Payroll management is an important aspect in every company – regardless if it is a big or small one. Smart and savvy business heads and human resource managers should be able to establish a clear and well-organized method of calculating and handling details pertaining to their employee’s payroll as it affects a company’s morale.

Having a Payroll Form allows companies and management staff to provide a clear and thorough breakdown of an employee’s pay, such as any deductions for statutory benefits, added bonuses, incentives, specialized allowances, or payroll deductions.

Employee Payroll Forms

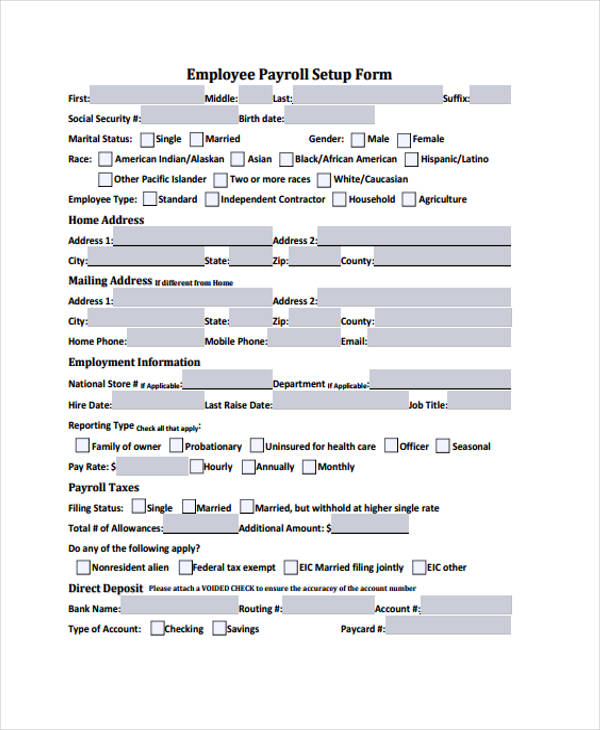

Employee Payroll Setup Form

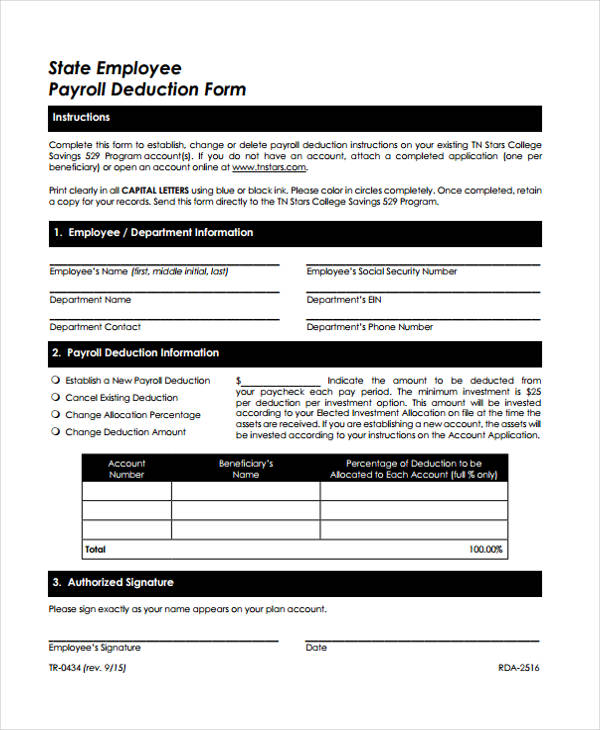

State Employee Payroll Deduction Form

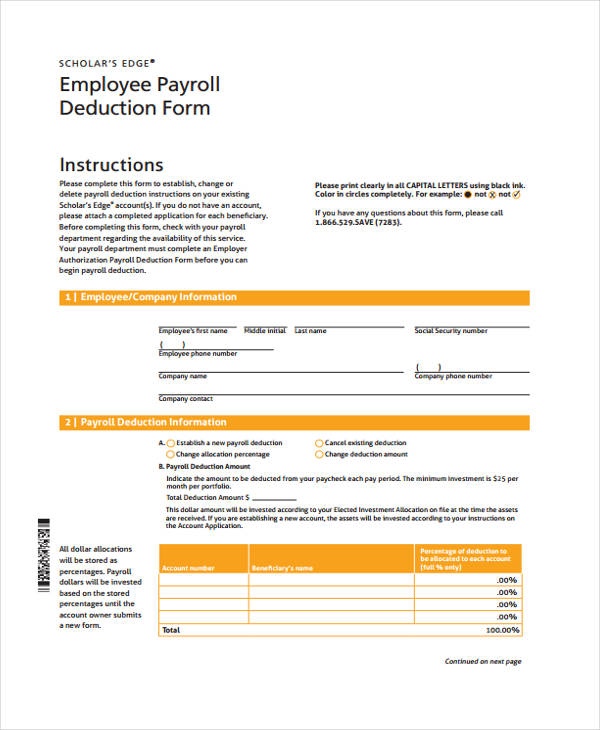

Employee Payroll Deduction Form

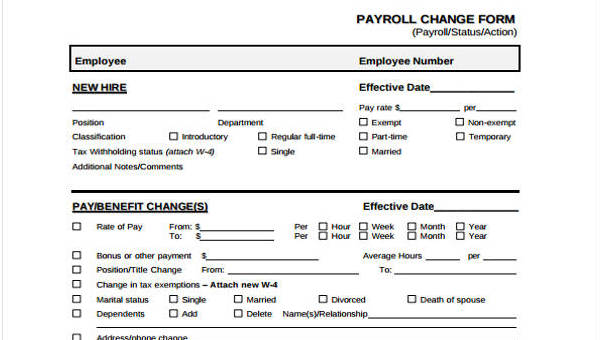

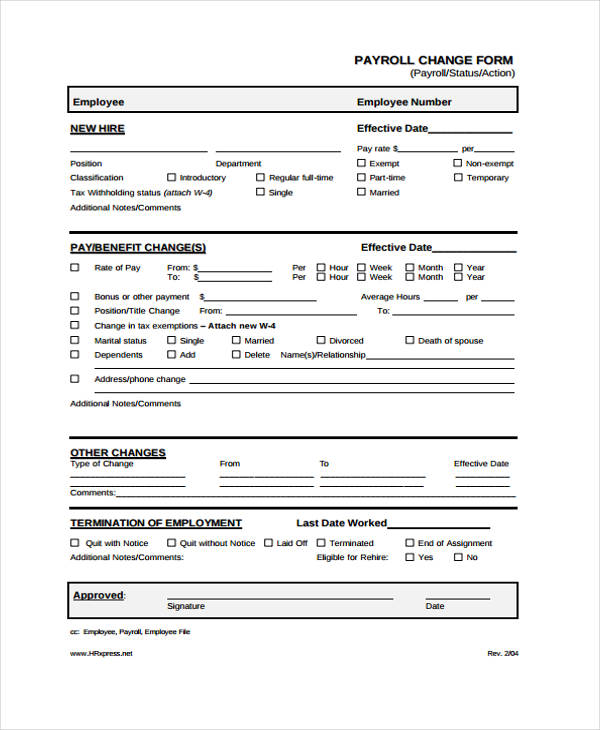

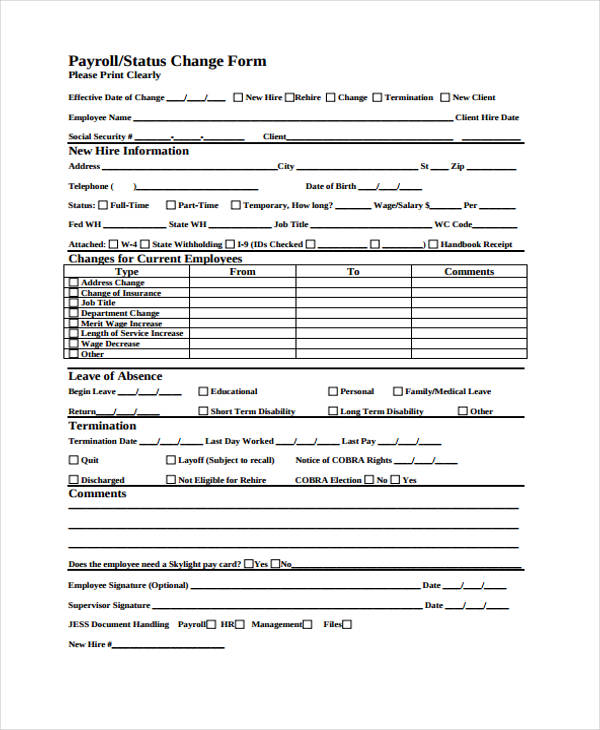

Payroll Change Forms

Blank Payroll Change Form

Payroll/Status Change Form

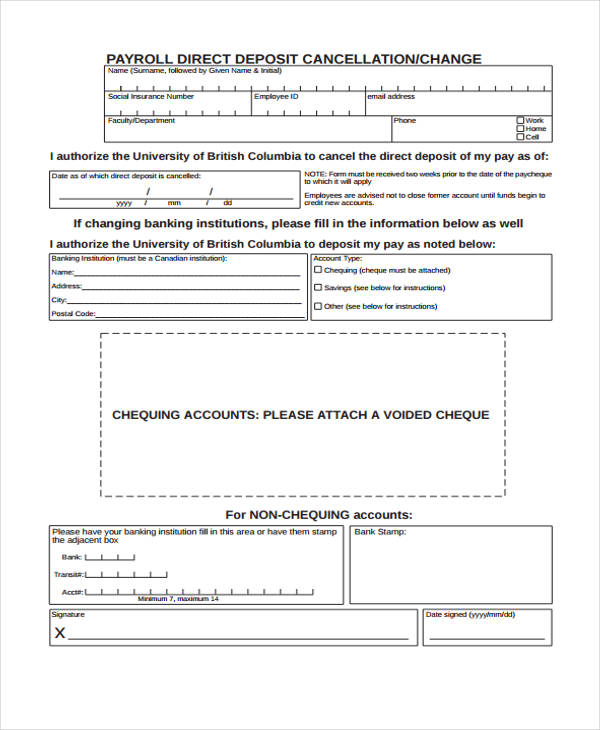

Payroll Direct Deposit Change Form

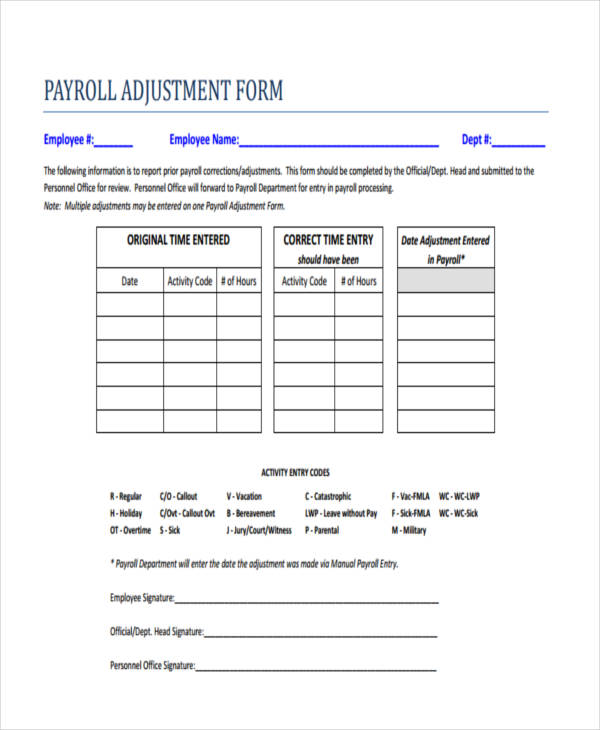

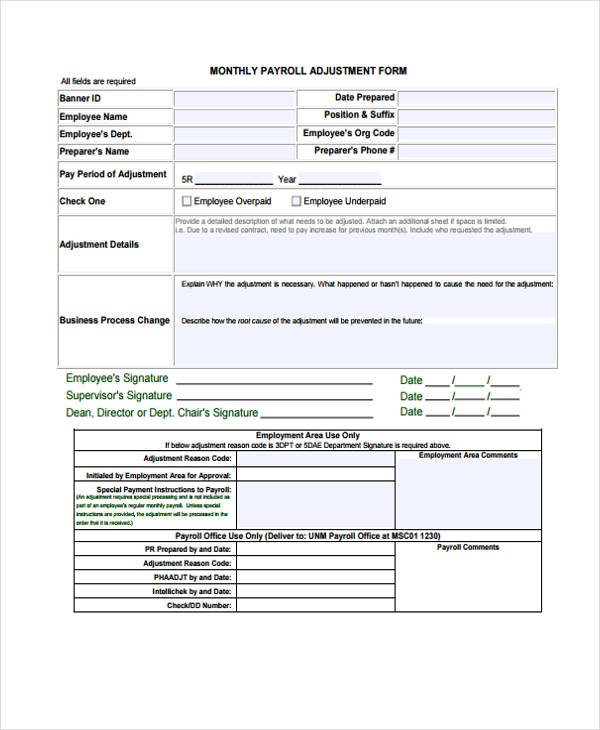

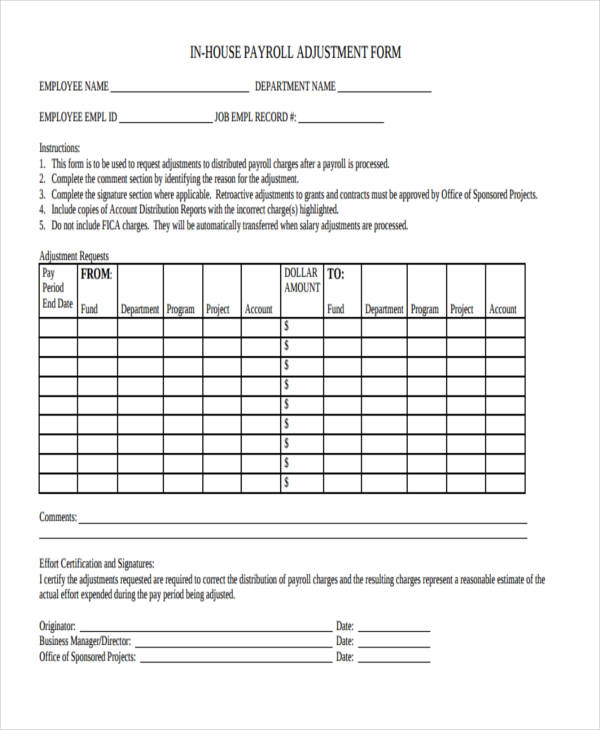

Payroll Adjustment Forms

Sample Payroll Adjustment Form

Monthly Payroll Adjustment Form

In-House Payroll Adjustment Form

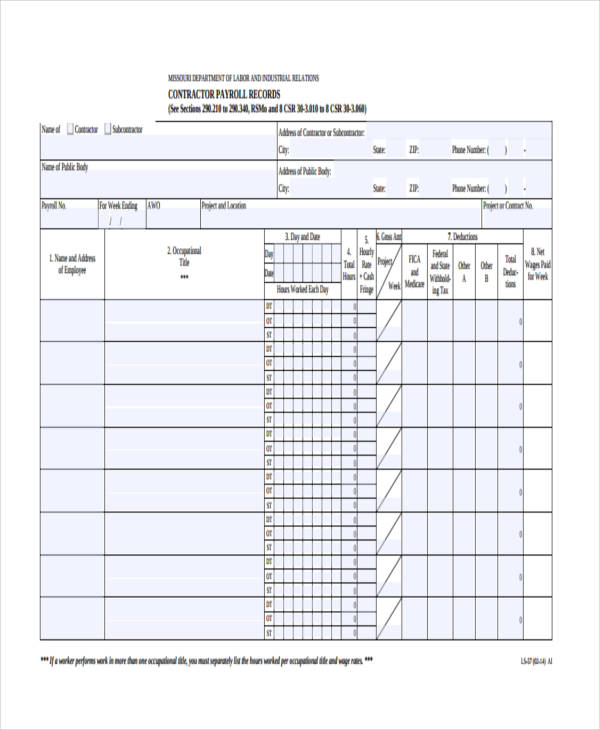

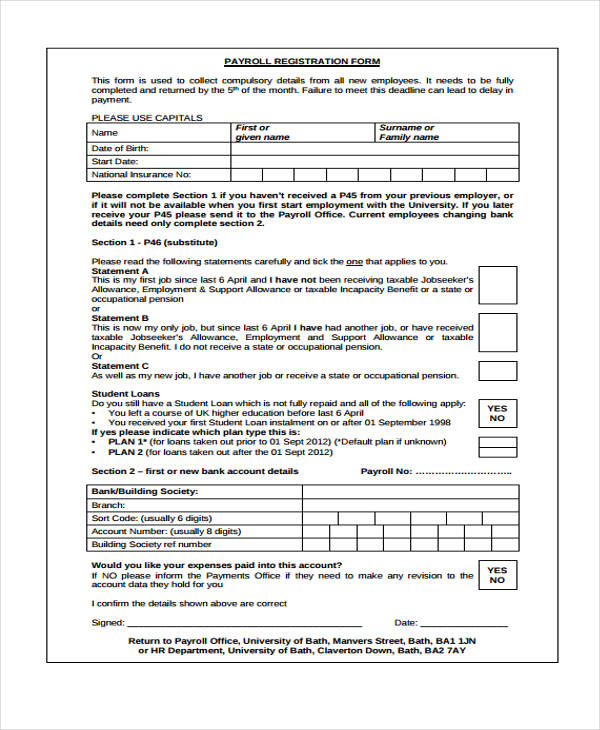

Payroll Register Forms

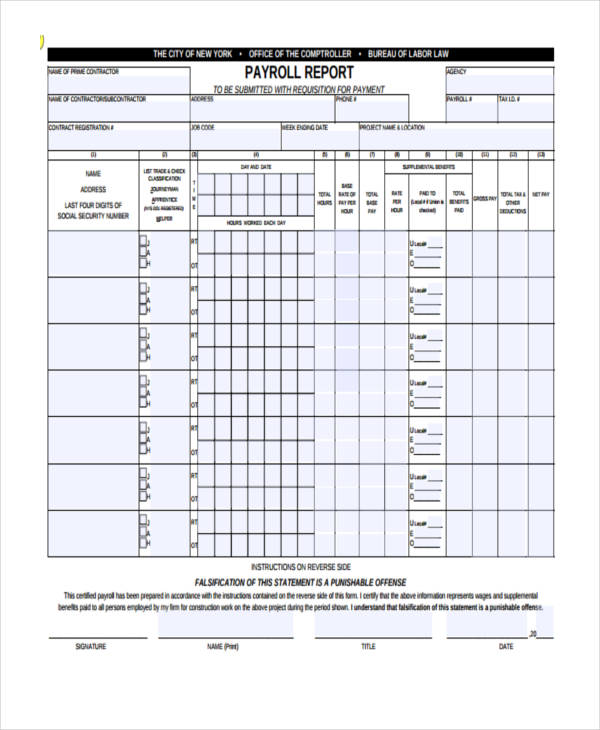

Blank Contractor Payroll Report Form

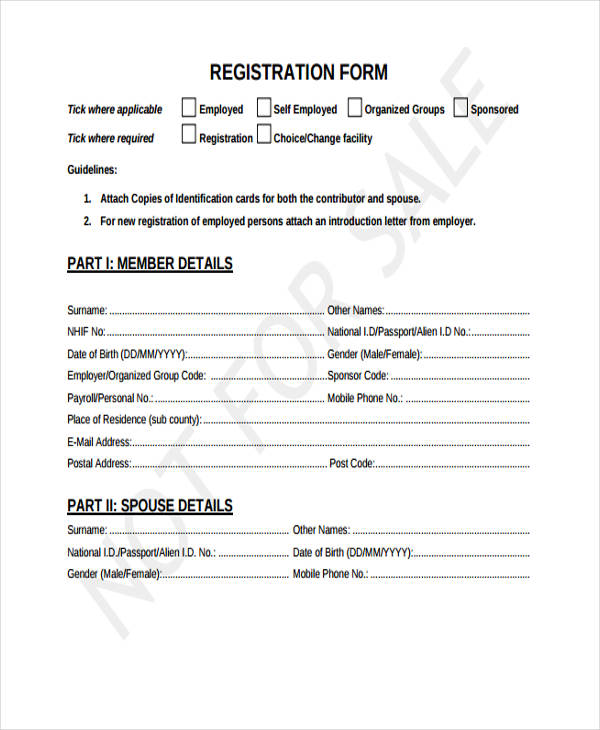

Payroll Registration Form in PDF

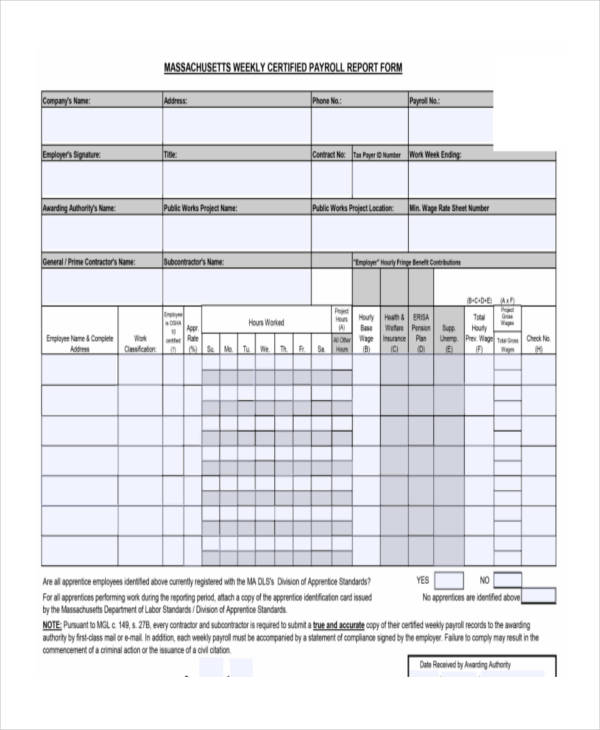

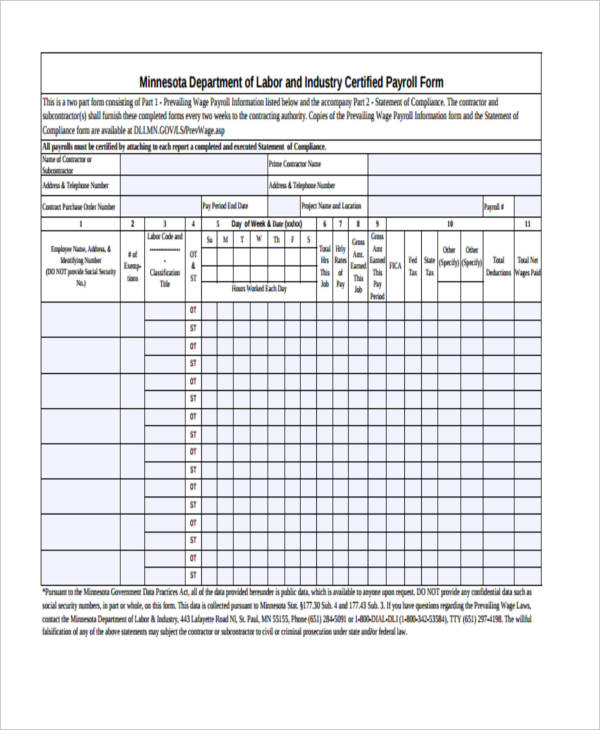

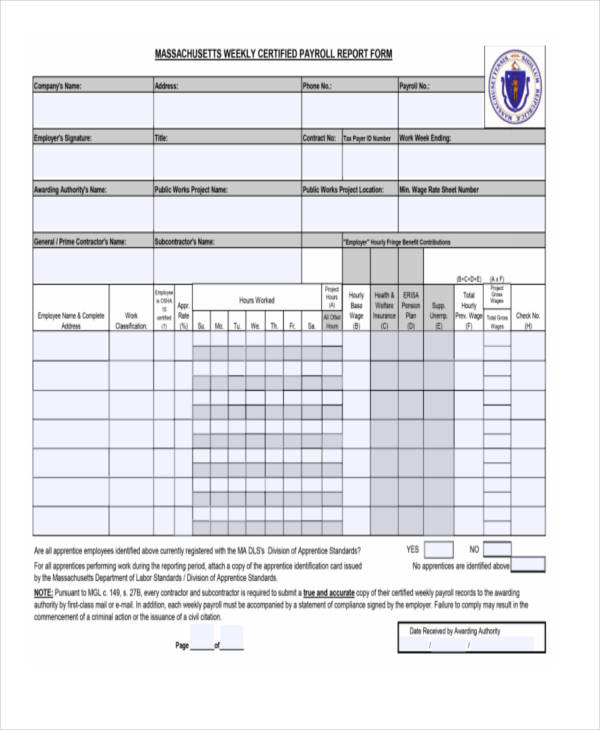

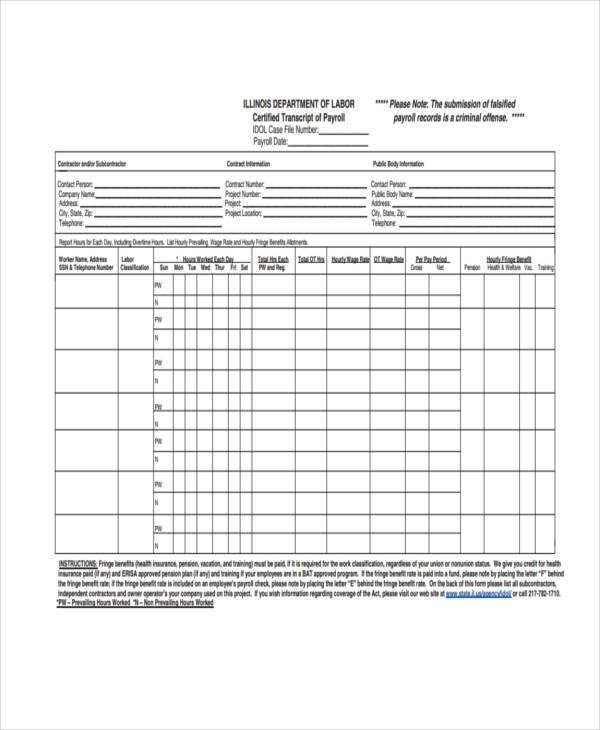

