A Rental History Form is a crucial document used by landlords and property managers to assess a tenant’s rental background. This record helps verify payment consistency, lease compliance, and overall rental behavior. A well-structured Rental Verification Form ensures transparency, reducing risks for property owners and increasing a tenant’s chances of approval. Whether you’re renting a house or apartment, maintaining an updated History Form strengthens your credibility. In this guide, we’ll cover essential components, templates, and best practices to create an accurate rental history record, ensuring a hassle-free rental application process.

Download Rental History Form Bundle

What is Rental History Form?

A Rental History Form is a document used to track a tenant’s past rental details, including previous addresses, landlord contacts, lease terms, and payment records. This form provides landlords with insight into a tenant’s reliability and rental behavior. It serves as a reference check, helping landlords assess risks before approving a new lease. Tenants with a positive rental history often find it easier to secure new housing. By providing a clear and accurate rental history, tenants improve their credibility and increase their chances of lease approval.

Rental History Format

Tenant Personal Information

Applicant Details:

- Full Name

- Contact Information

- Social Security Number (if required)

Previous Rental Addresses

Rental Property 1:

- Address

- Landlord’s Name and Contact

- Lease Period (Start and End Dates)

Rental Property 2:

- Address

- Landlord’s Name and Contact

- Lease Period (Start and End Dates)

Rental Payment History

Monthly Rent Amounts:

- Payment Consistency and Timeliness

- Late Payments or Outstanding Balances

Security Deposit Records:

- Refund Status and Deductions

Tenant Conduct and Lease Compliance

Property Maintenance and Rule Adherence:

- Complaints or Violations Reported

- Evictions or Legal Issues (if any)

