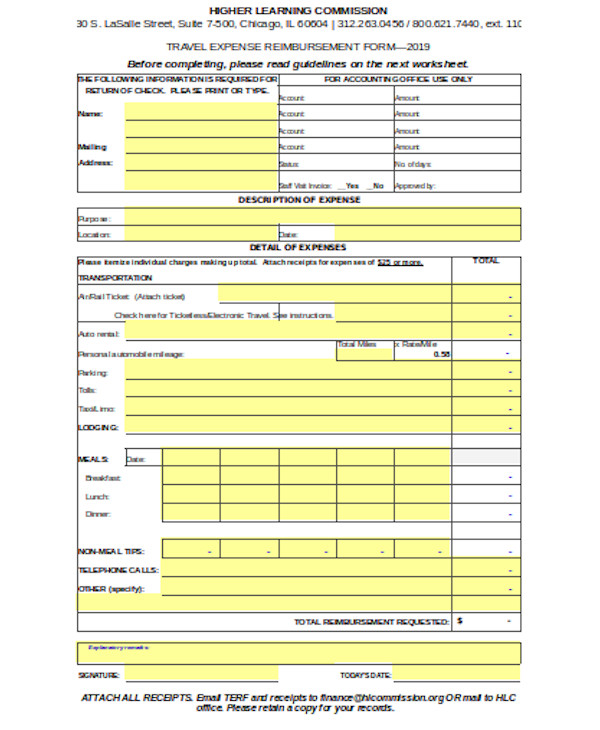

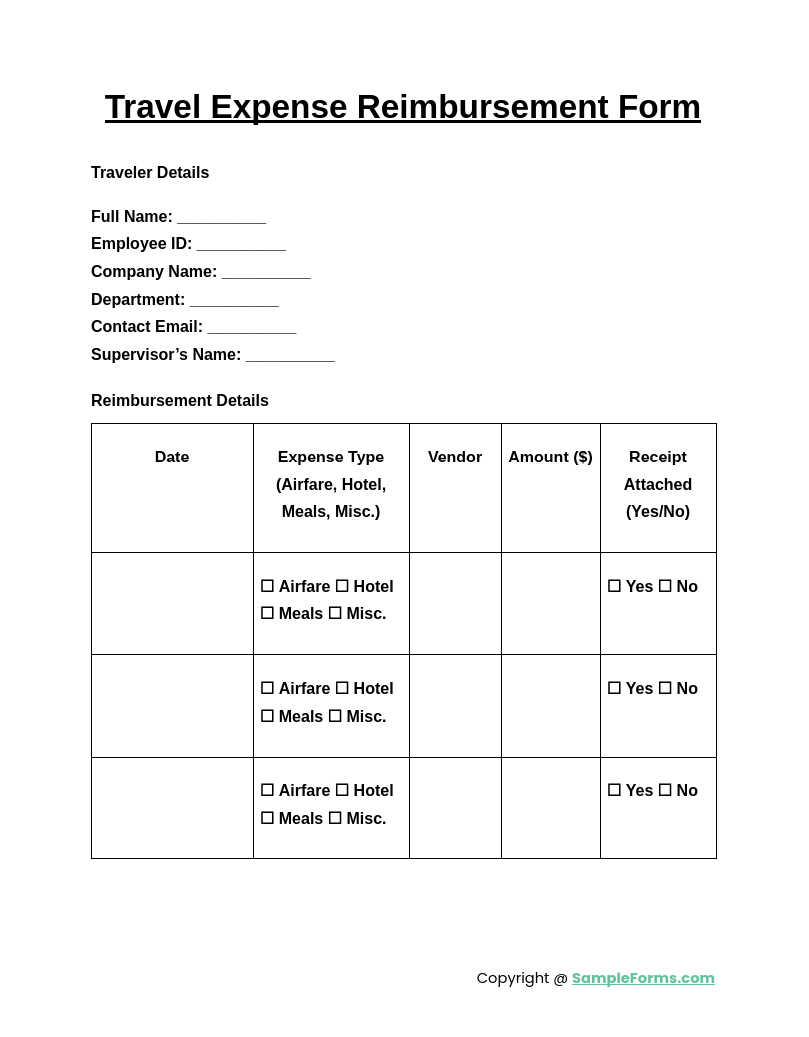

Travel Expense Reimbursement Form

A Travel Expense Reimbursement Form is essential for requesting reimbursement of approved travel costs. Similar to an Expense Approval Form, it ensures all expenses meet company policies, requiring receipts and proper documentation before approval and disbursement of funds.

