An Expense Report Form is essential for tracking and reimbursing business or personal expenses. This guide provides a comprehensive look at how to create, complete, and manage expense reports effectively. Covering detailed examples and practical steps, it simplifies the reporting process for both employees and employers. Whether you’re logging expenses for a trip or organizing finances for a project, this guide ensures you submit accurate reports and meet financial policies. Including resources like a Report Form and Service Report Form tips on calculating expenses, this guide is perfect for keeping records organized and accurate.

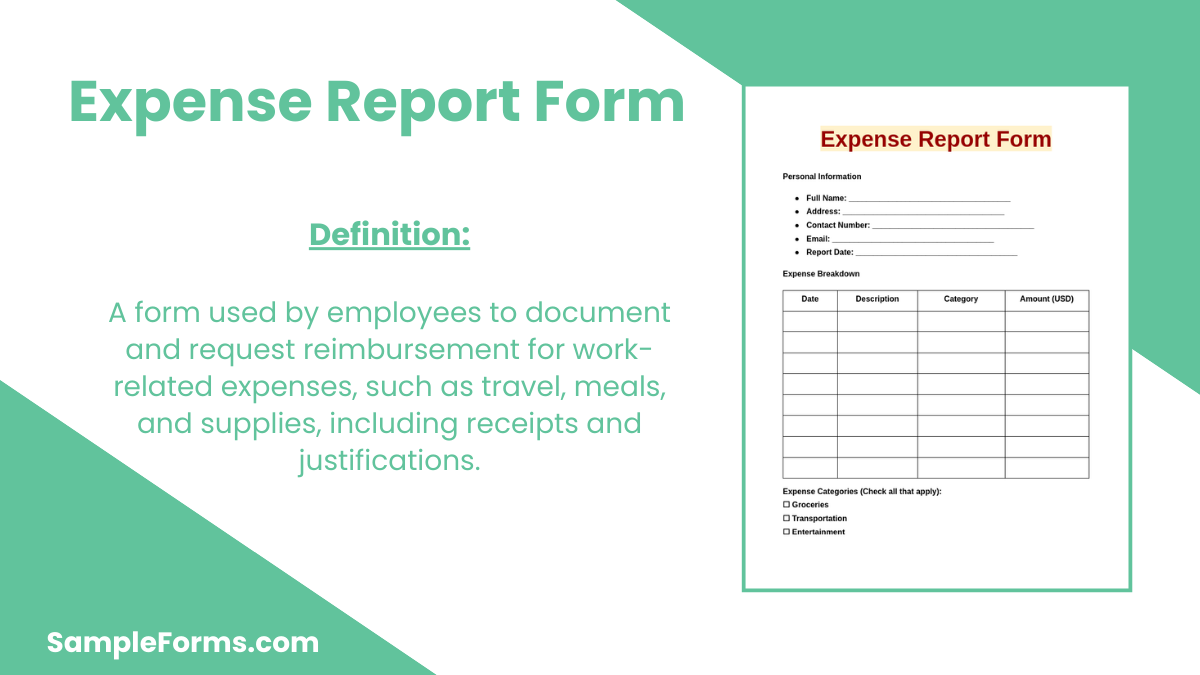

What is Expense Report Form

An Expense Report Form is a document used to record, categorize, and submit expenses for reimbursement or tracking purposes. It includes essential information like expense date, category, amount, and reason. Used in business and personal finance, it ensures accurate expense documentation, helping to streamline financial management and reporting processes. Common fields include travel, meals, and lodging, making it easier to track spending for business, budgeting, or tax purposes. The form is typically used by employees, freelancers, and business owners who need detailed expense logs for company reimbursements or personal budgeting.

Expense Report Format

Expense Report Form

- Employee Name:

[Enter full name] - Employee ID:

[Enter ID] - Department:

[Enter department] - Report Period:

From: [Enter start date]

To: [Enter end date] - Expense Details:

Date: [Enter expense date]

Description: [Enter description]

Category: [Select: Travel, Meals, Supplies, Other]

Amount: [Enter amount] - Total Amount Claimed:

[Enter total amount] - Receipts Attached?:

[Select: Yes, No] - Approval by Manager:

Name: [Enter manager’s name]

Signature: [Sign and date] - Payment Method for Reimbursement:

[Select: Direct Deposit, Check]

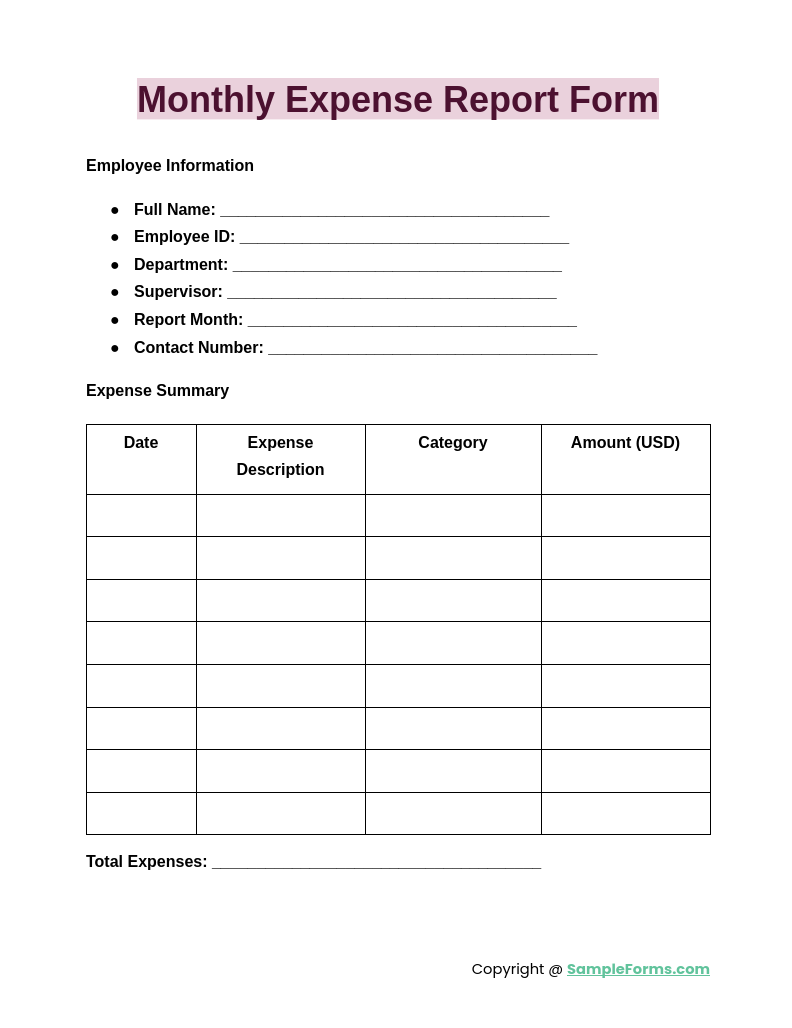

Monthly Expense Report Form

A Monthly Expense Report Form records all expenses over a month, helping individuals or businesses track spending patterns. This report form ensures accurate monthly summaries, much like preparing a Medical Report Form for organized record-keeping.

