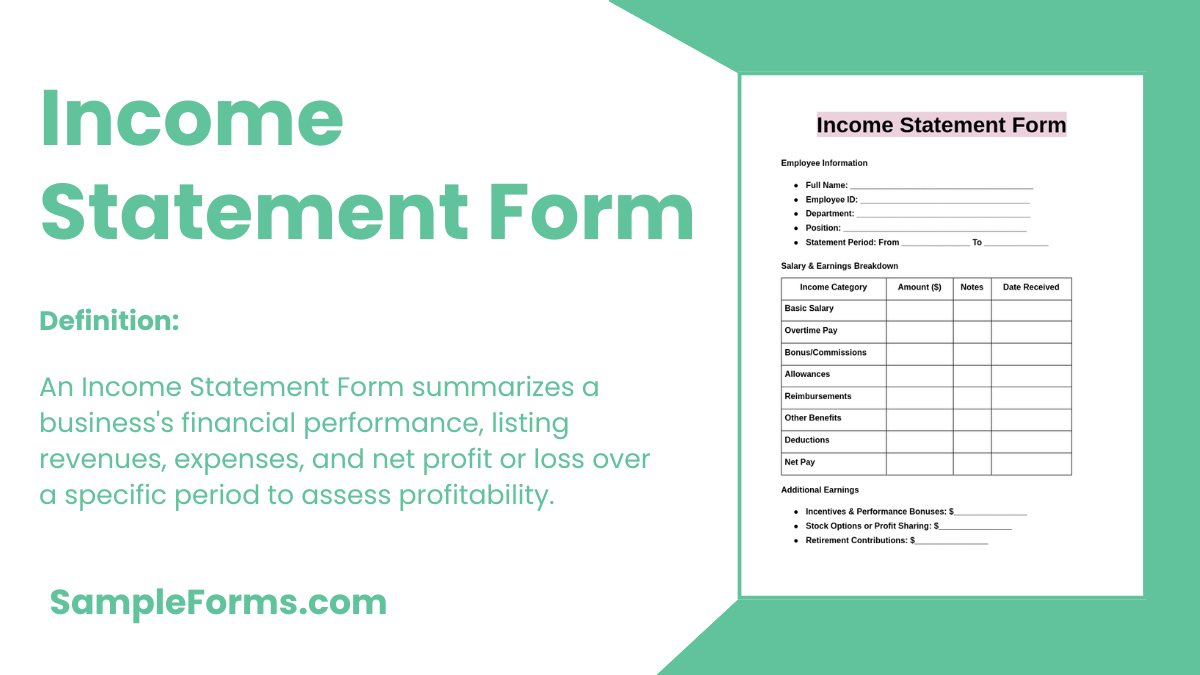

An Income Statement Form is essential for tracking revenue, expenses, and net income, providing a clear financial overview. Much like a Statement Form, it helps businesses and individuals assess profitability, make informed financial decisions, and ensure compliance with tax regulations. It outlines earnings, costs, and deductions over a specific period, offering insights into financial health. Whether used for business accounting, tax filing, or financial planning, a well-structured form simplifies record-keeping. This guide covers everything from understanding key components to using templates effectively, ensuring accuracy and efficiency in financial documentation.

Download Income Statement Form Bundle

What is Income Statement Form?

An Income Statement Form is a financial document that summarizes earnings and expenses over a defined period. It helps businesses, freelancers, and individuals assess profitability and financial stability. This form records total revenue, operating costs, and net profit, offering a snapshot of financial performance. It ensures compliance with tax regulations and supports strategic financial planning. A structured Income Statement Form is a vital tool for decision-making, allowing users to evaluate financial trends and make necessary adjustments for growth.