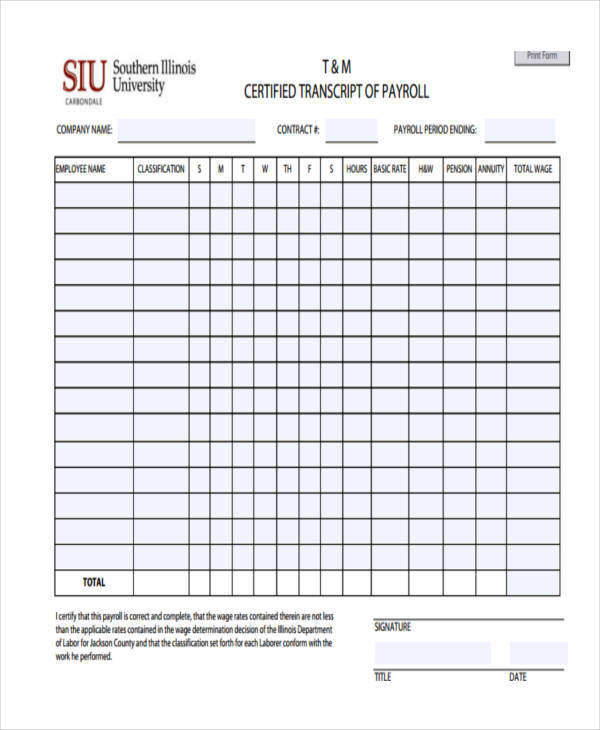

Certified Payroll Report Form

Payroll Advance Forms

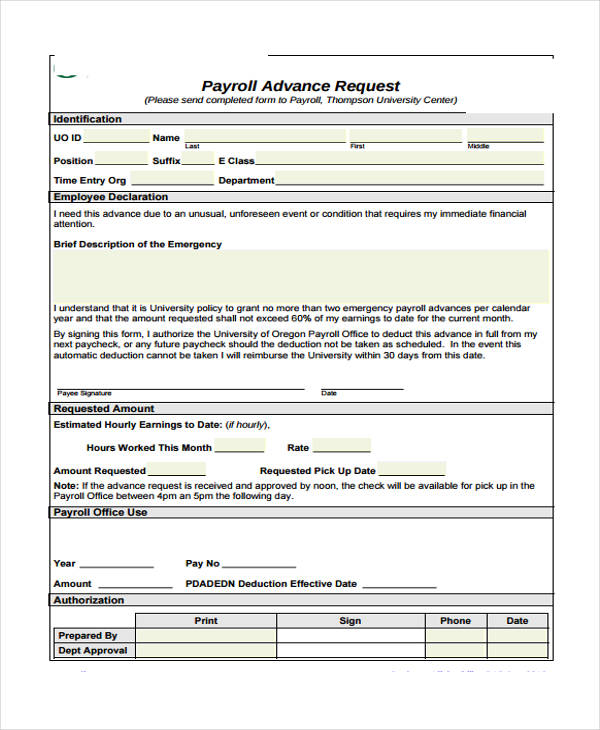

Payroll Advance Request Form

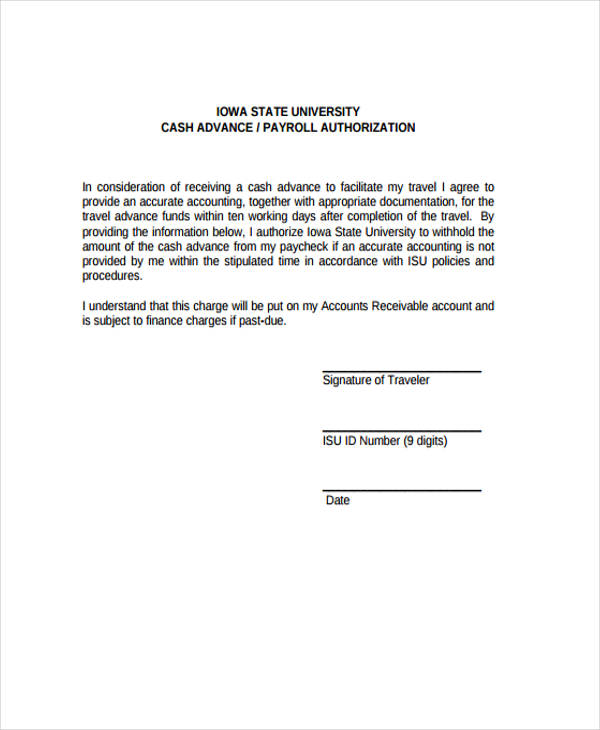

Payroll Advance Authorization Form

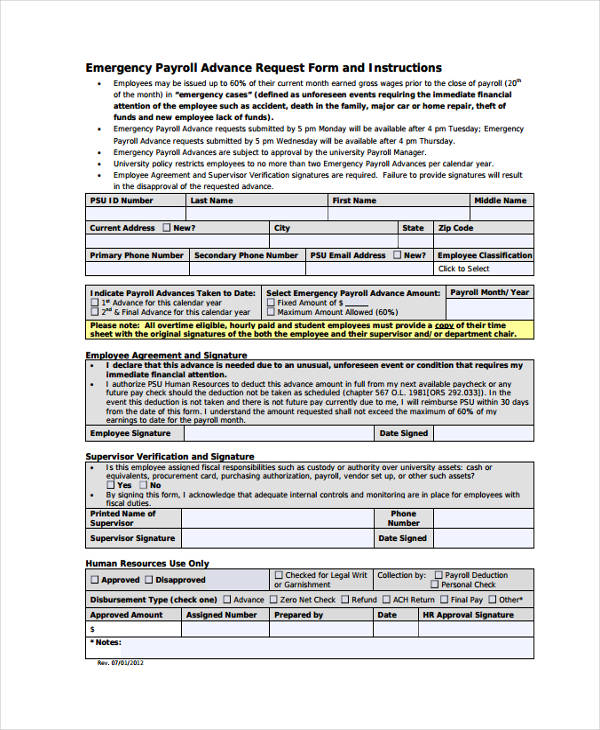

Payroll Advance Request Form

A Payroll Form is generally produced in using tables or columns and rows for easy tracking and monitoring of wages and deductions. One or more tables are created with multiple columns wherein different kinds of payroll-related information of a company’s workers need to be furnished along with properly calculated sums and figures. Payroll Forms are usually required for easy tracking and referencing of an employee’s pay, as well as for bank account and tax purposes. The upper-level members of a company usually convene together and set out to fill business payroll forms for all or certain employees in the organization. Apart from personal details, tax status and recurring earnings or deductions and details of time-off balance are also inserted in these forms.

A Basic Payroll Form contains all informational specifics of an employee’s days, dates, and times or attendance, and the corresponding payable amount for each is also specified. Lastly, the sum total is specified at the bottom end of the table as soon as all the deductions have been finalized and computed.

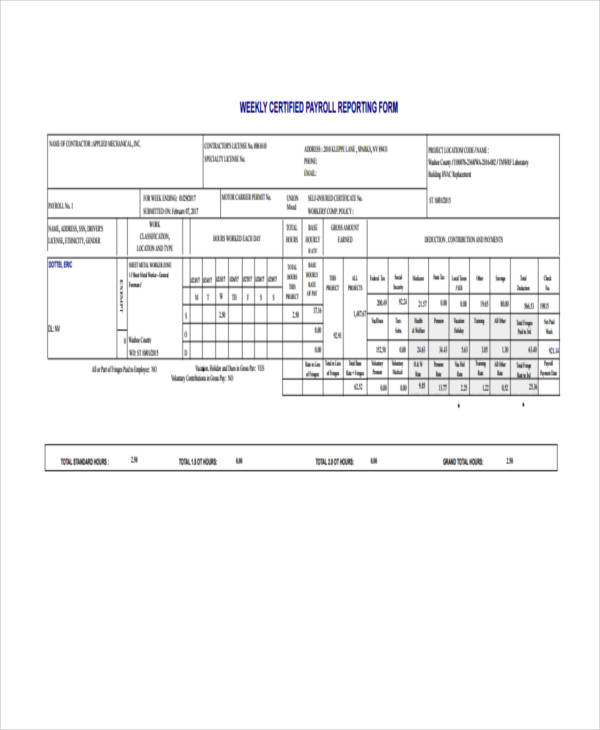

In many companies, a weekly wages formula is followed. According to this system, a weekly certified payroll form needs to be populated with the relevant and accurate details of the workers who are eligible for receiving a weekly wage for the work they did.

