A Receipt of Payment Form is an essential document for acknowledging financial transactions between parties. It ensures clarity, transparency, and accountability in payments. This guide explores the key features, benefits, and uses of this form in different scenarios. Whether for personal or business purposes, a Receipt Form provides accurate records that protect both payer and payee. Additionally, it simplifies audits and eliminates confusion about payment terms. Dive into this comprehensive guide for practical examples and tips on using a Payment Form effectively to enhance financial management.

Download Receipt of Payment Form Bundle

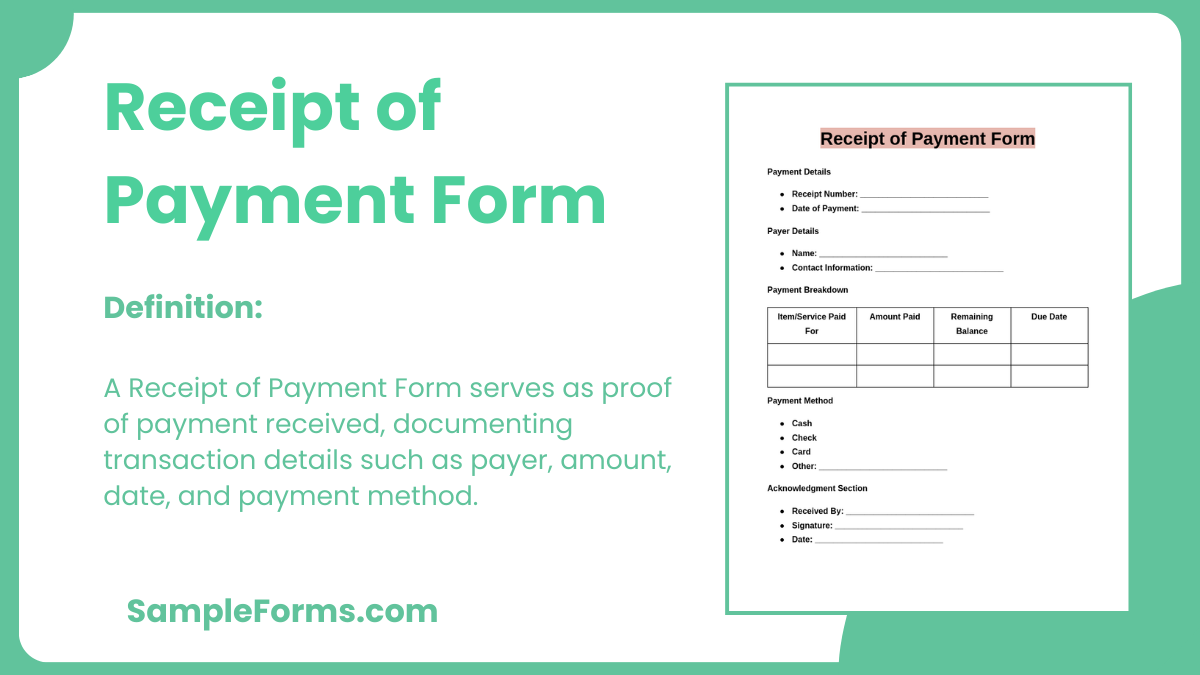

What is Receipt of Payment Form?

A Receipt of Payment Form is a formal document that acknowledges the transfer of money from one party to another. It records essential details such as the payer, payee, amount, date, and purpose of payment. Often used in personal, business, or legal transactions, it provides proof of payment and safeguards against disputes. This form is crucial for maintaining accurate financial records, promoting transparency, and ensuring both parties agree on the terms of the payment.

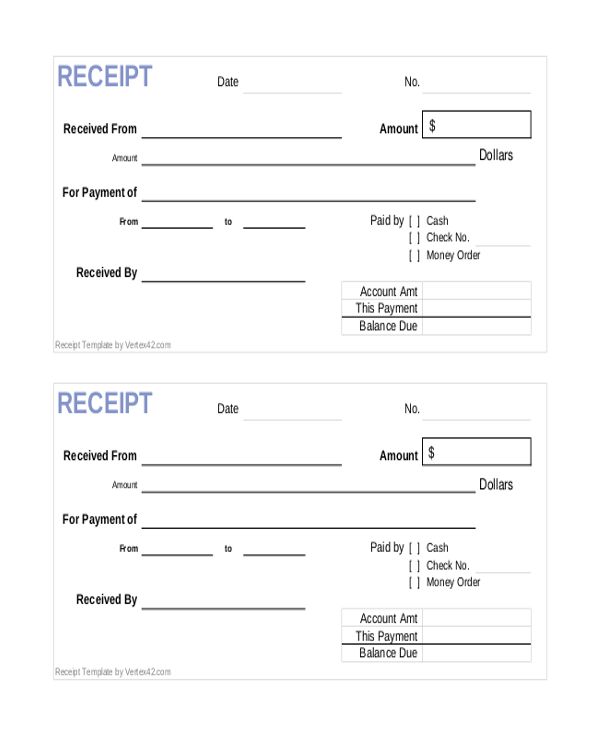

Receipt of Payment Format

Payment Details

Receipt Number: ____________________________

Payment Date: ____________________________

Amount Paid: ____________________________

Payment Method: ____________________________ (Cash / Check / Card / Bank Transfer)