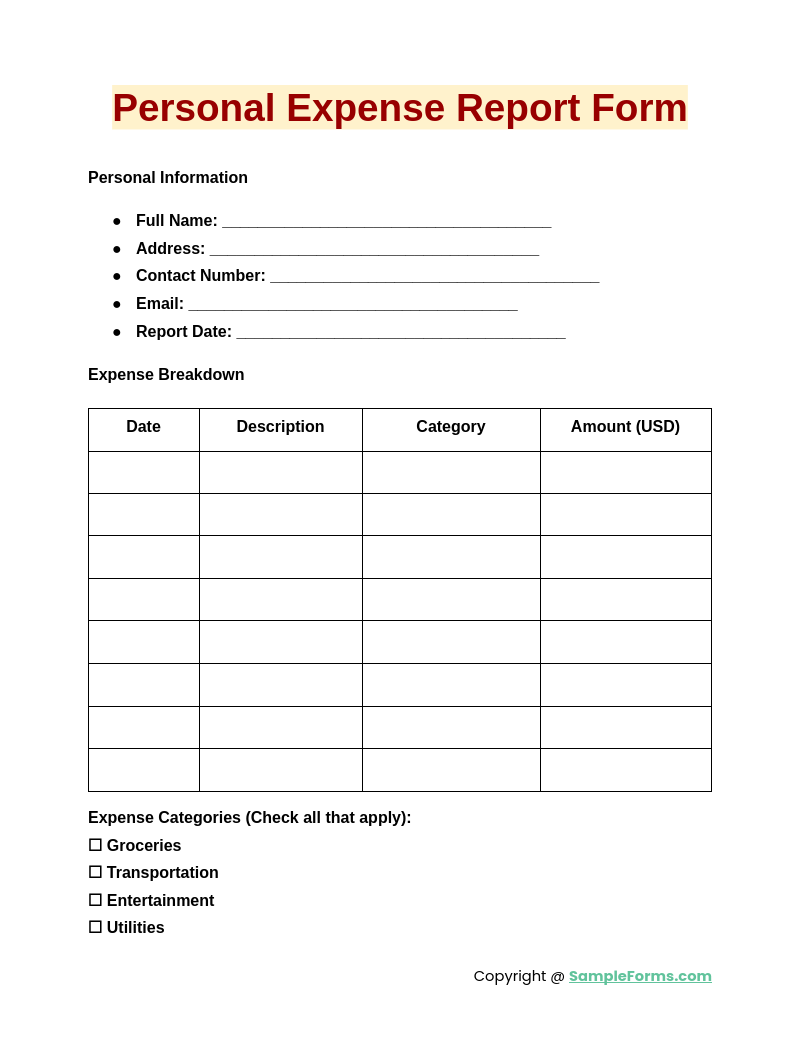

Personal Expense Report Form

A Personal Expense Report Form is used to track individual expenses, including daily purchases and bills. It supports budgeting and financial awareness, similar to using a Student Progress Report Form for academic tracking.

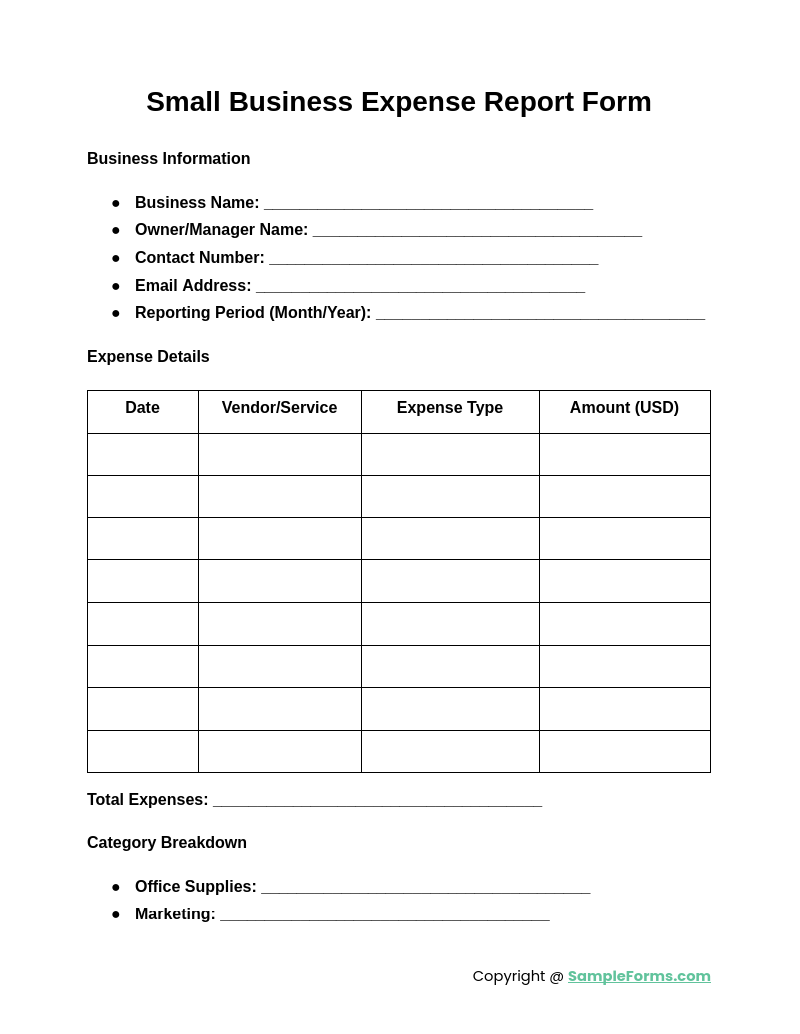

Small Business Expense Report Form

A Small Business Expense Report Form is essential for recording and categorizing business expenditures, from supplies to travel. It promotes organized accounting practices, similar to a thorough Inspection Report Form.

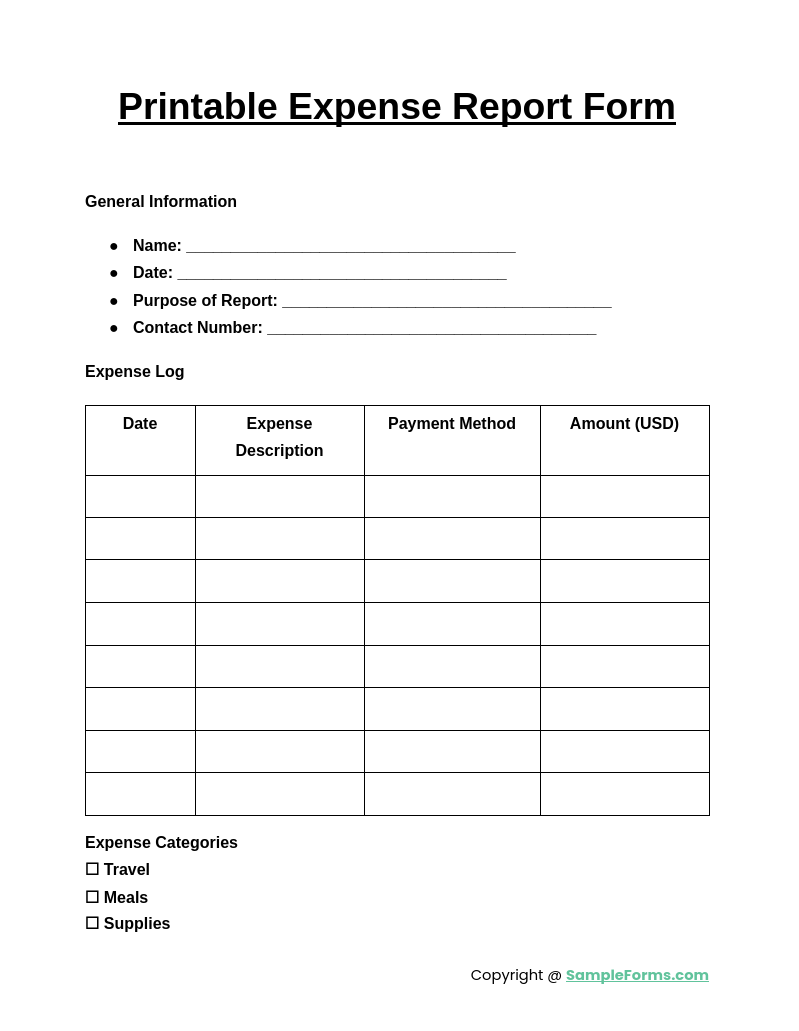

Printable Expense Report Form

A Printable Expense Report Form offers a ready-to-use format for recording expenses, ideal for traditional or offline use. It’s particularly convenient, similar to completing an Internship Report Form for easy documentation.

