A Title Form is more than just a piece of paper; it’s a gateway to ownership and rights over properties, assets, and vehicles. Acting as a testament to ownership, these printable forms come in various types, each with distinct implications. From real estate to automobiles, title forms provide a documented trail of an asset’s ownership history. Delving into its meaning, types, examples, and crafting nuances offers invaluable insights, ensuring seamless transactions and undisputed ownership rights. Let’s navigate this essential legal terrain together.

What is a Title Form ? – Definition

A Title Form is a legal document that establishes ownership and provides evidence of an individual’s right to possess, use, and dispose of a particular asset or property. It serves as an official record, detailing the transition of ownership between parties, whether through purchase, inheritance, gift, or other means. Depending on its type, a title form can pertain to real estate properties, vehicles, boats, and various other tangible assets. In essence, it acts as proof of a rightful claim to ownership, ensuring protection against disputes and unauthorized claims.

What is the Meaning of a Title Form?

The meaning of a Title Form extends beyond just a piece of paper; it signifies legal ownership and the right to a particular asset or property. In legal and transactional contexts, when someone holds the title, they are recognized as the lawful owner with the associated rights and responsibilities. The Title Form encapsulates this ownership, serving as tangible evidence of one’s entitlement to possess, use, benefit from, and even sell or transfer the asset. Whether it’s a house, car, boat, or land, this form delineates the lineage of ownership, ensuring clarity and preventing potential disputes.

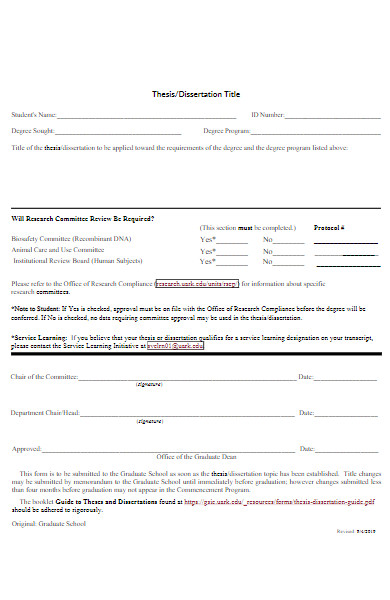

What is the Best Sample Title Form?

The best sample title form depends on the specific type of asset or property in question. Title forms differ based on whether they’re for real estate, vehicles, boats, or other tangible assets. However, I can provide a generalized outline of a basic title form for a piece of real estate:

Property Address: [123 Main St., City, State, Zip Code]

-

Title Number: [Unique Identifier/Number]

-

Date of Issue: [MM/DD/YYYY]

-

Current Owner Details:

- Name: [John Doe]

- Address: [456 Elm St., City, State, Zip Code]

- Contact Number: [(123) 456-7890]

-

Previous Owner Details: (If applicable)

- Name: [Jane Smith]

- Address: [789 Maple St., City, State, Zip Code]

- Contact Number: [(234) 567-8901]

-

Description of Property:

- Type: [Residential/Commercial/Agricultural]

- Size: [Square footage or acreage]

- Boundaries: [North: XYZ, South: ABC, East: LMN, West: OPQ]

-

Mortgage or Lien Information: (If applicable)

- Mortgage Holder: [Bank or Individual Name]

- Amount Owed: [$XXXX.XX]

- Maturity Date: [MM/DD/YYYY]

-

Encumbrances or Restrictions: (If any)

- Signature of Current Owner: ________________________ Date: ________

- Signature of Title Issuer/Notary: __________________ Date: ________

Please note that this is a very simplified and generic example. In real-world scenarios, title forms will be more detailed and might require additional information, legal descriptions, seals, and other pertinent data. Always consult with a legal expert or appropriate governmental agency when dealing with title forms to ensure accuracy and compliance with local regulations. You should also take a look at our Sample Title Transfer Forms.

