Unlock the essentials of financial documentation with our all-encompassing guide on Receipt Forms. From the traditional Receipt Book Form to the streamlined Cash Receipt Form, we delve into the nuances of each, providing practical examples. This guide is your key to mastering the art of receipt management, ensuring accurate and efficient tracking of all transactions.

What is a Receipt Form?

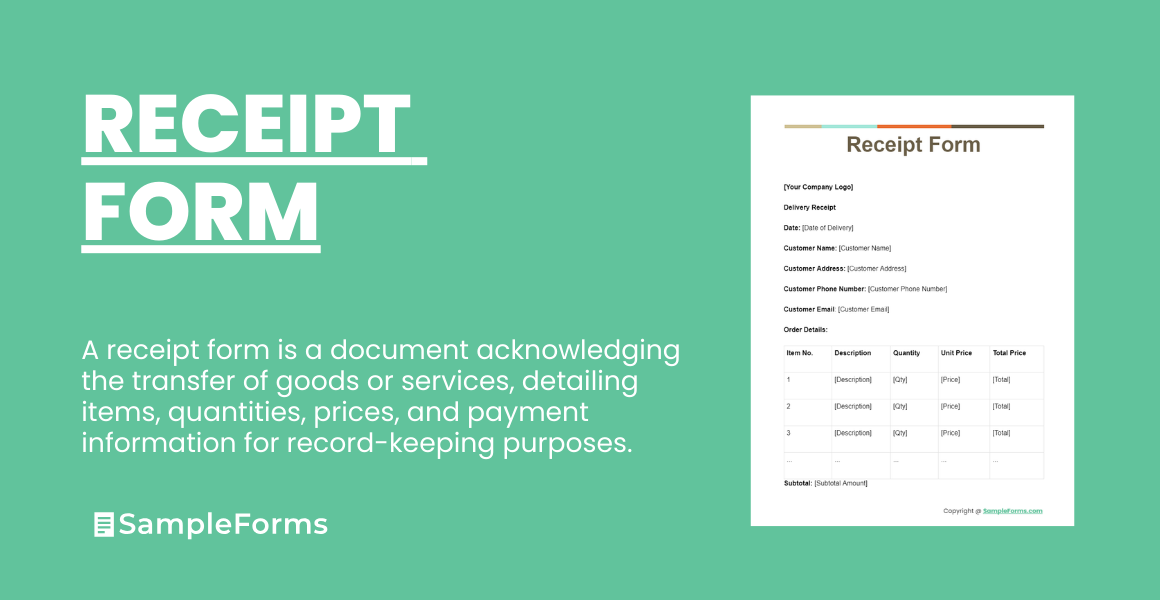

A Receipt Form is a crucial document that acknowledges the receipt of goods, services, or payments. It serves as proof of transaction between two parties, providing a detailed account of the exchange. Whether it’s for personal bookkeeping or business accounting, a receipt form is fundamental in maintaining transparent and accurate financial records.

Receipt Format

Heading: Receipt

This marks the document as a receipt, clearly identifying its purpose.

Receipt Information

- Receipt Number: A unique identifier for the receipt.

- Date: The date the receipt was issued.

Issuer Information

- Issued By: The name of the person or company issuing the receipt.

- Address: The physical or mailing address of the issuer.

- Contact Information: Phone number and/or email address for issuer communication.

Recipient Information

- Received By: The name of the individual or company receiving the receipt.

- Address: The recipient’s physical or mailing address, if necessary.

Payment Details

Subtotal: The total amount before taxes or discounts.

- Taxes: Applicable taxes on the transaction.

- Discounts: Any discounts applied to the transaction.

- Total Amount Paid: The final amount paid by the recipient.

Payment Method

- Method of Payment: How the payment was made (e.g., cash, credit card, check).

- Transaction Details: Additional details like check number, credit card last four digits, etc.

Acknowledgment

- Signature of Recipient: Confirms the receipt of the described goods or services.

- Print Name: Printed name of the person signing.

- Date: The date the receipt was acknowledged and signed.

Notes/Comments

Space for any additional notes or comments related to the transaction or receipt.

Simple Receipt Template PDF, Word, Google Docs

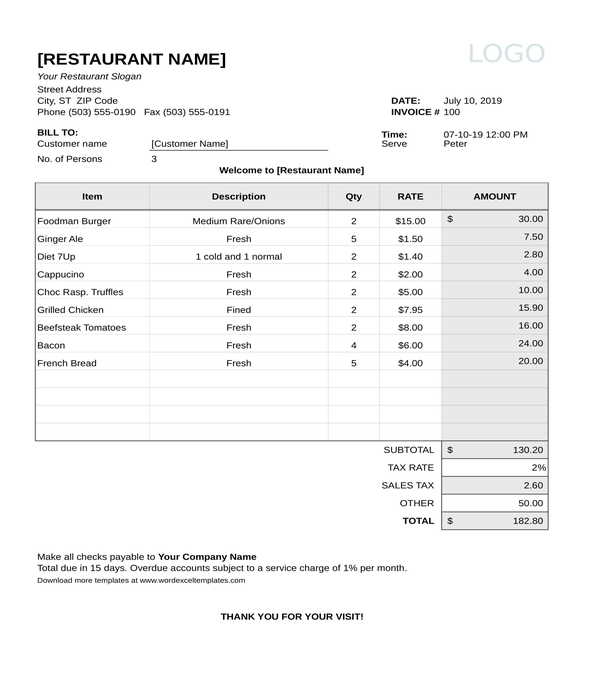

A Simple Receipt Template streamlines transactions with formats like the Restaurant Receipt Form and Payment Receipt Form, offering a versatile solution for documenting sales and services efficiently.

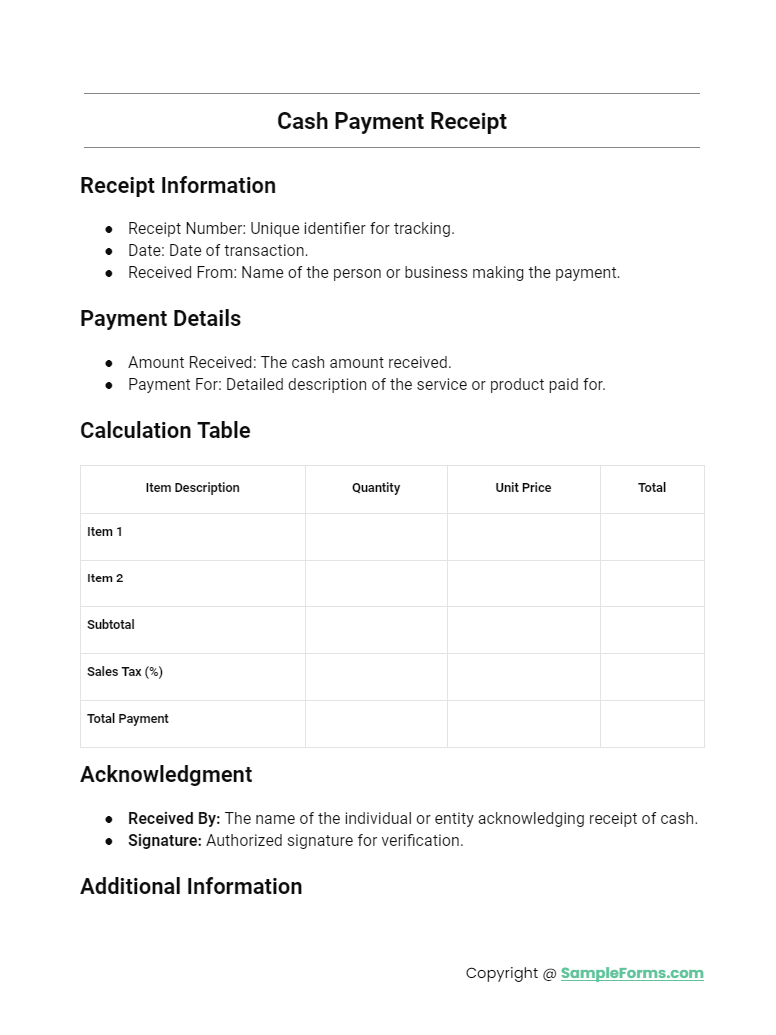

Cash Payment Receipt

The Cash Payment Receipt template, incorporating Hotel Receipt Form and Rent Receipt Form, is essential for tangible proof of cash transactions, providing clarity and security in financial dealings.