If an individual or employee requires a simple format payroll form for insurance or bank purposes, such a payroll form contains minimal fields wherein details such as employee name, phone, email, mailing address, insurance ID, and account number specifics need to be provided.

Why Are Payroll Forms Useful?

More often than not, small business owners usually have a more diverse work performance in a company; one of these is by establishing a payroll system. Employers need to be able to reassure their employees that they are dependable, reliable, and trustworthy enough to provide sufficient pay to their employees on a consistent basis and without delays. The method of handling payroll can greatly affect a business, particularly a small one. Here is why payroll is important:

1. Boosts a Company’s Morale

This is essentially one of the most crucial reasons why having a well-established payroll system is important. The way an employer provides an employee’s pay can greatly affect the company’s morale. This is especially true in smaller businesses wherein employees are always privy to the company’s financial status than those of a bigger company. Handing out salaries at a much later time than the specific date of pay will make employees question the financial integrity of the company, which will later on lead to a myriad of other negative effects such as demotivated employees, lack of productivity, under-performance, and even quick turnovers.

2. Determines an Employee’s Worth

One other benefit of having a structured payroll system is that it permits a worker to feel his total worth or value within the company or the organization. A worker’s aggregate remuneration is incorporated with finance. This incorporates his pay, benefits, and rewards. Employees normally experience yearly performance assessments by their bosses and are remunerated with an expansion in compensation, or a reward, or both. Benefits likewise mirror an employee’s worth inside an independent company. Representatives who get medical coverage, disaster protection, and annuity benefits feel they have a higher worth.

3. Lowers Taxes

One final important reason for having payroll is that it allows small businesses to lower their state and federal taxes. By filling out a W-4 withholding form correctly, the information that is provided on these forms will allow business owners to withhold personal taxes for employees.

Business owners should also make it a point to withhold the accurate amount of Federal Insurance Contributions Act (FICA) taxes each year from payroll. FICA percentages can change yearly based on legislation.

4. Regulate Salary Flow

Payroll forms are used to regulate the salary flow of employees working in an organization. In the case of any miscalculation or misjudgment, authorities can always go back and refer to the payroll form of the said employee in order to assess and understand his or her payroll history.

5. Helps Maintain Transparency

Payroll forms are important for maintaining transparency regarding payroll matters between employees and authorities in-charge.

Target Audience of Payroll Forms

Ideally, employees are the target audience of payroll forms. However, in cases wherein insurance companies are involved in the processing of payroll or in employer and employee relationships, both are considered an audience of payroll forms. The format and design of payroll forms differs from company to company. A payroll form can be extremely precise and straightforward in addition to being elaborate and detailed. The primary audience of payroll forms are the employees of an organization.

