A Receipt Book Form is essential for businesses to record financial transactions accurately. It serves as a written acknowledgment of payments received, detailing transaction dates, payer and payee information, amounts, and payment methods. This Receipt Form ensures transparency, helps in managing accounts, and provides legal proof of payment. Whether for personal use, small businesses, or large corporations, a Receipt Form helps maintain organized records. In this guide, we’ll explore different types of Receipt Book Forms, provide practical examples, and show how to create customized templates for efficient financial documentation.

Download Receipt Book Form Bundle

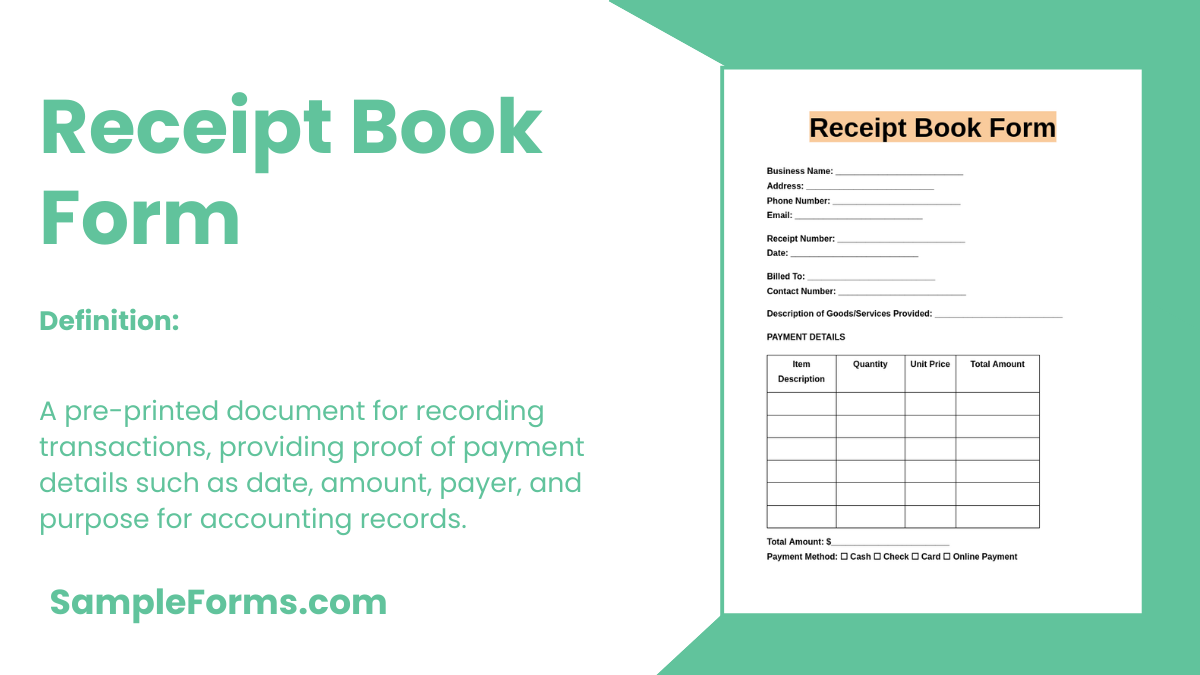

What is Receipt Book Form?

A Receipt Book Form is a pre-printed or digital document used to acknowledge and record financial transactions. It includes key details like the date, amount, payer, and reason for payment. Businesses use it to maintain accurate records, ensure financial transparency, and provide proof of payment. This form is commonly used in sales transactions, rent collections, and service payments to track income and manage bookkeeping efficiently.

