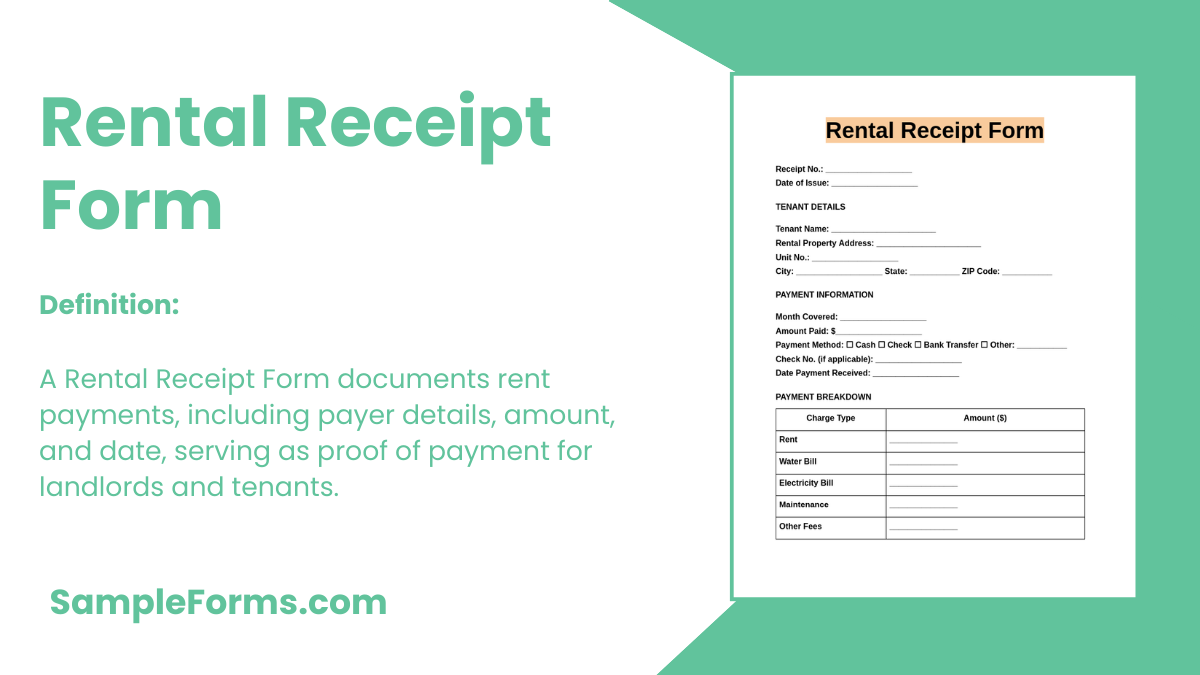

A Rental Receipt Form is essential for documenting rental payments, ensuring financial clarity between landlords and tenants. This structured Receipt Form serves as official proof of payment, preventing disputes and maintaining accurate records. Additionally, a Rental History Form helps tenants build a solid financial record, often required for future rentals. This guide provides examples, templates, and best practices to create a legally compliant rental receipt. Whether you’re a landlord ensuring smooth transactions or a tenant securing payment proof, a well-prepared receipt form is vital for organized rental management.

Download Rental Receipt Form Bundle

What is Rental Receipt Form?

A Rental Receipt Form is an official document that records rent payments made by a tenant to a landlord. It includes payment details such as date, amount, payment method, and property address. This receipt ensures transparency and prevents financial misunderstandings. Landlords use it to track income, while tenants rely on it as proof of timely payments. It is often required for rental applications, tax documentation, and lease renewals. Properly maintained receipts contribute to a seamless rental process, benefiting both landlords and tenants in financial and legal matters.

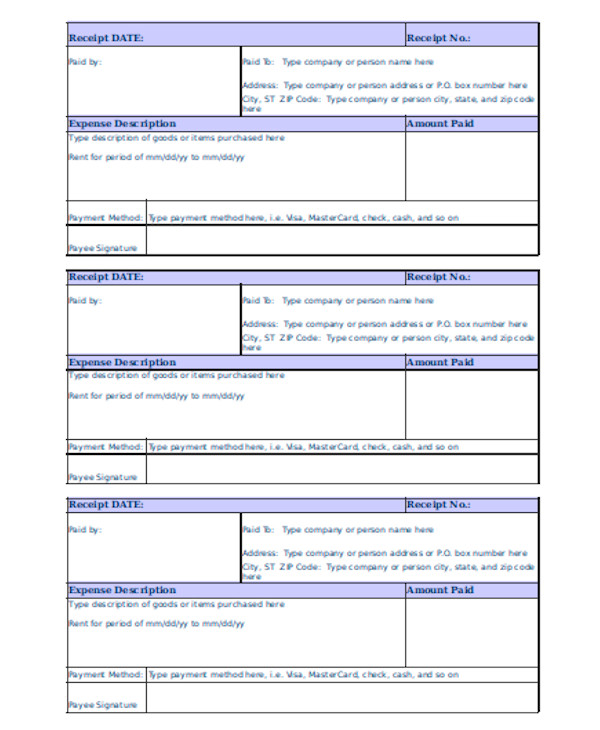

Rental Receipt Format

Receipt Details:

- Receipt Number: [Unique Identifier]