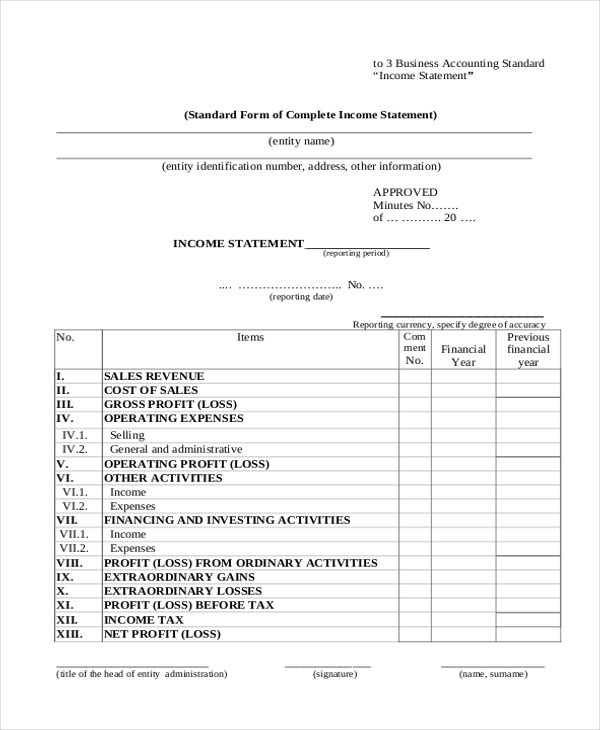

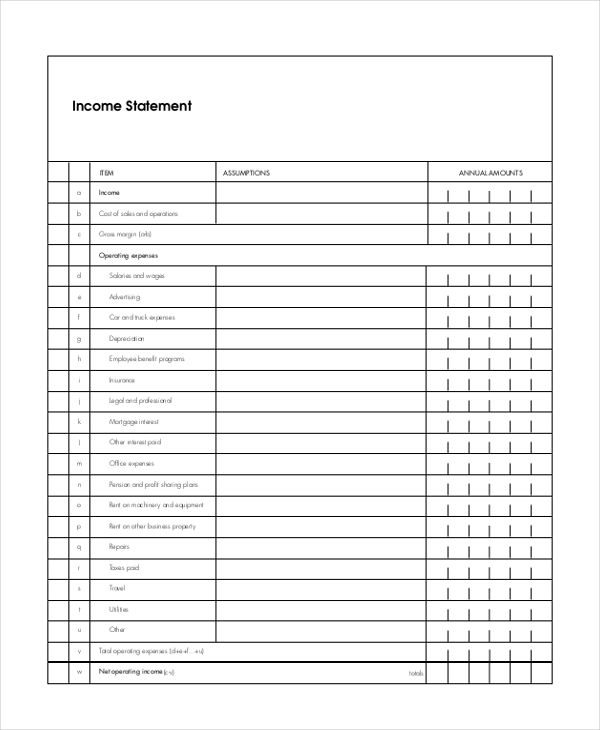

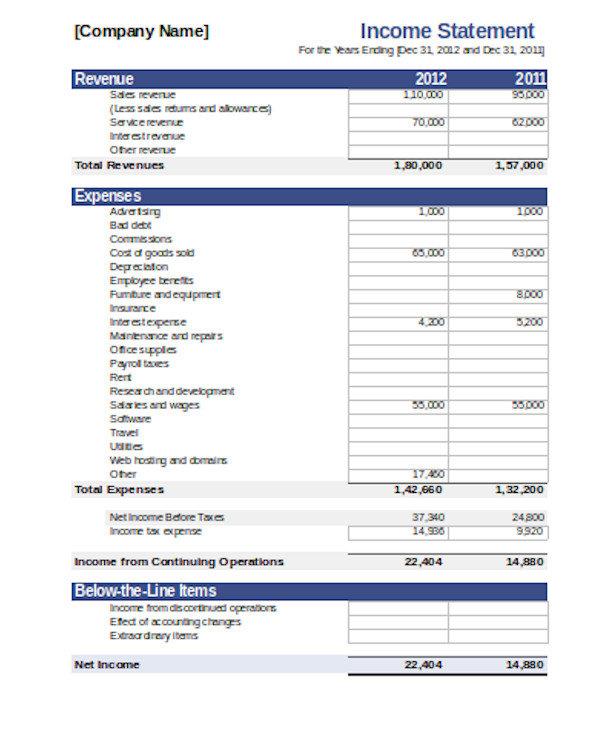

Income Statement Format

Business Information

Company Name

Business Address

Statement Period

Prepared By

Revenue Details

- Total sales revenue generated

- Other income sources such as interest, rental income, or royalties

- Discounts and allowances deducted from gross revenue

Cost of Goods Sold (COGS)

- Direct material costs

- Direct labor costs

- Manufacturing or service expenses

Gross Profit Calculation

- Revenue minus COGS

- Percentage of gross profit relative to revenue

Operating Expenses

Administrative and General Expenses

- Employee salaries and wages

- Office rent, utilities, and supplies

- Professional services fees

Marketing and Sales Expenses

- Advertising and promotional costs

- Commissions and incentives

- Market research and branding investments

Depreciation and Amortization

- Reduction in asset value over time

- Intangible asset amortization calculations

Operating Profit/Loss

- Gross profit minus operating expenses

- Assessment of profitability before non-operating income and expenses

Other Income and Expenses

- Gains or losses from investments

- Interest income or expenses

- Unusual or one-time financial events

Net Profit or Loss

- Final earnings calculation after all expenses

- Percentage comparison to previous periods

- Recommendations for financial improvements

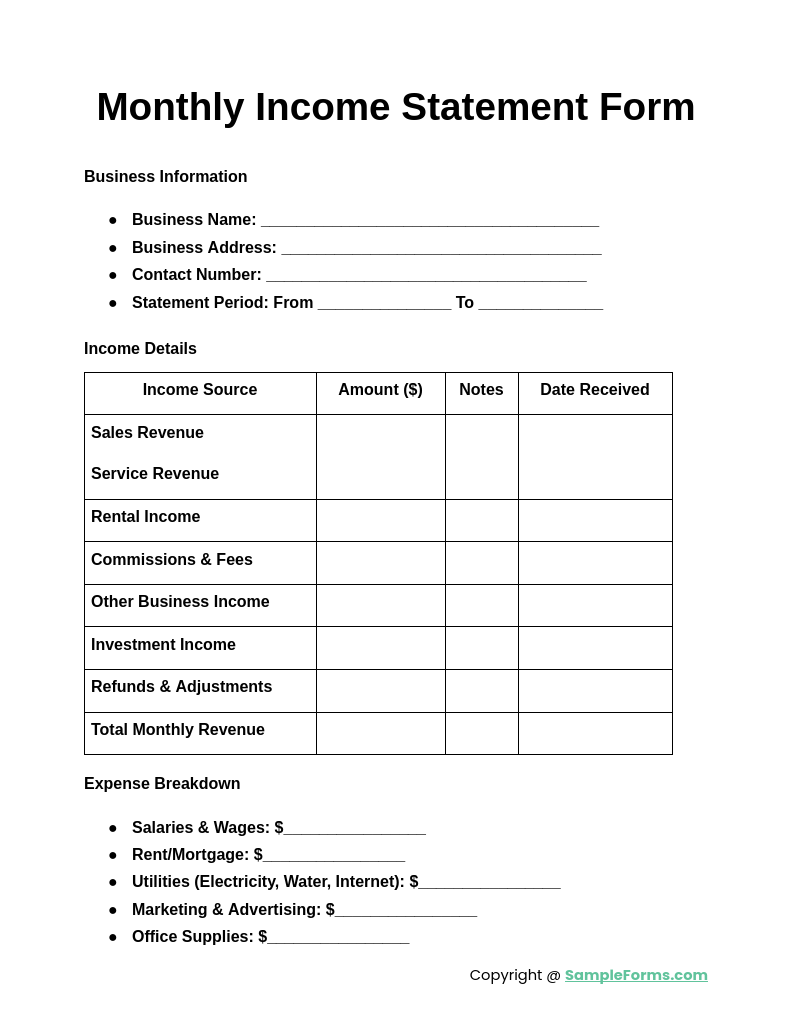

Monthly Income Statement Form

A Monthly Income Statement Form tracks earnings and expenses over a month, helping businesses manage finances efficiently. Similar to a Sworn Statement Form, it provides an official record of financial activity for analysis and reporting.