Reference Number (if applicable): ____________________________

Payer Information

Name: ____________________________

Address: ____________________________

Contact Number: ____________________________

Purpose of Payment

Description of Services/Products: ____________________________

Acknowledgment

By signing below, I confirm receipt of the above payment and that the information is accurate to the best of my knowledge.

Signature Section

Payer Signature: ____________________________ Date: _________________

Receiver Signature: ____________________________ Date: _______________

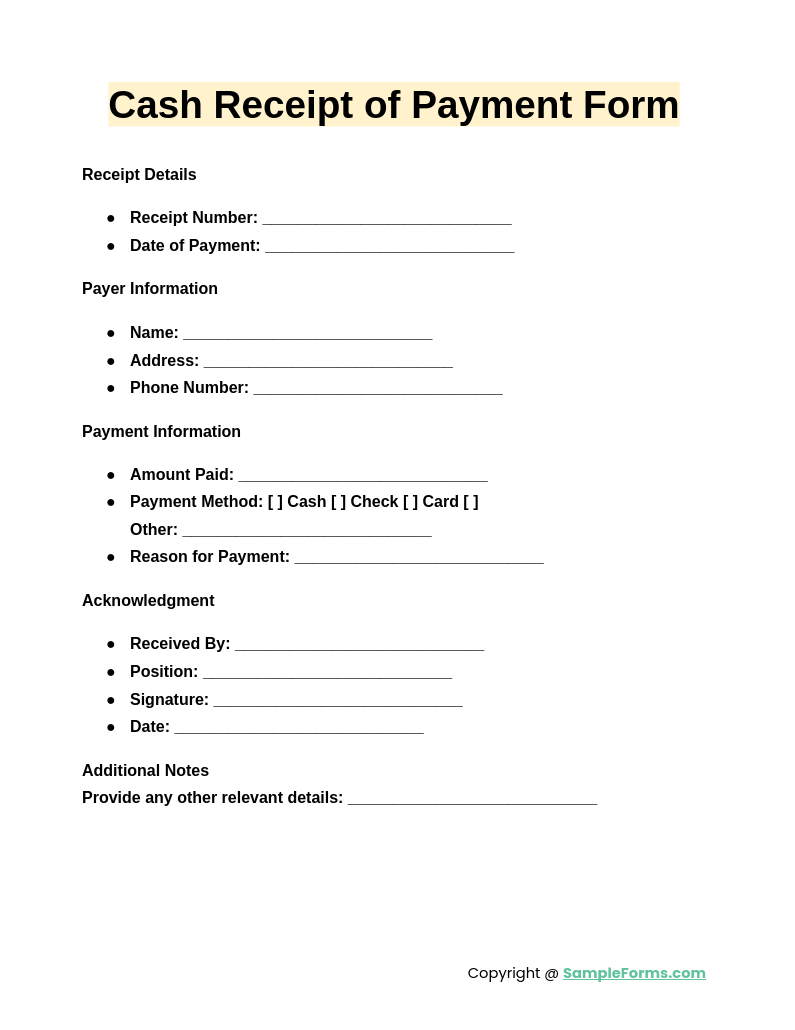

Cash Receipt of Payment Form

A Cash Receipt of Payment Form is crucial for recording cash transactions accurately. Similar to a Payment Receipt Form, it includes payer and payee details, transaction date, and payment amount to ensure accountability and transparency in cash dealings.