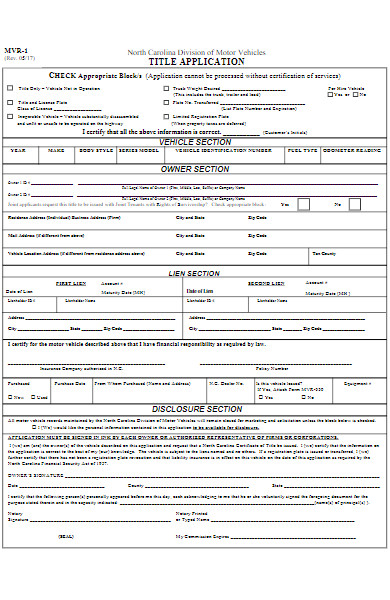

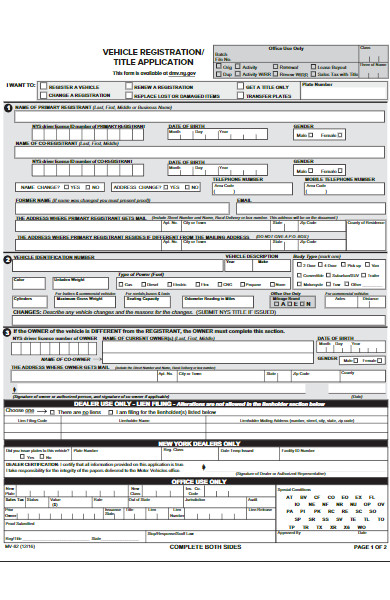

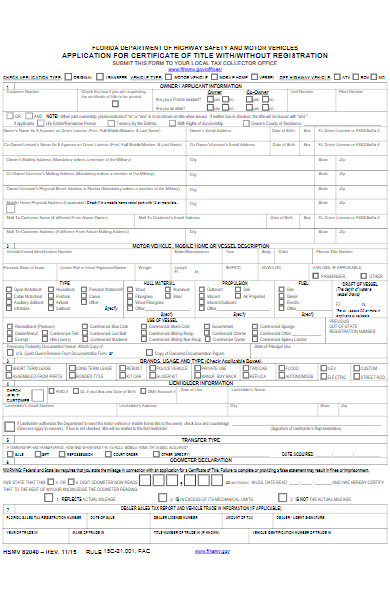

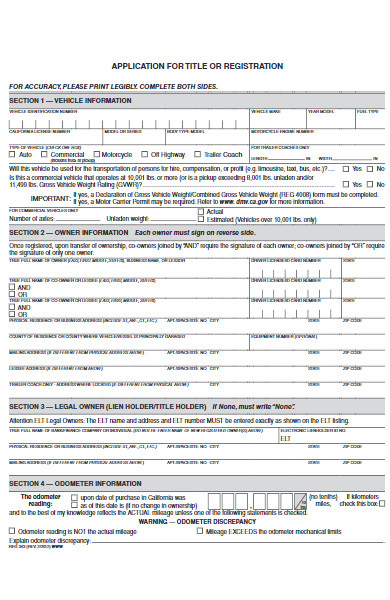

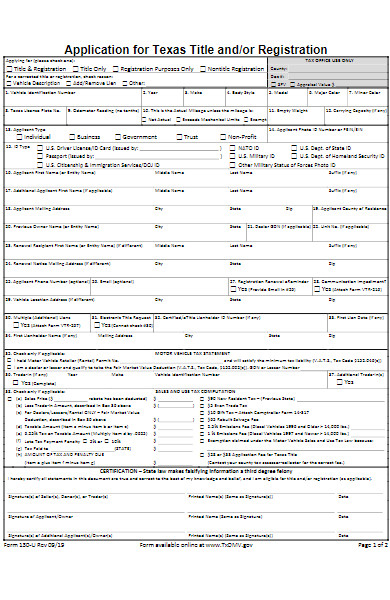

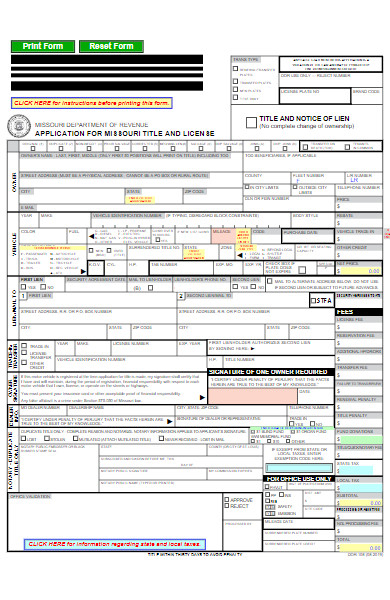

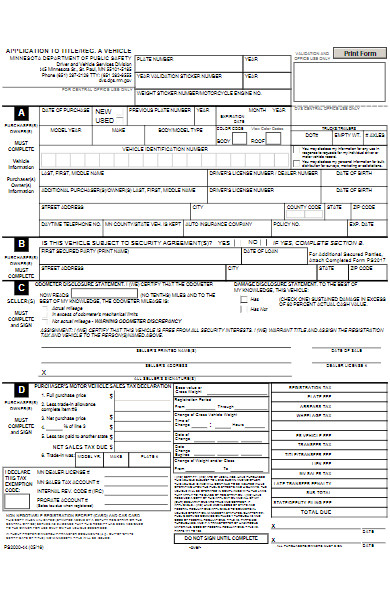

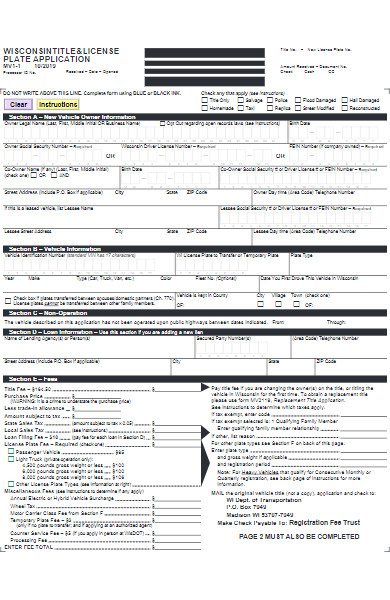

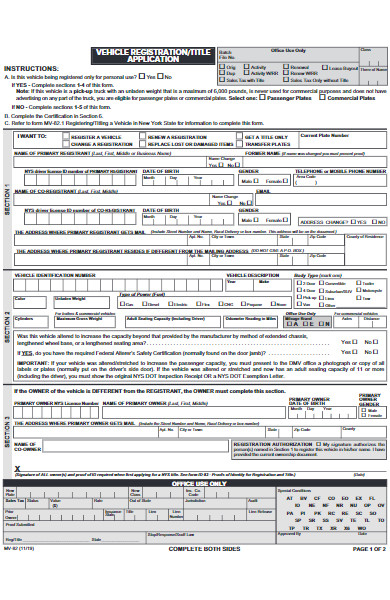

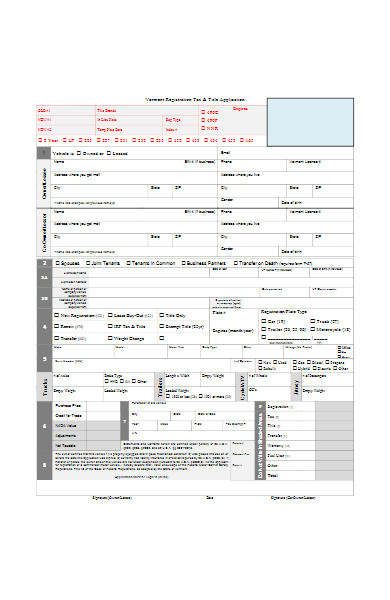

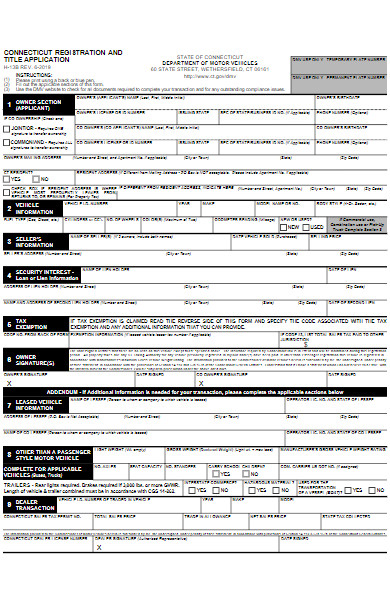

FREE 20+ Title Forms

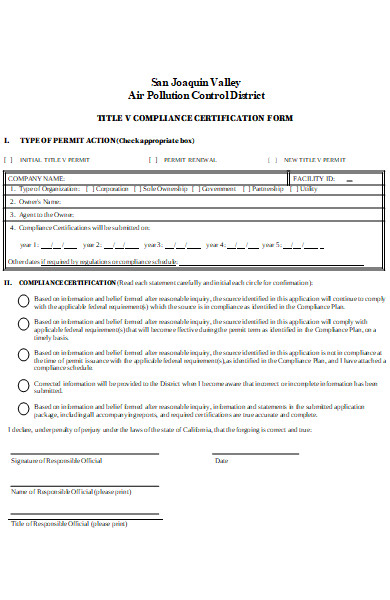

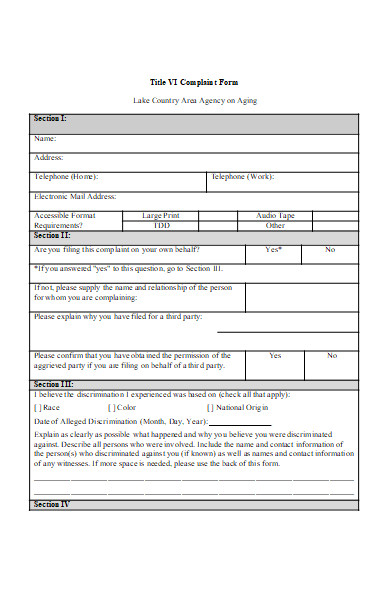

21. Title Complaint Form

- MS Word

What is a Title Form used for?

A title form is used to establish and confirm legal ownership of an asset or property. It serves as the official record and evidence of an individual’s or entity’s right to possess, use, and transfer that specific asset. Here are the primary uses of a title form:

- Proof of Ownership: The title form acts as a testament to the rightful ownership of an asset, ensuring protection against unauthorized claims or disputes.

- Transfer of Ownership: When selling, gifting, or otherwise transferring an asset like real estate or a vehicle, the title form facilitates the official change of ownership from one party to another.

- Legal Transactions: Many transactions, like securing a mortgage or loan using a property as collateral, require proof of clear and uncontested ownership. A title form provides this proof.

- Inheritance and Estate Planning: In cases of inheritance, a title form helps determine and establish the rightful heirs to an asset.