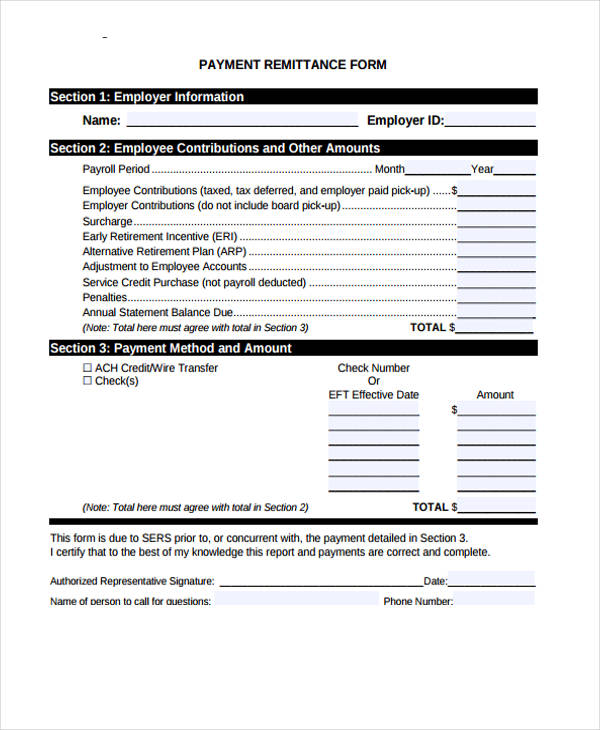

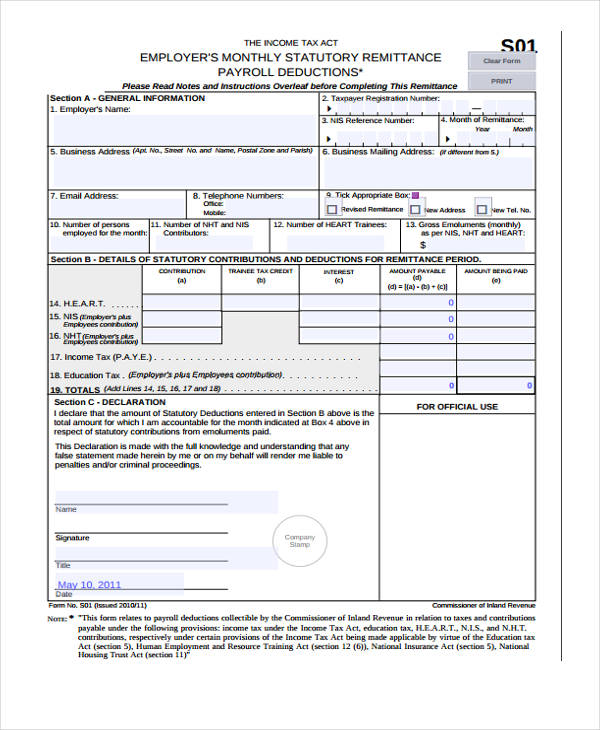

Payroll Remittance Forms

Sample Payroll Remittance Form

Monthly Payroll Remittance Form

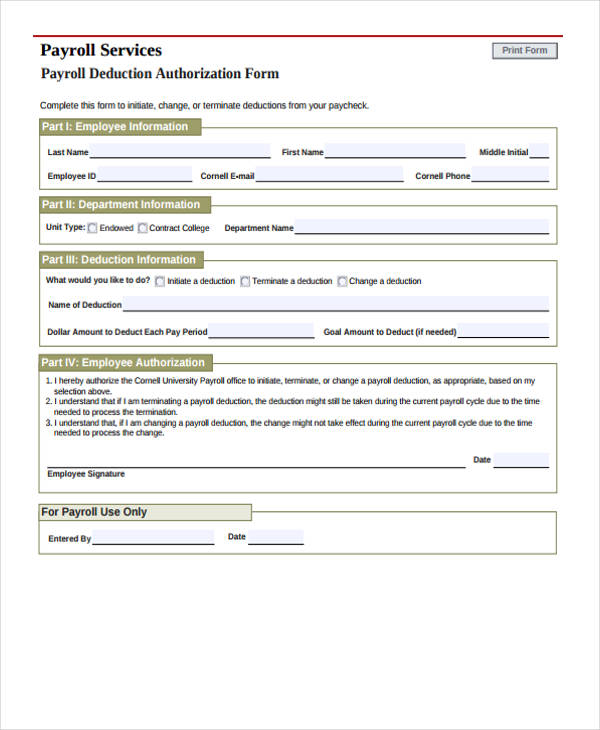

Payroll Deduction Authorization Form

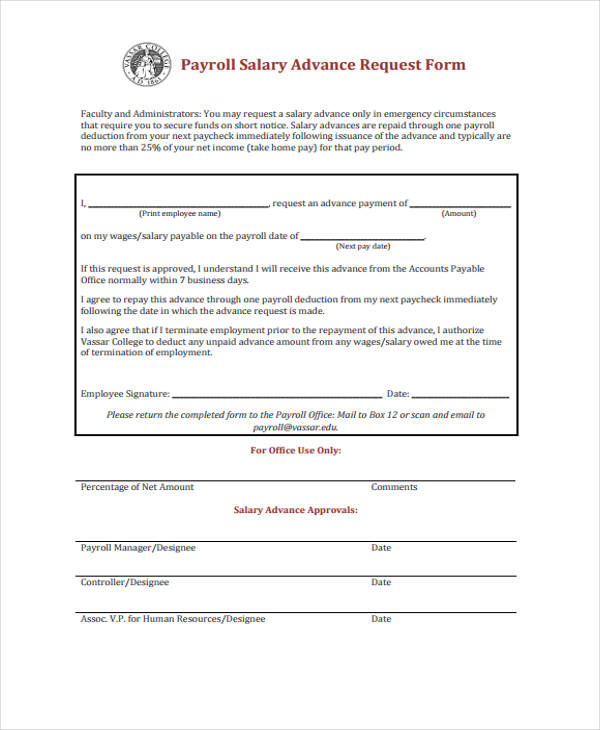

Payroll Advance Forms

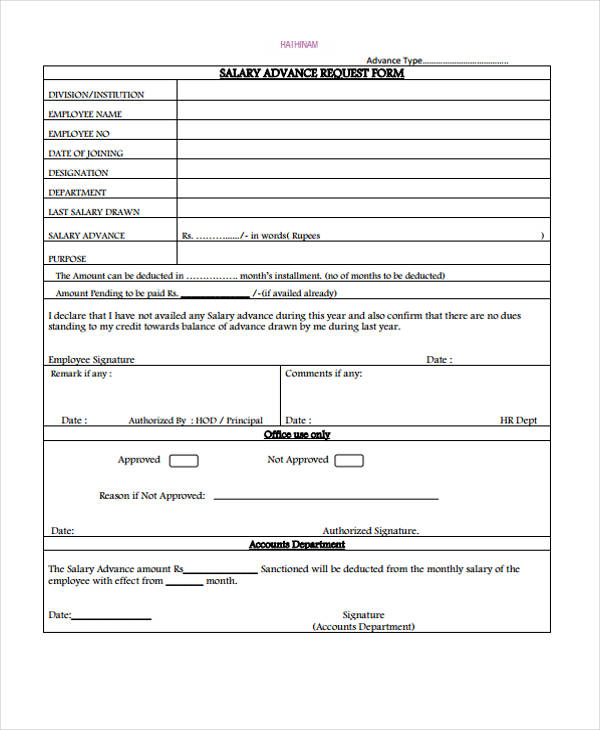

Payroll Salary Advance Request Form

Salary Advance Request Form

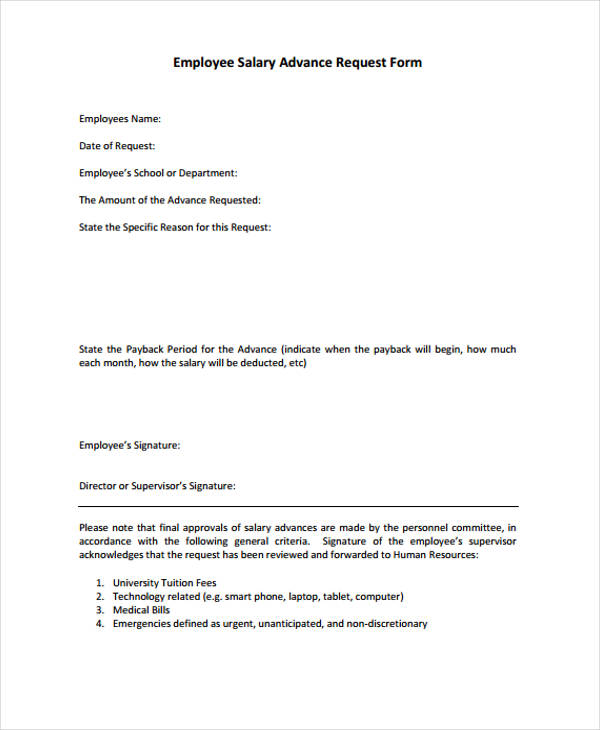

Employee Salary Advance Request Form

Payroll Deduction Forms

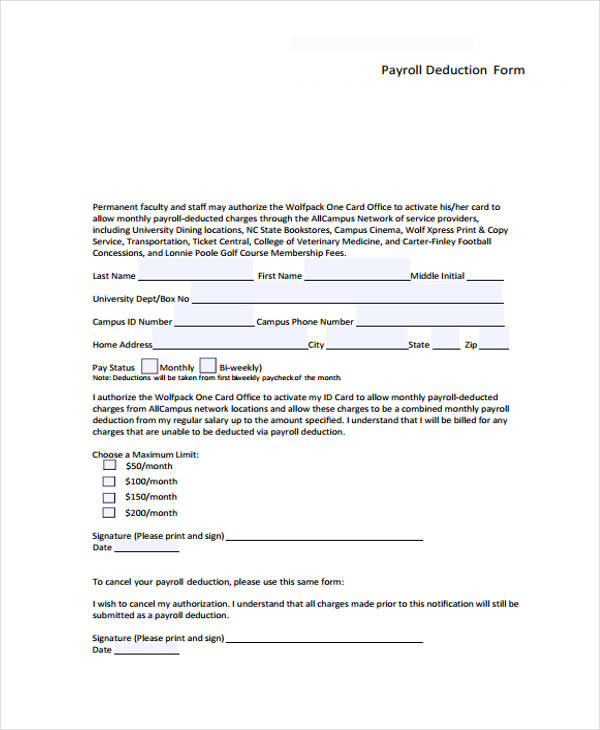

Sample Payroll Deduction Form

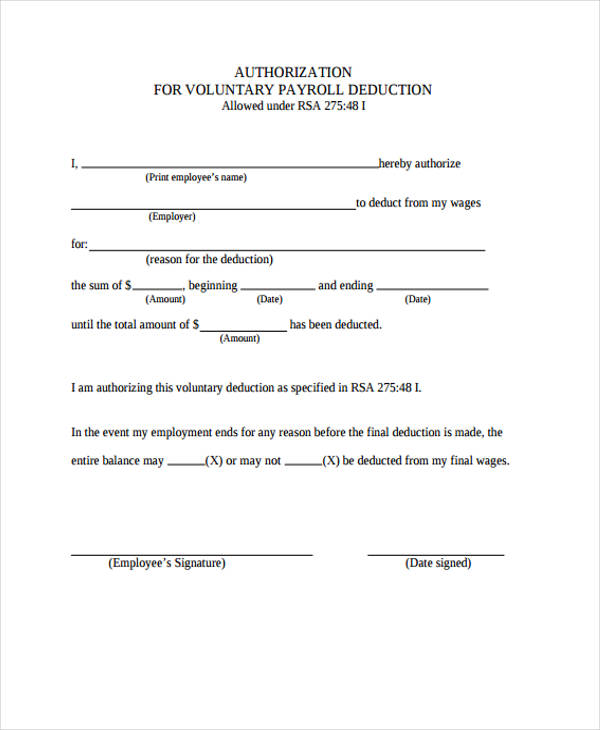

Payroll Deduction Authorization Form

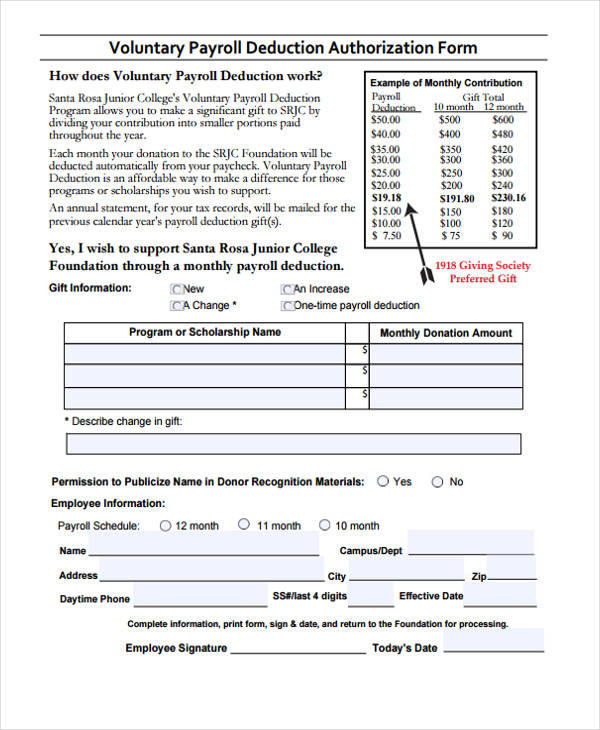

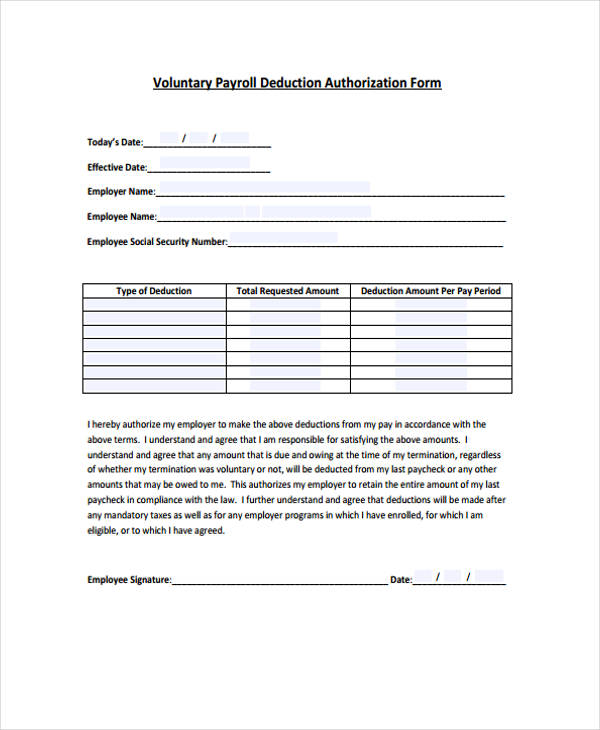

Voluntary Payroll Deduction Authorization Form

Payroll Register Forms

Sample Certified Payroll Form

Labor Payroll Report Form

Payroll and Personal Registration Form

Why Are Payroll Forms Helpful?

A lot of companies and employers utilize a Payroll Form because it enables human resource managers and supervisors to keep tabs on the payroll activity of employees working in the company. In case an issue of conflict or revision pops up, employees or the management need to fill and file the appropriate Payroll Form and take the necessary course of action.

Payroll tasks and management are crucial endeavors. In order to ensure that the payroll cycle of an employee or subject runs smoothly, it is important that payroll management is handled in a correct manner. This is achievable with the help of payroll forms. Depending on different situations, different kinds of Payroll Forms need to be populated and should be forwarded to the concerned parties.

The Flowchart of Payroll Processing

Payroll can be a pretty complex thing to do. If you are managing a conglomerate, then hiring a third-party professional in order to ensure that your payroll processing is exact and accurate, is a wise move. If you are a small business owner and you are handling a smaller group of employees, you can download our Payroll Forms and follow the following steps:

1. Let your employees fill out a W-4 form. All employees need to fill out a W-4 form as well as a New Hire Report for every new employee. This is done in order to document their filing status and to keep track of their personal allowances. Employees who have more dependents get to have lesser payroll taxes deducted from their paychecks.

2. Register for an Employer Identification Number. Having an Employer Identification Number (EIN) is one of the necessary requirements for an employer to conduct payroll. An Employer Identification Number is synonyomus to a Social Security Number (SSN); however, whereas an SSN is meant for personal individuals, an EIN is for a business entity or an organization.

