Dive into the essentials of managing employee benefits and deductions with our ultimate guide to Payroll Deduction Forms. From standard Payroll Form to specialized Payroll Advance Form templates, our comprehensive coverage provides you with everything you need to streamline your payroll processes. Ensure accuracy and compliance in every step, enhancing your financial management practices with our expertly designed examples and insights.

Download Payroll Deduction Form Bundle

What is a Payroll Deduction Form?

A Payroll Deduction Form is a crucial document used by employers to authorize regular deductions from an employee’s paycheck. This form can cover a wide range of deductions, from health insurance premiums to retirement plan contributions, ensuring transparent and accurate financial transactions between employers and employees. It plays a vital role in maintaining clear records for both parties, facilitating a smooth payroll process.

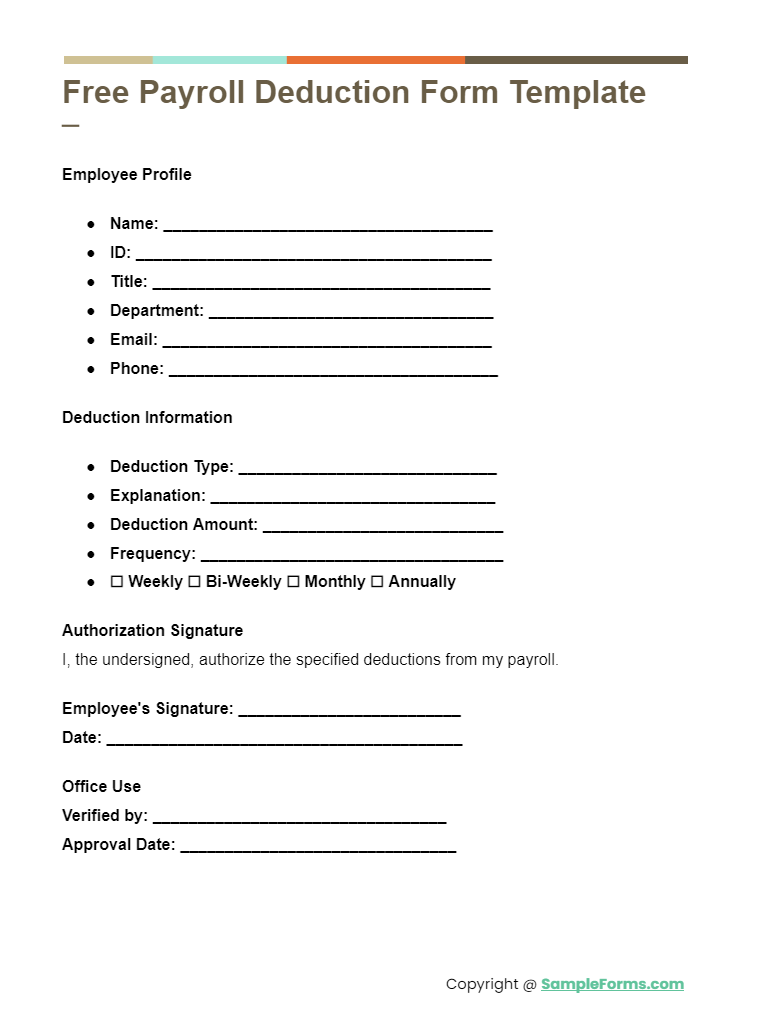

Payroll Deduction Form Format

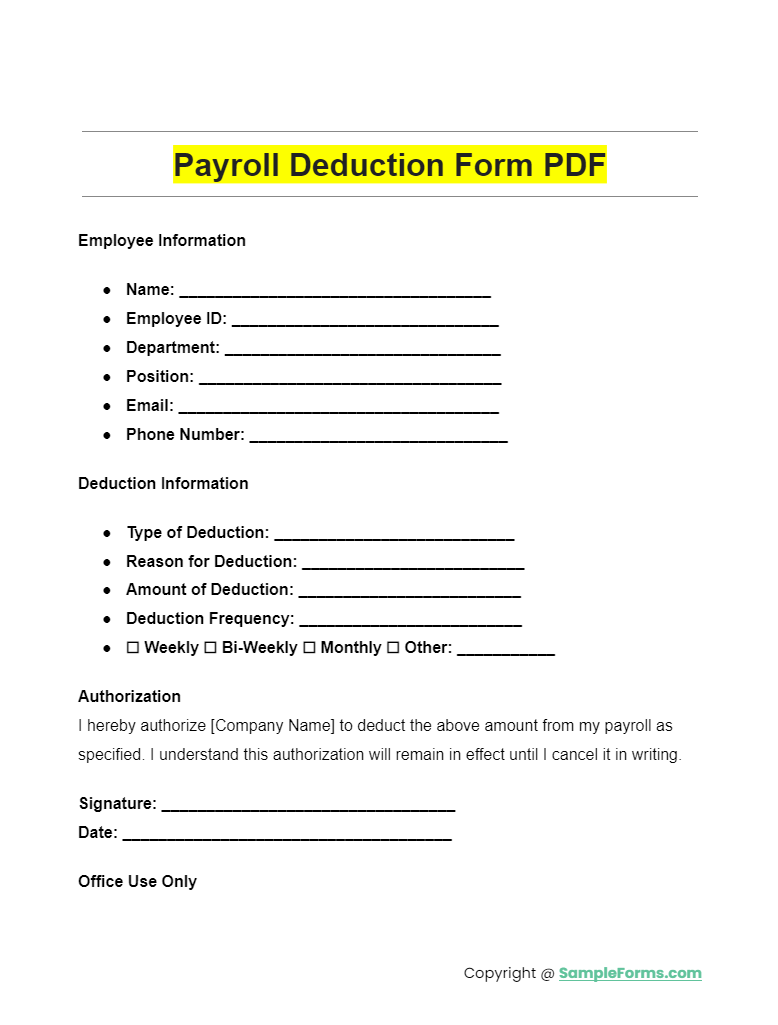

