A Tax Exemption Form is essential for individuals and businesses seeking to reduce taxable income. Whether you’re applying for a nonprofit status, personal exemptions, or sales tax relief, this guide covers everything you need. Understanding the right Business Tax Form ensures compliance and maximizes benefits. Learn about eligibility, necessary documentation, and step-by-step filing procedures. With proper knowledge, you can legally minimize tax liabilities and prevent errors. Our comprehensive guide provides sample forms, expert tips, and insights to help you navigate the process smoothly. Get started today and optimize your tax savings effectively.

Download Tax Exemption Form Bundle

What is Tax Exemption Form?

A Tax Exemption Form is a legal document that allows individuals or businesses to claim tax reductions or exemptions. It helps minimize tax liability by proving eligibility for deductions, nonprofit status, or other tax benefits. This form is used in various scenarios, such as sales tax exemption, income tax relief, and charitable organization exemptions. Depending on jurisdiction, applicants may need to submit supporting documents to qualify. Filing an accurate Tax Exemption Form ensures compliance and avoids unnecessary tax payments while maximizing financial benefits.

Tax Exemption Format

Applicant Information

Full Name: __________

Taxpayer Identification Number (TIN): __________

Contact Number: __________

Address: __________

Exemption Details

- Type of Exemption Requested: (e.g., Non-Profit Organization, Religious Institution, Government Entity)

- Justification: Provide a detailed explanation of why this exemption applies, referencing applicable tax laws or regulations.

- Supporting Documents: List attached documents, such as proof of eligibility, financial statements, or exemption certificates.

Declaration and Authorization

I certify that the information provided is accurate and that I meet all requirements for the requested tax exemption.