3. Have a payroll schedule. As soon as you have registered for an Employer Identification Number, you should then figure out the compensation for each employee you have. Use a Tracking Form online or offline wherein you can trace the specific compensation package of each of your employees. Afterward, you should then set the specific employee pay dates on your calendar. The most common pay schedules usually fall on the 15th and the 30th of every month; however, this usually varies from company to company as some companies opt to give pay every 5th and 20th, and so on. You should also put a schedule on your tracker for tax payment due dates, and tax filing deadlines.

3. Calculate and withhold income taxes. By using an IRS Withholding Calculator and your state’s resource or a paycheck calculator, you will need to determine the exact amount of state and federal taxes that need to be withheld from your employee’s pay. Remember to diligently pay taxes on a monthly basis as tax evasion is a serious criminal offense.

4. File W-2s and tax forms. Be sure to send in your employer federal tax return. This is usually done on a quarterly basis and to prepare your annual filings and W-2s at the end of the year.

Downloadable Payroll Forms

You can download from our wide array of Sample Payroll Forms and other related Payroll Forms to help you save on time and to make the burden a little more tolerable. If you are short on manpower, using Payroll Forms can help you get things organized.

Annual Payroll Forms

An Annual Payroll Form can help you understand how much revenue a company has received and how much of it has gone into the paycheck of employees for every calendar year. These forms are also helpful when computing income tax remittances.

Quarterly Payroll Forms

A Quarterly Payroll Form is the payroll form that is used to record and identify the payroll activities of employees per quarter. A quarterly payroll form is an essential tool as it provides payment details that can be used for comparison regarding the three-month period when salaries have been generated. Comparisons can be made in quarters within an entire year or also in any particular annual periods that is needed to be assessed.

Payroll Report Forms

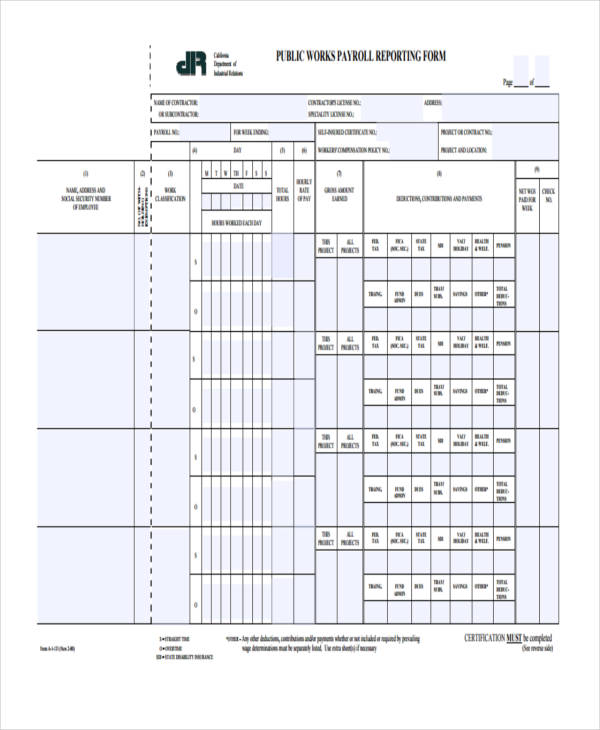

A Payroll Report Form is a comprehensive, detailed form wherein the personal and work hours specifics to an employee are mentioned meticulously. Daily hours worked (straight time and overtime hours separately specified), as well as the cost per hour are also specified.

Generic Payroll Forms

A Generic Employee Payroll Form consists of several fields and blank spaces which need to be filled with the employee’s name and other personal information, followed by his weekly and yearly salary figures. Information needs to be manually provided for these types of forms.

