Navigating through investment opportunities requires precision and clarity, which is where the Investment Agreement Form steps in. This crucial document lays the foundation for secure and transparent financial engagements between investors and recipients. Essential for structuring deals that range from simple loans to complex joint ventures, an Investment Agreement Form outlines the terms, conditions, and the roles of all involved parties. Incorporating terms from both an Agreement Form and an Investment Proposal Form, this guide will walk you through each section with examples, ensuring you understand how to tailor it to fit your specific investment needs effectively.

Download Investment Agreement Form Bundle

What is an Investment Agreement Form?

An Investment Agreement Form is a legally binding document used by businesses and investors to outline the specifics of an investment project. This form serves as a formal agreement that details the amount of investment, the ownership stakes, the distribution of profits, and other critical terms of the engagement. It is designed to protect the interests of all parties involved by clarifying obligations and expectations. The Investment Agreement Form is vital for ensuring transparency and accountability in financial transactions, making it a foundational tool for any business venture or partnership.

Investment Agreement Format

1. Introduction

- Purpose of the Agreement

- Date of Agreement

- Parties Involved

2. Definitions and Interpretations

- Terms Defined

- Interpretative Guidelines

3. Investment Details

- Amount of Investment

- Investment Structure (e.g., shares, bonds)

- Payment Terms

4. Representations and Warranties

- Party A’s Representations

- Party B’s Representations

- Disclosure Requirements

5. Conditions Precedent

- Legal Conditions

- Performance Conditions

6. Covenants and Agreements

- Operational Covenants

- Financial Covenants

7. Rights and Obligations of the Investor

- Voting Rights

- Dividend Rights

8. Term and Termination

- Agreement Duration

- Termination Clauses

9. Dispute Resolution

- Governing Law

- Dispute Resolution Mechanism

10. Signatures

- Parties’ Signatories

- Witnesses

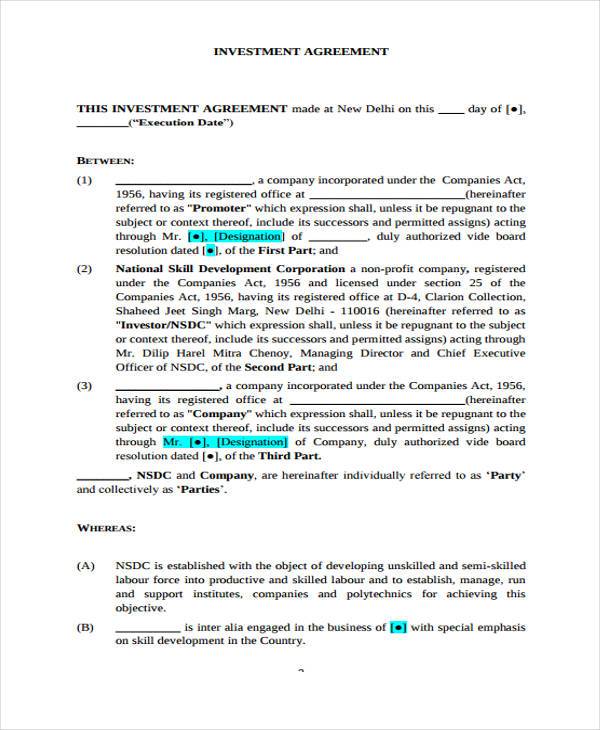

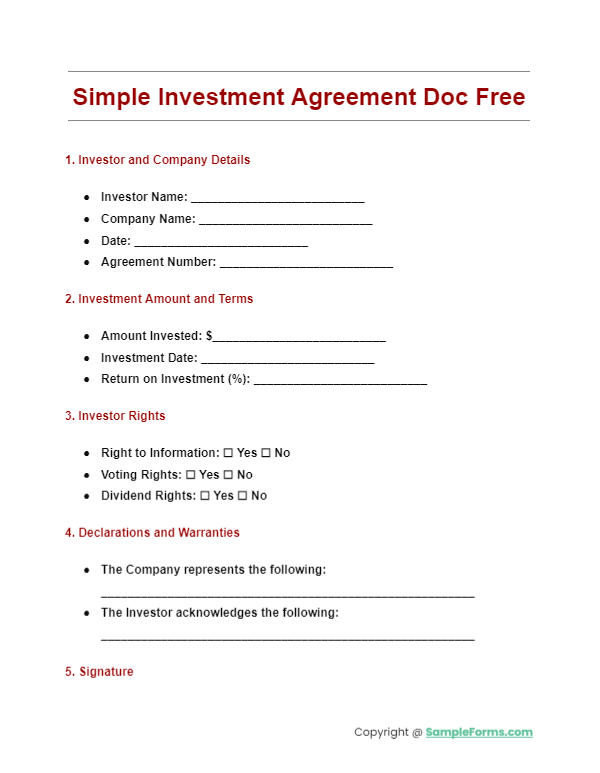

Simple Investment Agreement Doc Free

Explore our free Investment Trading Journal Form, offering straightforward terms for informal investments, streamlining your financial dealings with clarity and ease.

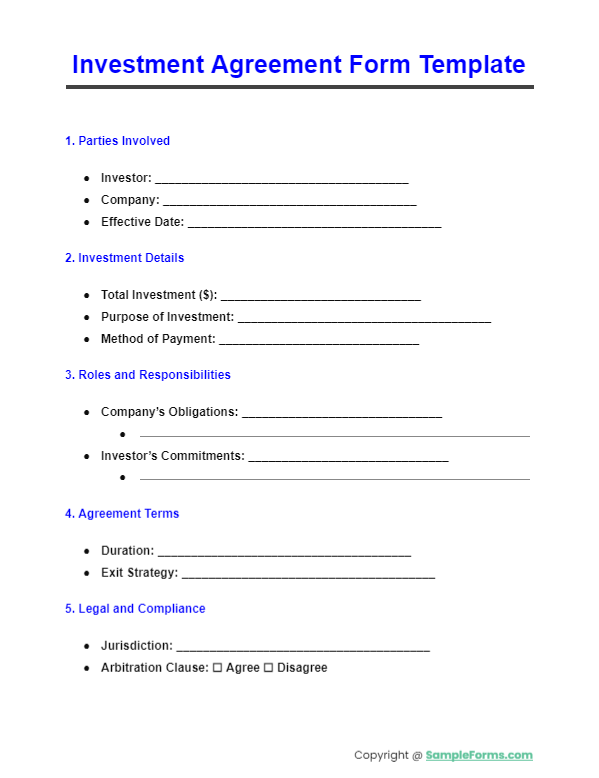

Investment Agreement Form Template

Utilize our detailed Promissory Note Agreement Form template to structure solid agreements, ensuring clear terms and mutual benefits for all involved parties.