Applicant Signature: __________

Date: __________

Tax Authority Representative: __________

Signature: __________

Date: __________

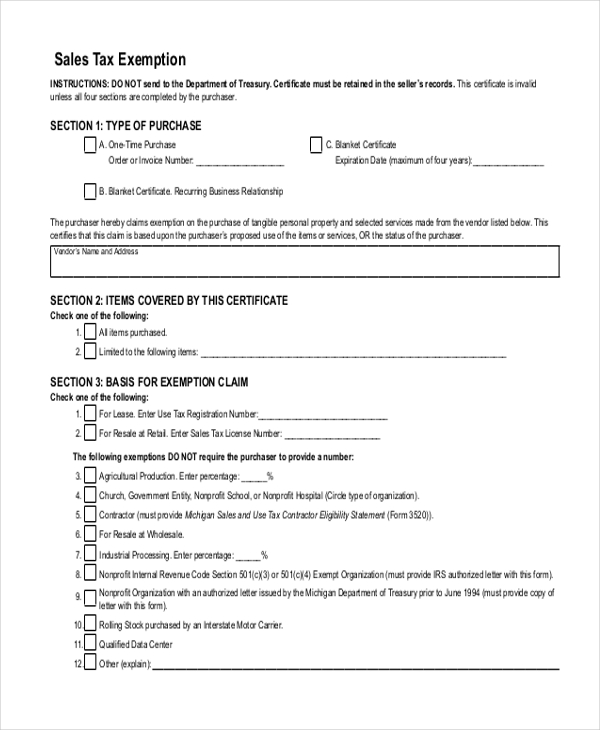

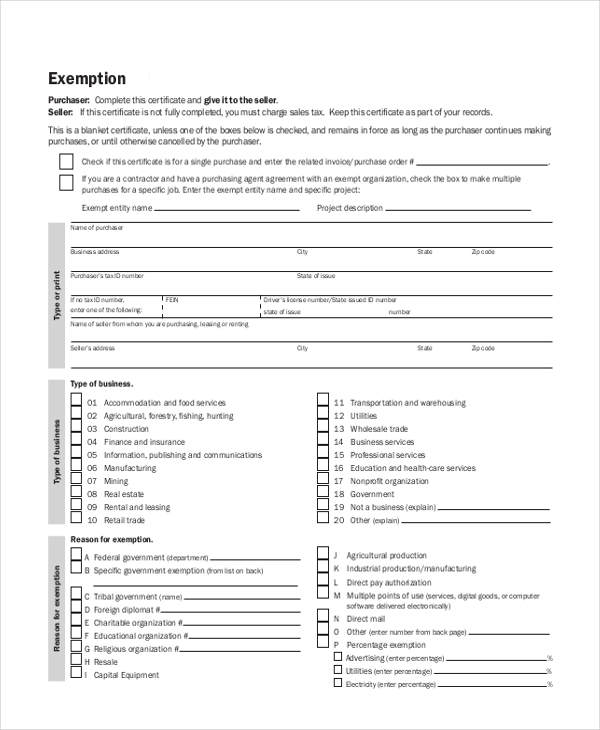

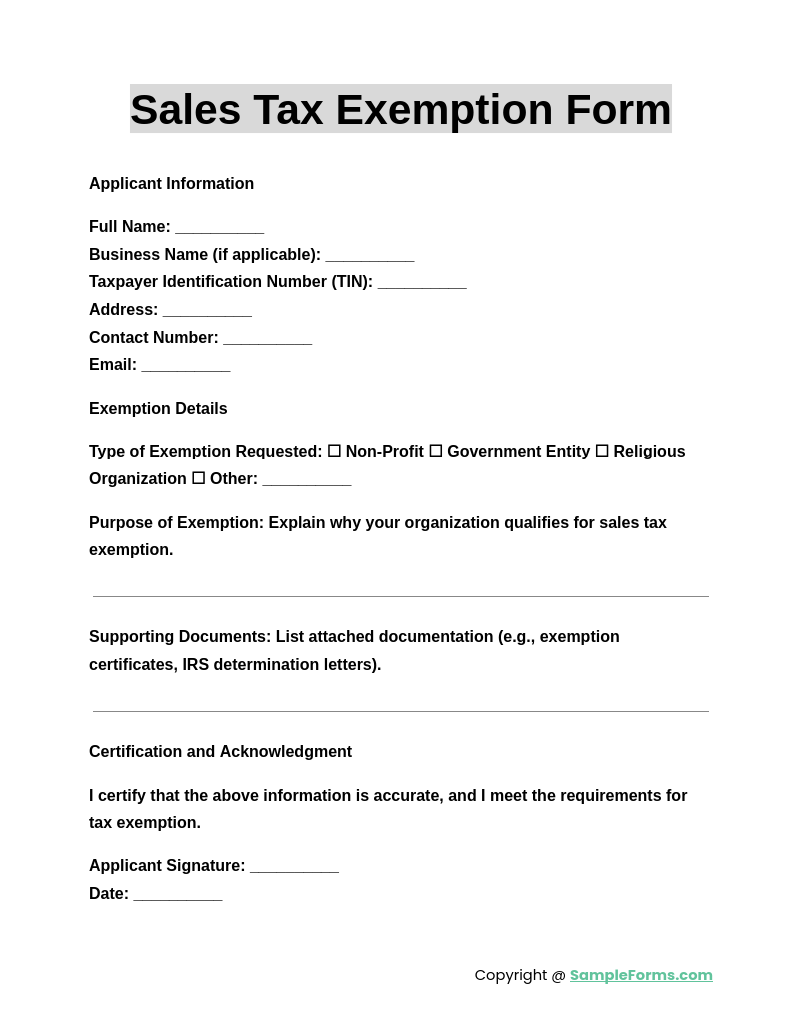

Sales Tax Exemption Form

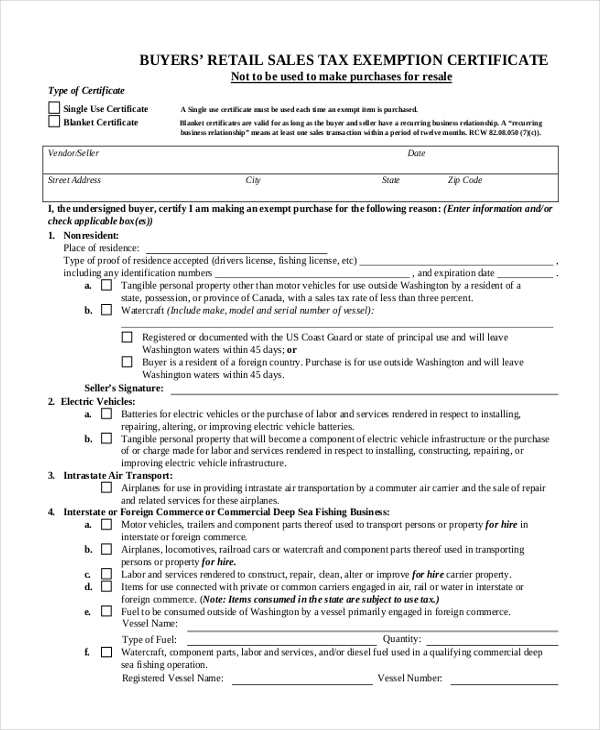

A Sales Tax Exemption Form allows businesses and organizations to purchase goods tax-free under specific conditions. Similar to a Notice of Exemption Form, it verifies eligibility for exemptions, ensuring compliance while reducing unnecessary tax expenses.