- Registration and Licensing: For assets like vehicles, a title form is essential for registration and licensing purposes.

- Taxation and Valuation: Authorities may refer to title forms to assess property values and determine applicable taxes.

- Dispute Resolution: In case of disagreements or claims over an asset, the title form can be used as an authoritative document to ascertain ownership.

In essence, a title form is a critical legal document that upholds the rights of owners, ensuring they can enjoy, utilize, and transfer their assets without ambiguity or contention. Our Motor Vehicle Transfer Forms is also worth a look at

How do I obtain a Title Form for my property?

Obtaining a title form (often simply called a “title”) for your property involves a series of steps, typically carried out during the property purchasing process. The exact procedure might vary depending on your jurisdiction and the local regulations, but the following is a general outline:

- Choose a Title Company or Attorney: Especially for real estate transactions, it’s common to work with a title company or a real estate attorney. They help ensure that the title to the property is clear (i.e., free of liens, disputes, or other issues).

- Title Search: The title company or attorney will perform a title search. This involves examining public records to trace the property’s ownership history, ensuring there are no liens, encumbrances, or ownership disputes.

- Title Insurance: It’s advisable to purchase title insurance. This protects you (and your lender, if you have a mortgage) from potential future claims or disputes related to the property’s title.

- Closing Process: If you’re buying the property, once everything is in order and all parties agree, you’ll proceed to the closing. This is where all documents, including the title, are signed and where the title transfers from the seller to the buyer.

- Recording the Deed: After closing, the deed (which shows the transfer of ownership) is recorded with the appropriate local or county office. This makes the transfer a matter of public record.

- Receiving the Title: Once the deed is recorded, you’ll receive the official title, either from the title company, your attorney, or directly from the county or local authority. For real estate, it’s usually in the form of a deed. For vehicles, you receive a title certificate.

- Safekeeping: Keep the original title in a safe place, such as a safe deposit box. You’ll need it if you ever decide to sell or refinance.

If you’ve lost the title form or never received one (for example, if the property has been in the family for generations), you can usually obtain a copy or initiate a new title form by visiting the local land records office or the equivalent authority in your jurisdiction. You might need to provide proof of ownership, such as tax receipts, and undergo a title search process. Always consult with a local real estate attorney or expert when dealing with title-related matters. In addition, you should review our Legal Ownership Forms.

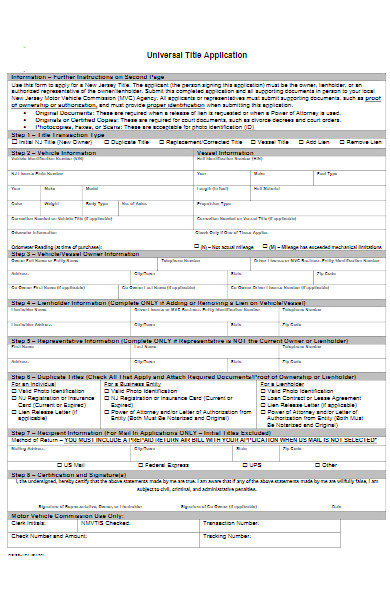

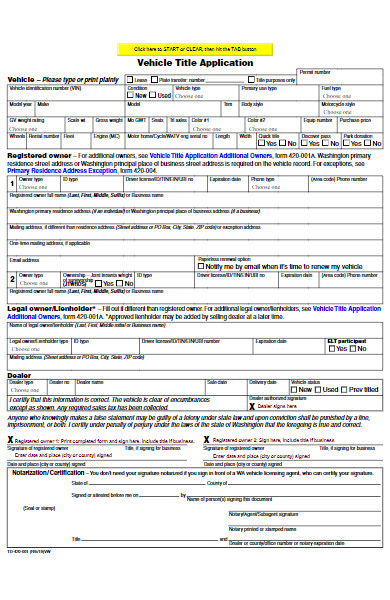

How do I transfer a title form for a car?

Transferring a title for a car is a crucial step when buying or selling a vehicle. The process can vary somewhat depending on the jurisdiction or state you’re in, but the following is a general outline of the steps to take:

- Prepare Necessary Documents: Both the seller and the buyer should prepare necessary documents, such as:

- Original car title: The seller should have the original car title.

- Bill of Sale: This document details the terms of the sale, including the purchase price, date of sale, names of both parties, and vehicle details like make, model, year, and VIN (Vehicle Identification Number).

- Release of Liability or Notice of Transfer: This form varies by state but is used to notify the Department of Motor Vehicles (DMV) that the vehicle has been sold and the seller is no longer responsible for it.

- Fill Out the Title Form:

- The seller needs to fill out the back of the title, providing details like the odometer reading (for some states, if the car is below a certain age), sale price, and buyer’s details.

- Both the seller and buyer should sign the title. In some states, this signature needs to be notarized.

- Payment: The buyer should pay the agreed-upon amount, and both parties should keep a record of the transaction.