- Date of Payment: [Insert Date]

Landlord/Property Owner Information:

- Full Name: [Owner’s Name]

- Contact Information: [Phone Number/Email]

- Property Address: [Full Rental Property Address]

Tenant Information:

- Full Name: [Tenant’s Name]

- Contact Information: [Phone Number/Email]

Rental Payment Details:

- Payment Amount: [$ Amount]

- Payment Method: [Cash, Card, Bank Transfer]

- Rental Period Covered: [Start Date] to [End Date]

- Security Deposit Paid (if any): [$ Amount]

Additional Charges (if applicable):

- Late Fees: [$ Amount]

- Utility Charges: [$ Amount]

- Maintenance Fees: [$ Amount]

Acknowledgment & Signatures:

By signing below, the landlord confirms receipt of the payment and the tenant acknowledges the transaction.

Landlord’s Signature: ___________ Date: ___________

Tenant’s Signature: ___________ Date: ___________

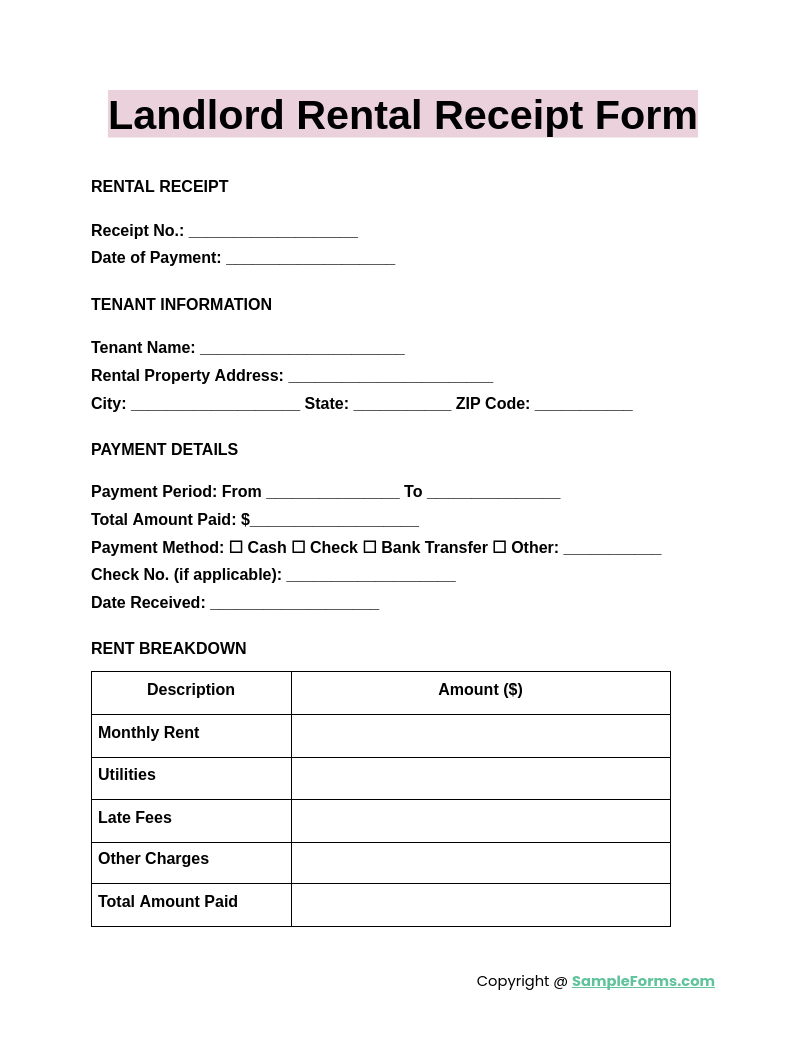

Landlord Rental Receipt Form

A Landlord Rental Receipt Form documents rental payments, ensuring financial clarity and preventing disputes. Similar to a Payment Receipt Form, it includes tenant details, payment method, rental period, and the landlord’s signature, serving as essential proof of transaction for both parties.