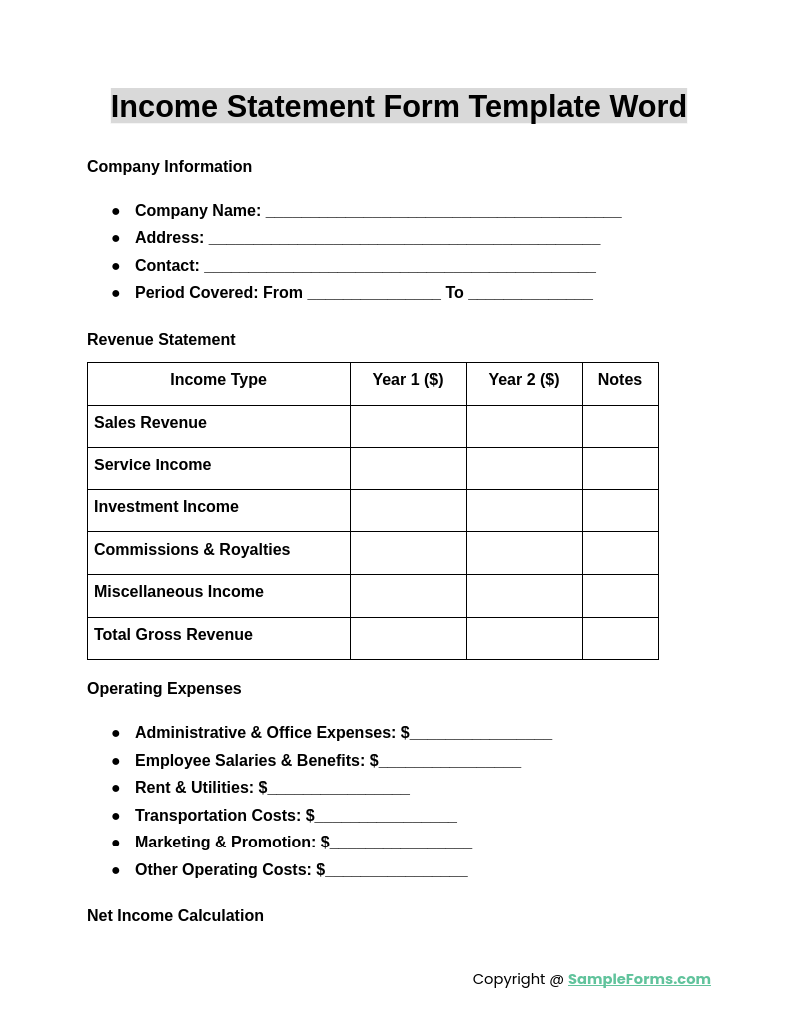

Income Statement Form Template Word

An Income Statement Form Template Word offers a structured format for financial documentation, ensuring accuracy. Much like a Counseling Statement Form, it organizes key details, making it easier to assess financial performance and profitability.

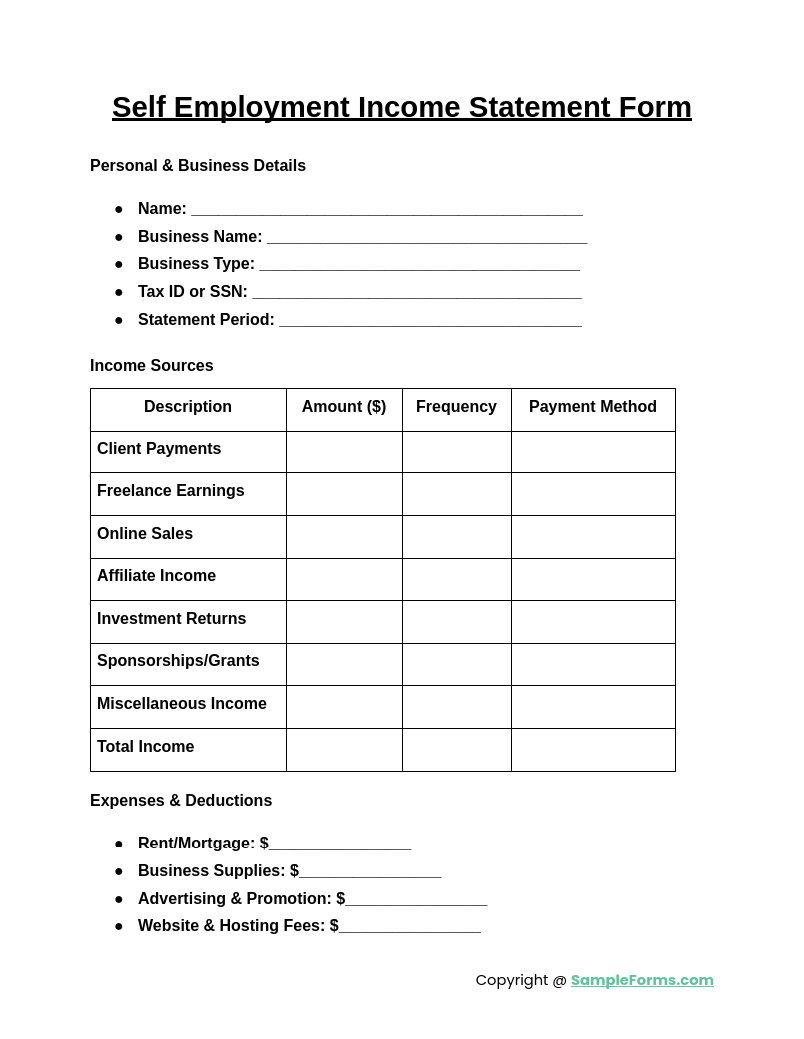

Self Employment Income Statement Form

A Self Employment Income Statement Form records an individual’s income, expenses, and net earnings. Similar to an Operating Statement Form, it provides a detailed breakdown for tax purposes and financial planning.