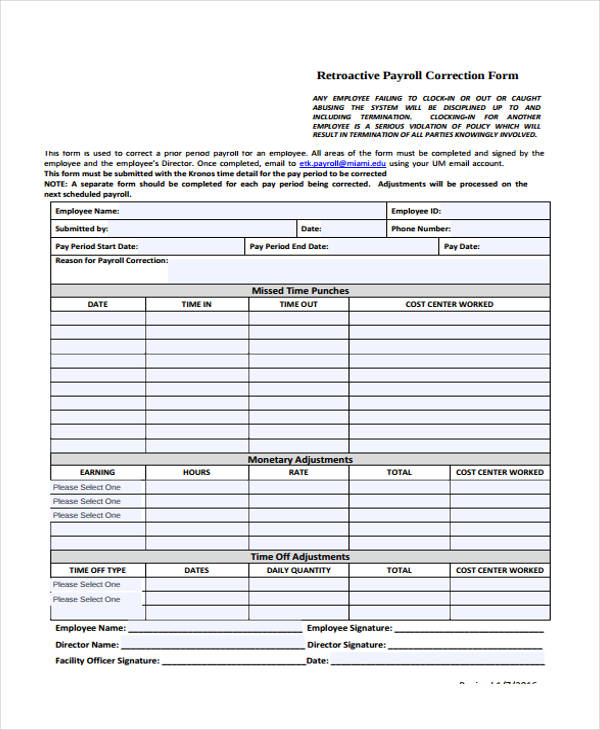

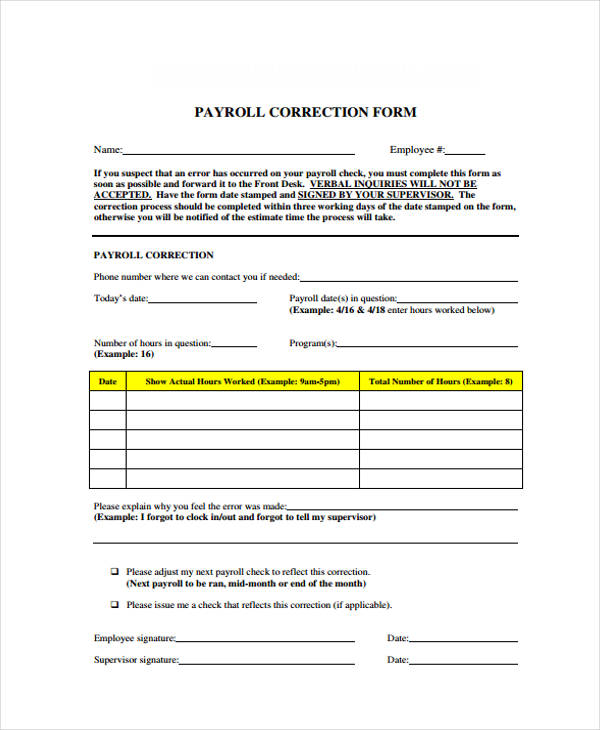

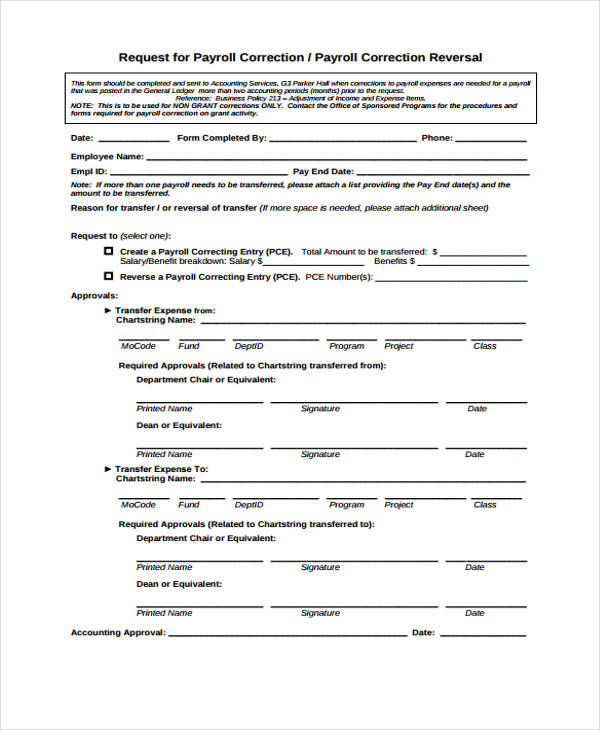

Payroll Correction Form

Retroactive Payroll Correction Form

Employee Payroll Correction Form

Request for Payroll Correction Form

Payroll Report Forms

Certified Payroll Report Form

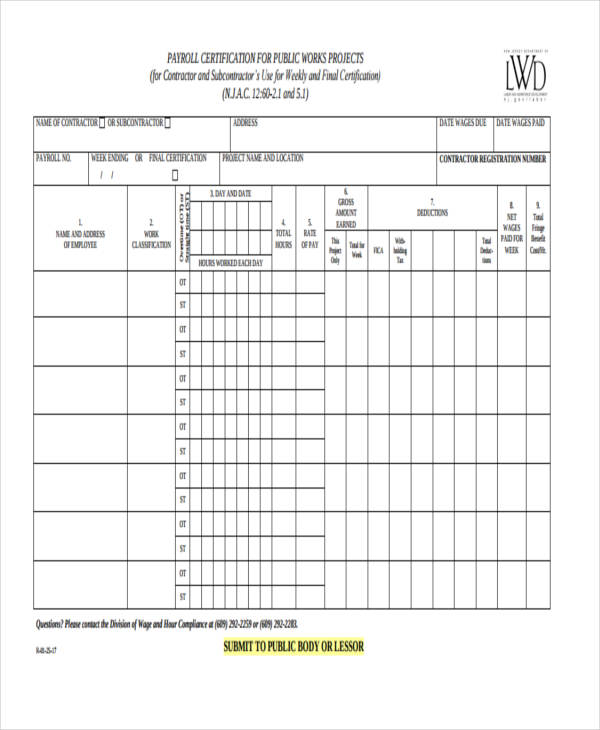

Public Works Payroll Reporting Form

Weekly Certified Payroll Reporting Form

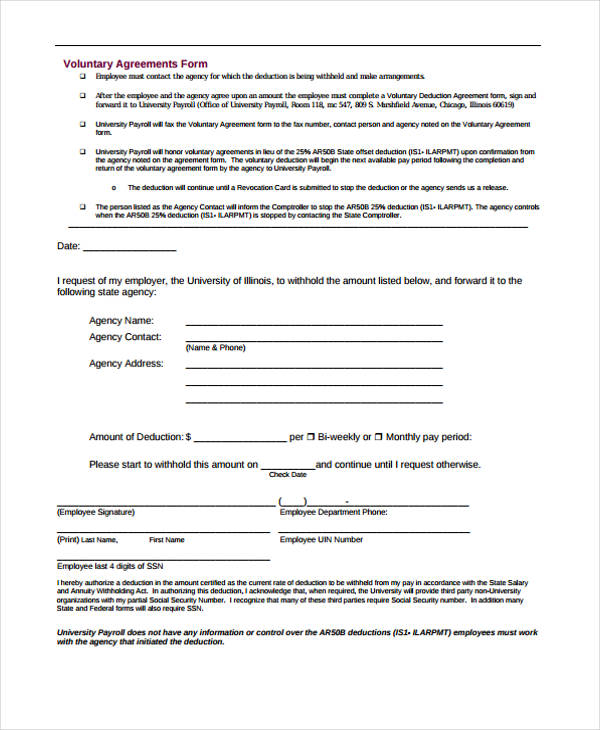

Voluntary Payroll Forms

Voluntary Payroll Deduction Authorization Form

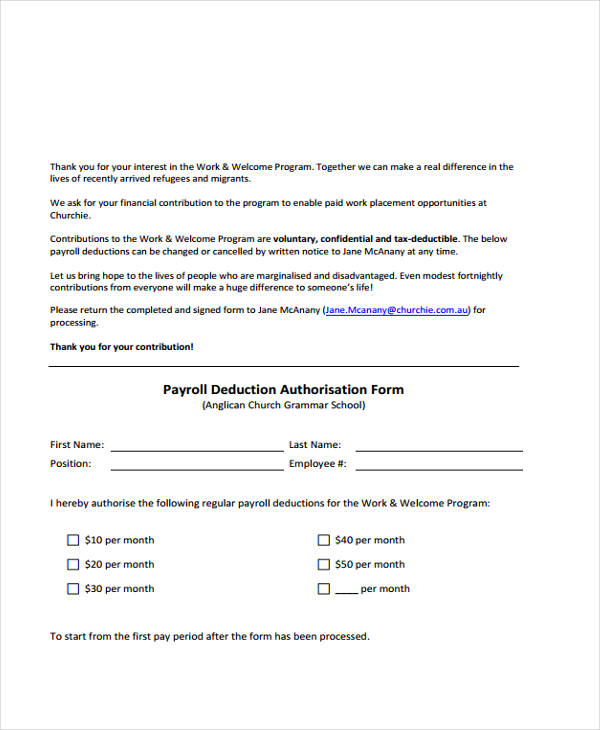

Payroll Deduction Authorization Form Sample

Voluntary Deduction Agreement Form

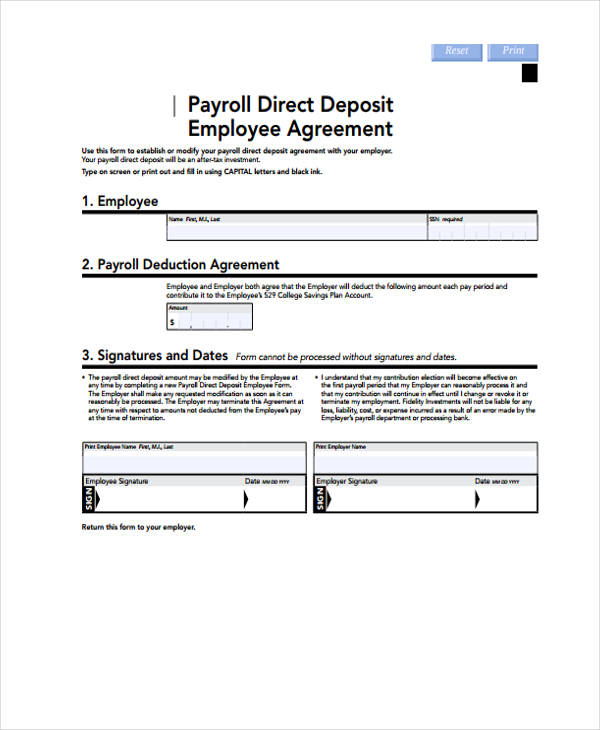

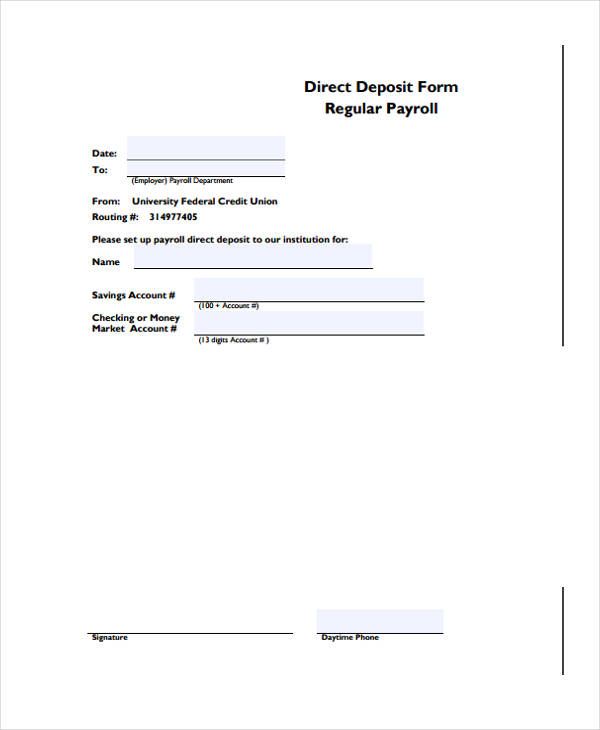

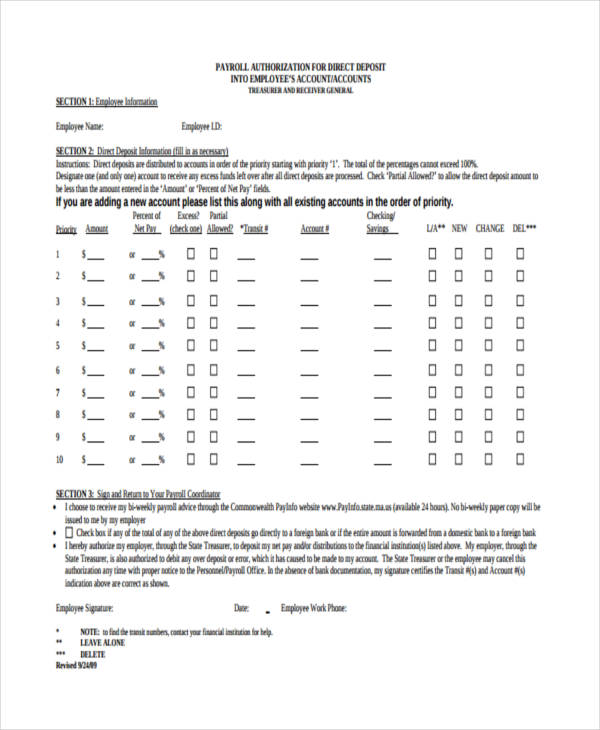

Payroll Direct Deposit Forms

Payroll Direct Deposit Employee Agreement Form

Regular Payroll Direct Deposit Form

Authorization for Direct Deposit of Payroll

Certified Payroll Forms

Certified Transcript of Payroll Sample

Certified Transcript of Payroll

Certified Project Payroll Form

Basic Employee Payroll Form

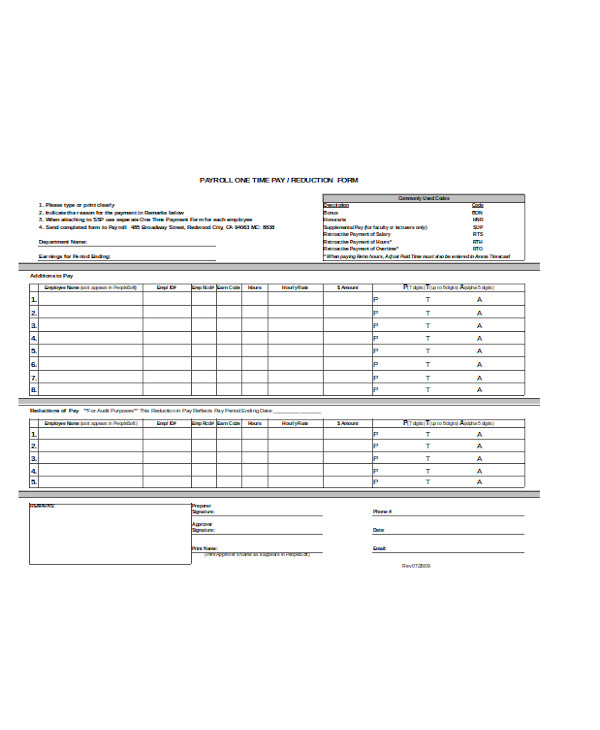

Employee Payroll Reduction Form

Weekly Payroll Forms

For employees and workers involved in a project with weekly wages. Companies or project managers are known to maintain a Weekly Payroll Report in which weekly calculations of work hours, wages, and deductions are given in a precise manner.

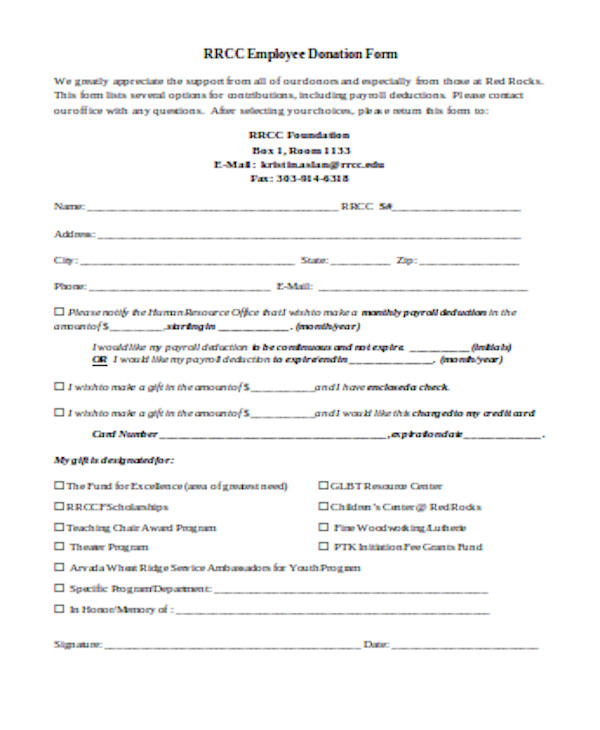

Payroll Deduction Forms

Most payslips contain deductions due to tax remittances, statutory benefits, fees, or cash advances. A Payroll Deduction Form can come in handy for these types of deductions. For example, an employee may have purchased an extra pair of uniform other than what was supplied by the company. The expense for these uniforms are no longer shouldered by the company but by the employee himself, the payment for which, can be taken from his wages.

Payroll Direct Deposit Forms

Payroll Tax Forms

