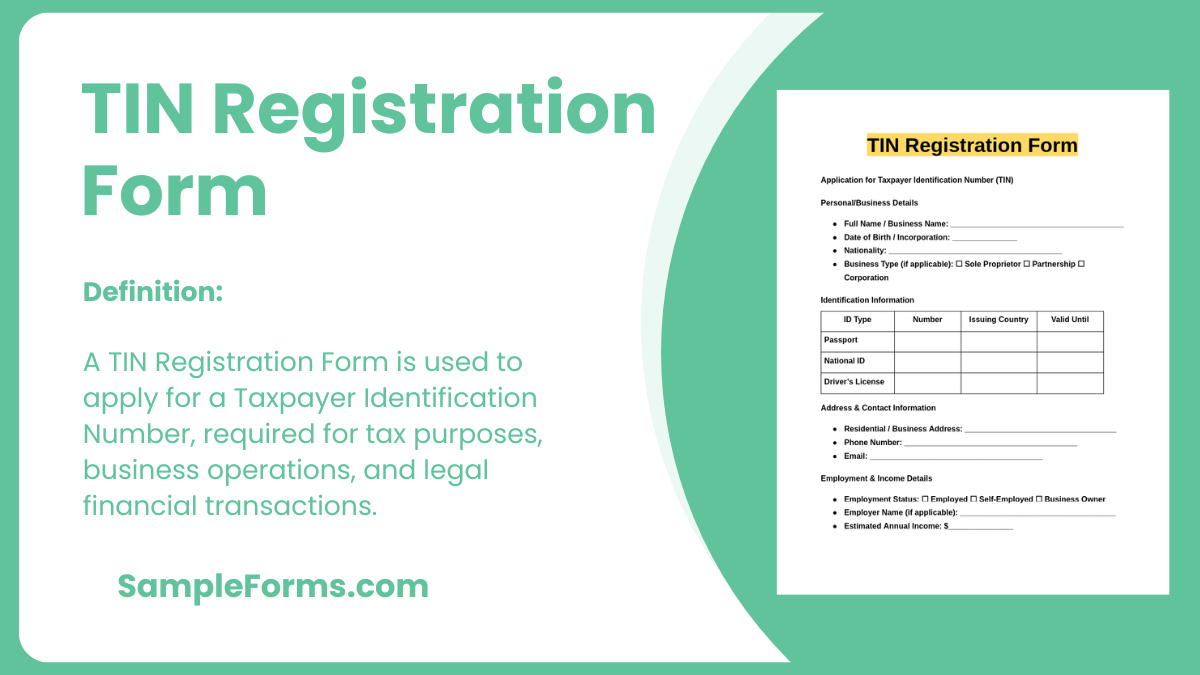

A TIN Registration Form is a vital document used by individuals and businesses to apply for a Taxpayer Identification Number (TIN) for tax reporting and financial compliance. A properly completed Registration Form ensures that taxpayers can legally conduct business, file tax returns, and meet government regulations. The form typically includes applicant details, business or individual information, tax classification, and supporting documentation. Proper registration prevents tax penalties and ensures a seamless tax payment process.

Download TIN Registration Form Bundle

What is TIN Registration Form?

A TIN Registration Form is an official document used to apply for a Taxpayer Identification Number (TIN), which is assigned by tax authorities to track tax obligations. This number is required for business operations, tax payments, banking transactions, and government compliance. The form includes applicant name, business name (if applicable), address, tax category, and identification details. Having a TIN helps businesses and individuals meet legal tax requirements and avoid fines. Properly completing and submitting a TIN Registration Form ensures that all tax-related transactions are recorded and recognized by the tax authorities.