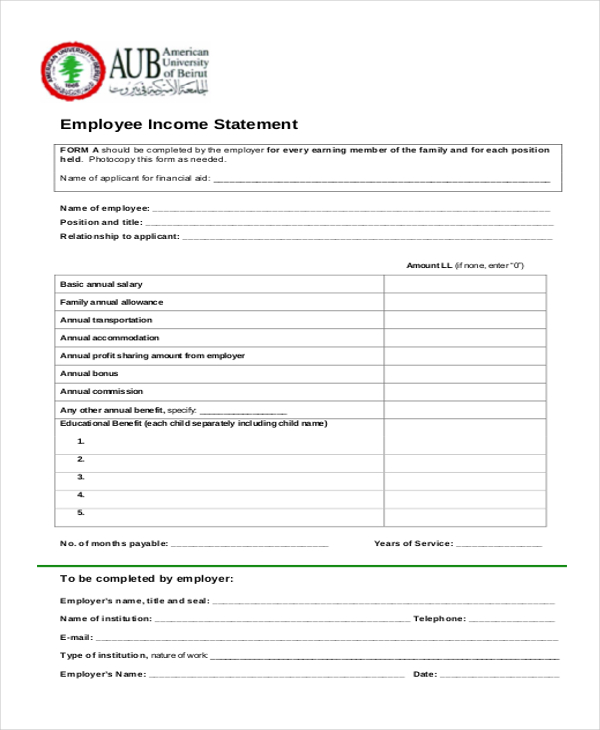

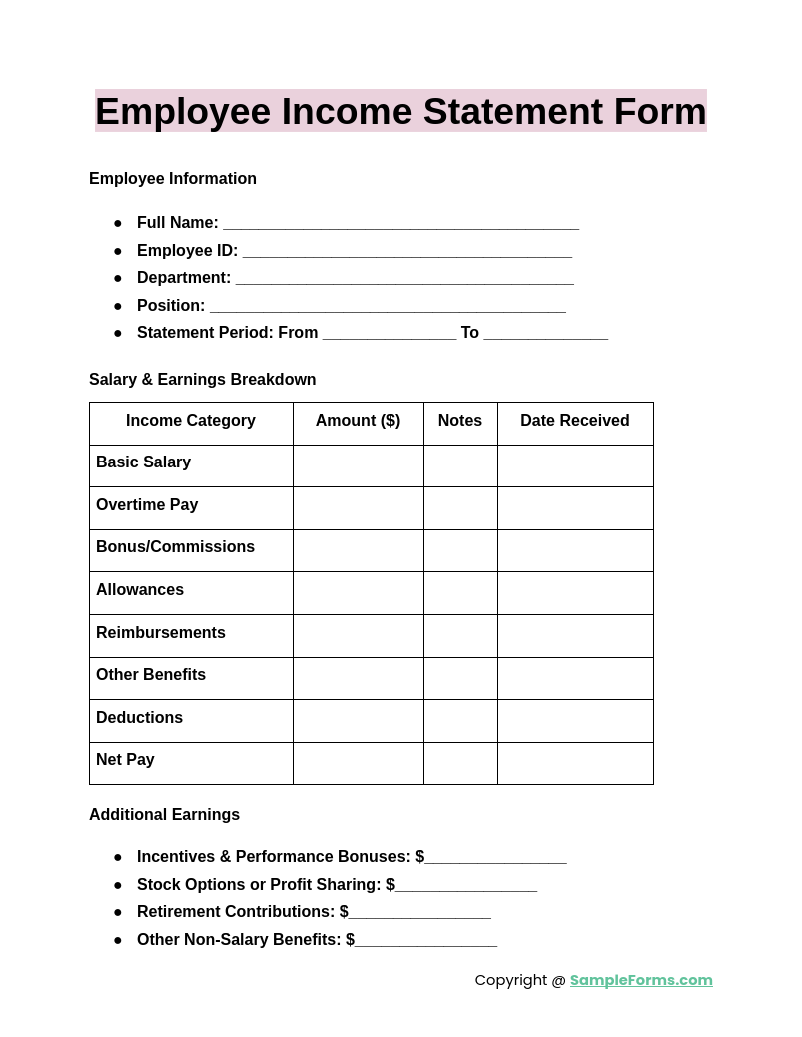

Employee Income Statement Form

An Employee Income Statement Form documents salary, deductions, and additional earnings. Like a Witness Statement Form, it serves as an official record, ensuring transparency and accuracy in employee compensation tracking.

