Crafting a Personal Loan Agreement Form is crucial for documenting loan terms and ensuring both parties are clear on the obligations and rights involved. This guide provides practical examples and insights into creating effective agreements using standard Agreement Form and Loan Form. Whether you’re lending to a friend or financing a personal project, these tips will help you structure a legally sound and clear agreement to safeguard both the lender and the borrower’s interests.

Download Personal Loan Agreement Form Bundle

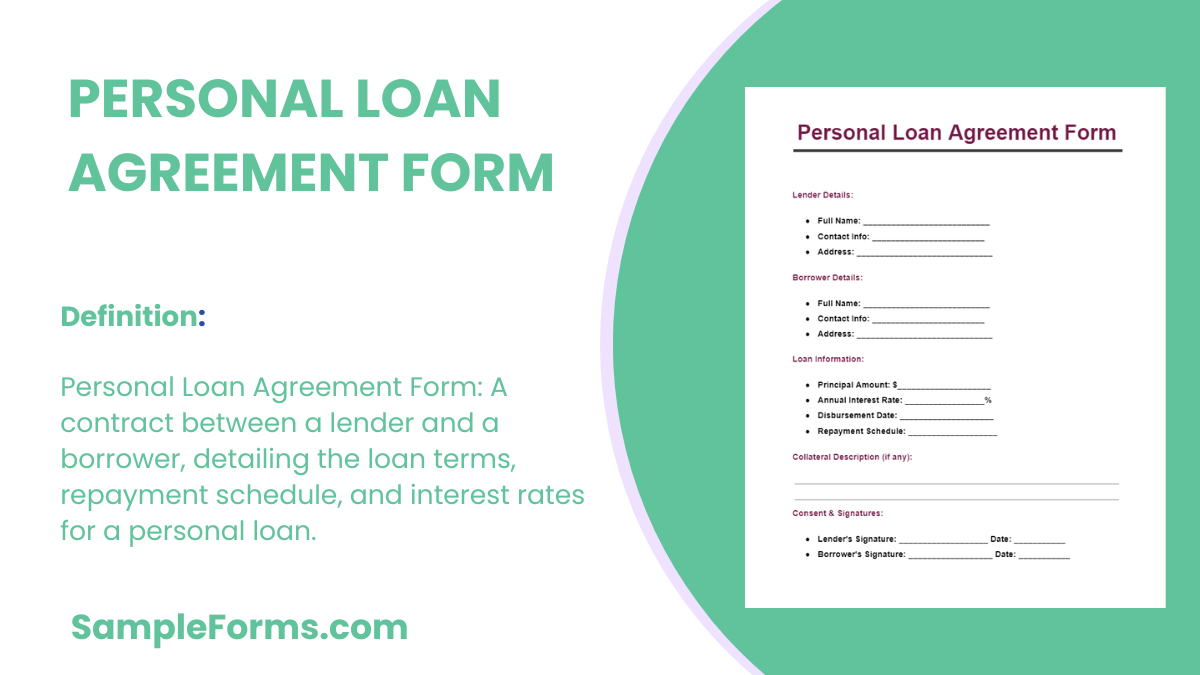

What is a Personal Loan Agreement Form?

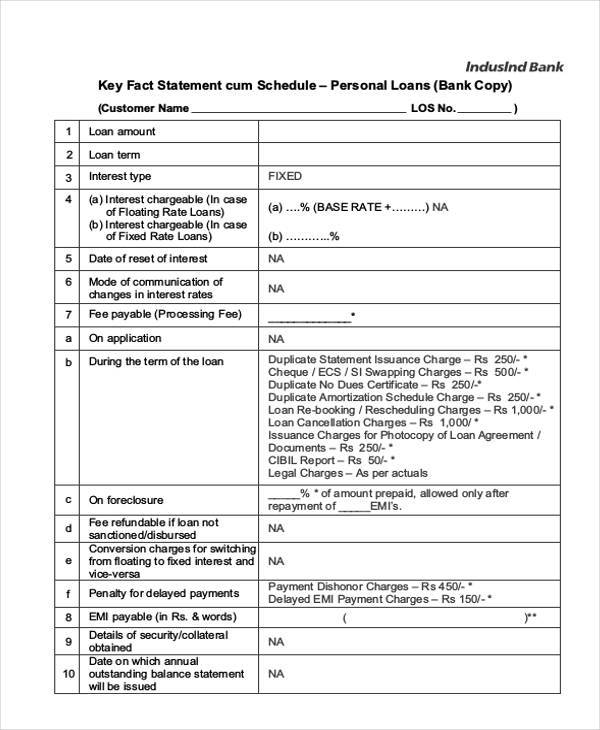

A Personal Loan Agreement Form is a legally binding document between a lender and a borrower that outlines the terms of a personal loan. It specifies the loan amount, interest rate, repayment schedule, and any other conditions agreed upon, ensuring both parties have a clear understanding of their commitments.