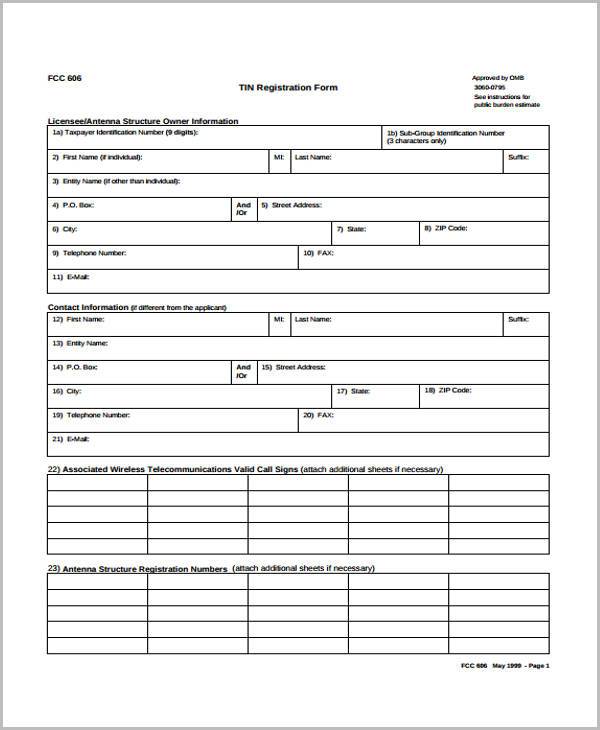

TIN Registration Format

Applicant Information

- Full Name – Legal name of the individual or business entity.

- Date of Birth/Business Establishment – Date for verification purposes.

- Contact Information – Phone number and email address.

- Residential/Business Address – Permanent address for official correspondence.

- Identification Details – Government-issued ID or business registration documents.

Taxpayer Classification

- Individual – For salaried employees or self-employed individuals.

- Business Entity – Companies, partnerships, or corporations requiring tax registration.

- Non-Profit Organization – Religious, educational, or charitable organizations.

- Foreign Applicant – Non-residents conducting business locally.

- Government Entity – Public institutions requiring taxation details.

TIN Registration Requirements

- Proof of Identification – National ID, passport, or birth certificate.

- Business Registration Certificate – For companies and organizations.

- Address Proof – Utility bills or rental agreements.

- Bank Account Details – For tax payment processing.

- Previous Tax Records – If applicable.

Application Submission and Processing

- Online Registration – Submission through government tax portals.

- In-Person Registration – Visiting a tax office for document submission.

- Processing Time – Standard duration for approval.

- Verification and Approval – Tax authority review process.

- TIN Issuance – Delivery of official taxpayer identification number.

Signatures and Authorization

- Applicant’s Signature – Declaration of accuracy.

- Tax Officer’s Signature – Approval from the tax authority.

- Date of Submission – Official record for processing.