Browse More Income Statement Forms

Sample Accounting Income Statement Form

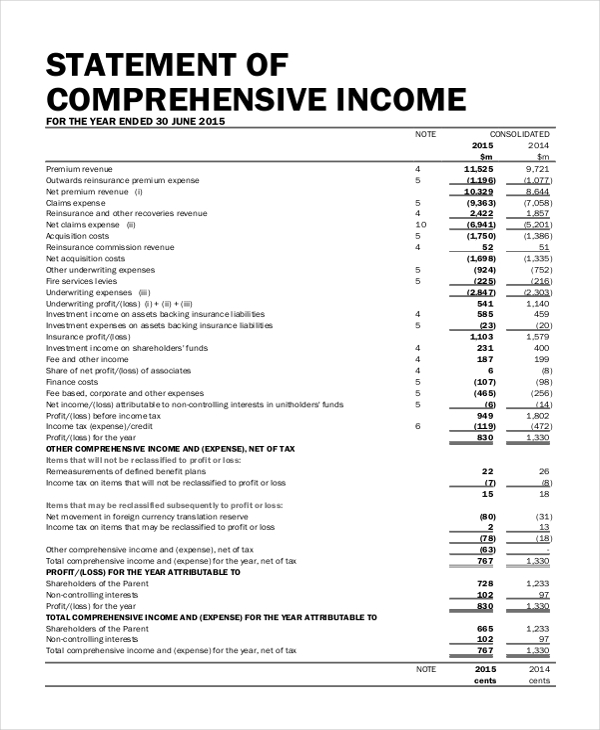

Statement of Comprehensive Income Form

Blank Income Statement Form

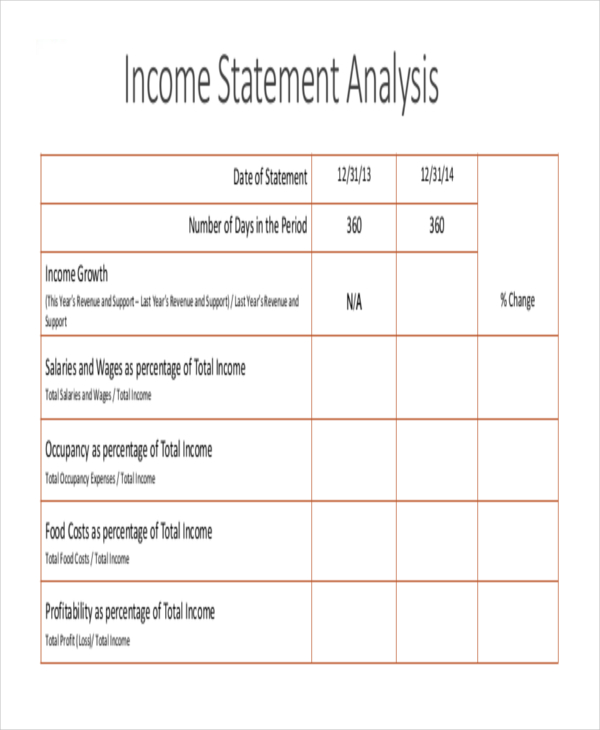

Sample Income Statement Analysis Form

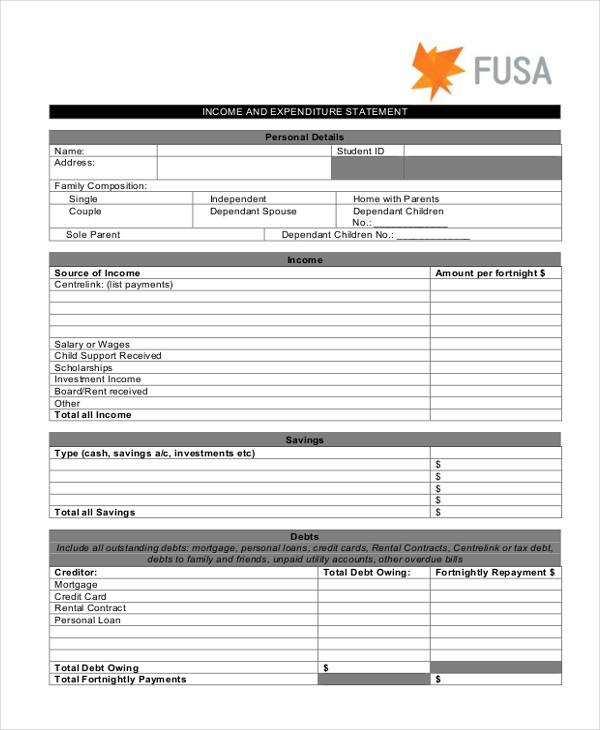

Income and Expenditure Statement Form

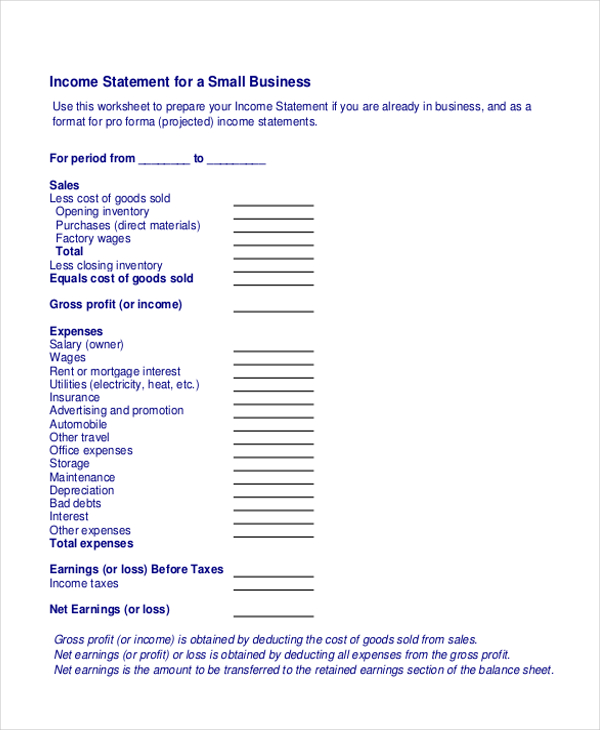

Small Business Income Statement Form

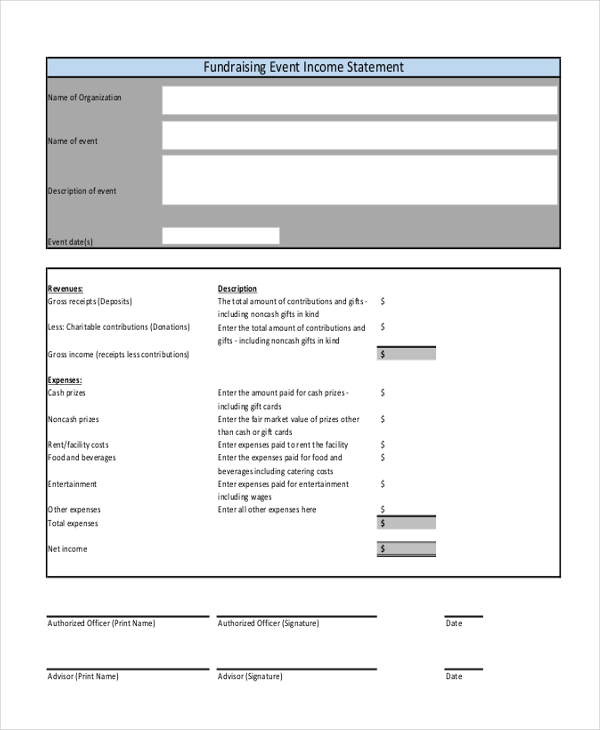

Sample Fundraising Event Income Statement Form

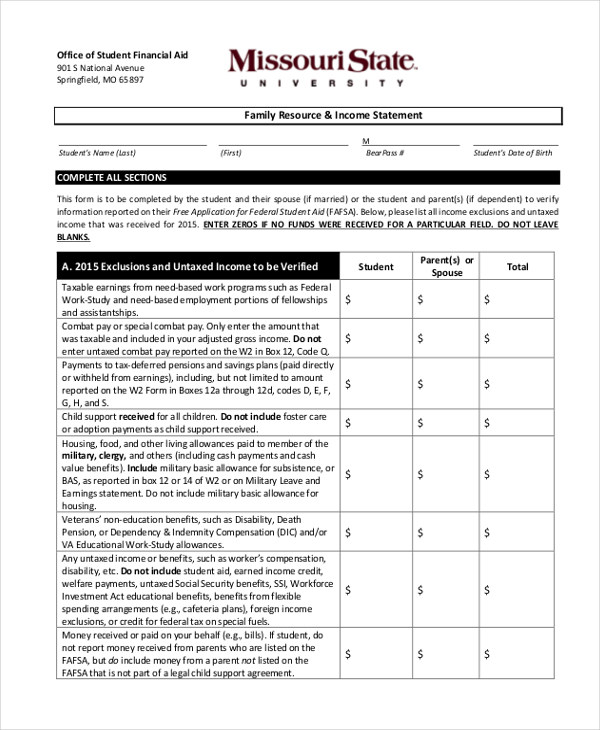

Family Resource & Income Statement Form

Employee Income Statement Form

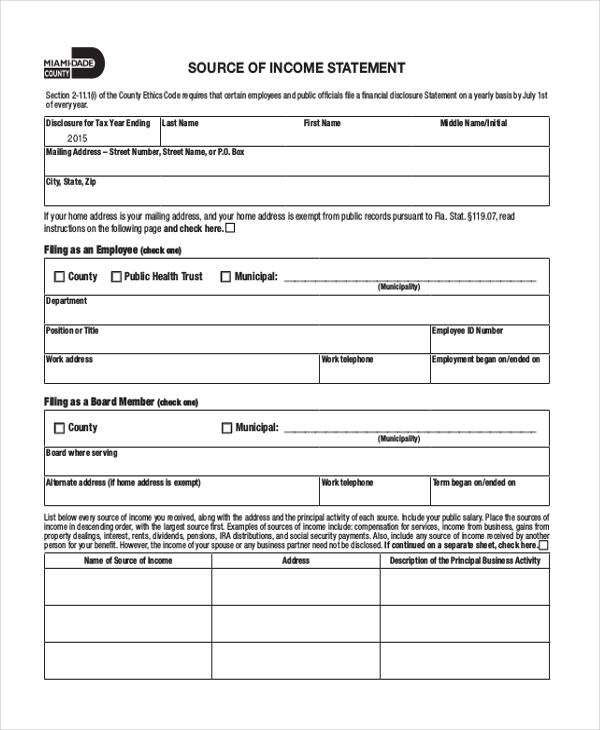

Sample Source Income Statement Form

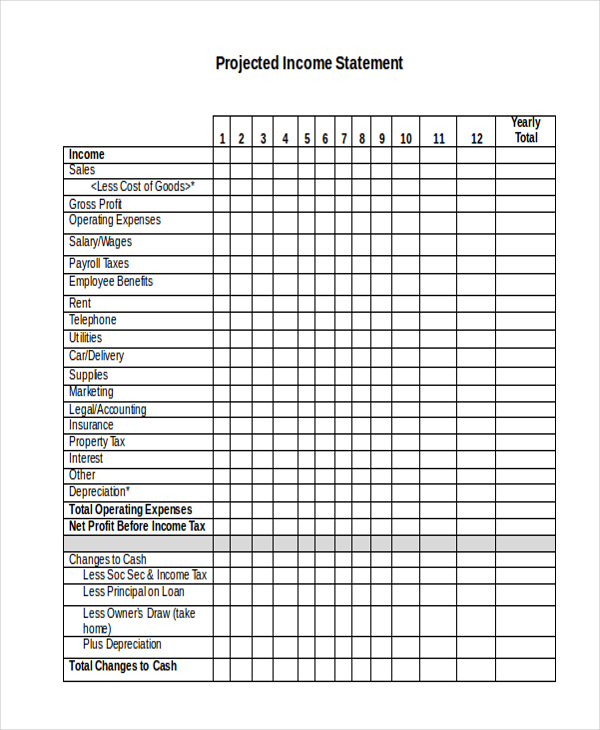

Projected Income Statement Form

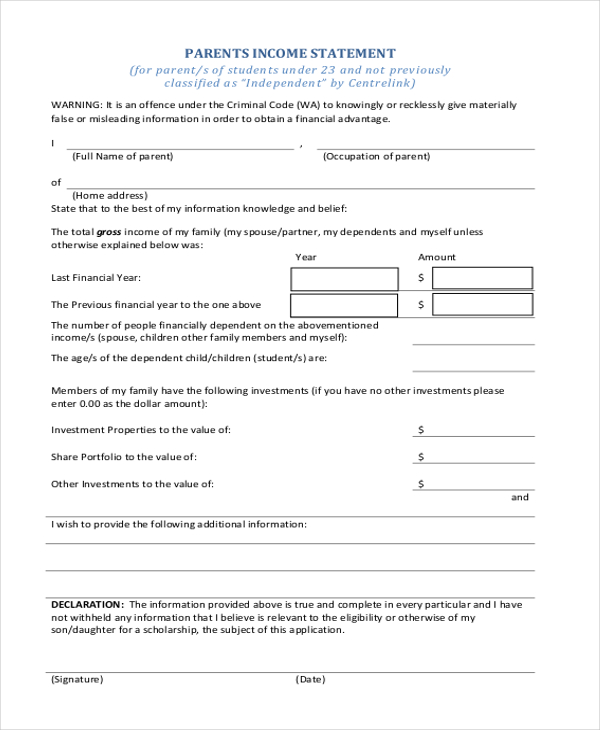

Parents Income Statement Form

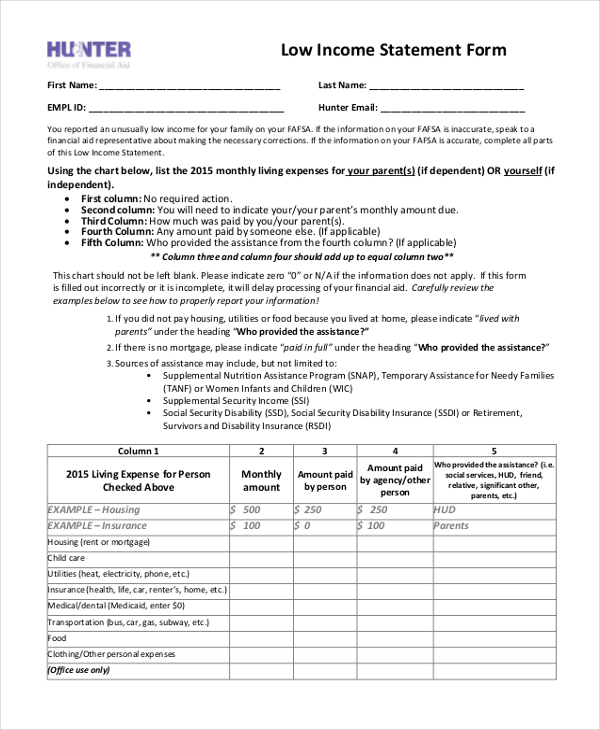

Low Income Statement Form

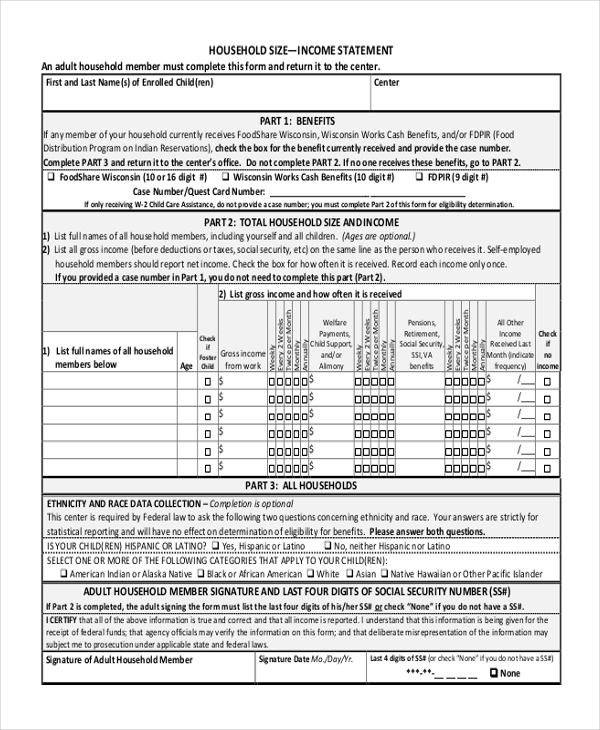

Household Income Statement Form

Simple Income Statement Form

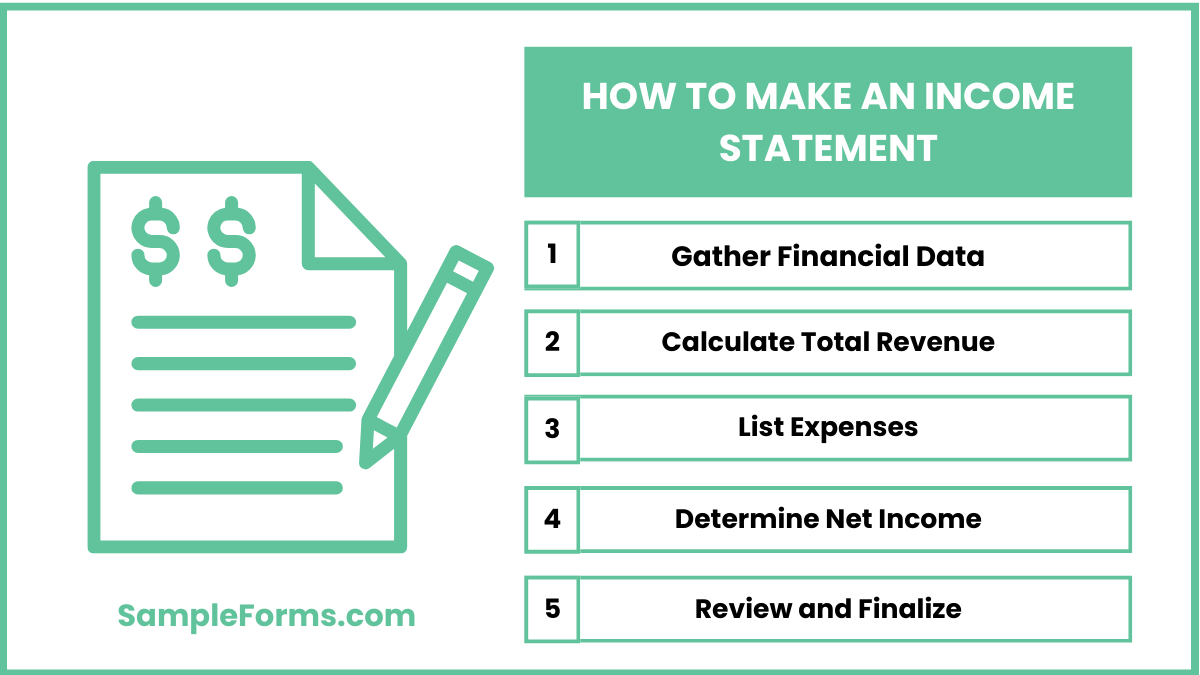

How to make an income statement?

An Income Statement Form outlines financial performance by summarizing revenues, expenses, and profits. Similar to a Personal Statement Form, it must be structured and detailed for accuracy.

