A Payroll is a document where the employees’ names are stated with their accompanying salary amount. Having a payroll system will help the company handle the taxes more efficiently. The payroll is usually being managed by the accounting department with the help of the human resource department.

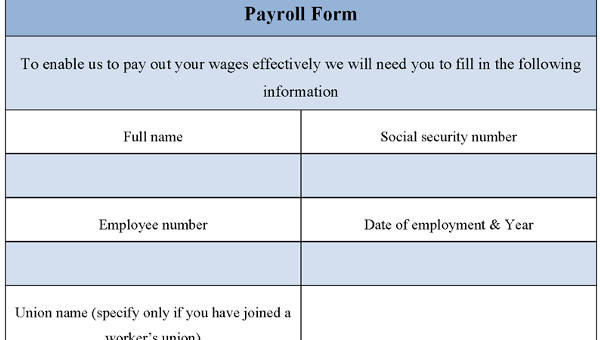

A Payroll Form is a company document that will show an employee’s total salary and the tax deductions associated with his employment. Sending out the payroll form is one of the duties of the human resource department, and they should be able to inform the employees on time regarding the accurate payroll computations.

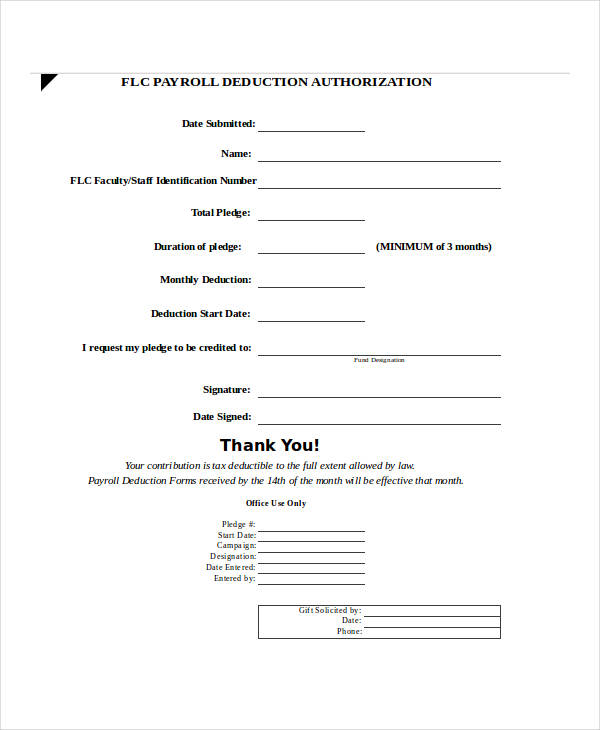

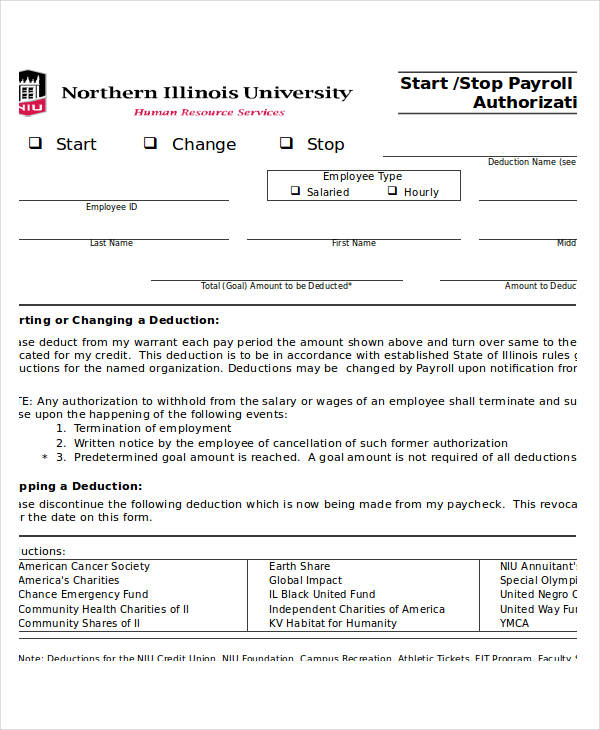

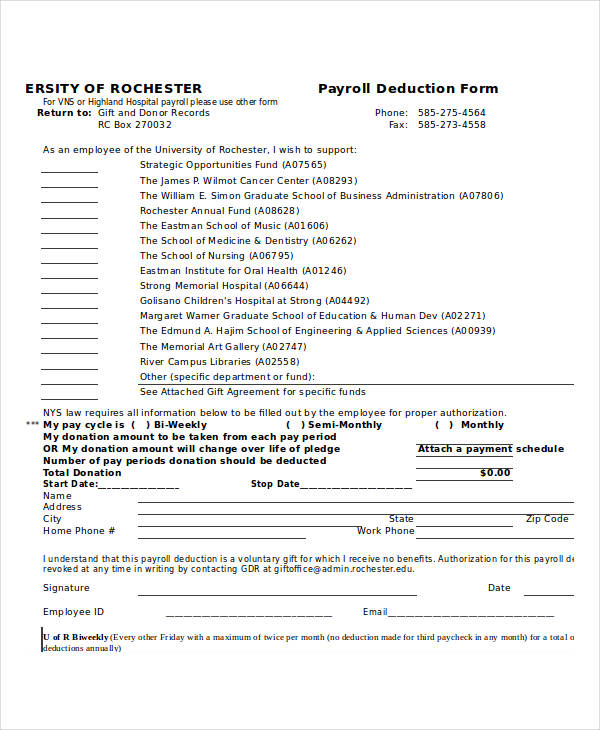

Payroll Deduction Forms

Employee Authorized for Payroll Deduction

Payroll Deduction Authorisation

Stop Payroll Deduction Authorisation

Free Payroll Deduction Form

Employee Payroll Forms

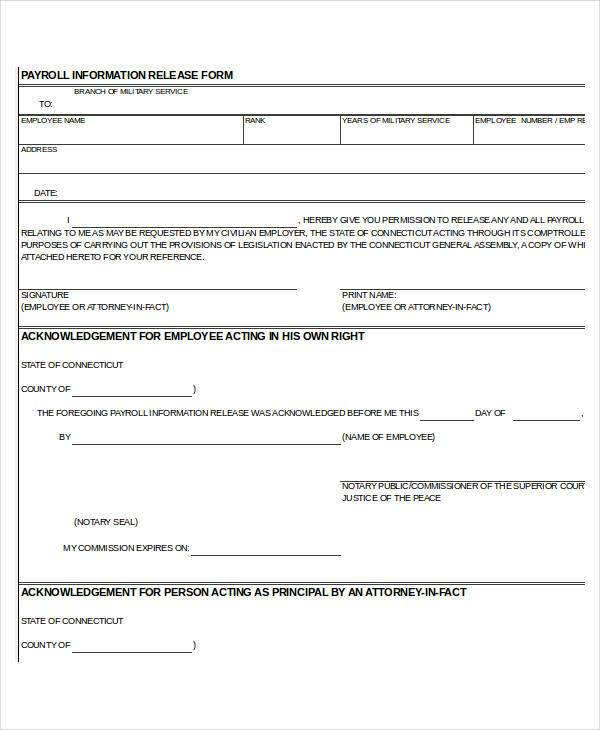

Employee Payroll Information Release

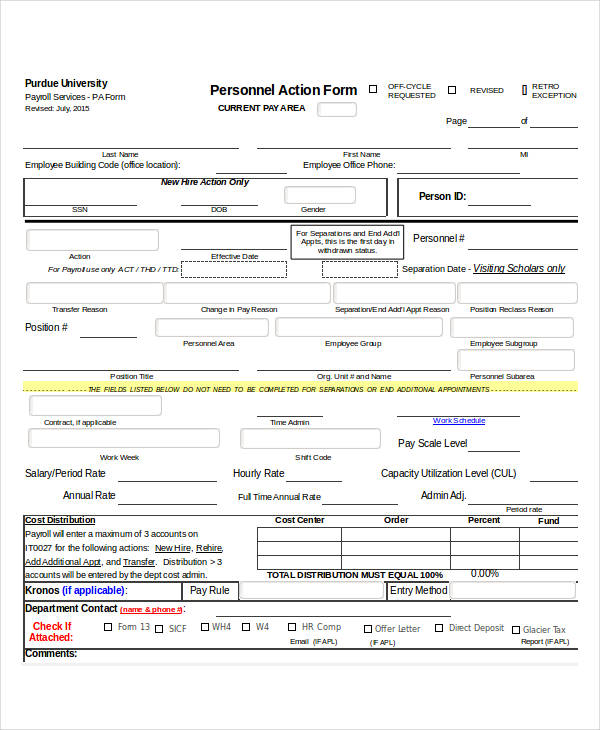

Employee Personnel Action

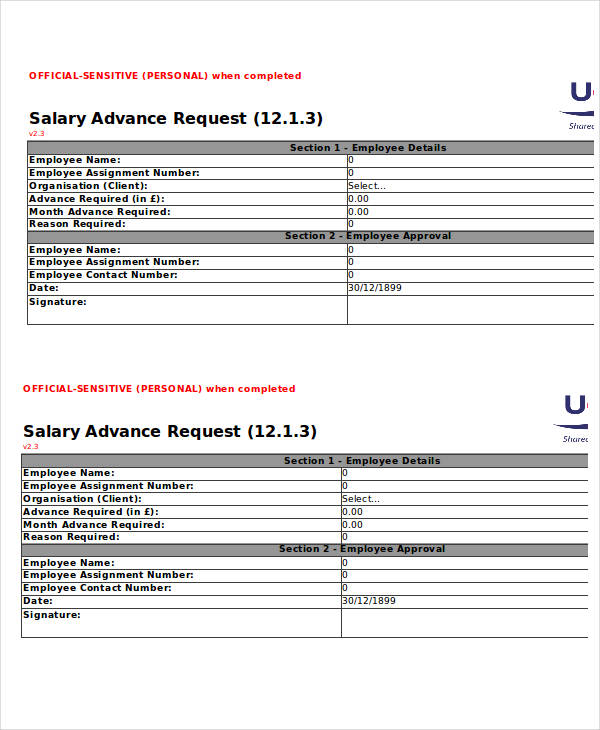

Employee Salary Advance Request

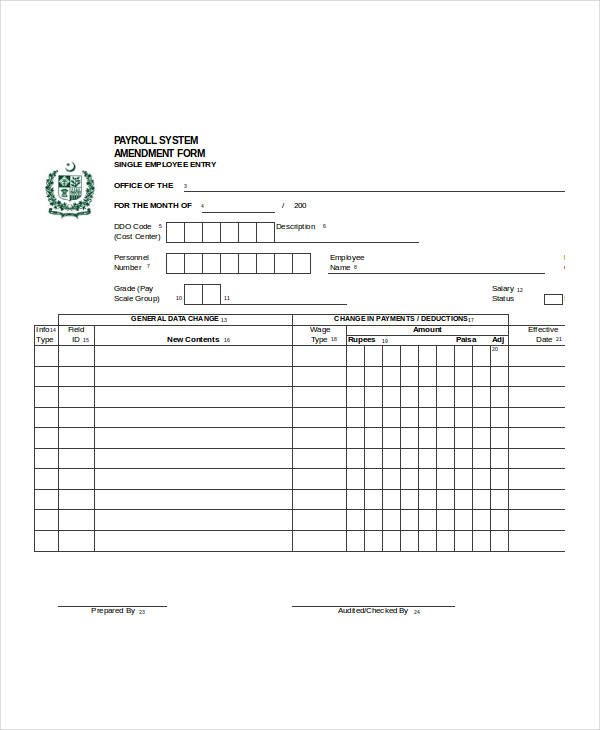

Sample Employee Payroll Form

Payroll Transfer Forms

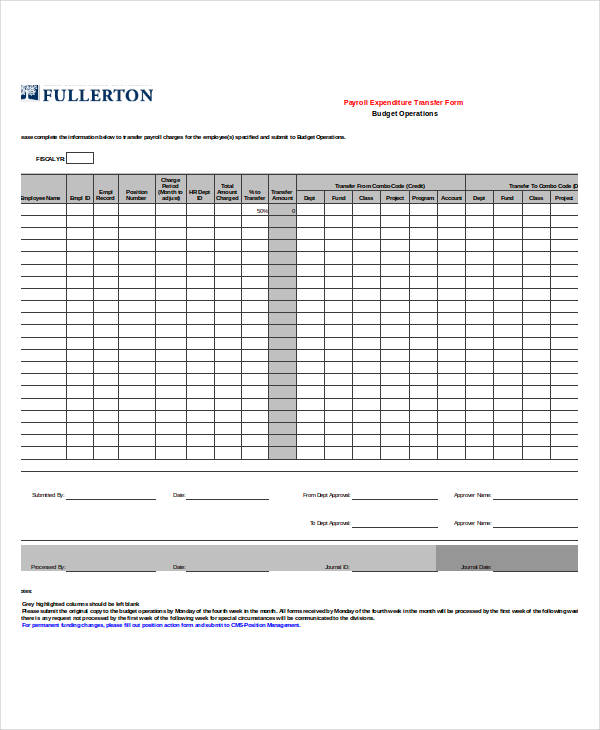

Payroll Expenditure Transfer

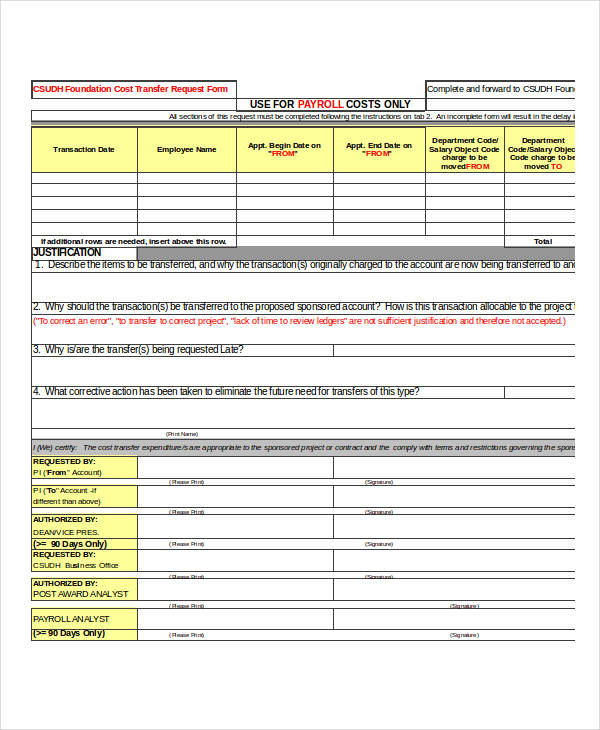

Payroll Cost Transfer Request Form

The Importance of Payroll Forms

Payroll Forms are very significant in a company as it serves as a document which will state the salary of their employees. One importance of having the payroll form is to have a complete record of the accumulated tax deductions per month and the total transactions that the company makes within a certain period.

The accounting team of the company is responsible for giving the exact computations for the wage, and the company’s net income. A mistaken digit in an employee’s payroll form will likely affect the company’s total expenditures, causing confusion when the company will have their Annual Accounting Statement.

Another vital role of a payroll form is that it can be used to indicate cash transfers. A Payroll Transfer Form is used for transferring the salary of an employee from one pay period to another. This will mean that the employee’s salary for the next pay period will be doubled due to the combination of two pay periods.

A cash advance may also be stated in a payroll form. When an employee needs some money and wants his payroll to be delivered ahead of the specified pay date, he is required to complete a Payroll Cash Advance Form and submit it to the authorized payroll personnel.

Releasing of Payroll Forms

Every company has their own regulation in releasing the payroll forms. Some companies produce the forms in varying intervals; weekly, bi-monthly, or monthly. The company will base their frequency in releasing the payroll from their viewed perspective of when an employee may benefit the regularity of receiving an income. There are also companies who outsource to have someone manage their payroll. The payroll forms are then sent directly online to every employee during the pay day of the company. This is a strategy that eases up the company’s operation with regards to computing the employee’s pay for a certain pay period.

Payroll Change Forms

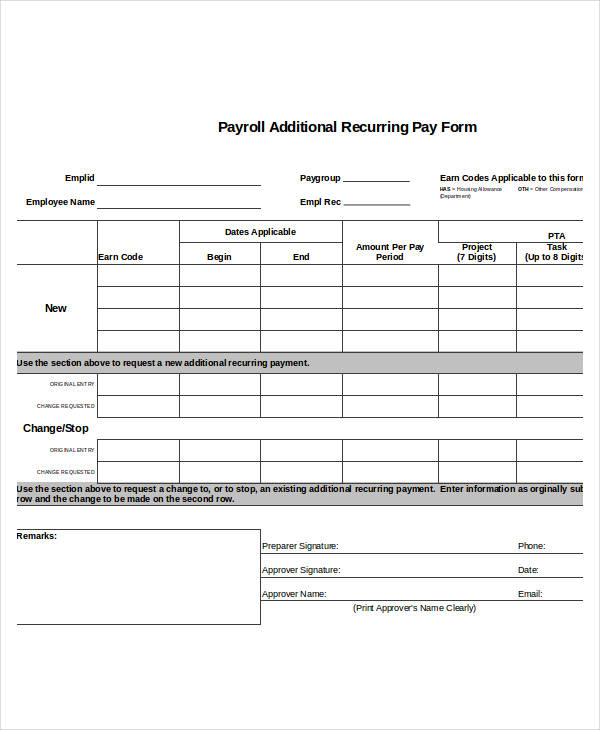

Payroll Additional Recurring Pay Form

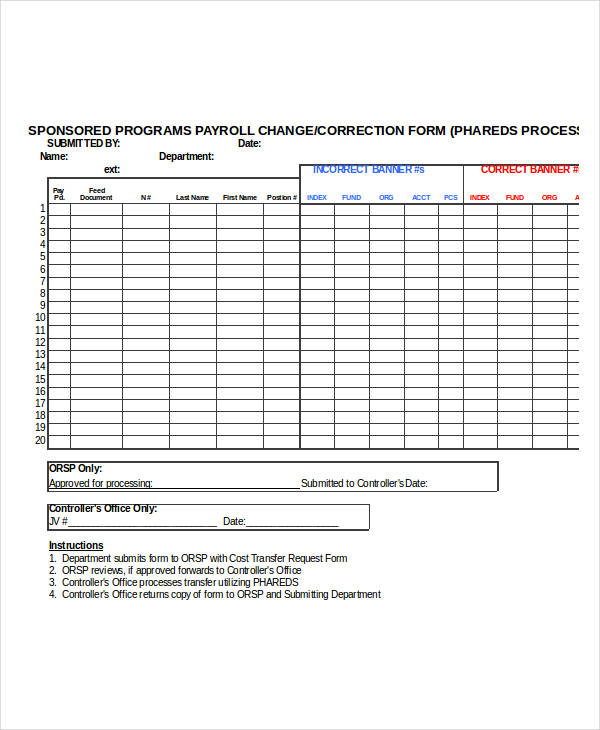

Payroll Change/Correction Form

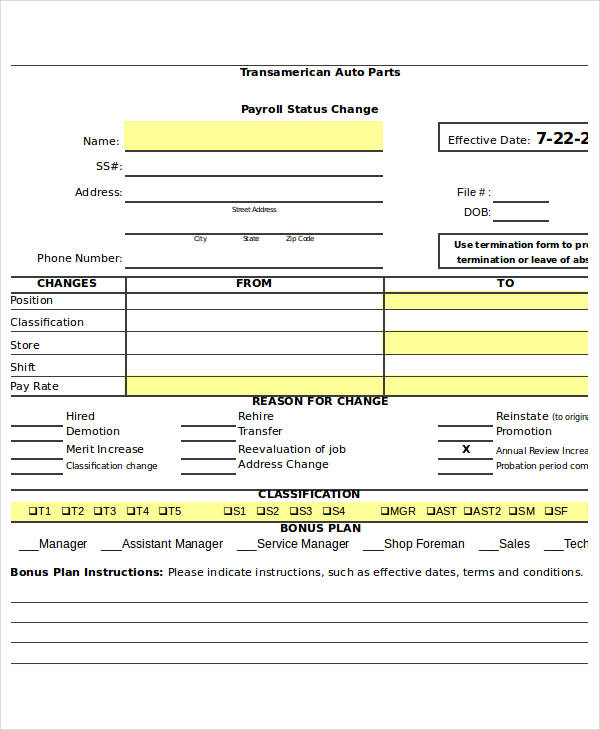

Payroll Status Change Form

Types of Payroll Forms

Payroll Forms are not just for knowing the salary that an employee will take for every pay date, but also the actions that may involve due to deductions, changes, and transfers authorized by the company. Here are the types of payroll forms that a company may use for its varying purposes:

- Payroll Deduction Form – This type of payroll form centers on the salary deductions due to income taxes, social security and insurance contributions. Some payroll deductions are voluntary while some are mandatory. The payroll deduction form may also include the hourly deduction amount if the employee is given an hourly salary.

- Payroll Information Release Form – This payroll form is to be completed by a previous employee of a company in order to have records of his previous payroll information. This form is sometimes a new employee’s requirement in some companies, or a registrant’s requirement for insurance and government organizations.

- Payroll Transfer Form – This is to be used by the management if the salary of an employee was not carried by the current payslip. The accounting team should complete the form and send it out to the bank to start the transaction of transferring his salary for the next pay period. This type of payroll form may also be used by a student employee. When he is able to have his own student bank account, he may send a Payroll Transfer Form to his company and let them know that he is interested in transferring his salary to his personal account.

- Payroll Change Form – This payroll form focuses on the changes and clarifications of an employee regarding his payroll information. A change in an employee’s name, status, and job position may be some of the relevant information involved pertaining to the role of this form.

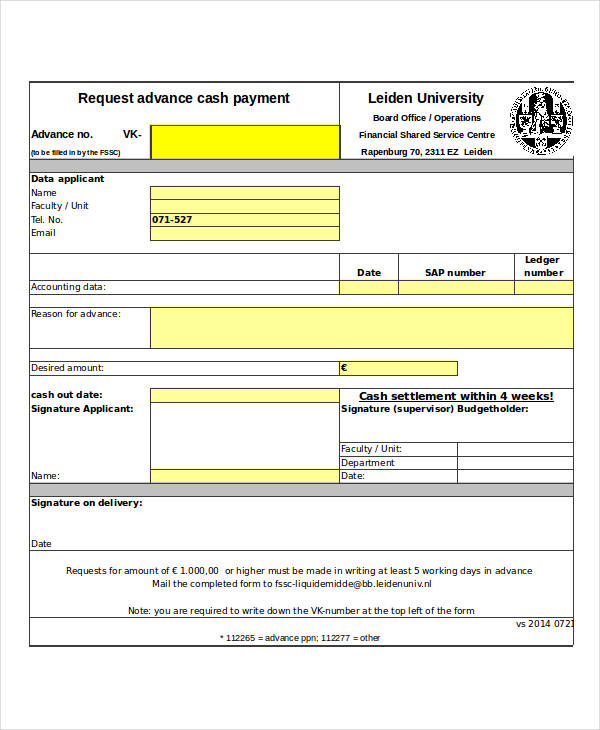

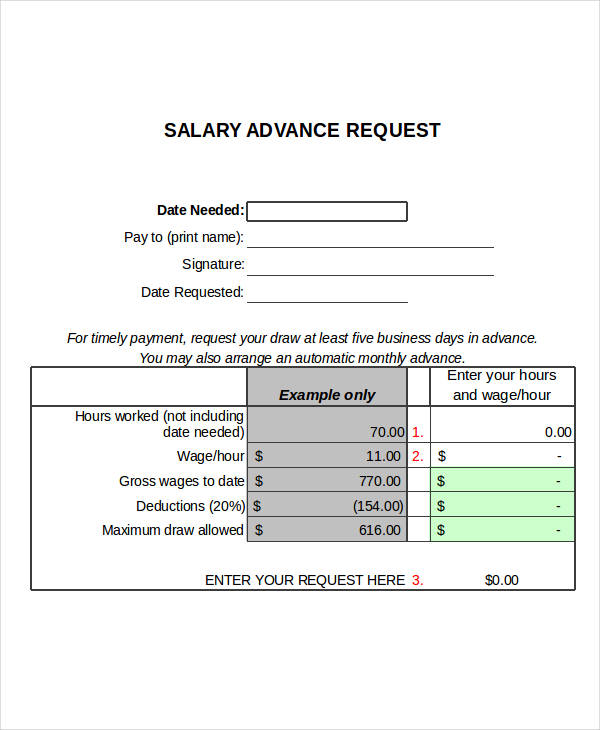

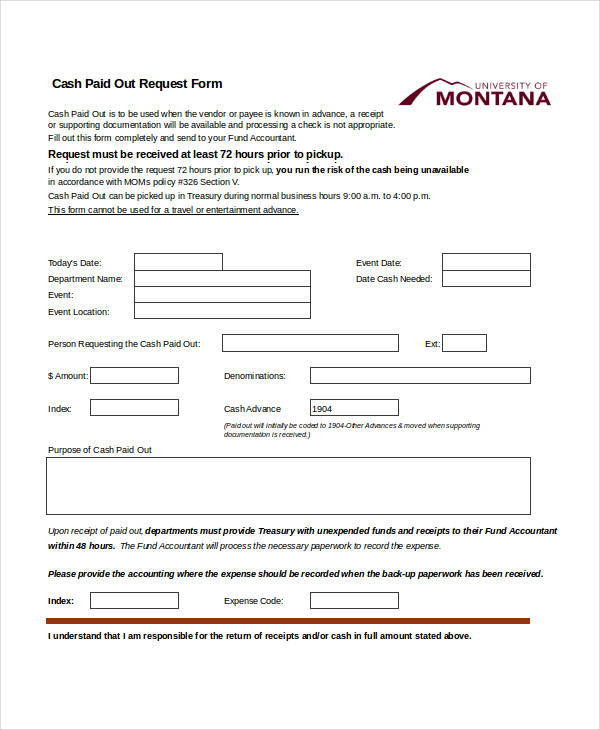

- Payroll Advance Form – Cash advances are unavoidable during emergency purposes within a company. An employee may submit this form to inform the accounting team that he needs his salary in advance. It will truly depend on the management if they allow cash advances and as to what the acceptable circumstances will be to grant the employee his request.

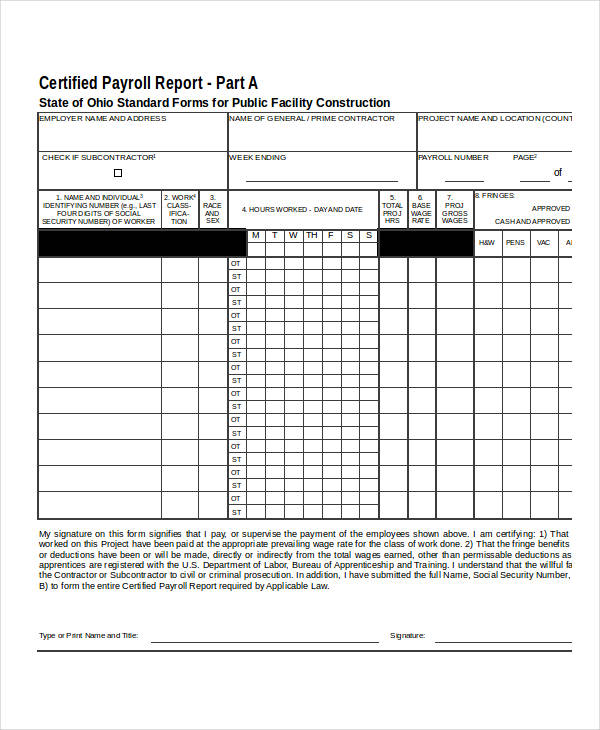

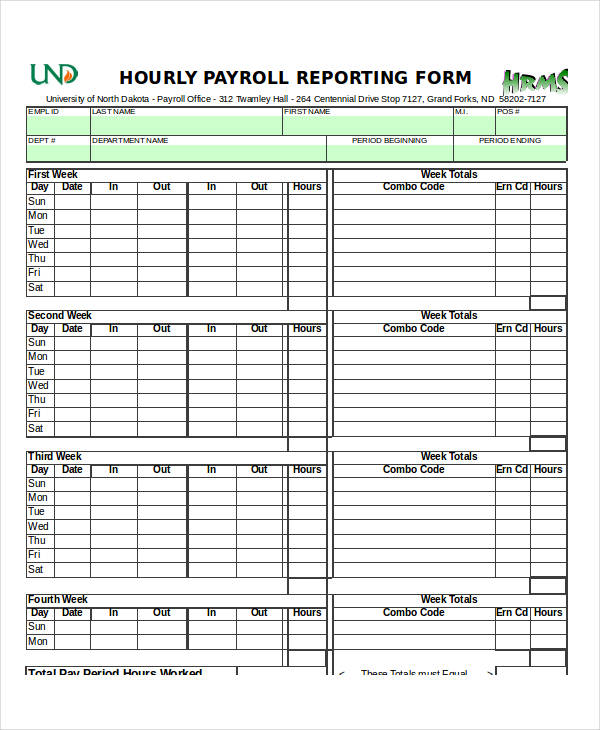

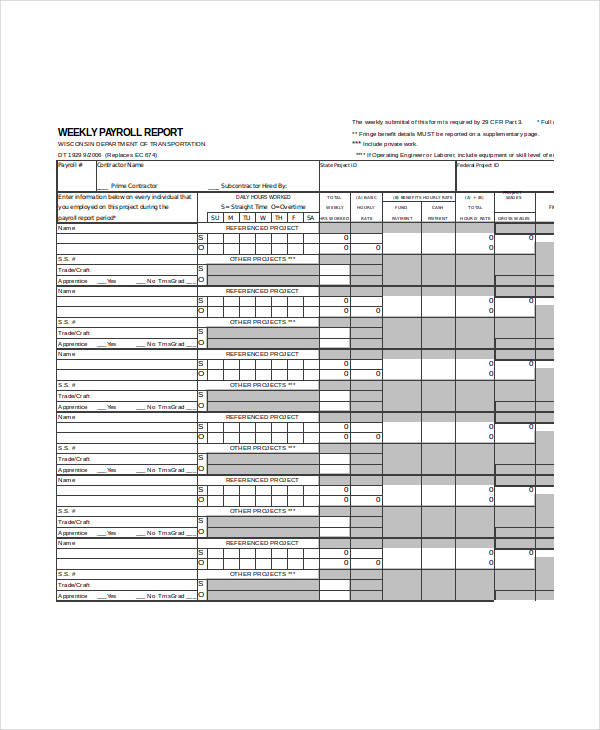

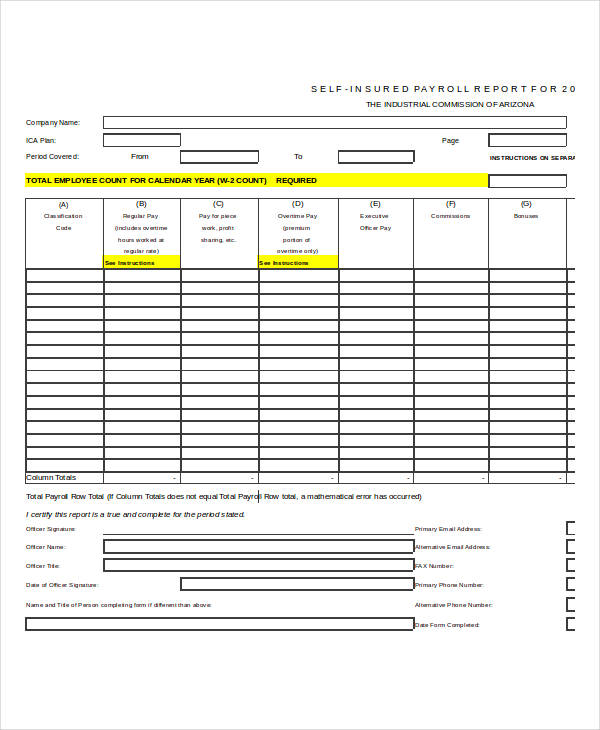

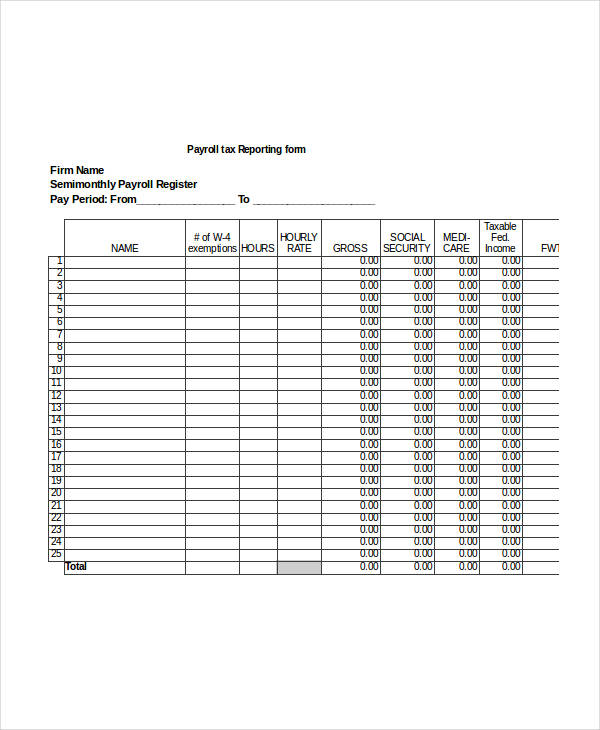

- Payroll Report Form – This is the most common payroll form since it is used by most companies and seen by every employee in different areas of business. This contains the employee’s wage, the tax deductions, and the total salary amount that the employee will receive on the pay day.

- Payroll Tax Form – In this type of payroll form, only the taxes are stated. This form may be attached to a General Employee Payroll Form to let the employee have a clearer understanding of his tax deductions.

Payroll Advance Forms

Request Advance Cash Payment

Salary Advance Request Form

Cash Paid Out Request

Payroll Report Forms

Certified Payroll Report

Hourly Payroll Report

Weekly Payroll Report

Self-Insured Payroll Report

Payroll Tax Forms

Payroll Tax Reporting

Vital Areas of an Employee Payroll Form

Though there are different formats and appearance for a payroll form, here are the most important parts that you should consider when you start making the form:

- The Name and Address of the Company. Every Payroll Form should indicate the company’s details even if it is used only within the company.

- The List of Employees. The human resource team should be able to submit an updated list of the employees regularly to avoid causing names being left unlisted. The full legal name of an employee in his bank account should be the name to be included in the list for easy accessing of information.

- The Positions of Employees. Varying job positions have varying work salaries. The management should know if there are updates on the employee’s status or position to have an accurate basis for his salary amount.

- Pay Period Days. This area appears like a calendar where the HR staff may indicate if an employee was absent or a filed for a leave during a specific day.

- The Daily Rates. The company shall state the daily work rate of an employee which is usually different from other employees unless they have the exact same job.

- Overtime and Holidays. This will serve as a bonus area where incentives due to an employee’s overtime work hours are stated. The computation of the additional holiday percentage should also be indicated as to the type of holiday, such as whether it is a special or a non-working holiday.

- The Deductions. This consists of the taxes and all the other insurance deductions of the employee.

- The Overall Total Salary. With the computations of the daily rates and additional incentives being deducted with the taxes and mandatory payments, the overall salary will then be stated at the last area of the payroll table.

Payroll Versus Payslip

Payroll Forms and payslips are two terms which are often misused. A lot of people are confused with the difference of a payroll from a payslip. One similarity that these two have is that they both contain the employees’ salary details. However, when a payslip is issued, it only states the salary details of only one employee, as compared to a payroll, which states a list of employees in the company in addition to each of their associated salary computations. Another difference is that a payroll is for the authorized personnel’s reference only and not to be disclosed to an employee.

We also have Payroll Registration and Payroll Direct Deposit Forms in our website to cater to your company’s needs. The Payroll Registration Form will be for newly hired employees wherein they must fill out their information while the Payroll Direct Deposit Form will be for the accounting team to allow instant salary deposits in the accounts of the company’s employees.

Related Posts

-

Payroll Advance Form

-

Payroll Deduction Form

-

FREE 10+ Sample Payroll Register Forms in PDF | Excel

-

FREE 8+ Sample HR Payroll Forms in PDF | Word | Excel

-

FREE 8+ Sample Payroll Tax Forms in PDF | Excel | MS Word

-

FREE 9+ Sample Certified Payroll Forms in PDF | Excel | Word

-

FREE 9+ Sample Payroll Remittance Forms in PDF | Excel