A Financial Evaluation Form is a vital tool for assessing an individual’s or organization’s financial health. It helps track income, expenses, assets, and liabilities to determine financial stability. This form is essential for budgeting, loan applications, investment analysis, and business planning. Whether for personal finance management or corporate assessments, using a structured Evaluation Form ensures accuracy and clarity. Additionally, integrating a Financial Form helps streamline the process, providing a comprehensive view of your financial position. This guide offers examples, templates, and expert tips for creating effective financial evaluations, helping you make informed decisions.

Download Financial Evaluation Form Bundle

What is Financial Evaluation Form?

A Financial Evaluation Form is a structured document used to assess an individual’s or organization’s financial status. It collects detailed information on income, expenses, assets, and liabilities, providing a clear snapshot of financial health. This form is crucial for financial planning, loan approvals, investment decisions, and business management. By systematically organizing financial data, it helps identify strengths, weaknesses, and areas for improvement, supporting informed decision-making and effective resource allocation.

Financial Evaluation Format

Applicant Information:

Full Name: ___________________________

Address: ___________________________

Contact Number: ___________________________

Date of Evaluation: ___________________________

Income Details:

Monthly Income: ___________________________

Other Income Sources: ___________________________

Total Monthly Income: ___________________________

Expenses Overview:

Housing/Rent: ___________________________

Utilities: ___________________________

Transportation: ___________________________

Groceries: ___________________________

Debt Payments: ___________________________

Other Expenses: ___________________________

Assets and Liabilities:

Bank Accounts: ___________________________

Investments: ___________________________

Property Owned: ___________________________

Outstanding Loans/Debts: ___________________________

Financial Summary:

Net Income: ___________________________

Debt-to-Income Ratio: ___________________________

Evaluator’s Comments: ___________________________

Evaluation Conducted By:

