A Quit Deed Form offers a swift and uncomplicated way to transfer property ownership without the warranty typical of traditional deeds. This approach is especially appealing for families, quick real estate transactions, or resolving minor title issues. By relying on mutual trust rather than guaranteeing clear title, it facilitates an easier handover of ownership rights. Homeowners often favor this method when the stakes are low, or an existing relationship of trust exists between the parties involved. Though relatively simple, it’s vital to ensure accuracy and legality throughout the process, including recording the document with the appropriate county office for complete validity and recognition.

Download Quit Claim Deed Form Bundle

What is Quit Claim Deed Form?

A Quit Claim Deed Form is a legal instrument used to transfer whatever ownership interest one has in a property to another party, without guaranteeing that the title is free from claims. Often used for gifting property or settling disputes among family members, it presents a straightforward way to convey interest swiftly. Unlike warranty deeds, it provides minimal protection to the recipient, transferring only the interest owned by the grantor at the time. Consequently, both parties should conduct thorough research and, if needed, seek legal advice to confirm the property’s status before finalizing the transfer.

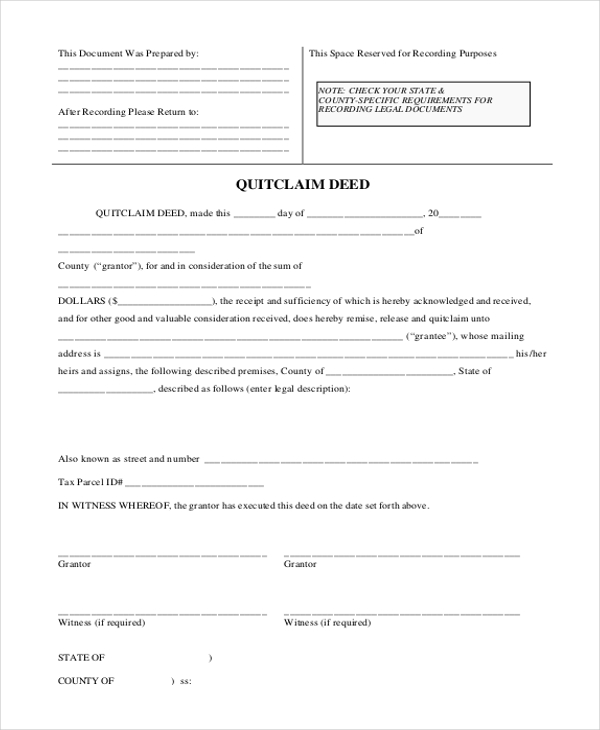

Quit Claim Deed Format

Parties Involved

Grantor Name: __________________________

Grantor Address: __________________________

Grantee Name: __________________________

Grantee Address: __________________________

Property Information

Legal Description: __________________________

Property Address: __________________________

Deed Details

Transfer Purpose: __________________________

Date of Transfer: __________________________

Grantor’s Declaration of No Warranty: __________________________

Signatures

Grantor Name: __________________________

Signature: __________________________

Date: __________________________

Notary Section

Notary Name: __________________________

Notary Signature: __________________________

Seal: __________________________

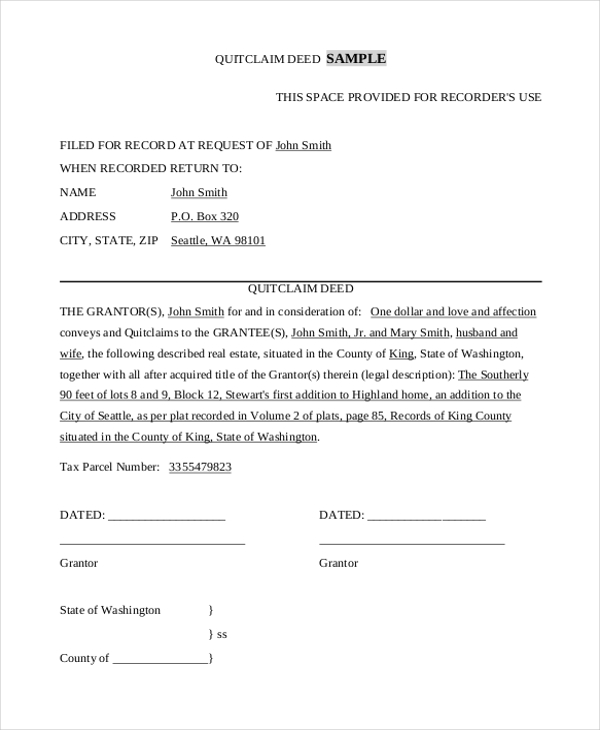

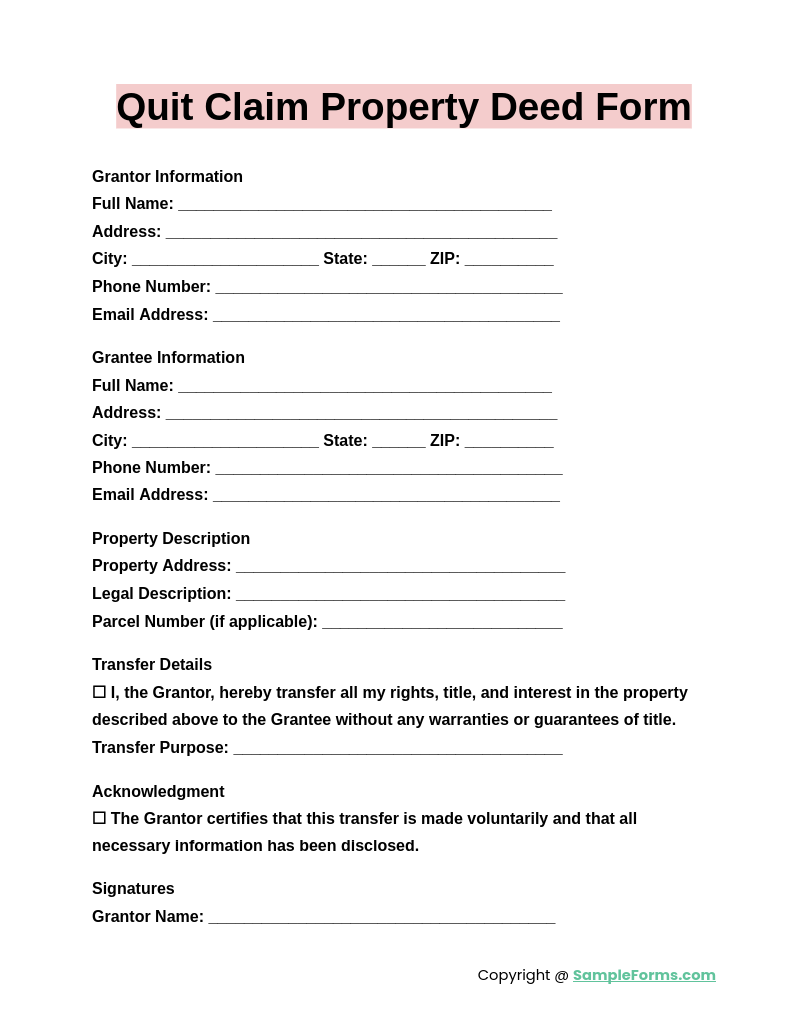

Quit Claim Property Deed Form

A Quit Claim Property Deed Form is used to transfer property without guaranteeing clear ownership. Similar to a Claim Form, it outlines the grantor and grantee details, property description, and official signatures required for a valid transfer, providing legal assurance.

