Master the intricacies of State Tax management with our essential guide on using a Power of Attorney. Tailored for both individuals and businesses, this resource provides strategic insights into appointing a tax agent and leveraging their expertise. Our tips ensure legal compliance and smooth tax operations, making tax season less daunting. Ideal for those seeking efficient tax handling, our guide simplifies complex tax procedures, empowering you with knowledge and confidence. Dive in to navigate state tax matters effortlessly

What is the State Tax / Power of Attorney Form?

A State Tax Power of Attorney Form is a legal document that allows an individual or business to appoint someone else, usually a tax professional, to handle their state tax matters. This form gives the appointed person authority to communicate with state tax authorities, access confidential tax information, and make decisions or represent the individual or business in tax-related issues at the state level. It’s specifically for state tax purposes, separate from federal tax matters.

What is the best Example of State Tax / Power of Attorney Form?

STATE TAX POWER OF ATTORNEY

Effective Date: [Insert Date]

I, [Principal’s Full Name]___________, residing at [Principal’s Address], hereby appoint [Agent’s Full Name], [Agent’s Title]__________ at [Agent’s Address]_____________, as my Attorney-in-Fact (“Agent”) to handle my state tax matters.

AUTHORIZED POWERS:

The Agent shall have full authority to represent me and perform on my behalf the following:

- Discuss and disclose with state tax authorities my tax matters.

- Receive confidential tax information.

- Enter into agreements, compromise, or settle tax matters.

- Execute consents extending the statutory period for tax assessments or collections.

TAX MATTERS:

This Power of Attorney is applicable to the following tax matters:

- Type of Tax: [Specify: Income, Sales, Property, etc.]

- Tax Periods: [Specify periods]

DURATION:

This Power of Attorney is effective immediately and will remain in effect until __[Insert End Date or Event]____, unless revoked earlier.

THIRD-PARTY RELIANCE:

Third parties may rely upon the representations of the Agent as to all matters regarding the powers granted.

REVOCATION:

This Power of Attorney may be revoked at any time by providing written notice to the Agent.

GOVERNING LAW:

This document is governed by the laws of the State of __[Insert State]____.

ACKNOWLEDGEMENTS:

Principal’s Signature: ___________________________

Date: _______________

Agent’s Signature: _____________________________

Date: _______________

NOTARIZATION:

Subscribed and sworn to before me this [Insert Day]__ day of [Insert Month]____, 20[Insert Year], by [Principal’s Full Name]___________ and [Agent’s Full Name]_________.

Notary Public’s Signature: _________________________________

My commission expires: _______________

SEAL:

INSTRUCTIONS: Complete all sections with the appropriate information. Ensure clarity and precision in defining the powers granted. The form should be notarized and may require witness signatures depending on your jurisdiction’s laws. Consult a legal professional for state-specific requirements and to ensure the document is accurately executed.