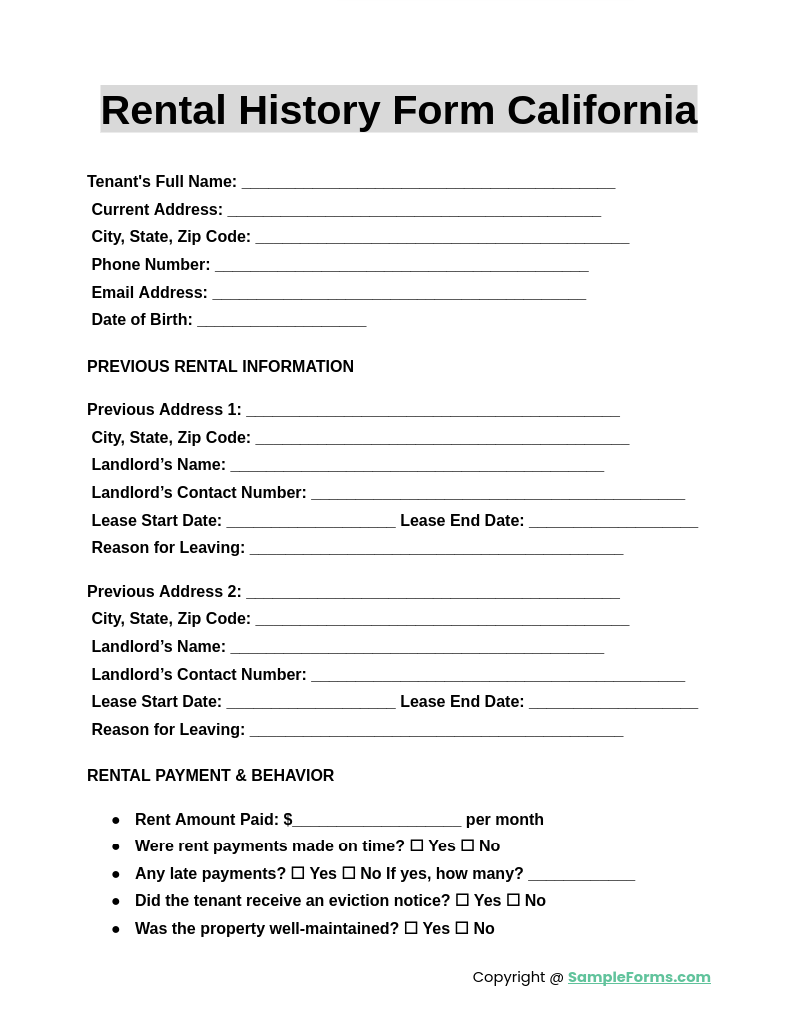

Rental History Form California

A Rental History Form California verifies a tenant’s rental background for landlords and property managers. Similar to a Month to Month Rental Agreement Form, it provides details about previous rentals, payment history, and landlord references, ensuring a smooth leasing process.