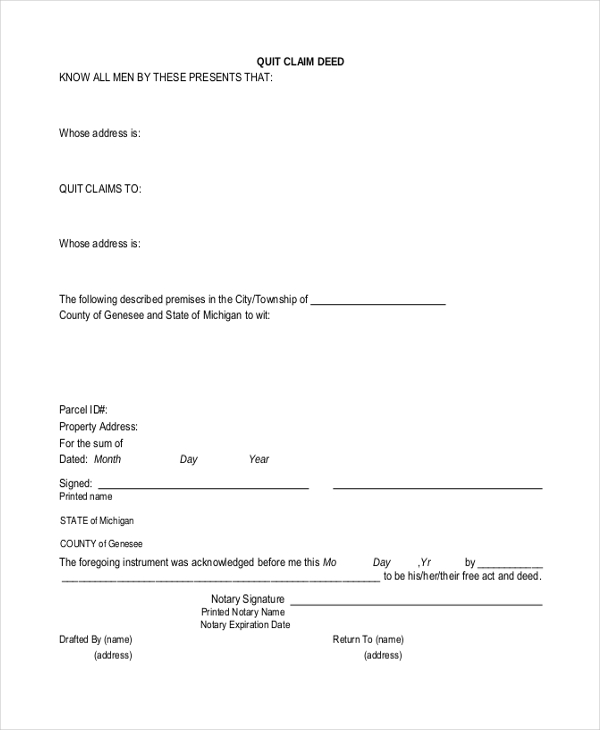

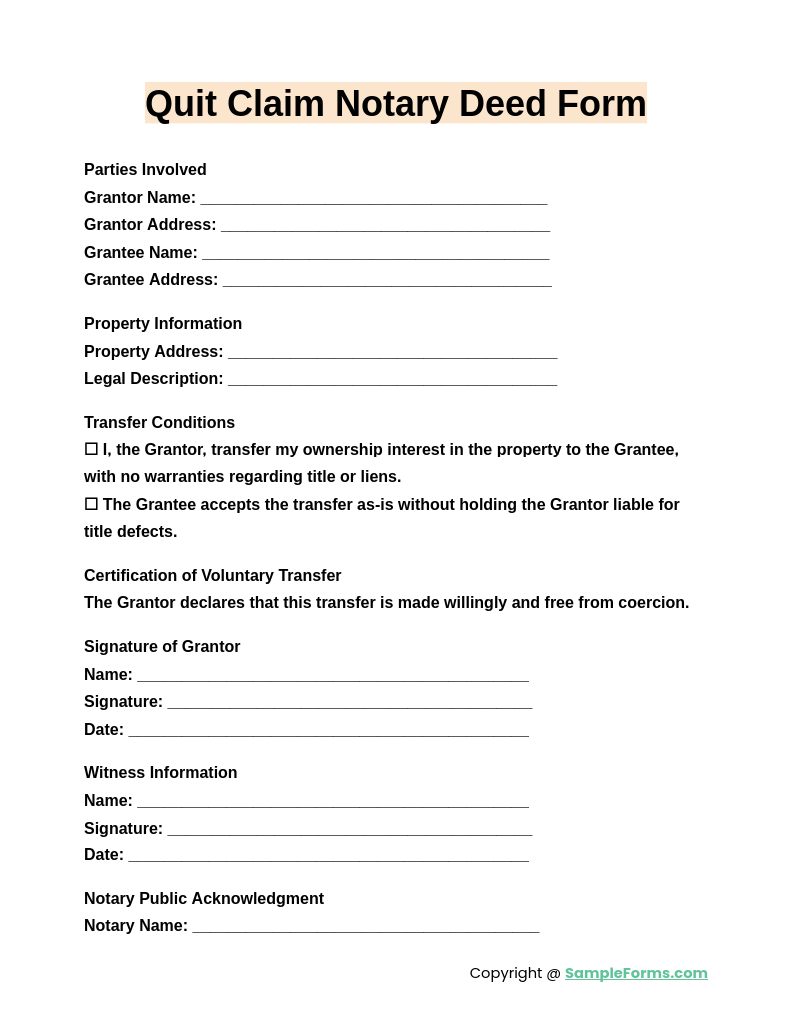

Quit Claim Notary Deed Form

A Quit Claim Notary Deed Form safeguards transfers by requiring notarized confirmation. Similar to a Warranty Claim Form, it ensures the document is properly witnessed, verifying identities and reducing future legal disputes over title or property claims, and accountability.