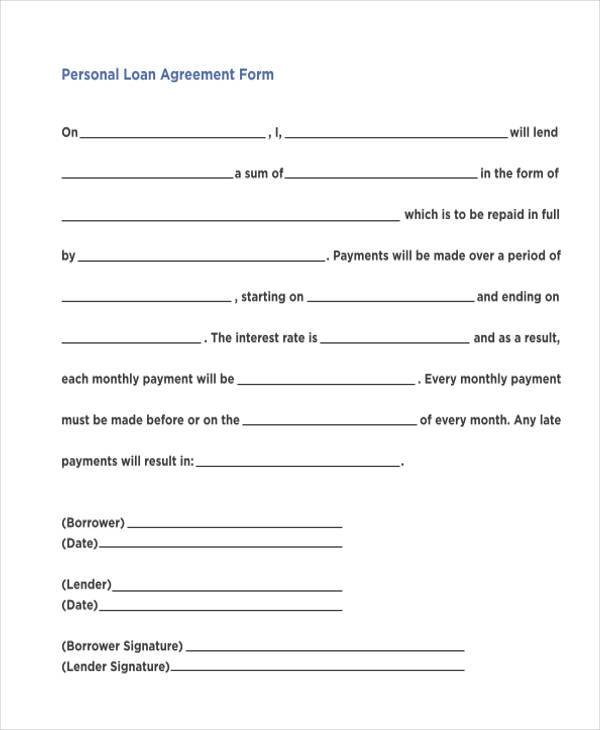

Personal Loan Agreement Format

Personal Loan Agreement

Lender Details:

- Name:

- Contact Information:

Borrower Details:

- Name:

- Contact Information:

Loan Terms:

- Loan Amount:

- Interest Rate:

- Repayment Terms:

- Late Payment Penalties:

Signatures:

- Lender’s Signature:

- Date:

- Borrower’s Signature:

- Date:

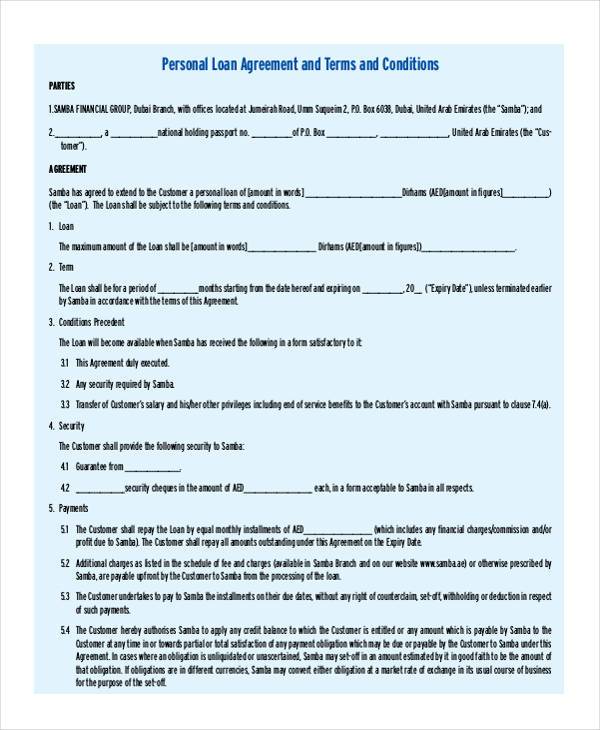

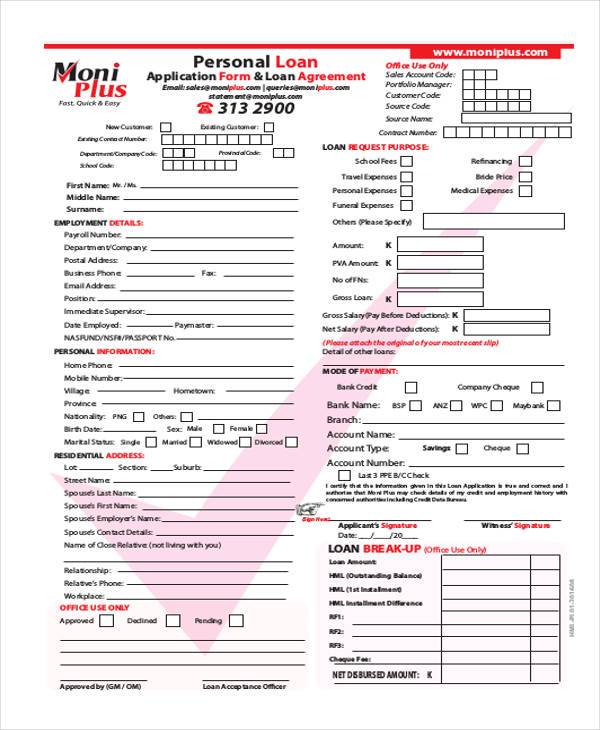

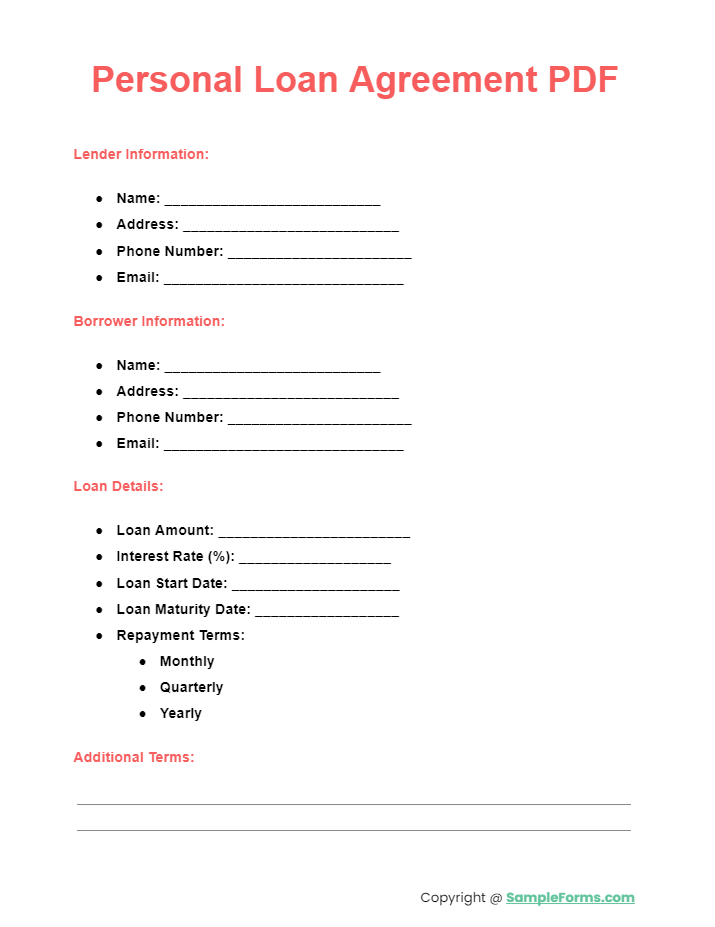

Personal Loan Agreement PDF

Download a Personal Loan Agreement PDF designed to simplify complex transactions. Include essential terms as detailed in a Tenancy Agreement Form, ensuring clarity and legal compliance in personal lending. You may also see Sublease Agreement Form