Name: ___________________________

Signature: ___________________________

Date: ___________________________

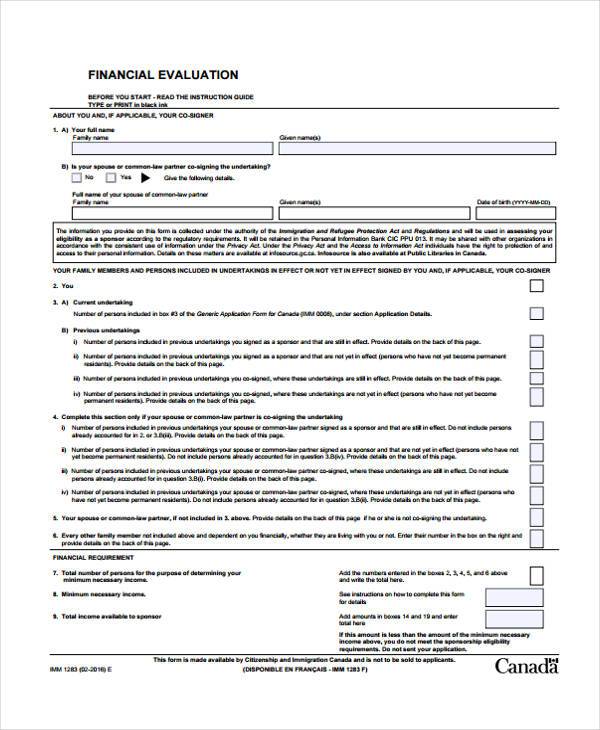

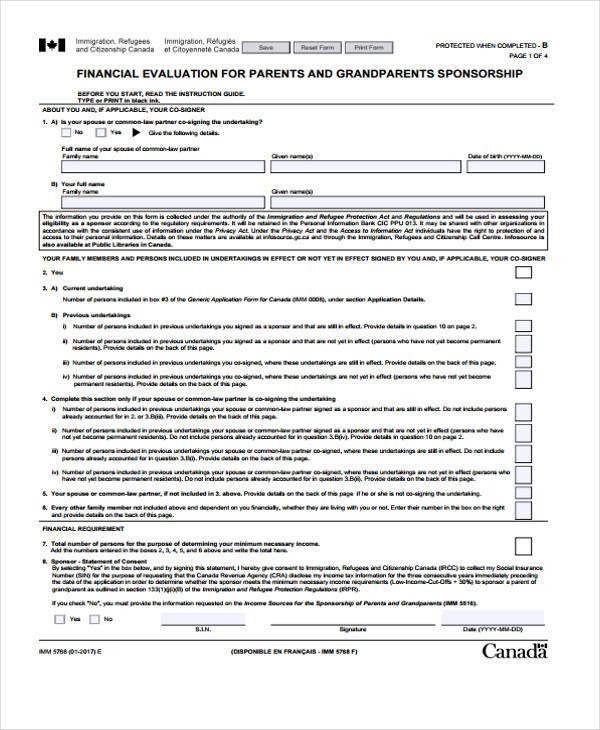

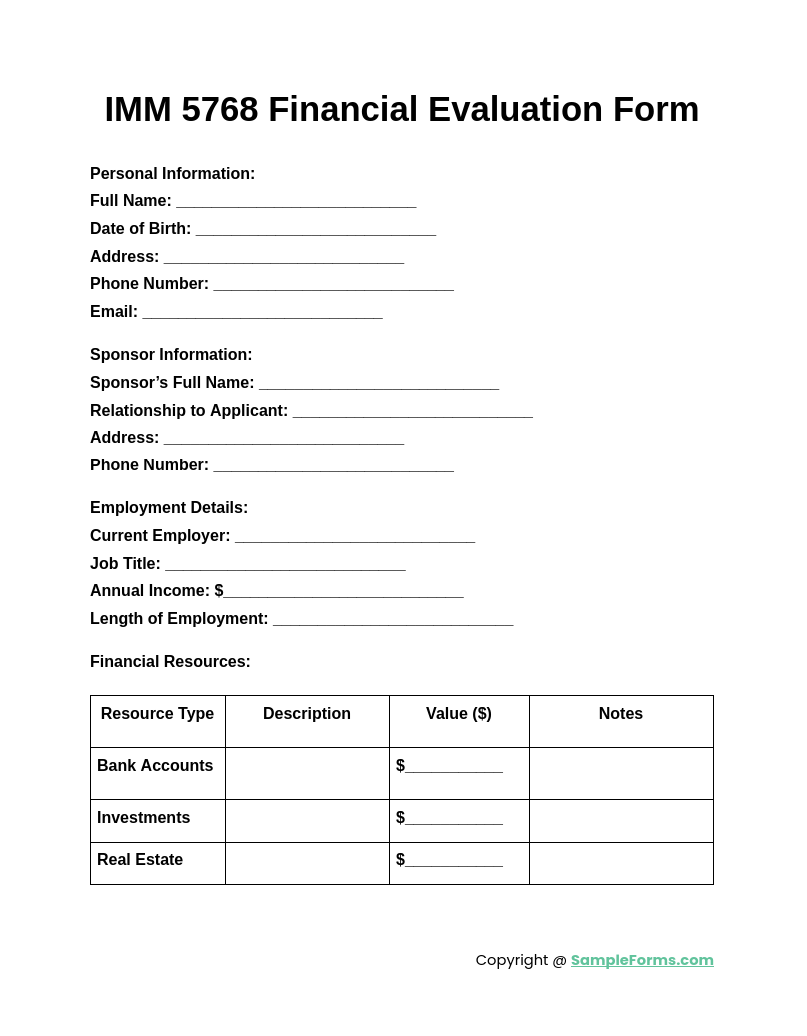

IMM 5768 Financial Evaluation Form

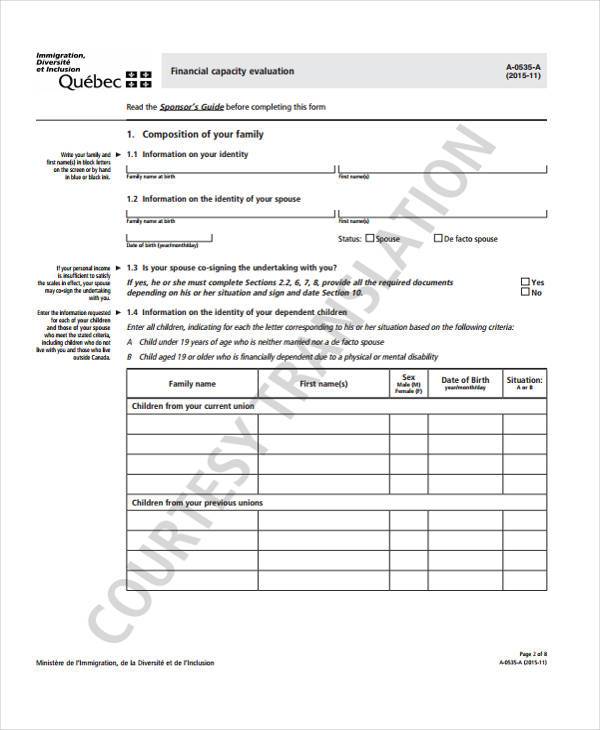

The IMM 5768 Financial Evaluation Form is essential for assessing a sponsor’s financial ability in Canadian immigration applications. It documents income, assets, and liabilities, similar to how a Training Evaluation Form measures performance outcomes in educational settings.