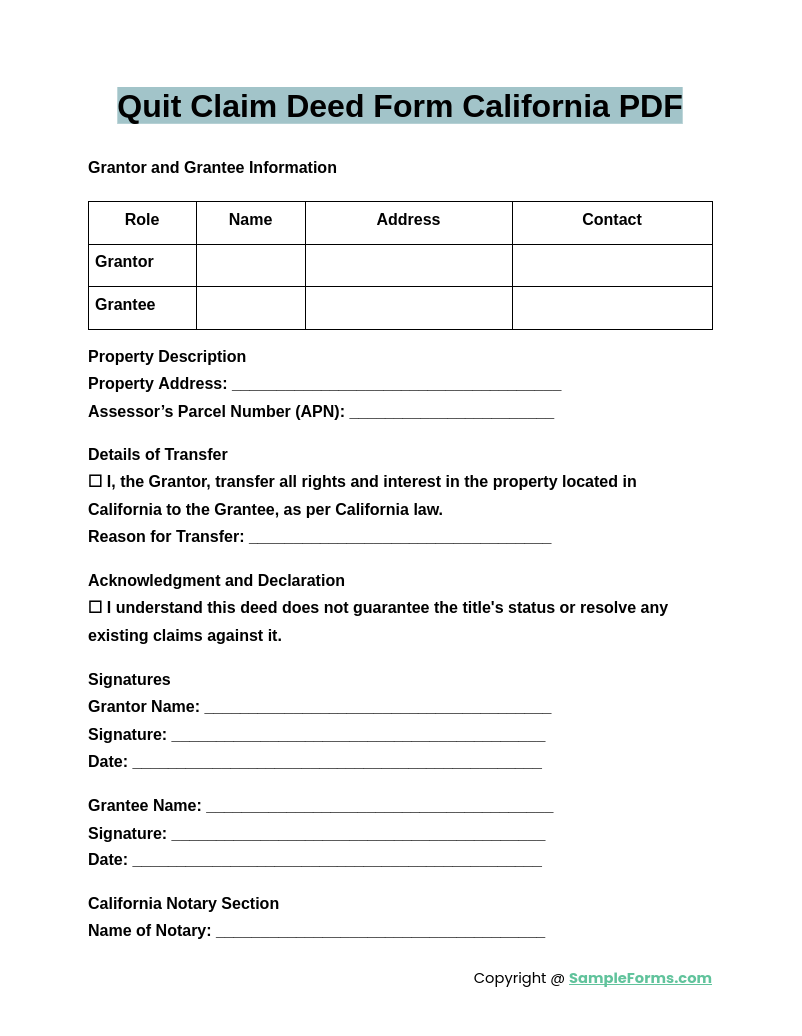

Quit Claim Deed Form California PDF

A Quit Claim Deed Form California pdf follows state-specific guidelines for smooth property transfers. Similar to a Statement of Claim Form, it details parties’ information, legal descriptions, and signatures, ensuring compliance with California law for streamlined and transparent ownership changes.

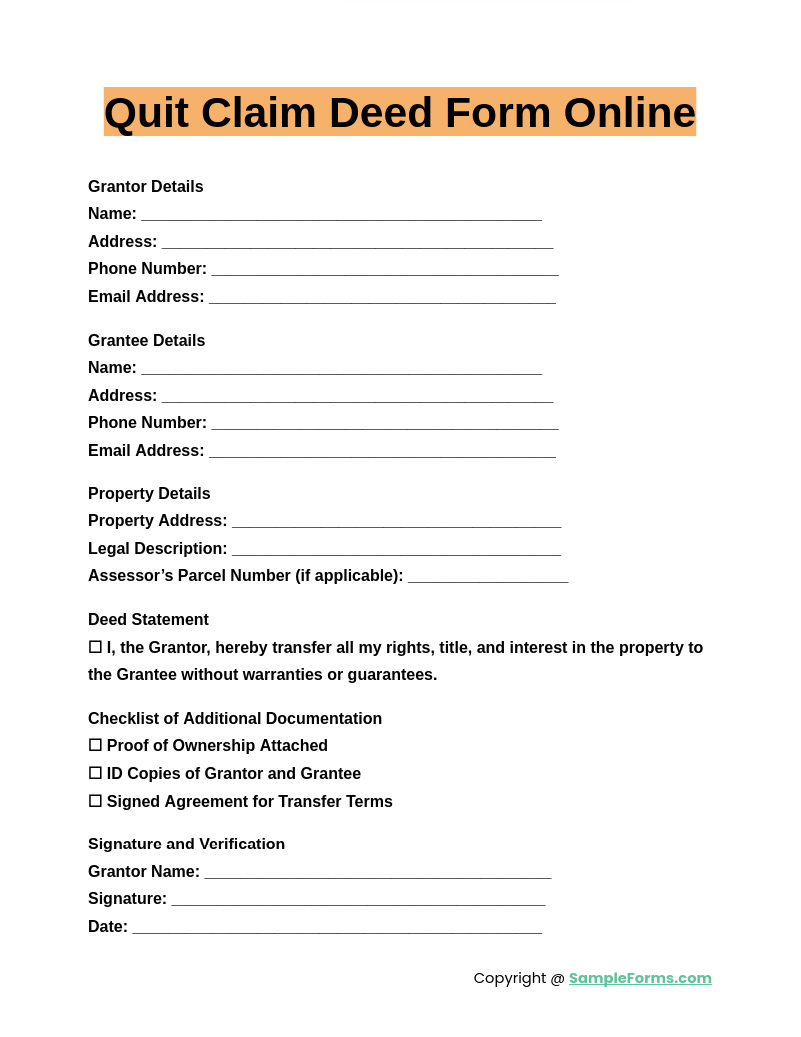

Quit Claim Deed Form Online

A Quit Claim Deed Form Online streamlines remote property transfers through digital means. Similar to an Insurance Claim Form, it verifies required details, enabling swift execution and clear recordkeeping without physical presence or extensive paperwork for hassle-free transactions and accuracy.