- Submit to DMV:

- The buyer should take the signed title, Bill of Sale, and any other necessary forms (like an application for a new title) to the local DMV or equivalent agency to register the vehicle in their name.

- The seller should submit the Release of Liability or Notice of Transfer form to the DMV to ensure they are not held liable for any incidents involving the car after the sale.

- Pay Transfer Fees and Taxes: The buyer will typically need to pay a title transfer fee and possibly sales tax or use tax on the purchase price. The exact amounts and requirements vary by state.

- Receive New Title: After processing, the DMV will issue a new title in the buyer’s name. This might be mailed to the buyer or, in some states with electronic titles, stored digitally.

- Update Insurance: The buyer should immediately add the purchased vehicle to their insurance policy. The seller should notify their insurance company that they’ve sold the vehicle and remove it from their policy.

It’s essential to complete the transfer process promptly to avoid potential legal issues or penalties. Always refer to your local DMV or equivalent agency’s guidelines, as requirements can vary. You may also be interested in our Property Form.

What information is needed on a title form?

The specific information required on a title form varies based on the type of asset (e.g., real estate, car, boat) and jurisdictional regulations. However, here’s a general overview of the information typically needed on various title forms:

Real Estate Title Form:

- Title Number: A unique identifier for the title record.

- Property Address: Full address of the property.

- Description of Property: This might include the type (residential, commercial), size (acreage or square footage), and often a legal description with boundaries or plot details.

- Current Owner Details: Name, address, and sometimes contact information.

- Previous Owner Details: Often required to show a clear chain of ownership.

- Mortgage or Lien Information: Details on any mortgages or liens against the property.

- Encumbrances or Restrictions: Any easements, covenants, or other restrictions affecting the property.

- Date of Transfer: The date when the property was last transferred or sold.

- Signatures: Depending on the form and purpose, signatures of the current owner, notary public, and/or other parties might be required.

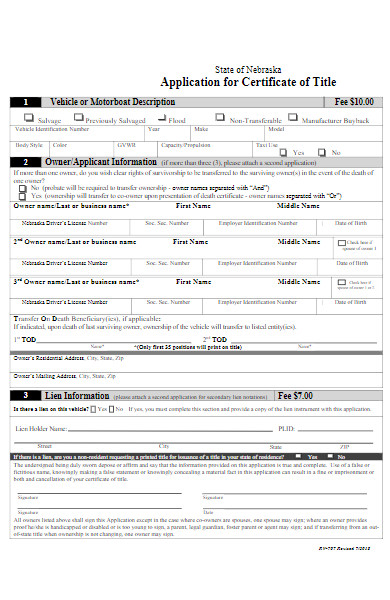

Vehicle Title Form (for cars, boats, etc.):

- Vehicle Identification Number (VIN): A unique code used to identify individual motor vehicles.

- Make, Model, and Year: Details of the vehicle’s manufacture.

- Odometer Reading: Typically required during a sale to verify the vehicle’s mileage.

- Owner Details: Name and address of the current owner.

- Lienholder Details: If there’s a loan on the vehicle, the lender’s information is usually listed.

- Date of Sale or Transfer: When the vehicle was sold or ownership changed.

- Purchase Price: Often required for tax purposes.

- Signatures: Both the buyer and seller usually need to sign during a transfer.

General Information Commonly Found on Title Forms:

- Date of Issue: When the title form was issued or created.

- Restrictions or Endorsements: Any conditions or specifics about the usage or transfer of the titled asset.

- Seals or Stamps: Some title forms require official seals or stamps, especially if notarization is necessary.

When dealing with title forms, always refer to the specific requirements set by your local or jurisdictional authorities. Mistakes or omissions can lead to legal complications, so accuracy and thoroughness are essential.

Are title forms required for all types of property?

No, title forms are not required for all types of property. However, they are essential for certain assets where legal ownership needs to be clearly established and where ownership might be transferred between parties. Here’s a breakdown:

Types of Property That Typically Require Title Forms:

- Real Estate: Whether it’s residential, commercial, or land, real estate transactions typically require a title to establish ownership. This title is often recorded at a local or county office, making it a public record.

- Motor Vehicles: Cars, trucks, motorcycles, and other roadworthy vehicles typically have titles that establish ownership. These titles are also essential for registration purposes.

- Watercraft: Boats, yachts, and other watercraft often come with titles, especially if they are of a certain size or value.

- Aircraft: Airplanes and other aircraft have specific titles to establish ownership.

- Mobile Homes: Even though they might be movable, mobile homes are significant assets that typically require titles, especially if they are not permanently affixed to a piece of land.

Types of Property That Typically Do NOT Require Title Forms:

- Personal Property: Everyday items like clothes, electronics, furniture, and other personal effects do not have titles. Ownership is usually proven by possession, receipts, or other documentation.

- Livestock and Pets: While some high-value animals (like racehorses) might have formal ownership documentation, most everyday pets and livestock do not have titles. However, registration or pedigree papers might be relevant in certain cases.