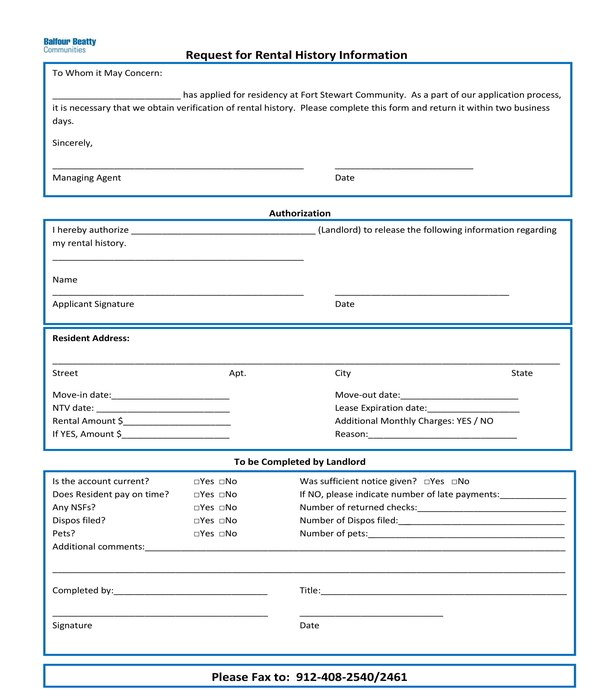

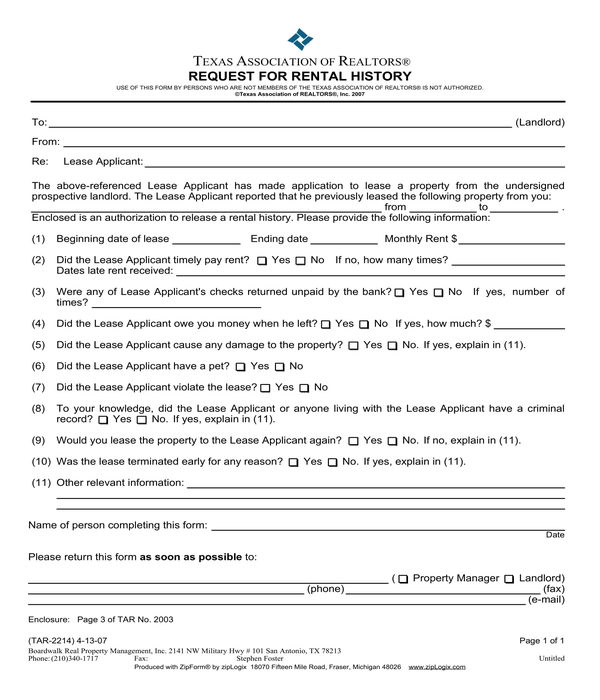

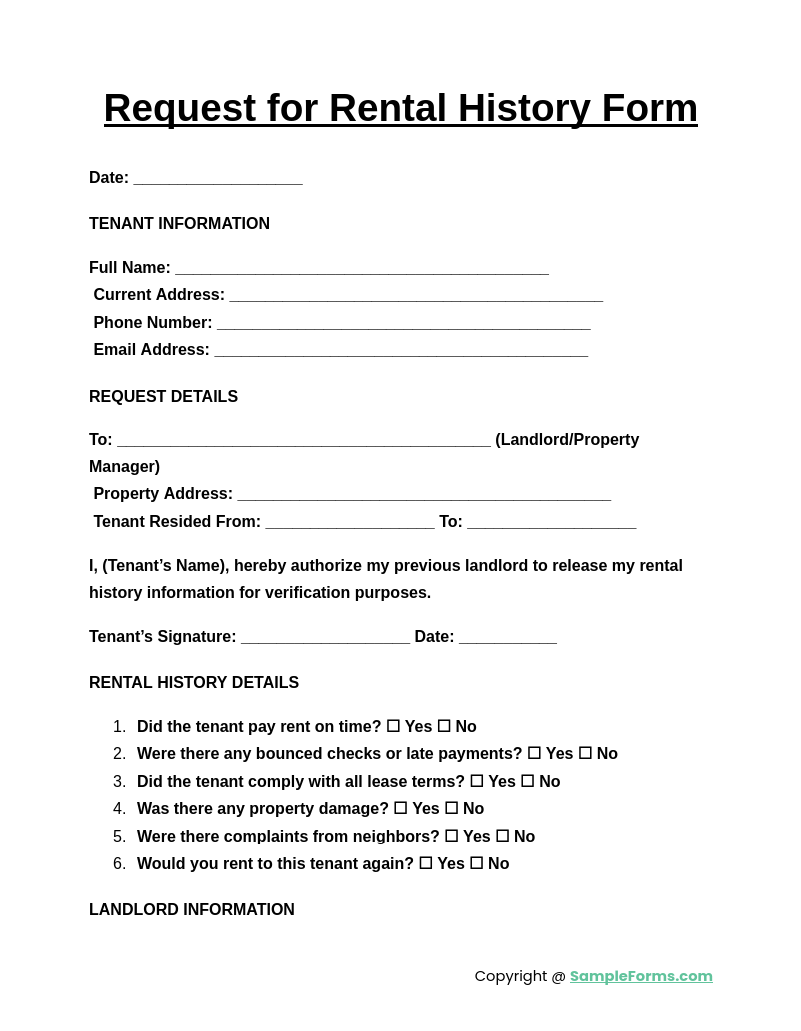

Request for Rental History Form

A Request for Rental History Form is used by tenants or landlords to obtain a rental record. Like a Commercial Rental Agreement Form, it helps verify past leases, payment consistency, and tenant behavior before approving a new rental application.