Introduction Section

- Employee Identification: Include fields for name, employee ID, department, position, email, and phone number.

Deduction Details Section

- Type of Deduction: Provide a space for the type and reason for the deduction.

- Amount and Frequency: Spaces for the deduction amount and frequency options (e.g., weekly, bi-weekly, monthly).

Authorization Section

- Employee Consent: A statement where the employee authorizes the deduction, with space for the employee’s signature and date.

- Approval: A section for office use only, including approval signature and date.

Additional Features

- Checkboxes: For selection options, such as deduction frequency.

- Lines for Signatures: Ensuring clarity on agreement and consent.

Payroll Deduction Form PDF, Word, Google Docs

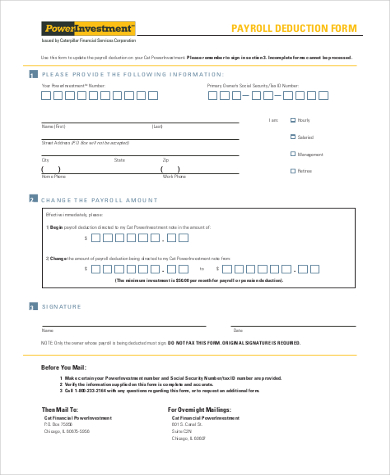

The Payroll Deduction Form PDF facilitates easy setup for automatic deductions from wages, crucial for managing Payroll Change Form and Payroll Adjustment Form efficiently, ensuring accurate payroll management and compliance.