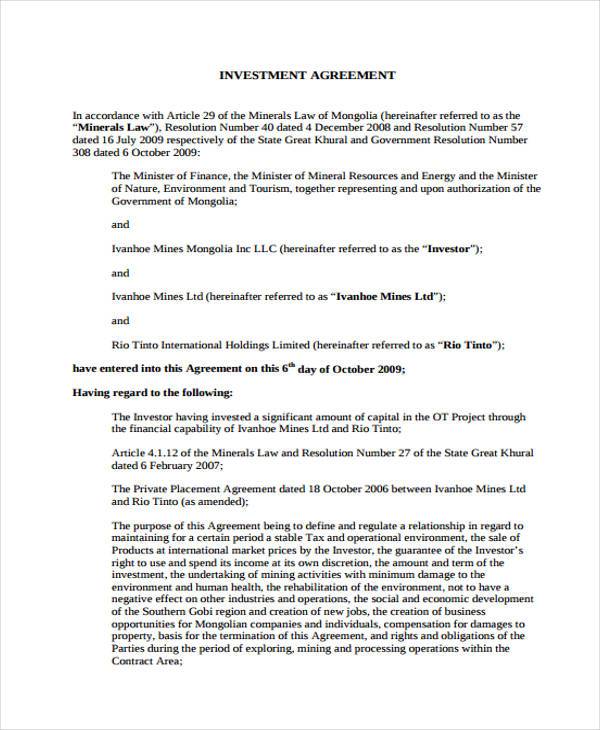

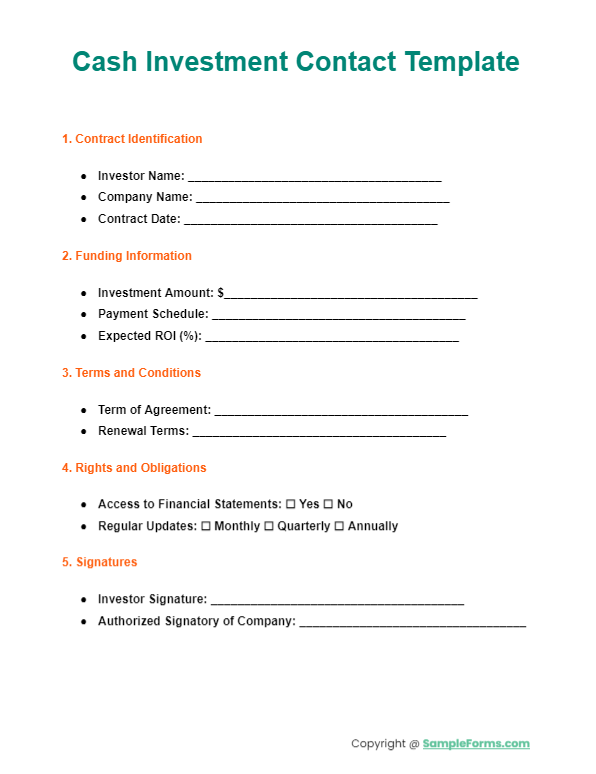

Cash Investment Contact Template

Download the Tenancy Agreement Form-inspired cash investment contract for secure, direct financial injections into your real estate ventures.