Daily Expense Report Forms

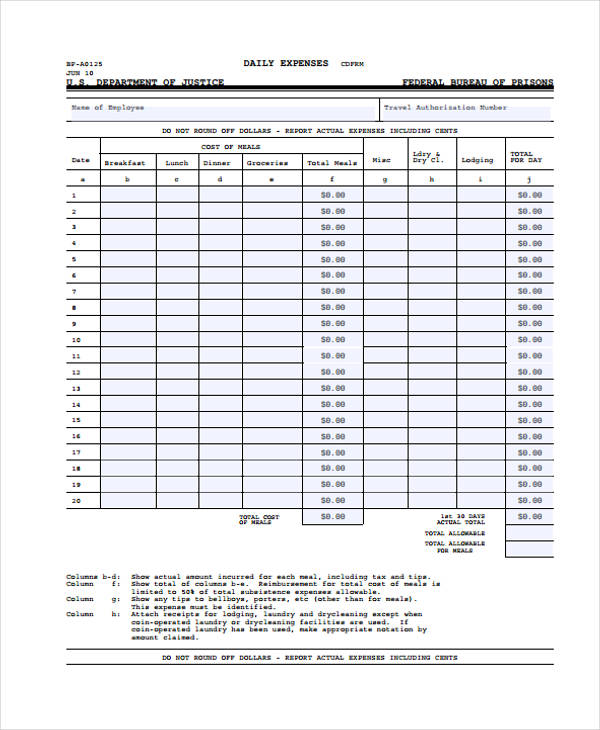

Daily Expense Report Form Example

Daily Travel Expense Worksheet Report Form Sample

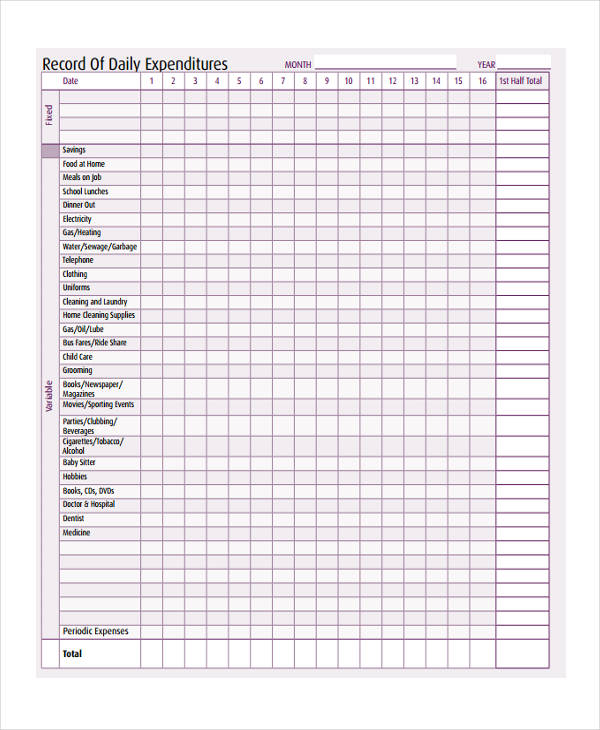

Daily Expenditure Record Form

Employee Expense Report Forms

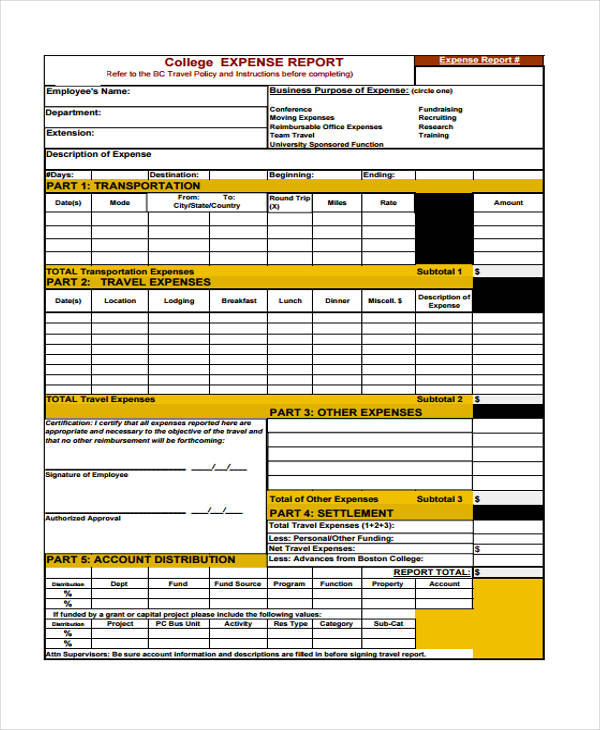

College Employee Travel Expense Report Form

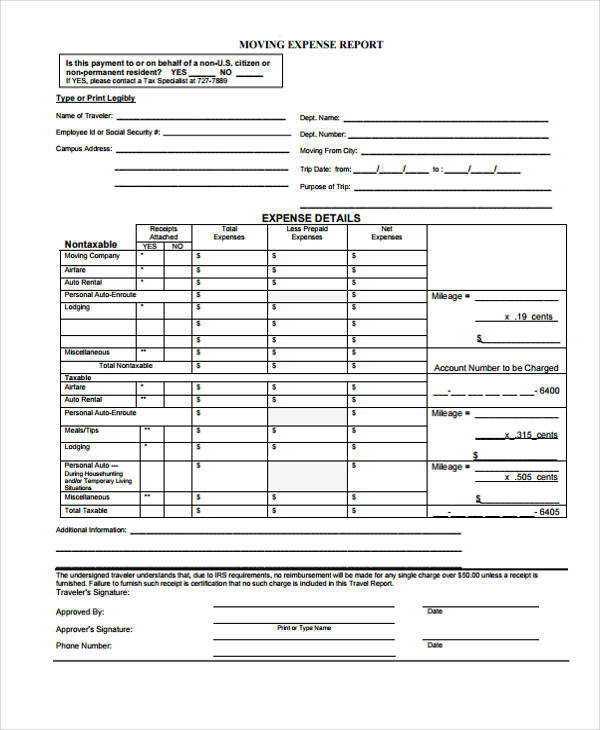

Employee Moving Expense Report Form

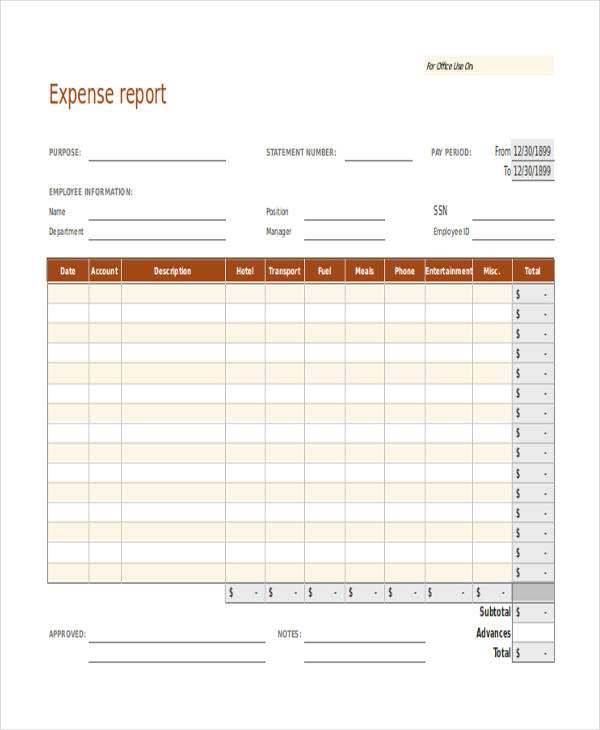

Employee Expense Report Form Sample

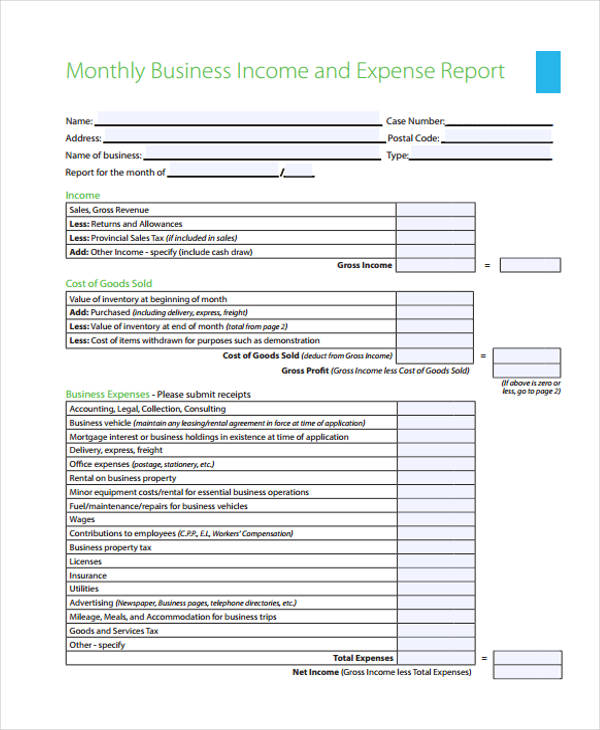

Monthly Expense Report Forms

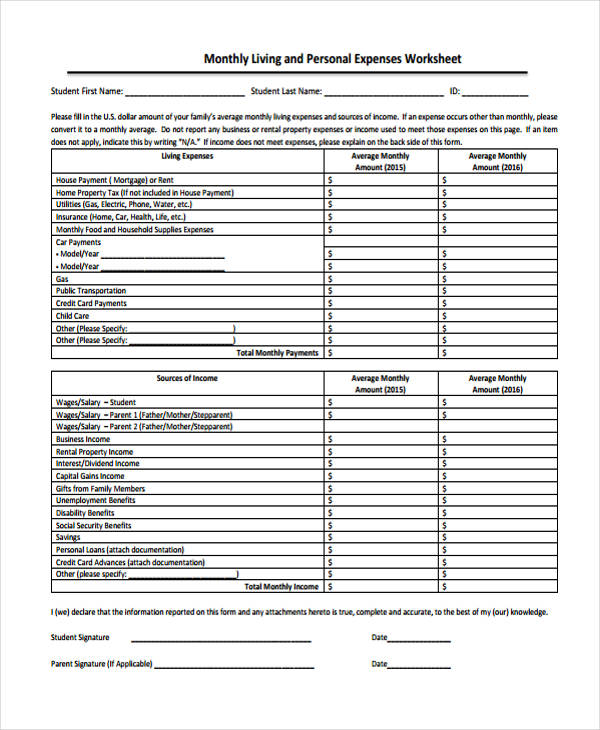

Monthly Personal Expense Worksheet Report Form

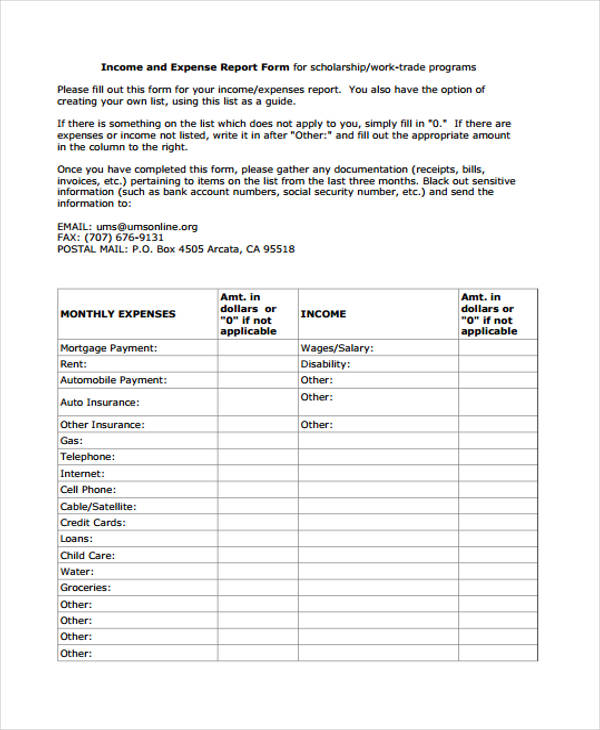

Monthly Income and Expense Report Form

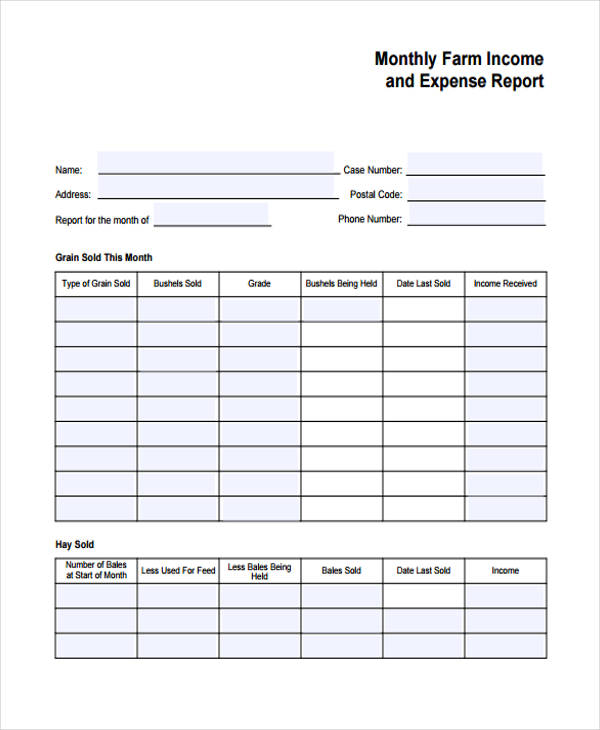

Monthly Farm Income Expense Report Form

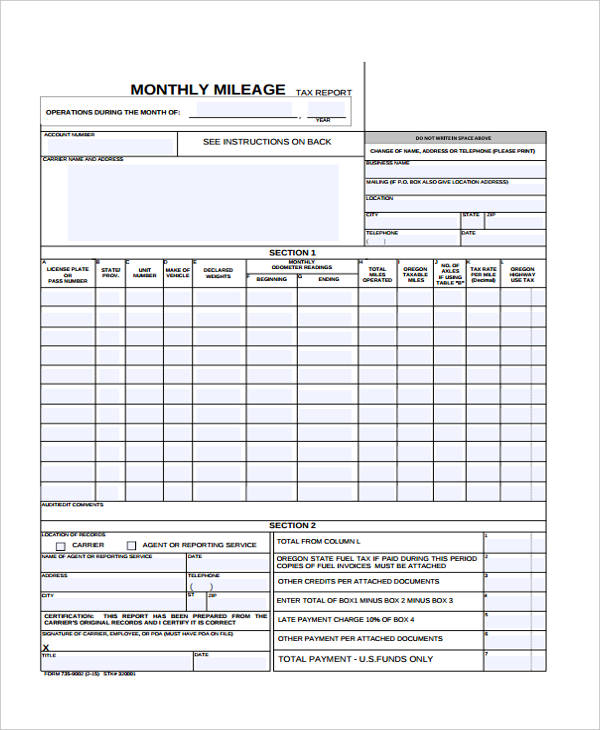

Monthly Mileage Expense Report Form

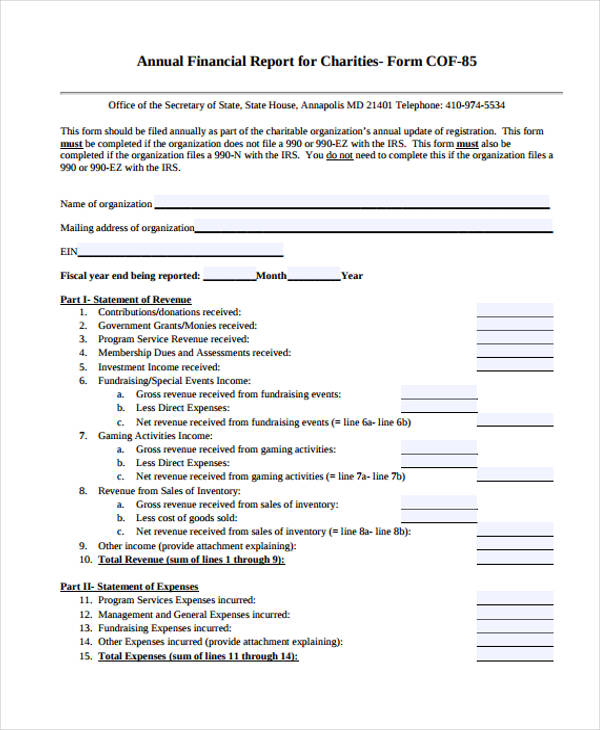

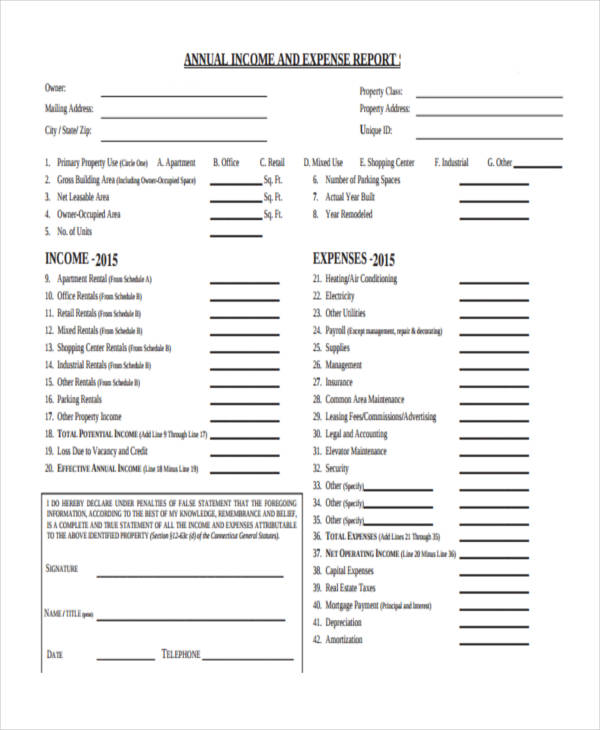

Annual Expense Report Forms

Annual Financial Expense Report Form

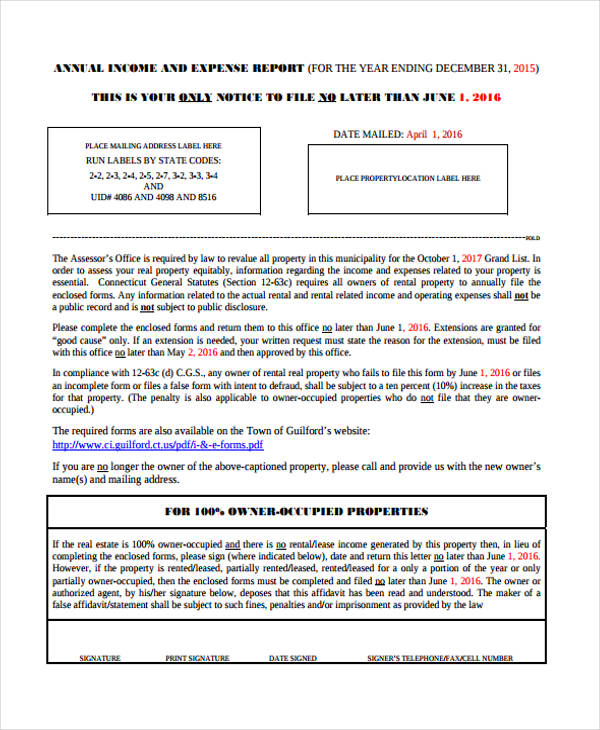

Annual Income and Expense Report Form Sample

Annual Charities Financial Expense Report Form

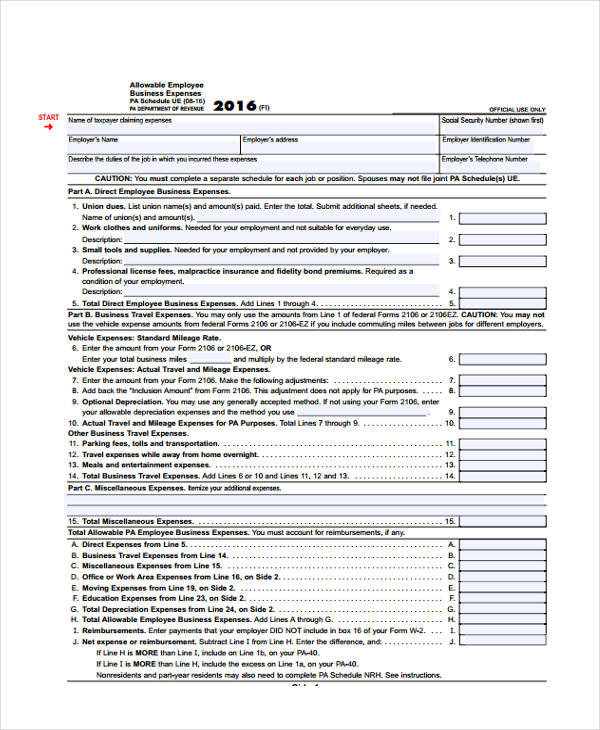

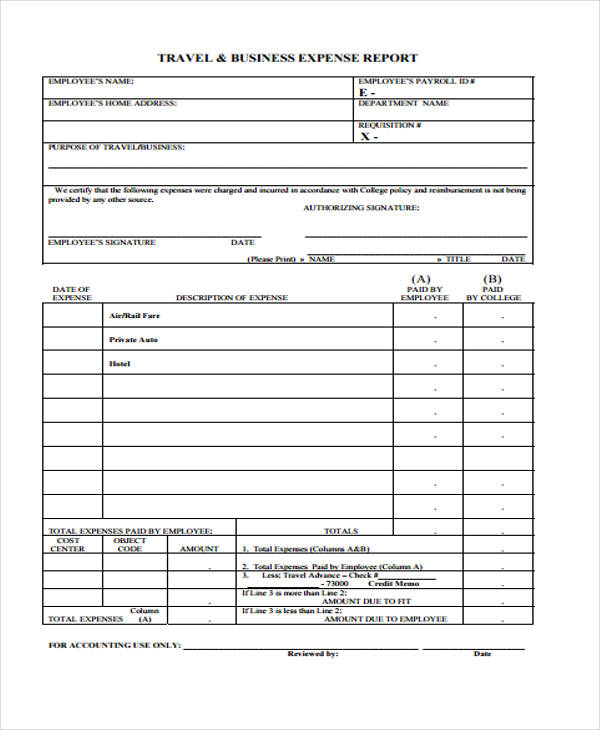

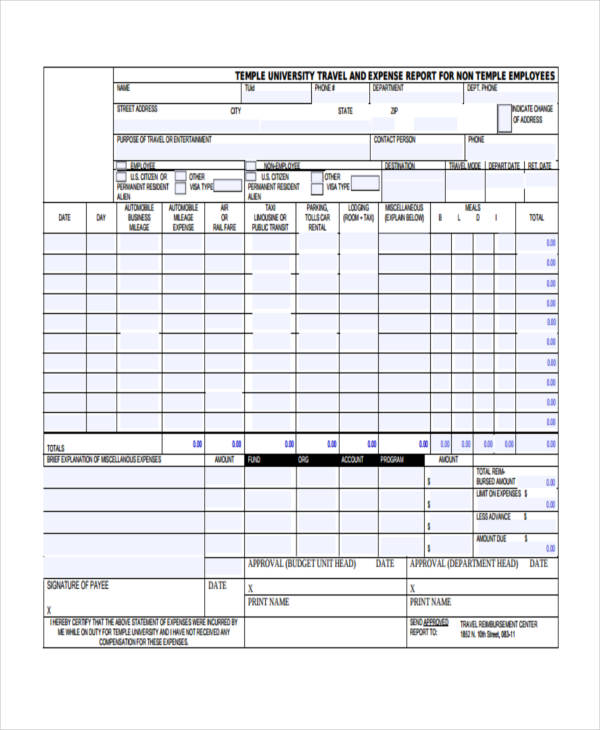