Browse More Quit Claim Deed Forms

Blank Quit Claim Deed Form

Generic Quit Claim Deed Form

Quit Claim Deed Sample Form

Printable Quit Claim Deed Form

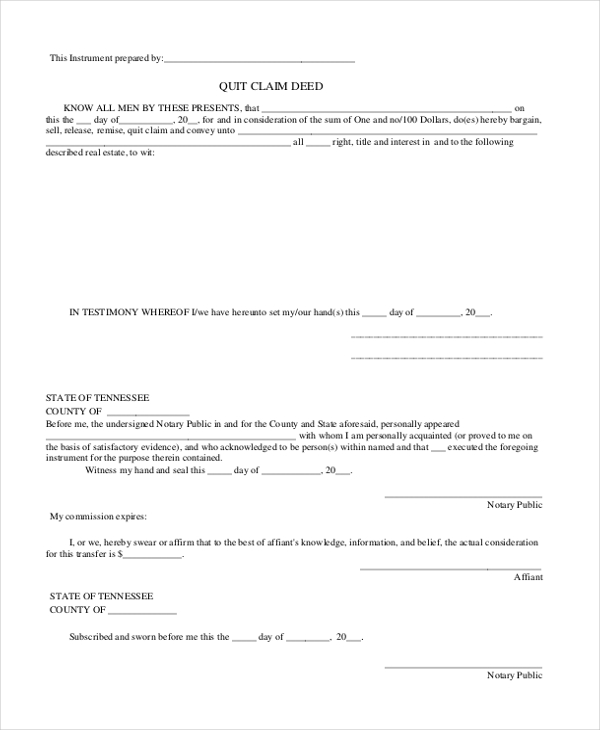

Quit Claim Deed Form Tennessee

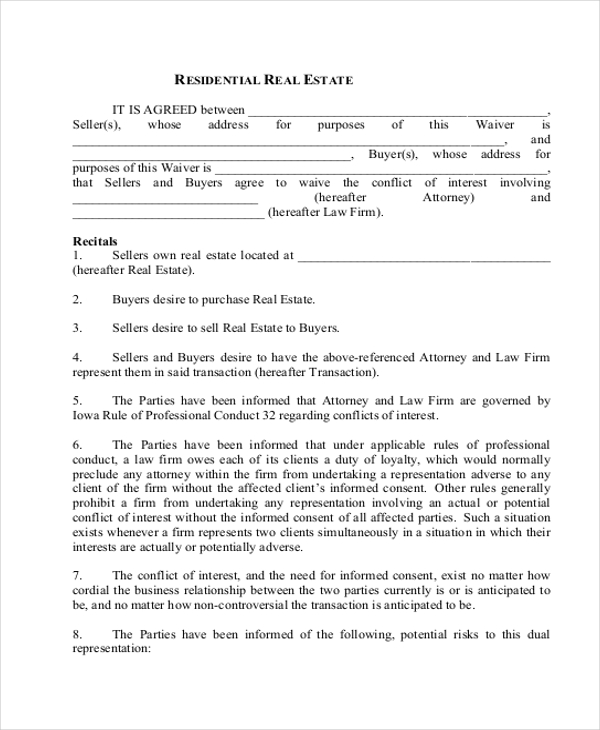

Sample Real Estate Quit Claim Deed Form

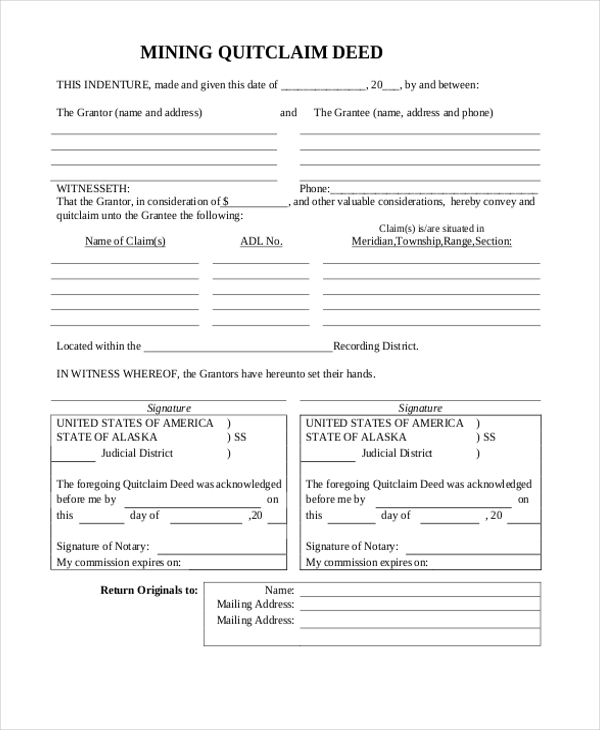

Mining Quit Claim Deed Form

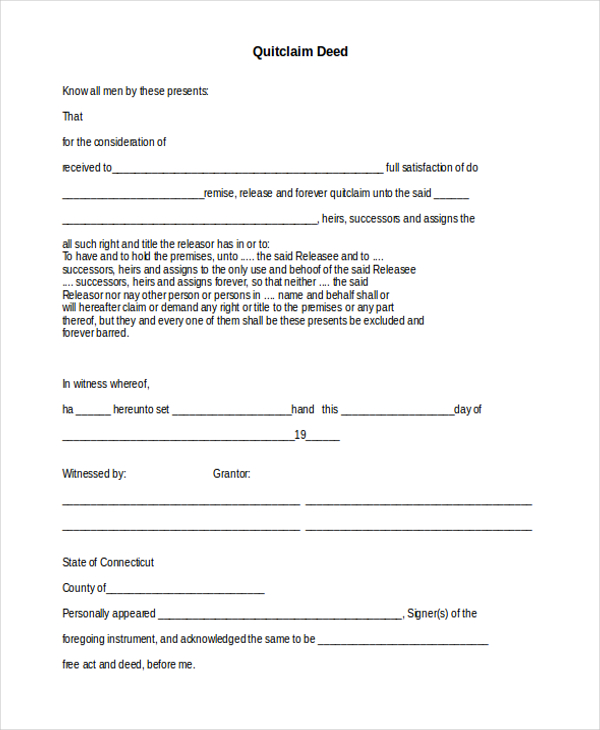

Connecticut QuitClaim Deed

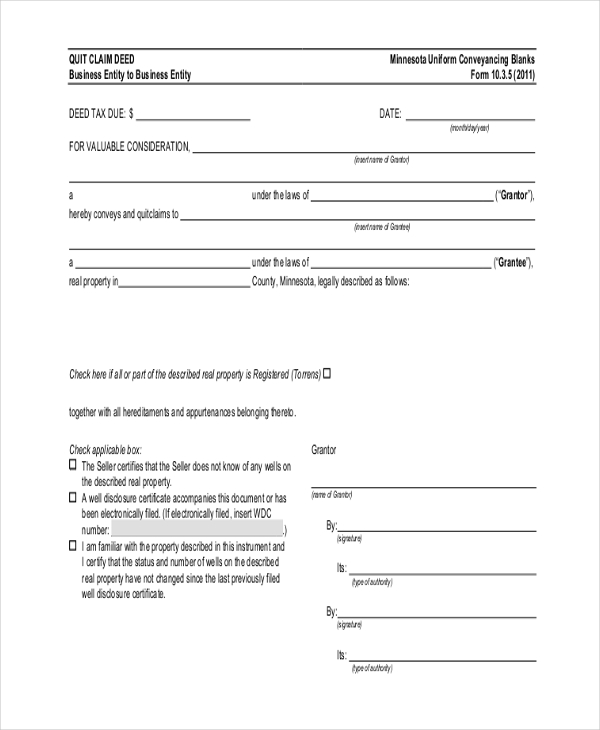

How does a quitclaim deed work in MN?

Quitclaim deeds in Minnesota permit swift property ownership transfers without warranties, requiring proper legal documentation and signatures to ensure validity.

- Eligibility Requirements: Similar to a Small Claim Form, both grantor and grantee must meet state guidelines to execute a valid transfer.

- Signature and Notarization: The grantor must sign in the presence of a notary, confirming legal intent.

- Witness Requirements: Minnesota law may demand an additional witness signature for further credibility.

- Recording Process: Submit the deed to the county recorder for official recognition and public record.

- Legal Implications: Quitclaim deeds grant no title warranty, so both parties should verify potential liens or claims beforehand.

What is the purpose of a quit claim deed?

Quit claim deeds provide a swift method to transfer ownership interests without guaranteeing clear title, often relying on trust between parties.

- Simple Family Transfers: Similar to a Travel Expense Claim Form, quickly handle property exchanges among trusted relatives.

- Rapid Property Gifts: Streamlines gifting assets without the formalities of a warranty deed.

- Business Restructuring: Adjust ownership stakes within organizations efficiently.

- Ease of Use: Minimal documentation and straightforward execution simplify the process.

- Risk Acceptance: Recipients assume possible title defects, emphasizing the importance of trust between parties.