- Stocks and Bonds: Ownership of these assets is typically proven through certificates, electronic records, or brokerage account statements rather than traditional titles.

- Intellectual Property: This includes patents, copyrights, trademarks, and trade secrets. These are protected and registered through specific intellectual property rights systems and not by titles.

- Small Recreational Items: Items like bicycles, kayaks, or smaller drones typically don’t come with titles. However, more significant or valuable versions (like motorized boats or commercial drones) might require them.

In summary, while not all property types require title forms, they are essential for certain high-value or transferable assets. If in doubt about whether a particular asset requires a title, it’s a good idea to check with relevant local or state authorities or consult with a legal professional. You may also be interested to browse through our other Restaurant transfer of ownership forms.

How do I correct errors on a title form?

Correcting errors on a title form is essential to ensure clear and indisputable ownership of an asset. The process can vary depending on the type of asset (e.g., real estate, vehicle) and the jurisdiction or state in which the title was issued. Here is a general procedure for correcting errors on a title form:

1. Identify the Error

Before you can correct an error, you need to identify it. Ensure that the mistake isn’t a misunderstanding on your part and that it genuinely needs rectification.

2. Contact the Issuing Agency

Reach out to the agency or office that issued the title:

- For Real Estate Titles: This will typically be the county recorder’s office or a similar local government entity.

- For Vehicle Titles: Contact the Department of Motor Vehicles (DMV) or its equivalent in your state or jurisdiction.

They will provide guidance on the specific steps you need to follow.

3. Complete a Correction or Affidavit Form

Many agencies have a dedicated form for correcting title errors:

- For Vehicles: This might be called an “Affidavit of Correction” or similar. The form will usually require details about the vehicle, the nature of the error, and the correct information.

- For Real Estate: The process can be more complex due to the legal implications of property ownership. You might need to file a “Corrective Deed” to rectify errors on a property deed. This document corrects the mistake made in the original deed.

4. Provide Supporting Documentation

You may need to provide evidence to support the correction:

- Proof of the Correct Information: This could be a driver’s license, passport, utility bill, or other official documents that confirm the correct details.

- Original Title: You’ll often need to submit the original title with the error.

5. Signatures and Notarization

Depending on the nature of the error and the type of title, you might need signatures from all involved parties. These signatures might also need to be notarized.

6. Submit the Form and Pay Fees

Return the completed form, any supporting documentation, and the original title (if required) to the issuing agency. There might be a fee associated with correcting the title.

7. Receive the Corrected Title

Once the agency processes your correction, they will issue a new, corrected title. Ensure all details are accurate upon receipt.

8. Keep All Documentation

It’s a good idea to keep copies of all correspondence, forms, and documentation related to the correction. This provides a paper trail in case of future disputes or issues.

Lastly, for significant assets like real estate, it’s advisable to consult with a legal professional or expert when dealing with title corrections. They can provide guidance tailored to your specific situation and jurisdiction. You should also take a look at our membership registration form.

How do I check the authenticity of a title form?

Checking the authenticity of a title form is crucial to prevent fraud and ensure you’re engaging in a legitimate transaction. Whether it’s real estate, a vehicle, or another asset, verifying the authenticity protects your interests. Here are steps you can take to check the authenticity of a title form:

1. Physical Examination:

- Quality of Paper: Authentic titles are often printed on high-quality, specialized paper.

- Watermarks: Some titles have watermarks that are visible when held against the light.

- Raised Seals: Some official documents have raised or embossed seals.

2. Check the Details:

- Ensure all information on the title matches what you know about the asset. For example, the Vehicle Identification Number (VIN) on a car title should match the VIN on the car itself.

- Look for inconsistencies in fonts, misaligned text, or other signs of tampering.

3. Verify with the Issuing Authority:

- Real Estate: Contact the local county recorder’s office or the land registration office where the property is located. They can confirm the legitimacy of a property title.

- Vehicles: Check with the Department of Motor Vehicles (DMV) or its equivalent in your jurisdiction. They can verify the authenticity of a vehicle title.

4. Use Online Databases:

- Many jurisdictions offer online databases where you can check the status of titles. For vehicles, some DMVs provide online title search tools. For real estate, some county websites offer property lookup tools.

5. Check for Liens and Encumbrances:

- Ensure that the title is clear of any liens or encumbrances that could affect ownership. A title company can help with this for real estate, and the DMV can provide information for vehicles.

6. Hire Professionals:

- Real Estate: Consider using a title company or an attorney specializing in real estate. They can conduct a title search to ensure its authenticity and that there are no issues with the property’s ownership history.

- Vehicles: There are third-party services that can provide comprehensive vehicle history reports, including title information.