Business Expense Report Forms

Monthly Business Income and Expense Report Form

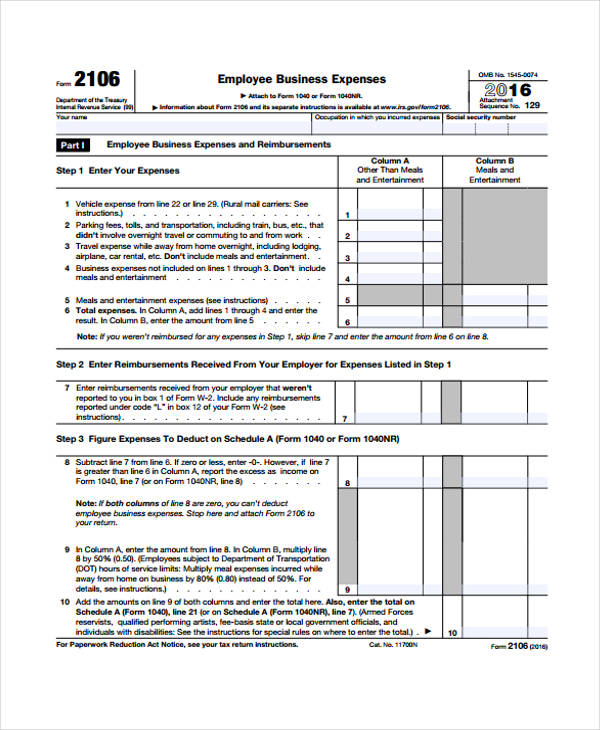

Employee Business Expense Report Form

Travel and Business Expense Report Form

Construction Expense Report Forms

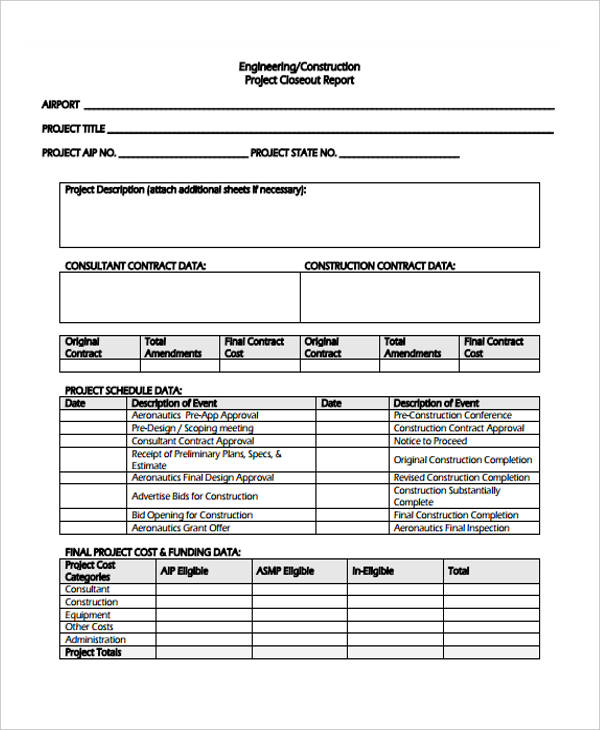

Construction Project Closeout Report Form

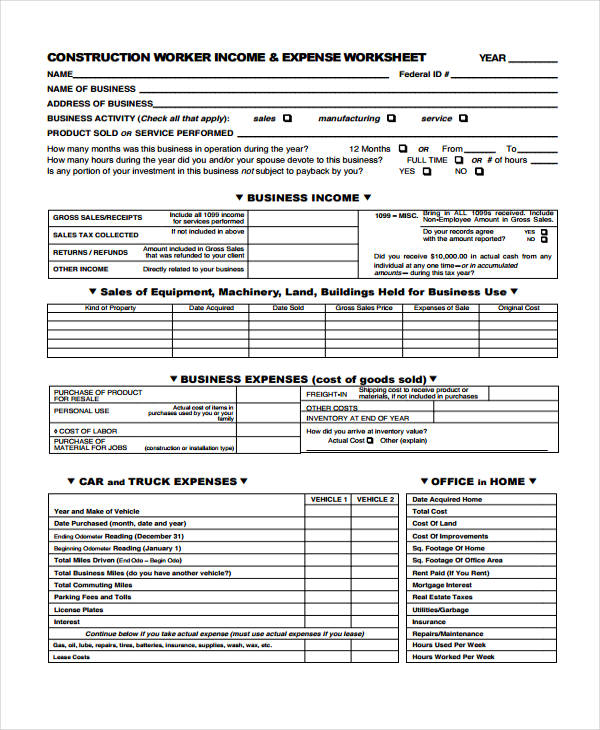

Construction Worker Income and Expense Worksheet

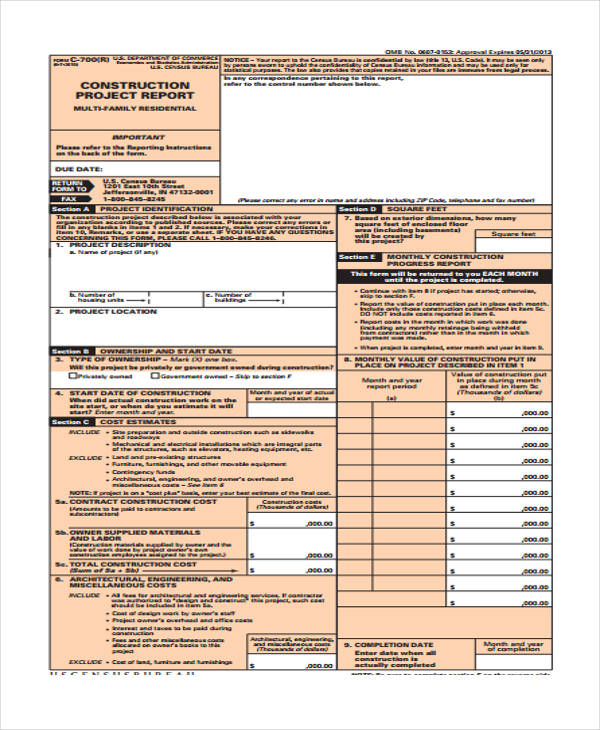

Construction Project Expense Report Form

Event Expense Report Forms

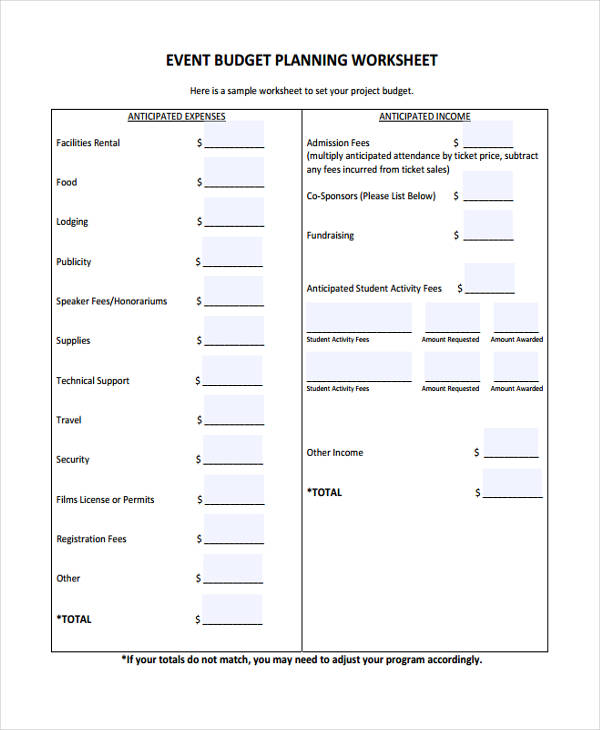

Event Budget Planning Worksheet

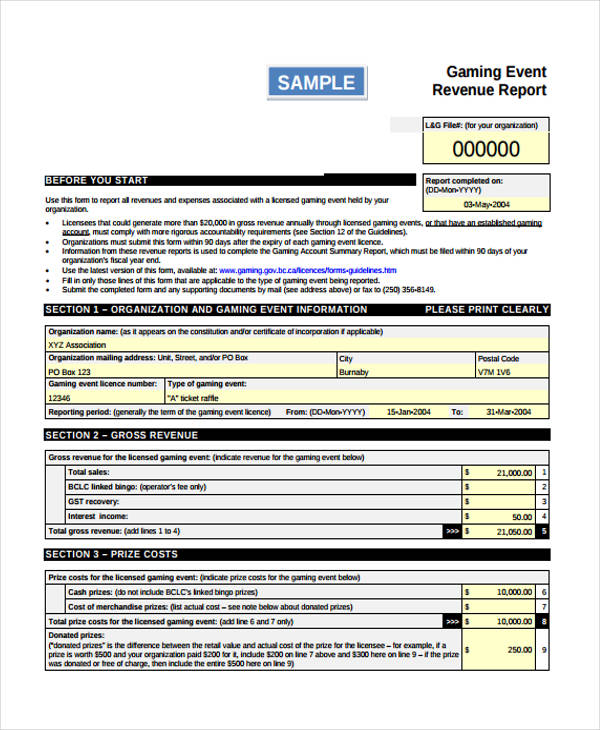

Gaming Event Revenue Report

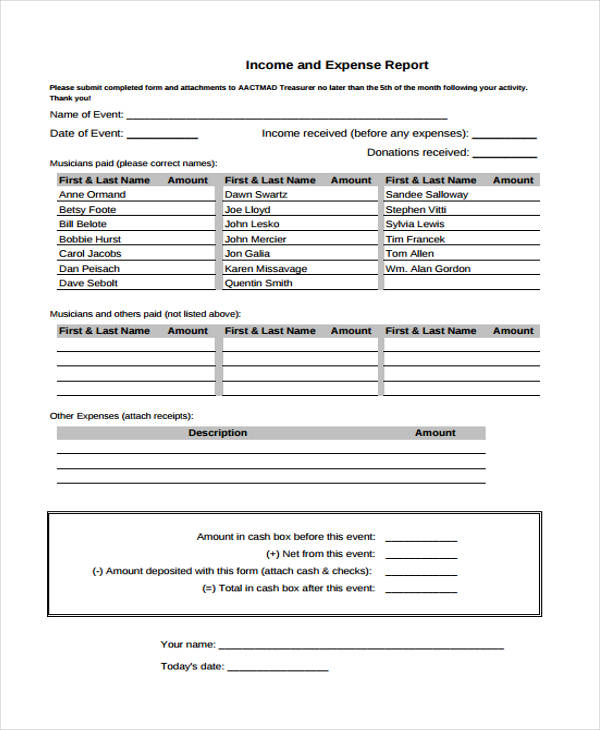

Event Income and Expense Report Sample

Personal Expense Report Forms

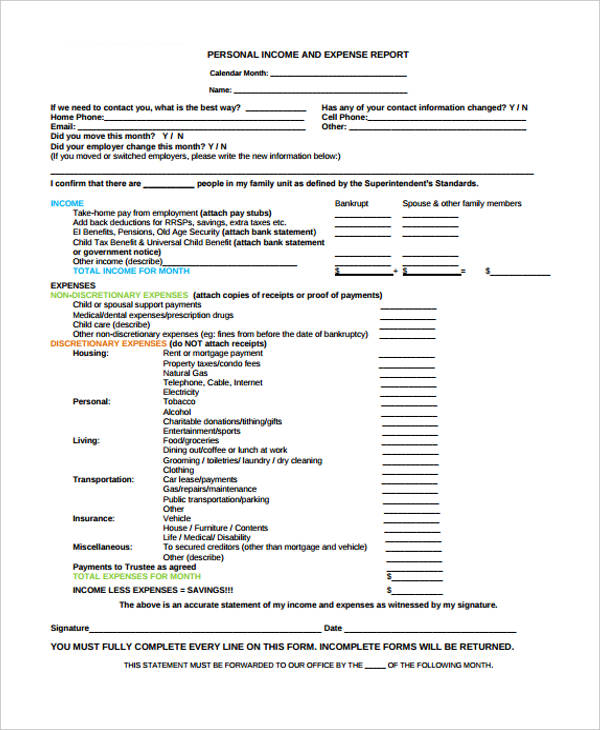

Personal Income and Expense Report

Employee Business Expense Form

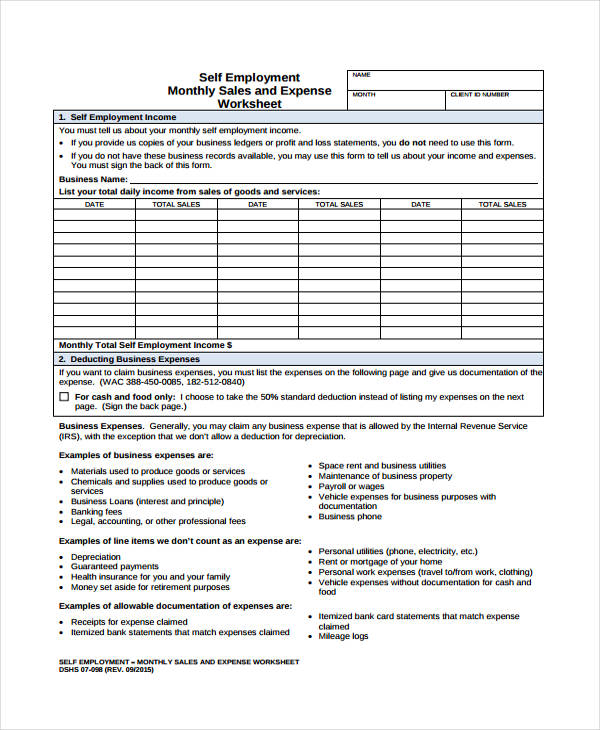

Sales Expense Report Forms

Annual Income and Expense Report

Monthly Sales and Expense Worksheet

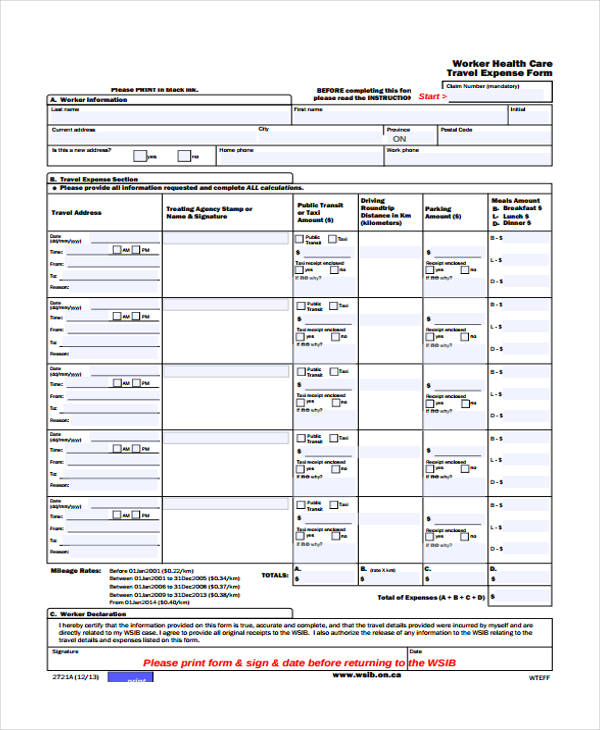

Travel Expense Report Forms

Worker Travel Expense Report Form

Travel Expense Report Form

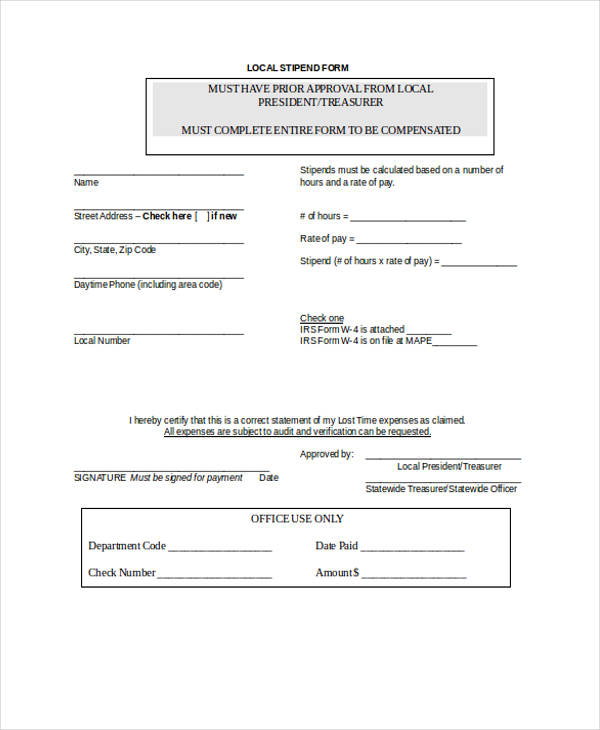

Lost Time Expense Report Form in DOC

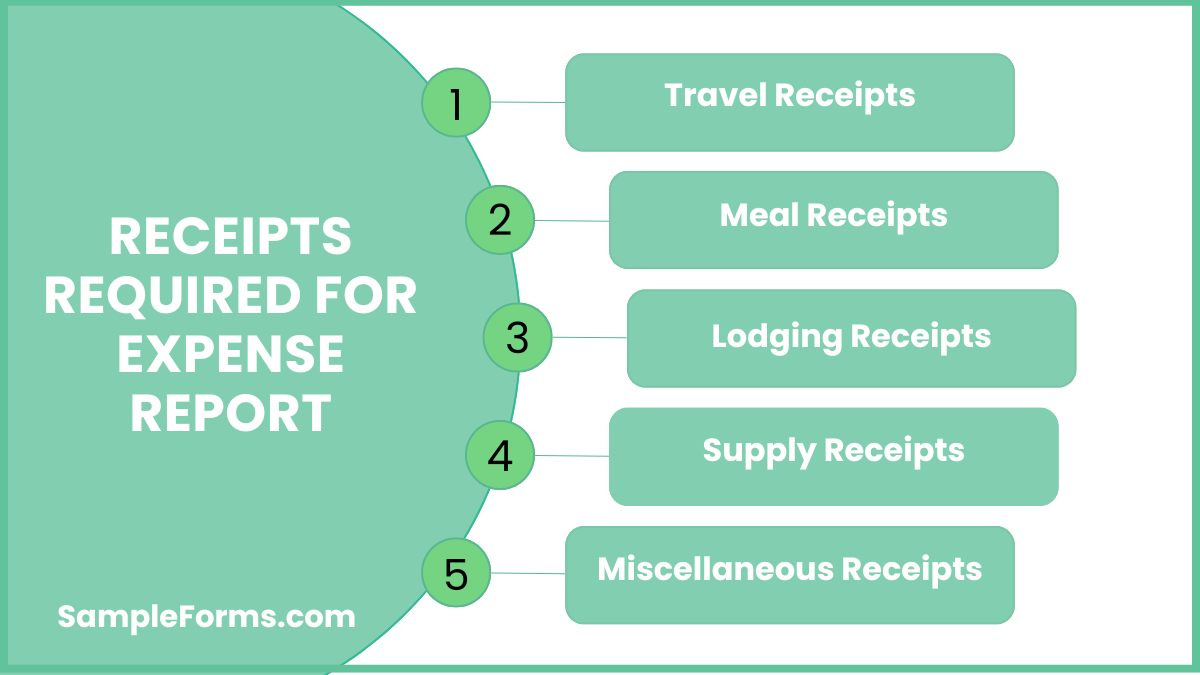

What receipts are required for expense reports?