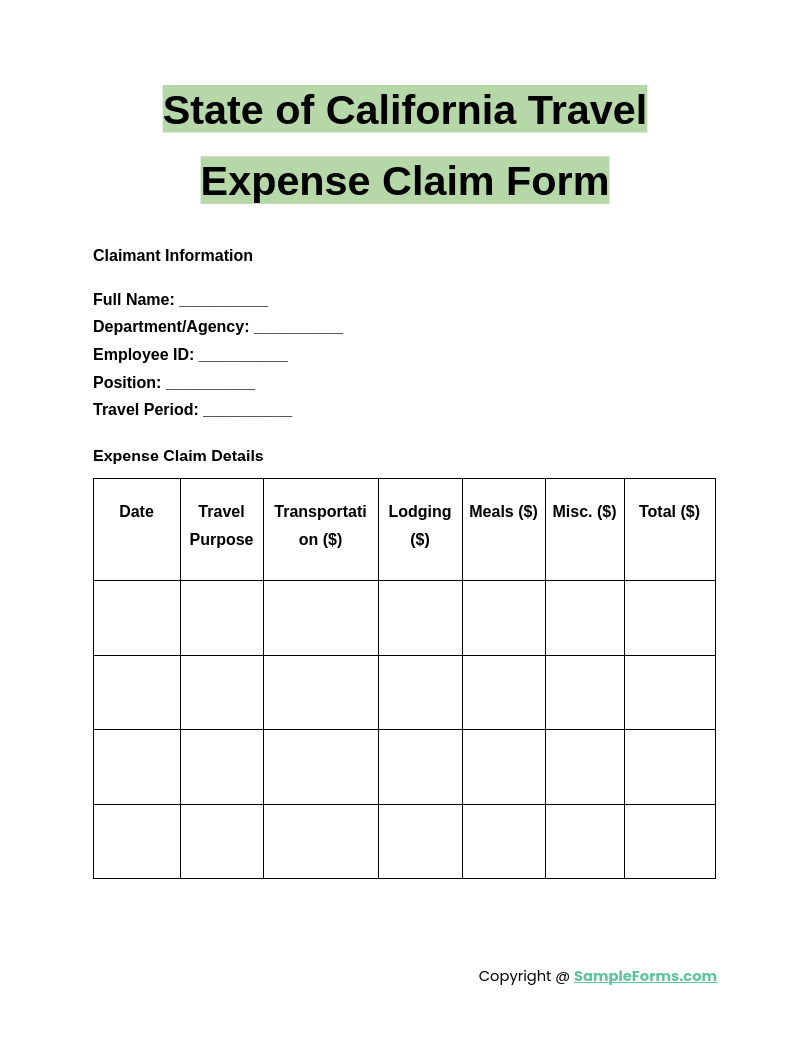

State of California Travel Expense Claim Form

A State of California Travel Expense Claim Form is required for government employees seeking reimbursement for official travel. Like a Travel Expense Claim Form, it ensures compliance with state regulations, tracks expenditures, and maintains accurate financial records for audits.