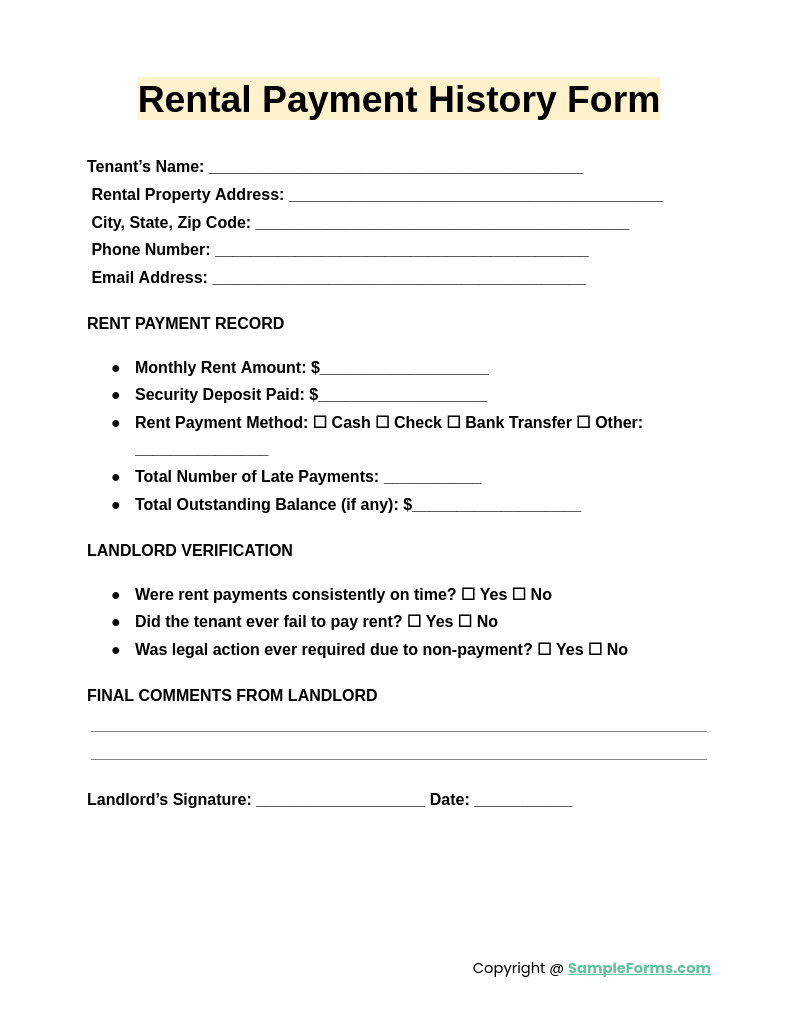

Rental Payment History Form

A Rental Payment History Form tracks past rental payments, ensuring tenants have a reliable financial record. Similar to a Rental Lease Agreement Form, it provides landlords with proof of timely payments and financial responsibility for rental approval.

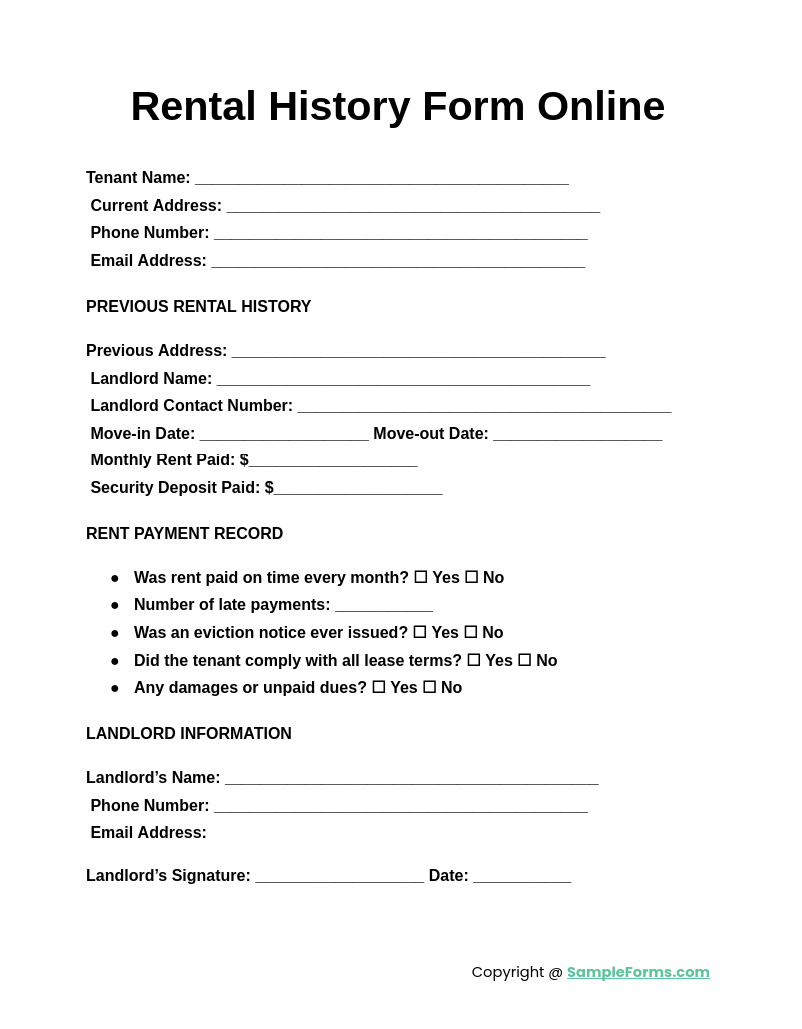

Rental History Form Online

A Rental History Form Online allows tenants to submit rental records digitally. Just like a Trailer Rental Agreement Form, it streamlines documentation, making it easier for landlords to verify past rental history quickly and efficiently.