- Gather Financial Data: Collect all revenue and expense records for the reporting period.

- Calculate Total Revenue: Sum up earnings from sales, services, or other income sources.

- List Expenses: Include operational costs, salaries, rent, and other business expenditures.

- Determine Net Income: Subtract total expenses from total revenue to calculate net profit or loss.

- Review and Finalize: Ensure accuracy and compliance before submitting the statement for financial reporting.

How to generate a statement of income?

A statement of income records financial performance for a specific period. Similar to a Landlord Statement Form, it must be precise and legally valid.

- Choose a Reporting Period: Select monthly, quarterly, or annual financial tracking.

- Identify Revenue Sources: List income from sales, rent, investments, or other streams.

- Account for Direct Costs: Deduct expenses like materials, labor, and operational costs.

- Include Taxes and Deductions: Factor in tax obligations, depreciation, and financial adjustments.

- Finalize the Statement: Ensure accuracy, proper formatting, and compliance with accounting standards.

What is included in an income statement?

An Income Statement Form includes as a financial record detailing earnings and expenditures. Much like a Medical Statement Form, it must contain specific information for validation.

- Revenue Details: A clear record of all earnings within a set period.

- Expense Breakdown: A categorized list of operational and fixed costs.

- Net Profit or Loss Calculation: The result of total revenue minus total expenses.

- Compliance with Accounting Standards: Ensuring alignment with financial regulations.

- Proper Documentation: A verified and recorded format for auditing or tax purposes.

How do you prove an income statement?

Proving an Income Statement Form requires documentation and verification. Similar to a Personal Financial Statement Form, it should include supporting evidence.

- Attach Financial Records: Include bank statements, invoices, and payroll reports.

- Ensure Proper Categorization: Clearly label income and expenses for easy verification.

- Cross-Check with Tax Returns: Ensure alignment with tax filings for consistency.

- Use Accounting Software: Digital records enhance accuracy and authenticity.

- Get Professional Verification: Certified accountants can validate financial reports.