Browse More Travel Expense Forms

Sample Travel Expense Reimbursement Claim

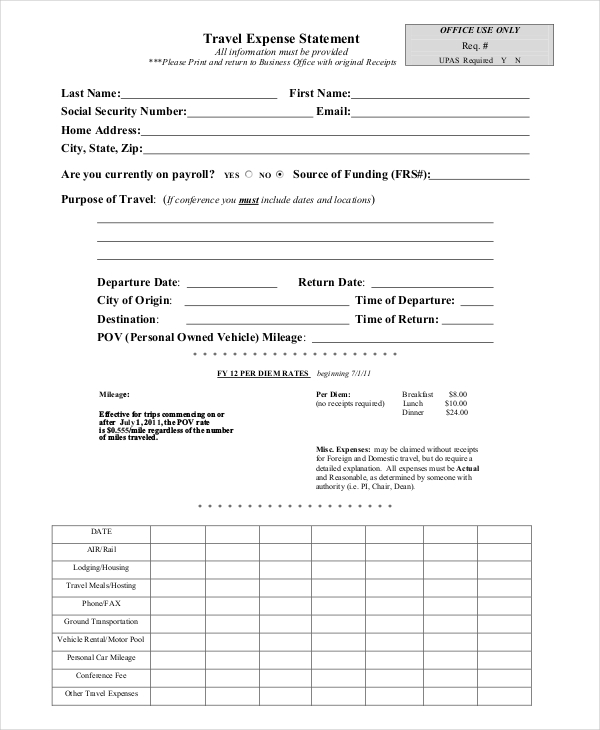

Travel Expense Statement

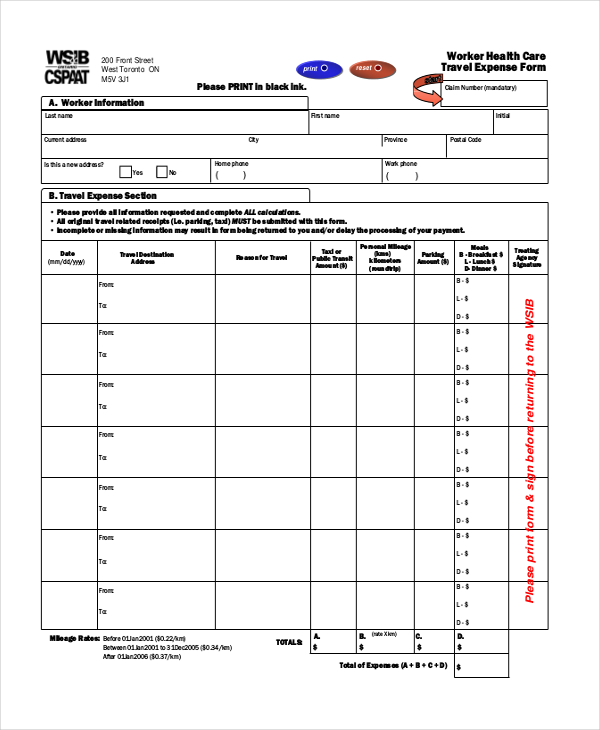

Worker Travel Expense Form

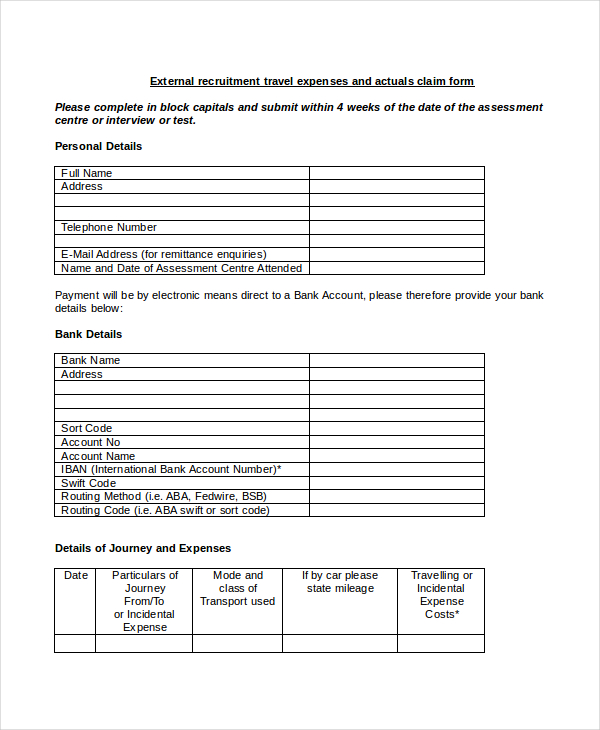

Sample External Recruitment Travel Expense

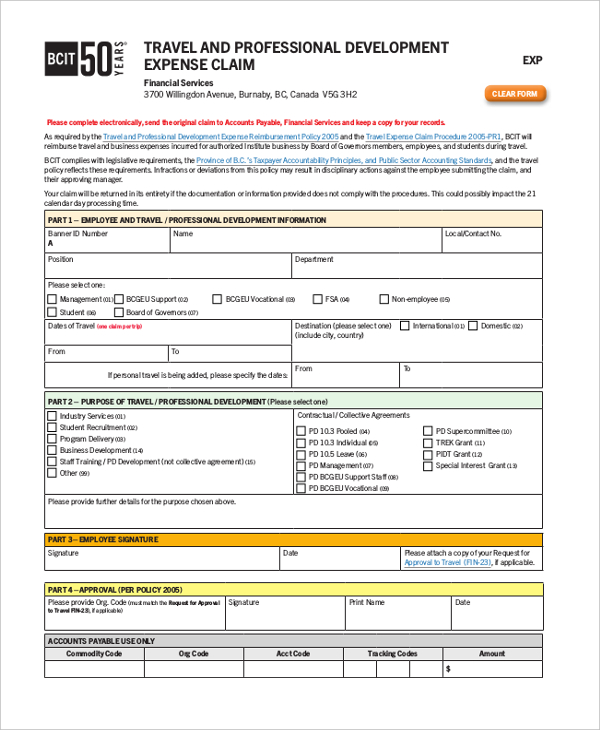

Travel and Professional Development Expense Reimbursement

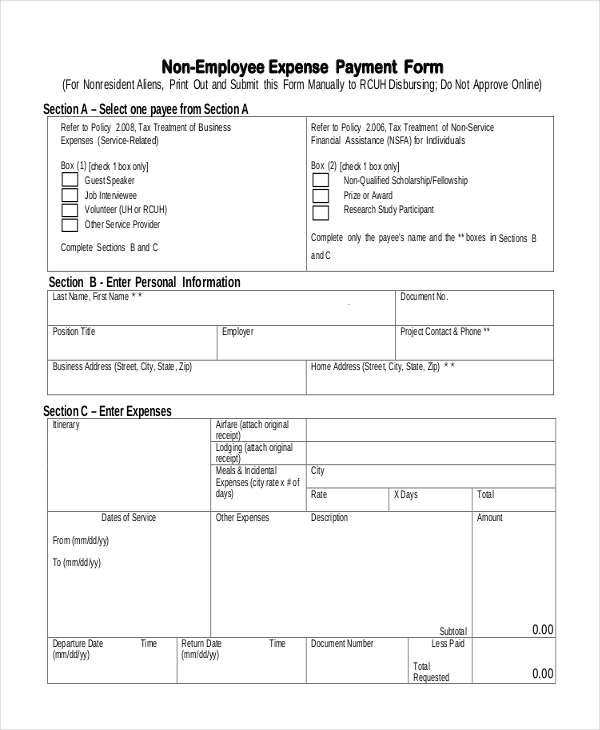

Non-Employee Travel Expense Payment Form

Travel Expense Report

Sample Vehicle and Travel Expenses

Travel Expense Report Form

Standard Travel Expense Form

How much can you write off for travel expenses?

Travel expenses are deductible based on business-related costs, helping reduce taxable income. Similar to a Child Care Expense Form, documentation is required to justify the deduction.

- Transportation Costs: Airfare, train, or mileage for business-related travel is deductible.

- Lodging Expenses: Hotel stays are deductible when travel is necessary for business purposes.

- Meal Deductions: Only 50% of business meals during travel are eligible for tax deductions.

- Business-Related Expenses: Conference fees, internet, and work-related materials qualify.

- Record-Keeping: Keep receipts and logs to justify deductions during tax filing.

What can I claim for travel expenses?