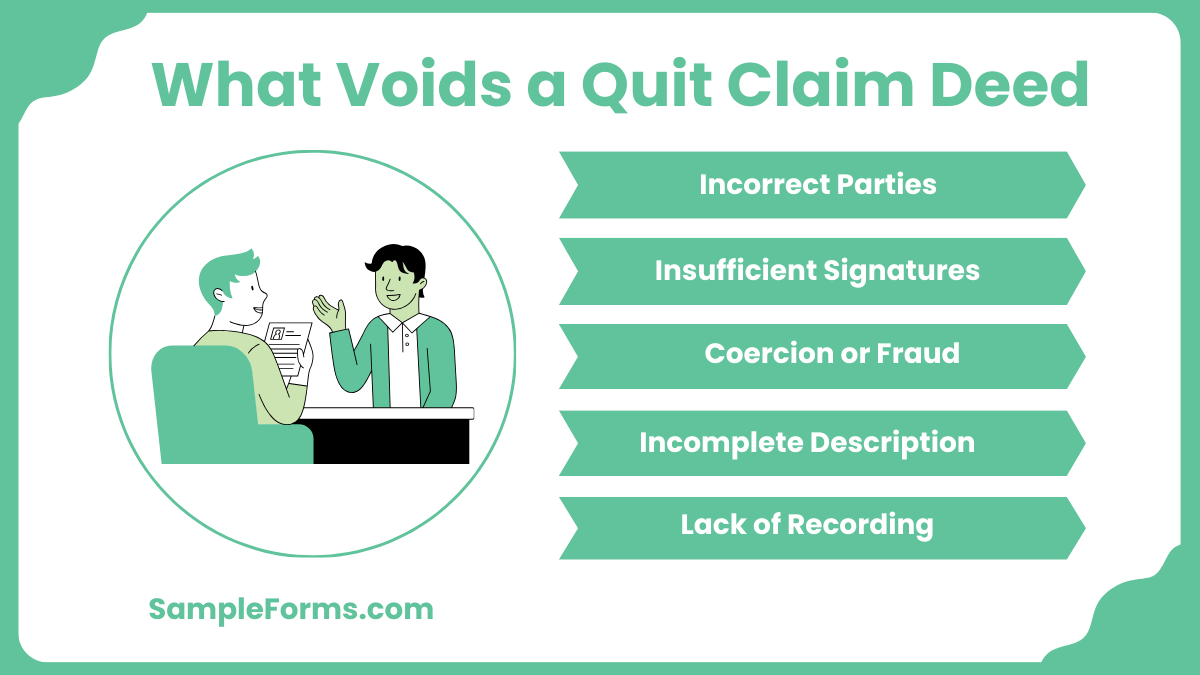

What voids a quit claim deed?

Errors, fraud, or legal deficiencies can invalidate quit claim deeds, potentially preventing intended ownership transfers and challenging subsequent property rights.

- Incorrect Parties: Misidentifying the grantor or grantee undermines the deed’s validity, much like a Travel Insurance Claim Form missing details.

- Insufficient Signatures: Omitting notary or witness endorsements can render the deed unenforceable.

- Coercion or Fraud: If the grantor was forced or the signature was forged, it nullifies the transfer.

- Incomplete Description: Vague or inaccurate property details invalidate the deed’s scope.

- Lack of Recording: Unrecorded deeds may not stand against future third-party claims.

Who benefits the most from a quitclaim deed?

Those seeking quick ownership transfers with trusted parties or minimal legal assurance often gain significantly the most from quitclaim deeds.

- Family Transfers: Ideal for moving property among relatives without formal title guarantees, akin to a Claim Reimbursement Form.

- Divorce Settlements: Quickly settles property division, minimizing disputes.

- Estate Adjustments: Efficient for adding or removing heirs from property titles.

- Business Partners: Easily shift real estate holdings when dissolving or restructuring partnerships.

- Low-Risk Transactions: Suited for scenarios where warranty deeds aren’t necessary or practical.