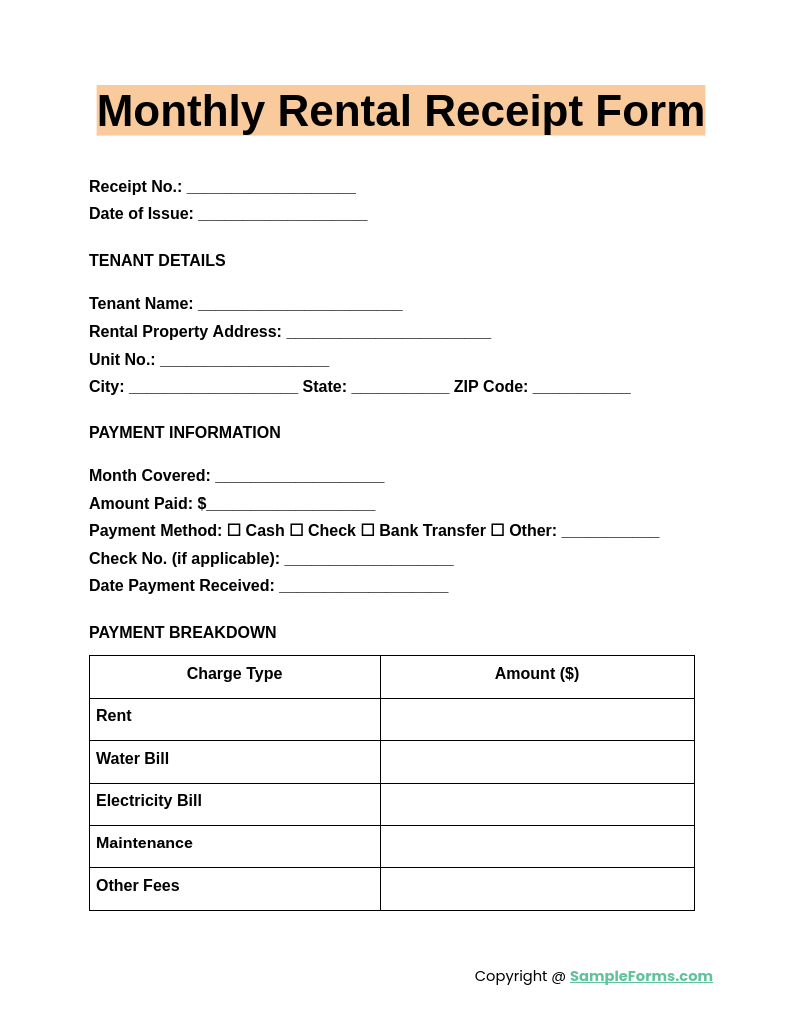

Monthly Rental Receipt Form

A Monthly Rental Receipt Form records recurring rent payments, ensuring tenants and landlords maintain proper financial documentation. Similar to a Restaurant Receipt Form, it includes payment date, amount, and rental period, helping with tax filings and rental history tracking.