Receipt Book Format

Receipt Information

Receipt Number: ____________________________

Date: ____________________________

Payer Details

Received From: ____________________________

Address: ____________________________

Contact Number: ____________________________

Payment Details

Amount Received: ____________________________

Payment Method (Cash, Check, Card): ____________________________

For (Description of Payment): ____________________________

Issuer Information

Issued By: ____________________________

Signature: ____________________________

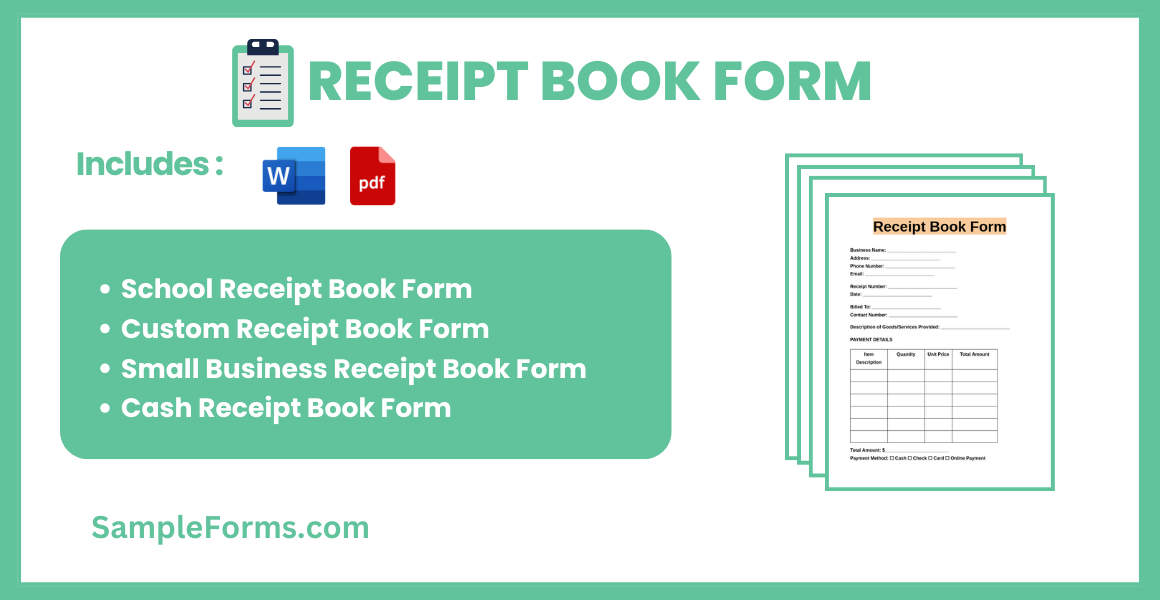

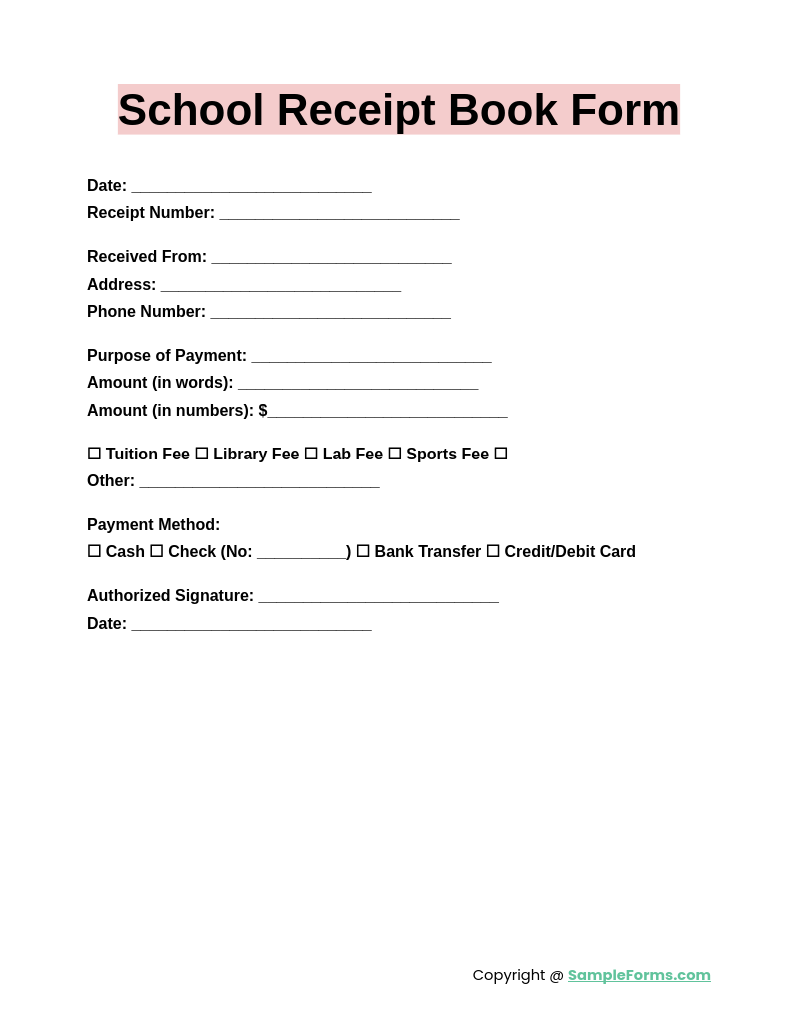

School Receipt Book Form

A School Receipt Book Form records payments for tuition, activities, and other fees. Similar to a Payment Receipt Form, it includes student details, payment dates, amounts, and reasons to ensure transparent financial tracking in educational institutions.