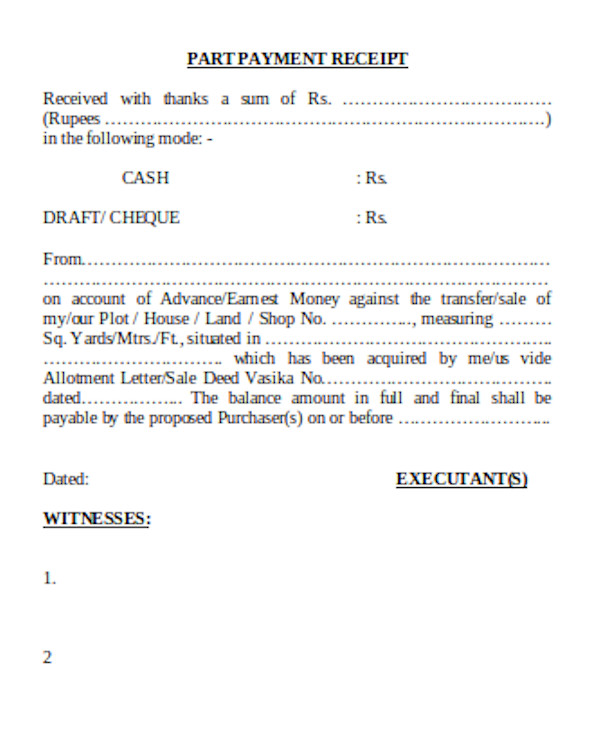

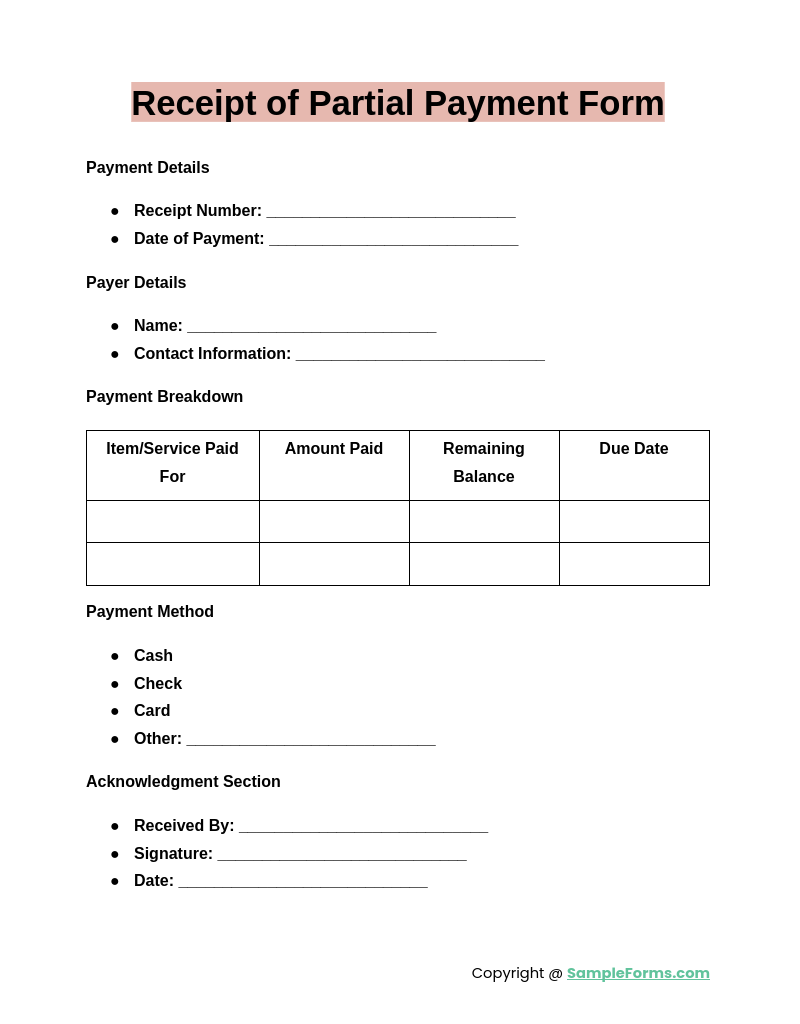

Receipt of Partial Payment Form

A Receipt of Partial Payment Form is used when payments are made in installments. Like a Rent Receipt Form, it specifies the amount paid, outstanding balance, and payment terms, ensuring clarity and agreement between both parties.