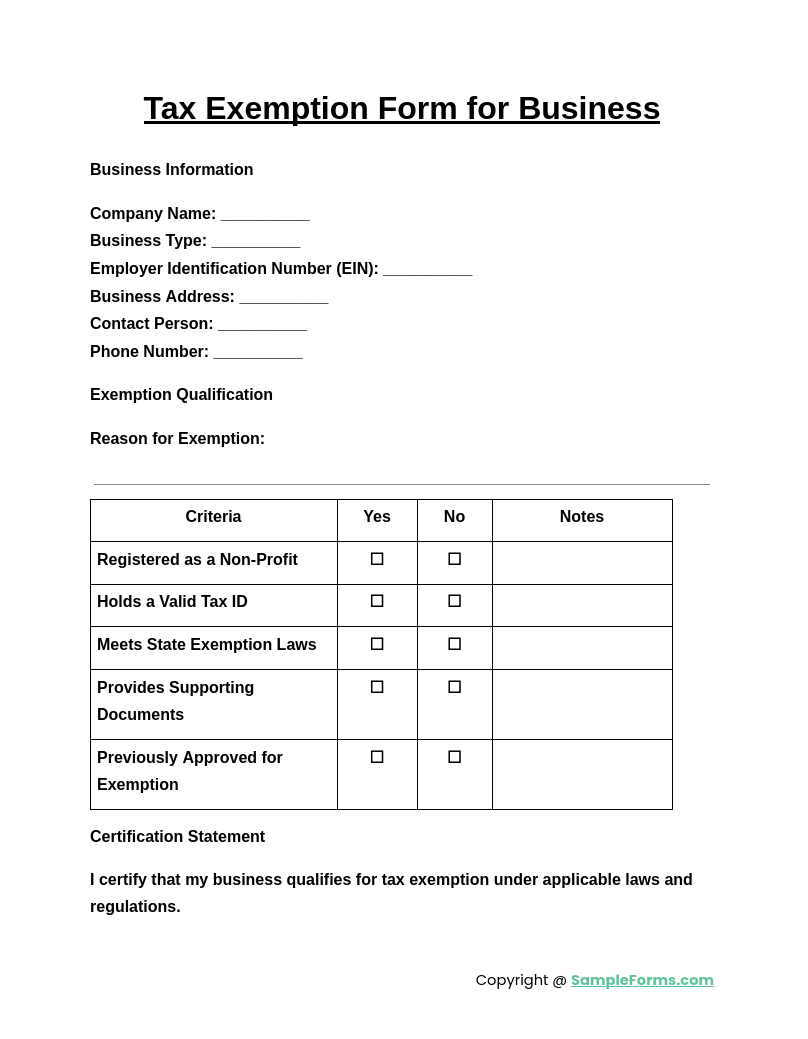

Tax Exemption Form for Business

A Tax Exemption Form for Business helps companies qualify for tax relief based on their operations. Like a Federal Tax Form, it documents exemption eligibility, reducing financial burdens while ensuring proper tax compliance with state and federal laws.

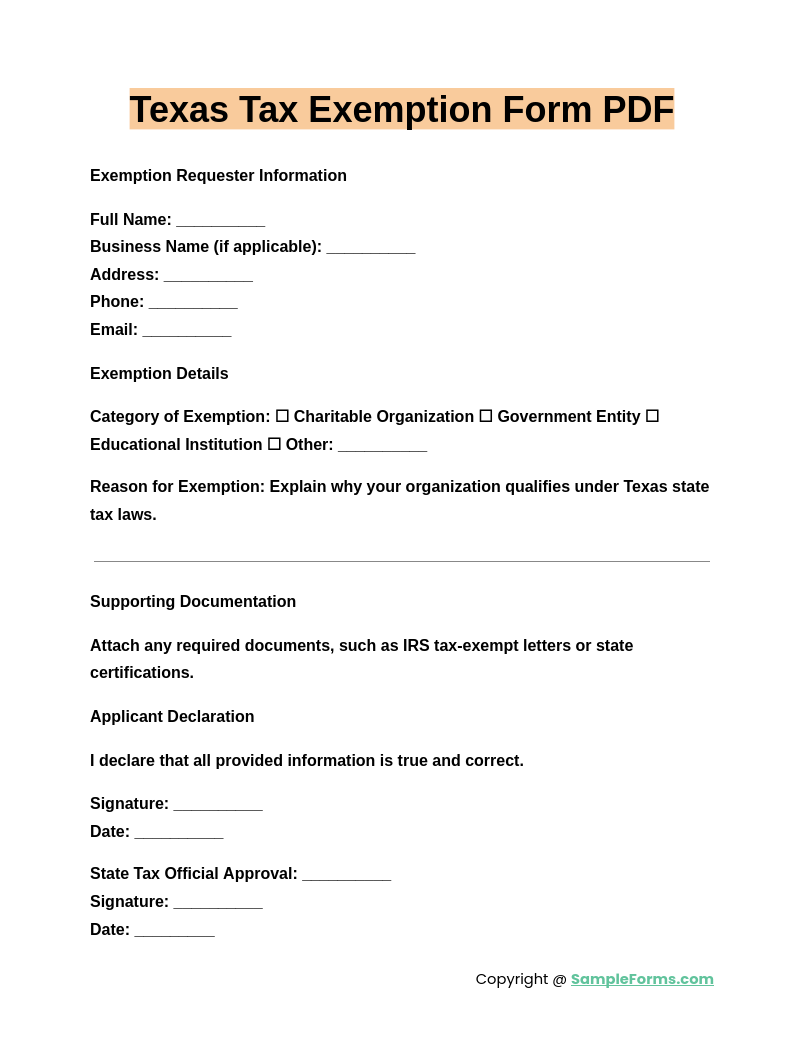

Texas Tax Exemption Form PDF

A Texas Tax Exemption Form PDF enables individuals and businesses to claim state tax exemptions. Similar to a Tax Verification Form, it ensures proper documentation, allowing qualified entities to legally minimize their tax liabilities in Texas.