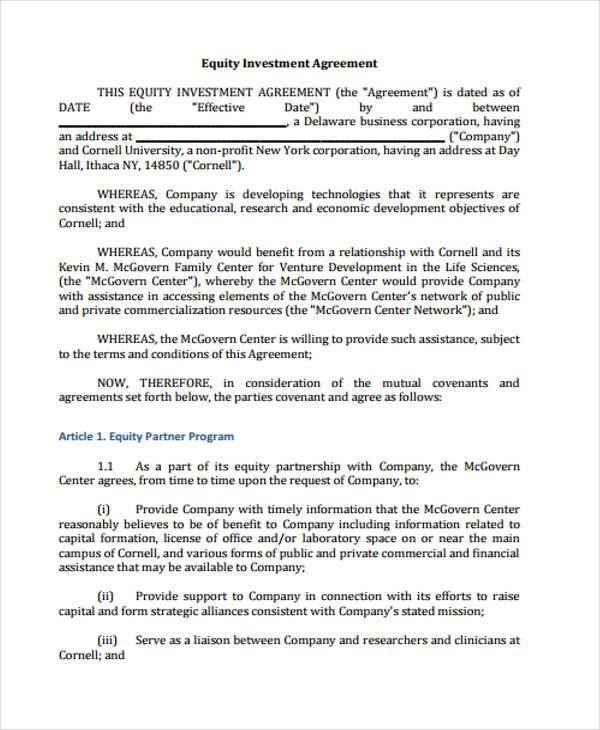

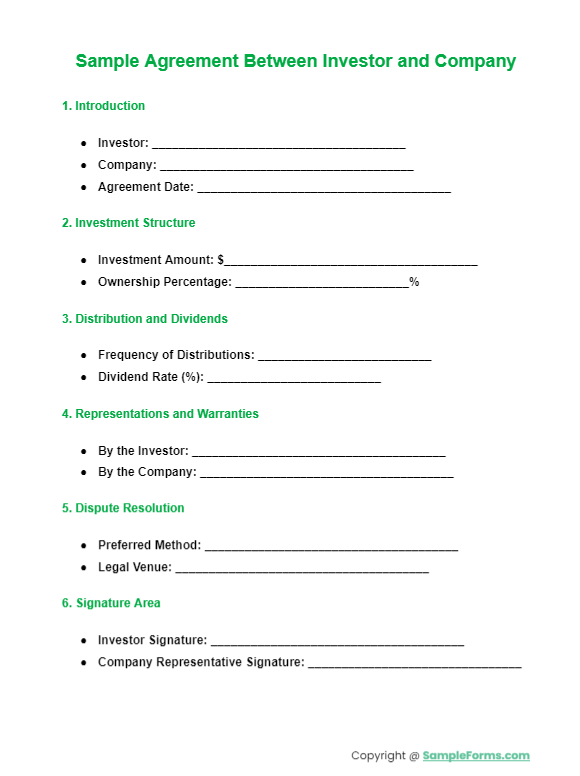

Sample Agreement Between Investor and Company

Adapt our Business Agreement Form sample for creating transparent and legally binding agreements between investors and businesses, promoting mutual growth and security.