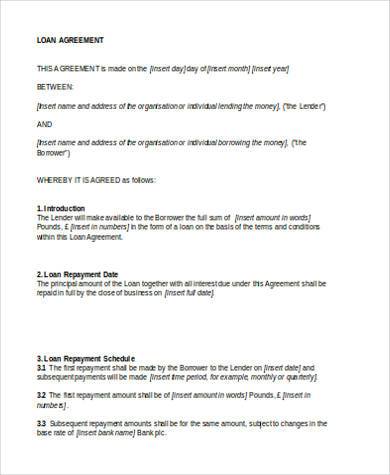

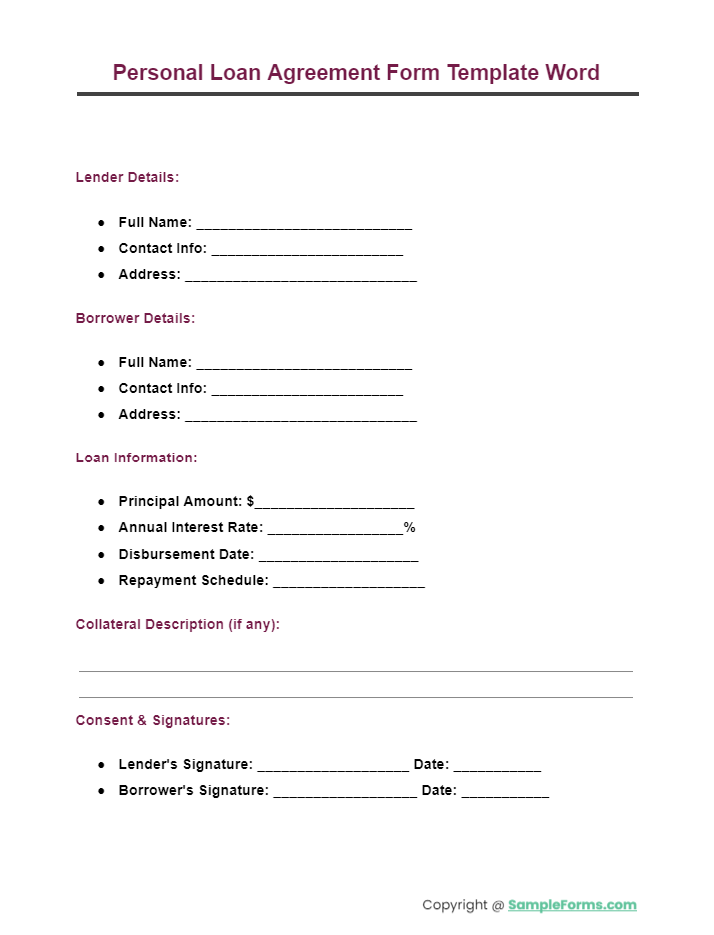

Personal Loan Agreement Form Template Word

Use our customizable Personal Loan Agreement Form Template Word to draft precise agreements. This template facilitates business dealings, much like a Business Agreement Form, by clearly defining the loan conditions and repayment terms. You may also see Joint Venture Agreement Form

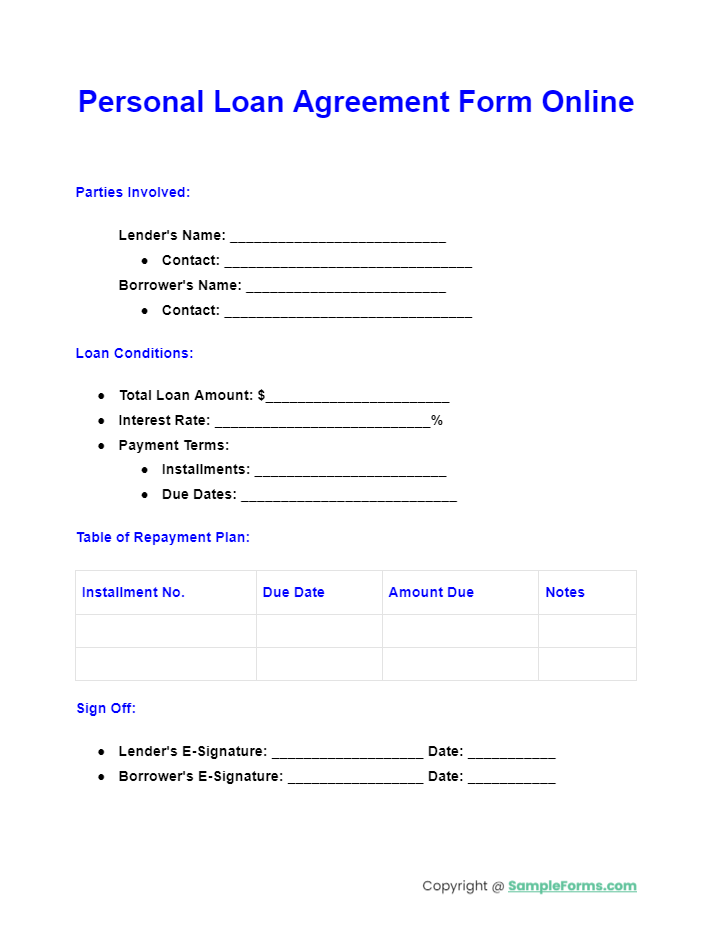

Personal Loan Agreement Form Online

Access and fill out a Personal Loan Agreement Form Online. This digital form, comparable to a Promissory Note Agreement Form, ensures accuracy in documenting loan details and borrower commitments electronically. You may also see Employment Agreement Form