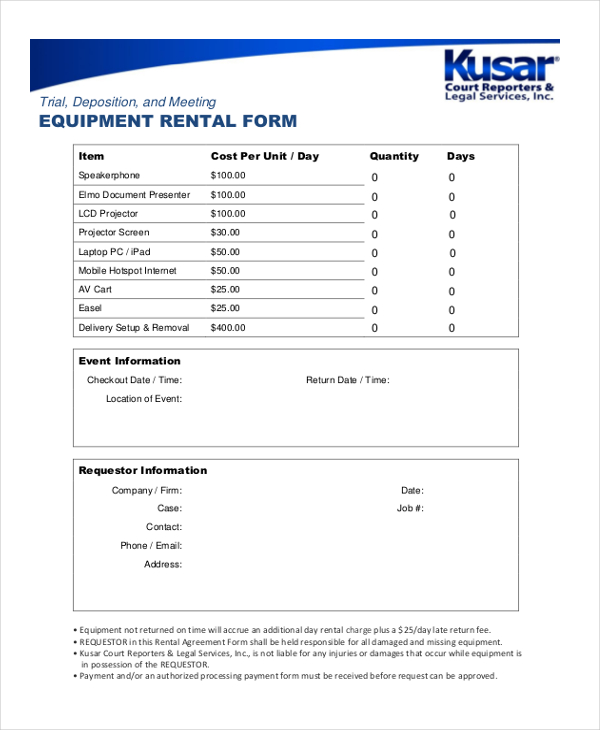

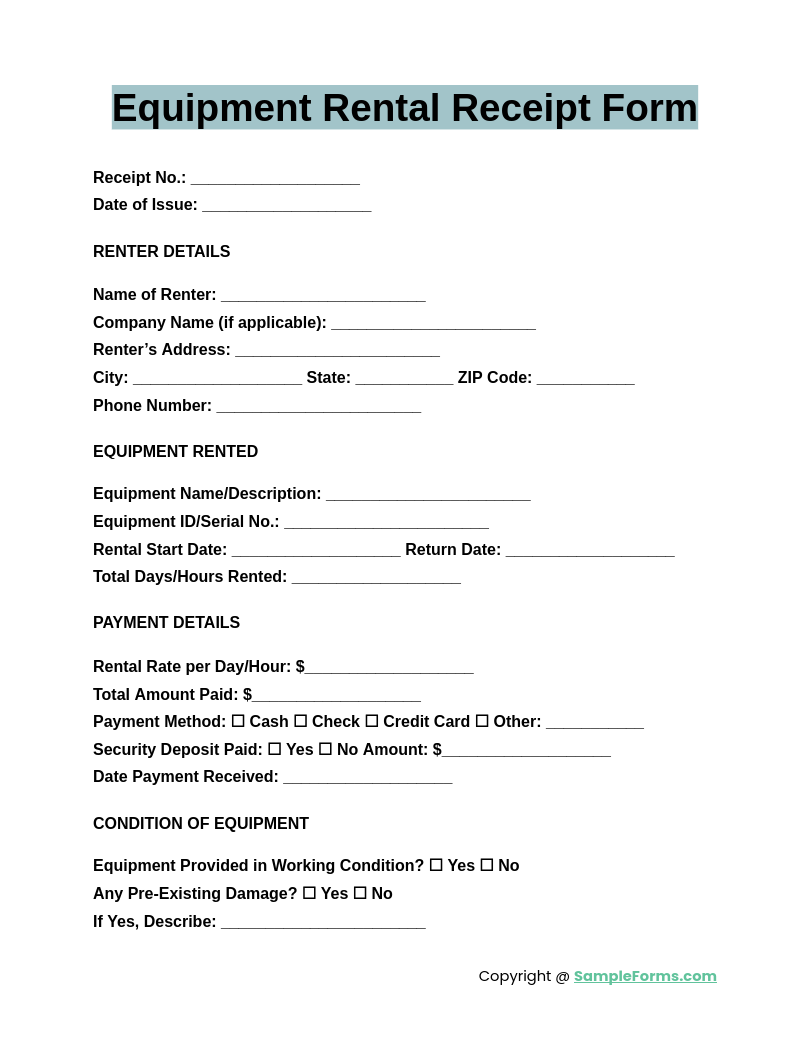

Equipment Rental Receipt Form

An Equipment Rental Receipt Form confirms payments for rented machinery, tools, or equipment. Like a Rent Receipt Form, it specifies rental duration, security deposits, and payment details, ensuring both parties acknowledge financial and usage terms.

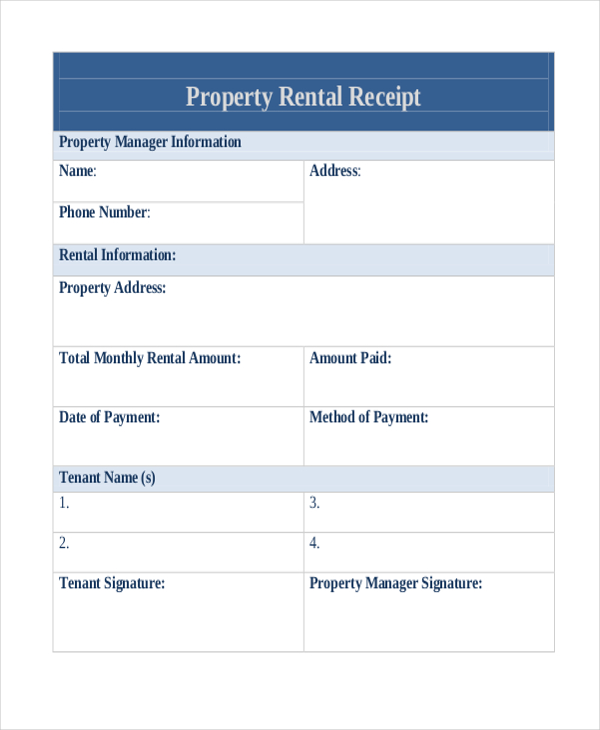

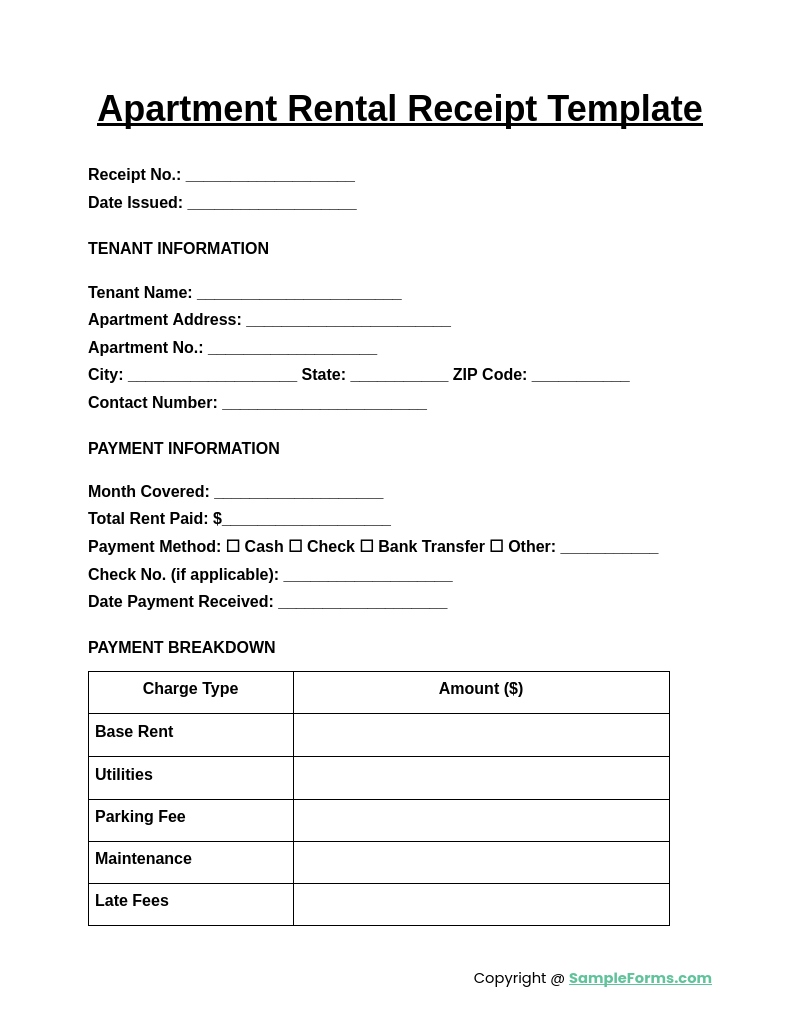

Apartment Rental Receipt Template

An Apartment Rental Receipt Template provides a structured format for recording rent transactions. Similar to a Hotel Receipt Form, it includes tenant details, rent amount, lease period, and payment confirmation, ensuring compliance with rental agreements and legal documentation.