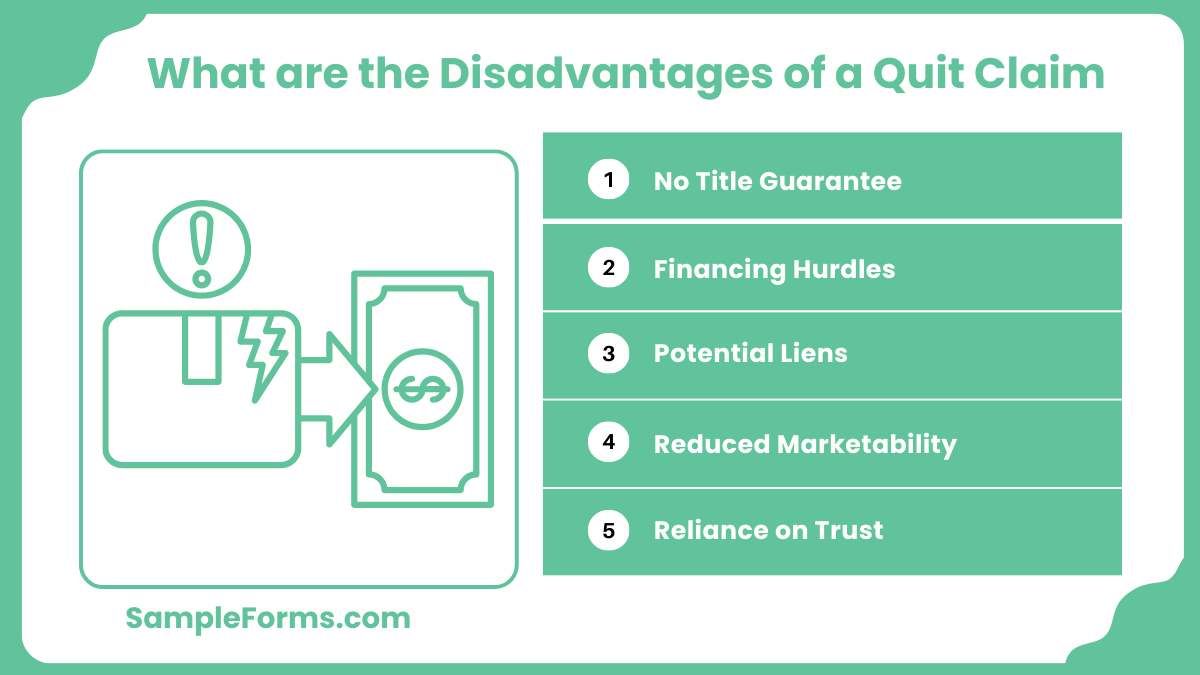

What are the disadvantages of a quit claim?

Quit claim deeds offer minimal protection to recipients, often risking hidden liens or title issues that become the transferee’s responsibility.

- No Title Guarantee: Unlike standard deeds, there’s no legal promise of undisputed ownership, similar to a Travel Claim Form with limited coverage.

- Financing Hurdles: Lenders may reject properties transferred via quit claim for mortgages or refinancing.

- Potential Liens: Undetected debts tied to the property become the recipient’s burden.

- Reduced Marketability: Future buyers may doubt the property’s clear title, affecting resale.

- Reliance on Trust: Confidence in the grantor’s honesty is essential, as no warranty is provided.

Can I prepare a quit claim deed myself?

You can draft a quit claim deed by yourself, following your state’s guidelines and providing accurate details. Similar to a Health Insurance Claim Form, correct documentation ensures a valid transfer. Seek legal advice if uncertain.

How much does it cost to file a quitclaim deed in Wisconsin?

Filing fees vary by county, typically ranging from $30 to $50. Similar to a Notice of Claim Form, correct submission ensures acceptance and accuracy. Verify local regulations to confirm final costs, including recording and taxes.

Is a quit claim deed OK?

A quit claim deed can be acceptable for transferring ownership without guaranteeing clear title. Similar to a Medical Claim Form, it requires accurate data and verification. Parties should research liens thoroughly before finalizing the transfer.

Does a quit claim deed override a will?

Yes, a recorded quit claim deed takes precedence over conflicting testamentary instructions. Similar to a Proof of Claim Form, it establishes the grantor’s intent in writing. Confirm state laws for proper execution and recording requirements.

Do both parties need to be present for quit claim deed?

Generally, both parties sign before a notary, though separate signings may be permissible. Similar to a Dental Claim Form, accurate details and proper witnessing are crucial. Confirm local requirements for valid execution and recording rules.

How do I get around a quitclaim deed?

Overturning or bypassing a quitclaim deed involves proving invalidation, mutual agreement, or court action. Similar to a Business Expense Claim Form, documentation accuracy helps clarify ownership. Seek legal counsel before modifying property rights or deeds.

What is the down side to a quit claim deed?

The downside is no warranty of clear title or lien-free status, risking hidden issues. Similar to a Disability Claim Form, limited assurances require thorough investigation. Recipients bear liabilities if problems emerge after the ownership transfer.

Is it hard to sell a house with a quit claim deed?

Yes, buyers may hesitate due to title uncertainty, as there’s no warranty. Similar to a Contract for Deed Form, thorough title checks and disclosures are necessary. Financing options might be limited, prolonging the selling process.

How long is a quitclaim deed good for?

Once recorded, a quitclaim deed remains valid indefinitely, unless legally challenged or rescinded. Similar to a Deed Transfer Form, it documents immediate rights transfer. Future title issues may arise if undisclosed liens or claims exist.

The Quitclaim Deed Form simplifies property transfers by allowing individuals to transfer ownership rights quickly, often between family members or trusted parties. Though it lacks the assurances that come with more formal deeds, it remains a valuable tool for specific situations like gifting property or clearing minor title discrepancies. When combined with appropriate legal advice, it can streamline transactions and prevent unnecessary complications. Whether you’re drafting sample forms, letters, or other related documents, be mindful of local recording requirements and best practices. This approach ensures transparency and a successful transfer, solidifying its usefulness in various real estate scenarios.

Related Posts Here

-

Pre Training Assessment Form

-

Workers Compensation Form

-

Security Deposit Refund Form

-

Land Purchase Agreement

-

Construction Risk Assessment Form

-

Child Medical Consent Form

-

Death Form

-

Car Receipt Form

-

Hotel Complaint Form

-

Equipment Requisition Form

-

Hotel Check-In Form

-

Background Verification Form

-

Approval Form

-

Contract Labor Form

-

Church Form