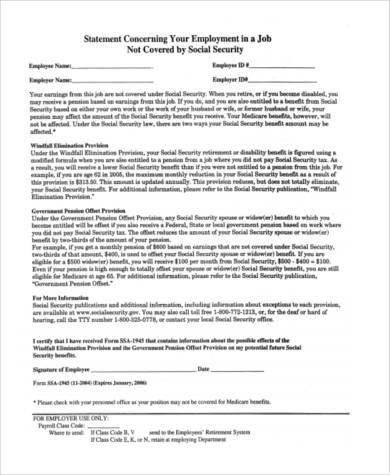

The Social Security Administration levies taxes from employers and employees, even those who are self-employed, to fund the retirement, disability, and survivor benefits received by million of American each year. The taxes being levied are based on the income of the employee.

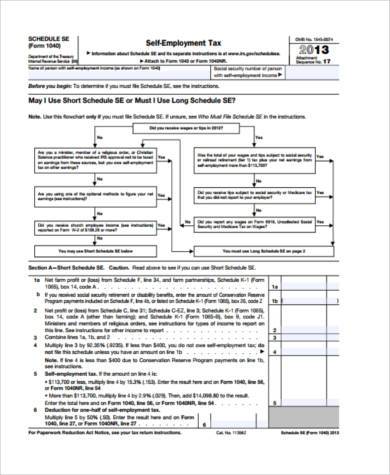

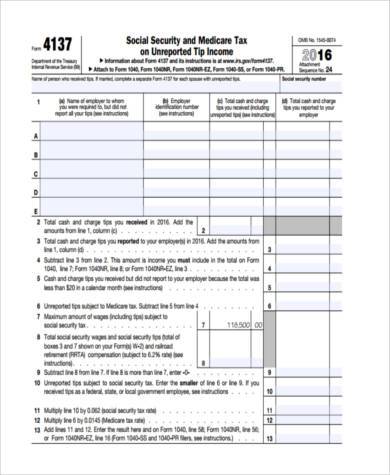

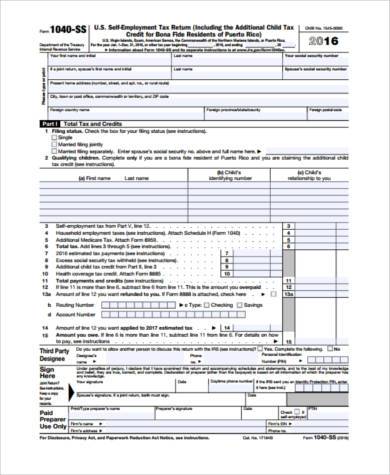

The current rate for Social Security taxes is 12.4%, half of which is paid by the employer. If you are self-employed, you are to pay all 12.4%, but there are certain deductions applicable so it wouldn’t be too heavy for the self-employed individuals. To properly document an individual’s income that are subject to taxes, the use of certain Social Security Forms is necessary.

