Alongside Payroll Forms, a payroll is a company’s record of the employees’ salaries, wages, bonuses, net pay, and deductions. In a company, payroll is the sum of all of the financial records of employee salaries, bonuses, and deductions. It details the amount given to employees for the work they have done over a period of time, and is, of course, of utmost importance to them.

Employees tend to be wary of errors and disputes – and rightly so. Hence, a company must disburse payroll timely and accurately, with the correct withholding amounts and deductions, and for them to ensure that any withholdings and deductions are submitted correctly.

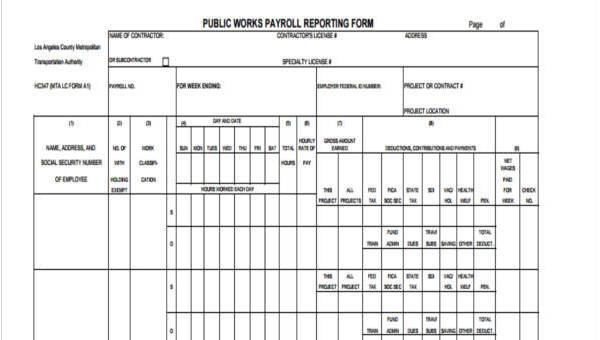

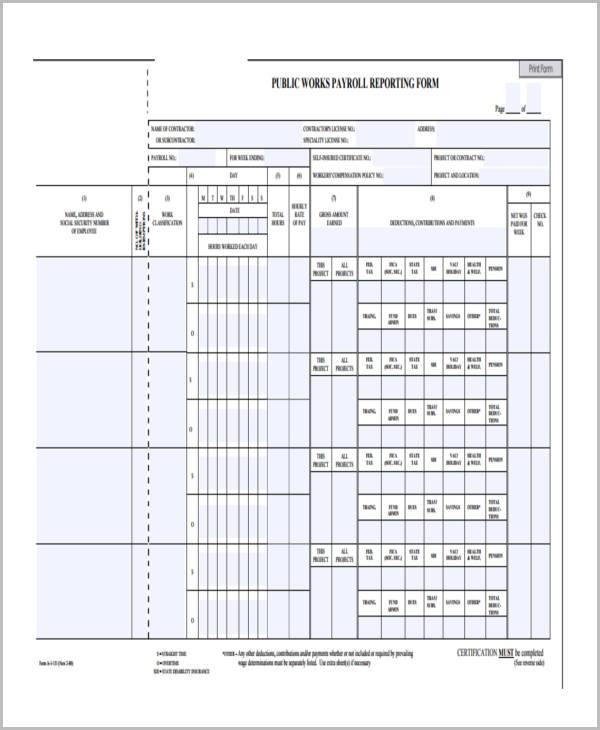

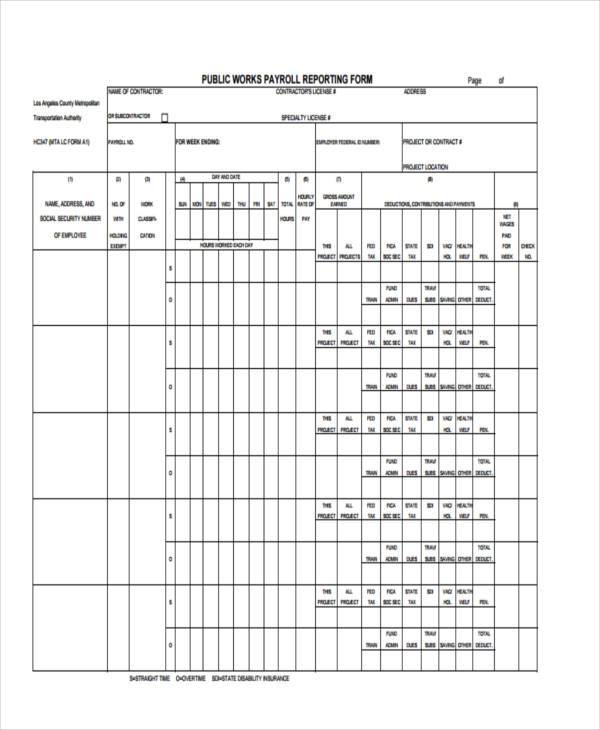

Public Works Payroll Reporting Form

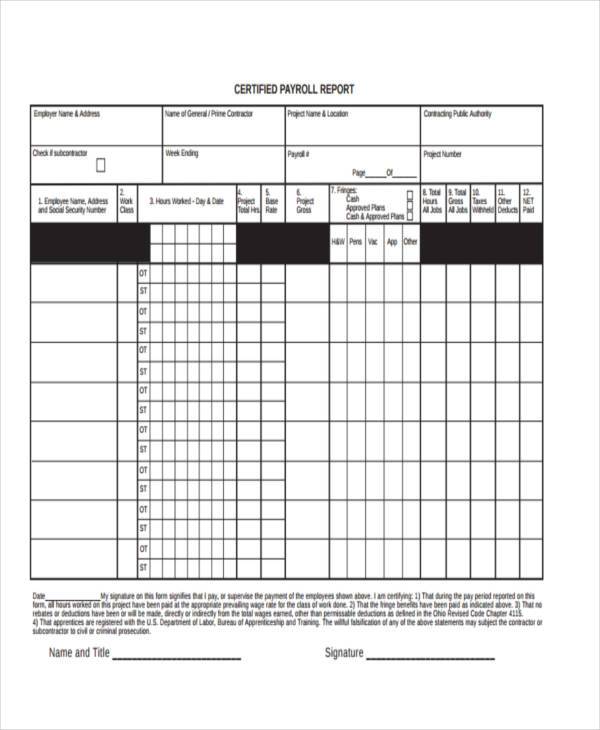

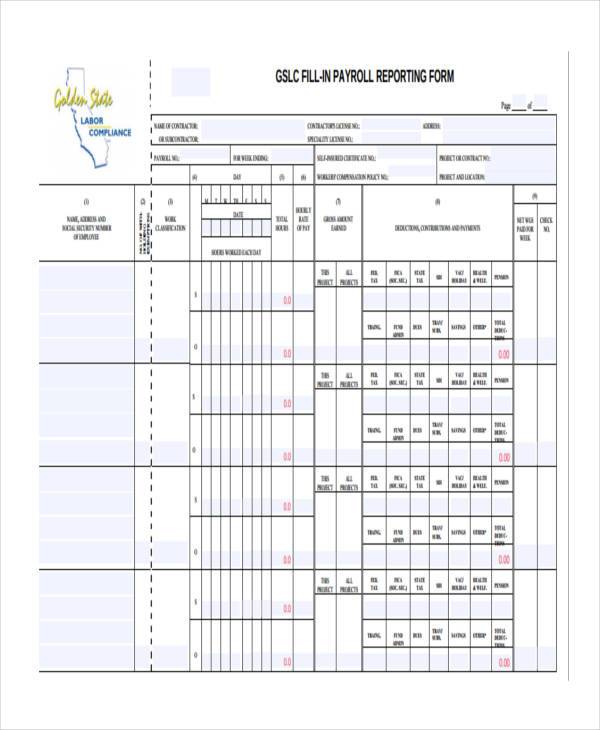

Certified Payroll Reporting Form

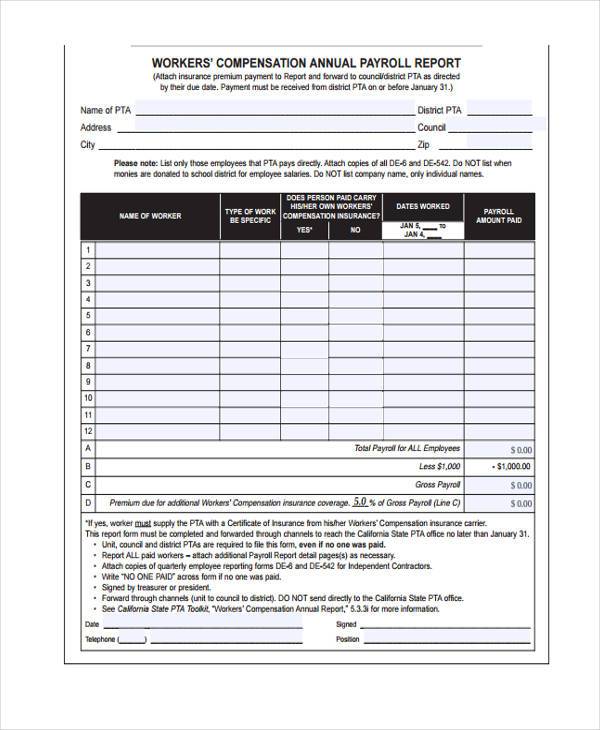

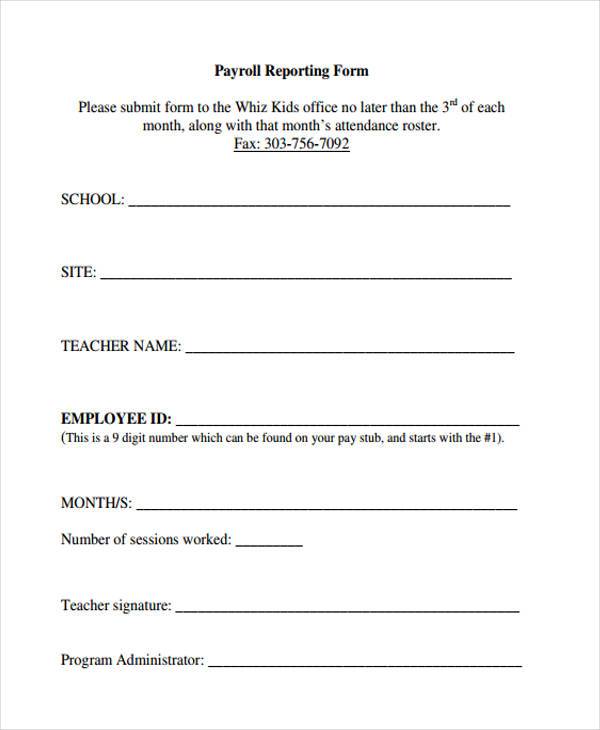