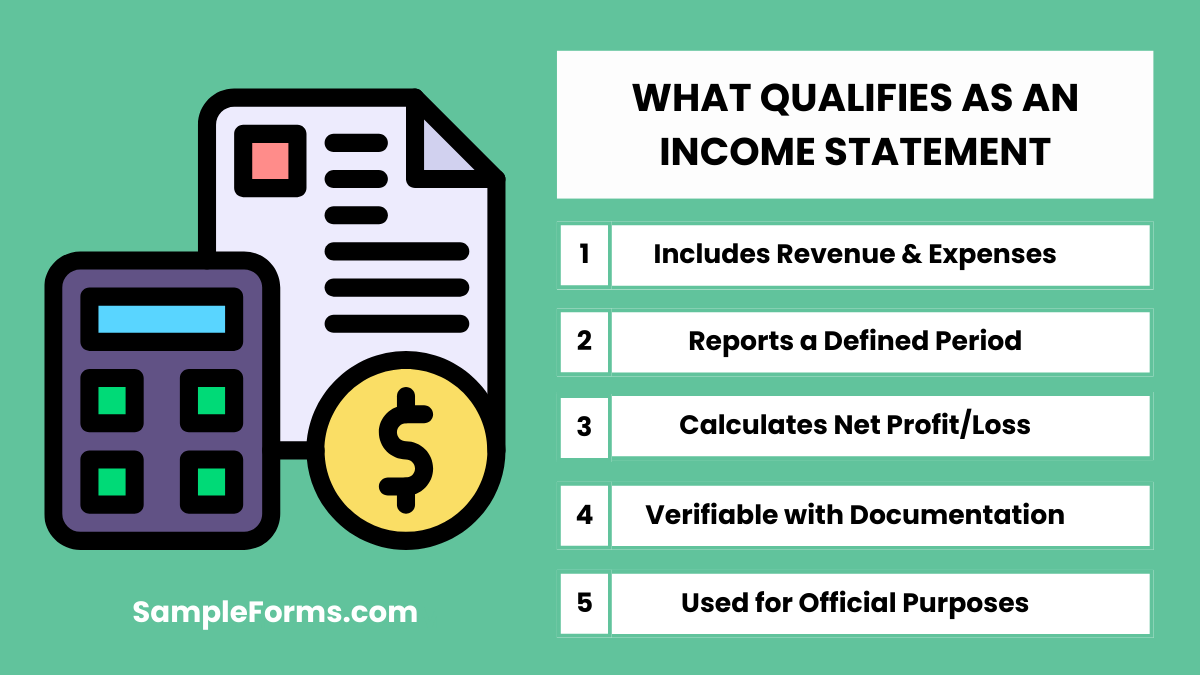

What qualifies as an income statement?

An Income Statement Form qualifies when it meets financial reporting standards. Like a Legal Statement Form, it must be documented correctly for legal and business use.

- Includes Revenue & Expenses: Clearly details income sources and expenditures.

- Reports a Defined Period: Specifies whether it covers monthly, quarterly, or yearly finances.

- Calculates Net Profit/Loss: Determines financial performance based on earnings and costs.

- Verifiable with Documentation: Must match receipts, invoices, and financial statements.

- Used for Official Purposes: Required for tax filings, loan applications, and financial analysis.

Do I need an income statement?

An Income Statement Form is essential for tracking earnings and expenses. Similar to a Wealth Statement Form, it provides a clear financial overview for businesses, self-employed individuals, and tax purposes.

Can I make my own income statement?

Yes, anyone can create an Income Statement Form by listing revenue, expenses, and net profit. Like a Voluntary Statement Form, it must be accurate and well-documented for financial reporting.

What is the basic income statement?

A basic Income Statement Form summarizes total income, expenses, and net profit over a period. Similar to a Property Statement Form, it ensures transparency in financial documentation and decision-making.

How do I check my annual income?

Annual income can be verified using tax returns, pay stubs, or an Income Statement Form. Similar to a Student Statement Form, it reflects earnings for a specific financial period.

How do I self-report income?

Self-reported income should include total earnings, expenses, and deductions. Like a Confirmation Statement Form, it requires accurate records such as invoices, receipts, and bank statements for verification.

What is proof of income statement for self-employed?

Self-employed individuals use an Income Statement Form, tax returns, or bank records as proof of earnings. Similar to an Income Affidavit Form, it officially documents financial standing for various purposes.

Do financial statements need to be notarized?

Financial statements usually don’t require notarization, but some official filings, like an Income and Expense Form, may need a notary for legal validity in certain financial transactions.

How to prove income when retired?

Retirees can prove income using pension statements, Social Security benefits, or an Income Assessment Form, ensuring proper documentation for loans, housing, or tax purposes.

What is another name for the income statement?

An Income Statement Form is also called a profit and loss statement. Similar to an Income Tax Extension Form, it records financial performance over a specific period.

Do banks have income statements?

Yes, banks use an Income Statement Form to track financial activities, just like an Income Verification Form, ensuring compliance, profitability, and financial stability for investors and regulatory authorities.

An Income Statement Form plays a crucial role in documenting financial transactions for businesses and individuals. A well-organized Employee Witness Statement Form helps track income sources, expenses, and net earnings, ensuring accurate record-keeping and financial stability. Whether for tax reporting, loan applications, or business planning, this form simplifies financial analysis and promotes transparency. By using structured templates and best practices, organizations can streamline financial reporting, minimize errors, and enhance overall financial management. Explore our expert guidelines and ready-to-use samples for a seamless financial tracking experience.

Related Posts

-

Closing Statement Form

-

FREE 13+ Operating Statement Forms in PDF | MS Word

-

FREE 6+ Contribution Margin Forms in Excel

-

FREE 5+ Gross Profit Margin Forms in Excel

-

FREE 10+ Sample Disclosure Statement Forms in MS Word | PDF

-

FREE 7+ Business Statement Forms in MS Word | PDF

-

FREE 12+ Sample Medical Statement Forms in PDF | MS Word

-

FREE 7+ Profit and Loss Statement Forms in PDF

-

FREE 8+ Voluntary Statement Forms in MS Word | PDF

-

Accident Statement Form

-

What are Financial Statement Forms? [ How to, Include, Functions, Importance ]

-

Statement Form

-

Financial Statement Form

-

Salary Statement Form

-

Instructions for Other Uses Statement Of Claimant [ What Is, Uses, Instructions ]