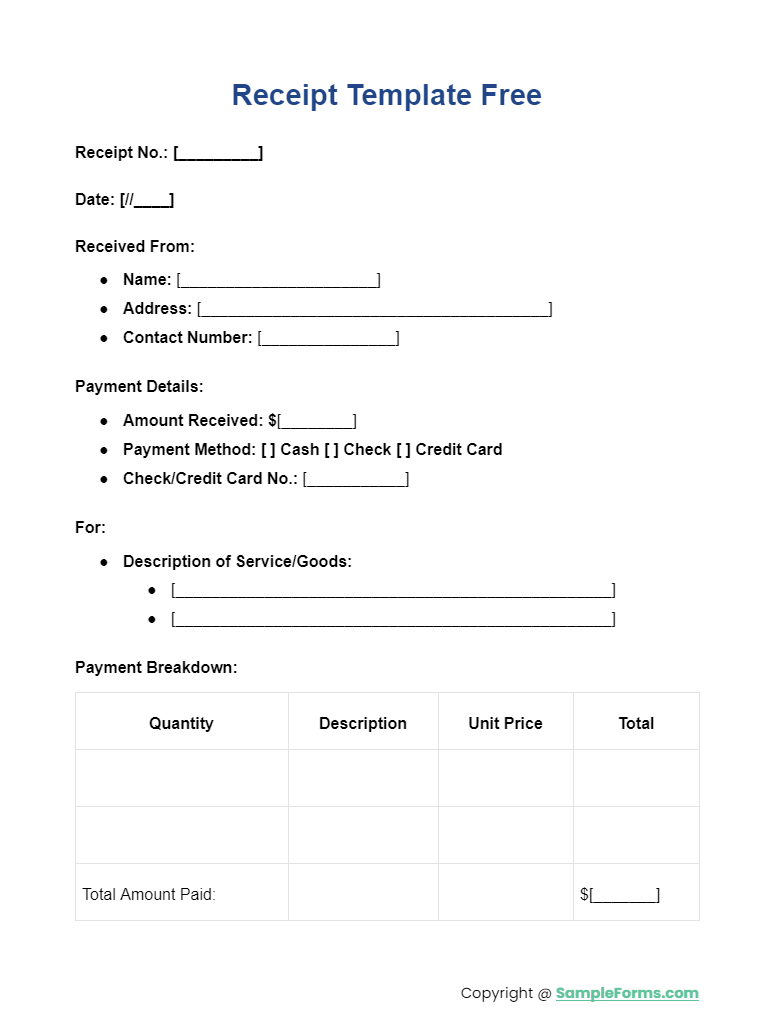

Receipt Template Free

Access a variety of Receipt Template Free options, including Sales Receipt Form and Donation Receipt Form, enabling businesses and charities to document transactions accurately without added costs.

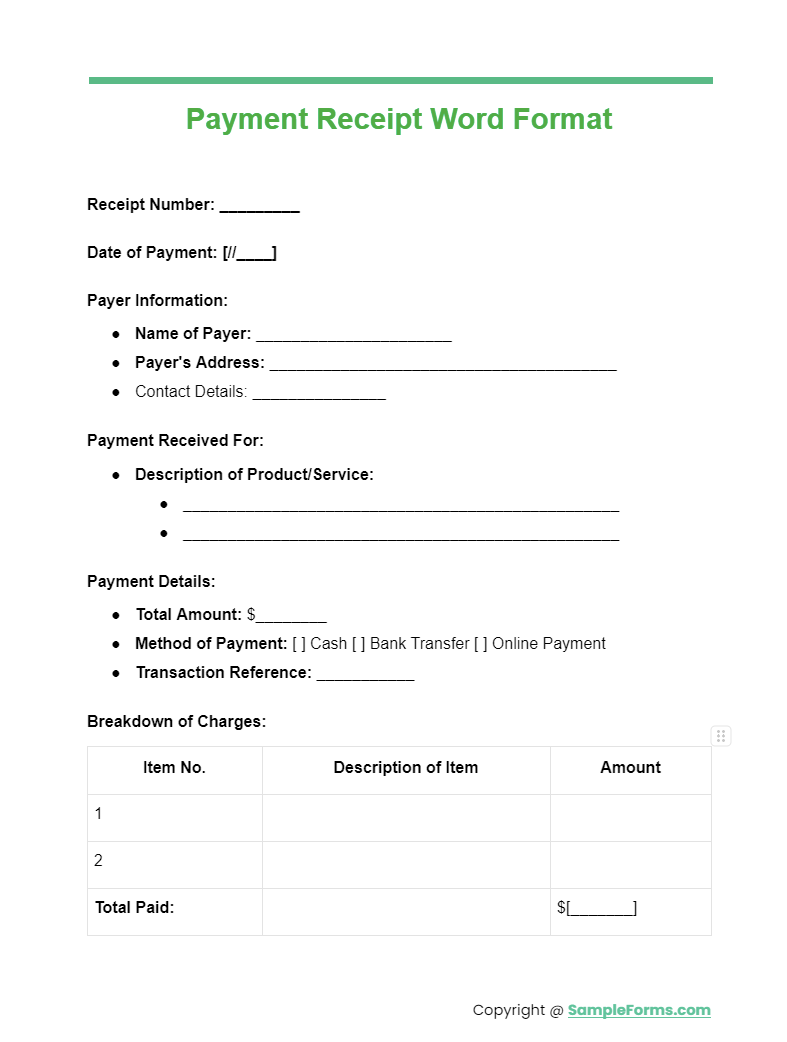

Payment Receipt Word Format

Optimize financial documentation with the Payment Receipt Word Format, featuring the Receipt of Payment Form and Purchase Receipt Form, designed for comprehensive and clear transaction records.

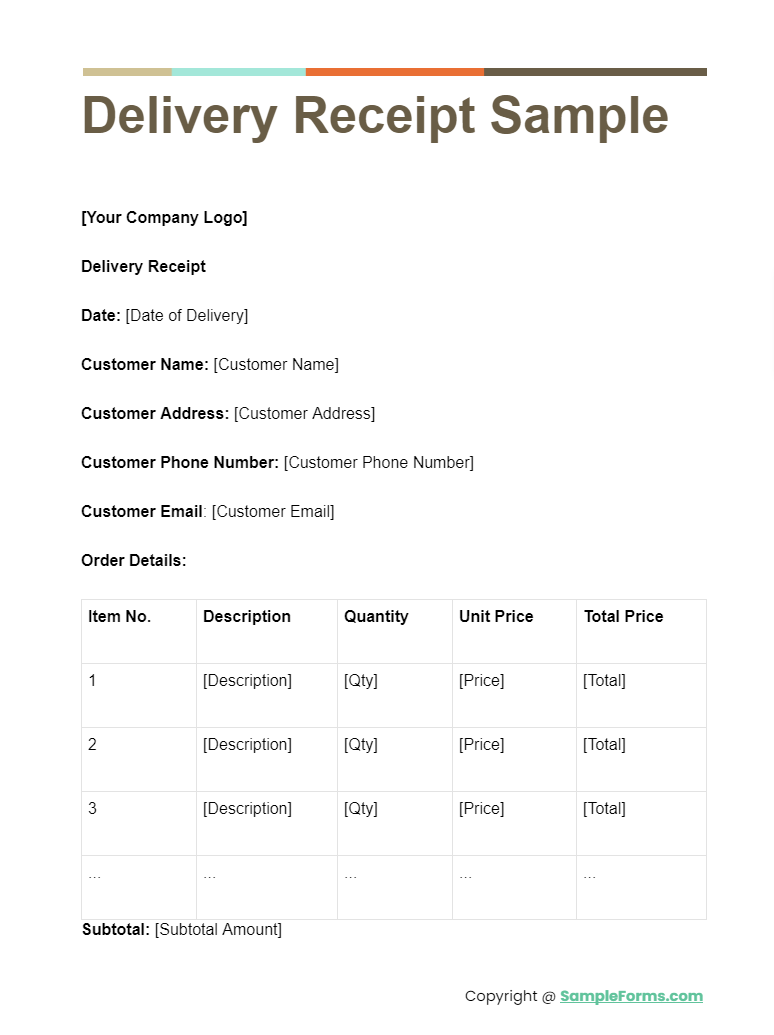

Delivery Receipt Sample

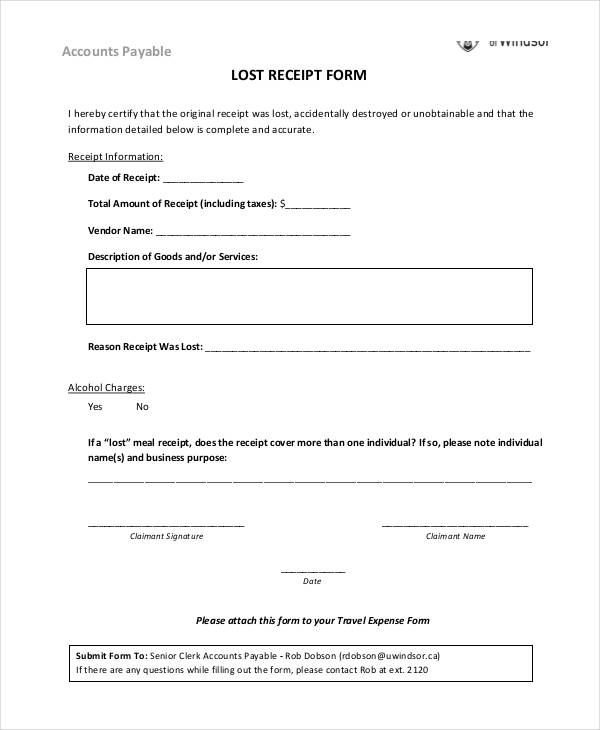

The Delivery Receipt Sample, including Rental Receipt and Lost Receipt Form, ensures accurate tracking and verification of goods delivered, with provisions for replacing misplaced documents.