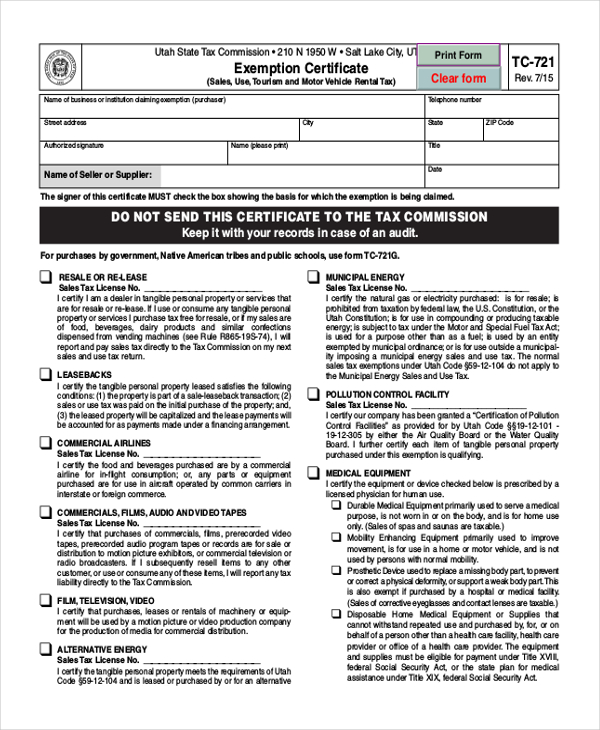

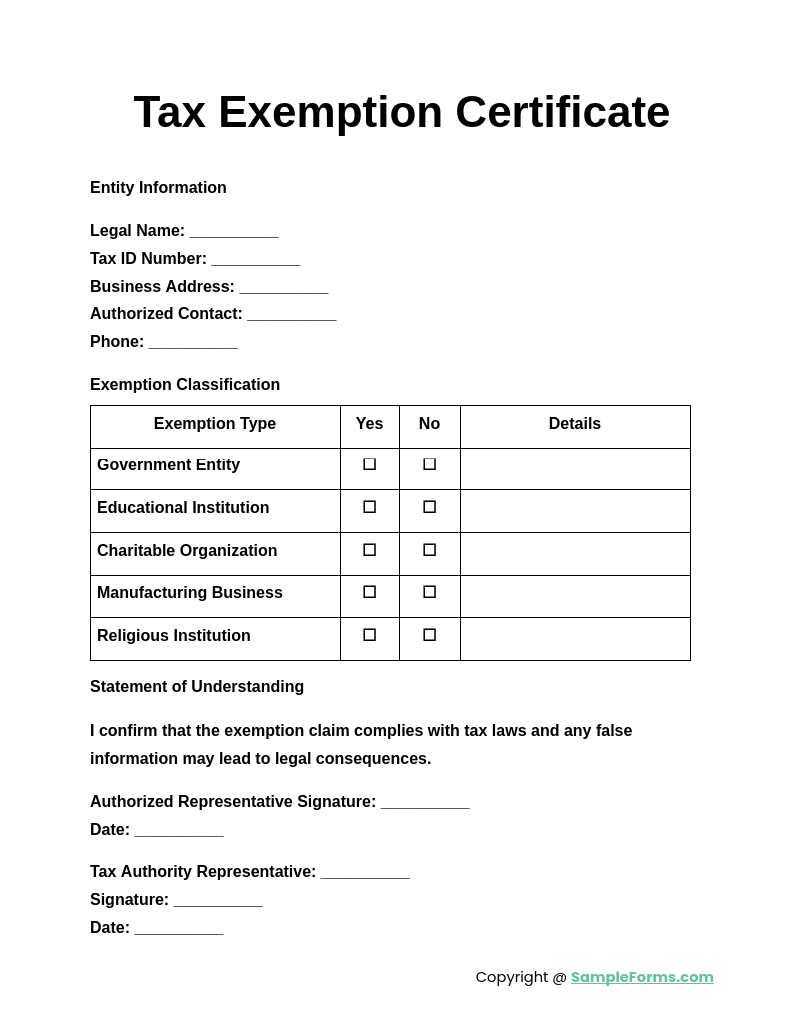

Tax Exemption Certificate

A Tax Exemption Certificate provides proof of tax-exempt status for eligible entities. Much like an Income Tax Extension Form, it requires proper filing to validate exemption claims, helping businesses and individuals comply with tax regulations while maximizing savings.