Eligible travel expenses include costs incurred for business, medical, or relocation purposes. Like a Personal Expense Form, these claims must align with official policies.

- Business Travel: Airfare, lodging, and rental cars for work-related trips are claimable.

- Mileage Costs: Business-use mileage reimbursement is based on standard IRS rates.

- Per Diem Allowances: Daily allowances for meals and incidentals are partially deductible.

- Medical Travel: Transportation to medical appointments may qualify for deductions.

- Documentation Required: Receipts and detailed logs must be maintained for reimbursement.

How to reimburse travel expenses?

Travel reimbursement requires accurate documentation and company approval. Similar to an Income and Expense Form, expenses must be categorized properly for processing.

- Expense Submission: Employees submit receipts and records of travel-related expenses.

- Approval Process: Managers or HR review the expenses for policy compliance.

- Reimbursement Method: Payments are issued via payroll or company accounts.

- Tax Considerations: Certain reimbursements may be taxable if not pre-approved.

- Retention of Records: All expense documents must be retained for audit purposes.

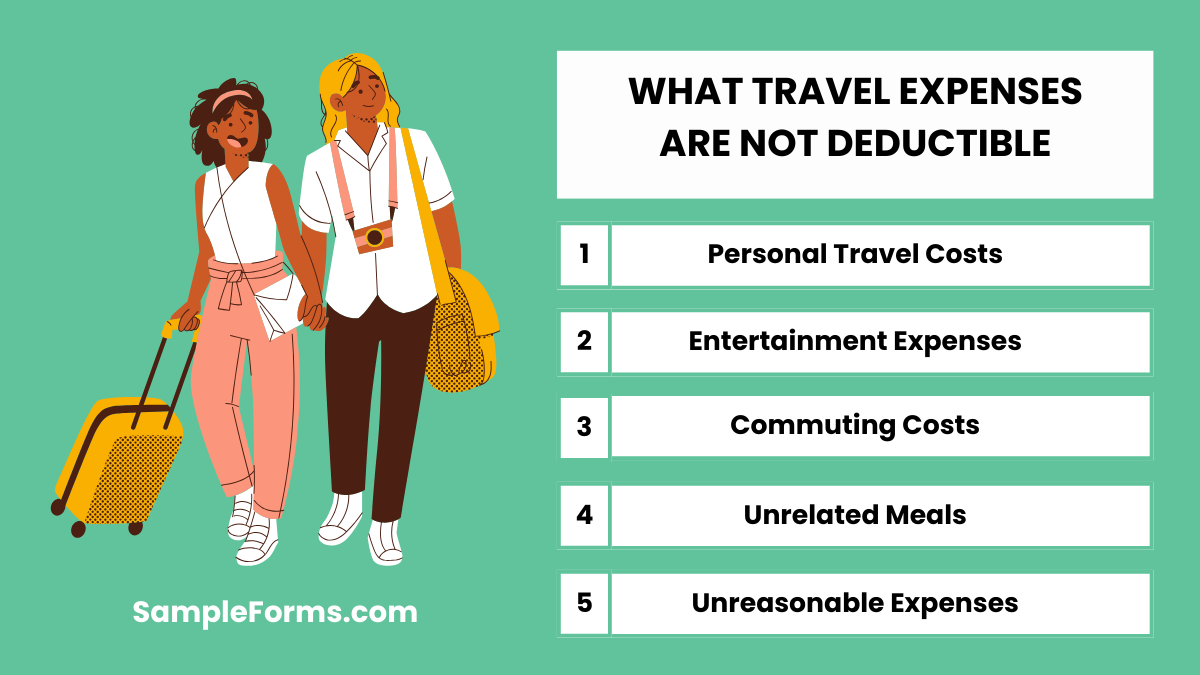

What travel expenses are not deductible?

Not all travel expenses qualify for deductions, as personal and luxury costs are excluded. Similar to an Expense Request Form, clear rules apply.

- Personal Travel Costs: Non-business-related vacations are not deductible.

- Entertainment Expenses: Luxury outings and leisure activities do not qualify.

