A Holding Deposit Agreement Form is essential for securing a rental property before signing a lease. A Deposit Form ensures that both tenant and landlord understand the terms of the deposit, preventing misunderstandings or disputes. This Agreement Form outlines the amount paid, reservation period, refund policies, and conditions under which the deposit may be forfeited or applied to rent. Having a properly structured form helps protect financial interests while confirming property availability. In this guide, explore various templates, best practices, and key clauses to include for a legally sound deposit arrangement.

Download Holding Deposit Agreement Form Bundle

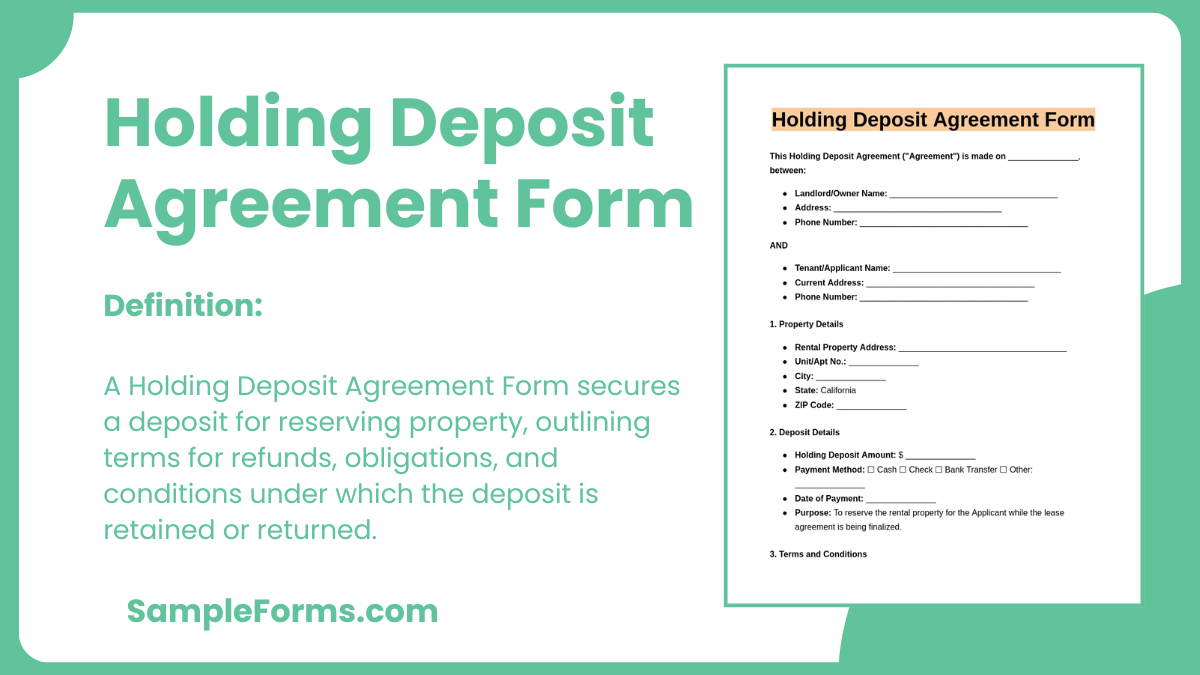

What is Holding Deposit Agreement Form?

A Holding Deposit Agreement Form is a legally binding document confirming that a tenant has paid a deposit to secure a rental property before lease signing. It sets clear terms regarding refundability, forfeiture conditions, and how the deposit will be applied. The Agreement Form ensures both parties agree on the rental reservation period, preventing double bookings and unnecessary financial risks. It provides legal protection to tenants and landlords by defining responsibilities, ensuring a smooth rental process. This document is commonly used in residential and commercial property agreements.

Holding Deposit Agreement Form

Agreement Overview

- Date of Agreement: [Agreement Date]

- Deposit Amount: [Total Deposit Paid]

- Property Address: [Full Property Address]

Parties Involved

- Landlord/Agent Name: [Full Name]

- Contact Information: [Phone and Email]

- Tenant Name: [Full Name]

- Contact Information: [Phone and Email]

Deposit Terms

- Purpose of Deposit: [Reservation or Other Reason]

- Holding Period: [Duration of Hold]

- Refund Conditions: [When the Deposit is Refundable]

- Non-Refundable Conditions: [Circumstances of Forfeiture]

Obligations and Responsibilities

- Landlord’s Responsibilities: [Duties of the Landlord/Agent]

- Tenant’s Responsibilities: [Duties of the Tenant]

Agreement Termination

Conditions for Termination: [When the Agreement Ends]

Consequences of Breach: [What Happens if Terms Are Violated]

Landlord/Agent Signature: [Signature]

Tenant Signature: [Signature]

Date of Execution: [Signing Date]