Browse More Tax Exemption Forms

Sample Sales Tax Exemption Form

Free Military Hotel Tax Exemption Form

Example of Federal Sales Tax Exemption Form

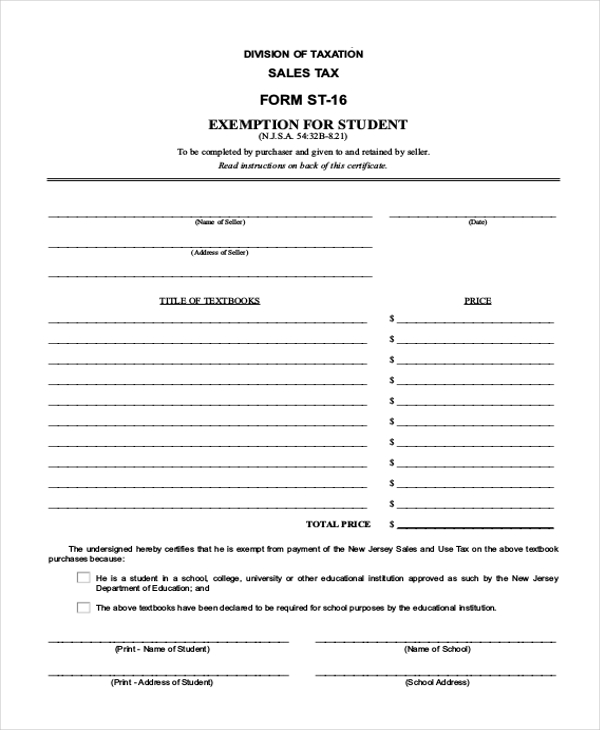

Tax Exemption Form For Student

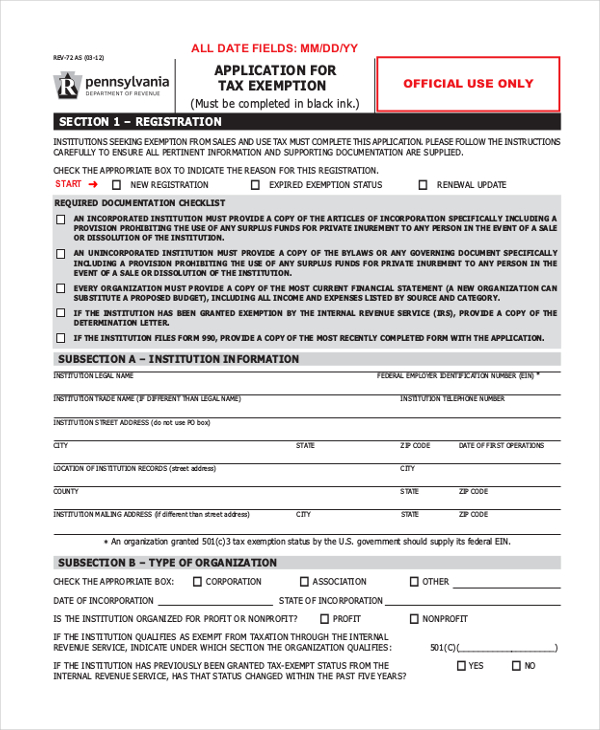

Downloadable Application For Tax Exemption Form

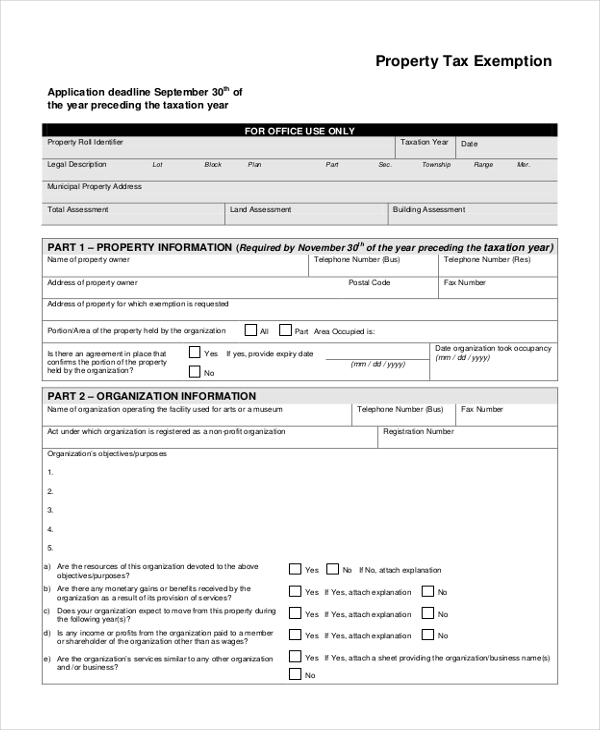

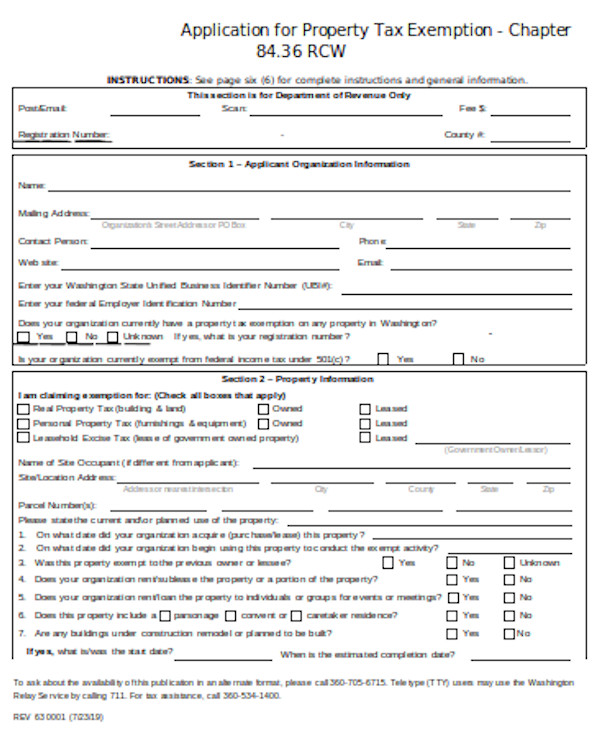

Property Tax Exemption Form in PDF

Utah Sales Tax Exemption Certificate Form Format

Buyer’s Retail Sales Tax Exemption Certificate Form

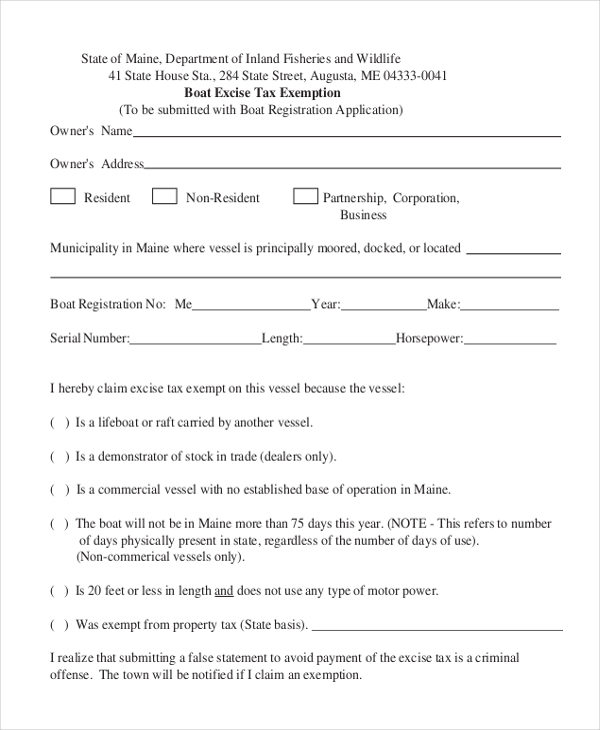

Boat Excise Tax Exemption Form

Tax Exemption Application Form

How do you get a tax-exempt form?

Obtaining a tax-exempt form requires meeting eligibility criteria and following the proper filing process. Similar to an Assessment Form, the process ensures compliance with legal tax exemptions.