Browse More Rental History Forms

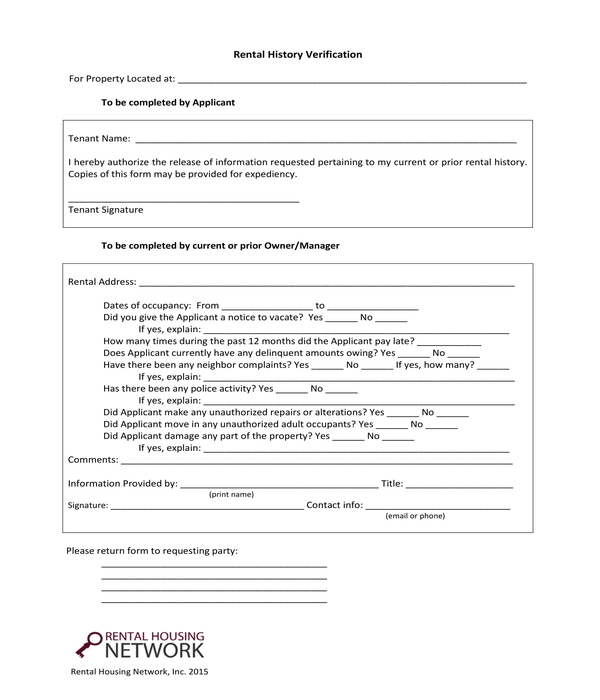

Rental History Verification Form

Rental History Verification Request Form

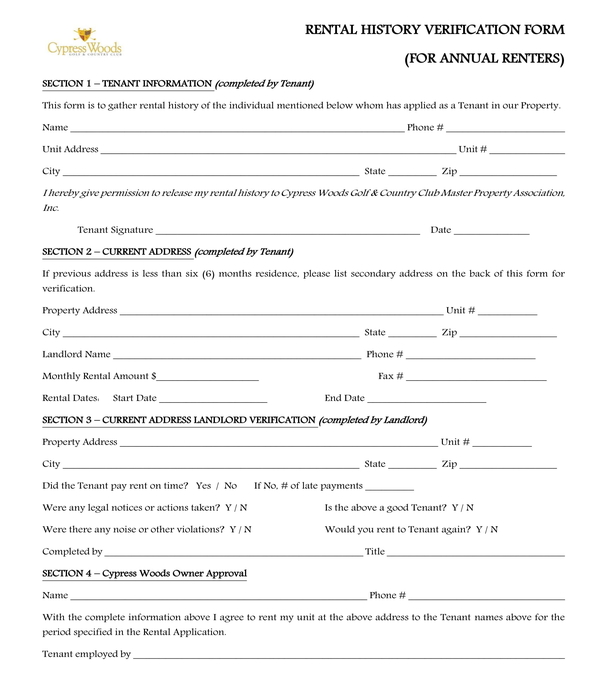

Annual Renters Rental History Verification Form

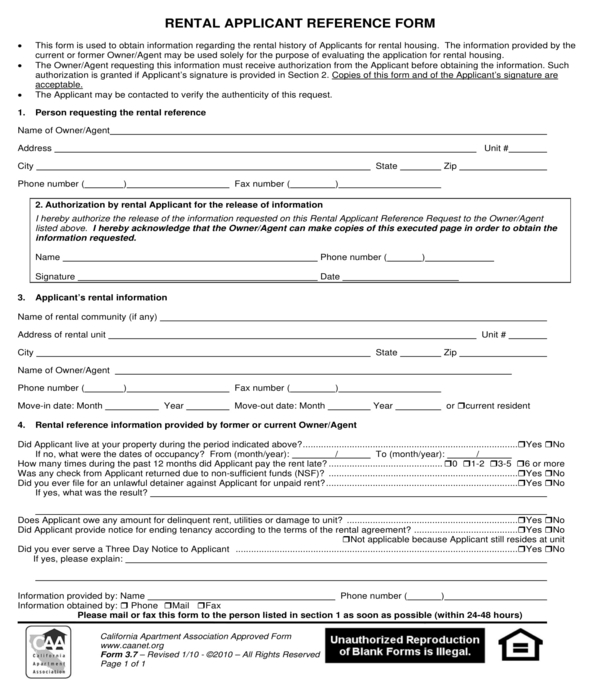

Rental Application Reference Form

Rental History Information Request Form

Rental History Request Form

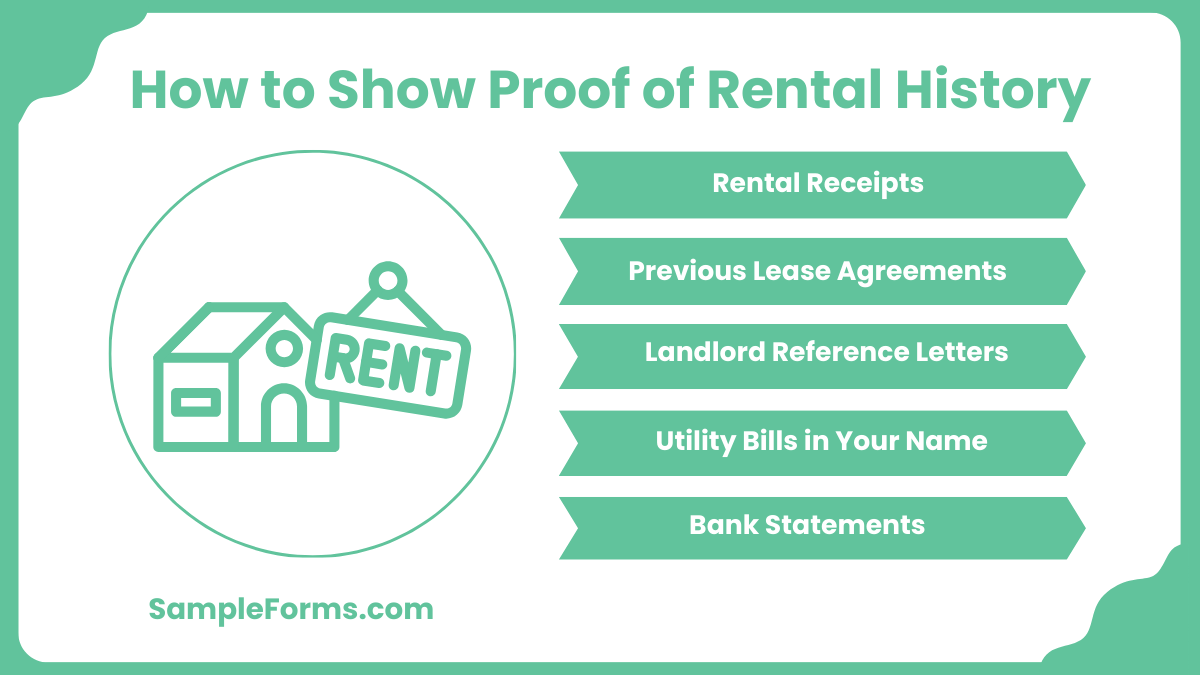

How can I show proof of rental history?

Providing proof of rental history is essential when applying for a new lease. Proper documentation helps landlords assess your reliability as a tenant.

1. Rental Receipts: Keep copies of each Rental Receipt to prove on-time rent payments and financial responsibility.

2. Previous Lease Agreements: Provide copies of past lease contracts to verify rental duration and terms.

3. Landlord Reference Letters: Obtain written statements from previous landlords confirming payment history and rental behavior.