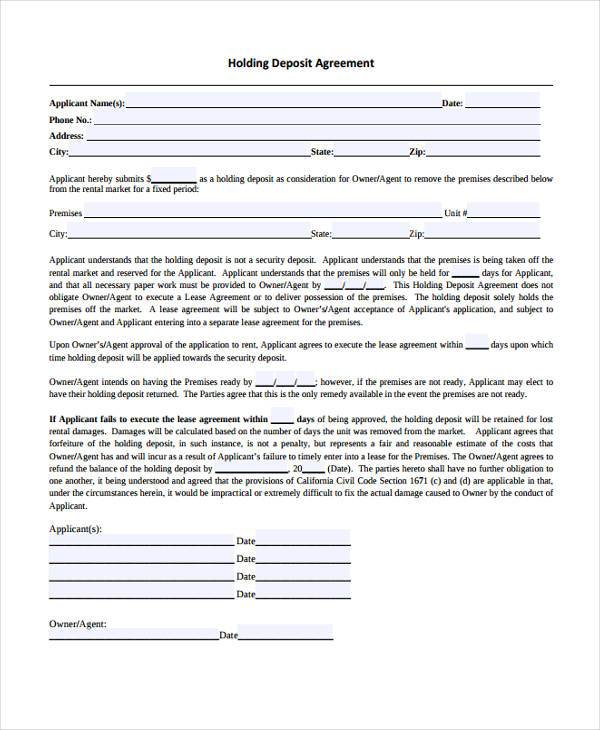

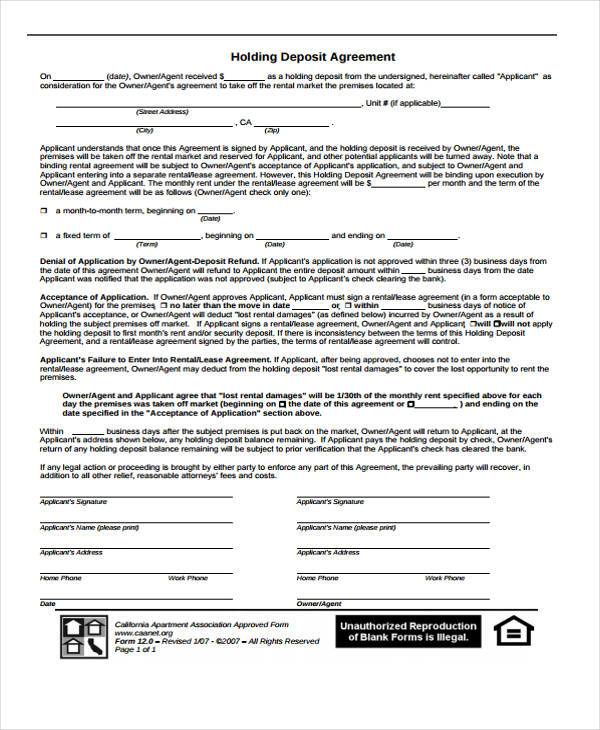

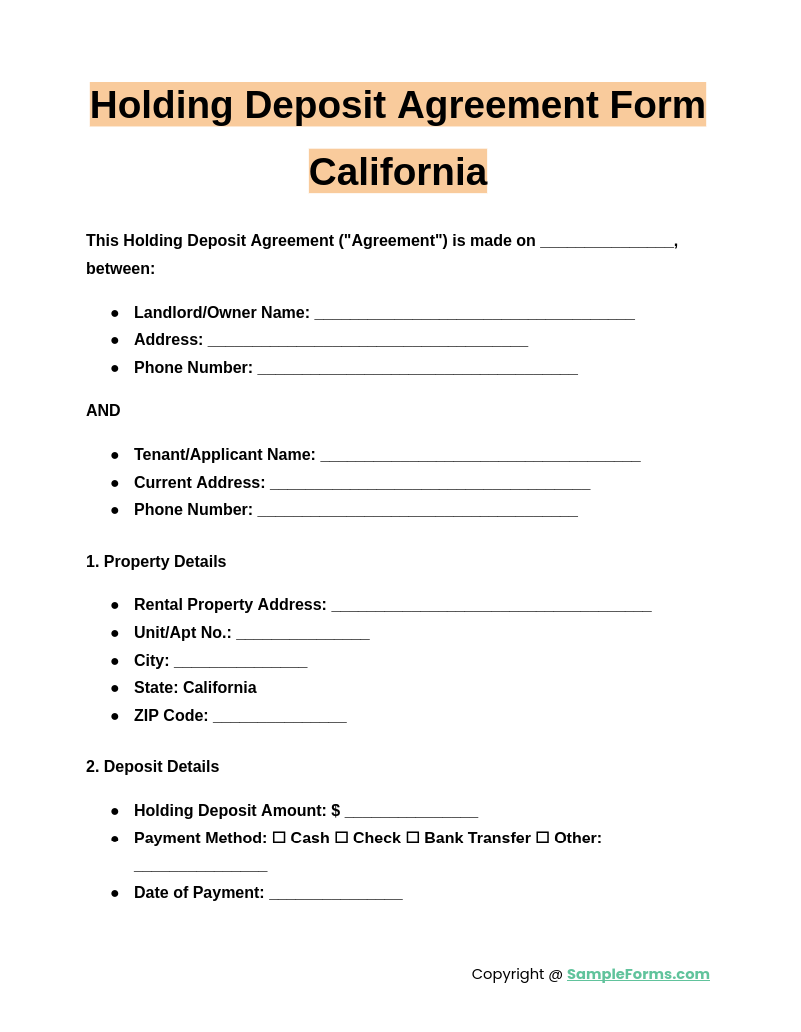

Holding Deposit Agreement Form California

A Holding Deposit Agreement Form California ensures legal compliance when reserving a rental property. Similar to a Settlement Agreement Form, it defines deposit terms, refund policies, and conditions under which the deposit is retained or returned, protecting both parties.