Social Security Disability Tax Form

Social Security Income Tax Form

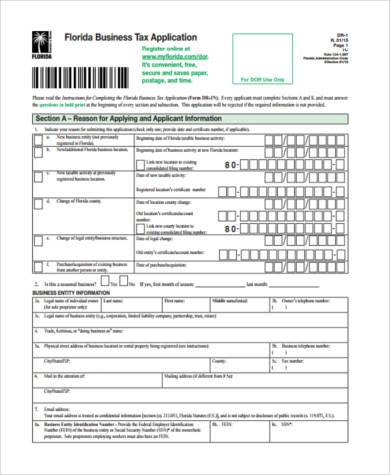

Social Security Tax Information Form

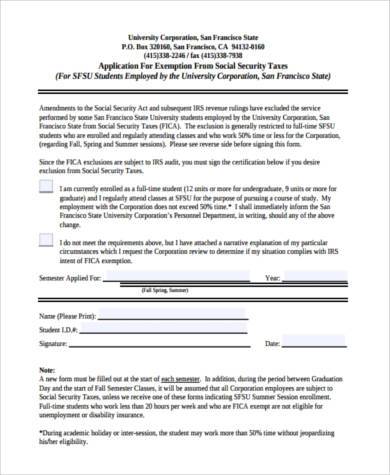

Social Security Tax Exemption Form

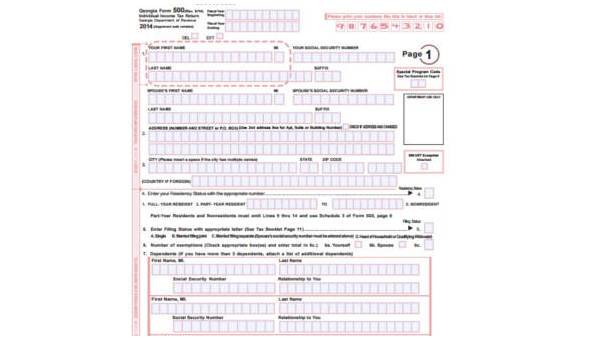

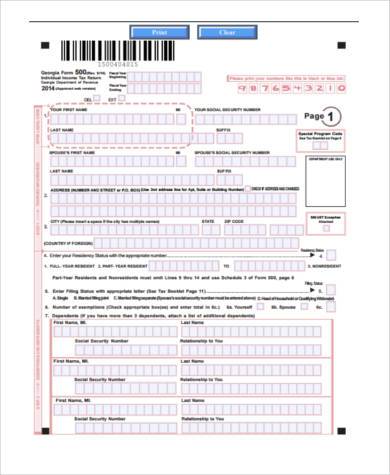

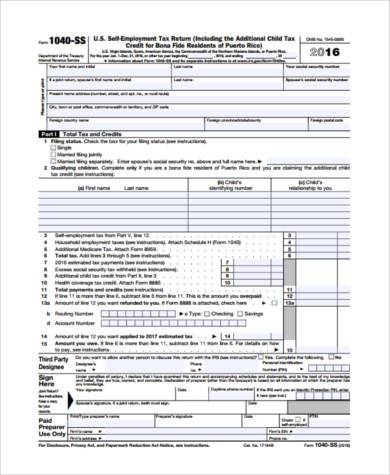

Social Security Tax Return Form

Supplemental Security Income (SSI) Benefits

This is a program administered by the Social Security Administration for the following individuals:

- disabled individuals

- blind individuals

- individuals who are over 65 years of age

In addition, they would also have to meet the following requirements to qualify:

- has limited income or low income

- has limited resources

- is a citizen of the United States or an alien who belongs in the eligible categories

What Does “Disabled” Mean?

In SSI, disabled means that the individual has a physical or mental incapacity that hinders the individual from doing meaningful and gainful activities and tasks. This also means that the individual’s condition is medically examined, can result to death, and is expected or can last continuously for more than 12 months. Disability can also include emotional or learning impairments.

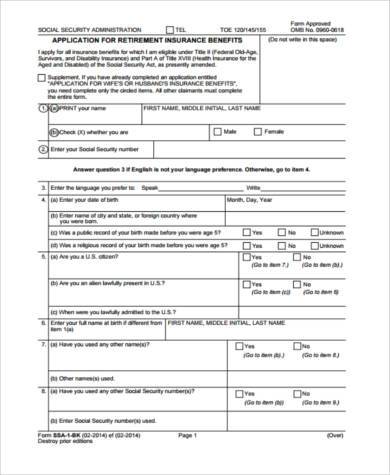

To qualify for disability benefits, certain Social Security Disability Forms have to be duly filled out by the claimant and submitted to the Social Security Administration, along with the necessary medical test results and other medical forms used to substantiate the claim. Aside from determining an individual’s eligibility for disability benefits, these forms will also be used to calculate the amount an individual is to receive, given that his claim is approved.

Self Employed Social Security Tax Form

Social Security Tax Form in PDF

Social Security Tax Form Example

Free Social Security Tax Form

What Does “Limited Income” Include?

An individual’s income is counted by the Social Security Administration. A person’s income could potentially reduce the SSI benefit amount that he or she would receive. For SSI, the following items are considered income:

- an individual’s salary or wages earned from work

- free food and shelter the individual receives

- money received from other sources, such as friends and relatives, veterans’ benefits, Social Security benefits, worker’s compensation, or unemployment benefits

All these, along with various other information, are to be declared on Social Security Application Forms when applying for Supplemental Security Income.

Who are not Eligible for SSI?

- Individuals who have escaped from custody or confinement, or those who have unsatisfied warrants of arrest

- Individuals who are presently in a prison, jail, or any correctional institution

- Individuals who are admitted in a public institution that is run by the local, state, or federal government

- Individuals who sell or give away their resources listed under what is considered as SSI resources so as to reduce their resource limit

- Individuals who have already received SSI benefits but have been absent from the United States for a whole month or more than 30 consecutive days

- non-citizens who are already receiving SSI benefits but no longer meet the requirements for qualified aliens

Related Posts Here

-

Landlord Consent Form

-

60-Day Notice to Vacate Form

-

Financial Statement Form

-

Product Evaluation Form

-

Construction Contract

-

School Receipt Form

-

Restaurant Training Form

-

Daily Cash Log

-

Volleyball Evaluation Form

-

Holding Deposit Agreement Form

-

License Agreement Short Form

-

Fund Transfer Form

-

Business Financial Statement Form

-

Sales Proposal Form

-

Event Evaluation Form