Browse More Rental Receipt Forms

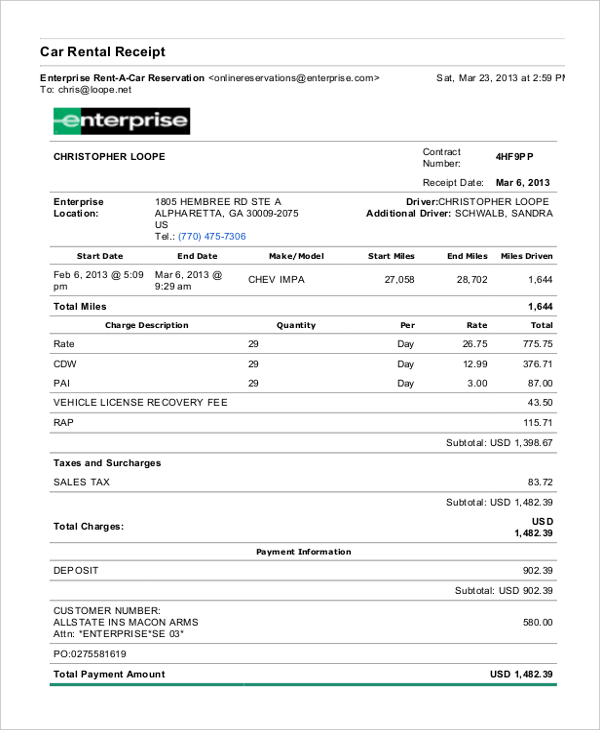

Sample Car Rental Receipt Form

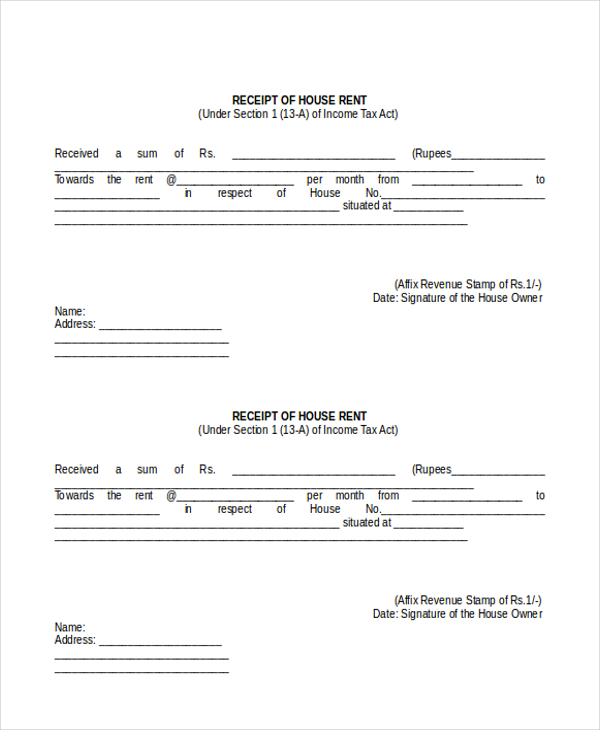

Receipt of House Rental Form in Word

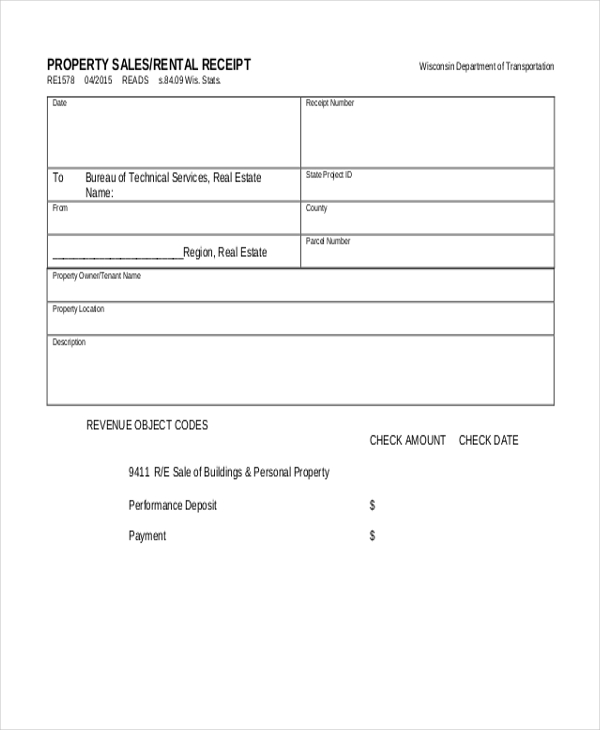

Sales Rental Receipt Transmittal Form

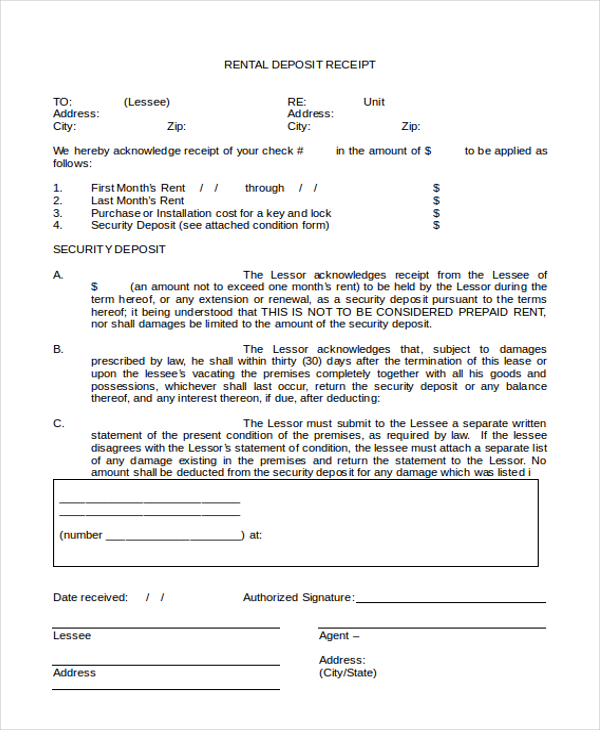

Free Rental Deposit Receipt Form

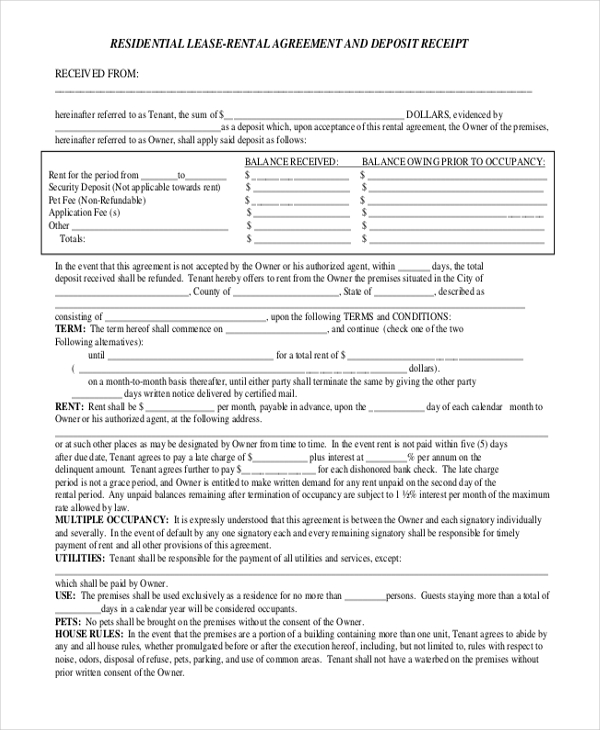

Residential Lease-Rental Agreement and Deposit Receipt

Equipment Rental Receipt Form Format

Example of Property Rental Receipt Form

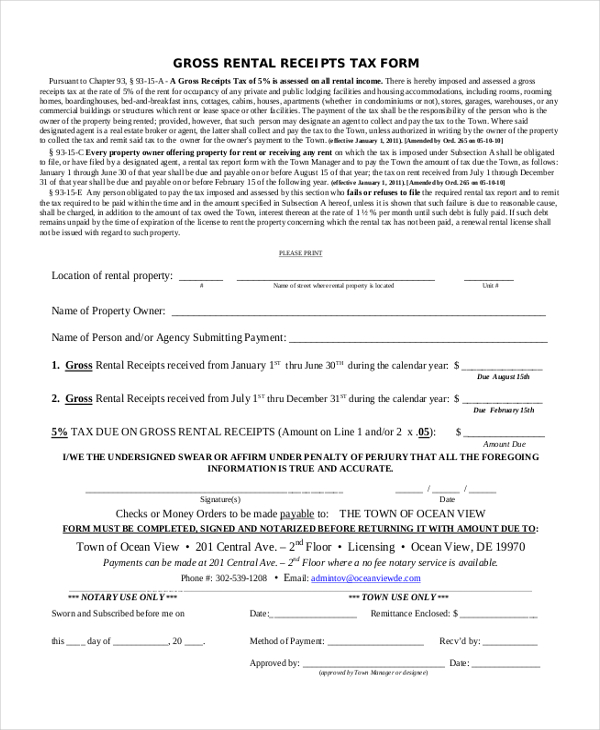

Gross Rental Receipts Tax Form

Simple Rental Receipt Form

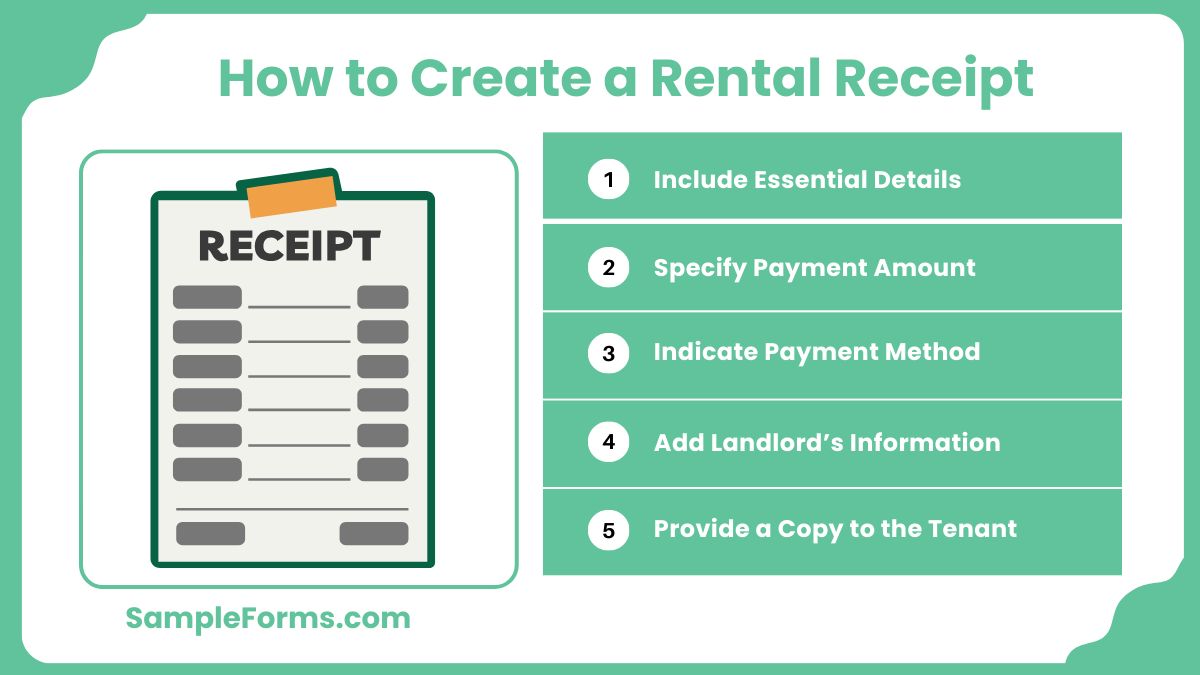

How to create a rental receipt?

A rental receipt serves as proof of payment between a landlord and tenant. Similar to a Cash Receipt Form, it ensures clear documentation of rental transactions.

- Include Essential Details: Add the tenant’s name, rental property address, and payment date.

- Specify Payment Amount: Clearly mention the rent paid, including any additional fees or deposits.