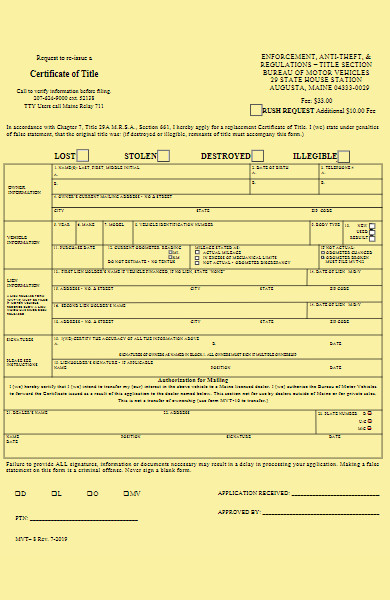

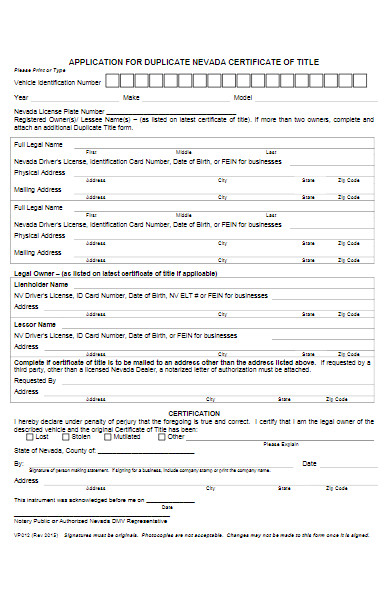

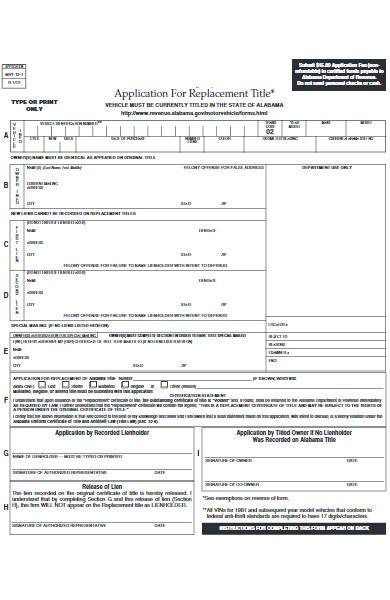

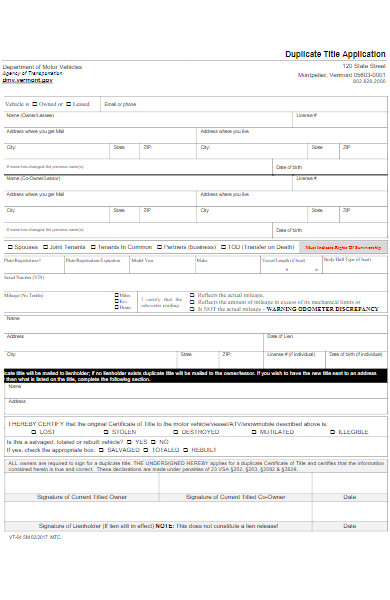

What happens if I lose my title form?

If you lose your title form, whether it’s for real estate, a vehicle, or another significant asset, it’s important to take steps to obtain a duplicate or replacement title. Here’s what you should do if you lose a title form:

1. Report the Loss:

- If you suspect the title was stolen, rather than just misplaced, report the theft to your local police department. This will provide a record in case someone tries to use the title fraudulently.

2. Contact the Issuing Agency:

- Real Estate: Get in touch with the county recorder’s office or the land registration office where the property is located. They maintain copies of property titles.

- Vehicles: Contact the Department of Motor Vehicles (DMV) or its equivalent in your jurisdiction.

3. Complete the Required Paperwork:

- Real Estate: The process and paperwork will vary depending on your jurisdiction. You might need to fill out an application for a copy of the deed or title.

- Vehicles: Fill out an application for a duplicate title. This form will usually require details about the vehicle and an explanation for why you need a duplicate title (e.g., the original was lost, stolen, or damaged).

4. Pay the Fee:

There is often a fee associated with obtaining a duplicate title. Check with the issuing agency to find out the amount and acceptable payment methods.

5. Signatures and Notarization:

Depending on your jurisdiction and the reason for the replacement, your application for a duplicate title might need to be notarized. For vehicles, if there’s a lien on the title, the lienholder might also need to sign the application.

6. Wait for Processing:

Once you’ve submitted the required paperwork and fees, the issuing agency will process your application. This can take anywhere from a few days to several weeks, depending on the agency and type of title.

7. Receive the Duplicate Title:

After processing, the agency will issue a duplicate title. This title often looks like the original but may be marked as a “duplicate” or “copy.”

8. Safe Storage:

Once you receive your duplicate title, store it in a safe, secure location to prevent future loss. Consider using a safe deposit box, a fireproof safe, or another secure location.

Lastly, if you find the original title after receiving the duplicate, destroy the original to prevent confusion or potential misuse.

How to Create a Title Form?

Creating a title form is a critical task as it involves establishing ownership of an asset. The exact process can vary based on jurisdiction and the type of asset (e.g., real estate, vehicle), but here’s a general step-by-step guide:

1. Determine the Type of Title Form:

Identify the asset for which you’re creating the title form. For instance, is it a title for real estate property, a vehicle, a boat, or some other asset?