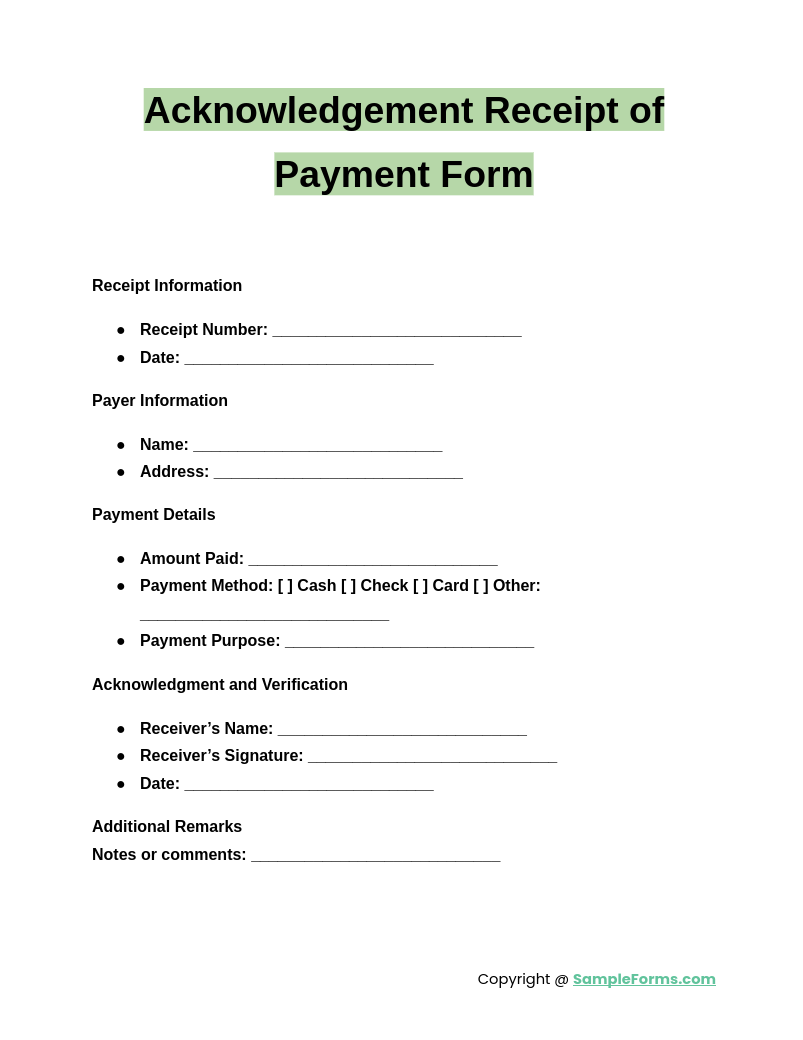

Acknowledgement Receipt of Payment Form

An Acknowledgement Receipt of Payment Form formally confirms a payment has been received. Comparable to a Hotel Receipt Form, it details transaction information, payment method, and parties involved to ensure comprehensive documentation for reference.

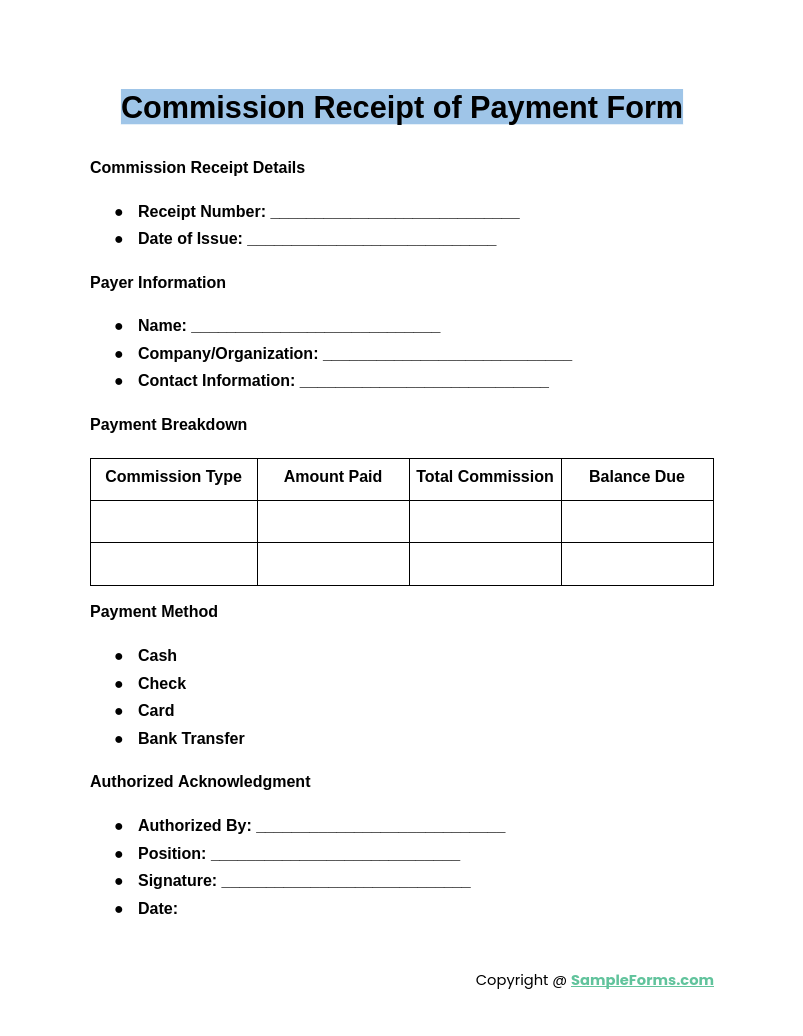

Commission Receipt of Payment Form

A Commission Receipt of Payment Form records commission payments between businesses or individuals. Similar to a Restaurant Receipt Form, it includes payer, payee, and payment specifics, guaranteeing accurate records and eliminating potential disputes over commissions.