Receipts substantiate costs and are essential for accuracy in expense reports. Collecting receipts is like organizing details in a Financial Report Form.

- Travel Receipts: Tickets, boarding passes, and taxi fares.

- Meal Receipts: Itemized food and beverage bills.

- Lodging Receipts: Hotel bills showing charges and dates.

- Supply Receipts: Purchases for work materials.

- Miscellaneous Receipts: Any other work-related expenses.

How do I make an expense report?

Creating an expense report involves listing all expenses with dates, amounts, and receipts for reimbursement or record-keeping. Follow these steps:

- Gather Receipts: Collect all relevant receipts for documentation and proof of expenses.

- Organize by Date: Arrange expenses chronologically to improve readability, similar to a Visit Report Form.

- Categorize Expenses: Group items under categories like travel, meals, and lodging.

- Total the Expenses: Sum up each category and calculate the overall total.

- Attach Documentation: Include receipts and any required forms for verification.

What qualifies as an expense report?

An expense report documents incurred costs, typically for reimbursement, covering items like travel, supplies, or meals, similar to how a Book Report captures information concisely.

- Detailed Itemization: Lists each expense with descriptions.

- Date and Amount: Includes exact date and cost for each item.

- Category Assignment: Assigns categories for easy tracking.

- Purpose of Expense: Explains why the expense was necessary.

- Receipt Attachments: Provides proof of each cost for validation.

Who fills out expense reports?

Expense reports are commonly filled out by employees, freelancers, or business owners to document costs for reimbursement or tax purposes, similar to completing an Audit Report Form.

- Employees: For job-related expenses needing reimbursement.

- Freelancers: To track client-specific project expenses.

- Small Business Owners: To document operational spending.

- Contractors: For reimbursable materials and travel.

- Nonprofit Volunteers: To report donation-related expenses.

What is included in an expense report?

An expense report includes a detailed breakdown of costs, dates, descriptions, and receipts, ensuring financial accuracy, much like a School Report Form tracks student details.

- Expense Dates: Lists when each cost was incurred.

- Descriptions: Brief explanation of each expense.

- Amounts: Shows exact cost for transparency.

- Expense Categories: Groups costs by type.

- Supporting Receipts: Attaches proof for every entry.

What does the IRS require for an expense report?