4. Utility Bills in Your Name: Show consistent utility payments at previous rental addresses as additional proof.

5. Bank Statements: Demonstrate regular rent payments by providing transaction records from your bank account.

How do I run my own rental history report?

Running your rental history report allows you to check for inaccuracies before applying for a new lease. Follow these steps to get an accurate record.

1. Check Credit Reports: Review your credit report for rental-related information like past evictions or unpaid rent.

2. Request Tenant Screening Reports: Use online services to obtain a background check similar to what landlords use.

3. Contact Previous Landlords: Ask for copies of past House Rental Contract agreements and landlord verification letters.

4. Gather Payment Records: Collect rental receipts, bank statements, and utility bills to verify payment consistency.

5. Verify Public Records: Check court records for any rental-related judgments or disputes.

How far back does rental history go?

Rental history typically covers the past seven years, but landlords may look further depending on the property’s requirements.

1. Standard Reporting Period: Most tenant screening services include rental history for the last seven years.

2. Landlord Preferences: Some landlords may review records from past leases, including a House Rental Application from over a decade ago.

3. Credit and Eviction Reports: Credit reports track rental-related debts indefinitely, while eviction records usually last for seven years.

4. State Laws and Regulations: Some states limit how far back rental history checks can go.

5. Rental Verification Practices: Landlords may contact past property managers beyond seven years if necessary.

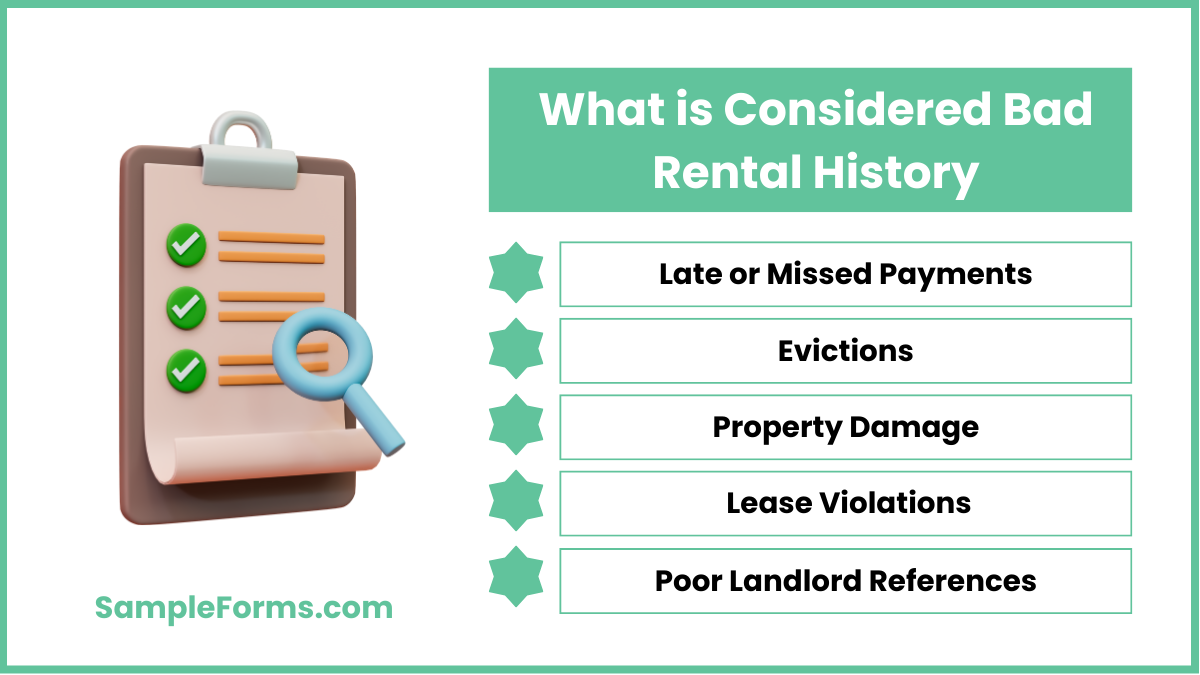

What is considered bad rental history?