More Receipt Form Samples

Delivery Receipt Forms

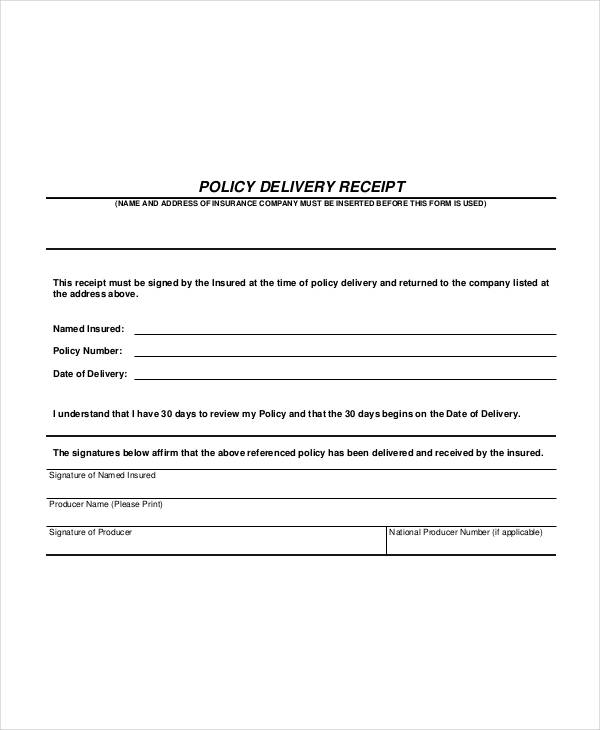

Policy Delivery

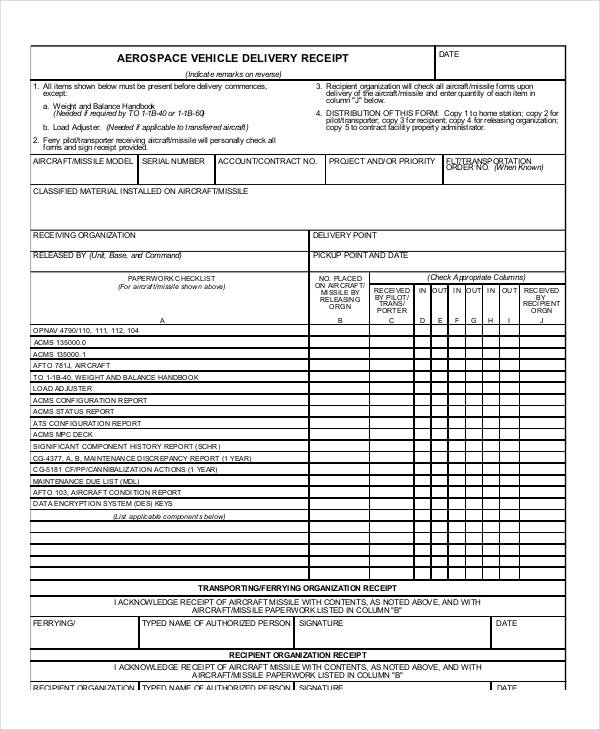

Aerospace Vehicle Delivery

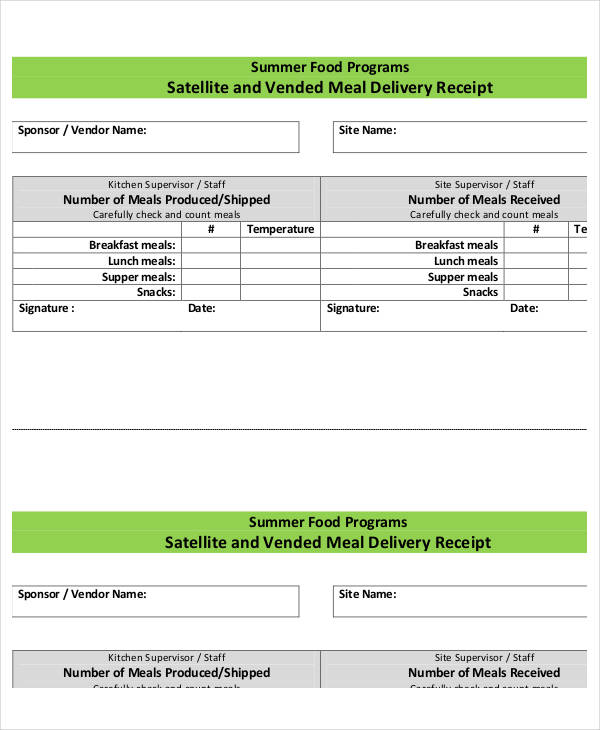

Vended Meal Delivery

Cash Receipt Forms

Free Cash Receipt

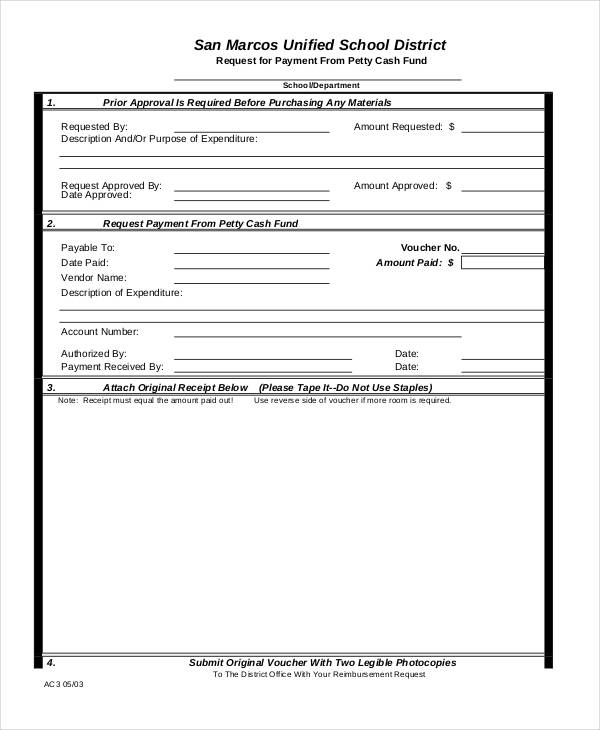

Petty Cash Fund

Sales Receipt Format

Payment Receipt Forms

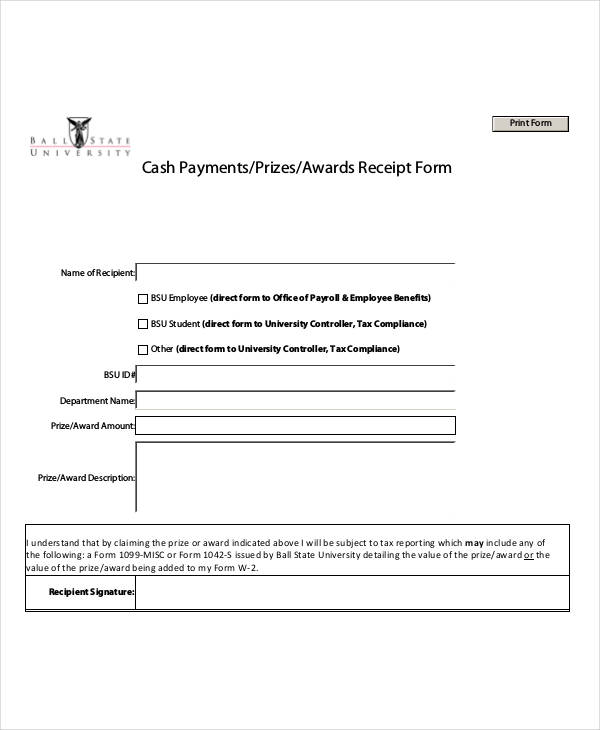

Cash Payment Acknowledgement

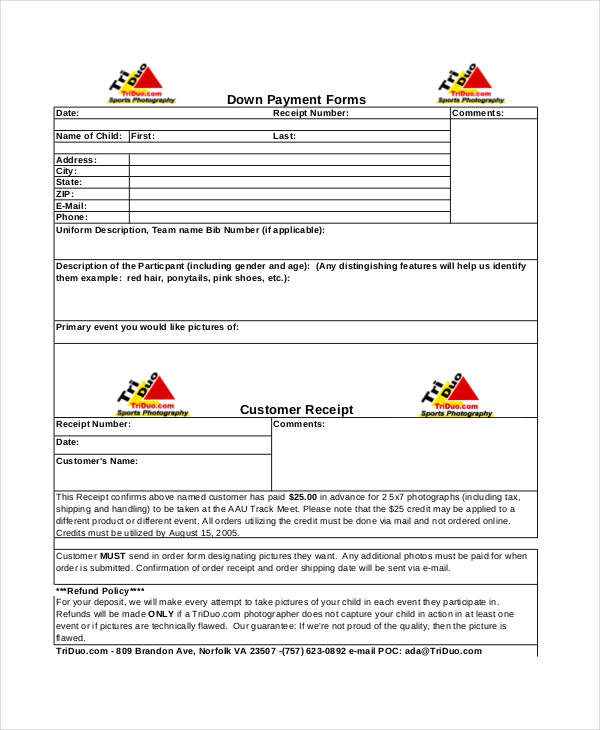

Down Payment Form

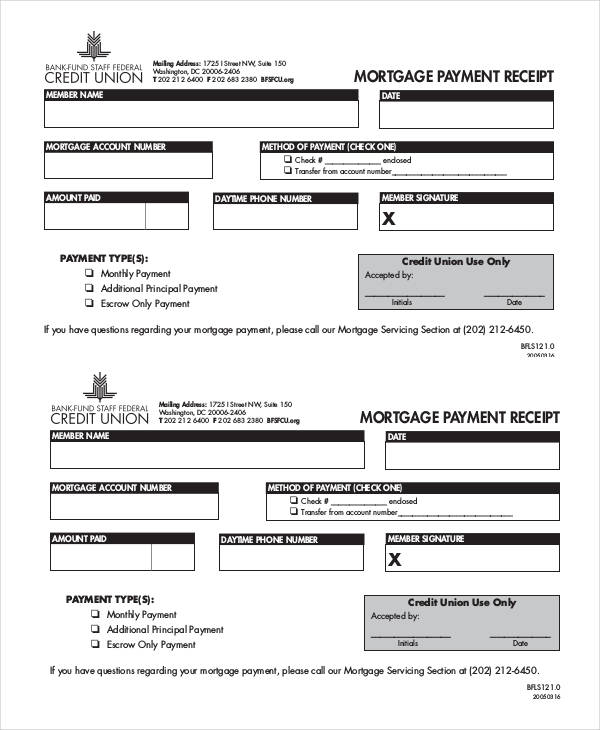