The IRS requires details like date, amount, purpose, and receipts for each expense. An organized Daily Report Form provides similar structured documentation.

Do expense reports count as income?

No, expense reports document reimbursed business costs, not income. They track incurred expenses, unlike a Missing Report Form, which records lost or unaccounted items.

Who prepares an expense report?

Employees, freelancers, or business owners prepare expense reports to track costs and request reimbursements, similar to filing a Car Accident Report Form for documentation purposes.

How much do expense reports really cost a company?

Expense reports cost companies both in processing time and administration fees. Reviewing and approving reports is essential, similar to handling a Patient Report Form.

What is counted as an expense?

Expenses include business-related costs like travel, meals, and supplies. Documented similarly to a Construction Report Form, expenses help track necessary expenditures for operations.

How should an expense report look?

An expense report should include clear dates, descriptions, amounts, and receipts, much like the structured details in an Evaluation Report Form for clarity and accuracy.

How do I document my expenses?

Document expenses by listing each cost with date, amount, and purpose. Organize records similarly to a Marketing Report Form for a professional presentation.

What is the 60 day rule for expense reports?

The 60-day rule requires employees to submit expenses within 60 days of incurring them to qualify for reimbursement, ensuring timely processing similar to a Referee Report Form.

What is the best app to track expenses?

Apps like Expensify, QuickBooks, and Mint are excellent for tracking expenses efficiently, offering safety and ease, similar to the simplicity of a Safety Report Form.

Can you claim expenses without receipts?

Yes, some minor expenses may be claimed without receipts, though documentation is recommended, similar to a Behavior Report Form that details information without physical proof.

The Expense Report Form guide provides all the tools and insights needed to manage expenses effectively. From templates to step-by-step instructions, this resource ensures users can document expenses accurately and submit for approval. Whether completing a Mileage Report Form for travel reimbursements or logging daily business expenses, this guide simplifies the process, promoting accuracy and efficiency. Using structured forms reduces errors, ensures compliance with company policies, and helps track financial activities for better budgeting and planning.