Free Investment Agreement Form Sample

Investment Agreement Form in PDF

Equity Investment Agreement Form Example

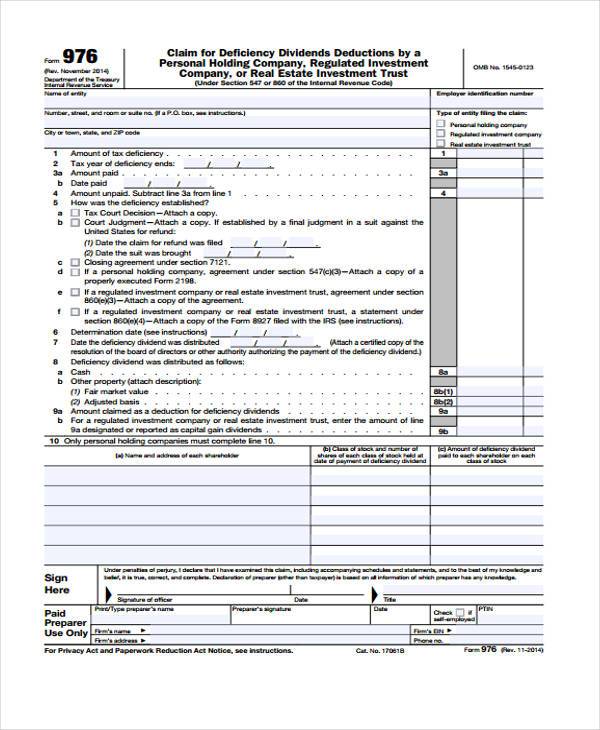

Real Estate Investment Trust Agreement Form

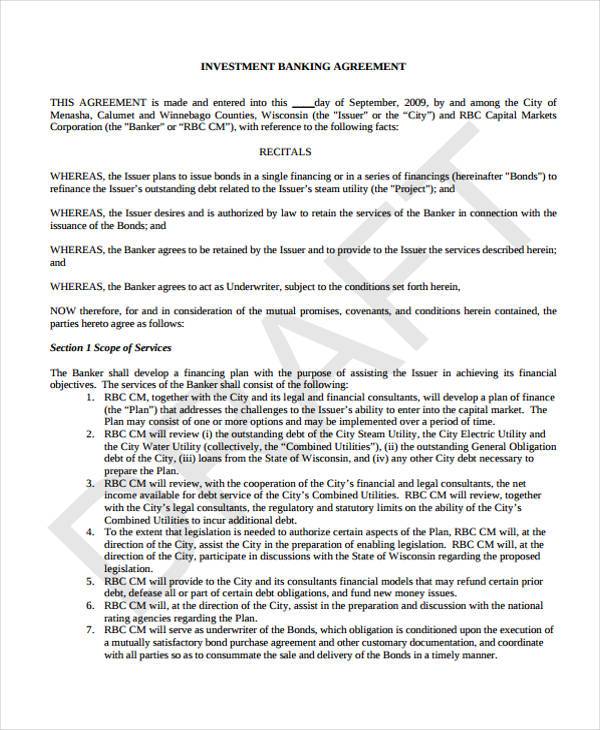

Investment Banking Agreement Form

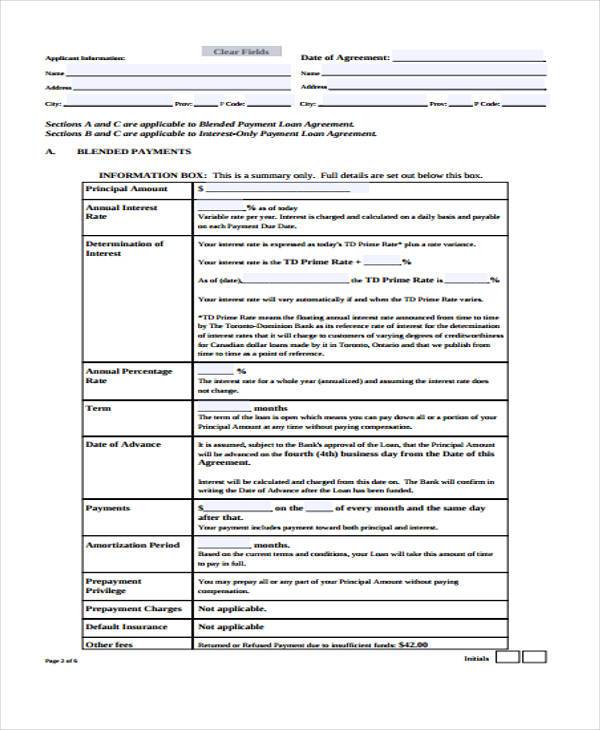

Investment Loan Agreement Form Example

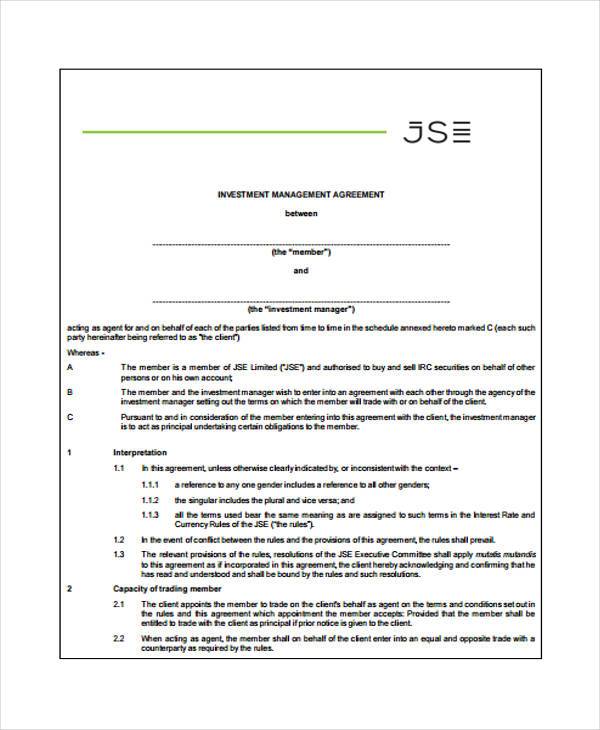

Investment Management Agreement Form

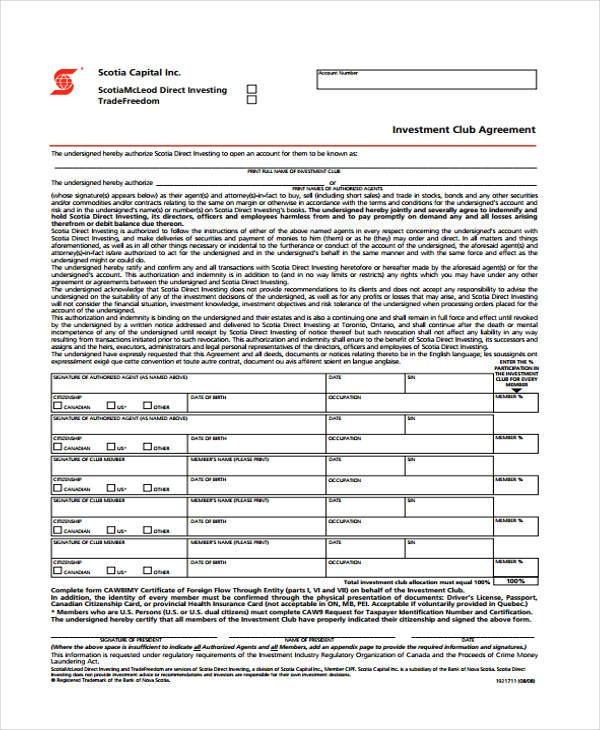

Investment Club Agreement Form

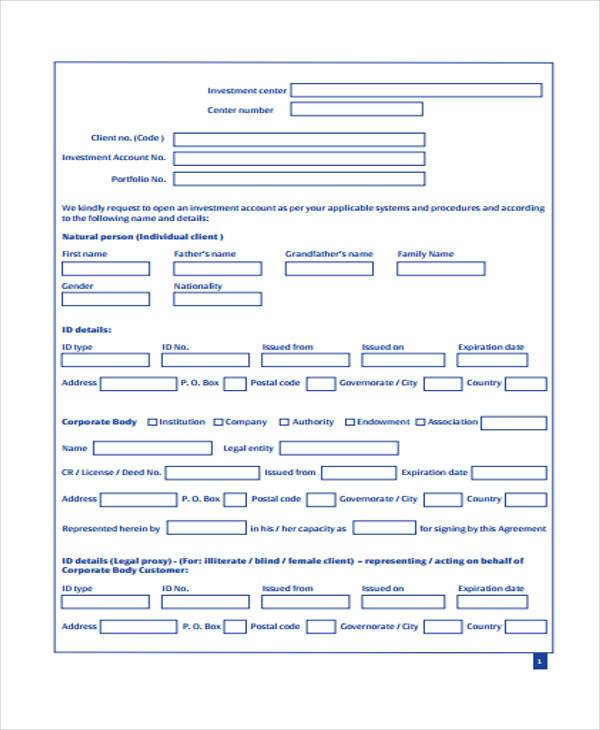

Investment Account Opening Agreement Form Sample

Basic Investment Agreement

How do you write an investment agreement?

Creating an investment agreement is essential for formalizing the financial relationship between parties.

- Identify the Parties: Include the full legal names, addresses, and roles of all entities involved.