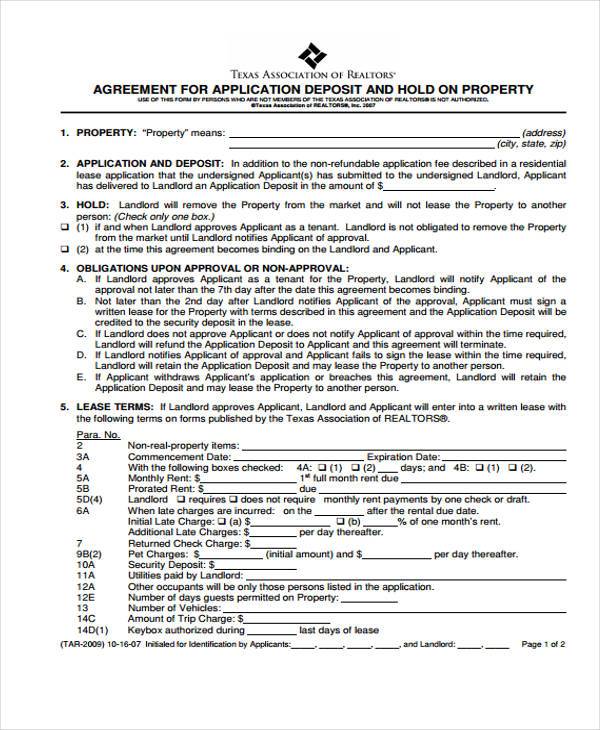

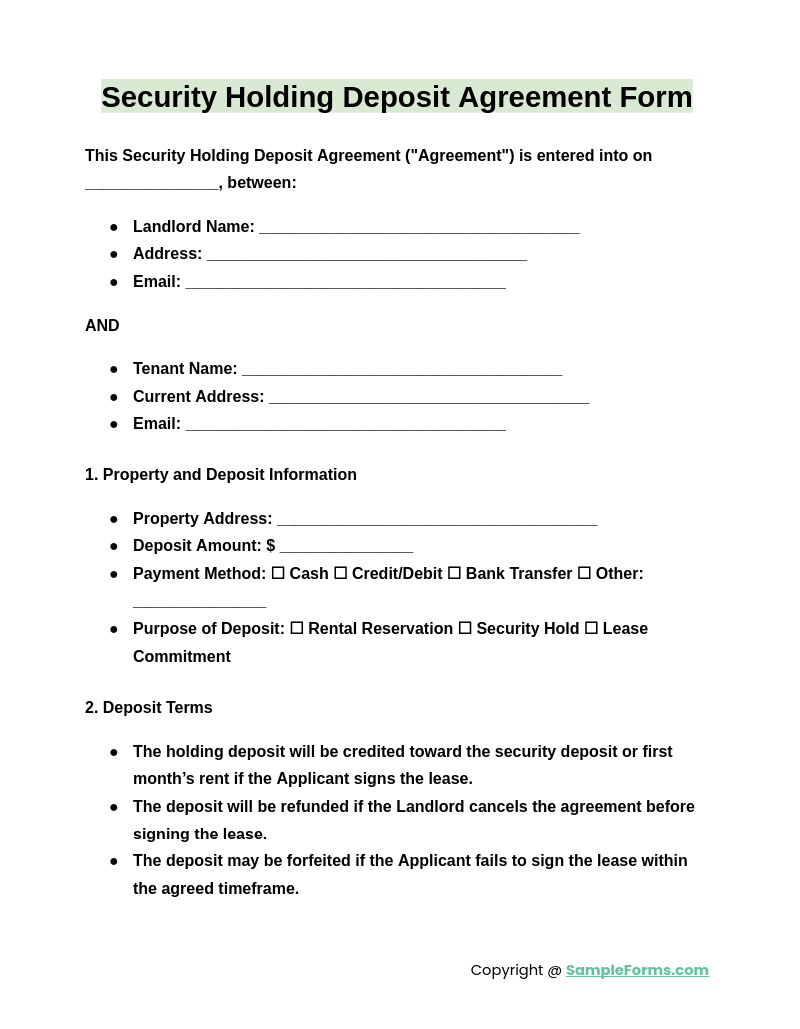

Security Holding Deposit Agreement Form

A Security Holding Deposit Agreement Form safeguards both tenants and landlords by clarifying security deposit terms. Similar to a Rental Lease Agreement Form, it outlines financial obligations, property conditions, and refund policies, ensuring a transparent rental transaction without disputes.