Mortgage Payment

Donation Receipt Forms

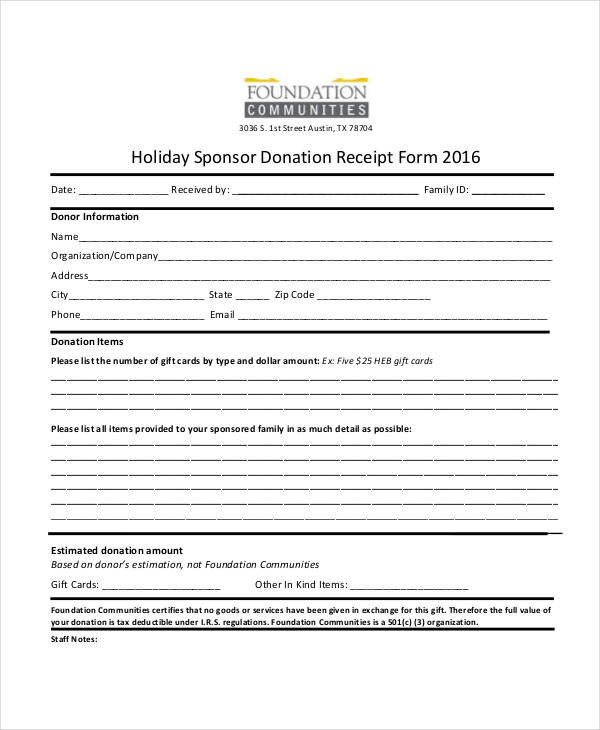

Holiday Sponsor Donation

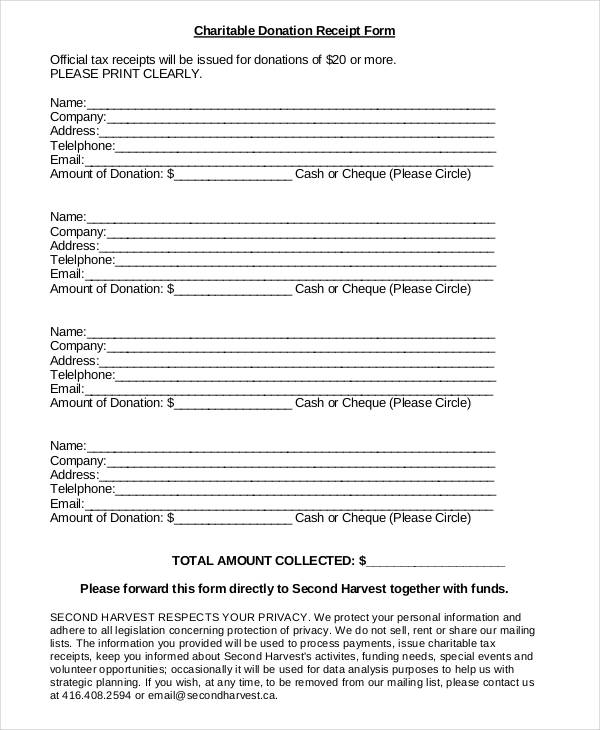

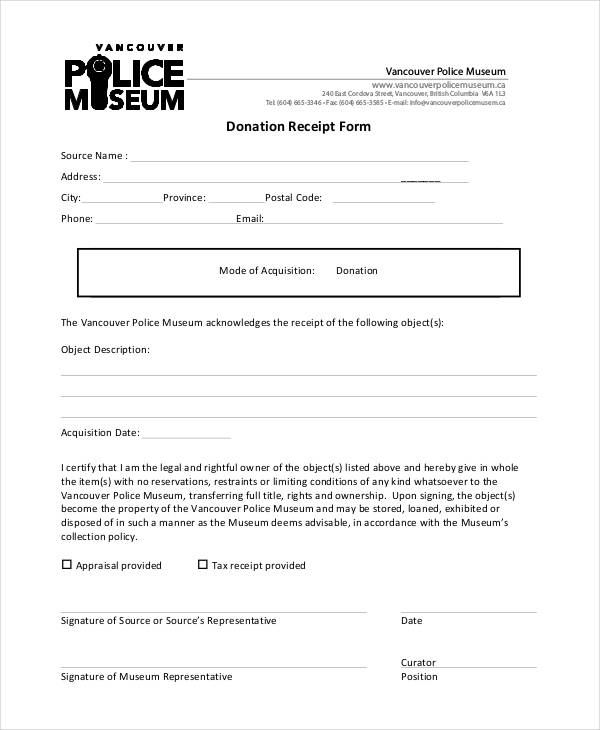

Charitable Donation

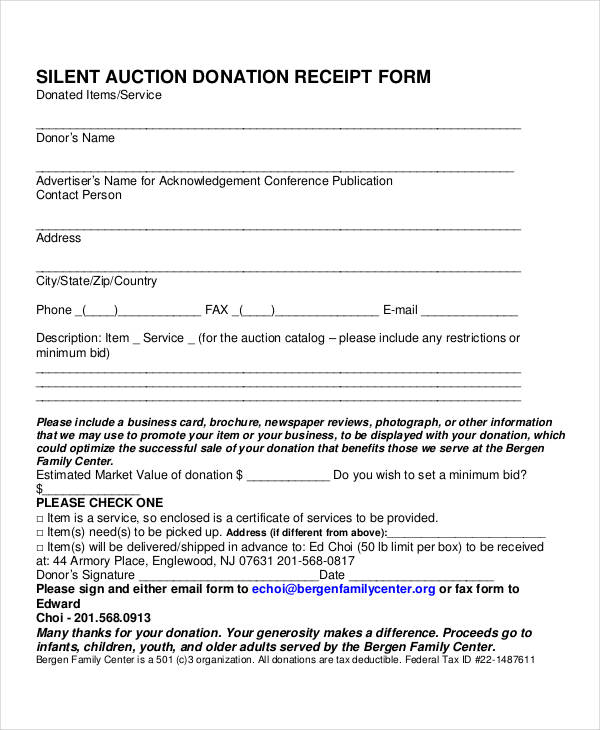

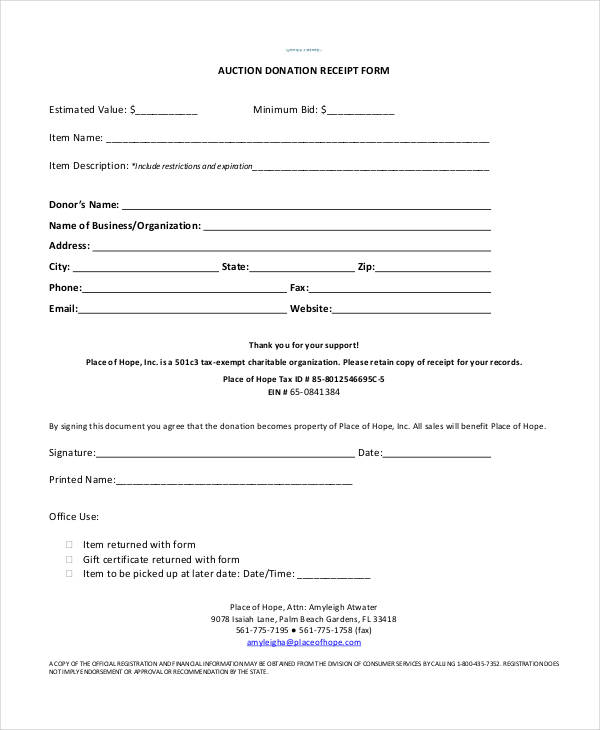

Silent Auction Donation

Business Receipt Forms

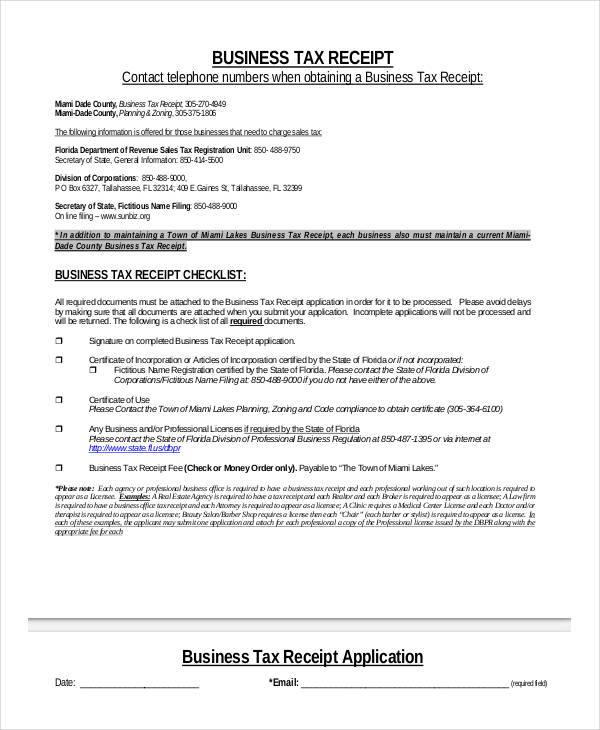

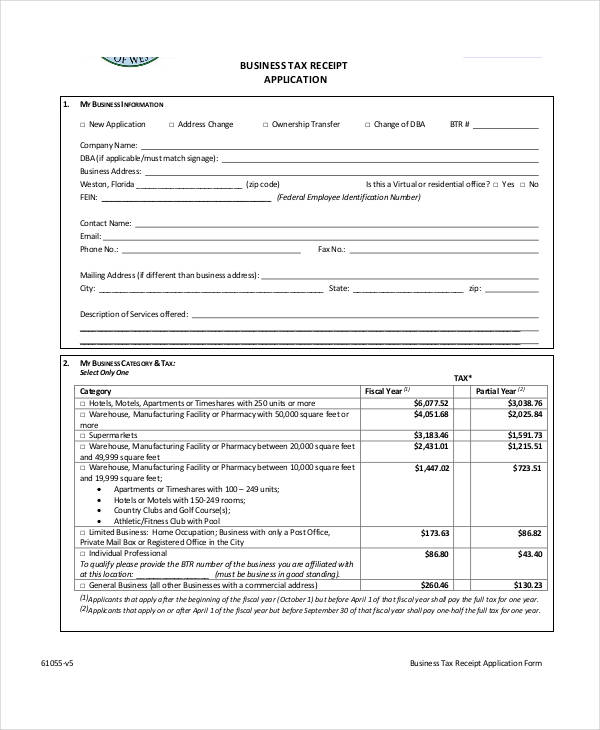

Business Tax Receipt

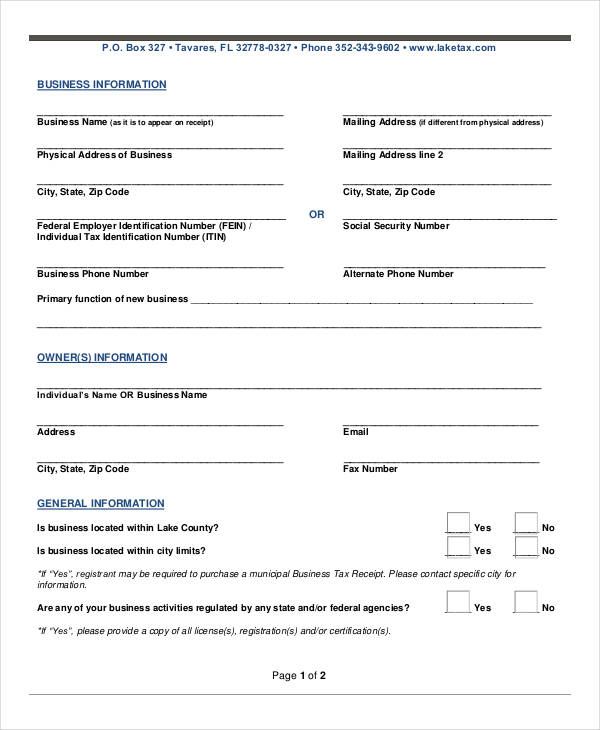

Local Business Tax

Local Business Tax Application