- Define the Investment Terms: Clearly outline the amounts, timelines, and expectations.

- Detail the Payment Terms: Specify schedules and conditions for all transactions, ensuring clarity in the Payment Agreement.

- Outline Obligations and Rights: Describe the responsibilities and rights of each party, covering all crucial aspects of the agreement.

- Incorporate Legal Clauses: Include clauses for dispute resolution, confidentiality, and termination. You may also see Employment Agreement Form

How to create an investment document?

An investment document formalizes the engagement between investors and recipients.

- Prepare the Document: Start with gathering necessary financial and investor information.

- Specify Loan Details: Include specific terms related to the Personal Loan Agreement Form, adjusting it to fit the investment.

- Detail Investment Objectives: State the investment aims, detailing expected returns and outlining strategic goals.

- Disclose Risks: Inform all parties of potential risks, encouraging transparency and trust.

- Obtain Signatures: Ensure all parties sign the document to validate the agreement. You may also see Deposit Agreement Form

What qualifies as an investment contract?

An investment contract binds parties to a financial agreement with expectations of a return.

- Financial Contribution: Document the initial capital or assets provided by the investor.

- Expectation of Profits: Clarify that profits are anticipated, based on the enterprise’s performance.

- Common Enterprise: Link all parties’ returns to the success of the common enterprise.

- Efforts of Others: Highlight that profits will mainly arise from the efforts of the promoter or third party, similar to the dynamics in a Vehicle Purchase Agreement.