Browse More Receipt of Payment Forms

Sample Cash Receipt Form

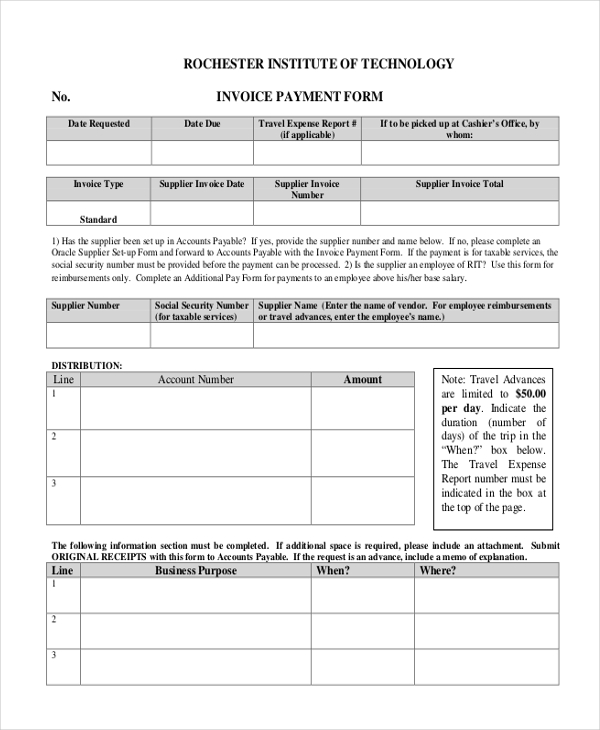

Invoice Payment Form

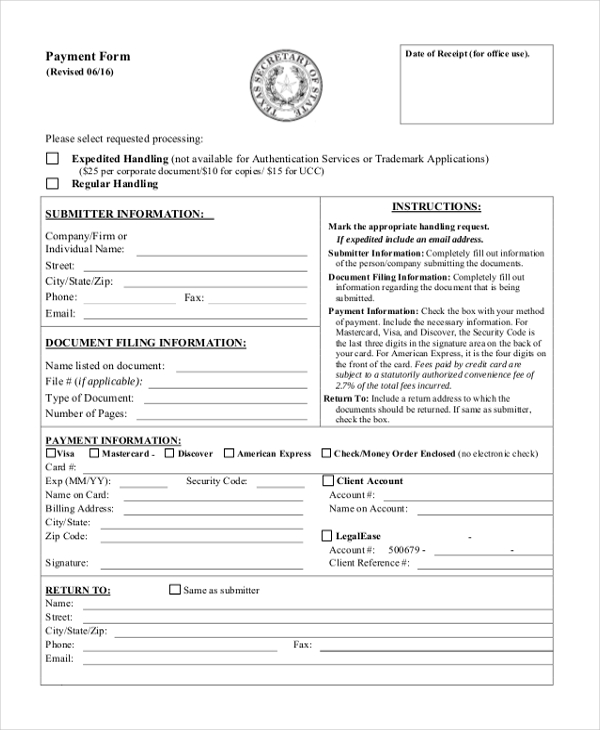

Sample Payment Form

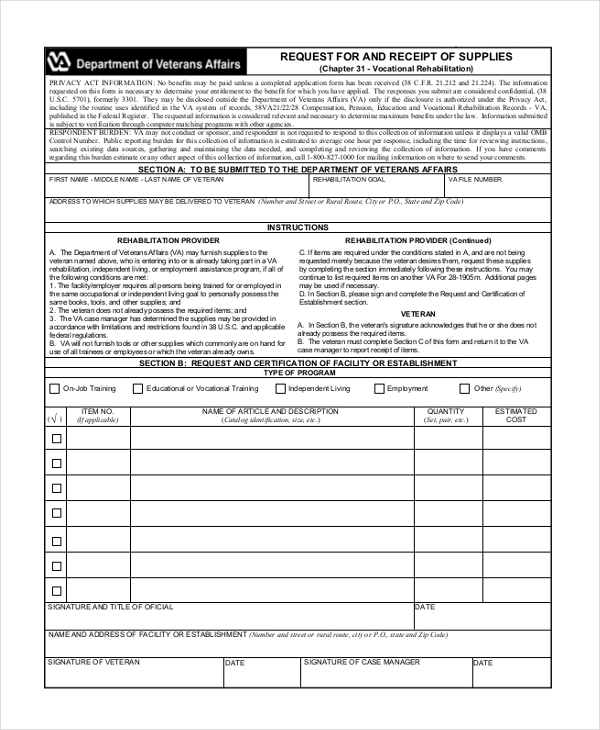

Request for and Receipt of Supplies Form

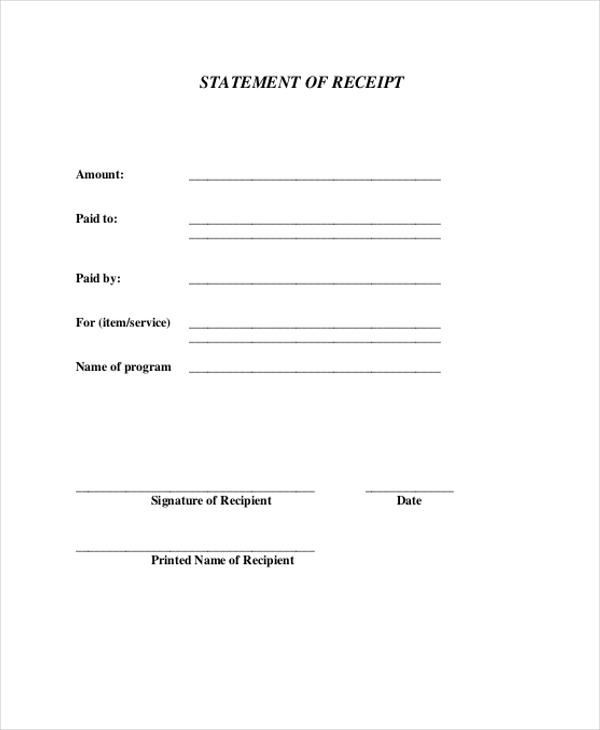

Generic Receipt Form