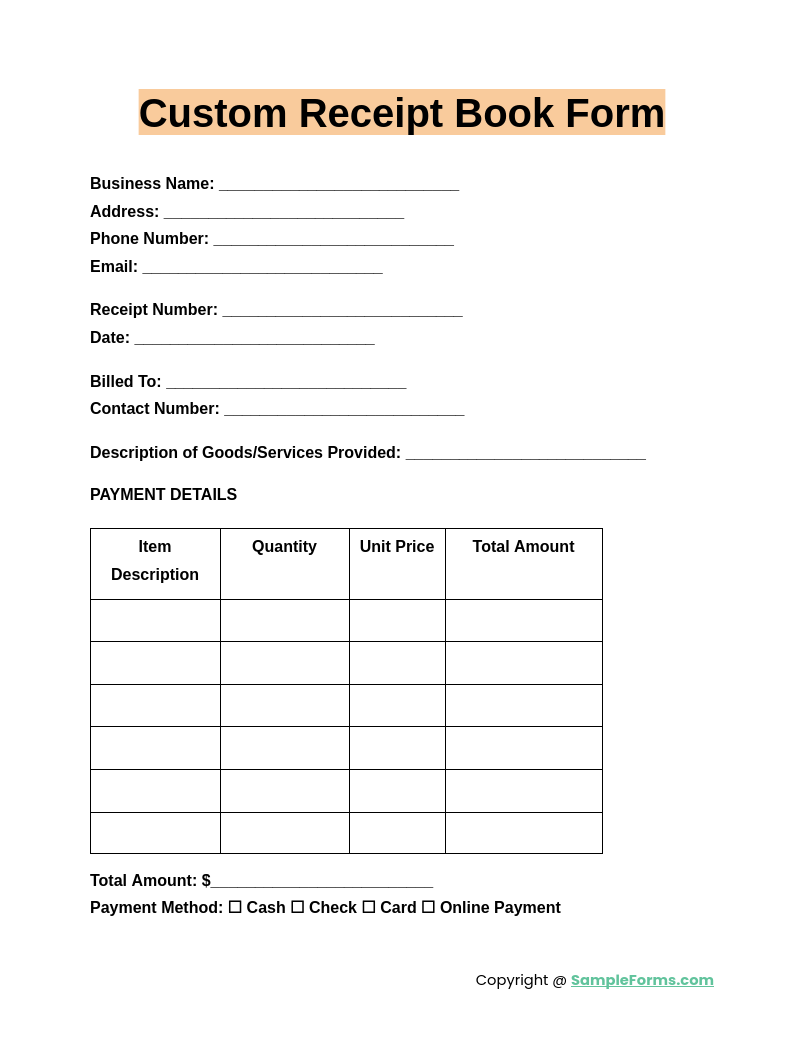

Custom Receipt Book Form

A Custom Receipt Book Form allows businesses to personalize receipt formats based on specific needs. Like a Restaurant Receipt Form, it includes tailored sections for client information, services provided, and payment details to enhance brand identity and record-keeping.