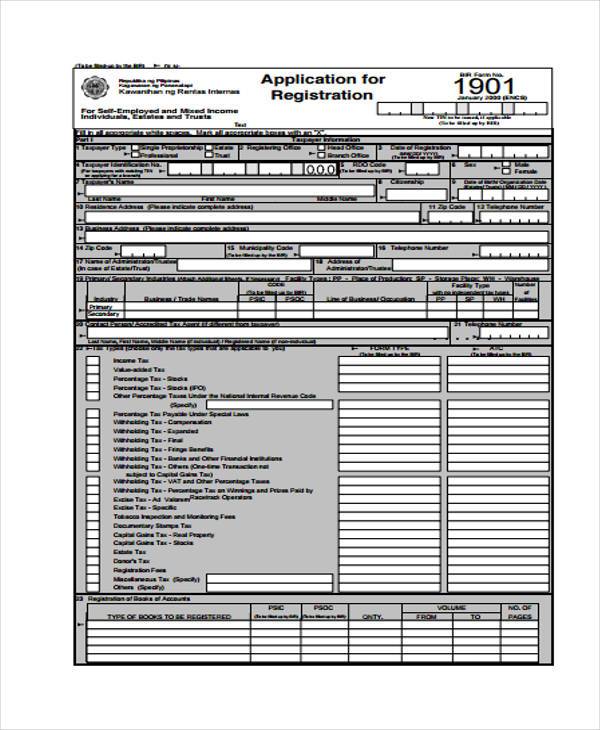

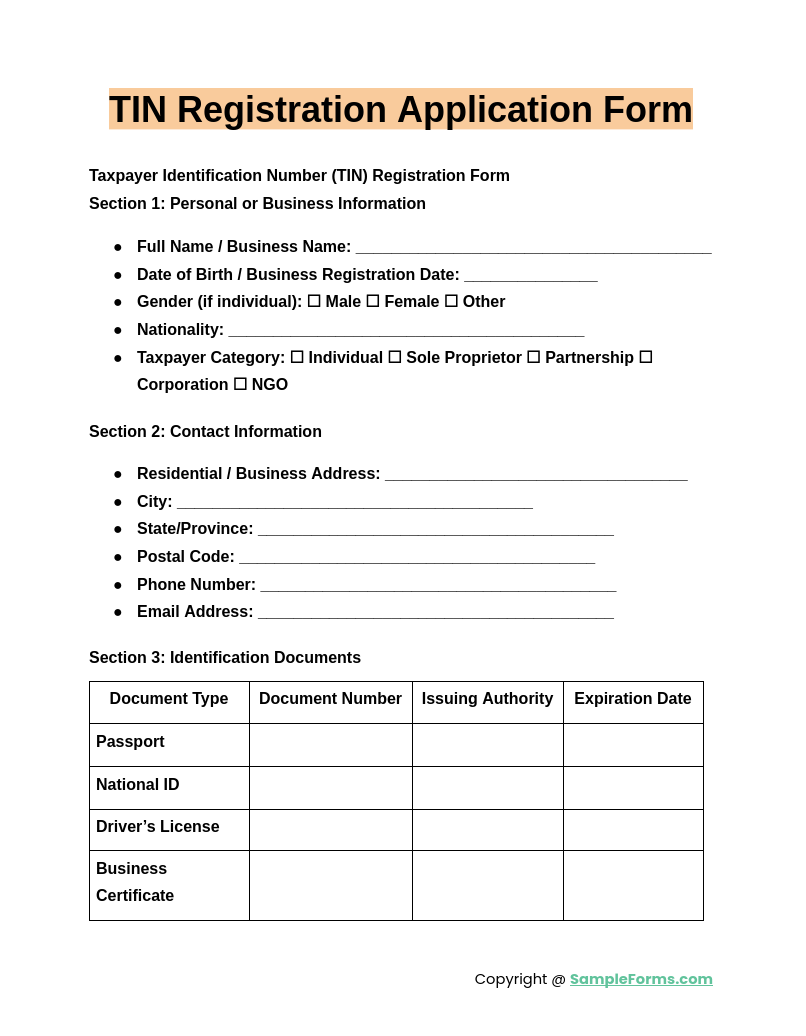

TIN Registration Application Form

A TIN Registration Application Form is required to apply for a Taxpayer Identification Number for tax compliance. Similar to a Basketball Registration Form, it ensures proper documentation by collecting applicant details, business classification, and tax category for verification.