Free 10+ State Tax / Power of Attorney Forms

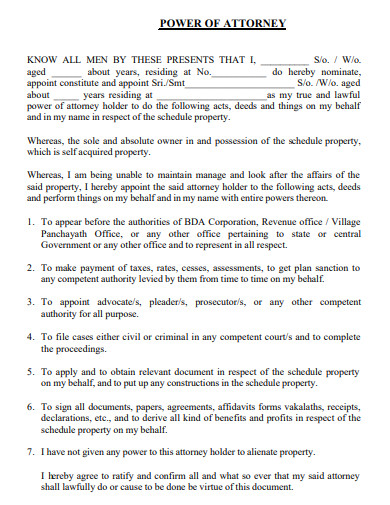

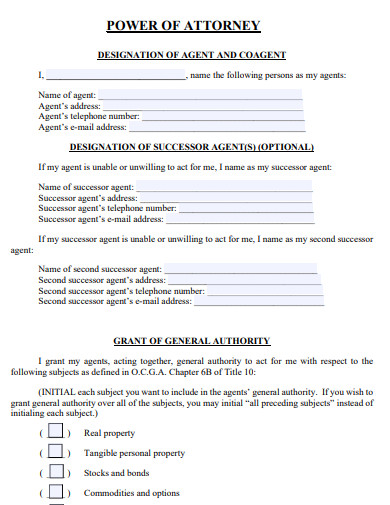

1. Simple Power of Attorney Form

2. Georgia Power of Attorney Form

3. Pennsylvania Power of Attorney Form

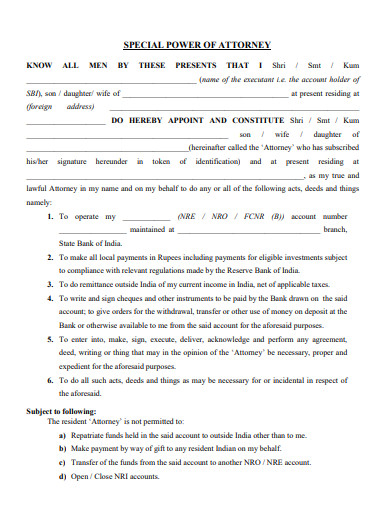

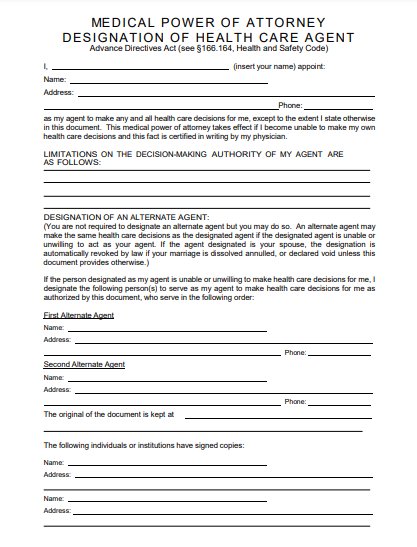

4. Special Power of Attorney Form

5. Blank Power of Attorney Form

6. Lasting Power of Attorney Form

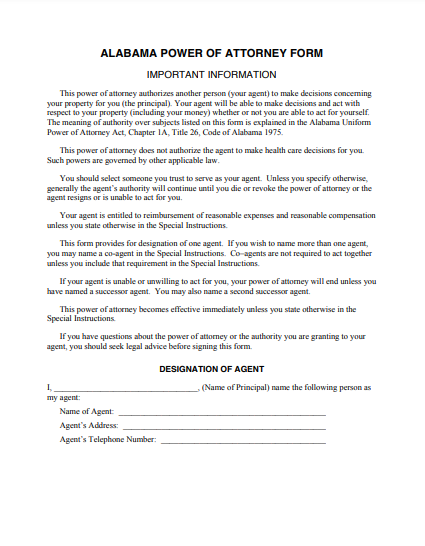

7. Alabama Power of Attorney Form

8. Special Power of Attorney Forms

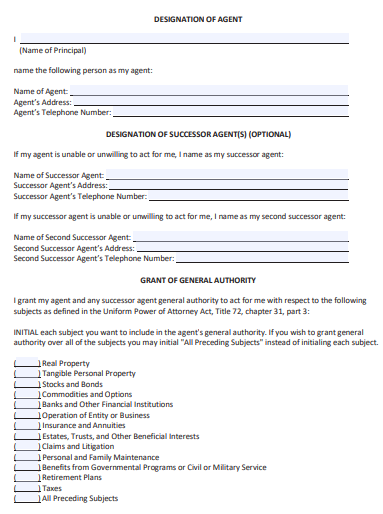

9. New York Power of Attorney Form

10. Montana Power of Attorney Form

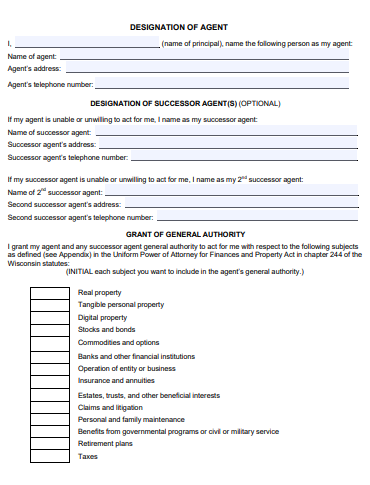

11. Wisconsin Power of Attorney Form

What tax details are needed for a State Tax Power of Attorney Form?