Rent Receipt Form

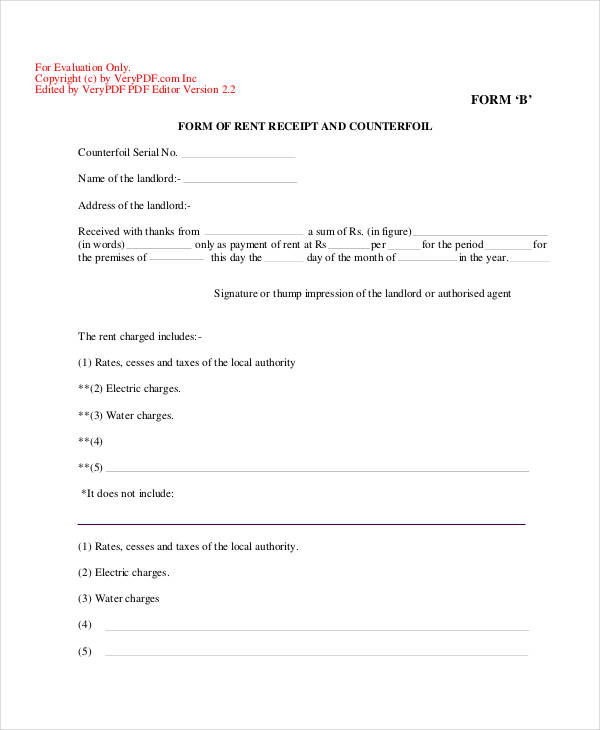

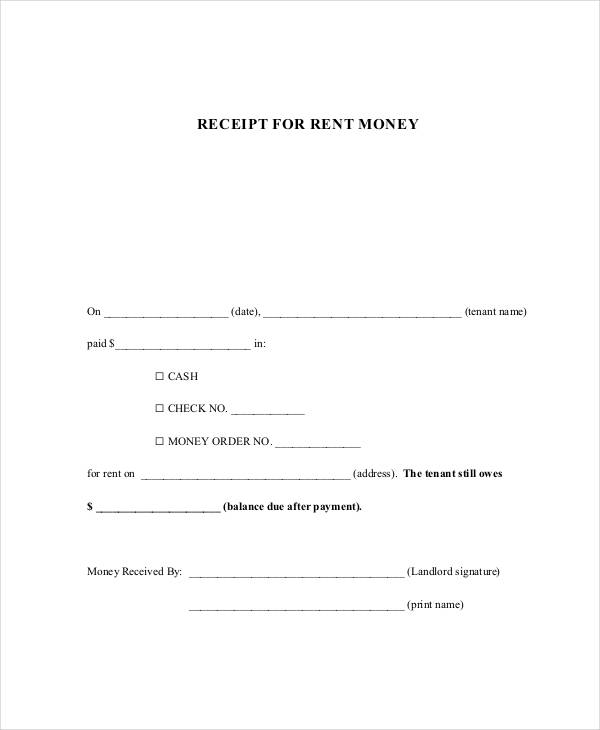

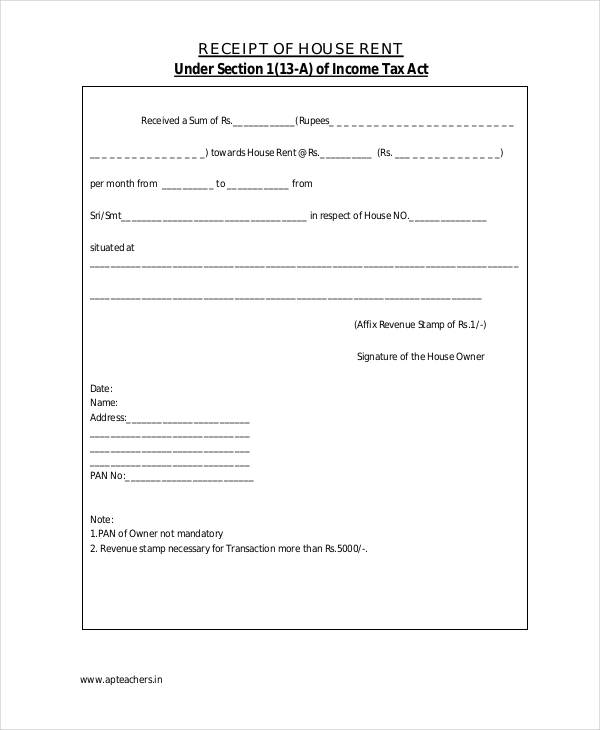

Sample Rent Counterfoil

Receipt for Rent

House Rent Receipt

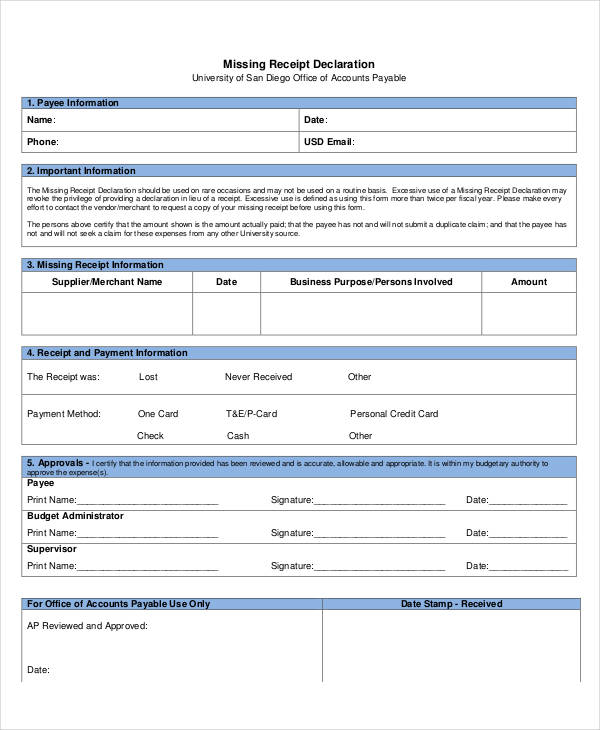

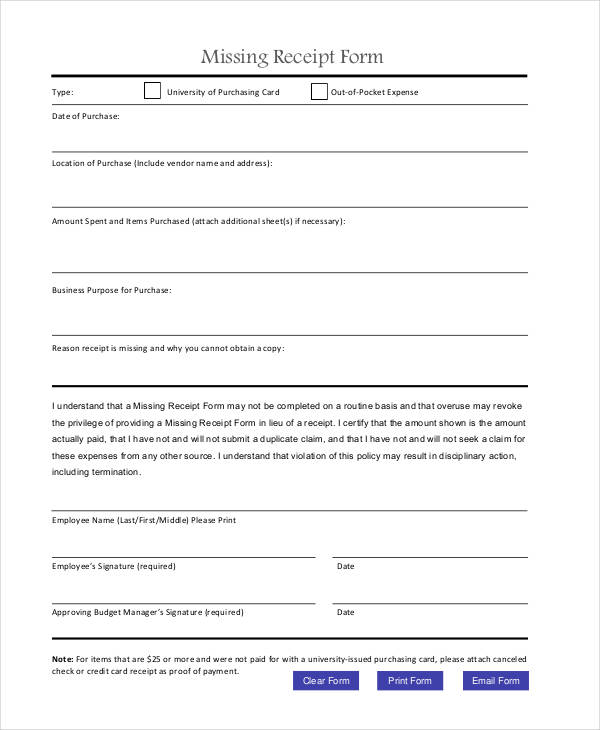

Missing Receipt Forms

Procurement Card Missing

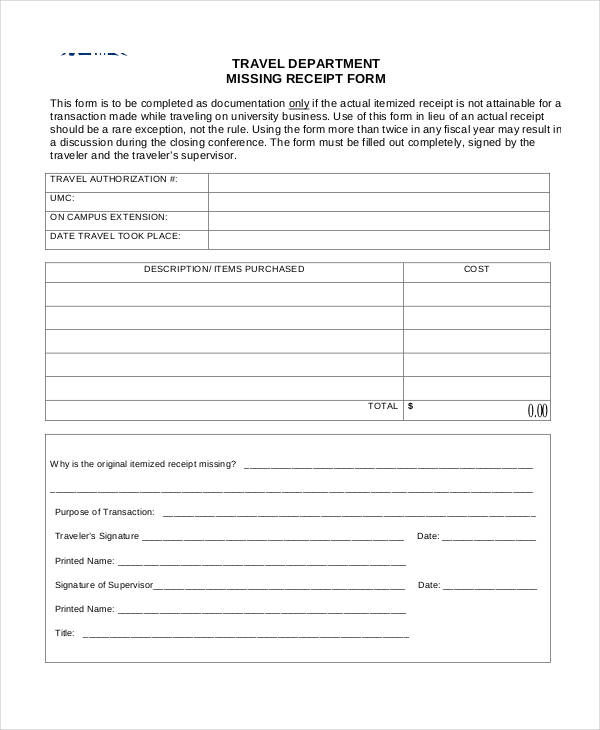

Travel Department Missing

Missing Receipt Declaration

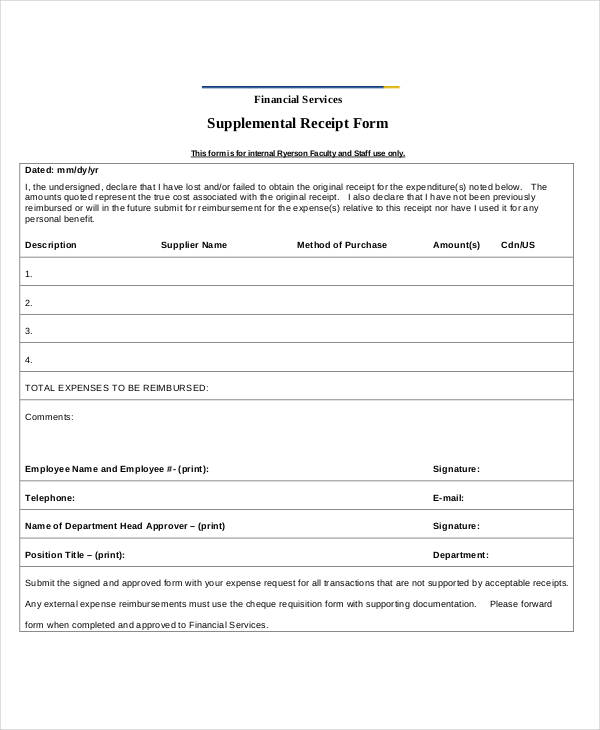

Sample Blank Receipt Forms

Blank Supplemental

Blank Lost Counterfoil