Payroll Tax Forms are forms that play a vital role in the processing of income taxes for employees. An example of which is a W-4 Tax Withholding Form. Several state and federal laws have been established pertaining to laws and regulations on paying the right and the proper amount of taxes.

Payroll Cash Advance Authorization Form/ Payroll Salary Advance Request Form

Some employees might request for a cash advance from their employers when the need arises. In such circumstances, the employee can deduct the amount that has been taken in advance in one lump-some, or, through installments. The payment process will vary from company to company and will depend on the agreement between the employer and the employee. However, employers cannot just automatically deduct the amount from the employee’s pay without proper or prior authorization. A Payroll Cash Advance Authorization Form and a Payroll Salary Advance Request Form can be useful in these situations. Typically, a Payroll Cash Advance Authorization Form should be signed by an employee each time an amount is deducted from the total wages to pay off the cash advance to serve as tangible proof that the employee consented to the deduction or the withholding of wages. A Payroll Salary Advance Request Form, on the other hand, is filled out by an employee when he wishes to make an advanced claim of his pay.

The way you handle payroll can greatly affect the way your employees perform. Remember that your employees are the fuel to your business and their lack of motivation to perform well at work can greatly affect you and your business. Be sure to properly manage your Payroll System with an efficient and an adept method of organization. You can download our online Sample Payroll Forms, Payroll / Status Change Forms, Payroll Registration Forms in PDF, and many more, to help get you started.

Related Posts

-

FREE 10+ Sample Payroll Register Forms in PDF | Excel

-

FREE 8+ Sample HR Payroll Forms in PDF | Word | Excel

-

FREE 8+ Sample Payroll Tax Forms in PDF | Excel | MS Word

-

FREE 9+ Sample Certified Payroll Forms in PDF | Excel | Word

-

FREE 9+ Sample Payroll Remittance Forms in PDF | Excel

-

Payroll Advance Form

-

Payroll Deduction Form