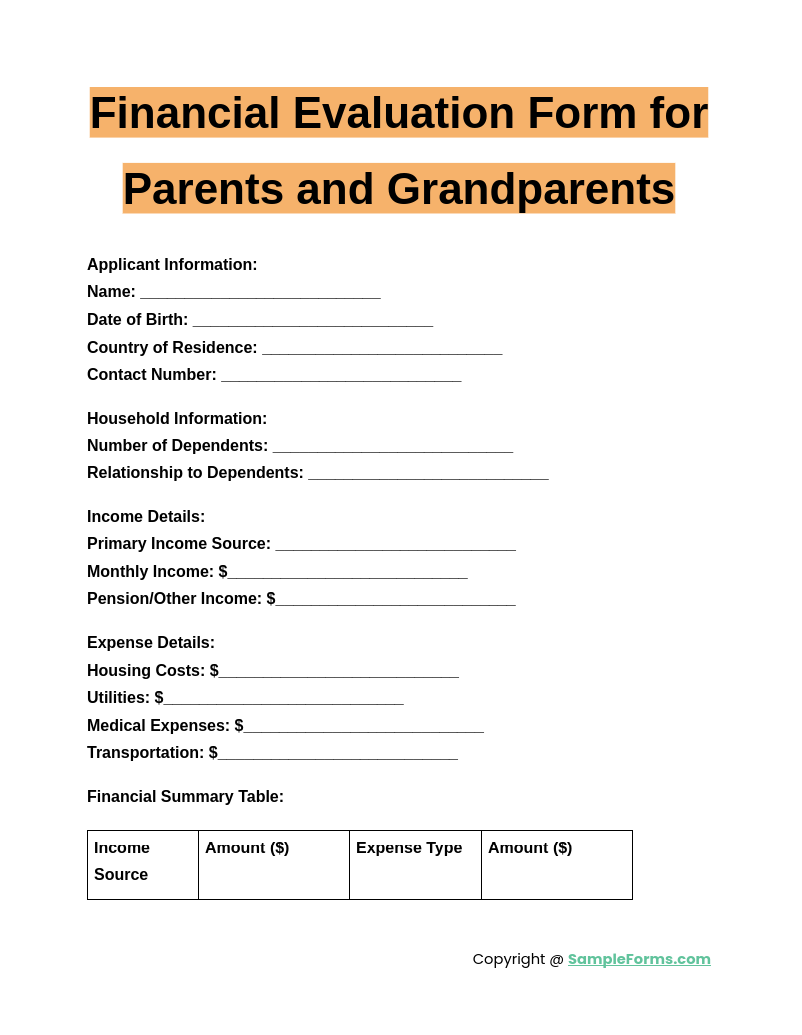

Financial Evaluation Form for Parents and Grandparents

The Financial Evaluation Form for Parents and Grandparents ensures sponsors meet income requirements for family sponsorship. It details household size, income sources, and financial commitments, akin to an Employee Self Evaluation Form where individuals assess their own competencies and responsibilities.

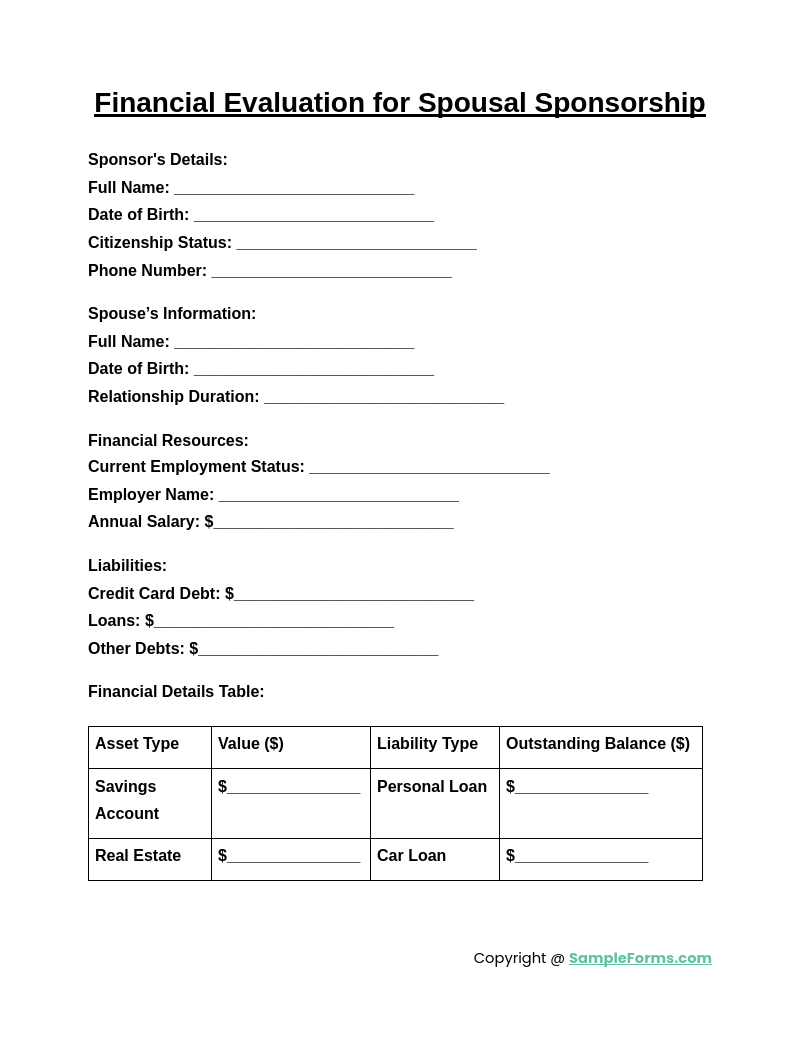

Financial Evaluation for Spousal Sponsorship

A Financial Evaluation for Spousal Sponsorship verifies the sponsor’s financial stability to support a spouse without government assistance. It tracks income and expenses, much like a Peer Evaluation Form assesses performance within a team dynamic, promoting accountability.