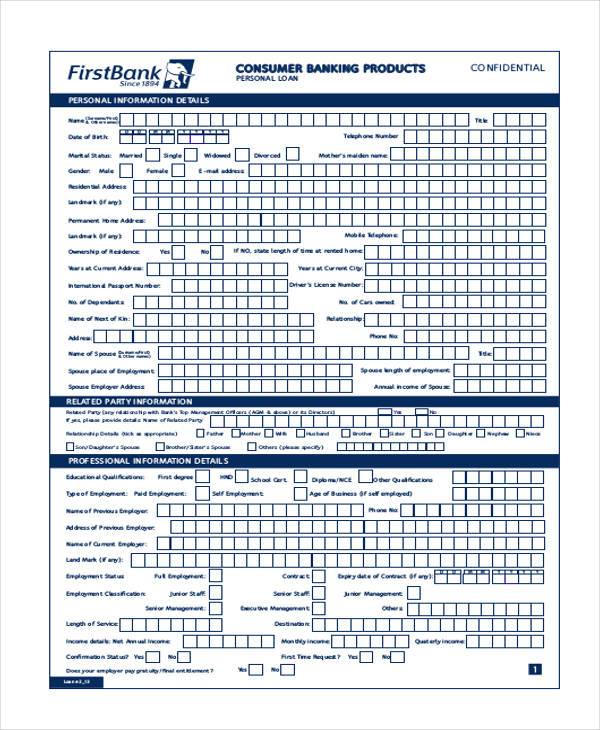

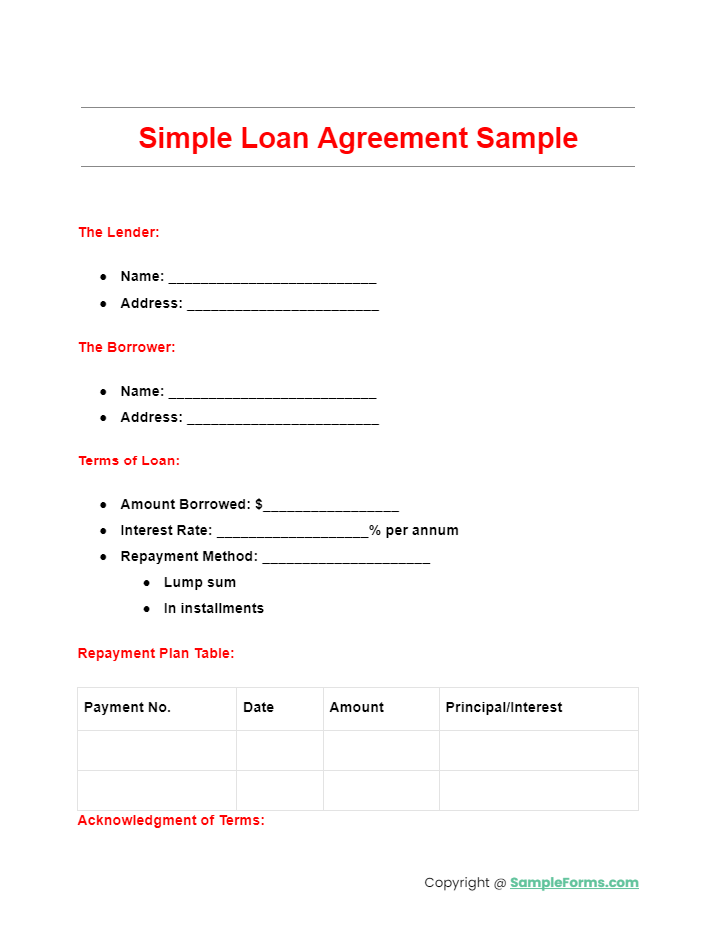

Simple Loan Agreement Sample

More Personal Loan Agreement Form Samples

Free Personal Loan Agreement Form

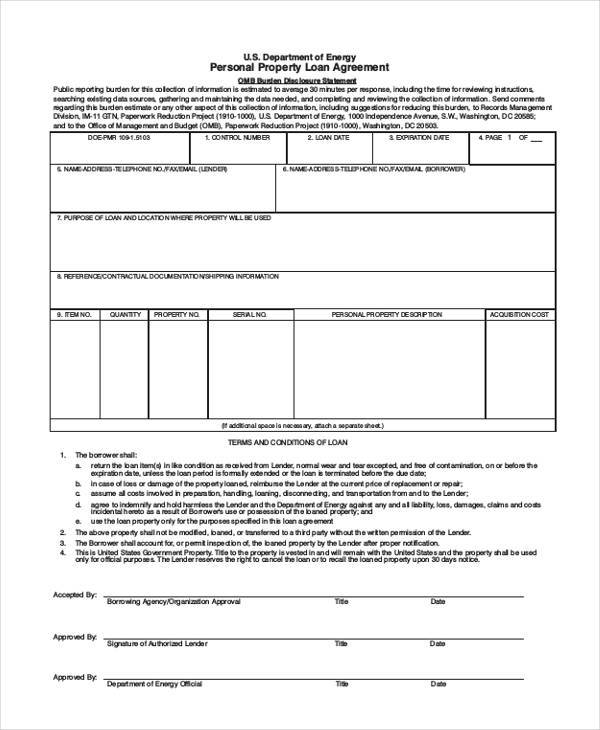

Personal Property Loan Agreement Form

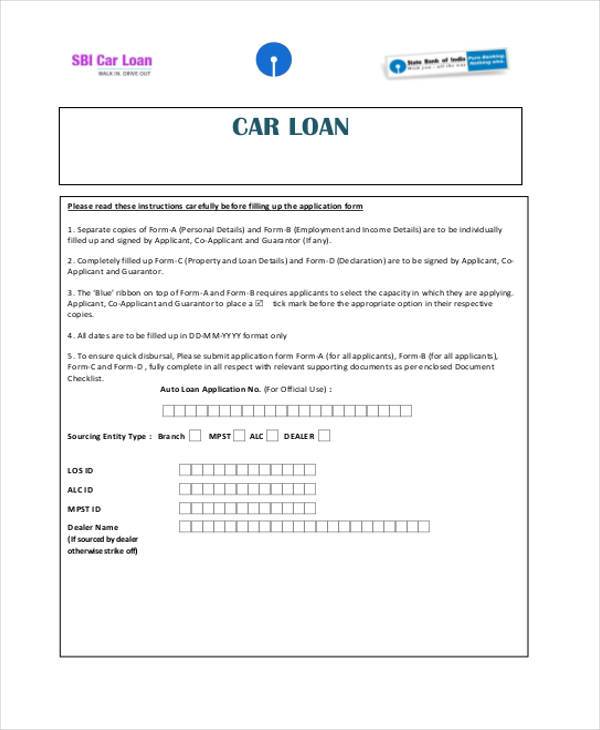

Personal Auto Loan Agreement Form

Personal Loan Agreement Sample Form

Personal Car Loan Agreement Form

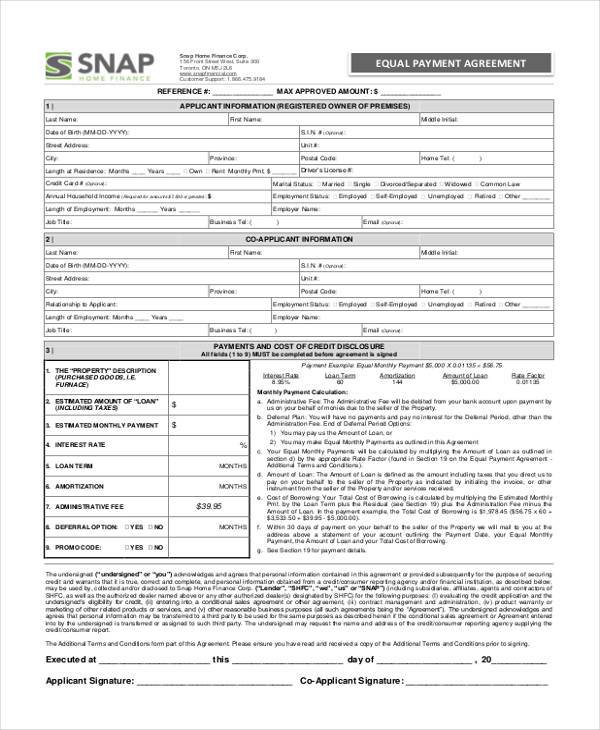

Personal Loan Payment Agreement Form

Personal Loan Agreement Form Example

Printable Personal Loan Agreement Form

Personal Loan Agreement Form in Word format