- Determine Eligibility: Verify if you qualify for tax-exempt status based on organization type or individual income criteria.

- Gather Required Documents: Collect supporting paperwork, such as business registration or proof of nonprofit status.

- Complete the Application: Fill out the necessary tax-exempt forms provided by the IRS or state tax authorities.

- Submit to the Appropriate Authority: File the form with the relevant tax agency, ensuring all required information is accurate.

- Receive and Maintain Exemption Status: Once approved, regularly review tax exemption rules to maintain compliance.

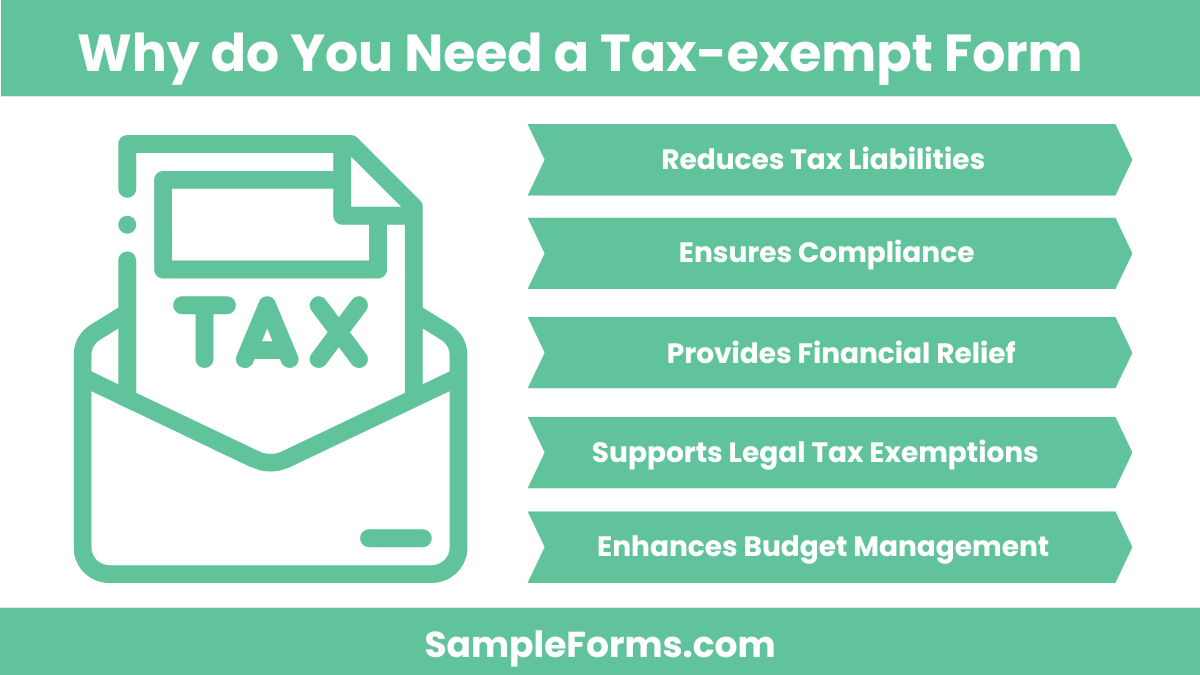

Why do you need a tax-exempt form?