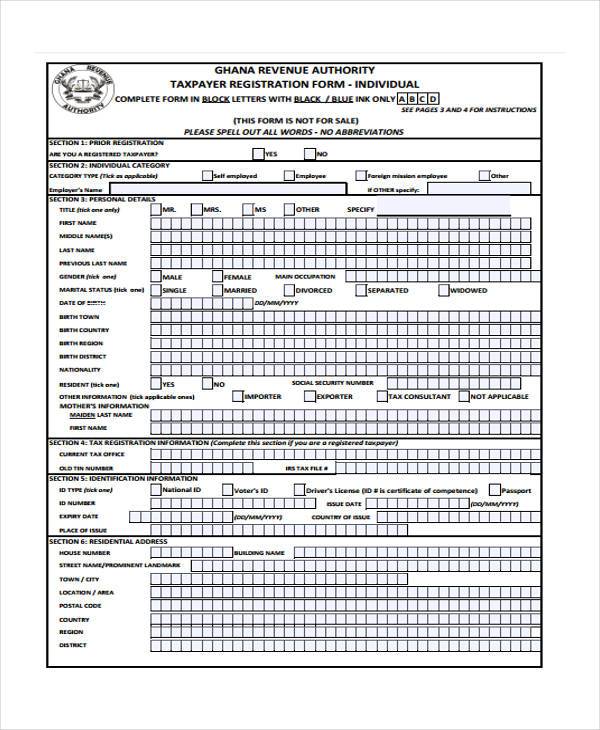

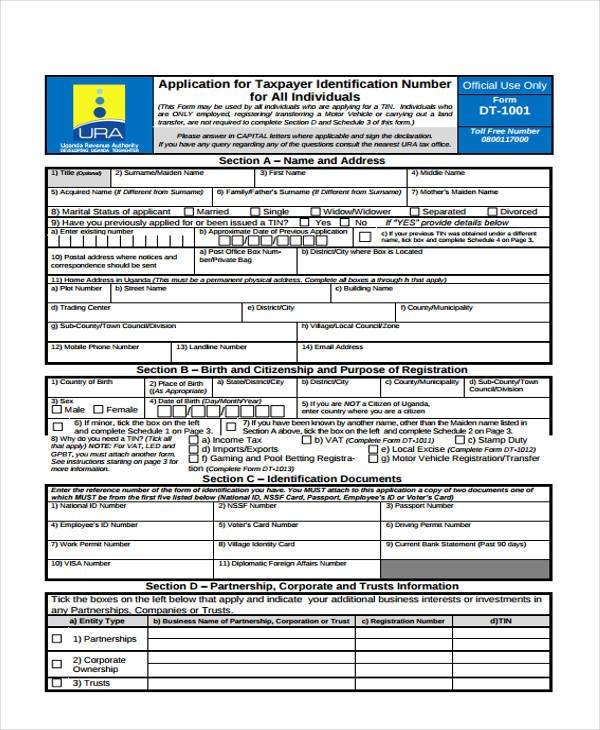

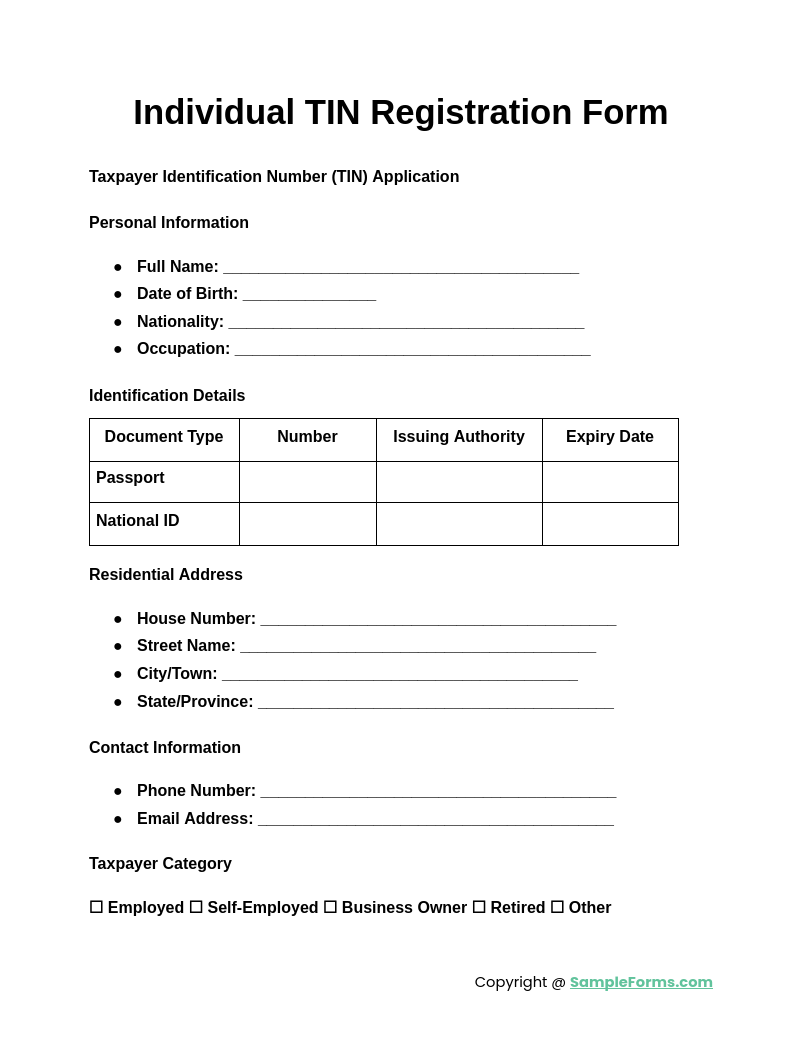

Individual TIN Registration Form

An Individual TIN Registration Form is used by individuals to obtain a unique tax number for legal tax reporting. Like a Student Registration Form, it includes personal details, identification information, and financial classification to establish tax compliance.