- Indicate Payment Method: Specify whether the payment was made via cash, check, or bank transfer.

- Add Landlord’s Information: Include the landlord’s full name, contact details, and signature for authentication.

- Provide a Copy to the Tenant: Ensure the tenant receives a copy of the receipt for their records.

What if I have no receipts for expenses?

Without receipts, tracking rental expenses can be challenging. Akin to a Donation Receipt Form, alternative documentation can help maintain accurate financial records.

- Use Bank Statements: Maintain bank records to show rent and expense-related transactions.

- Record Expenses in a Ledger: Keep a detailed log of rental payments and costs.

- Request Copies of Bills: Obtain duplicates of invoices for utilities, maintenance, or repairs.

- Use Digital Payment Records: Track online transactions as proof of payments.

- Consult a Tax Professional: Seek advice on acceptable proof of expenses for tax deductions.

How do I organize my receipts for rental property?

Proper receipt organization prevents financial confusion. Similar to a Sales Receipt Form, structured record-keeping ensures smooth financial tracking and tax compliance.

- Use a Filing System: Sort receipts by category, such as rent, maintenance, and utilities.

- Label Receipts Clearly: Note the purpose and date of each expense.

- Store Digital Copies: Scan receipts and store them in cloud-based storage.

- Separate Personal & Rental Expenses: Maintain different accounts for rental and personal finances.

- Review Monthly: Regularly check and update records to ensure accuracy.

What if my landlord refuses to give me a receipt?

A landlord is responsible for providing a rent receipt upon request. Similar to a Purchase Receipt Form, it confirms payments and protects tenant rights.

- Request in Writing: Send a formal request for a receipt via email or letter.

- Keep Proof of Payment: Retain bank statements or canceled checks as evidence.

- Use a Witness: Have someone present when handing over cash payments.

- Report to Authorities: File a complaint if a receipt is legally required but denied.

- Document Communication: Maintain records of all conversations regarding receipt requests.