A tax-exempt form is essential for reducing taxable income and ensuring legal compliance. Similar to a Risk Assessment Form, it helps evaluate financial benefits and liabilities.

- Reduces Tax Liabilities: Eligible individuals or organizations can legally lower their tax obligations.

- Ensures Compliance: Filing the form helps prevent penalties for tax misfiling or non-payment.

- Provides Financial Relief: Charitable organizations and nonprofits benefit from reduced operational costs.

- Supports Legal Tax Exemptions: Allows businesses and individuals to claim rightful deductions under tax laws.

- Enhances Budget Management: Savings from tax exemptions can be allocated to other financial priorities.

What is the disadvantage of the tax exemption?

Although tax exemptions offer benefits, they also come with limitations. Similar to an Interview Assessment Form, they require careful evaluation before applying.

- Strict Eligibility Requirements: Only specific organizations and individuals qualify for exemptions.

- Frequent Compliance Audits: Tax authorities may conduct audits to ensure continued eligibility.

- Limited Deductions: Some exemptions restrict the types of expenses that can be deducted.

- Potential Loss of Benefits: Misuse or misfiling can lead to penalties or loss of exemption status.

- Complex Application Process: Filing for tax-exempt status often involves detailed paperwork and strict documentation.

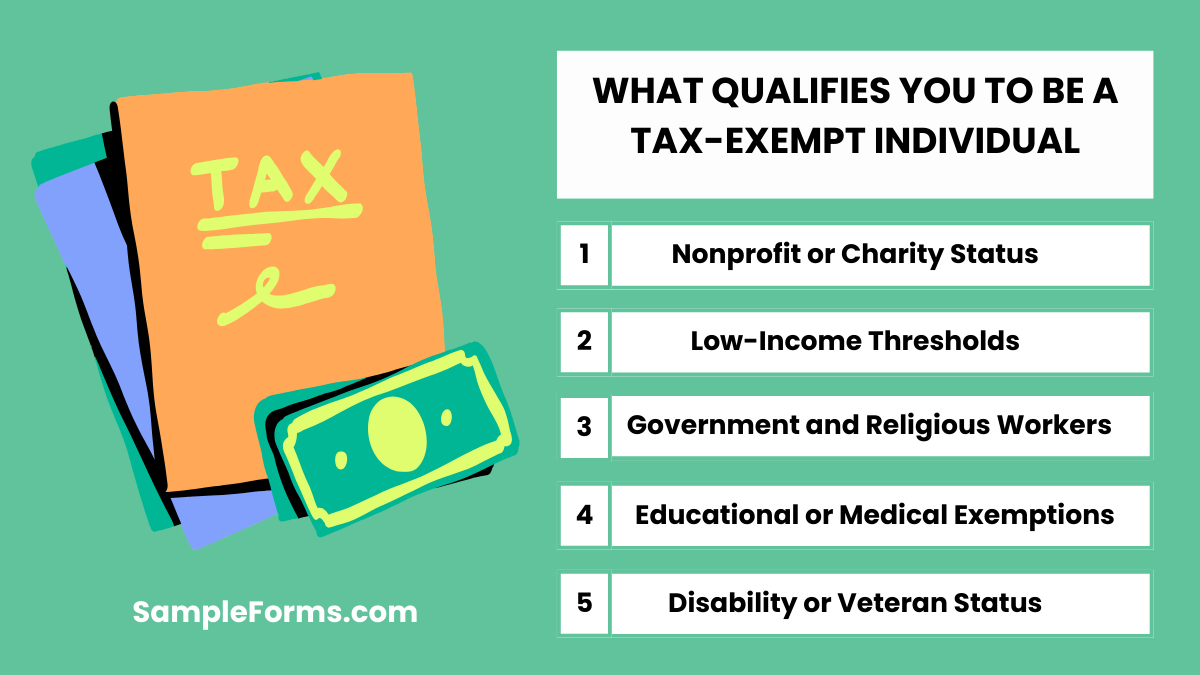

What qualifies you to be a tax-exempt individual?

Tax-exempt status depends on income, organization type, and purpose. Similar to a Physical Therapy Assessment Form, it involves meeting specific criteria for eligibility.

- Nonprofit or Charity Status: Individuals working for recognized nonprofit organizations may qualify.

- Low-Income Thresholds: Certain income levels allow individuals to be exempt from federal taxes.

- Government and Religious Workers: Some government employees and religious personnel qualify for exemptions.

- Educational or Medical Exemptions: Students, researchers, or medical patients may be eligible for tax relief.

- Disability or Veteran Status: Some individuals with disabilities or veterans receive tax-exempt benefits.

What are the consequences of going exempt?

Going tax-exempt can impact financial and tax responsibilities. Similar to a Nursing Assessment Form, it requires careful consideration of potential risks.

- Higher Tax Burden Later: Incorrectly claiming exemption can result in large tax payments at year-end.

- Loss of Tax Refunds: Exempt individuals may not receive refunds on tax withholdings.