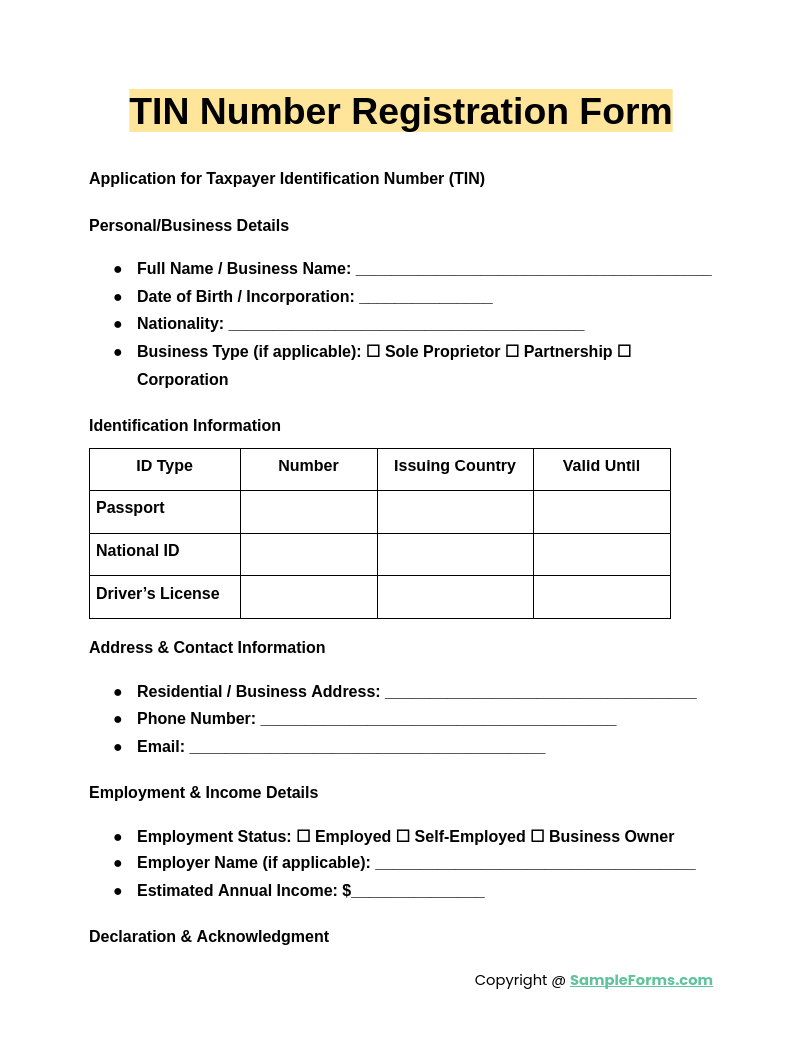

TIN Number Registration Form

A TIN Number Registration Form allows businesses and self-employed individuals to register for tax identification. Similar to a Daycare Registration Form, it verifies essential details such as income sources, tax obligations, and official records for financial tracking.