- Legal Framework: Use relevant legal standards to ensure the contract is enforceable. You may also see Service Agreement

How do you write a simple written agreement?

A simple written agreement clearly states the terms of a contract between two or more parties.

- State Party Information: Include detailed information about all parties involved.

- Describe the Agreement’s Purpose: Clearly define what the agreement aims to achieve.

- Define Terms Clearly: Use straightforward language to describe all terms and conditions.

- Specify Lease Terms: Clearly outline the terms similar to those found in a Lease Agreement Form, if applicable.

- Sign and Date: Ensure the agreement is signed by all parties to signify consent. You may also see Assignment Agreement Form

What is the purpose of the investment contract?

The investment contract secures financial commitments and details the terms between investors and businesses.

- Secure Investment: Protect the interests of both parties under the terms of the agreement.

- Clarify Terms: Offer a detailed description of the investment structure, similar to how a Rent Lease Agreement specifies rental terms.

- Manage Risk: Outline strategies for risk management, ensuring all parties are aware of potential issues.

- Define Roles and Responsibilities: Clearly delineate the responsibilities of each party to prevent future disputes.

- Facilitate Legal Compliance: Ensure that the agreement complies with relevant laws and regulations. You may also see Land Purchase Agreement

How do I write an investment proposal template?

An investment proposal template is designed to outline a potential investment to attract funding.

- Executive Summary: Provide a compelling summary of the investment opportunity.

- Business Description: Give a thorough overview of the business, including market and potential growth.

- Investment Details: Outline the funding requirements and the proposed uses of the funds.

- Financial Projections: Include detailed financial projections to demonstrate the potential financial returns, similar to outlining expected revenue in a Room Rental Agreement.

- Closing Statement: Summarize the proposal’s value proposition, encouraging potential investors to engage. You may also see Room Agreement Form

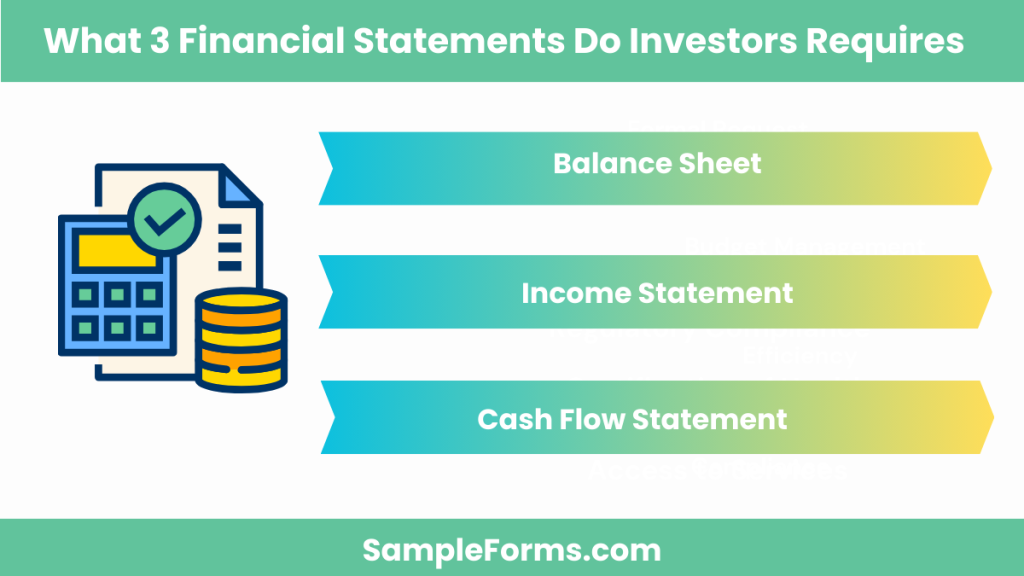

What 3 financial statements do investors require?

Investors need detailed financial statements to assess the health and viability of a business.

- Balance Sheet: Shows the company’s financial position, including assets, liabilities, and equity.