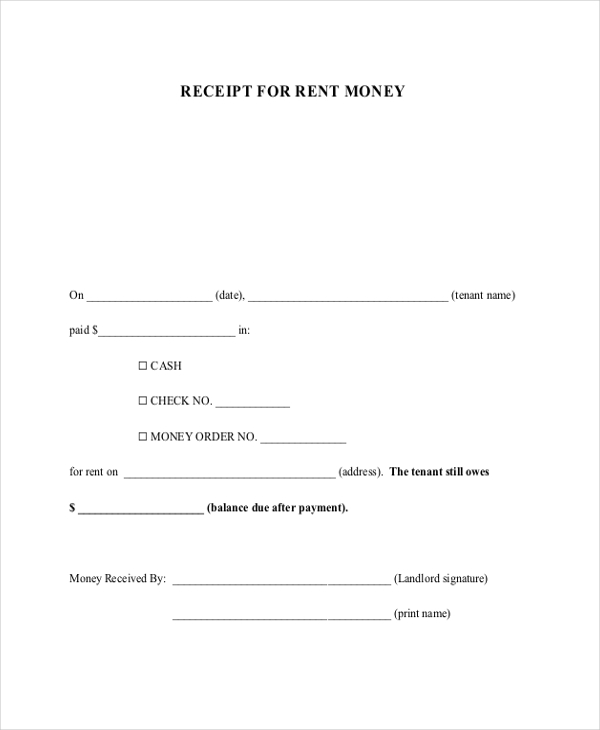

Receipt of Rent Payment Form

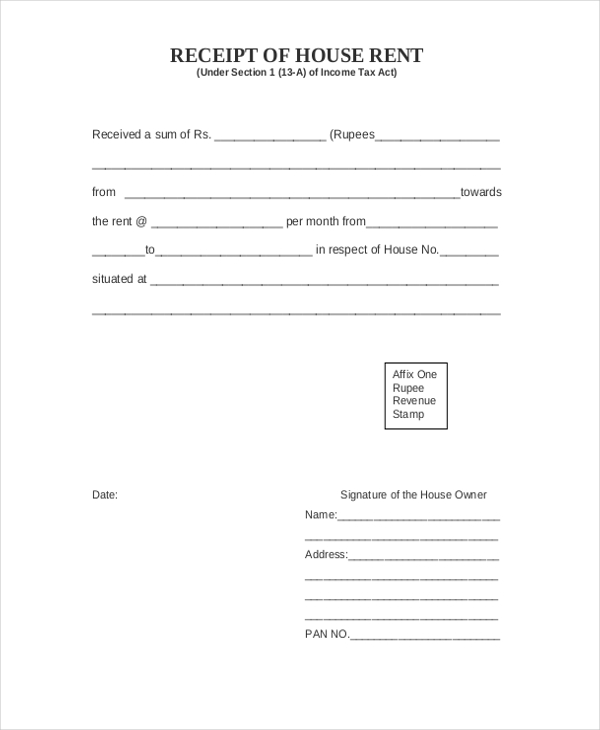

Sample House Payment Rent Receipt

Basic Receipt of Payment Form

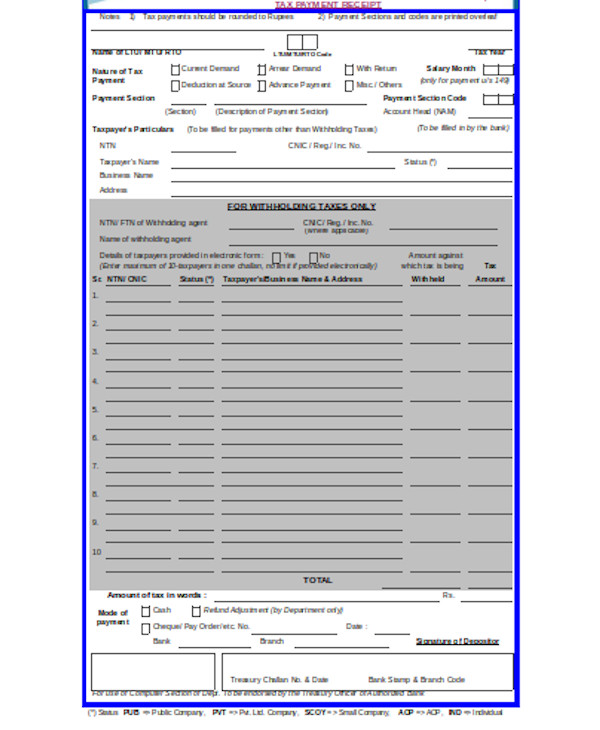

Receipt of Tax Payment Form

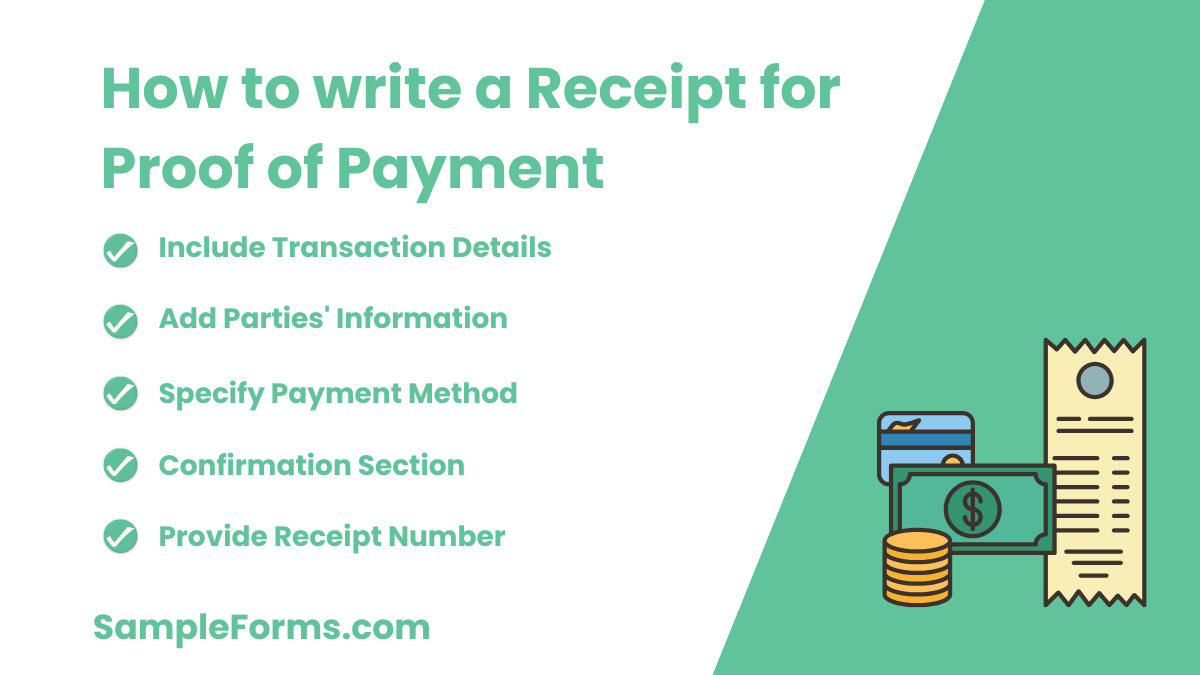

How do I write a receipt for proof of payment?

Creating a receipt for proof of payment requires accurate details, clear formatting, and acknowledgment. A Cash Receipt Form serves as an excellent template for structured documentation.

- Include Transaction Details: Record the date, amount, and purpose of the transaction.

- Add Parties’ Information: Mention the payer and payee names along with their contact information.