Simple Annual Payroll Reporting Form

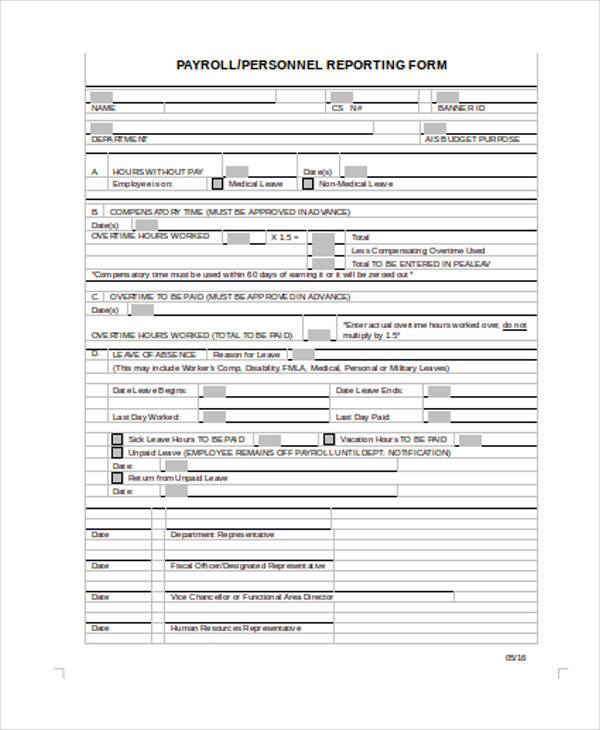

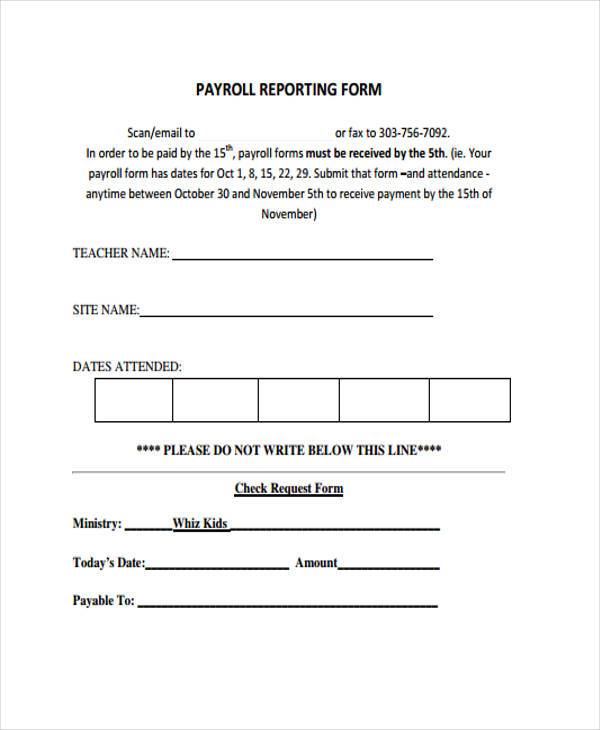

Payroll Reporting Form in PDF

The Payroll Register Forms are electronic or physical papers documenting all the specifics of payroll information. A register begins with details about each employee including their name, birthday, Social Security number, and employee number. A basic payroll register format comprises multiple columns that list and summarize information for specific periods. Payroll software can produce a payroll register for any period, allowing employers access to relevant data (costs associated with wages, benefits, etc.). It then shows the payroll details for each employee starting with the hours worked in the current period.

The personnel that handles the payroll should keep a paper trail of totals for all employees for the following elements:

- Totals withheld from employee pay for federal, state, and local income taxes

- Totals withheld for the employee share of social security and Medicare

- Totals withheld for all optional donations, such as charitable giving, union dues, and others.

- Total gross wages, total Social Security wages (up to the maximum for each employee each year), and the total Medicare wages

In addition, the payroll personnel should not forget to set aside an amount equal to the total Social Security and Medicare deduction.

Free Payroll Reporting Form

Payroll Reporting Form in Doc

Payroll Reporting Form Example

Generic Payroll Reporting Form

An amount withheld by an employer from an employee’s earnings is called “payroll deduction.” This usually comes with a Payroll Deduction Form and includes income tax, Social Security contributions, group insurance or pension fund contributions, association dues, wage assignments, child support payments, taxes, and uniform dues, etc. However, all other deducted amounts are optional. No matter how many hours an employee has worked, payroll deductions must be withheld from checks. In the event that no subtractions are withheld, the employer becomes responsible for any mandated amounts that were supposed to be withheld, which thus translates to paying the deductions or cancelling the insurance policy altogether.

This website guarantees that the huge library of forms it keeps is always stocked and never runs out. Additionally, this website is built for individuals who are not technologically inclined. If you are someone who wants to know about payroll forms, then utilize this website to its full potential. For those types who are on a tight budget, do not worry. We do not sell these forms, so yes, you can go ahead and download as many forms as you want.

Related Posts

-

FREE 10+ Sample Payroll Register Forms in PDF | Excel

-

FREE 8+ Sample HR Payroll Forms in PDF | Word | Excel

-

FREE 8+ Sample Payroll Tax Forms in PDF | Excel | MS Word

-

FREE 9+ Sample Certified Payroll Forms in PDF | Excel | Word

-

FREE 9+ Sample Payroll Remittance Forms in PDF | Excel

-

Payroll Advance Form

-

Payroll Deduction Form