Navigating the complexities of a Rhode Island Power of Attorney (POA) form can be straightforward with the right guidance. This essential tool empowers individuals to designate a trusted person to manage their affairs, be it financial, medical, or legal. Our comprehensive guide offers insightful tips and step-by-step instructions on effectively using a POA in Rhode Island, ensuring your decisions are respected and your future is secure. Perfect for those seeking clarity and control over their personal and legal matters.

What is the Rhode Island Power of Attorney Form?

A Rhode Island Power of Attorney (POA) form is a legal document that allows an individual, known as the principal, to appoint someone else, referred to as the agent or attorney-in-fact, to make decisions on their behalf. This form can cover a range of responsibilities, from financial and property management to healthcare decisions. The POA becomes effective based on the terms set by the principal, which can be immediately or upon the occurrence of a future event, often the principal’s incapacity. This tool is essential for planning and ensuring that your affairs are handled according to your wishes, especially in unforeseen circumstances.

What is the Best Sample Rhode Island Power of Attorney Form?

Creating a sample Rhode Island Power of Attorney (POA) form with fillable blanks involves providing a template that can be customized to fit individual needs. Below is a basic structure for such a form. Please note, for legal accuracy and compliance, it’s advisable to consult with a legal professional or use officially provided forms.

RHODE ISLAND POWER OF ATTORNEY FORM

Principal’s Information:

- Name: [__________]

- Address: [__________]

- Contact Number: [__________]

Agent’s Information:

- Name: [__________]

- Address: [__________]

- Contact Number: [__________]

Powers Granted (check applicable powers):

- Financial Decisions

- Real Estate Management

- Personal and Family Maintenance

- Business Operations

- Insurance Transactions

- Health Care Decisions

- Other: [__________]

Effective Date and Duration:

- This Power of Attorney shall become effective on [__________] and will (check one):

- Continue indefinitely unless revoked.

- Expire on [__________].

Special Instructions:

- [________________________________________________________________]

Durable Power of Attorney:

- This Power of Attorney shall (check one):

- Continue to be effective even if I become disabled, incapacitated, or incompetent.

- Not be durable.

Signatures:

- Principal’s Signature: [] Date: []

- Agent’s Signature: [] Date: []

Acknowledgment by Notary Public:

- State of Rhode Island

- County of [__________]

On [__________], before me, [Notary’s Name], personally appeared [Principal’s Name], known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

- Notary’s Signature: [__________]

- Notary’s Seal: [__________]