Certainly! Here are the steps outlining the tax details needed for a State Tax Power of Attorney Form:

- Type of Tax: Specify the type of state tax for which the POA is applicable. This could be income tax, sales tax, property tax, etc.

- Tax Periods: Clearly state the specific tax years or periods covered by the POA. For example, “State Income Tax for the years 2022-2023.”

- Tax Matters: Detail any particular tax matters the agent is authorized to handle. This might include filing returns, handling audits, or dealing with tax liabilities.

- Taxpayer Identification: Include the taxpayer’s identification number, such as a Social Security Number or Employer Identification Number.

- Principal’s Details: Provide the full legal name and address of the principal (the person granting the POA).

- Agent’s Details: Include the full legal name and contact information of the agent (the person authorized to act).

By following these steps, you ensure that the State Tax Power of Attorney Form contains all the necessary tax-related information to be effective and valid.

How to select an agent for a State Tax Power of Attorney Form?

Selecting an agent for a State Tax Power of Attorney Form involves careful consideration:

- Assess Expertise: Choose someone knowledgeable in state tax matters, ideally a tax professional like a CPA or tax attorney.

- Evaluate Trustworthiness: Ensure the agent is trustworthy, as they will handle sensitive tax information and make important decisions on your behalf.

- Check Availability: Confirm that the agent is willing and able to dedicate the necessary time and attention to your tax matters.

- Review Communication Skills: Choose someone who communicates clearly and effectively, as they will be liaising with tax authorities on your behalf.

- Confirm Understanding: Ensure the agent understands your tax situation and your expectations regarding the handling of your affairs.

- Verify Credentials: If selecting a professional, check their credentials and experience in handling state tax issues.

By following these guidelines, you can select a competent and reliable agent for your State Tax Power of Attorney Form.

How to revoke a State Tax Power of Attorney Form?

Can I change powers in an existing State Tax Power of Attorney Form?

Yes, you can change the powers in an existing State Tax Power of Attorney Form. However, this typically cannot be done by simply amending the existing document. Instead, you should:

- Revoke the Current POA: Create and execute a revocation document for the current Power of Attorney. Notify the agent and relevant state tax authorities of this revocation.

- Draft a New POA: Prepare a new State Tax Power of Attorney Form that includes the updated powers and specifications you desire.

- Execute the New POA: Follow the standard procedure for executing a Power of Attorney, including signing, dating, and potentially notarizing the document.

- Notify the Agent and Authorities: Provide the new POA to your agent and submit it to the necessary state tax authorities.

This process ensures that the changes in powers are clearly documented and legally recognized.

What is the power of attorney for tax authority?

A Power of Attorney for tax authority is a legal document that authorizes an individual or a professional, such as a tax attorney or accountant, to represent another person or entity in matters related to taxes. This authorization can include handling tax filings, communicating with tax agencies, obtaining and providing tax information, and making decisions about tax payments, disputes, or negotiations. The scope of authority can be broad or limited to specific tax-related tasks, depending on how the Power of Attorney is structured. This document is especially useful for individuals or businesses that require expertise in managing complex tax matters or for those who are unable to handle their tax affairs personally.

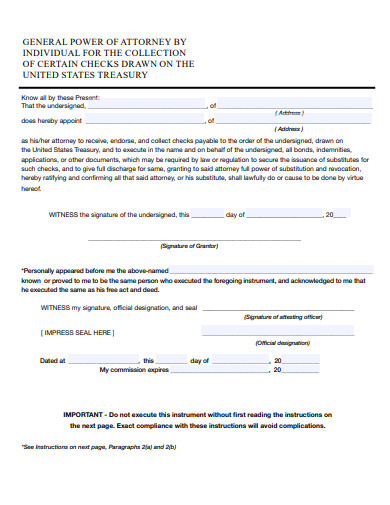

How do I submit power of attorney to IRS?

To submit a Power of Attorney (POA) to the IRS, you typically use Form 2848, “Power of Attorney and Declaration of Representative.” Here’s how to do it:

- Complete Form 2848: Fill in all required information, including your name, taxpayer identification number (SSN or EIN), your address, the name and address of your appointed representative, and their CAF number (if they have one).