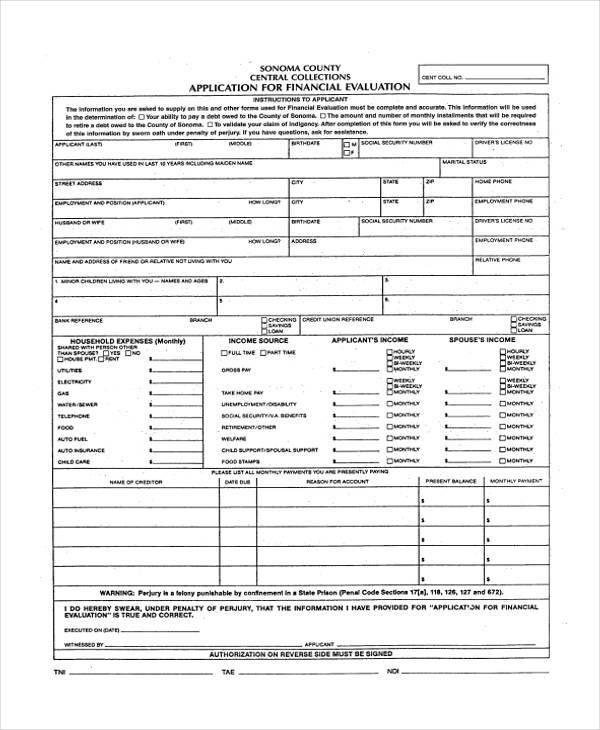

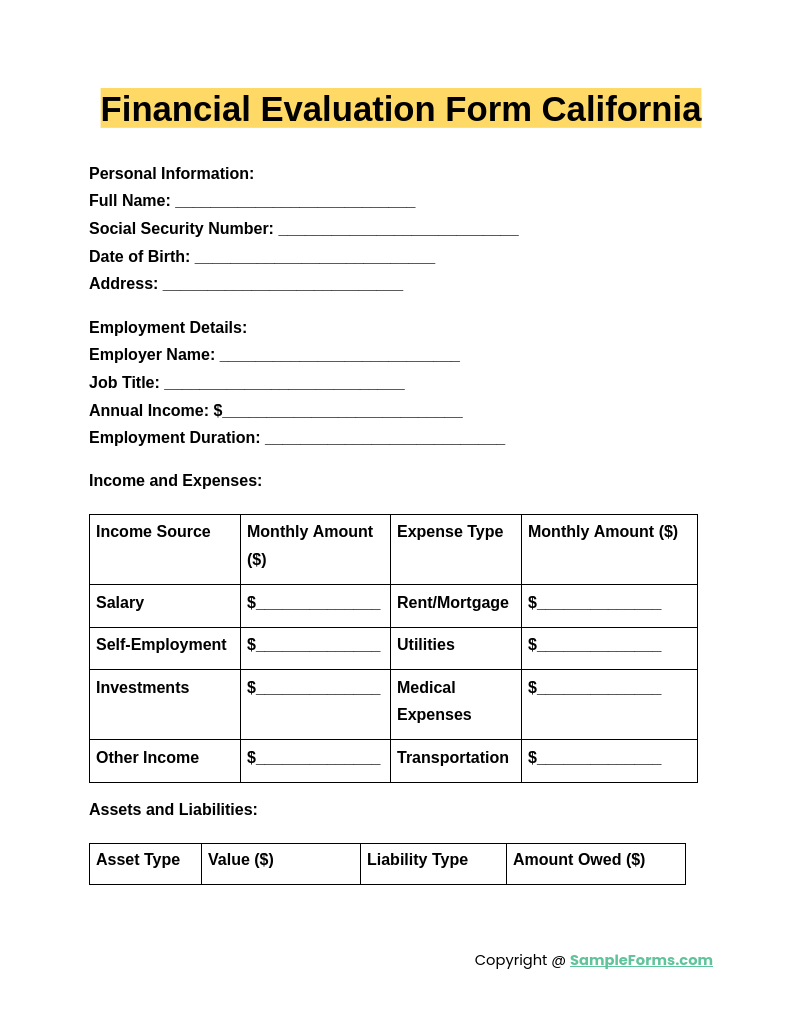

Financial Evaluation Form California

The Financial Evaluation Form California is used to determine eligibility for financial aid, legal assistance, or government benefits. It assesses income and assets, similar to an Interview Evaluation Form that systematically evaluates candidates’ qualifications during the hiring process.