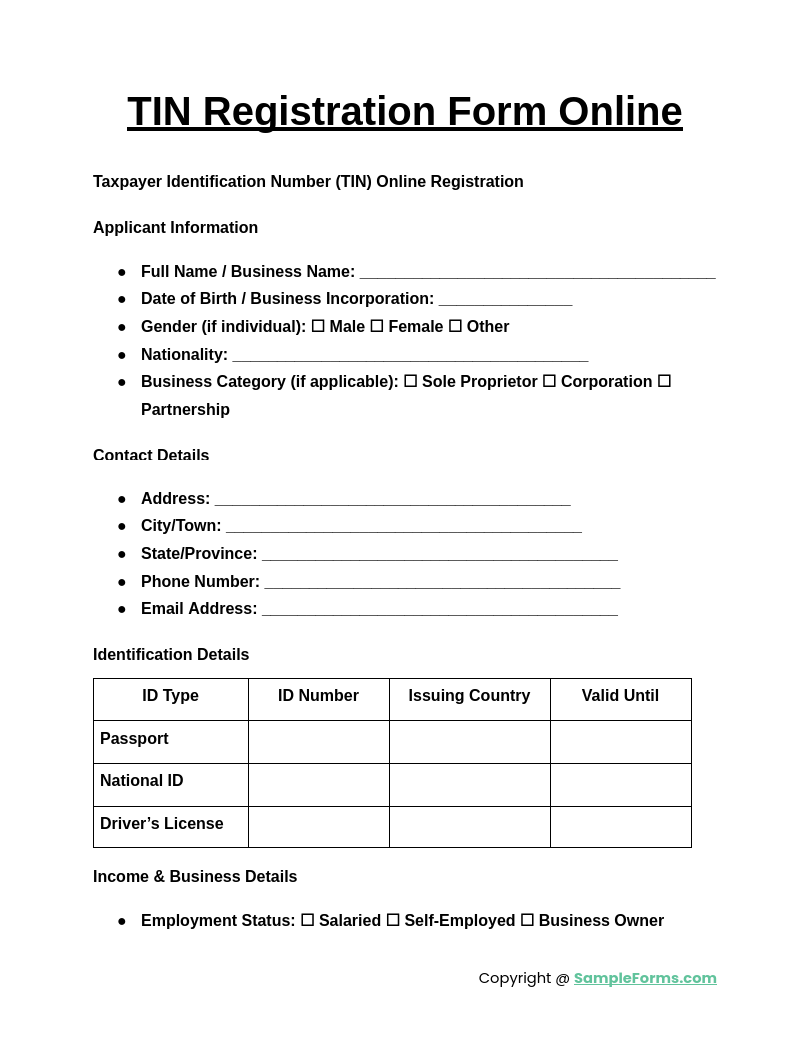

TIN Registration Form Online

A TIN Registration Form Online simplifies the process of applying for a tax number through digital submission. Like a Camp Registration Form, it streamlines data entry, document verification, and approval, making tax registration more accessible and efficient.