Blank Missing Receipt

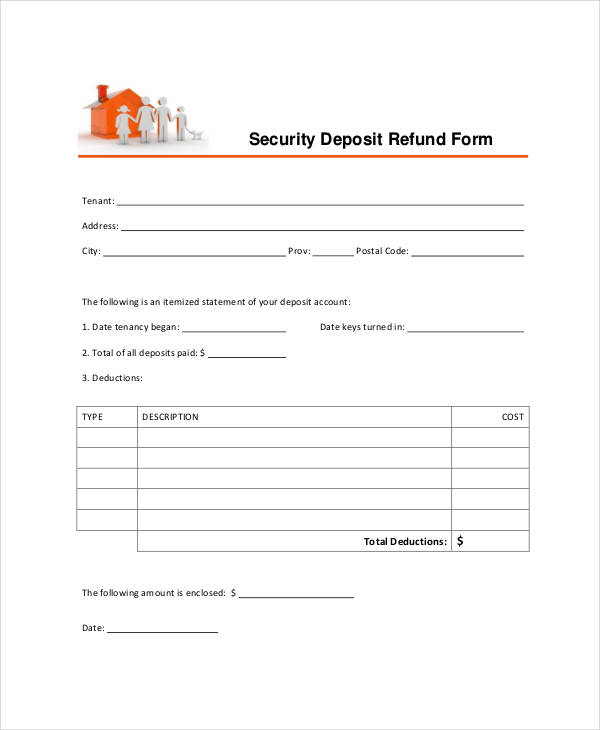

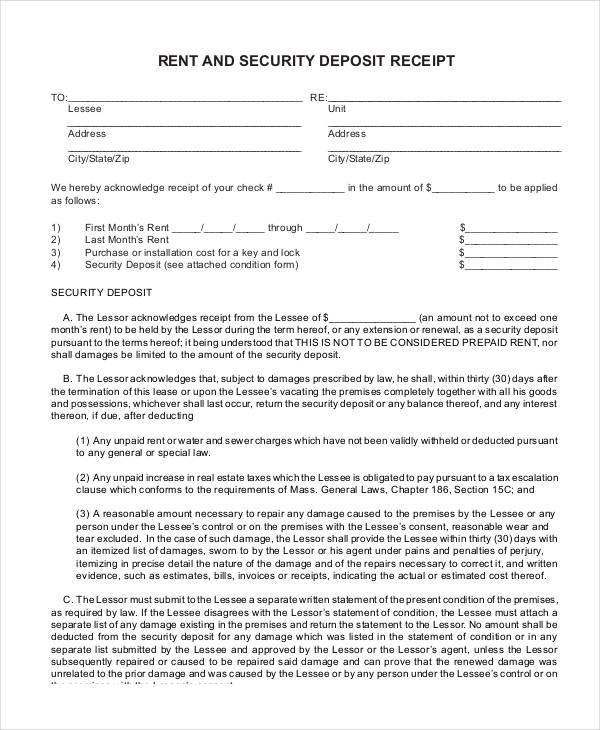

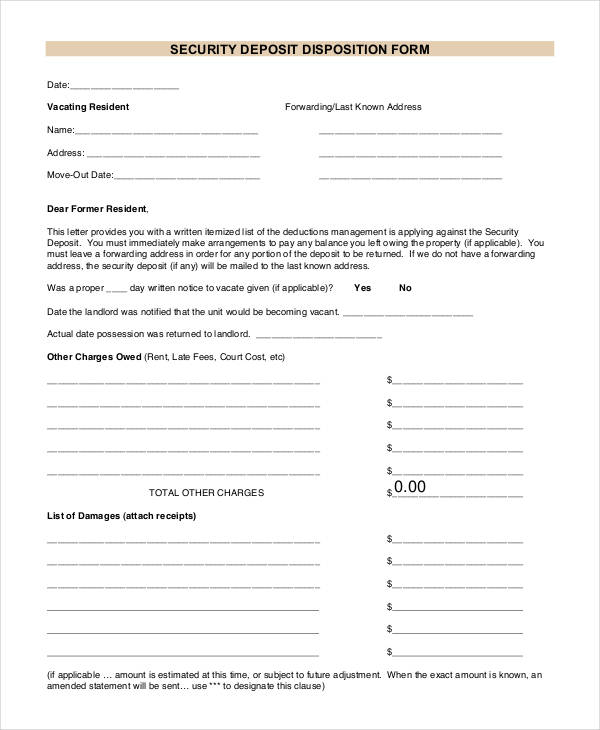

Security Deposit Receipt Forms

Security Deposit Refund Form

Rent and Security Deposit Receipt

Security Deposit Disposition Form

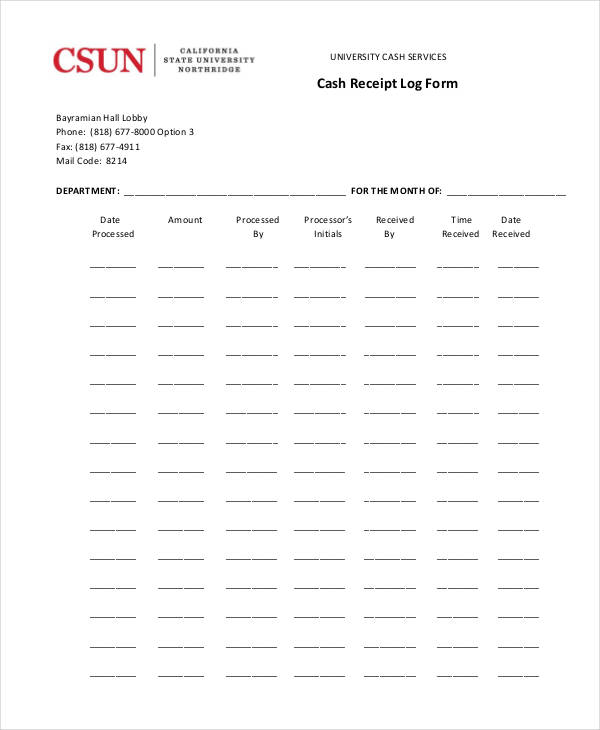

Cash Receipt Forms

Cash Log Form

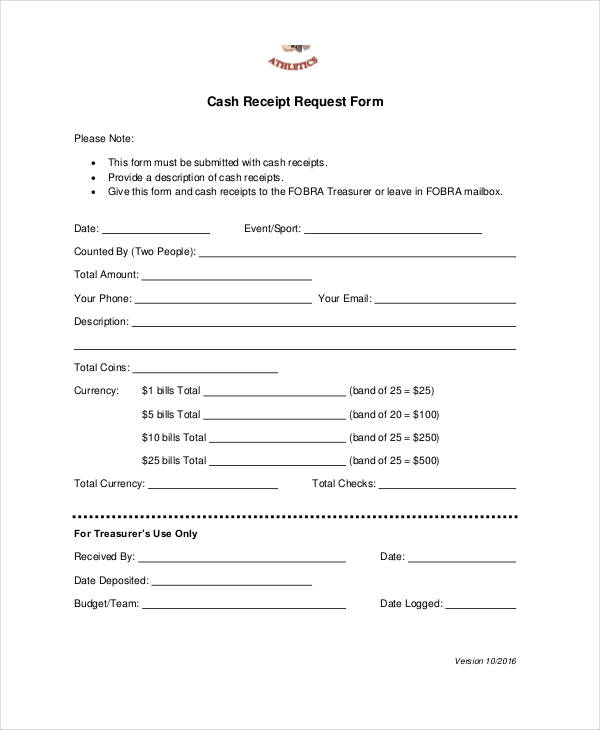

Cash Request Form

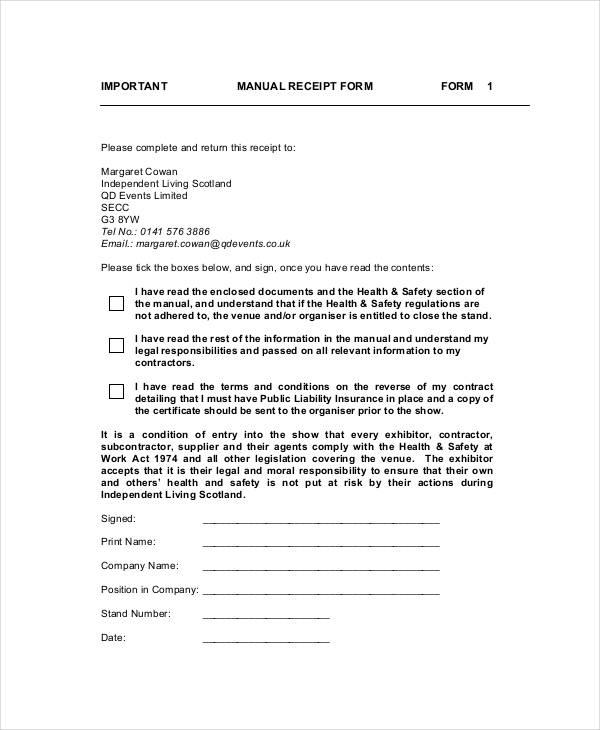

Manual Acknowledgement Form

Sales Receipt Forms

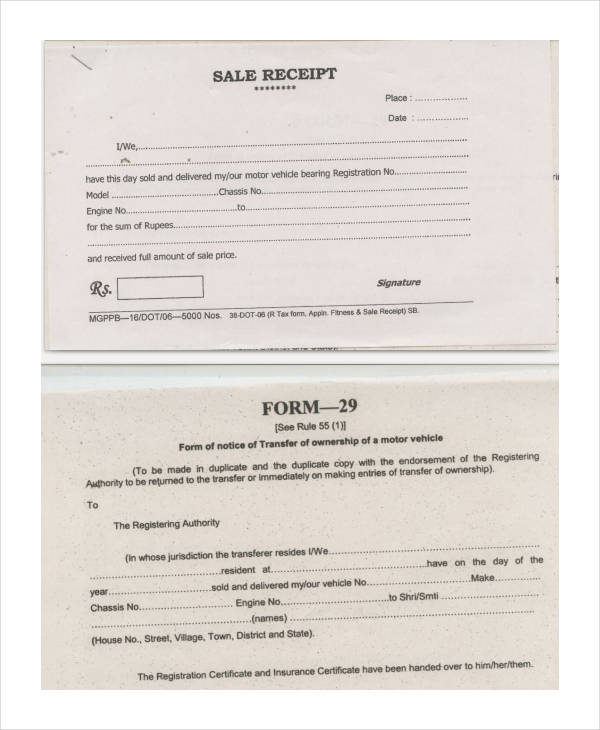