- Income Statement: Details the company’s revenue, costs, and expenses over a period.

- Cash Flow Statement: Tracks the flow of cash in and out of the business, highlighting liquidity and operational efficiency. You may also see Rental Agreement Form

Significance of an Investment Agreement Form

Having an Agreement Form is important for documentation purposes and for legal matters. The earnings should be discussed with details as to when you will see the growth of your money. You should also know what type of business the company you are investing in is in, and make sure that they are as solid an investment as they come. You may also see Sales Agreement Form

Quick Tips on Investing

- Know yourself. Be aware of your preference, your income, your future profit, and your business to deal with.

- Look for Investment Packages. In banks, there are investment packages that can fit rightly for you, so don’t be shy in asking the tellers for brochures of their available services. This also helps you avoid investing into programs for which you do not understand the risks and benefits.

- Start with 15%. It may sound like a small amount, but big things start from small beginnings, don’t they? Just be consistent with investing and adding up another 15% per month. This strategy will surely make your wealth grow fast without you noticing much. You may also see Guarantor Agreement Form

When you’re lucky enough to gain enough profit, you might as well want to own a house, right? So we have here samples of House Agreement Forms that you may download and use in Doc and PDF formats. You may also see Purchase Agreement Form

What is an investment plan template?

An investment plan template organizes financial goals and strategies, similar to a Financial Agreement Form, guiding structured asset allocations and investment timelines.

What is a fair percentage for an investor?

A fair percentage for an investor depends on the risk, investment size, and expected return, akin to stipulations in a Consignment Agreement.

How do you ask an investor for money?

To ask an investor for money, present a clear, compelling pitch that outlines potential returns and risk management, structured like a Trust Agreement Contract Form.

Do investors own the company?

Investors may own a part of the company proportional to their investment, governed by terms similar to those in a Confidentiality Agreement Form to protect proprietary information.

Can you write an agreement without a lawyer?

Yes, you can draft an agreement without a lawyer using standard forms like a Car Lease Agreement, but professional review is recommended to ensure legality and completeness.

Is a handwritten agreement legal?

A handwritten agreement is legally binding if it contains essential elements and signatures, much like a Pet Agreement Form.

What is an investment plan called?

An investment plan is often referred to as a portfolio strategy or financial blueprint, similar in structure to an Easement Agreement Contract Form, defining investment boundaries and conditions.

In conclusion, the Investment Agreement Form is an indispensable tool in the realm of business finance, enabling structured and secure investment processes. Whether you’re drafting a simple investment proposal or entering into a complex Joint Venture Agreement Form, these documents are tailored to safeguard interests and outline the specifics of financial contributions and benefits. Samples, customizable forms, and guideline letters available in this resource make it easier to navigate the intricacies of various investment scenarios. Utilizing these tools ensures that all parties are on the same page, leading to successful and profitable ventures.

Related Posts

-

FREE 5+ Rent a Room Agreement Forms in PDF | MS Word

-

FREE 5+ Commercial Sublease Agreement Forms in PDF | MS Word

-

FREE 50+ Mortgage Forms Download – How to Create Guide, Tips

-

FREE 4+ Real Estate Listing Information Forms in PDF | MS Word

-

FREE 7+ Garage (Parking) Rental Agreement Forms in PDF | MS Word

-

FREE 7+ Office Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Salon Booth Rental Agreement Forms in PDF | MS Word

-

FREE 5+ Roommate Rental Agreement Forms in PDF | MS Word

-

Electrical Subcontractor Agreement Form

-

FREE 10+Non-Disclosure Forms in PDF | MS Word

-

FREE 5+ Construction Subcontractor Agreement Forms in PDF | MS Word

-

FREE 5+ Real Estate Lease Guarantee Co-Signer Agreement Forms in PDF | MS Word

-

FREE 5+ Lease with an Option to Purchase Agreement Forms in PDF | MS Word

-

FREE 7+ Realtors Lease Agreement Forms in PDF

-

FREE 10+ Subordination Agreement Forms in PDF | MS Word