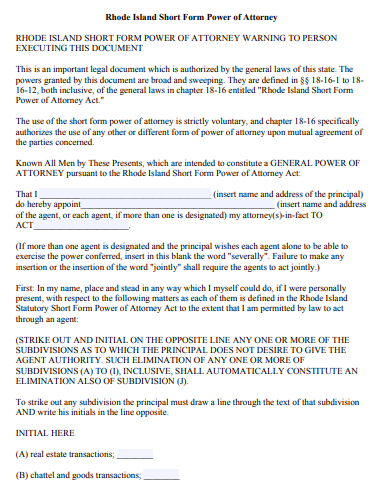

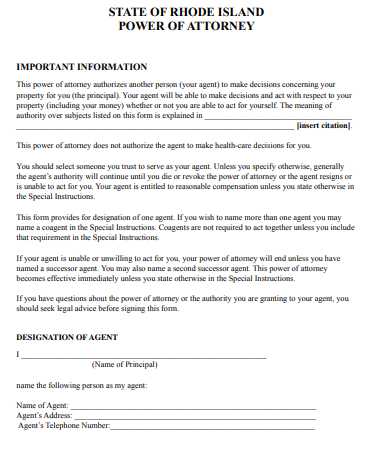

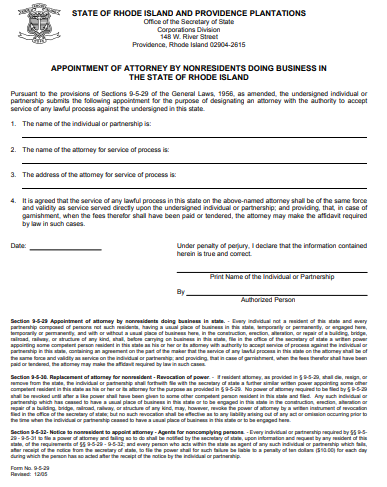

1. State of Rhode Island Power of Attorney Form

2. Rhode Island Simple Power of Attorney Form

3. Rhode Island Short Power of Attorney Form

4. Rhode Island Sample Power of Attorney Form

5. Rhode Island Printable Power of Attorney Form

6. Rhode Island Power of Attorney Form

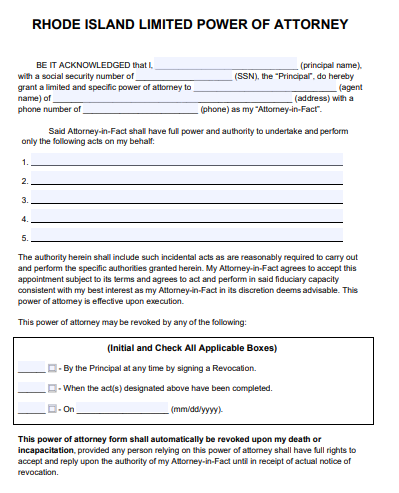

7. Rhode Island Limited Power of Attorney Form

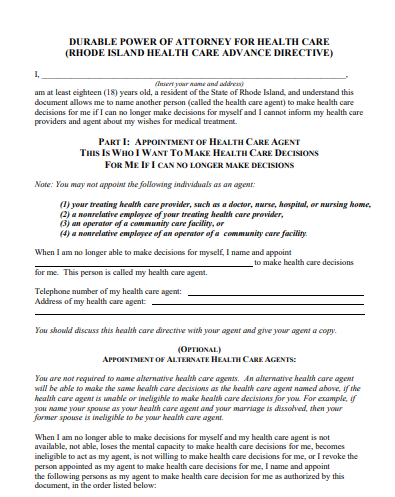

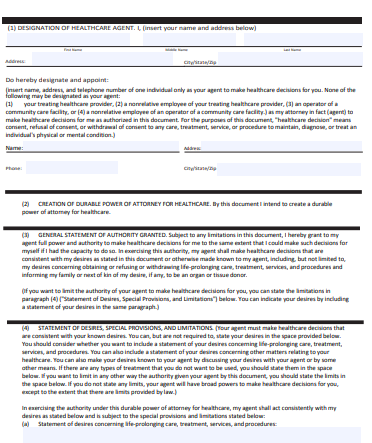

8. Rhode Island Health Care Power of Attorney Form

9. Rhode Island General Power of Attorney Form

10. Rhode Island Durable Power of Attorney Form

11. Rhode Island Blank Power of Attorney Form

How do I File a Power of Attorney in Rhode Island?

Filing a Power of Attorney (POA) in Rhode Island involves creating a legal document that grants an agent authority to act on your behalf. It’s essential to ensure the form complies with state laws and is signed by all parties. Once completed, the POA should be notarized and, depending on its type, may need to be filed with specific state offices or agencies.

Examples of Filing a POA in Rhode Island

1. Financial POA:

File with the Rhode Island Secretary of State if it involves real estate transactions.

2. Healthcare POA:

Keep copies with healthcare providers and the agent.

3. Durable POA:

Notarize and keep copies with financial institutions.

4. Limited POA:

File with relevant entities, like the DMV for vehicle-related matters.

5. General POA:

Notarize and distribute copies to relevant parties, such as banks or lawyers.

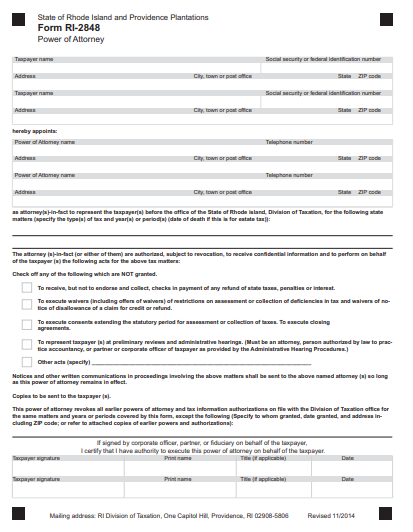

What is the Form for Power of Attorney for Rhode Island Taxes?

The Rhode Island tax power of attorney form, typically known as Form RI-2848, is used to authorize an individual, usually a tax professional, to represent you in tax matters before the Rhode Island Division of Taxation. This form allows your agent to receive confidential information and make decisions regarding your taxes.

Examples of Using RI Tax POA

1. Appointing a CPA:

Authorize a certified public accountant to handle tax filings.

2. Tax Dispute Representation:

Use for representation in tax disputes or audits.

3. Tax Return Preparation:

Allow a tax preparer to file your state tax returns.

4. Tax Payment Arrangements:

Authorize an agent to set up payment plans.

5. Tax Information Access:

Grant access to tax records for estate planning.