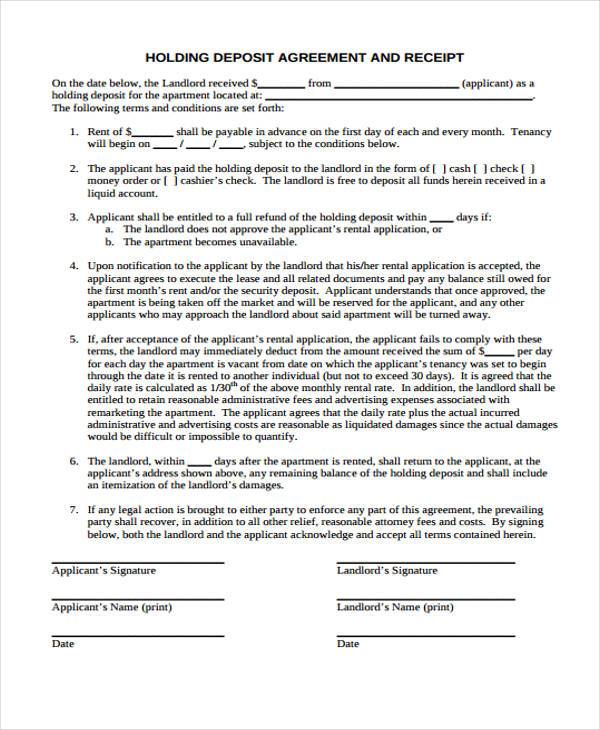

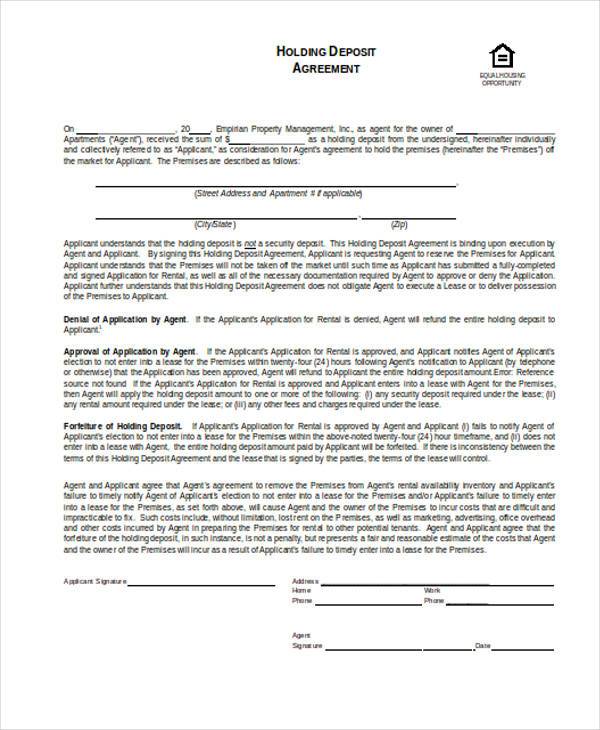

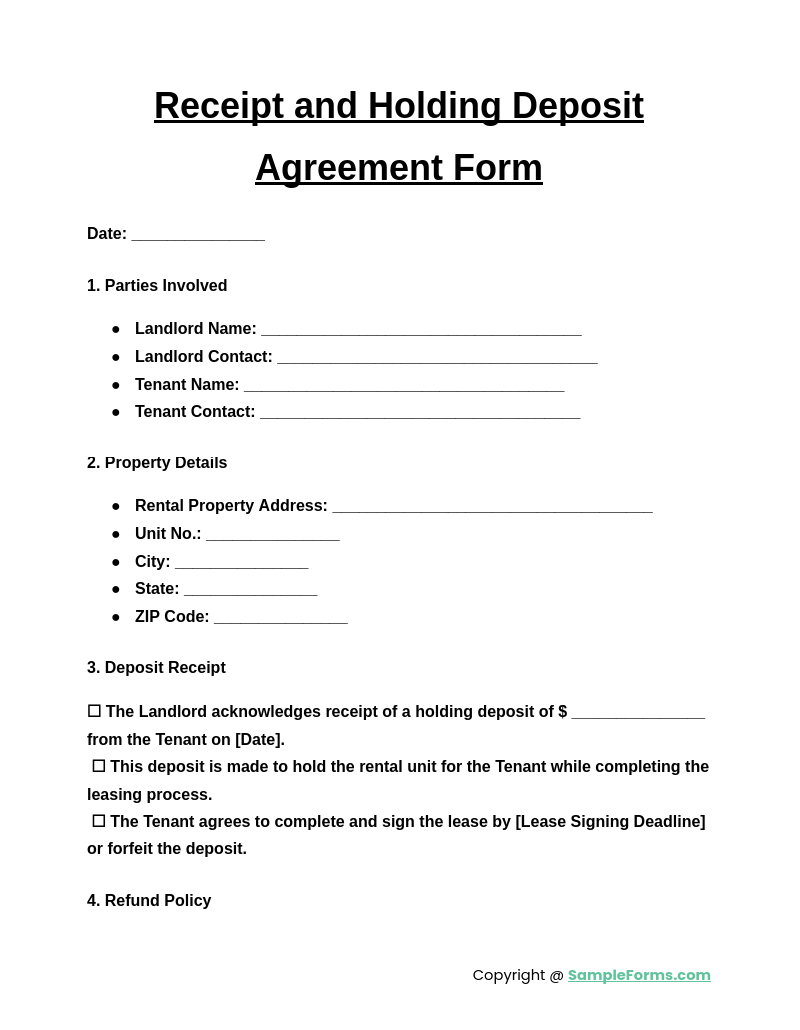

Receipt and Holding Deposit Agreement Form

A Receipt and Holding Deposit Agreement Form provides proof of deposit payment and terms. Similar to a Trailer Rental Agreement Form, it confirms financial commitments, specifies reservation periods, and ensures accountability between the property owner and prospective tenant.