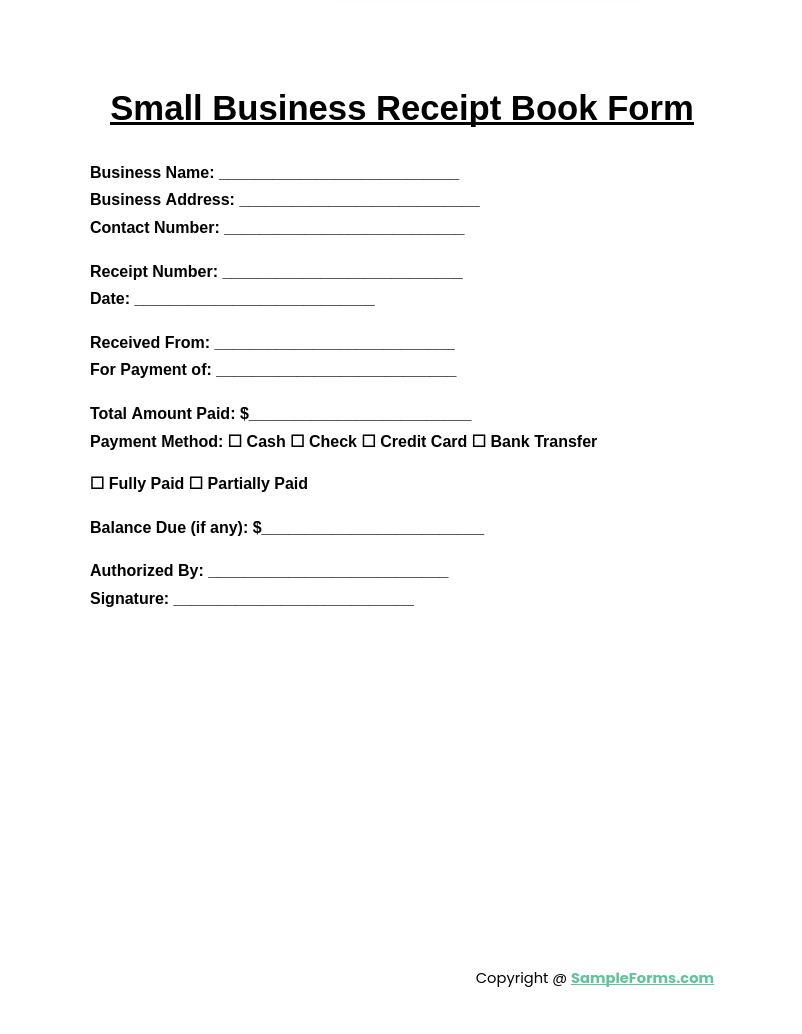

Small Business Receipt Book Form

A Small Business Receipt Book Form helps track sales, payments, and expenses efficiently. Similar to a Rent Receipt Form, it documents transaction dates, amounts, payer details, and purposes to maintain organized financial records for small enterprises.

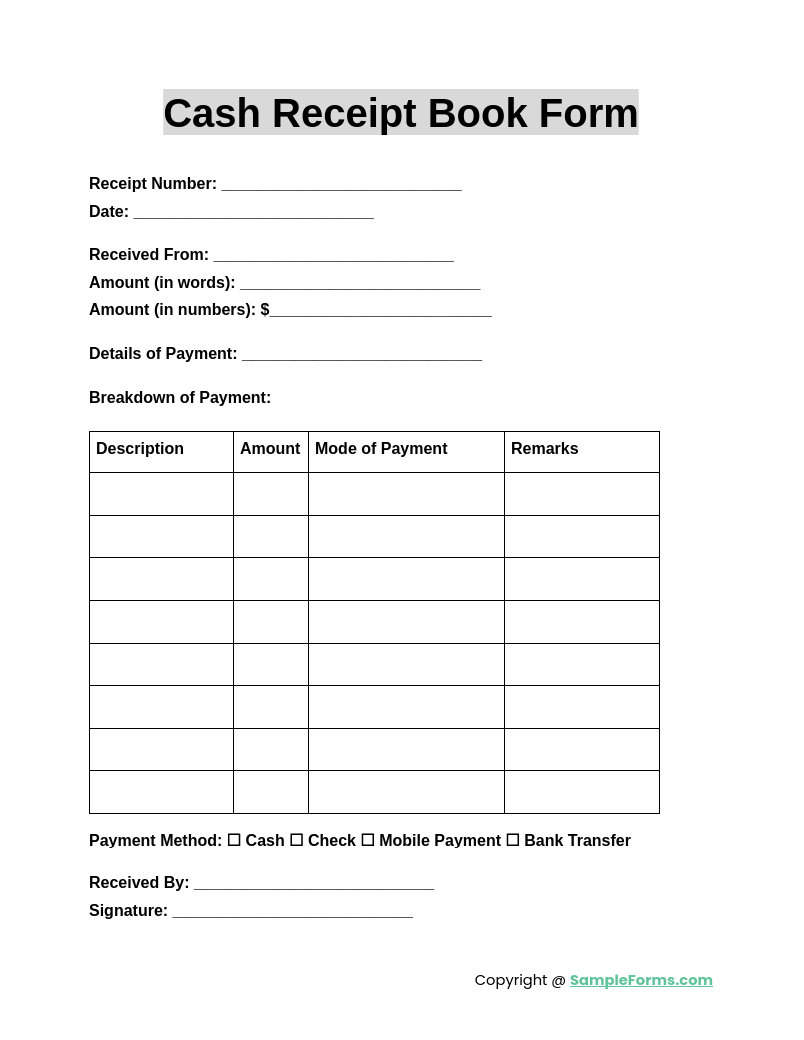

Cash Receipt Book Form

A Cash Receipt Book Form is used to acknowledge received cash payments. Like a Hotel Receipt Form, it includes essential details such as payer information, payment date, transaction amount, and purpose, ensuring clear and accurate financial documentation.