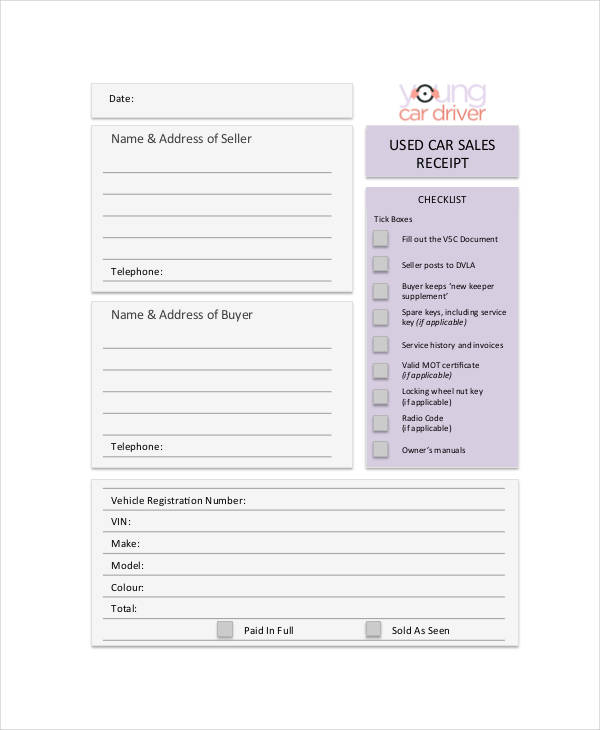

Used Car Sales

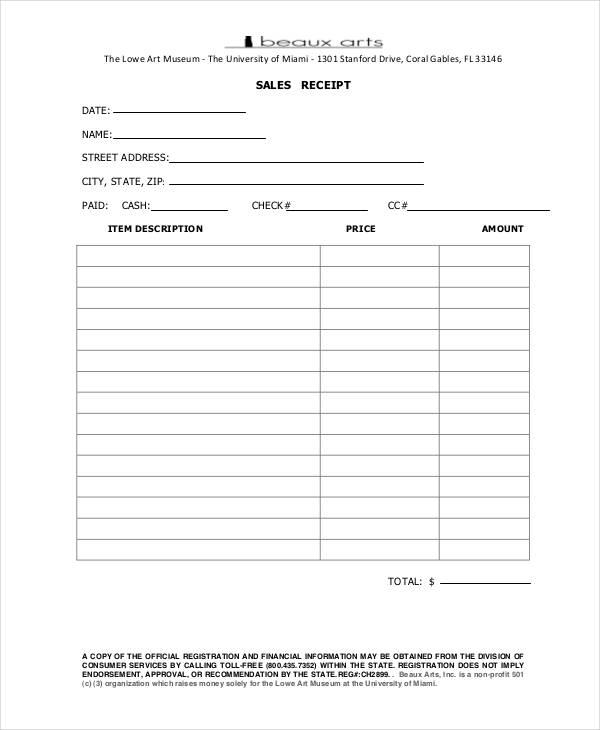

Sample Sales Receipt

Donation Receipt Forms

Auction Donation

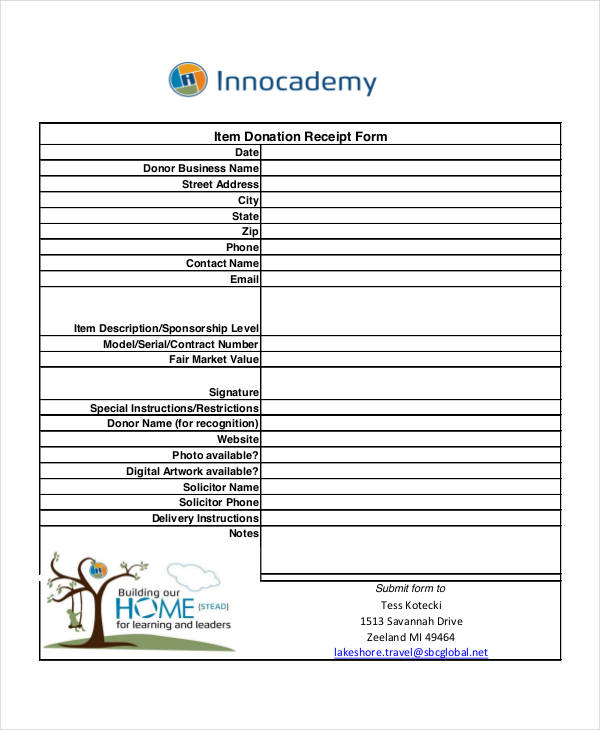

Item Donation

Sample Donation Receipt

Restaurant Receipt Form Template in XLS

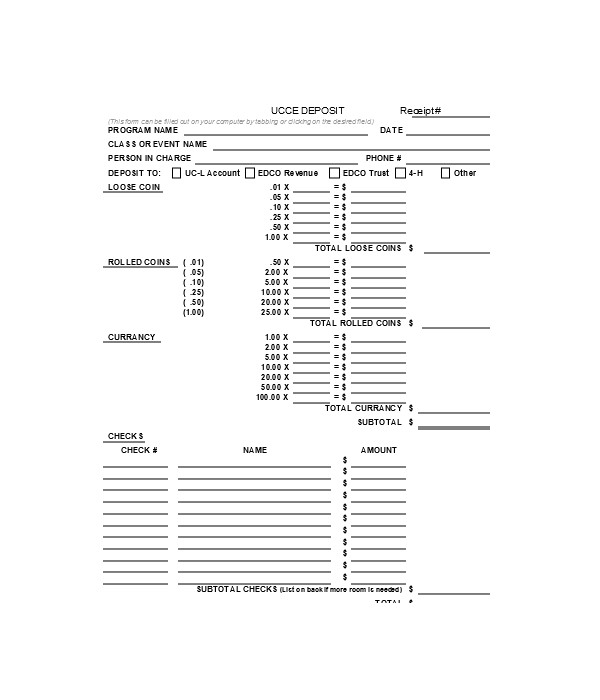

Basic Deposit Receipt Form

The Anatomy of a Business Receipt

- Seller Details – The details of the seller should include the company’s name, address, phone number, and email address on the top part of the receipt.