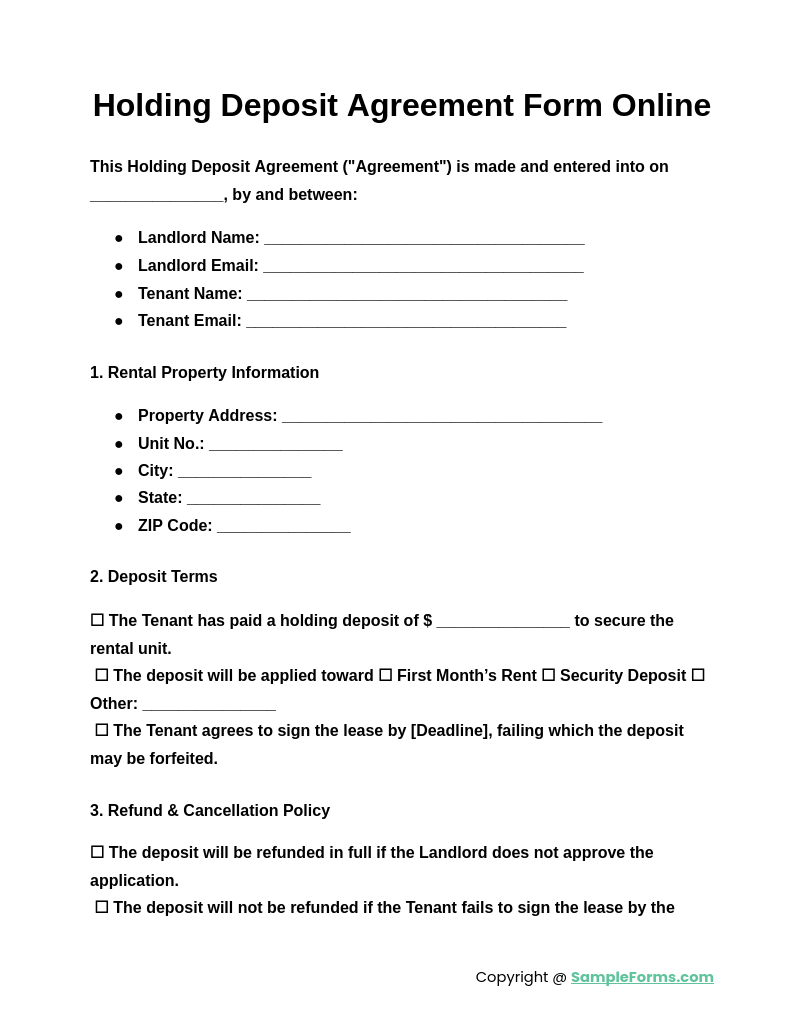

Holding Deposit Agreement Form Online

A Holding Deposit Agreement Form Online simplifies property reservations through digital agreements. Similar to a Business Purchase Agreement Form, it ensures secure transactions, defines deposit conditions, and offers legal protection for both parties in an online rental arrangement.