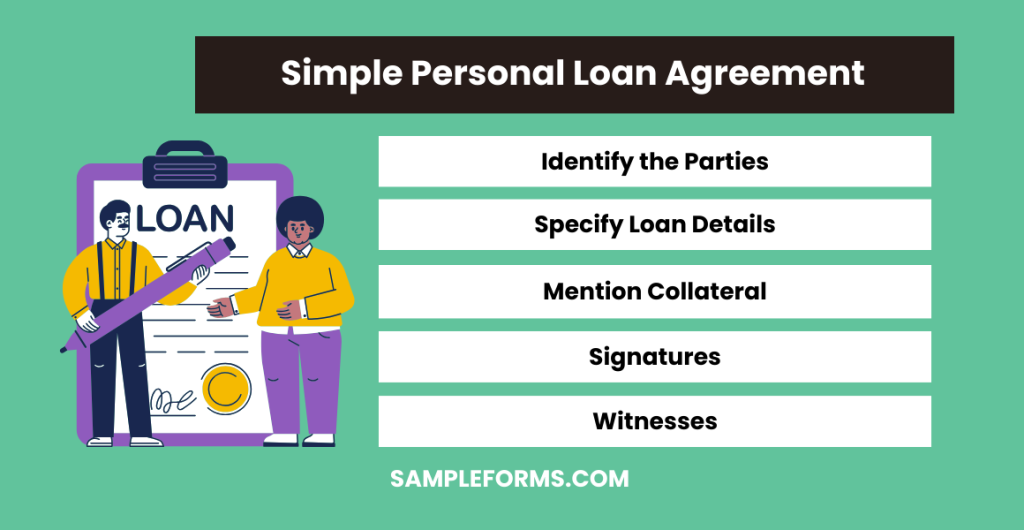

How do I write a simple personal loan agreement?

- Identify the Parties: Clearly state the names and addresses of the lender and borrower.

- Specify Loan Details: Include the loan amount, interest rate (if applicable), and repayment schedule.

- Mention Collateral: If collateral is involved, describe it in detail akin to a Lease Agreement Form.

- Signatures: Both parties should sign and date the document.

- Witnesses: Optionally, have witnesses sign the agreement for additional validation. You may also see Child Support Agreement Form

How do I write a loan agreement between family members?