Types of Receipt Book Form Templates

Donation Receipt Book Form

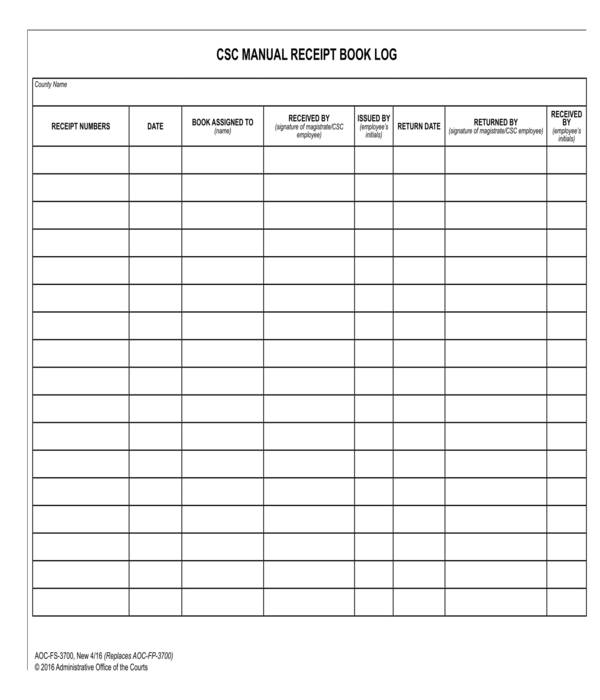

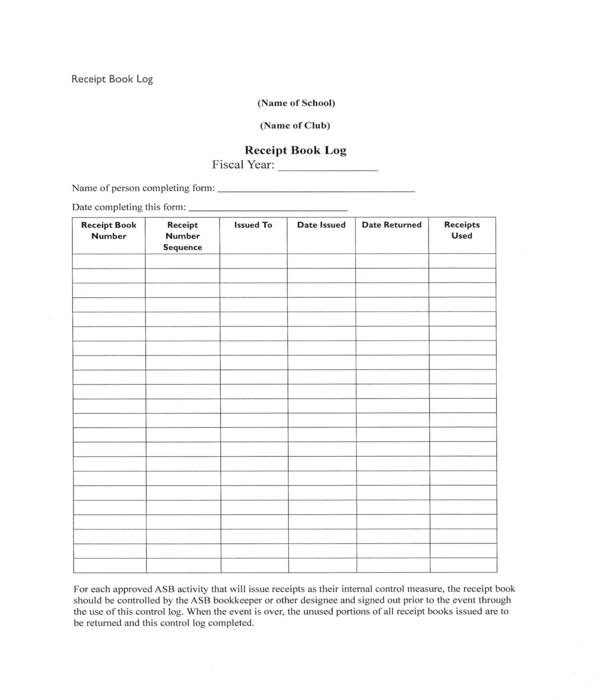

Manual Receipt Book Log Template

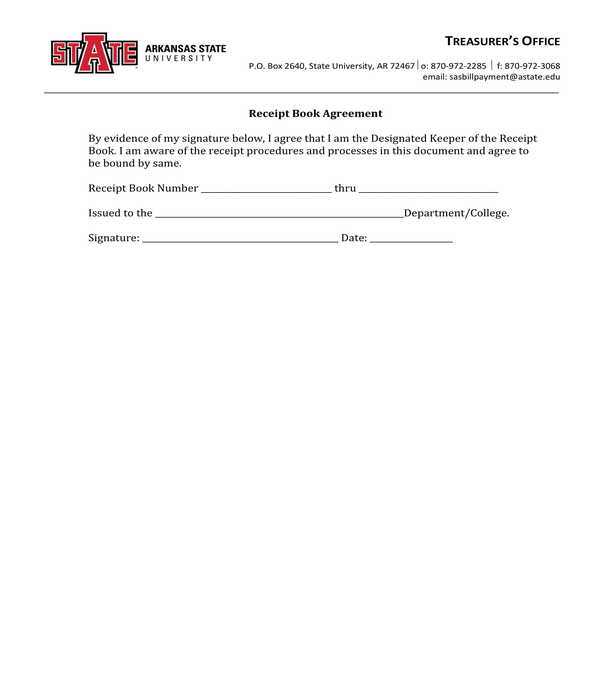

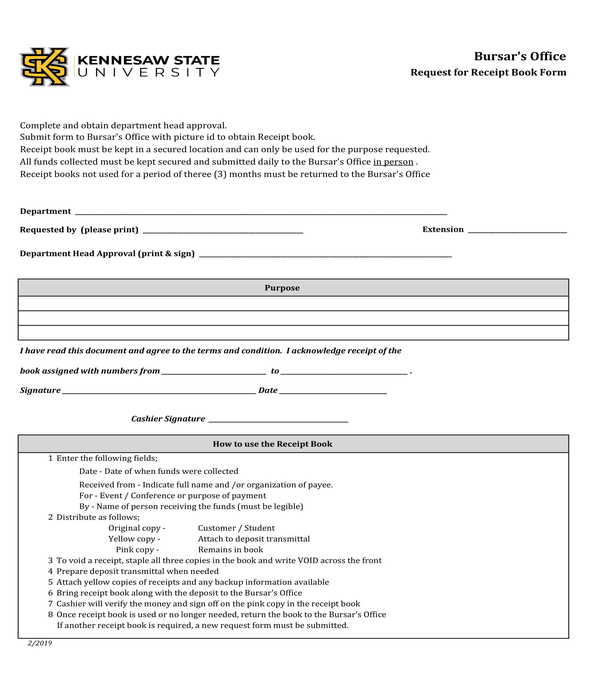

Receipt Book Agreement Form

Receipt Book Log Template

Receipt Book Request Form

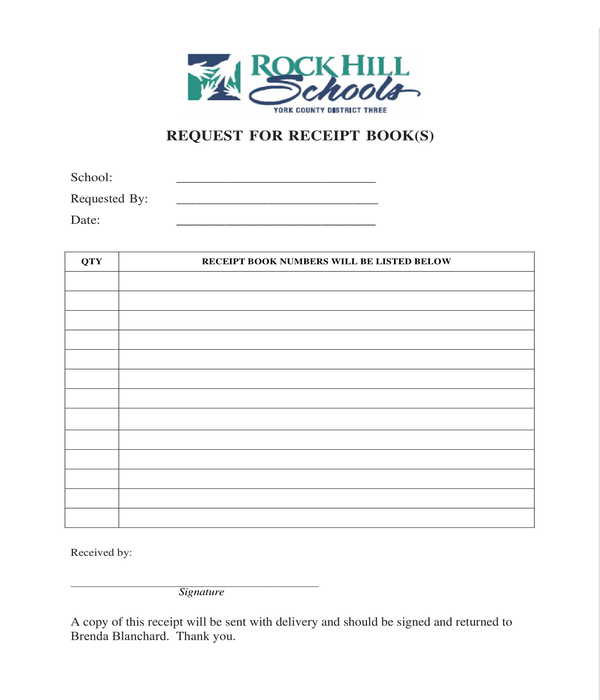

School Receipt Book Request Form

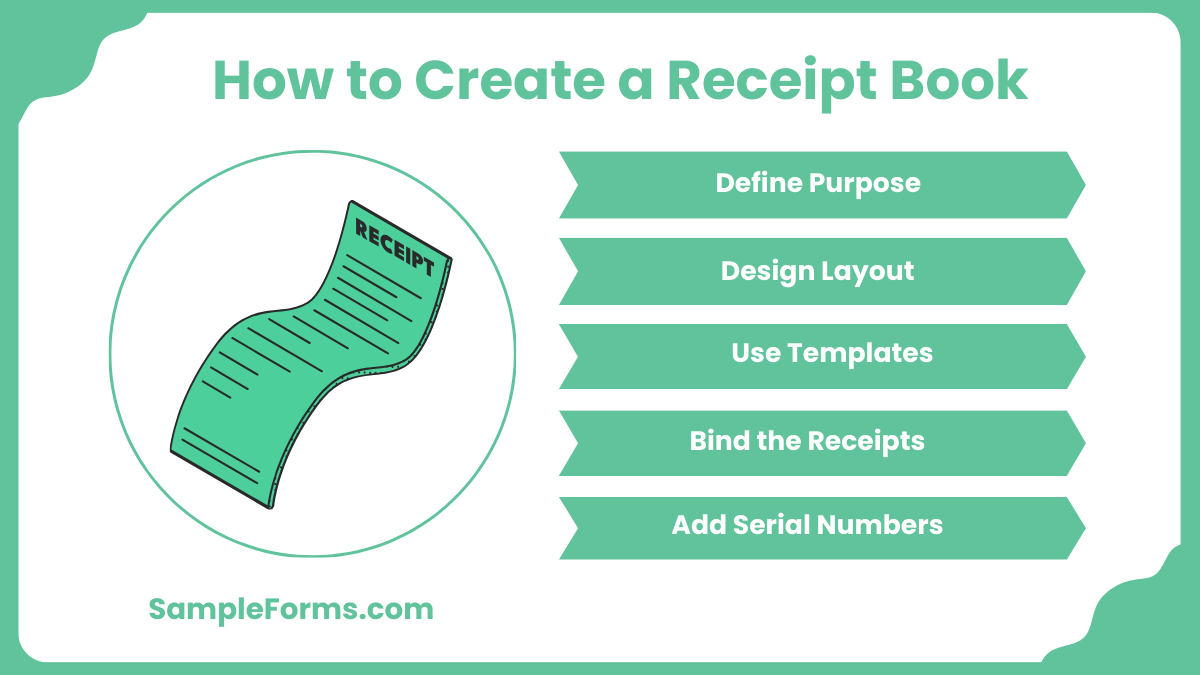

How to Create a Receipt Book?

A Receipt Book Form helps track transactions systematically. Key steps include:

- Define Purpose: Decide if it’s for sales, rent, or a Cash Receipt Form to track cash transactions.

- Design Layout: Include fields for date, payer/payee details, amount, and payment method.

- Use Templates: Utilize printable or digital templates for easy formatting.

- Bind the Receipts: Print and bind receipts in sequence for organized record-keeping.

- Add Serial Numbers: Number each receipt to maintain chronological records and avoid duplication.

How Do I Make a Receipt Form?

Creating a Receipt Book Form requires essential transaction details. Key steps include:

- Add Business Information: Include company name, logo, and contact details for authenticity.

- Include Transaction Details: Add date, description, amount, and payer information, like in a Donation Receipt Form.

- Specify Payment Method: Indicate whether payment was made via cash, check, or card.

- Signature Section: Add space for signatures to validate the transaction.

- Template Usage: Use editable templates for consistency and efficiency.

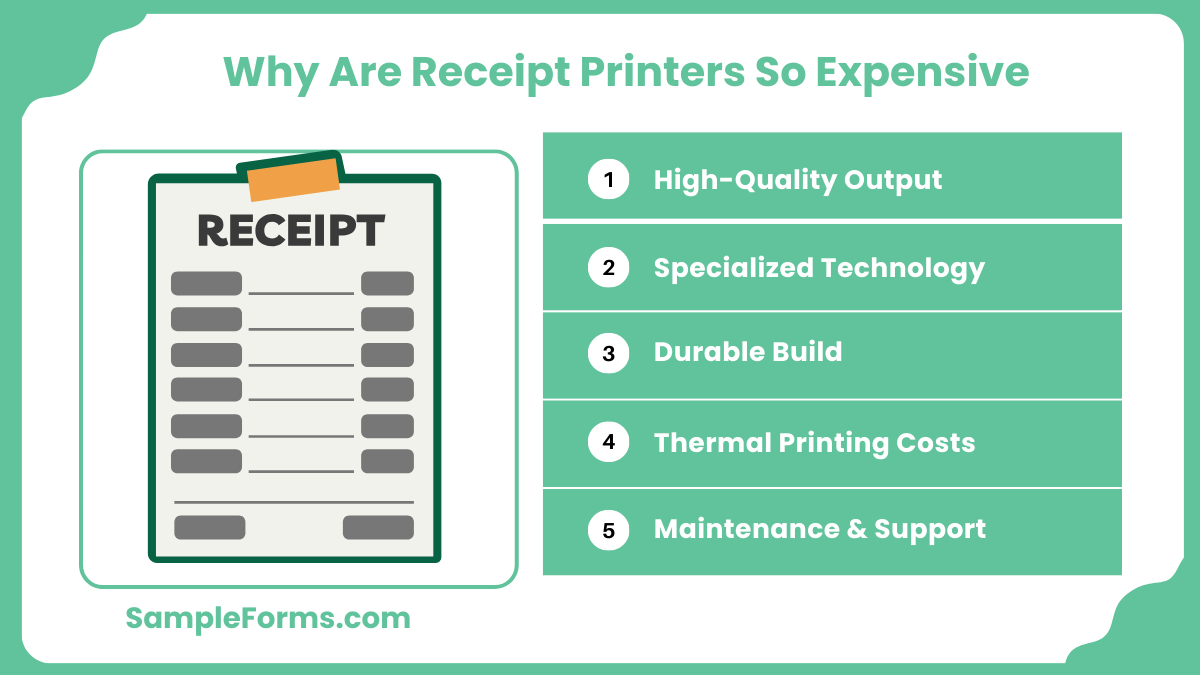

Why Are Receipt Printers So Expensive?