Browse More Holding Deposit Agreement Forms

Receipt Holding Deposit Agreement Form

Holding Deposit Agreement Form Example

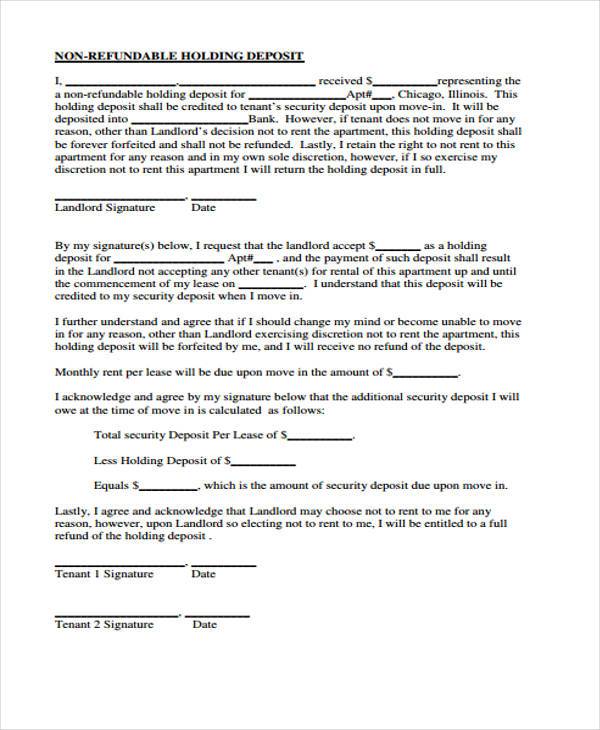

Non-Refundable Holding Deposit Agreement Form

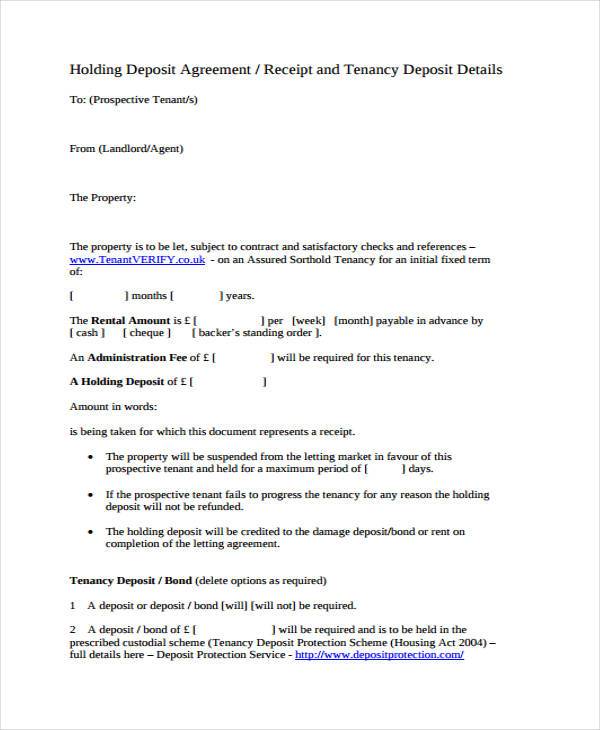

Tenancy Holding Deposit Agreement Form Sample

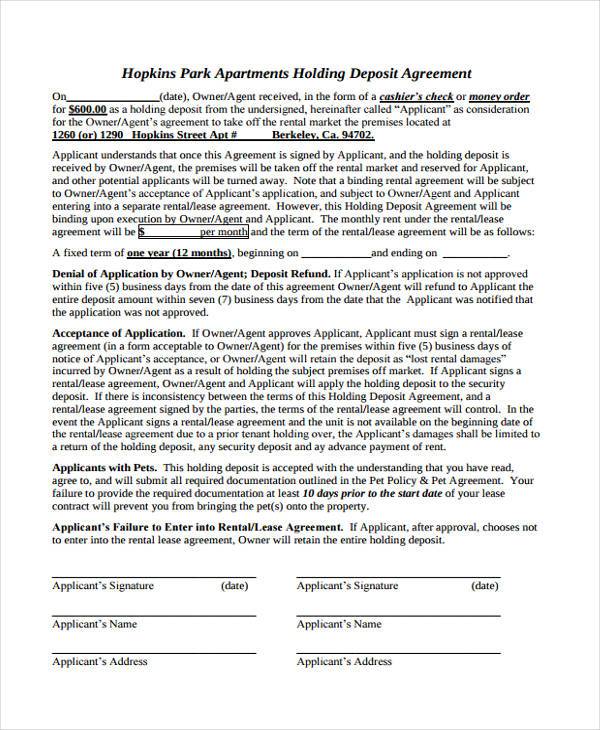

Apartment Holding Deposit Agreement Form

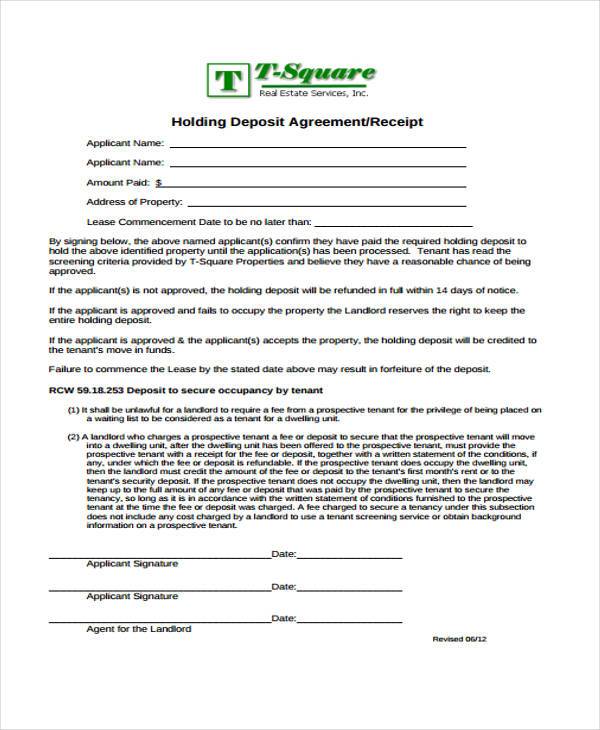

Holding Deposit Agreement/Receipt Form

Holding Deposit Agreement Form Sample

Easy Holding Deposit Agreement Form Example

Holding Deposit Property Agreement Form

Holding Deposit Agreement Form in Word Format

How to write a holding deposit agreement?