- Commuting Costs: Daily travel between home and work is not tax-deductible.

- Unrelated Meals: Personal or family meals during trips are non-deductible.

- Unreasonable Expenses: Excessive lodging or first-class airfare may be excluded.

What are the three requirements for a traveling expense deduction?

To qualify for a travel expense deduction, IRS regulations must be met. Similar to a Medical Expense Form, specific eligibility criteria must be followed.

- Business Purpose: Travel must be essential for work-related duties, not personal reasons.

- Necessity of Travel: The trip must be necessary and not just a convenience.

- Proper Documentation: Receipts, logs, and expense reports must be maintained.

- Proportional Deductions: Only expenses directly tied to business qualify for deduction.

- Compliance with IRS Guidelines: The deduction must follow tax regulations to be valid.

Is travel 100% deductible?

Business travel expenses are not fully deductible. Meals are 50% deductible, while airfare, lodging, and transportation are 100% deductible if necessary. Like a Travel Document Form, proper documentation is required for tax compliance.

Do travel reimbursements count as income?

Travel reimbursements do not count as taxable income if they follow an accountable plan. Like a Travel History Form, they must be properly recorded and justified as business-related to avoid classification as additional compensation.

Can you reimburse a contractor for mileage?

Yes, contractors can receive mileage reimbursement at standard IRS rates. Like a Travel Insurance Claim Form, mileage records should be maintained, and reimbursement agreements must be established to ensure accurate compensation for business-related travel.

How much can you make on a 1099 before you have to claim it?

Independent contractors must report income exceeding $600 annually. Similar to a Travel Claim Form, all earnings must be documented and reported on tax returns to comply with IRS regulations for self-employment income.

How do you justify travel expenses?

Travel expenses must be business-related, reasonable, and necessary. Like a Travel Advance Form, justification includes detailed records, receipts, and explanations linking expenses to work purposes, ensuring IRS compliance for tax deductions or reimbursements.

Can a company refuse to reimburse travel expenses?

Yes, companies can refuse reimbursement if expenses violate policies. Like a Travel Registration Form, reimbursement eligibility depends on pre-approved guidelines, proper documentation, and adherence to company expense policies to ensure valid claims.

What counts as travel expenses?

Travel expenses include transportation, lodging, meals, and work-related costs. Like a Travel Questionnaire Form, expenses must be documented, reasonable, and directly related to business activities to qualify for tax deductions or employer reimbursements.

Can you write off transportation to work?

Commuting costs from home to work are not deductible. Like a Travel Approval Form, tax-deductible transportation must be work-related, such as travel between job sites or for temporary work assignments.

What is not considered a travel expense?

Personal expenses, entertainment, and luxury upgrades are not deductible. Like a Travel Medical Form, only essential, documented business-related travel costs qualify for tax deductions or employer reimbursements.

How do I prove travel expenses for taxes?

Travel expenses require receipts, mileage logs, and business purpose documentation. Like a Travel Risk Assessment Form, accurate records help verify claims, ensuring IRS compliance for deductions and employer reimbursements.

A Travel Consent Form is crucial for legal travel permissions, while a Travel Expense Form is vital for financial tracking and reimbursements. Proper documentation of travel expenses helps organizations manage budgets effectively and ensures employees receive timely reimbursements. Businesses use structured expense forms to maintain financial integrity, prevent errors, and streamline approval processes. Whether used for corporate travel or personal budget management, a well-documented travel expense form reduces administrative burdens and enhances accuracy. Implementing a standardized travel expense process ensures compliance, simplifies tax reporting, and keeps financial records well-organized.

Related Posts Here

-

Event Contract Form

-

Contest Registration Form

-

Waiting List Form

-

Restaurant Schedule Form

-

Mobile Home Bill of Sale

-

Landlord Consent Form

-

60-Day Notice to Vacate Form

-

Financial Statement Form

-

Product Evaluation Form

-

Construction Contract

-

School Receipt Form

-

Restaurant Training Form

-

Daily Cash Log

-

Volleyball Evaluation Form

-

Holding Deposit Agreement Form