- Set Clear Terms: Define the loan amount, interest rate, repayment schedule, and any other conditions.

- Document Relationships: Acknowledge the relationship between the parties to maintain transparency.

- Include a Hold Harmless Agreement Form Clause: Protect against future liabilities related to the agreement.

- Sign and Date: Both parties should sign, preferably in the presence of a witness.

- Keep Records: Both parties should keep a copy of the signed document. You may also see Loan Proposal Form

How do I write a private loan agreement for a friend?

- Agree on Loan Terms: Discuss and agree on the amount, interest rate, repayment terms, and due dates.

- Draft the Agreement: Include all agreed-upon terms in writing.

- Use a Consignment Agreement Form Approach: Itemize any goods involved as collateral.

- Sign and Witness: Both parties sign the agreement and have it witnessed to enhance its credibility.

- Keep Copies: Distribute copies of the agreement to both parties. You may also see Financial Agreement Form

How do you write a simple agreement form?

- Title the Document: Clearly label the document as an agreement form.

- Parties’ Information: List the names and addresses of all parties involved.

- Agreement Terms: Clearly state the terms and conditions, similar to an Apprenticeship Agreement Form.

- Signatures: Ensure all parties sign the document.

- Date: Include the date on which the agreement was signed. You may also see Confidentiality Agreement Form

How do I write a hand loan agreement?

- Document Identification: Identify both the lender and borrower by full name and contact information.

- Loan Details: Specify the loan amount, interest rate, and repayment plan.

- Witnesses: Have the agreement signed in front of witnesses for additional legal weight.

- Incorporate a Investment Agreement Form Style: Clearly outline any investment terms if applicable.

- Record Keeping: Both parties should retain a copy of the signed document. You may also see Roommate Agreement Form

How can I legally loan money to my family?

- Draft a Formal Agreement: Write a clear agreement stating the loan amount, interest rate, and repayment schedule.

- Consider a Purchase Agreement Form Format: Ensure all purchase-related terms are included if applicable.

- Legal Advice: Consider consulting with a lawyer to ensure the legality of the agreement.

- Signatures: Have all involved parties sign the document.

- Notarization: Optionally, get the agreement notarized to affirm its seriousness. You may also see Pet Agreement Form

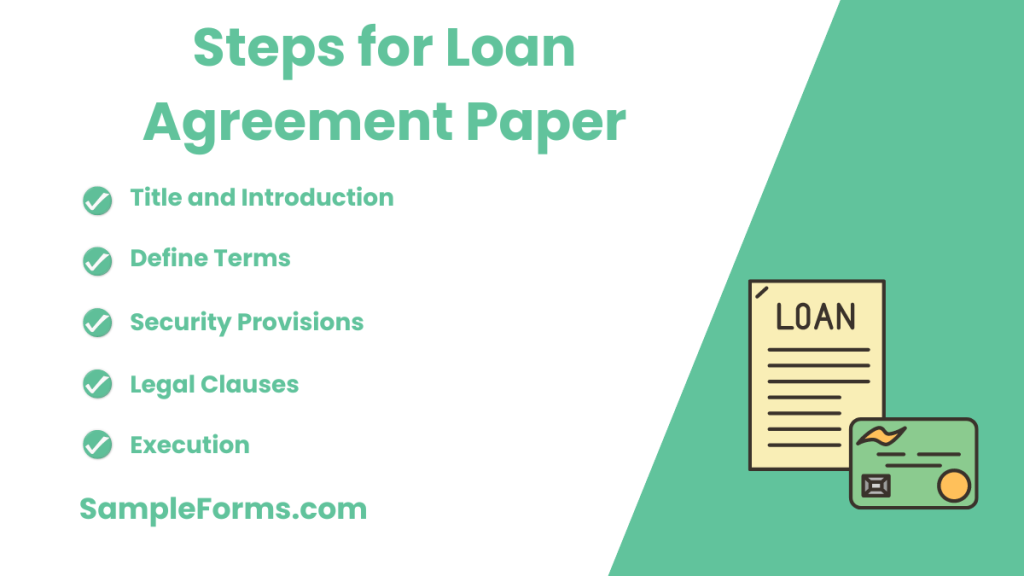

How to make loan agreement paper?

- Title and Intro: Start with a title and a brief introduction explaining the purpose of the loan.

- Define Terms: Clearly outline the loan amount, interest rate, repayment conditions, and schedule.

- Security Provisions: If applicable, detail any collateral as would be described in a Guarantor Agreement Form.

- Legal Clauses: Include any pertinent legal clauses, such as those found in a Custody Agreement Form or Prenuptial Agreement Form, if relevant.