- Specify Payment Method: Clearly state whether it was cash, card, or bank transfer.

- Confirmation Section: Include a signed acknowledgment to validate the payment.

- Provide Receipt Number: Ensure each receipt has a unique identifier for tracking purposes.

How do you write an acknowledge receipt of payment?

Acknowledging a receipt confirms the payment has been successfully processed. A Donation Receipt Form is ideal for formalizing such transactions.

- Mention Payment Details: Specify the amount and date of receipt.

- State Purpose: Highlight what the payment was made for.

- Include Payer Information: Add the payer’s name and address.

- Add Receipt ID: Assign a unique number for easy reference.

- Sign and Stamp: Ensure the receipt is signed and, if necessary, stamped for authenticity.

What is legally considered a receipt?

A receipt is a legally binding document confirming payment was received. Using templates like a Sales Receipt Form ensures compliance and proper documentation.

- Transaction Information: Include the date, amount, and item description.

- Payer and Payee Details: Clearly identify both parties involved.

- Payment Method: Document whether it was cash, card, or another form of payment.

- Signature Section: Both parties may need to sign for legal validity.

- Retention Clause: Keep a copy for records in case of disputes.

How do I make a valid receipt?

Creating a valid receipt requires completeness and accuracy. A Purchase Receipt Form ensures all details meet legal and practical requirements.

- List All Details: Include date, payer, payee, and payment description.

- Proof of Payment: Clearly mark it as “Paid” or provide equivalent confirmation.

- Add Receipt Number: Assign unique identifiers for each receipt.

- Signature and Contact: Include signatures and contact information for both parties.

- Provide Copies: Offer a copy to the payer while retaining one for records.

What qualifies as proof of purchase?

Proof of purchase verifies a transaction took place. A Delivery Receipt Form can serve as an effective document for this purpose.

- Transaction Date and Amount: These should be clearly stated.

- Itemized Details: List all purchased items or services.

- Payment Confirmation: Specify the mode and status of payment.

- Recipient Acknowledgment: Include the recipient’s signature.

- Retention Policy: Maintain copies for auditing or resolving disputes.

How to make a payment receipt template?

Design a professional receipt using a Receipt Book Form. Include payment details, payer and payee information, transaction date, and signature for validation.

What is the form of proof of payment?

A Car Receipt Form acts as a robust proof of payment by recording transaction details, payment mode, and acknowledgment from both parties involved.

What is an example of proof of payment?

A School Receipt Form showing paid fees, payment date, and amount serves as a valid example of proof of payment.

What is a valid form of payment?

Valid payments include checks, cash, or digital transfers documented through a Daycare Receipt Form to ensure acknowledgment.

Is a receipt legal proof of payment?

Yes, receipts like a Contractor Receipt Form are legally binding documents confirming payment details between two parties.

How to write a payment received?

Use a Missing Receipt Form to document unrecorded transactions. Include date, payer information, amount, and the reason for missing the original receipt.

Is a picture of a receipt good enough?

Yes, digital images of a Cleaning Receipt Form are often accepted as proof of payment if clear and legible.

What is the legal document for gifting money?

An Asset Receipt Form works as a legal document, detailing the gifted amount, donor, and recipient information, ensuring transparency.

Can someone sue you for money they gave you?

Yes, unless a Petty Cash Receipt Form or equivalent document clarifies it as a gift or loan, they can sue for recovery.

Are handwritten receipts legal?

Handwritten receipts, like an Event Receipt Form, are legally valid if they include essential transaction details and the signatures of both parties.

In conclusion, a Receipt of Payment Form is more than just a document; it’s a tool for trust and accountability. It ensures transparency, safeguards financial records, and minimizes disputes in various transactions. Whether used for personal payments or business dealings, the Receipt of Agreement solidifies terms and provides peace of mind. Utilize it to streamline processes and foster better financial management in all your interactions.

Related Posts

-

FREE 8+ Sample Payment Receipt Forms in PDF | MS Word | MS Excel

-

Payment Receipt Form

-

How to Write a Receipt Form? [ Types, Includes ]

-

FREE 6+ Asset Receipt Forms in MS Word | PDF

-

Cash Receipt Form

-

Lost Receipt Form

-

Donation Receipt Form

-

FREE 6+ Contractor Receipt Forms in PDF | MS Word

-

Delivery Receipt Form

-

FREE 7+ Service Receipt Forms in PDF | MS Word

-

What is Delivery Receipt Form? [ Definition, Policy and Procedures, Tips ]

-

What is Receipt Form? [ How to Fill, Uses ]

-

Deposit Receipt Form

-

Receipt Form

-

FREE 9+ Sample Receipt Forms in MS Word | PDF | Excel