Browse More TIN Registration Forms

TIN Number Registration Form

TIN Individual Registration Form

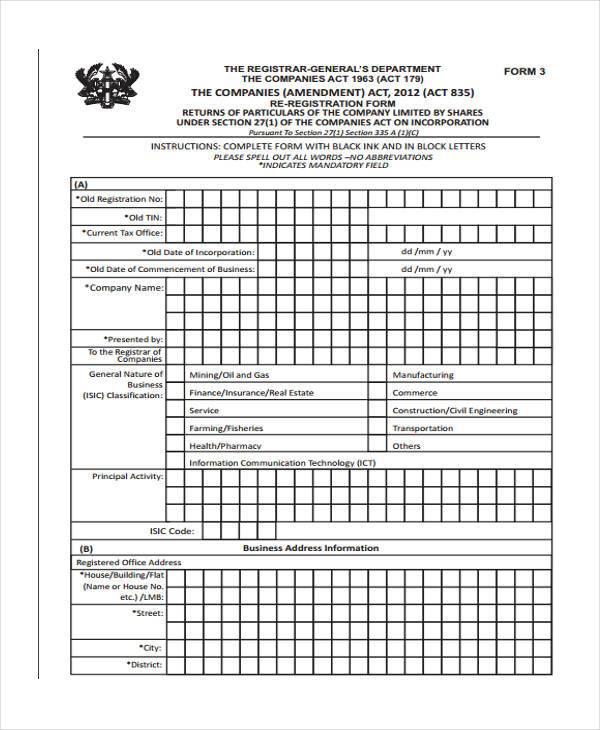

TIN Re-Registration Form Sample

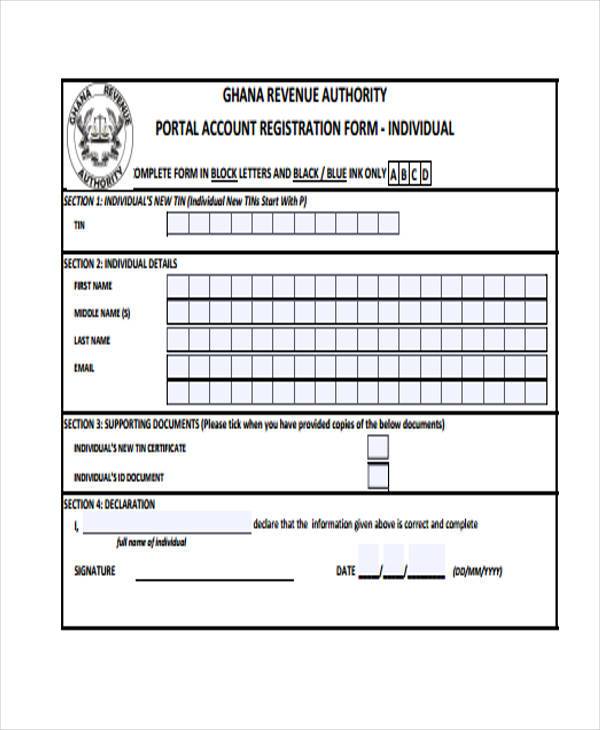

TIN Account Registration Form

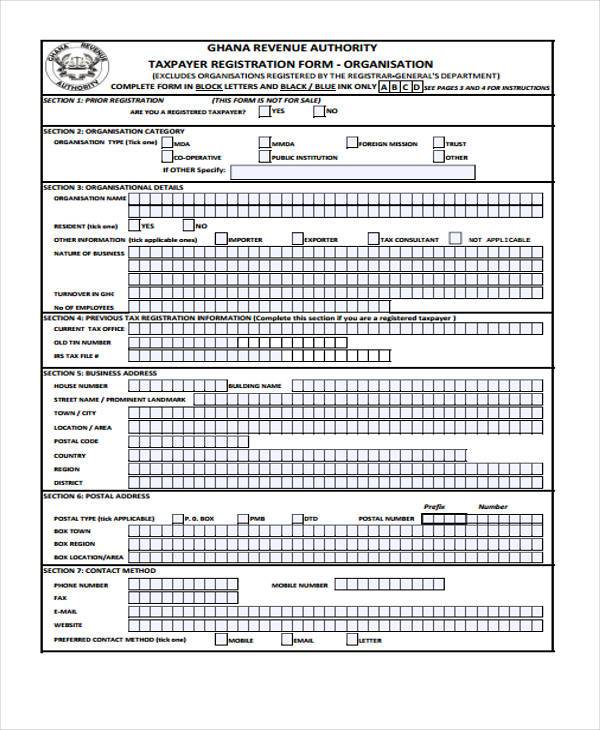

TIN Revenue Organisation Registration Form

Individual TIN Application Registration Form

Portal TIN Registration Form Example

How do I get a TIN number?

A TIN (Taxpayer Identification Number) is required for tax filing and business operations. Similar to a Course Registration Form, obtaining a TIN involves completing forms and submitting necessary identification for verification.

- Determine Eligibility: Individuals, businesses, and self-employed persons must apply for a TIN based on tax requirements.

- Complete the Application Form: Fill out the official tax authority form with accurate details.

- Submit Identification Documents: Provide necessary documents, such as a passport or business license.

- Process the Application: Submit the form via mail, online, or in person at the tax office.

- Receive Your TIN: Upon approval, the tax office issues the TIN for future tax-related transactions.

How do I get TIN verification?

TIN verification ensures a valid taxpayer number is registered with tax authorities. Like a Summer Camp Registration Form, the process involves checking identity records for accuracy.

- Visit the Tax Authority Website: Many tax offices provide online verification tools.

- Enter TIN Details: Input your TIN and personal/business details for verification.

- Check for Matching Records: Ensure the provided information matches tax office records.

- Request Official Confirmation: If required, apply for a TIN verification letter.

- Resolve Discrepancies: If errors occur, update records with the tax authority.

How do undocumented immigrants get ITIN?

An ITIN (Individual Taxpayer Identification Number) allows undocumented immigrants to file taxes legally. Similar to a Gym Registration Form, applying requires proof of identity and completing a government-issued form.

- Obtain Form W-7: The IRS provides Form W-7 for ITIN applications.

- Provide Identification: Submit a passport, national ID, or birth certificate.

- Attach Tax Return Documents: ITIN applications often require a completed tax return.

- Submit the Application: Mail Form W-7 and supporting documents to the IRS or apply at an IRS-approved center.