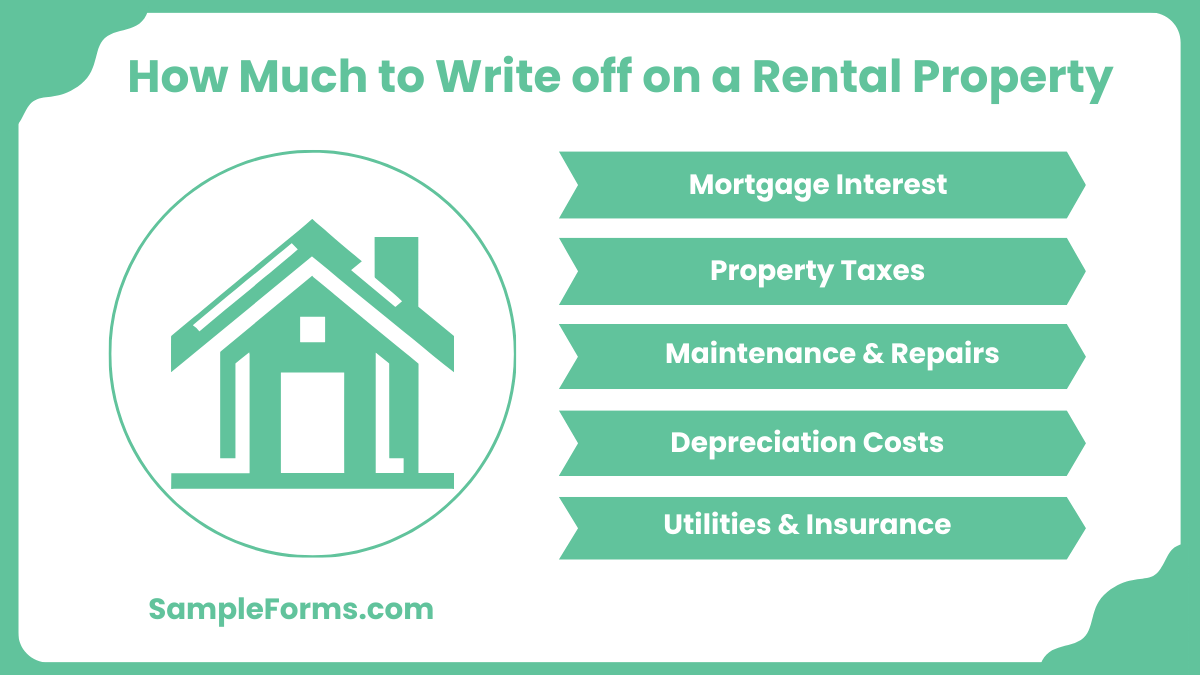

How much can I write off on a rental property?

Rental property owners can deduct several expenses from their taxable income. Similar to a Delivery Receipt Form, proper documentation ensures valid claims.

- Mortgage Interest: Deduct interest paid on property loans.

- Property Taxes: Include annual property tax payments in deductions.

- Maintenance & Repairs: Write off expenses for necessary property upkeep.

- Depreciation Costs: Claim deductions for property wear and tear over time.

- Utilities & Insurance: Deduct the cost of insurance and utilities if the landlord pays for them.

Who keeps the original rent receipt template?

The landlord usually keeps the original rent receipt for record-keeping, while the tenant receives a copy. Similar to a Deposit Receipt Form, it serves as proof of payment and protects both parties in financial transactions.

How to make a rent receipt pdf?

To create a rent receipt PDF, use an editable template, input payment details, and save the file. A Lost Receipt Form is useful if receipts are misplaced and need to be reissued for documentation.

What is a rent receipt called?

A rent receipt is often called a rental payment acknowledgment, serving as official proof of payment. Similar to a Car Receipt Form, it ensures transaction transparency and serves as a record for financial tracking.

How does the IRS know if I have rental income?

The IRS tracks rental income through tax filings, bank deposits, and third-party reports. Similar to a School Receipt Form, detailed documentation ensures compliance and prevents potential audits for landlords.

What states require rent receipts?

Several states require landlords to provide rent receipts upon request, especially for cash payments. Similar to a Daycare Receipt Form, this document confirms financial transactions and supports legal compliance in tenant-landlord agreements.

Can a rent receipt be handwritten?

Yes, a rent receipt can be handwritten as long as it includes essential details like payment amount, date, and signatures. A Contractor Receipt Form also follows similar guidelines for validating business transactions.

Do I need receipts for rental expenses?

Yes, receipts are necessary to track rental expenses for tax deductions and reimbursements. Similar to a Missing Receipt Form, alternative documentation like bank statements can serve as proof when receipts are unavailable.

Can my husband rent an apartment without me?

Yes, your husband can rent an apartment without you if his name is on the lease agreement. A Cleaning Receipt Form helps document security deposits related to rental property maintenance.

Does the IRS track rent payments?

The IRS does not track rent payments directly but verifies rental income through tax filings. Similar to an Asset Receipt Form, landlords maintain records to ensure tax compliance and avoid potential legal issues.

Does a landlord have to provide a copy of a lease?

Yes, landlords must provide tenants with a copy of the lease agreement upon signing. Similar to a Petty Cash Receipt Form, it serves as a formal record for legal and financial reference.

A structured Rental Verification Form is essential for maintaining accurate rental records. A well-documented Rental Receipt Form helps prevent disputes, track payments, and provide financial proof for both tenants and landlords. This guide highlights key elements, templates, and best practices to create a professional receipt. Whether used for residential or commercial rentals, keeping proper receipts ensures financial security, supports legal compliance, and strengthens rental history documentation. Proper record-keeping enhances trust, simplifies audits, and facilitates smooth rental transactions.

Related Posts

-

How to Write a Receipt Form? [ Types, Includes ]

-

FREE 6+ Asset Receipt Forms in MS Word | PDF

-

Cash Receipt Form

-

Lost Receipt Form

-

Donation Receipt Form

-

FREE 6+ Contractor Receipt Forms in PDF | MS Word

-

Delivery Receipt Form

-

FREE 7+ Service Receipt Forms in PDF | MS Word

-

What is Delivery Receipt Form? [ Definition, Policy and Procedures, Tips ]

-

What is Receipt Form? [ How to Fill, Uses ]

-

Deposit Receipt Form

-

Receipt Form

-

FREE 9+ Sample Receipt Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Payment Receipt Forms in PDF | MS Word | MS Excel

-

FREE 8+ Sample Donation Receipt Forms in PDF | Excel