Being self-employed is great. You control your own time, especially if you work freelance. No one can boss you around because you are your own boss. But still, that doesn’t exempt you from certain responsibilities like paying taxes. Calculating taxes can give anyone a headache. We need all the help we can get, which is why there are Tax Forms that provide guidelines and information regarding tax returns.

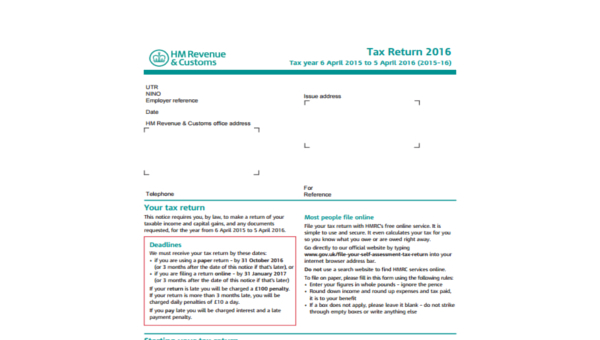

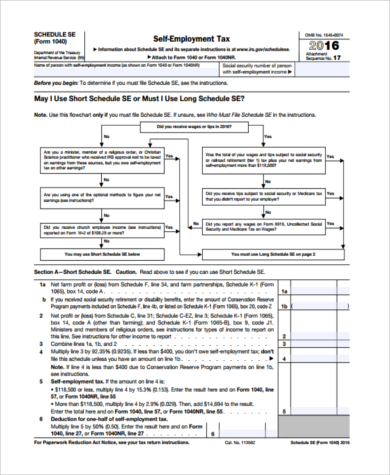

Self Employed Tax Return Form

Income Tax Form for Self Employed

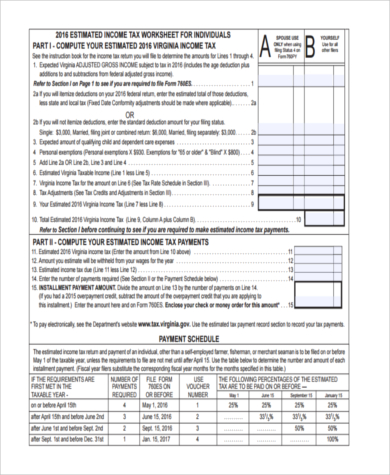

Self Employed Quarterly Tax Form

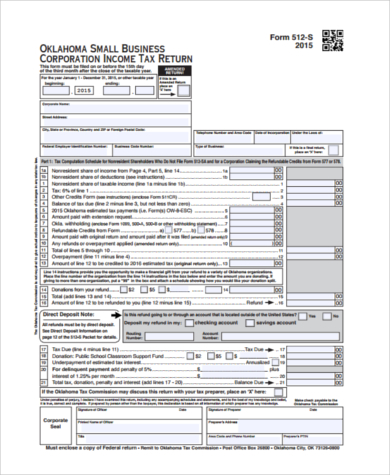

Tax Form for Small Business

What Is the Self-Employment Tax?

The self-employment tax consists of Social Security and Medicare taxes. When you are an employee, you and your employer will each pay half the percentage of your Social Security and Medicare taxes, but when you are self-employed, you will have to pay the combined employer and employee amount.

The good thing is that you get to deduct half of your self-employment tax from your total taxable net income because the IRS treats this as a business expense and allows you to deduct it. Not only that; you are only to pay self-employment tax for 92.35% of your total net income. So at the end of the day, the taxes you pay when you are self-employed are just about the same as when you work for an employer. You may also see our Sample Employment Forms.

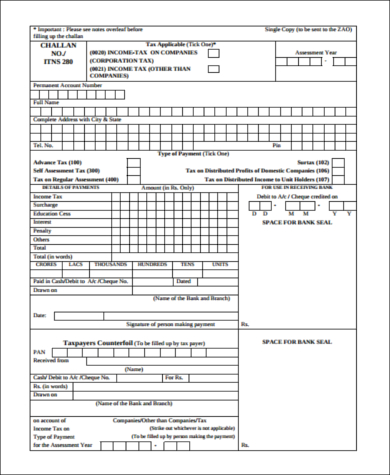

Self Employment Tax Payment Form

Self Employed Income Tax Form

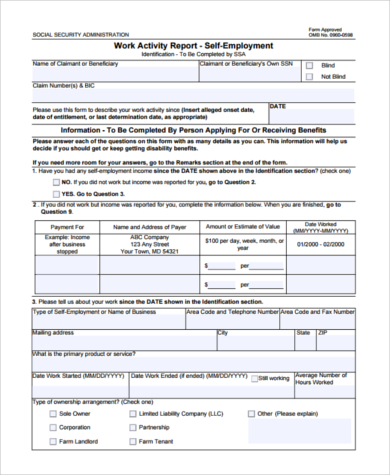

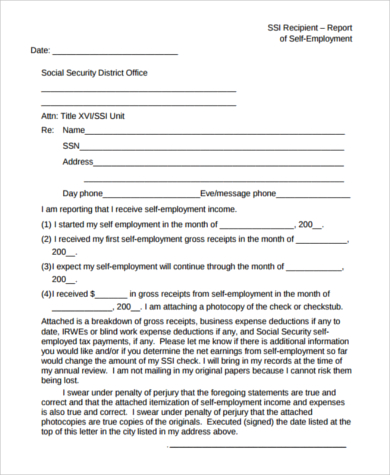

Self Employed Social Security Tax Form

Self Employed Contractor Tax Form

Who Can Use Self-Employment Tax Forms?

Anyone who is running a small business, is self-employed, an independent contractor, or a freelance worker can use Self-Employment Tax Forms and other Self Employment Forms. Although there are guidelines and information on the forms, it would also help to check the IRS website so that you can calculate the exact amount of taxes you have to pay so that there won’t be any surprises later and so that you can maximize your tax deductions.

What Are the Tax Deductions That Self-Employed Individuals Qualify for?

- Home Office: You can deduct your expenses as a home office expense for work spaces that you regularly use, regardless of whether you rent or own it.

- Internet and Phone: You can deduct your expenses for internet, phone, and fax bills as long as they are used for business purposes only.

- Health Insurance: If you are self-employed, you have to pay for your own health insurance, and this can be deducted from your taxes. You can also include health insurance that you pay for your spouse and other dependents.

- Meals and Entertainment: This is for when you are on meetings with clients. You have to make sure that you actually discussed business with them, though, and only 50% of the actual cost can be deducted.

- Travel and Car: This is for business trips and when you use your car for business purposes.

There are a lot more other deductions that a self-employed individual can qualify for. The most important thing to remember is that the expenses would have to be related to your business and are expenses that would result to more income. Also, always make sure to keep all of your receipts so that you can defend your expenses if ever you are audited by the IRS.

Related Posts Here

-

Mobile Home Bill of Sale

-

Landlord Consent Form

-

60-Day Notice to Vacate Form

-

Financial Statement Form

-

Product Evaluation Form

-

Construction Contract

-

School Receipt Form

-

Restaurant Training Form

-

Daily Cash Log

-

Volleyball Evaluation Form

-

Holding Deposit Agreement Form

-

License Agreement Short Form

-

Fund Transfer Form

-

Business Financial Statement Form

-

Sales Proposal Form