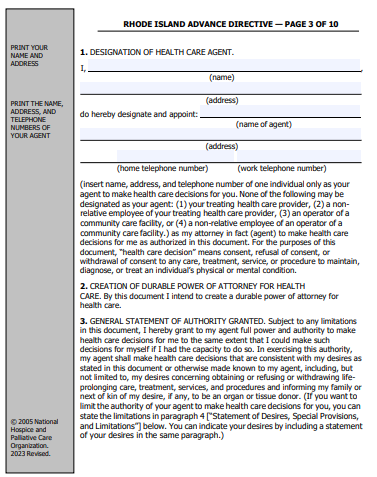

What is the Durable Power of Attorney Statute in Rhode Island?

The durable power of attorney statute in Rhode Island, found in Title 18 of the Rhode Island General Laws, outlines the legal framework for creating a POA that remains in effect even if the principal becomes incapacitated. This statute ensures that the agent can continue to make decisions on behalf of the principal, covering financial, legal, and sometimes health care decisions.

Examples of Durable POA in Rhode Island

1. Healthcare Decisions:

Make medical decisions if the principal is incapacitated.

2. Financial Management:

Handle banking and investment decisions.

3. Real Estate Transactions:

Manage or sell real estate properties.

4. Legal Matters:

Represent the principal in legal proceedings.

5. Personal Affairs:

Make decisions about personal care and living arrangements.

What is a Minor Power of Attorney in Rhode Island?

A minor power of attorney in Rhode Island is a legal document that allows a parent or guardian to grant another adult the authority to make decisions and take care of their child for a temporary period. This can include decisions about education, health care, and general welfare.

Examples of Minor POA in Rhode Island

1. Temporary Guardianship:

During a parent’s absence due to travel or illness.

2. Educational Decisions:

Enroll the child in school and make educational choices.

3. Medical Care:

Make healthcare decisions in the parent’s absence.

4. Day-to-Day Activities:

Authority to manage daily activities and needs.

5. Emergency Situations:

Act on behalf of the child in urgent scenarios.

Is Rhode Island an Attorney State for Real Estate?

Rhode Island is considered an attorney state for real estate transactions. This means that an attorney is typically required to be involved in the process of buying or selling real estate. The attorney ensures that the transaction complies with state laws and that the interests of their client are protected.

Examples of Attorney Involvement in RI Real Estate

1. Closing Process:

Overseeing the closing and document signing.

2. Title Search:

Conducting title searches and resolving any issues.

3. Contract Review:

Reviewing and advising on real estate contracts.

4. Legal Compliance:

Ensuring compliance with state real estate laws.

5. Dispute Resolution:

Assisting in resolving any disputes that arise.

Does a Power of Attorney Need to be Notarized in Rhode Island?

In Rhode Island, a power of attorney must be notarized to be legally valid. Notarization provides a layer of security by verifying the identity of the signer and ensuring that the signature is genuine and made willingly.

Examples of Notarization in Rhode Island POA

1. Financial POA:

Notarization for bank and financial institution acceptance.

2. Healthcare POA:

Notarized to ensure acceptance by medical providers.

3. Real Estate POA:

Mandatory notarization for real estate transactions.

4. Durable POA:

Notarization to uphold durability in case of incapacity.

5. General POA:

Notarization for broad acceptance and legal validity.

Do I Need an Attorney to Sell My House in Rhode Island?

While it’s not legally required to have an attorney to sell a house in Rhode Island, it’s highly recommended. An attorney can provide valuable assistance in navigating the complexities of real estate transactions, ensuring legal compliance, and protecting your interests.

Examples of Attorney Assistance in Selling a House

1. Contract Review:

Ensuring the sales agreement is fair and legally sound.

2. Title Issues:

Resolving any title issues before the sale.

3. Closing Process:

Guiding through the closing process and documentation.

4. Legal Advice:

Providing legal advice on tax implications and liabilities.

5. Dispute Resolution:

Handling any disputes that arise during the sale.

How to Prepare a Rhode Island Power of Attorney Form

Preparing a Power of Attorney (POA) form in Rhode Island is a crucial process that requires attention to detail and an understanding of legal requirements. Here’s a step-by-step guide to help you navigate this process effectively:

- Determine the Type of POA Needed: Decide whether you need a General, Durable, Healthcare, or Limited POA based on the specific powers you want to grant.

- Choose the Agent Wisely: Select a trusted individual who will act in your best interests. This person should be responsible, trustworthy, and capable of handling the duties assigned.

- Draft the POA Document: You can use a template or consult an attorney to draft a POA form. Ensure it includes all necessary details like your name, the agent’s name, powers granted, and duration of the POA.