2. Gather Necessary Information:

Collect all pertinent details of the asset:

- Real Estate: Property description, parcel number, legal description, owner details, etc.

- Vehicle: Vehicle Identification Number (VIN), make, model, year, color, owner details, etc.

3. Choose the Right Template or Form:

Depending on the asset and jurisdiction, there might be predefined templates or forms available:

- Check with local government agencies or departments (e.g., county recorder’s office for real estate, DMV for vehicles).

- Consider using specialized software or online platforms that provide title form templates.

4. Input the Details:

Fill in the template/form with the information you gathered in step 2. Make sure all details are accurate to prevent future complications.

5. Include Additional Relevant Details:

- Restrictions or Easements: For real estate, mention any restrictions or easements on the property.

- Liens: Clearly indicate if there are any liens on the asset.

6. Obtain Signatures:

- Depending on the asset and jurisdiction, you might need signatures from multiple parties, like sellers and buyers.

- Ensure all signatures are genuine and obtained without duress.

7. Notarization:

Many title forms require notarization to be legally binding. This involves having a licensed notary public witness the signing and then affixing their seal to the document.

8. File the Title Form:

Once completed and notarized, submit the title form to the appropriate authority:

- Real Estate: Typically, this would be the county recorder’s office or equivalent in your jurisdiction.

- Vehicle: Submit the form to the DMV or its equivalent.

9. Pay Associated Fees:

There might be fees associated with filing the title form. Ensure you know the amount and make the necessary payment.

10. Receive the Official Title:

After processing, the authority will issue the official title, either as a printed document or electronically, depending on the system in place.

11. Store Safely:

Keep the title in a secure location, like a safe deposit box, to prevent loss, damage, or unauthorized access.

12. Review and Update as Needed:

If there are changes in ownership or details of the asset, ensure you update the title form accordingly.

Lastly, given the legal implications of title forms, it’s advisable to consult with professionals, like attorneys or notaries, especially when dealing with significant assets or complex situations. Our Asset Transfer Form is also worth a look at

Tips for creating an Effective Title Form

Creating an effective title form is crucial as it signifies ownership and provides a legal record. Here are some tips to ensure your title form is both accurate and efficient:

1. Clarity is Key:

Ensure that every section of the title form is clear and easy to understand. Use straightforward language and avoid jargon that might confuse the reader.

2. Use a Standardized Format:

Adopt a consistent layout and font throughout the document. Standardized formats reduce confusion and make the form look professional.

3. Gather All Necessary Information:

Before beginning, have all essential data on hand, such as personal details, property description, or vehicle identification number (VIN), to prevent errors or omissions.

4. Provide Detailed Instructions:

Include clear guidelines on how to fill out the form, especially for complex sections. This can minimize mistakes and ensure completeness.

5. Specify Mandatory Fields:

Highlight fields that are mandatory to fill out, using asterisks or bold fonts, so they don’t get overlooked.

6. Include Space for Additional Information:

Leave space for notes or additional details that might be relevant, such as restrictions, easements, or special conditions.

7. Limit Use of Legal Jargon:

While some legal terms might be necessary, try to keep the language as simple as possible, and provide definitions or explanations for less common terms.

8. Ensure Data Protection:

If the form is digital or online, ensure that the platform you’re using complies with data protection regulations. Confidential information should remain secure.

9. Incorporate Validation Measures:

For digital forms, include validation measures to ensure that data entered (like dates or ID numbers) is in the correct format.

10. Provide Contact Details:

Include contact details for the issuing or overseeing body, so individuals can reach out with questions or concerns.

11. Review and Proofread:

Before finalizing, double-check the form for typos, errors, or omissions. It’s beneficial to have a second set of eyes review the document.

12. Regularly Update the Form:

Laws, regulations, and requirements can change. Periodically review and update the title form to ensure it remains compliant and relevant.

13. Include a Declaration Section:

This section allows the person filling the form to declare that all the information provided is accurate and true. This can protect against fraudulent claims.

14. Seek Legal Input:

Given the importance of title forms, it’s wise to have them reviewed by legal professionals who can provide insights and ensure the form’s legality.

15. Store Templates Safely:

Whether digital or printed, store your title form templates in a safe and secure location to prevent unauthorized access or alterations.

Remember, the goal of an effective title form is not just to document ownership, but also to ensure a smooth and legally sound process for all parties involved.

Related Posts Here

-

Accident Statement Form

-

Performance Review Form

-

Event Contract Form

-

Contest Registration Form

-

Waiting List Form

-

Restaurant Schedule Form

-

Mobile Home Bill of Sale

-

Landlord Consent Form

-

60-Day Notice to Vacate Form

-

Financial Statement Form

-

Product Evaluation Form

-

Construction Contract

-

School Receipt Form

-

Restaurant Training Form

-

Daily Cash Log