Receipt printers are costly due to specialized features. Key reasons include:

- High-Quality Output: Produces clear, durable receipts suitable for legal or accounting purposes.

- Specialized Technology: Advanced tech ensures fast printing, especially for high-volume businesses like those using Sales Receipt Form.

- Durable Build: Designed for long-term, continuous use in busy environments.

- Thermal Printing Costs: Uses heat-sensitive paper, which adds to the expense.

- Maintenance & Support: Comes with software updates and technical support, increasing overall cost.

How to Make a Receipt for Proof of Purchase?

A Receipt Book Form serves as proof of purchase. Key steps include:

- Identify Transaction: Mention the purchase date, items bought, and seller details.

- Specify Amount: Clearly state the total amount paid, like in a Purchase Receipt Form.

- Payment Method: Indicate whether payment was made by cash, card, or other means.

- Provide Signatures: Include buyer and seller signatures for validation.

- Add Reference Number: Assign a unique receipt number for tracking.

How Do I Create an Automatic Receipt?

An automatic Receipt Book Form saves time and reduces errors. Key steps include:

- Use Accounting Software: Choose software that supports automatic receipt generation.

- Template Setup: Customize a template with company details, similar to a Delivery Receipt Form.

- Automate Data Input: Link receipt fields with payment data for automatic updates.

- Enable Email Receipts: Set up auto-email delivery for digital receipts after transactions.

- Integrate Payment Gateways: Connect with online payment platforms for real-time receipt creation.

Is a Receipt Book the Same as an Invoice Book?

No, a receipt book records payments received, while an invoice book requests payments due. A Car Receipt Form is an example of payment confirmation after purchase.

What Is Receipt Book Paper Called?

Receipt book paper is commonly referred to as carbonless copy paper (NCR paper), often used in creating multi-copy receipts like a School Receipt Form.

Is There an App to Create a Receipt?

Yes, apps like Wave, Invoice Simple, and QuickBooks help create digital receipts efficiently, similar to generating a Daycare Receipt Form for record-keeping.

Does Word Have a Receipt Template?

Yes, Microsoft Word offers receipt templates that can be customized for different transactions, including formats similar to a Contractor Receipt Form.

Can I Make a Receipt Myself?

Yes, you can create a receipt manually or digitally, ensuring it includes all transaction details, much like a Missing Receipt Form for lost payment records.

What Can I Use Instead of Paper Receipts?

Digital receipts via email or apps can replace paper receipts, offering eco-friendly alternatives similar to generating an electronic Cleaning Receipt Form.

What Is a Receipt Maker Called?

A receipt maker is often referred to as receipt generator software, used to create documents like an Asset Receipt Form for financial transactions.

Is a Handwritten Receipt Legal?

Yes, handwritten receipts are legal if they include essential transaction details, signatures, and dates, similar to a properly documented Petty Cash Receipt Form.

What Paper Is Used for Receipts?

Thermal paper is commonly used for receipts due to heat-sensitive properties, ideal for fast printing in businesses like those issuing an Event Receipt Form.

What Papers Are Used for Receipts?

Receipts typically use thermal, bond, or carbonless copy paper, depending on the business need, similar to a Cash Payment Receipt Form for official transactions.

In conclusion, a Receipt Book Form is a vital tool for documenting financial transactions across various industries. It ensures transparency, legal compliance, and helps in maintaining organized financial records. Whether for sales, services, or rent payments, this form captures key transaction details, making it easier to manage accounts and prevent disputes. Using different formats like samples, templates, and customized forms enhances efficiency. Additionally, incorporating related documents like a Receipt of Agreement strengthens business documentation and provides comprehensive proof of transactions, ensuring accountability in all financial dealings.

Related Posts

-

FREE 6+ Asset Receipt Forms in MS Word | PDF

-

Cash Receipt Form

-

Lost Receipt Form

-

Donation Receipt Form

-

FREE 6+ Contractor Receipt Forms in PDF | MS Word

-

Delivery Receipt Form

-

FREE 7+ Service Receipt Forms in PDF | MS Word

-

What is Delivery Receipt Form? [ Definition, Policy and Procedures, Tips ]

-

What is Receipt Form? [ How to Fill, Uses ]

-

Deposit Receipt Form

-

Receipt Form

-

FREE 9+ Sample Receipt Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Payment Receipt Forms in PDF | MS Word | MS Excel

-

Rental Receipt Form

-

FREE 8+ Sample Donation Receipt Forms in PDF | Excel