- Include Specific Powers and Limitations: Clearly outline the powers you are granting. Be as specific as possible to avoid any ambiguity.

- Comply with Legal Requirements: Ensure the document meets Rhode Island’s legal requirements, including being in writing, containing the date, and clearly stating the powers granted.

- Sign and Notarize the Document: Sign the POA in the presence of a notary public. Rhode Island law requires notarization for the POA to be legally valid.

- Provide Copies to Relevant Parties: Give a copy of the notarized POA to your agent and any institutions or individuals that may require it, such as banks or healthcare providers.

- Review and Update Regularly: Regularly review the POA and update it as necessary to reflect any changes in your situation or wishes.

Tips for Using Effective Rhode Island Power of Attorney Form

Once you have prepared your Rhode Island Power of Attorney form, using it effectively is key to ensuring your wishes are carried out as intended. Here are some tips for effective use:

- Communicate with Your Agent: Have a detailed discussion with your agent about your expectations and the extent of their powers. Clear communication can prevent misunderstandings.

- Inform Relevant Parties: Notify any relevant parties, such as family members, financial institutions, or healthcare providers, about the POA and provide them with the necessary documentation.

- Keep the Original Document Safe: Store the original POA document in a secure location, such as a safe deposit box, and let your agent know where it is kept.

- Regularly Review the POA: Circumstances change, and it’s important to review and possibly update your POA periodically to ensure it still reflects your current wishes.

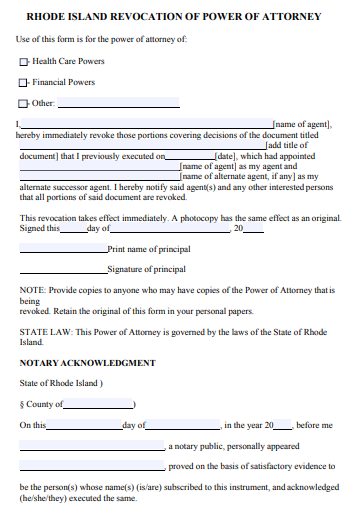

- Understand Revocation Process: Be aware of how to revoke the POA if needed. This typically requires a written notice to your agent and any institutions that have a copy of the POA.

- Avoid Co-Agents When Possible: Appointing multiple agents can lead to conflicts. If necessary, clearly define each agent’s role to avoid disputes.

- Consider a Successor Agent: Appoint a successor agent in case the original agent is unable or unwilling to serve.

- Seek Legal Advice: If you have any doubts or complex requirements, consult with a legal professional to ensure your POA is effective and compliant with Rhode Island laws.

By following these steps and tips, you can prepare and use a Rhode Island Power of Attorney form effectively, ensuring your affairs are managed according to your wishes.

How Can I Get a Rhode Island Power of Attorney Template for Free?

Free Rhode Island Power of Attorney templates are available online through legal resource websites. Ensure the template complies with Rhode Island laws for validity.

Who Should Have a Rhode Island PoA?

Anyone in Rhode Island seeking to ensure their affairs are managed during incapacity or absence should have a Power of Attorney. It’s essential for estate planning and unforeseen circumstances.

Which Type of Power of Attorney Do I Need in Rhode-Island?

The type of Power of Attorney in Rhode Island depends on your needs: General for broad powers, Durable for long-term planning, Medical for healthcare decisions, or Limited for specific tasks.

Do I Need a Lawyer to Review My Rhode Island PoA?

While not mandatory, having a lawyer review your Rhode Island Power of Attorney ensures legal accuracy and alignment with your intentions, especially for complex estates or specific wishes.

How Much Would I Normally Need to Pay to Get a Power of Attorney Form in Rhode Island?

Costs for a Rhode Island Power of Attorney form vary. Free templates are available, but professional legal services for personalized forms may range from nominal fees to several hundred dollars.

Is Anything Else Required After Making a Rhode Island Power of Attorney?

After creating a Rhode Island Power of Attorney, ensure it’s signed, notarized, and shared with relevant parties. Regularly review and update it as needed to reflect current wishes and circumstances.

Creating a Rhode Island Power of Attorney is a vital step in managing your affairs. By choosing the right type, understanding legal requirements, and ensuring proper execution, you can effectively safeguard your interests. Regular reviews and updates, along with informed decisions about agents and powers granted, will ensure that your Power of Attorney remains an effective tool for your personal and financial well-being.

Related Posts

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Massachusetts (MA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kentucky (KY) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Indiana (IN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Illinois (IL) Power of Attorney Form Download – How to Create Guide, Tips