Browse More Financial Evaluation Forms

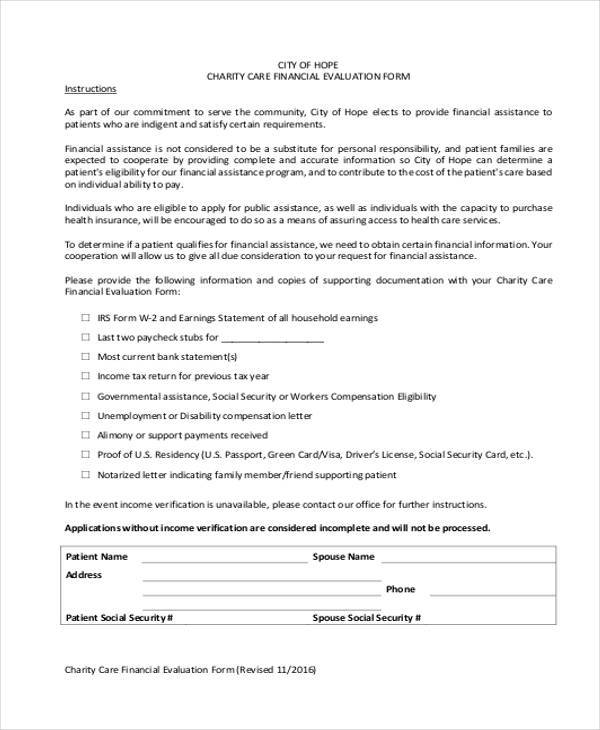

Charity Care Financial Evaluation Form

Sponsor Financial Evaluation Form

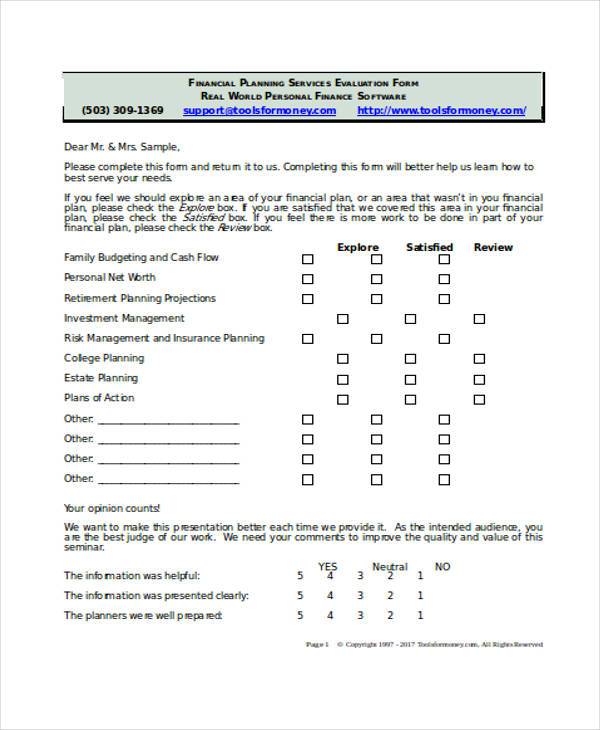

Financial Planning Services Evaluation Form

Financial Capacity Evaluation Form Example

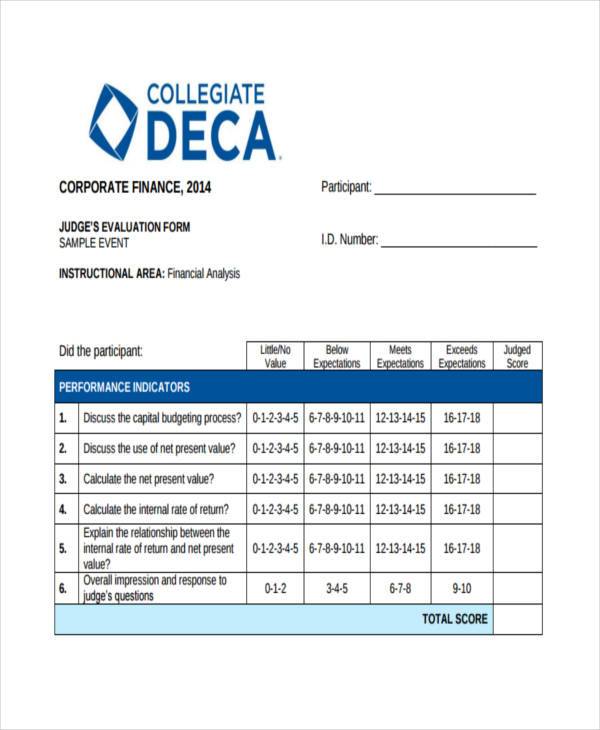