A Holding Deposit Agreement Form should clearly define the deposit terms, payment conditions, and refund policies to protect both parties.

- Identify Parties Involved: List the landlord and tenant details, similar to an Electrical Subcontractor Agreement Form, ensuring accurate identification.

- State Deposit Amount: Clearly mention the deposit amount and its purpose to avoid future disputes.

- Define Reservation Period: Specify the timeframe for holding the property before signing a rental agreement.

- Refund & Forfeiture Terms: Explain when the deposit is refundable or forfeited due to agreement violations.

- Include Signatures & Date: Both parties should sign and date the document to make it legally enforceable.

What is the purpose of a holding deposit?

A Holding Deposit Agreement Form secures a property before the lease is signed, preventing it from being rented to another applicant.

- Reserves the Property: Like a Non Compete Agreement Form, it ensures exclusivity by temporarily taking the property off the market.

- Shows Tenant’s Commitment: Confirms serious intent by requiring a financial deposit upfront.

- Protects the Landlord: Ensures compensation if the tenant backs out after reserving the rental unit.

- Outlines Refund Terms: Clearly defines when the deposit will be returned or forfeited.

- Prevents Lease Delays: Helps both parties proceed smoothly toward finalizing the rental agreement.

How do I get a deposit hold release?

A deposit hold release removes the financial hold placed on a rental deposit, ensuring funds are returned to the tenant.

- Fulfill Agreement Conditions: Meet all rental requirements as outlined in a Room Agreement Form to qualify for a refund.

- Request a Release in Writing: Submit a formal written request to the landlord or property manager.

- Verify Property Inspection: Ensure the property is in good condition per the agreement to avoid deductions.

- Provide Bank Details: Confirm where the deposit should be refunded and request a timeline for payment.

- Obtain a Confirmation Letter: A landlord-issued confirmation ensures legal proof of the deposit release.

How does holding a deposit work?

A Holding Deposit Agreement Form temporarily secures a property by requiring a financial deposit before signing the lease.

- Deposit Payment: The tenant submits an agreed deposit amount, similar to a Parking Agreement Form, to hold the property.

- Reservation Period Begins: The landlord reserves the unit for a specified period, preventing other applicants from renting it.

- Lease Signing or Withdrawal: If the tenant signs the lease, the deposit is applied toward rent. If they back out, refund terms apply.

- Landlord’s Obligations: The landlord must honor the agreement and return the deposit if terms are met.

- Deposit Handling: The funds are held securely until the lease is signed or the reservation expires.

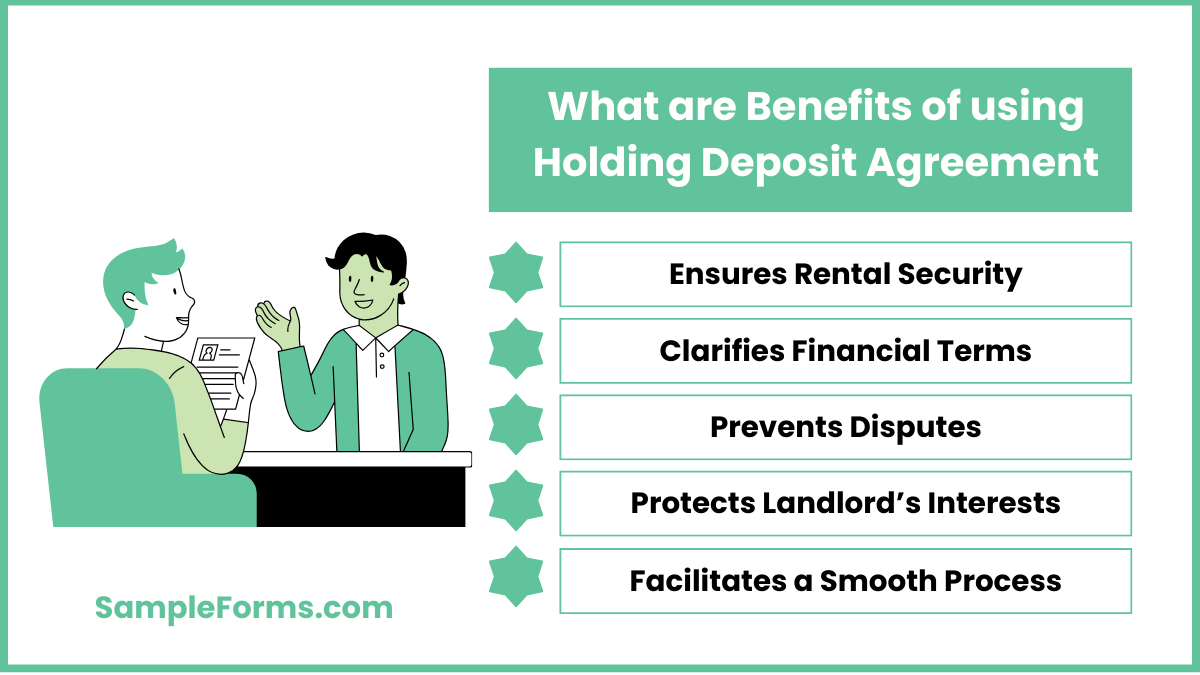

What are benefits of using holding deposit agreement?