- Execution: Both parties sign and date the agreement, possibly in front of a witness or notary. Include a clause similar to those in a Sales Agreement Form if the loan involves sales transactions. You may also see Assignment Agreement Form

Five Vital Parts of a Loan Agreement Form

- The Statement – This is where the terms of repayment, interests, and the details of the borrower will be indicated.

- Collateral – This refers to the borrower’s property which he pledges in case he cannot pay the loan. This could be a car, a house, or anything else that has an equivalent amount to the money borrowed. You may also see House Agreement Form

- The Covenants – These are statements that forbid the borrower to take certain actions; may also serve as the terms and conditions of the loan.

- The Borrower’s Guarantees – These are the people who are willing to assume the obligation of the borrower if he can no longer pay the debt. Most of the guarantors are close relatives of the borrower to which he gives his full trust that this person will be behind his back to help him when he is in need.

- Events of Default – This includes the failure to pay the amount for a regular basis and the sanctions associated with it. The borrower should read this important portion so he will be aware of the possible punishments he will face if the debt is unpaid. You may also see Parking Agreement Form

Our website contains tons of sample forms for various purposes. We also have Personal Agreement Form which are available for download. You may also see Room Agreement Form

Benefits to Having Personal Loan Agreement Forms

Agreements are documents with details, terms, and conditions agreed to and signed by two parties. It is important to have Personal Loan Agreement Forms since these are formal documents that evidence the loan. If you are a serious person in lending people amounts of money and want to make sure that they will pay before their due date comes, you should acquire an agreement. One main benefit with presenting this agreement form is that the borrower will know the legalities of the lender’s loan and will be prompted to pay on time. You may also see Sponsorship Agreement Form

Quick Tips to Consider in Making Personal Loan Agreement Forms

- The date should be on top of the page. If you are the lender in a Loan Agreement Form, you may put a blank space for you to write the date as soon as you delivered the money to the borrower.

- Specify the terms of the loan. State the amount of money borrowed, the purpose of the borrower and the amount the borrower will pay per day as initial payment. You may also see Business Purchase Agreement Form

- Set a duration. A loan can’t wait to be repaid indefinitely, right? So set a time frame as to when the due date will be. Include in your terms and conditions the additional interest per day after the due date of the loan.

- Sign and record the document. Let your borrower sign with his name below with the date beside it to ensure accuracy. You may also see Loan Contract Form

Does a personal loan agreement need to be notarized?

Notarization is not mandatory but highly recommended for personal loan agreements, as it adds a layer of authenticity and may be required for enforcement, similar to a Rental Agreement Form.

Can I write my own loan agreement?

Yes, you can write your own loan agreement. Ensure it includes all key terms such as loan amount, interest rate, repayment schedule, and is similar in structure to a Construction Agreement Form.

What makes a loan agreement invalid?

A loan agreement becomes invalid if it includes illegal terms, lacks mutual consent, or if one party was not competent to agree, much like issues that would invalidate a Vendor Agreement Form.

What is the minimum interest rate for a family loan?

The minimum interest rate for a family loan should at least match the IRS Applicable Federal Rate (AFR) to avoid tax implications, similar to financial considerations in a Land Purchase Agreement Form.

Can you make an interest-free loan to a family member?

Yes, you can make an interest-free loan to a family member. However, for tax reasons, it’s advisable to document this decision in a manner akin to a Service Level Agreement Form.

What is a good sentence for agreement?

“A good sentence for an agreement clearly outlines the obligations and expectations of all parties, akin to clauses found in a Training Agreement Form.”

What is the legal document for borrowing money from a friend?

The legal document for borrowing money from a friend is a promissory note or a personal loan agreement, structured similarly to an Operating Agreement Form or a Land Agreement Form, detailing payment terms and conditions.

Related Posts

-

FREE 3+ Triple-Net (NNN) Lease Agreement Samples in PDF | MS Word

-

FREE 3+ Month-to-Month Residential Lease Agreement Samples in PDF | MS Word

-

FREE 9+ Apartment Lease Agreements in PDF | MS Word

-

FREE 6+ Joint Lease Agreements in PDF | MS Word

-

FREE 4+ Massage Rental Agreement Forms in PDF | MS Word

-

FREE 5+ College Roommate Agreement Samples in PDF | MS Word

-

FREE 5+ Rent a Room Agreement Forms in PDF | MS Word

-

FREE 5+ Commercial Sublease Agreement Forms in PDF | MS Word

-

FREE 50+ Mortgage Forms Download – How to Create Guide, Tips

-

FREE 4+ Real Estate Listing Information Forms in PDF | MS Word

-

FREE 7+ Garage (Parking) Rental Agreement Forms in PDF | MS Word

-

FREE 7+ Office Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Salon Booth Rental Agreement Forms in PDF | MS Word

-

FREE 5+ Roommate Rental Agreement Forms in PDF | MS Word

-

Electrical Subcontractor Agreement Form