Financial Analysis Judge’s Evaluation Form Sample

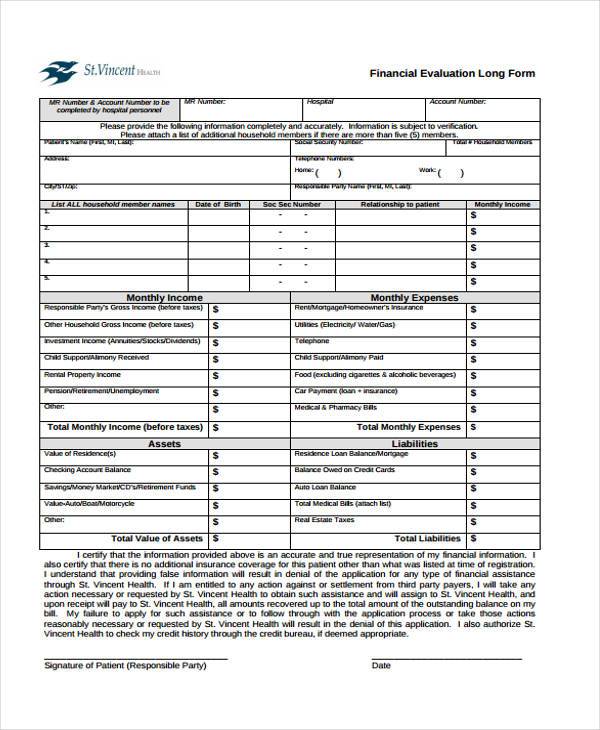

Financial Evaluation Long Form

Family Financial Evaluation Form Example

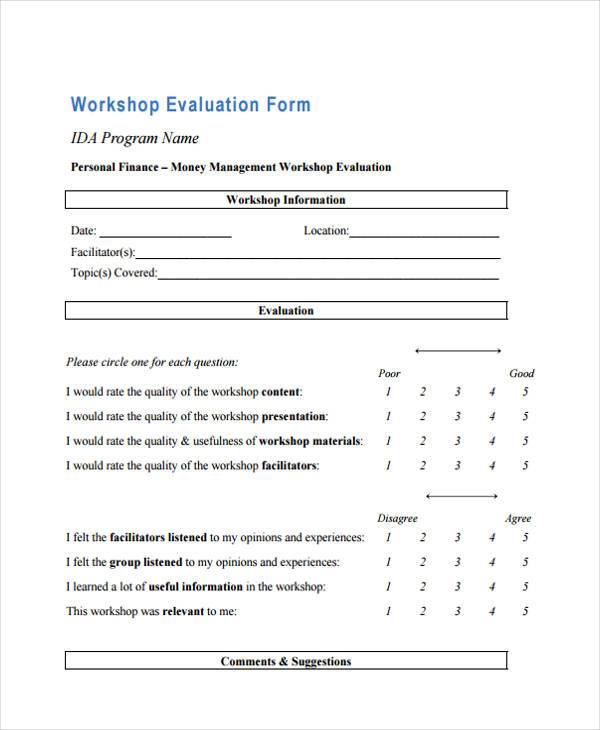

Finance Workshop Evaluation Form

Financial Evaluation Application Form

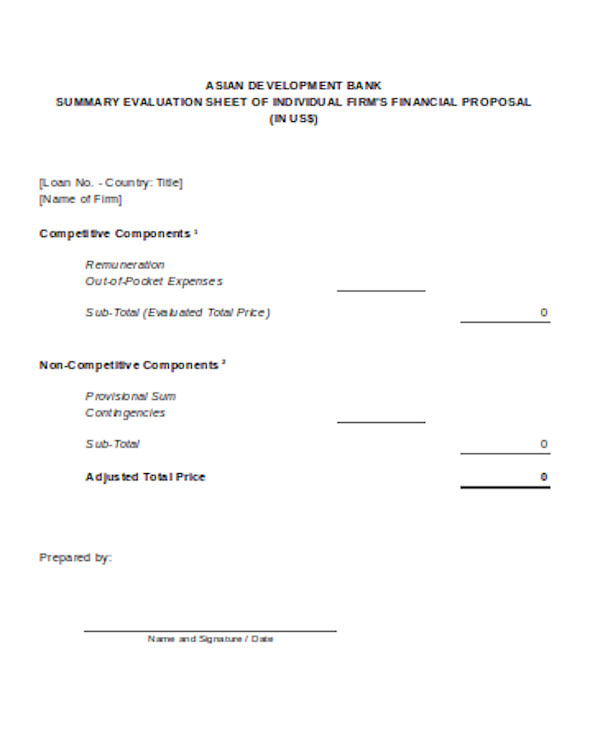

Financial Proposal Evaluation Form.

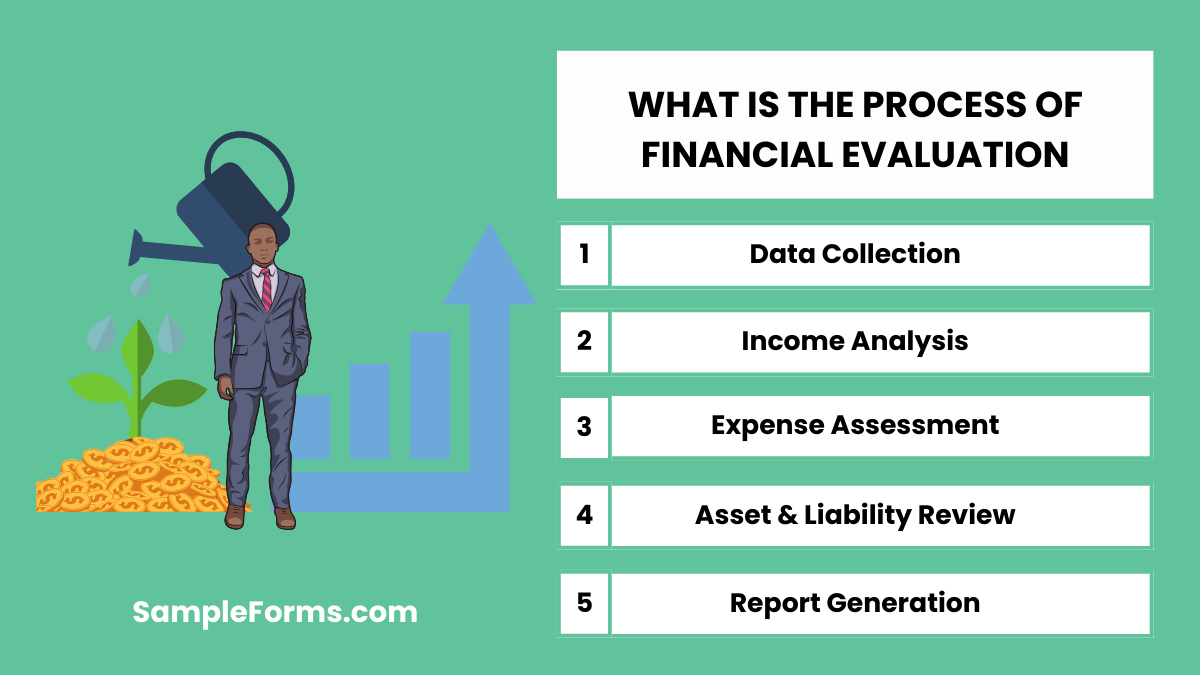

What is the Process of Financial Evaluation?

Financial evaluation assesses an individual’s or organization’s financial health by analyzing income, expenses, assets, and liabilities, similar to a Presentation Evaluation Form reviewing key performance areas.

- Data Collection: Gather financial documents like income statements, balance sheets, and tax returns.

- Income Analysis: Review income sources, including salaries, investments, and business revenue.

- Expense Assessment: Identify fixed and variable expenses to understand spending habits.

- Asset & Liability Review: Calculate net worth by comparing assets against liabilities.

- Report Generation: Summarize findings in a financial report for informed decision-making.

What is the Financial Evaluation for Parents and Grandparents?

This evaluation assesses a sponsor’s ability to financially support parents or grandparents, similar to analyzing data in a Food Sensory Evaluation Form for comprehensive insights.

- Sponsor’s Income Review: Verify employment income, investments, and government benefits.

- Household Size Calculation: Determine the number of dependents supported by the sponsor.

- Financial Threshold Check: Compare income against legal minimum requirements for sponsorship.

- Document Submission: Provide tax returns, pay stubs, and financial affidavits.

- Approval Process: Authorities assess eligibility based on financial documentation provided.

How Do You Conduct a Financial Review?

Conducting a financial review involves evaluating financial performance for accuracy and efficiency, much like a Speech Evaluation Form assesses clarity and structure.

- Gather Financial Records: Collect bank statements, tax returns, and financial reports.

- Analyze Income & Expenses: Compare income streams with outgoing expenses to determine profitability.

- Assess Debt Levels: Review outstanding debts and repayment schedules.

- Evaluate Investments: Analyze asset performance, returns, and risks.

- Identify Financial Risks: Highlight vulnerabilities and areas for improvement.

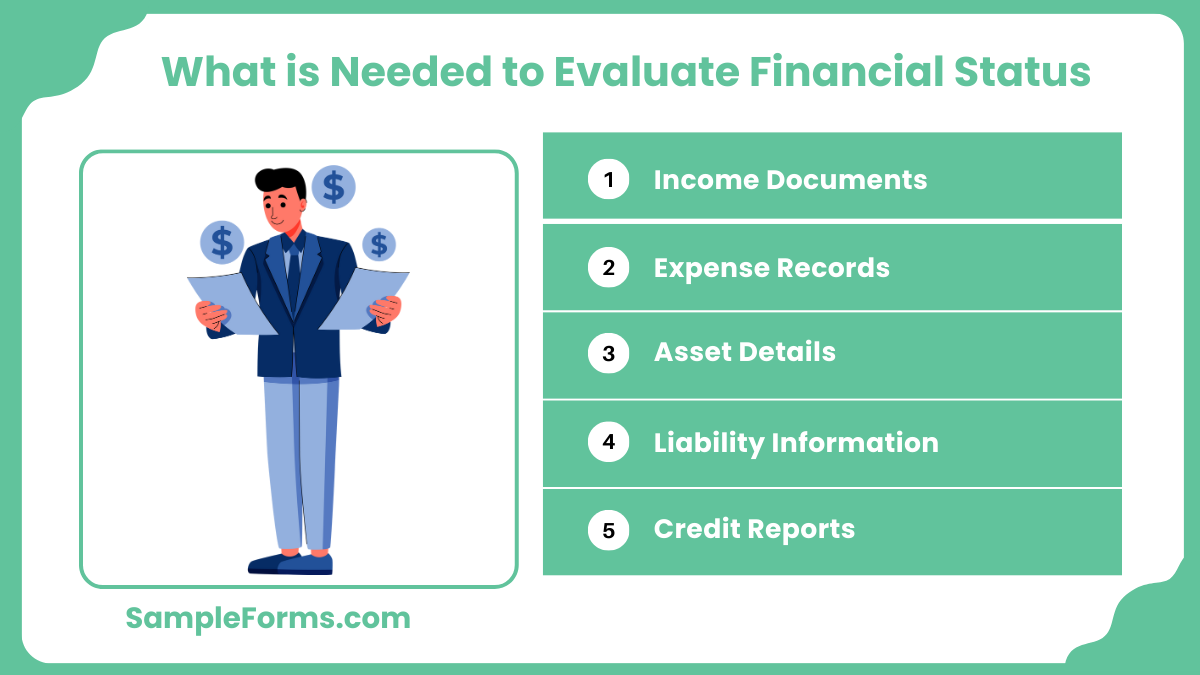

What is Needed to Evaluate Financial Status?

To evaluate financial status, you need key documents and metrics that provide an overview of financial health, like metrics used in a Supplier Evaluation Form.

- Income Documents: Pay stubs, tax returns, and business revenue statements.

- Expense Records: Bills, bank statements, and credit card summaries.

- Asset Details: Property deeds, investment accounts, and savings.

- Liability Information: Loan documents, mortgage statements, and debt schedules.

- Credit Reports: Assess creditworthiness and financial reliability.

How Do I Fill Out a Financial Evaluation Form?

Filling out a financial evaluation form involves accurately reporting financial data, similar to the detailed process required in a Contractor Evaluation Form.

- Personal Information: Enter basic details like name, address, and contact information.

- Income Reporting: List all income sources, including wages, investments, and other earnings.

- Expense Documentation: Outline monthly expenses, such as rent, utilities, and groceries.

- Asset & Liability Declaration: Provide information about owned assets and existing debts.

- Review & Sign: Double-check entries for accuracy and sign the form to confirm authenticity.

Can grandparents get paid to watch their grandchildren?

Yes, grandparents can receive payment through family arrangements, government programs, or childcare subsidies, similar to performance reviews using a Nurse Evaluation Form to assess care standards.

What does financial support from parents mean?

Financial support from parents includes covering expenses like housing, education, or healthcare, akin to evaluating performance in a Debate Evaluation Form to track contributions effectively.

What is evaluating financial statements?

It’s analyzing income statements, balance sheets, and cash flows to assess financial health, similar to an Internship Evaluation Form reviewing an intern’s progress and performance.

What is an example of evaluation?

Assessing an employee’s productivity using an Employee Performance Evaluation Form is a good example, focusing on specific performance metrics and improvement areas.

How do you evaluate personal finances?

Review income, expenses, debts, and savings to gauge financial health, much like assessing food quality with a Food Evaluation Form for detailed analysis.

How do I make my own evaluation form?

Define objectives, create relevant questions, and structure it clearly, similar to designing a Course Evaluation Form to collect meaningful feedback.

How to tell if a company is doing well financially?

Analyze profits, revenue growth, cash flow, and debt ratios, like assessing mentorship success with a Mentee Evaluation Form based on key performance indicators.

How to assess your financial situation?

Review income, expenses, savings, and debts regularly, much like using a Sensory Evaluation Form to assess product quality through systematic observation.

What is a financial impact assessment?

It evaluates potential economic effects of decisions on businesses or individuals, like using an Candidate Evaluation Form to measure workplace efficiency and outcomes.

What does evaluation of financial needs mean?

It’s identifying financial resources required for goals, similar to a Driver Evaluation Form assessing skills for safe and effective vehicle operation.

In conclusion, the Financial Evaluation Form is an essential tool for personal and business financial management. It helps track financial performance, plan budgets, and make informed decisions. Whether used for loan applications, investment analysis, or business evaluations, this form ensures accuracy and clarity in financial assessments. Incorporating templates and examples makes it easier to customize according to specific needs. Moreover, when combined with tools like the Call Monitoring Evaluation Form, it provides a comprehensive approach to performance tracking, both financially and operationally, ensuring well-rounded decision-making.

Related Posts

-

FREE 6+ Business Credit Checklist Forms in PDF

-

Employee Pay Increase Form

-

Chef Evaluation Form

-

FREE 8+ Kitchen Evaluation Forms in PDF | MS Word

-

Customer Service Evaluation Form

-

FREE 15+ Grant Evaluation Forms in PDF | MS Word

-

FREE 14+ Volunteer Evaluation Forms in PDF

-

Mentee Evaluation Form

-

Speaker Evaluation Form

-

FREE 14+ Vehicle Evaluation Forms in PDF

-

FREE 14+ Trainee Evaluation Forms in MS Word | PDF

-

Resume Evaluation Form

-

FREE 14+ Retreat Evaluation Forms in PDF

-

Debate Evaluation Form

-

FREE 14+ Book Evaluation Forms in PDF | MS Word