- Buyer Details – Refers to the first and last name of the buyer.

- Date of Transaction – The day, month, and year of the transaction should be supplied for tax purposes.

- Product Details and Itemized Cost – A brief description of the items or the services provided and its quantity and cost should be detailed in the receipt for reference purposes.

- Mode of Payment – This detail can come in handy when trying to give a customer a refund or when doing an accounting of a business’s sales. Modes of payment can be in the form of cash, check, credit card, or debit card.

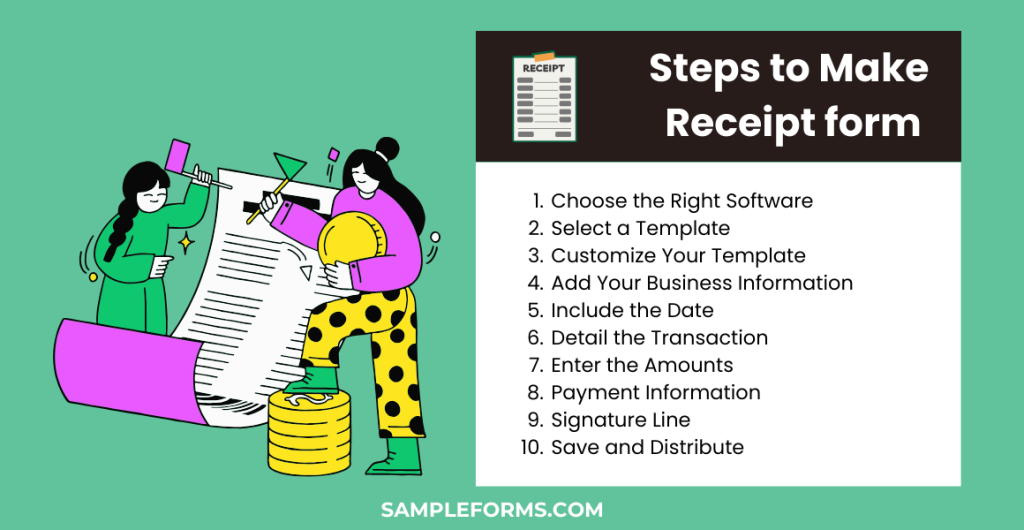

How do I make a Receipt Form?

- Choose the Right Software: Select a program like Microsoft Word or Excel, which offers flexibility in designing a receipt form.

- Select a Template: Look for templates that closely match your needs, such as a Petty Cash Receipt Form, Deposit Receipt Form, or an Asset Receipt Form.

- Customize Your Template: Modify the selected template to suit your specific requirements. Ensure it includes fields for date, amount, and description.

- Add Your Business Information: Include your business name, address, and contact information at the top of the receipt form.

- Include the Date: The date of the transaction is crucial for record-keeping.

- Detail the Transaction: Clearly describe the goods or services provided. Use separate lines for each item for clarity.

- Enter the Amounts: Specify the amount for each item, along with any taxes or discounts. Include subtotal, total amount, and form of payment.

- Payment Information: If it’s a Petty Cash Receipt Form or Deposit Receipt Form, detail the payment method and any relevant transaction details.

- Signature Line: Add a line for the signature of the person receiving the payment or asset, especially important for an Asset Receipt Form.

- Save and Distribute: Save your completed receipt form. Print or email it to the recipient and keep a copy for your records.

How do you write Proof of Receipt?

Writing proof of receipt involves creating a document that acknowledges the exchange of goods or services for payment. Here’s how to do it effectively:

- Start with a Header: Begin with a clear title, such as Sales Receipt, Cash Payment Receipt Form, or Event Receipt Form, to immediately identify the document’s purpose.

- Business Information: Include your business or personal contact information, establishing the issuer’s identity.

- Date and Time: Note the date and time of the transaction to maintain accurate records.

- Description of Transaction: Provide a detailed description of the goods or services sold, including quantities and prices. For a Cash Payment Receipt Form, specify the form of payment.

- Total Amount: Calculate the total amount paid, including any applicable taxes or discounts. This is crucial for both Sales Receipts and Event Receipt Forms.

- Payment Method: Clearly state the payment method used, such as cash, check, credit card, or online payment.

- Recipient Information: If relevant, include the name and contact details of the recipient, especially in the case of a Sales Receipt or Event Receipt Form.

- Acknowledgment Statement: Include a statement confirming that the recipient has received the goods or services as described.

- Signature: Both parties should sign the receipt, providing a legally binding proof of the transaction and receipt of goods or services.

- Keep Records: Always keep a copy of the receipt for your records, ensuring both parties have proof of the transaction and payment.

How Important Are Receipts?

Whether or not you are a business owner, it is always a good practice to ask, give, and keep receipts. Receipts are important documents that prove payment and are an essential form of paper trail. To exercise our creative imaginations, let’s say for example you were charged with murder and you needed proof for your alibi. A receipt of the caramel macchiato that you purchased at a coffee shop 500 miles away from the site of the murder, and that also shows a time and a date stamp of you buying it on the time of the murder can be your ticket to freedom. But let’s not get carried away by our fanciful notions. Below are some of the basic reasons why a receipt is essential:

1. Receipts serve as proof of purchase. The ultimate reason for having and keeping receipts is because they literally serve as proof of purchase which will be very much useful when you are claiming for warranties on big and expensive purchases such as jewelries, gadgets, appliances, etc.

2. To close and complete financial records. In business, a receipt is essential because it serves as a tangible piece of evidence to support payment transactions. Accountants can then verify payments or lack thereof when conducting audits.

3. Serves as proof for claims as deduction or refund. Official receipts are useful and serve as hard evidences for claiming reimbursements such as expenses incurred on business trips or lunch meetings.

How to Determine the Right Type of Receipt for Business

Different types of businesses call for different types of receipts. A business may be involved in selling products or goods, providing services, or both services and merchandise.

For businesses that sell products or goods, a sales invoice can double as a receipt. A Delivery Receipt is more applicable to businesses that involve the provision of goods or merchandise. For businesses that provide service, an Official Receipt can be provided for individual customers while a billing statement or an official receipt can be given when dealing with other businesses. For businesses that sell both product and service, a delivery receipt, a sales invoice, a collection receipt, and a billing statement can be used.

How to Create a Receipt for Business

Receipts are not very complicated documents to create. Nevertheless, you have to make sure that your receipts contain the details that need to be included in a receipt. We offer ready-to-use receipt forms and templates that you can easily download to help you save time. Our receipt templates are in doc format and are easily accessible to save you from the hassle and the inconvenience of having to whip one up from scratch. Below are some tips and guidelines to follow if you opt to make your own receipt forms:

Provide a company stamp or your company name and logo on your receipts to give it an official and a professional feel. This will also come in handy when clients are trying to organize their receipts. Use a carbon copy if your receipts are handwritten, to help you save time.

Provide the necessary details in your sales receipt, pre-indicate them onto your receipt templates, or have a section that allows you to manually supply the details. Information such as your company name, your business address and phone number, the date of the transaction, the name of the client or the buyer, an itemized list of the items purchased or the service that was rendered, the cost of each item, the total amount, and the mode of payment all need to be incorporated in a business receipt.

Is There a Receipt Template in Word?

Yes, Word offers templates including a Missing Receipt Form, ideal for creating detailed and professional receipts to replace lost or misplaced documents.

How do I Make a Printable Receipt?

Utilize online tools or software that offer templates like the Contractor Receipt Form to create and print customized receipts for transactions and services.

Is There a Free App to make Receipts?

Numerous free apps are available to create receipts, including templates for specific uses like the Daycare Receipt Form, facilitating easy and professional documentation.

How do I Manually Write a Receipt?

To manually write a receipt, include essential details similar to a School Receipt Form, ensuring clarity in transaction records and participant identification.

How can I get Proof of payment without Receipt?

For proof without a traditional receipt, consider alternatives like a Car Receipt Form, bank statements, or digital payment confirmations as valid documentation.

In summary, the Receipt Form, with its various samples, forms, letters, and uses, stands as an indispensable tool for both personal and professional financial management. The inclusion of a Lost Receipt Form word underscores its significance in replacing or compensating for misplaced receipts, ensuring continuity and integrity in financial documentation.

Related Posts

-

How to Write a Receipt Form? [ Types, Includes ]

-

FREE 6+ Asset Receipt Forms in MS Word | PDF

-

Cash Receipt Form

-

Lost Receipt Form

-

Donation Receipt Form

-

FREE 6+ Contractor Receipt Forms in PDF | MS Word

-

Delivery Receipt Form

-

FREE 7+ Service Receipt Forms in PDF | MS Word

-

What is Delivery Receipt Form? [ Definition, Policy and Procedures, Tips ]

-

What is Receipt Form? [ How to Fill, Uses ]

-

Deposit Receipt Form

-

FREE 9+ Sample Receipt Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Payment Receipt Forms in PDF | MS Word | MS Excel

-

Rental Receipt Form

-

FREE 8+ Sample Donation Receipt Forms in PDF | Excel