A Holding Deposit Agreement Form offers legal and financial protection for both landlords and tenants in rental transactions.

- Ensures Rental Security: Like a House Agreement Form, it confirms property reservation, preventing other applicants from leasing it.

- Clarifies Financial Terms: Defines how much is paid, when it’s refundable, and conditions for forfeiture.

- Prevents Disputes: Written agreements minimize misunderstandings and provide a legal basis for enforcement.

- Protects Landlord’s Interests: Compensates property owners if a tenant backs out after reserving the unit.

- Facilitates a Smooth Process: Streamlines the transition from deposit payment to lease signing without delays

How long is a holding deposit good for?

A Holding Deposit Agreement Form typically lasts 7–14 days, depending on the terms. Similar to a Financial Agreement Form, the timeframe must be clearly stated to prevent disputes regarding property reservation.

How do I make a deposit agreement?

Draft a Holding Deposit Agreement Form outlining payment details, conditions, and refund policies. Like a Joint Venture Agreement Form, it should be legally binding and signed by both parties to ensure transparency and compliance.

What is a typical holding deposit?

A Holding Deposit Agreement Form usually equals one week’s rent. Similar to a Deposit Agreement Form, it secures the property while finalizing lease terms, preventing other applicants from renting the unit during the hold period.

How much is a typical holding deposit?

The amount varies but is commonly 5-10% of the monthly rent. Like a Land Purchase Agreement Form, the deposit ensures commitment from the tenant while the lease is being finalized.

Can you charge a holding deposit?

Yes, landlords can charge a holding deposit to secure a rental. Similar to a Lease Agreement Form, it guarantees the property remains reserved while the tenant completes necessary paperwork before moving in.

How to calculate holding deposit?

A holding deposit is typically one week’s rent. Like an Employment Agreement Form, its calculation must be transparent, ensuring fairness for both parties while protecting financial interests in rental agreements.

Do I have to return a holding deposit?

Yes, if terms are met, the deposit must be refunded. Similar to a Sublease Agreement Form, refund policies should be clearly defined, outlining when deductions apply due to tenant withdrawal.

Do you get your deposit back if someone takes over your lease?

Yes, but only if terms allow it. Similar to a Security Deposit Form, the landlord may deduct fees or transfer responsibility based on the agreement’s conditions and lease takeover approval.

How much is the average holding deposit?

The average holding deposit is $200–$500, varying by location. Similar to a Rental Deposit Form, it secures the property for the tenant and may be applied to rent upon lease signing.

How much money can I deposit without a hold?

Most banks allow up to $5,000 in deposits without a hold. Similar to a Vendor Direct Deposit Form, larger amounts may require verification or additional processing time before funds are fully available.

A Holding Deposit Agreement Form plays a crucial role in protecting both landlords and tenants by clearly stating deposit terms. It ensures transparency in rental transactions, reducing disputes over refunds or property reservations. A well-drafted form guarantees financial security by detailing conditions for deposit use, return, or forfeiture. Understanding its structure and legal importance prevents costly mistakes. Whether securing a short-term lease or a long-term rental, having a properly formatted agreement simplifies the process. For business-related leases, a Commercial Rental Agreement Form may also be necessary.

Related Posts

-

FREE 5+ Commercial Sublease Agreement Forms in PDF | MS Word

-

FREE 50+ Mortgage Forms Download – How to Create Guide, Tips

-

FREE 4+ Real Estate Listing Information Forms in PDF | MS Word

-

FREE 7+ Garage (Parking) Rental Agreement Forms in PDF | MS Word

-

FREE 7+ Office Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Salon Booth Rental Agreement Forms in PDF | MS Word

-

FREE 5+ Roommate Rental Agreement Forms in PDF | MS Word

-

Electrical Subcontractor Agreement Form

-

FREE 10+Non-Disclosure Forms in PDF | MS Word

-

FREE 5+ Construction Subcontractor Agreement Forms in PDF | MS Word

-

FREE 5+ Real Estate Lease Guarantee Co-Signer Agreement Forms in PDF | MS Word

-

FREE 5+ Lease with an Option to Purchase Agreement Forms in PDF | MS Word

-

FREE 7+ Realtors Lease Agreement Forms in PDF

-

FREE 10+ Subordination Agreement Forms in PDF | MS Word

-

FREE 10+ Condominium Lease Agreement Forms in PDF | MS Word