- Legal Penalties: Falsely claiming exempt status can lead to IRS fines or legal consequences.

- Limited Financial Planning Options: Exempt status can affect future deductions and tax credits.

- Additional Documentation Requirements: Exemption status often requires extra paperwork and verification.

Is it good to claim exemption?

Claiming exemption can reduce tax withholding but may result in a tax bill later. Similar to a Fitness Assessment Form, it requires careful evaluation to ensure financial benefits without unexpected tax liabilities.

How much exemption should I claim?

The number of exemptions depends on income, deductions, and dependents. Like a Psychosocial Assessment Form, analyzing financial factors helps determine the right balance between immediate income and future tax responsibilities.

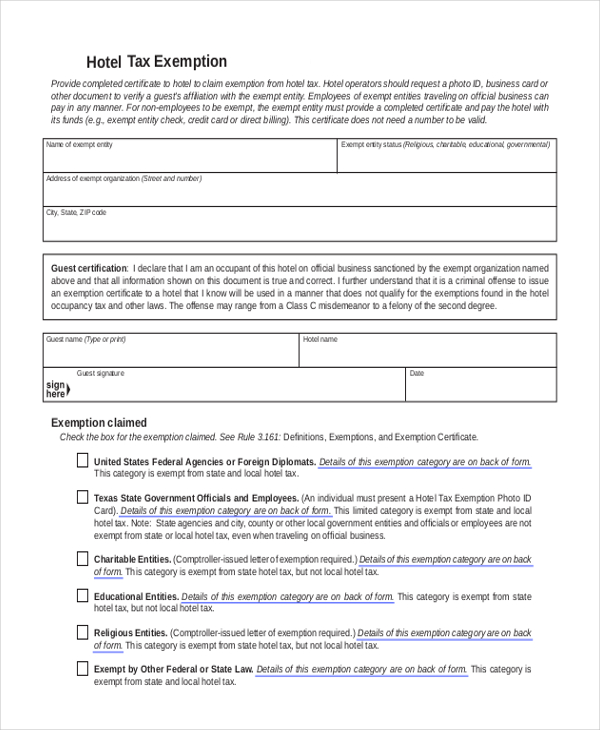

What qualifies for tax-exempt in Texas?

Nonprofits, religious organizations, and government entities qualify for tax exemptions in Texas. Similar to a Nutrition Assessment Form, verifying eligibility ensures compliance and financial benefits without tax liabilities.

How do I get my exemption certificate?

Obtain a tax exemption certificate by applying through the state or IRS. Like a Mental Health Assessment Form, it requires proper documentation, eligibility verification, and submission to the appropriate tax authority.

How do you qualify for a personal exemption?

Individuals qualify based on income, dependents, and filing status. Similar to a Functional Behavior Assessment Form, meeting specific criteria ensures eligibility for tax-exempt benefits and reduces taxable income legally.

How do I make myself tax-exempt?

To become tax-exempt, meet income-based or nonprofit requirements. Like a Health Assessment Form, gathering documentation, filing the right forms, and verifying status ensures compliance with exemption laws.

How do I become a tax-exempt employee?

Employees can file exemption forms if they meet IRS requirements. Similar to a Skills Assessment Form, verifying income levels and employment type is essential before claiming tax-exempt status.

How to check tax-exempt status?

Tax-exempt status can be checked through the IRS or state databases. Like a Teacher Assessment Form, reviewing official records ensures compliance and confirms ongoing eligibility for tax benefits.

What kind of income is not taxable?

Certain income types, like gifts, inheritances, and some benefits, are tax-free. Similar to a Preschool Assessment Form, verifying exclusions ensures proper tax reporting and financial planning.

Can you deny tax-exempt?

Tax authorities can deny exemption if eligibility is not met. Like a Patient Assessment Form, accurate documentation and compliance with regulations are crucial to securing tax-exempt status.

An Initial Assessment Form is crucial in determining eligibility for tax exemptions. With accurate individuals and businesses can apply for tax relief efficiently. Proper documentation and understanding of exemptions ensure compliance with tax regulations while optimizing financial savings. Whether for personal deductions, business exemptions, or nonprofit status, using the correct Initial Assessment Form streamlines the process. By staying informed and submitting accurate forms, taxpayers can avoid penalties and maximize exemptions legally.

Related Posts

Sample Affidavit Form - 15+ Free Documents in PDF, Doc

Payroll Deduction Form Samples - 9+ Free Documents in Word, PDF

8+ Sample Donation Receipt Forms

Sample Payroll Forms - 19+ Free Documents in Word, PDF

Service Contract Approval Form - 8+ Free Documents in PDF, Doc

9+ Sample Injured Spouse Forms

41 Sample Student Application Forms

8+ Sample Employee Status Change Forms Sample Forms

Sample DMV Bill of Sale Forms - 8+ Free Documents in PDF

Free Change Forms

7+ Quit Claim Deed Form Samples

20+ Sample Tax Forms

8+ Sample Federal Tax Forms

Sample Employee Tax Forms - 9+ Free Documents in Word, PDF

7+ Income Assessment Form Samples - Free Sample, Example ...