- Receive ITIN: The IRS processes applications within 6-8 weeks and issues the ITIN.

How do I find my US TIN number?

Locating a US TIN number involves checking official records and previous tax documents. Similar to a Business Registration Form, taxpayers can retrieve their number through tax agencies or financial institutions.

- Check Previous Tax Returns: Your TIN is listed on past filings with the IRS.

- Review Employer Records: Employers may have your TIN on tax-related paperwork.

- Contact the IRS: Call the IRS helpline for TIN retrieval assistance.

- Verify with Financial Institutions: Banks and lenders may store TIN details.

- Request a TIN Confirmation Letter: The IRS provides official verification upon request.

How to apply TIN number online?

Applying for a TIN number online is a quick process that eliminates paperwork delays. Similar to a Hotel Registration Form, it requires filling out a digital form and submitting essential details.

- Visit the Tax Authority’s Website: Locate the official TIN application portal.

- Complete the Online Form: Enter personal or business details and upload supporting documents.

- Verify Information: Double-check details to ensure accuracy before submission.

- Submit the Application: Follow the portal instructions to finalize the application.

- Receive TIN Confirmation: The tax office issues the TIN electronically after approval.

Who is eligible for an ITIN number?

Individuals who do not qualify for an SSN but need to file taxes can apply. Similar to a Company Registration Form, it ensures proper documentation for tax compliance.

How long does it take to get an ITIN?

The IRS typically processes ITIN applications within 6-8 weeks. Like a Conference Registration Form, accurate details and required documents help speed up the approval process.

Can undocumented immigrants get a TIN?

Yes, undocumented immigrants can apply for an ITIN, allowing them to file taxes. Similar to a Sports Registration Form, it requires submitting an application with identification documents.

Is my TIN number on my W2?

Yes, your TIN or SSN is listed on your W-2 for tax purposes. Like a Car Registration Form, it ensures proper identification for financial and tax records.

Who needs a TIN?

Businesses, self-employed individuals, and taxpayers who need to report income require a TIN. Similar to a Team Registration Form, it verifies identity for official purposes.

What is the TIN number example?

A TIN number example in the U.S. follows this format: 12-3456789 for businesses or 123-45-6789 for individuals, like an Event Registration Form confirming tax identity.

Is it better to use ITIN or SSN?

An SSN is preferred for employment, while an ITIN is only for tax purposes. Like a Dance Registration Form, both serve different purposes based on eligibility.

Do you need a TIN to file taxes?

Yes, a TIN, SSN, or ITIN is required to file taxes legally. Like a Customer Registration Form, it verifies taxpayer identity for accurate processing.

Can I get a TIN without a SSN?

Yes, individuals without an SSN can apply for an ITIN for tax purposes. Like a Patient Registration Form, it ensures eligibility for government records.

Can a US citizen apply for an ITIN number?

No, U.S. citizens must apply for an SSN instead of an ITIN. Similar to a Supplier Registration Form, the correct identification number is essential for tax filing.

A TIN Registration Form is essential for businesses and individuals to obtain a tax identification number for official transactions. Similar to a School Registration Form, it ensures compliance with government regulations and helps in tax filings. The form serves multiple purposes, including opening a business bank account, filing income tax returns, applying for business permits, and verifying tax obligations. It is a critical document for anyone engaging in taxable activities. Proper registration provides legal protection and ensures smooth financial transactions without tax-related complications.

Related Posts

-

FREE 9+ Volunteer Sign On – Sign Off Sheet Forms in PDF | MS Word

-

Vendor Registration Form

-

Hotel Guest Registration Form

-

Church Registration Form

-

Summer Camp Registration Form

-

FREE 9+ Copyright Registration Forms in PDF

-

Hospital Registration Form

-

FREE 11+ Basketball Registration Forms in PDF | MS Word | Excel

-

FREE 9+ Event Vendor Registration Forms in PDF | MS Word

-

FREE 10+ Registration Request Forms in PDF | MS Word

-

Daycare Registration Form

-

What Is a Competition Entry Registration Form? [ with Samples ]

-

Visitor Sign In-Out Sheet

-

Sign In – Sign Up Sheet

-

Employee Sign-In Sheet