- Specify Tax Matters: Clearly detail the specific tax matters, tax forms, and years or periods for which the POA is valid.

- Sign and Date the Form: As the taxpayer, you must sign and date the form. If you’re filing jointly, both spouses must sign if both are granting the POA.

- Representative’s Signature: The appointed representative must also sign and date the form, declaring their eligibility to represent you before the IRS.

- Submit the Form: You can mail or fax the completed form to the IRS. The appropriate fax number or mailing address depends on your state, which you can find in the instructions for Form 2848.

- Keep a Copy: Retain a copy of the signed form for your records.

- Await Confirmation: The IRS will send a notice confirming they’ve received and processed your POA.

Note: If your situation involves a specific tax issue, like an audit or collection matter, you might need to send the form to a different address or fax number. Always check the latest IRS guidelines or consult with a tax professional to ensure correct submission.

How to Prepare a State tax / Power of Attorney Form

Preparing a State Tax Power of Attorney Form involves a series of steps to ensure it’s legally valid and meets your specific needs:

Step 1: Obtain the Correct Form

- Most states have a specific form for State Tax Power of Attorney. Obtain the correct form from your state’s tax authority or website.

Step 2: Fill Out Your Information

- Enter your full name, address, and taxpayer identification number (like your Social Security Number or Employer Identification Number).

Step 3: Appoint Your Agent

- Choose a trusted individual or a qualified professional (like a CPA or tax attorney) as your agent. Fill in their full name and contact details.

Step 4: Specify Tax Matters

- Clearly define the tax matters for which the agent is being granted authority. This can include specific tax types (income, sales, property, etc.) and tax years or periods.

Step 5: Define the Powers

- Detail the exact powers you’re granting to your agent. This can include the power to receive confidential information, represent you in tax matters, and make decisions on your behalf.

Step 6: Sign and Date the Form

- You (the principal) need to sign and date the form. Depending on the state’s requirements, your signature may need to be notarized.

Step 7: Have the Agent Sign

- In some states, the appointed agent must also sign the form, acknowledging their acceptance of the responsibilities.

Step 8: Notarize (If Required)

- If your state requires notarization, have the form notarized after signing.

Step 9: Make Copies

- Keep a copy of the completed form for your records. Provide a copy to your agent and any other relevant parties.

Step 10: Submit the Form

- Submit the completed form to the appropriate state tax authority. The submission process may vary by state.

Step 11: Follow Up

- Ensure that the state tax authority has processed your Power of Attorney.

Remember, each state may have different requirements for a State Tax Power of Attorney. It’s advisable to check with your state’s tax authority or consult a tax professional to ensure you’re following the correct procedure and the form is filled out accurately.

Tips for Using Effective State tax / Power of Attorney Form

Can Power of Attorney Be Made in Different State?

Yes, a Power of Attorney can be made in a different state, but it must comply with the legal requirements of the state where it will be used.

What is the Role of a Power of Attorney for Income Tax?

The role of a Power of Attorney for income tax is to authorize an agent to handle tax filings, communications, and negotiations with tax authorities on behalf of the principal.

What Are the New Rules of Power of Attorney?

New rules of Power of Attorney can vary by jurisdiction and often involve updates in legal formalities, recognition of digital signatures, or changes in witnessing requirements.

Can Power of Attorney Be Cancelled?

Yes, a Power of Attorney can be cancelled or revoked by the principal at any time, as long as they are mentally competent and follow the proper legal procedure.

What is Irrevocable Power of Attorney?

An Irrevocable Power of Attorney is a legal document that cannot be easily revoked or altered once it is executed, often used in specific situations like trust management or business transactions.

State Tax Power of Attorney Form is an essential tool for effectively managing state tax affairs through a designated agent. This guide provides key insights into drafting the form accurately and tips for using it effectively. By carefully selecting an agent, understanding legal requirements, and regularly reviewing the form, you can ensure your state tax matters are handled proficiently and in accordance with your wishes

Related Posts

-

FREE 33+ State Based Power of Attorney Forms in PDF | Ms Word

-

10+ Free New Hampshire (NH) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Massachusetts (MA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kentucky (KY) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips