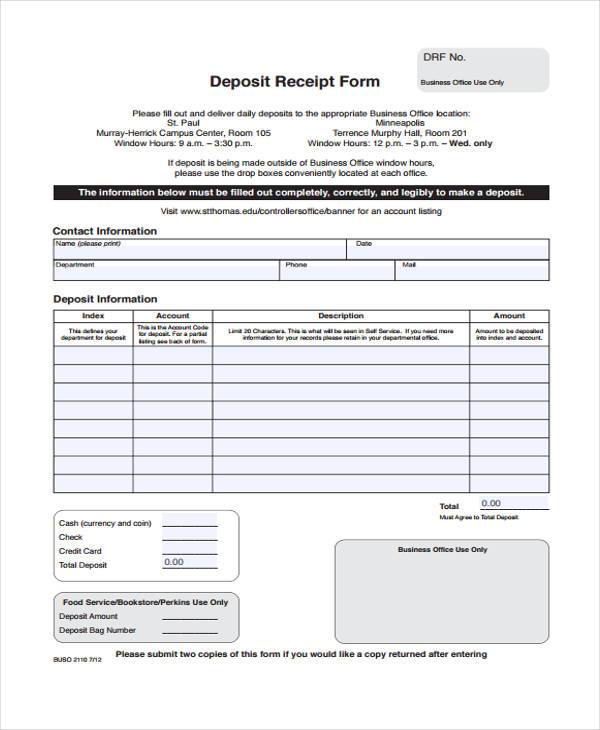

A Deposit Receipt Form is an essential document for recording monetary deposits, ensuring clarity and accountability in transactions. Designed to detail every deposit transaction, it includes essential fields such as depositor details, transaction amount, and payment type. Whether for personal use or business purposes, the form enhances transparency and trust between parties. Explore various Receipt Form examples to create or customize one that meets your specific needs. A Deposit Form, when effectively used, strengthens financial records and mitigates errors. Its simplicity and utility make it a must-have for seamless deposit management in any scenario.

Download Deposit Receipt Form Bundle

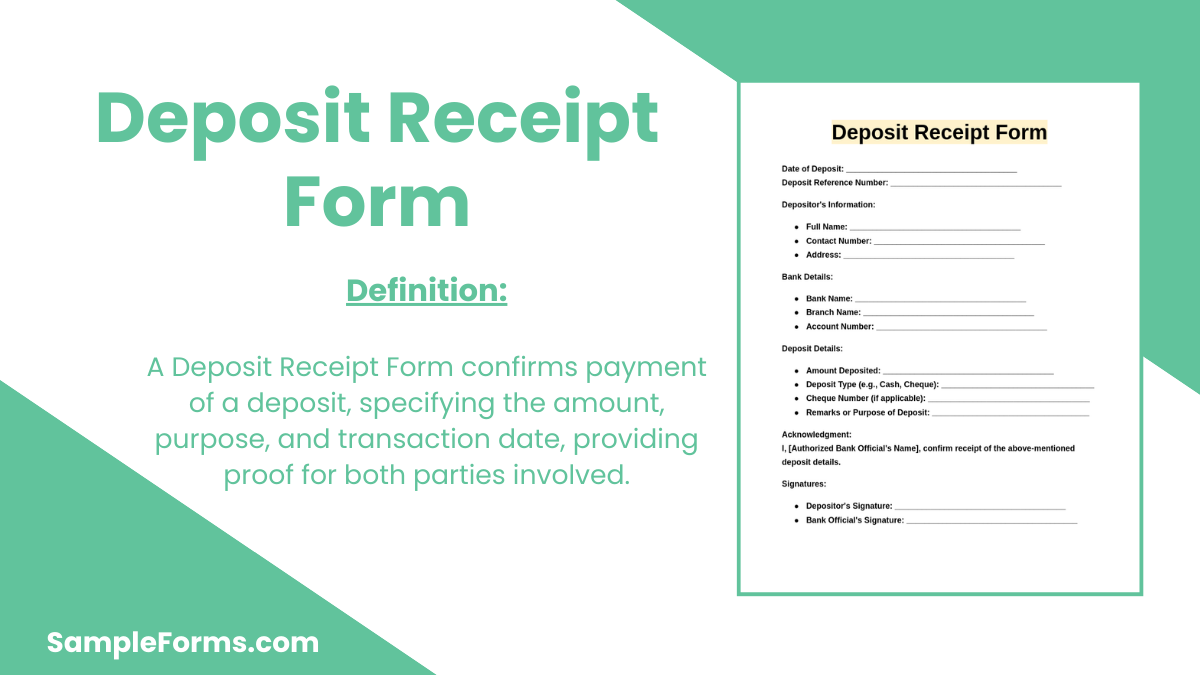

What is Deposit Receipt Form?

A Deposit Receipt Form is a formal document confirming the receipt of a monetary deposit. It provides essential details like the depositor’s information, transaction type, amount, and purpose, ensuring accuracy and accountability in financial transactions. Its usage spans businesses, landlords, and service providers, making it an indispensable tool for transparent dealings.

Deposit Receipt Format

Heading: Deposit Receipt

Date: [Insert Date]

Receipt Number: [Insert Number]

Payer’s Information:

- Full Name: [Insert Name]

- Address: [Insert Address]

- Contact Number: [Insert Contact Information]

Deposit Details:

- Amount Deposited: [Insert Amount]

- Purpose of Deposit: [Insert Purpose]

- Date of Deposit: [Insert Date]

- Payment Method: [Insert Method]

Acknowledgment Statement:

I, [Recipient’s Name], acknowledge the receipt of the above-mentioned deposit and agree to the specified terms and conditions.

Signature:

- Payer’s Signature: [Insert Signature]

- Receiver’s Signature: [Insert Signature]

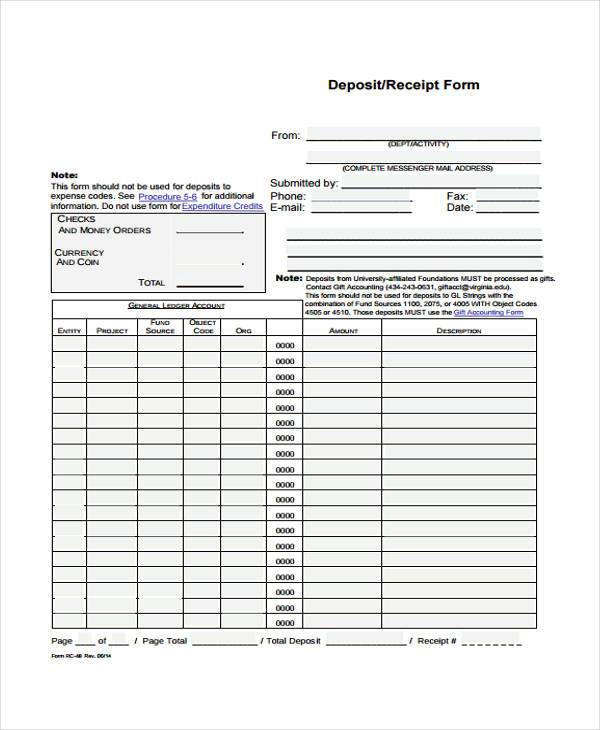

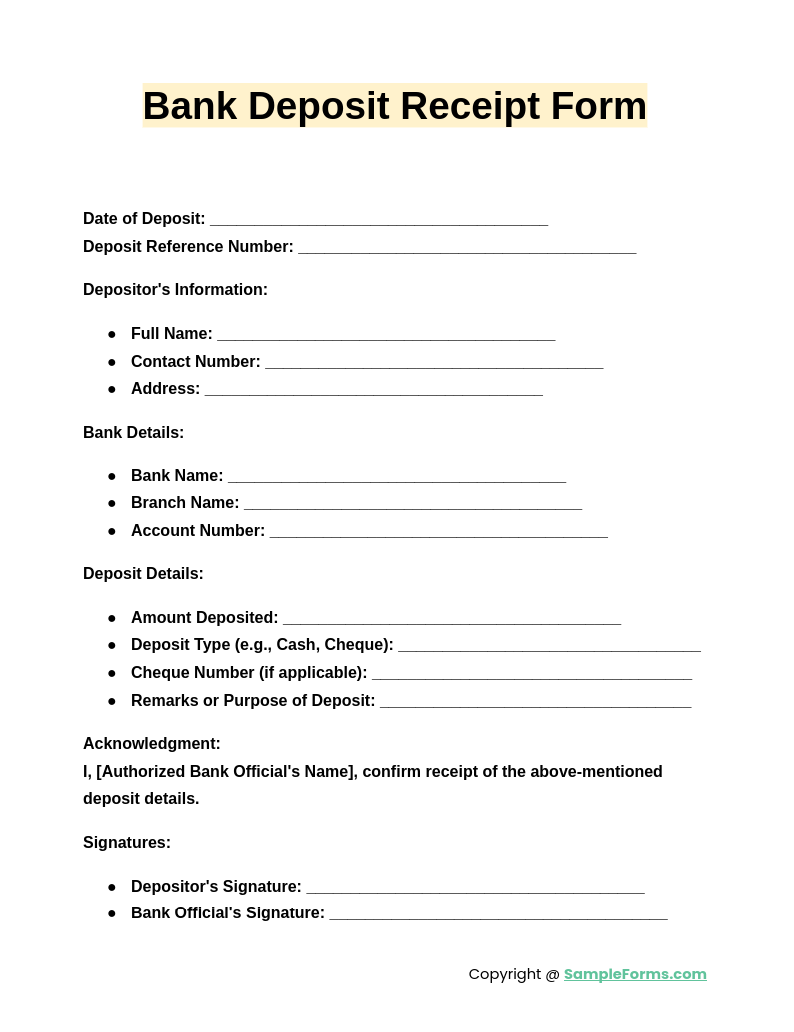

Bank Deposit Receipt Form

A Bank Deposit Receipt Form documents financial transactions, providing proof of deposits. It supports transparency, like a Payment Receipt Form, ensuring accurate record-keeping and accountability. Essential for banking operations, it safeguards against transaction errors.

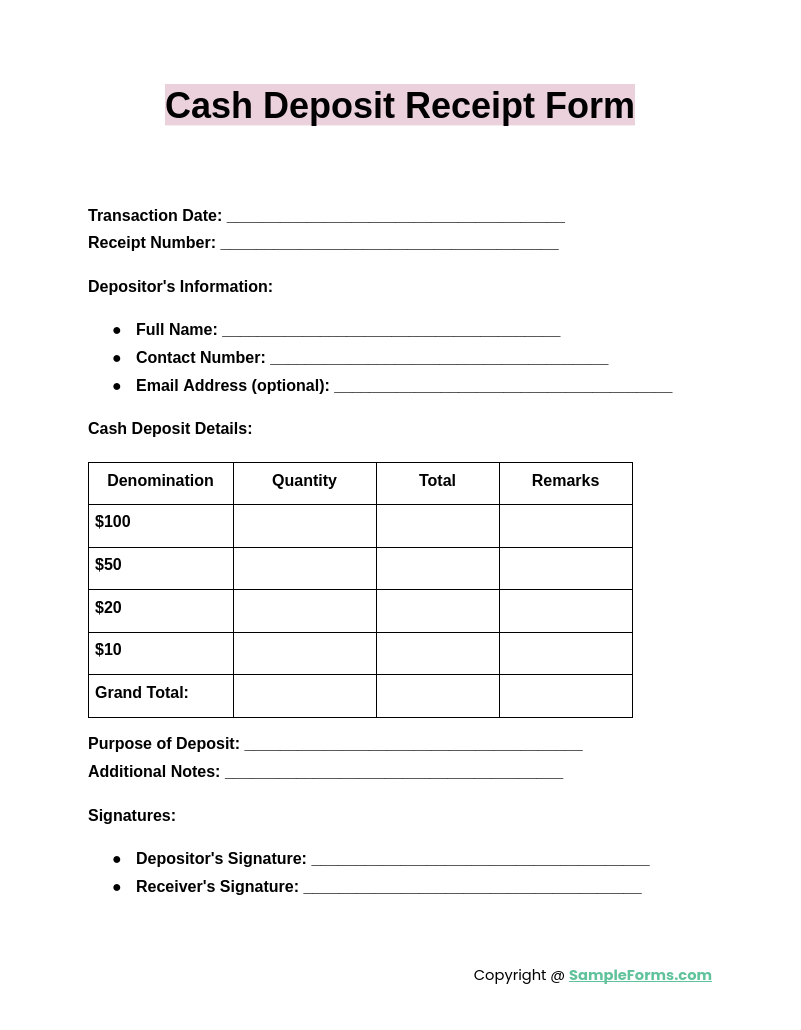

Cash Deposit Receipt Form

A Cash Deposit Receipt Form captures details of cash transactions for secure records. Similar to a Restaurant Receipt Form, it emphasizes clarity in amounts, dates, and payer details, enhancing financial tracking and minimizing discrepancies.

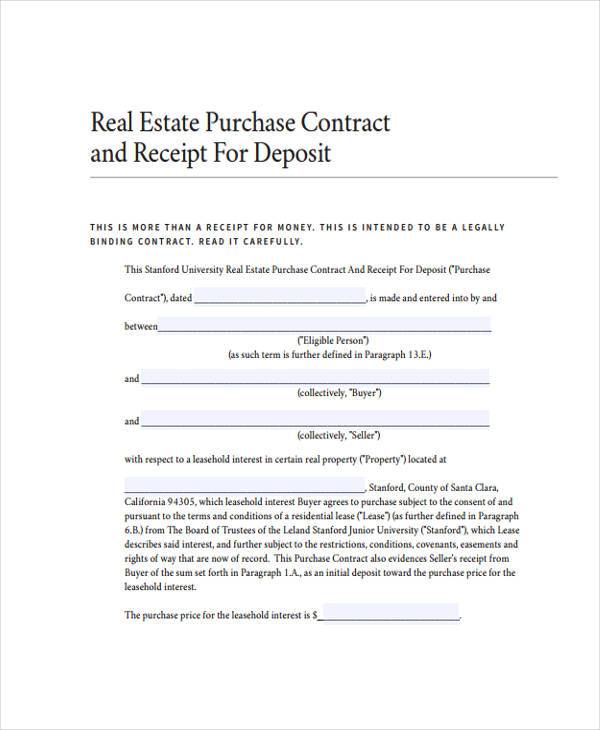

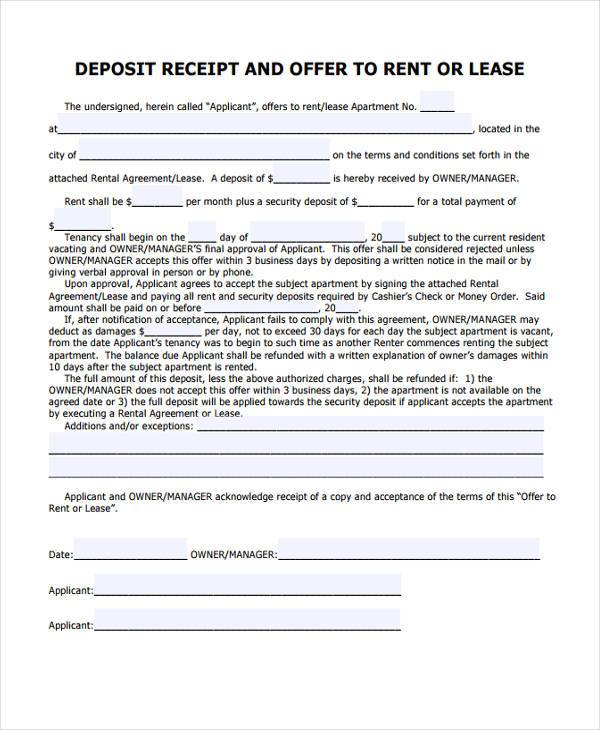

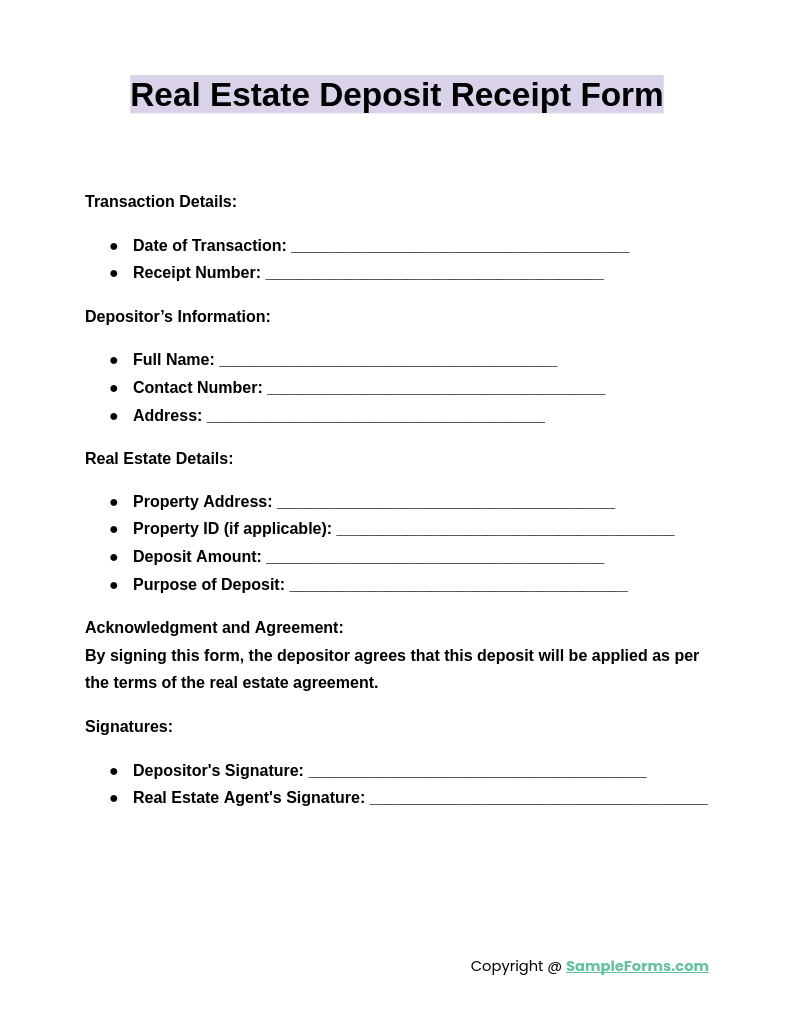

Real Estate Deposit Receipt Form

This form confirms deposits for property transactions, offering clarity for buyers and sellers. It mirrors the structured detail of a Rent Receipt Form, ensuring transparent agreements and safeguarding funds during real estate dealings.

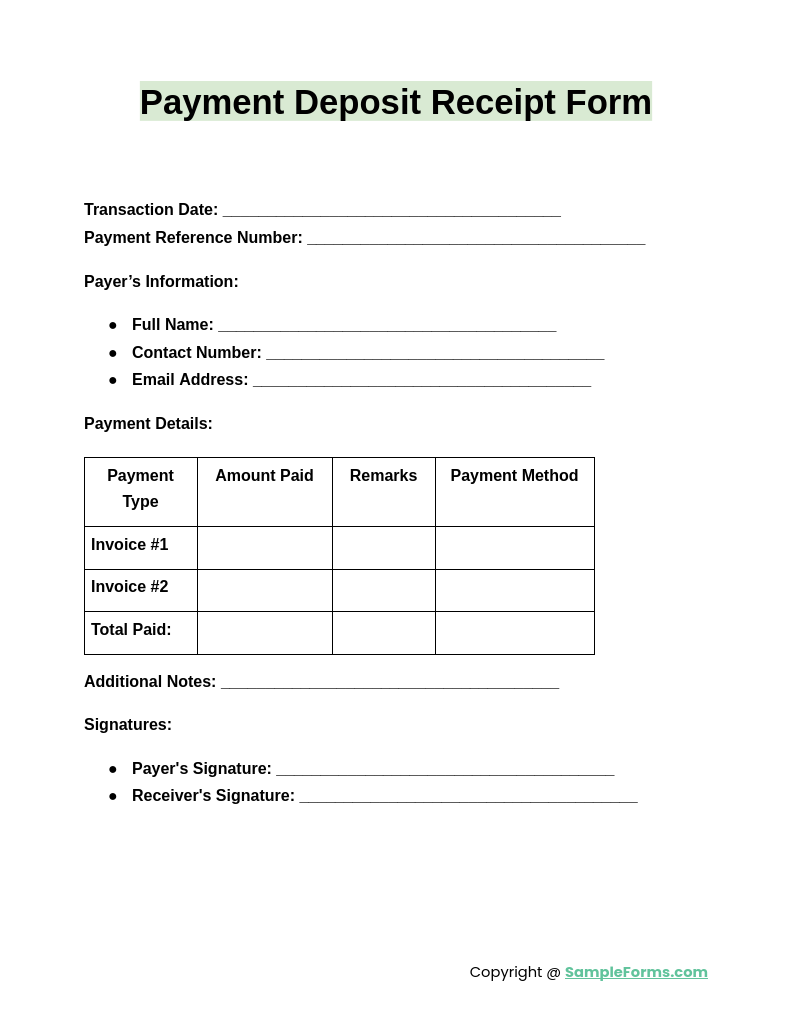

Payment Deposit Receipt Form

A Payment Deposit Receipt Form verifies monetary exchanges, crucial for financial reliability. Resembling a Hotel Receipt Form, it documents payer information and transaction specifics, fostering trust and clear records for both parties.

Browse More Deposit Receipt Forms

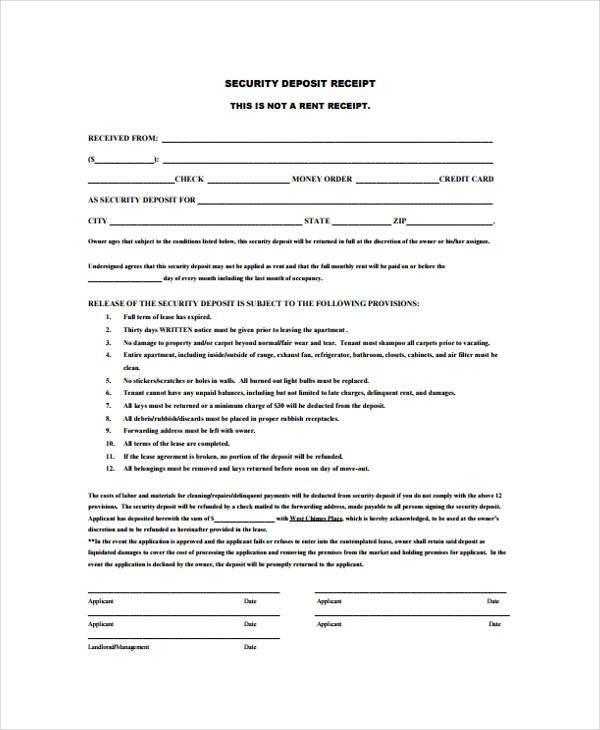

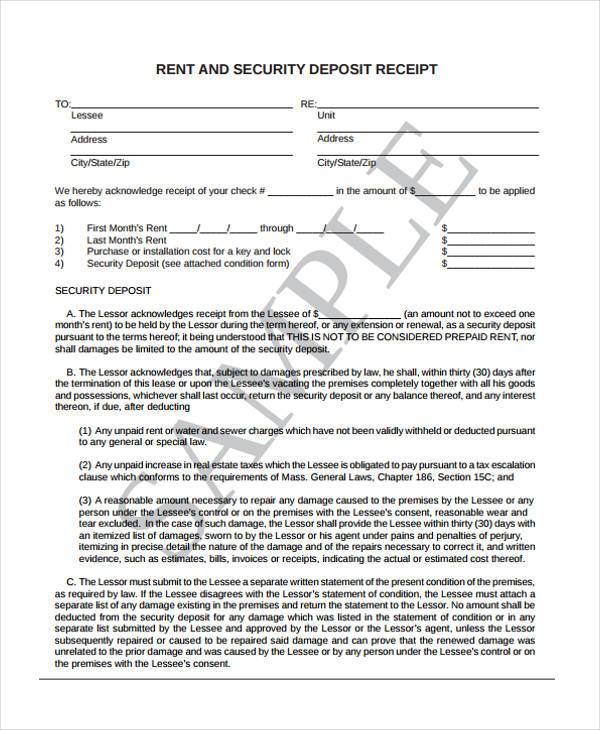

Security Deposit Receipt Form Example

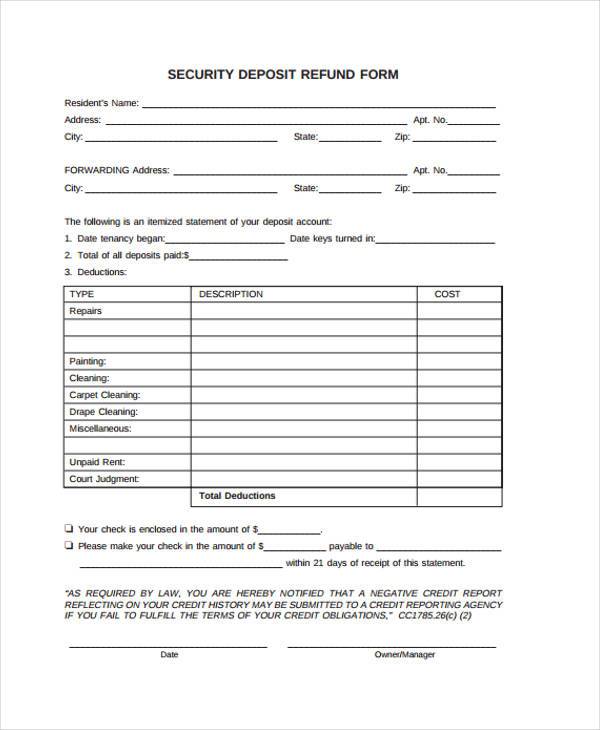

Security Deposit Refund Form

Sample Deposit/Receipt Form

Real Estate Deposit Receipt Form

Generic Deposit Receipt Form Example

Printable Deposit Receipt Form

Deposit Receipt Form Example

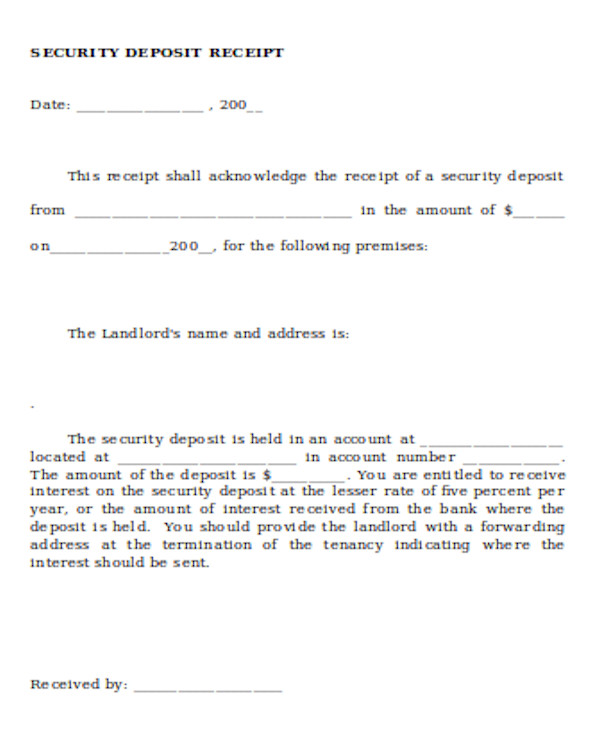

Security Deposit Receipt Form

Sample Security Deposit Receipt Form

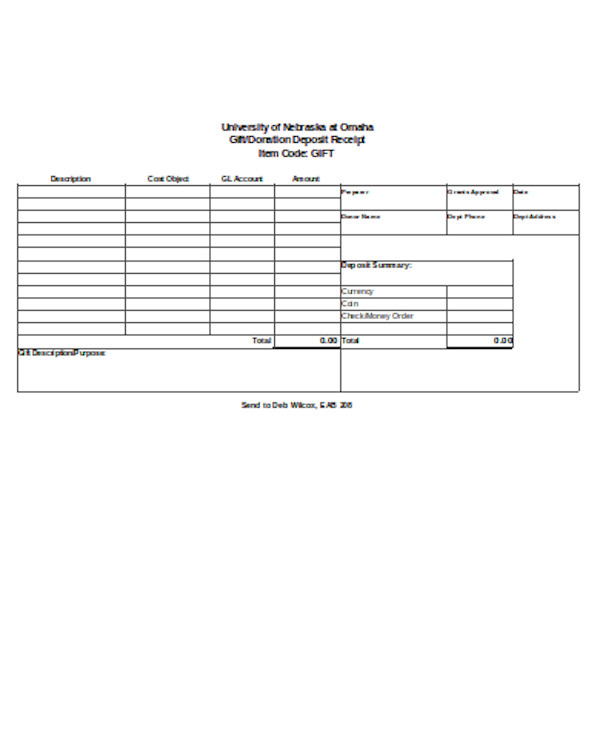

Gift Deposit Receipt Form

How do you create a deposit receipt?

Creating a deposit receipt ensures financial transparency, much like a Cash Receipt Form. It outlines transaction details for both parties’ records and reference.

- Include Basic Information: Add payer and recipient names, date, and receipt number for clear identification.

- Mention Transaction Details: Specify deposit amount, payment method, and purpose of payment to ensure accuracy.

- State Terms Clearly: Highlight terms and conditions of the deposit, if applicable, for legal clarity.

- Provide Contact Information: Include recipient’s contact details for any follow-ups or clarifications.

- Obtain Signatures: Secure signatures from both parties to confirm agreement and authenticity.

How do you write a deposit invoice?

A deposit invoice formalizes the request for partial payment, similar to how a Sales Receipt Form confirms a sale, ensuring professionalism and clarity in business transactions.

- Use a Professional Format: Include your business logo, name, and contact details for authenticity.

- Add Invoice Details: Mention invoice number, issue date, and due date for tracking.

- Break Down Charges: Clearly list the deposit amount, remaining balance, and total payable amount.

- Provide Payment Instructions: Include bank account or payment link details to simplify the transaction process.

- State Terms and Conditions: Highlight refund and payment policies to avoid disputes.

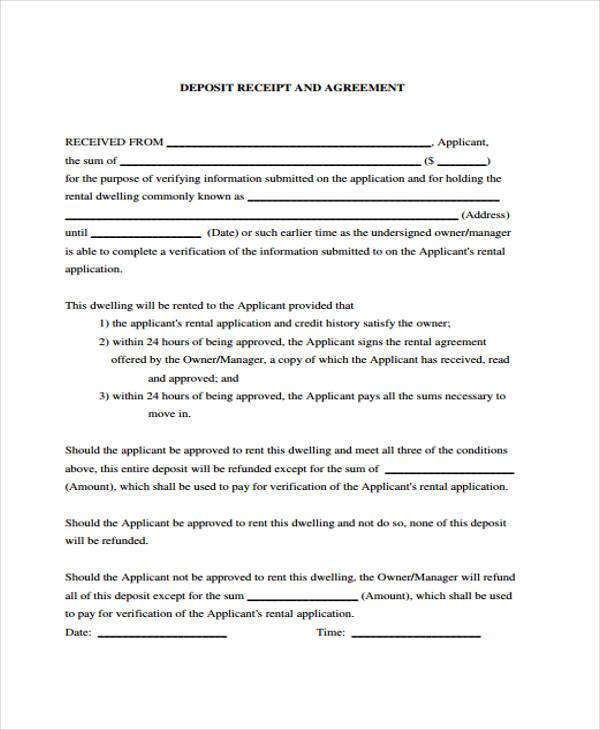

How to write a receipt for a security deposit?

Writing a security deposit receipt provides clear evidence of payment, akin to a Donation Receipt Form for its accuracy and transparency in financial documentation.

- Title the Receipt Clearly: Use a descriptive title like “Security Deposit Receipt” for easy identification.

- Specify Payment Details: Mention the payment amount, date, and method for clear documentation.

- Include Property Information: Add property address or details related to the deposit for context.

- State Deposit Purpose: Clearly indicate that the payment is for security purposes to avoid misunderstandings.

- Add Both Parties’ Signatures: Ensure both landlord and tenant sign to validate the receipt’s authenticity.

How do I ask for a refund of a deposit?

Requesting a deposit refund is a formal process, much like detailing expenses in a Purchase Receipt Form, requiring clarity and documentation.

- Use Polite Language: Begin with a respectful tone, requesting the deposit’s return.

- Mention Transaction Details: Specify the deposit amount, date, and purpose for clear reference.

- Provide Reason for Refund: Clearly explain why the refund is being requested.

- Attach Supporting Documents: Include relevant receipts or agreements to validate the request.

- Set a Timeline: Politely mention a reasonable deadline for the refund.

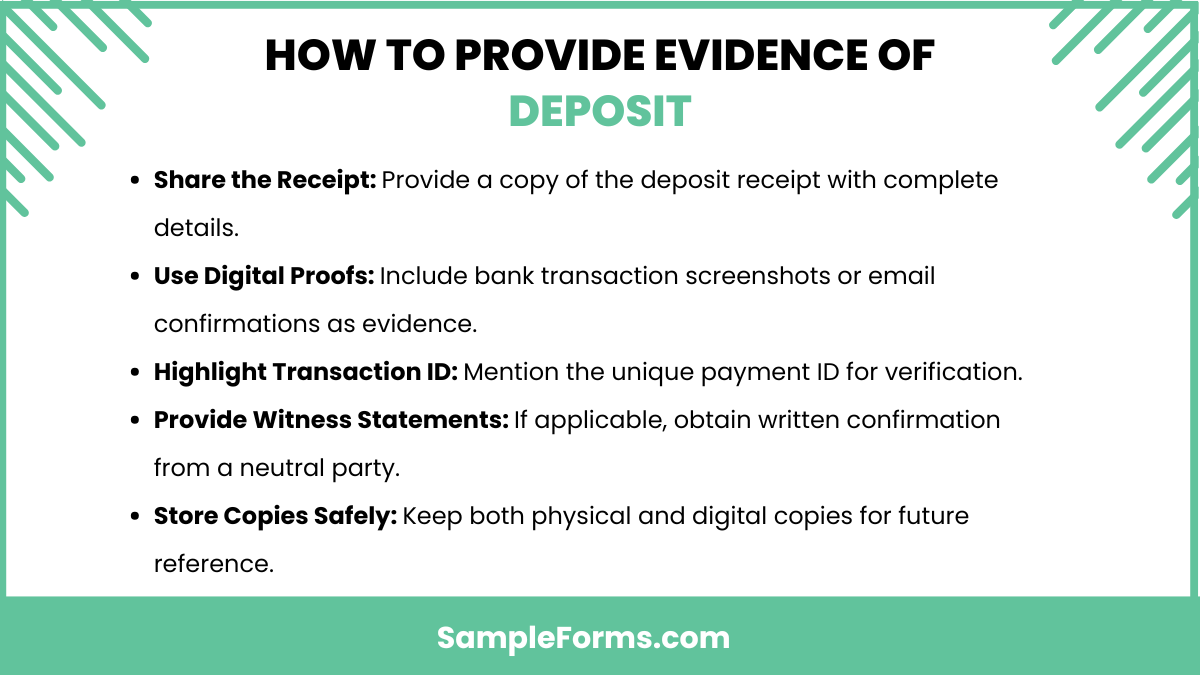

How do you provide evidence of deposit?

Providing deposit evidence ensures transaction clarity, paralleling the purpose of a Delivery Receipt Form, by documenting and validating payment details for both parties.

- Share the Receipt: Provide a copy of the deposit receipt with complete details.

- Use Digital Proofs: Include bank transaction screenshots or email confirmations as evidence.

- Highlight Transaction ID: Mention the unique payment ID for verification.

- Provide Witness Statements: If applicable, obtain written confirmation from a neutral party.

- Store Copies Safely: Keep both physical and digital copies for future reference.

Is a deposit receipt the same as a deposit slip?

A deposit receipt confirms the transaction, while a deposit slip records details before payment. It differs from a Lost Receipt Form for tracking purposes.

How do I make a deposit form?

Create a clear template with payer and payment details. A Car Receipt Form inspires structured design, ensuring accurate transaction records.

Can I print my own deposit slips?

Yes, but ensure they meet bank standards for acceptance, similar to customizing a School Receipt Form for specific requirements.

How do I make a receipt for cash payment?

Record payment details with date, amount, and payer information, ensuring authenticity like a Daycare Receipt Form for financial transparency.

Can you write a check for a security deposit?

Yes, checks are widely accepted for deposits, offering proof of payment akin to a Contractor Receipt Form for services.

Can I create my own direct deposit form?

Yes, include bank details and authorization. Use a structured approach like a Missing Receipt Form for professional documentation.

Can I write myself a check to deposit?

Yes, ensure it’s from your account to maintain a clear audit trail, much like an Asset Receipt Form tracks ownership.

Do you need a deposit slip to make a deposit?

Not always, as many banks accept electronic alternatives. A Petty Cash Receipt Form can substitute for smaller transactions.

Do banks still use deposit slips?

Yes, especially for in-person transactions, ensuring accuracy like an Event Receipt Form for detailed documentation.

What is proof that a deposit has been made?

Bank statements, receipts, or transaction IDs serve as proof, similar to how a Cleaning Receipt Form verifies service payment

A Deposit Receipt Form is a critical tool for maintaining financial clarity and trust in monetary dealings. By documenting essential deposit details, it aligns with similar formats like the Direct Deposit Authorization Form, ensuring precision. Whether used in businesses or personal scenarios, its structured format guarantees transparency and mitigates disputes.

Related Posts

-

FREE 5+ Sample Cleaning Receipt Forms in PDF

-

How to Write a Receipt Form? [ Types, Includes ]

-

FREE 6+ Asset Receipt Forms in MS Word | PDF

-

Cash Receipt Form

-

Lost Receipt Form

-

Donation Receipt Form

-

FREE 6+ Contractor Receipt Forms in PDF | MS Word

-

Delivery Receipt Form

-

FREE 7+ Service Receipt Forms in PDF | MS Word

-

What is Delivery Receipt Form? [ Definition, Policy and Procedures, Tips ]

-

What is Receipt Form? [ How to Fill, Uses ]

-

Receipt Form

-

FREE 9+ Sample Receipt Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Payment Receipt Forms in PDF | MS Word | MS Excel

-

Rental Receipt Form