Bad rental history can reduce your chances of securing a lease. Landlords assess these factors before approving applications.

1. Late or Missed Payments: Repeated late rent payments or unpaid balances on a Parking Space Rental Agreement Form can raise concerns.

2. Evictions: Past evictions due to lease violations, non-payment, or property damage significantly impact rental approval.

3. Property Damage: Records of excessive damage beyond normal wear and tear create red flags for landlords.

4. Lease Violations: Breaking rental terms, unauthorized subletting, or illegal activities can negatively affect your rental reputation.

5. Poor Landlord References: Negative feedback from previous landlords regarding behavior or rent payments can lead to application rejection.

How to apply without rental history?

If you have no rental history, you can still secure a lease by providing alternative proof of reliability and financial stability.

1. Use a Co-Signer: A financially stable guarantor can sign alongside you, ensuring the landlord receives rent payments.

2. Show Proof of Income: Provide pay stubs, tax returns, or financial statements to demonstrate your ability to afford rent.

3. Offer a Larger Deposit: Paying a higher security deposit can reassure landlords when signing Weekly Rental Agreements.

4. Provide Character References: Professional or personal references can vouch for your responsibility and reliability.

5. Find Private Landlords: Independent property owners may have more flexible requirements than large property management companies.

What is a good rental history?

A good rental history includes on-time payments, no evictions, and positive landlord references. A Rental Agreement Form showing lease compliance improves approval chances for future rentals.

Can landlords look up rental history?

Yes, landlords can check rental history through credit reports, tenant databases, and references. A Rental Application typically requires consent to access past rental records.

What if I don’t have any rental history?

Without rental history, offer proof of income, references, or a co-signer. A completed Rental Application Form helps demonstrate financial stability and reliability to potential landlords.

What does bad rental history look like?

Bad rental history includes missed payments, evictions, lease violations, or negative landlord feedback. A Rental Deposit Form with unpaid balances can also be a red flag for landlords.

Can you check rental history for free?

Yes, tenants can request rental reports from credit bureaus or ask landlords directly. Some services provide limited access, like a Garage Parking Rental Agreement Form check.

What is the best way to check rental history?

The best way is through tenant screening services, credit reports, and past landlord references. A Vacation Rental Agreement Form may also serve as verification.

Does living with your parents count as rental history?

No, living with parents doesn’t count as rental history. However, a Rental Contract Form for a shared household may help establish credibility.

Can you get in trouble for lying about rental history?

Yes, falsifying rental history on applications can lead to denial, eviction, or legal action. Landlords verify details using a Salon Booth Rental Agreement Form or past lease records.

How long does a broken lease stay on your rental history?

A broken lease stays on rental history for seven years. An unpaid Apartment Rental Agreement balance may negatively impact future rental approvals.

Why do apartments check rental history?

Apartments check rental history to assess reliability, payment consistency, and lease compliance. A Massage Rental Agreement record helps landlords determine tenant responsibility.

A well-documented Room Rental Agreement is essential for both tenants and landlords. It helps establish a tenant’s credibility, ensuring a smoother rental approval process. Keeping a detailed Rental History Form allows landlords to verify past rental behavior, reducing risks associated with missed payments or property damage. For tenants, having a transparent rental record improves their chances of securing a lease without delays.

Related Posts Here

-

Mobile Home Bill of Sale

-

Landlord Consent Form

-

60-Day Notice to Vacate Form

-

Financial Statement Form

-

Product Evaluation Form

-

Construction Contract

-

School Receipt Form

-

Restaurant Training Form

-

Daily Cash Log

-

Volleyball Evaluation Form

-

Holding Deposit Agreement Form

-

License Agreement Short Form

-

Fund Transfer Form

-

Business Financial Statement Form

-

Sales Proposal Form