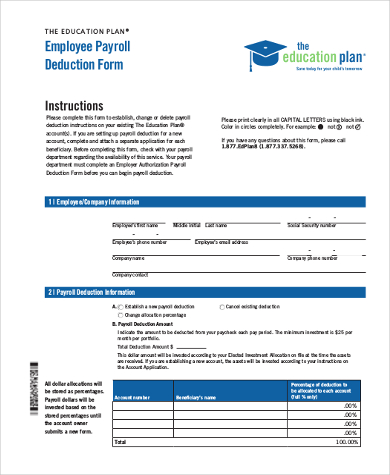

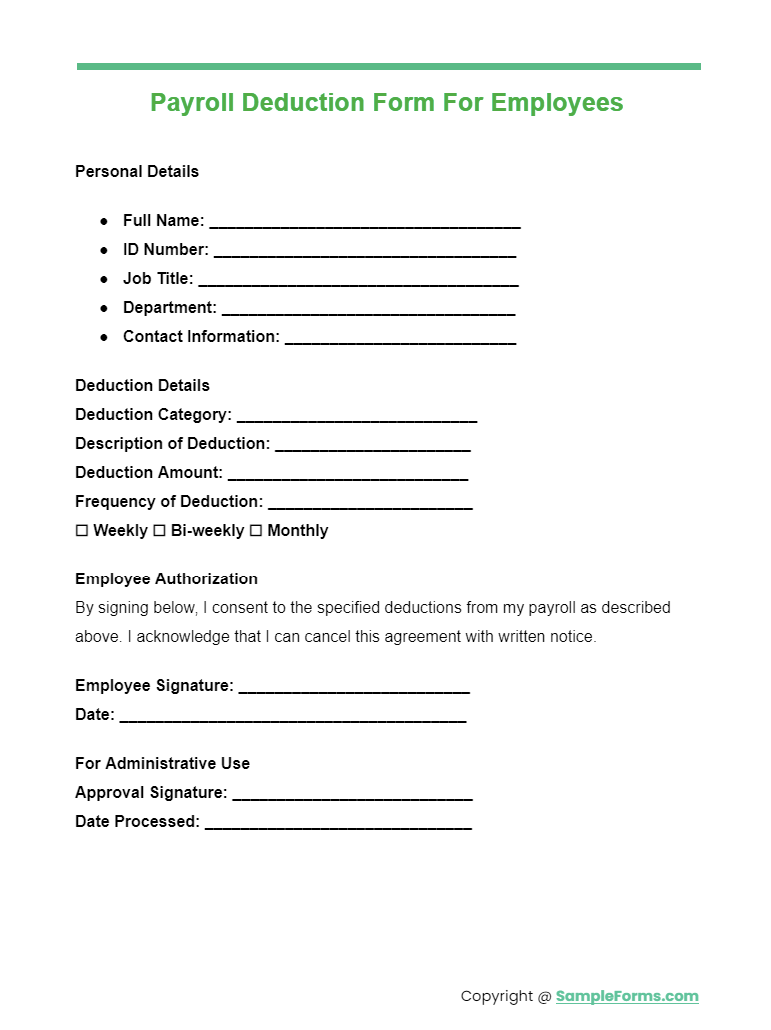

Payroll Deduction Form For Employees

Utilizing the Payroll Deduction Form for Employees streamlines the deduction process, directly impacting the Employee Payroll Form. This form is essential for accurate record-keeping and seamless integration with Payroll Verification Form procedures.

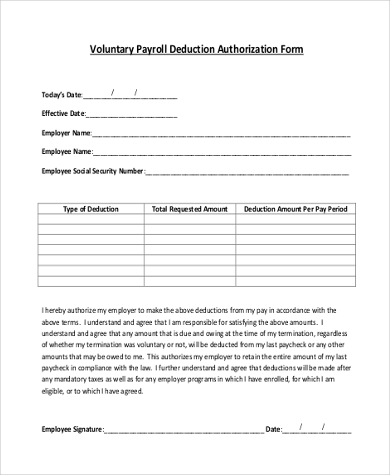

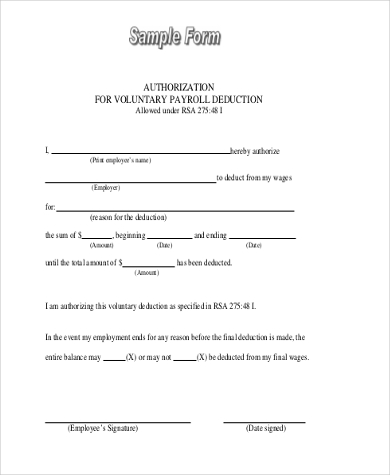

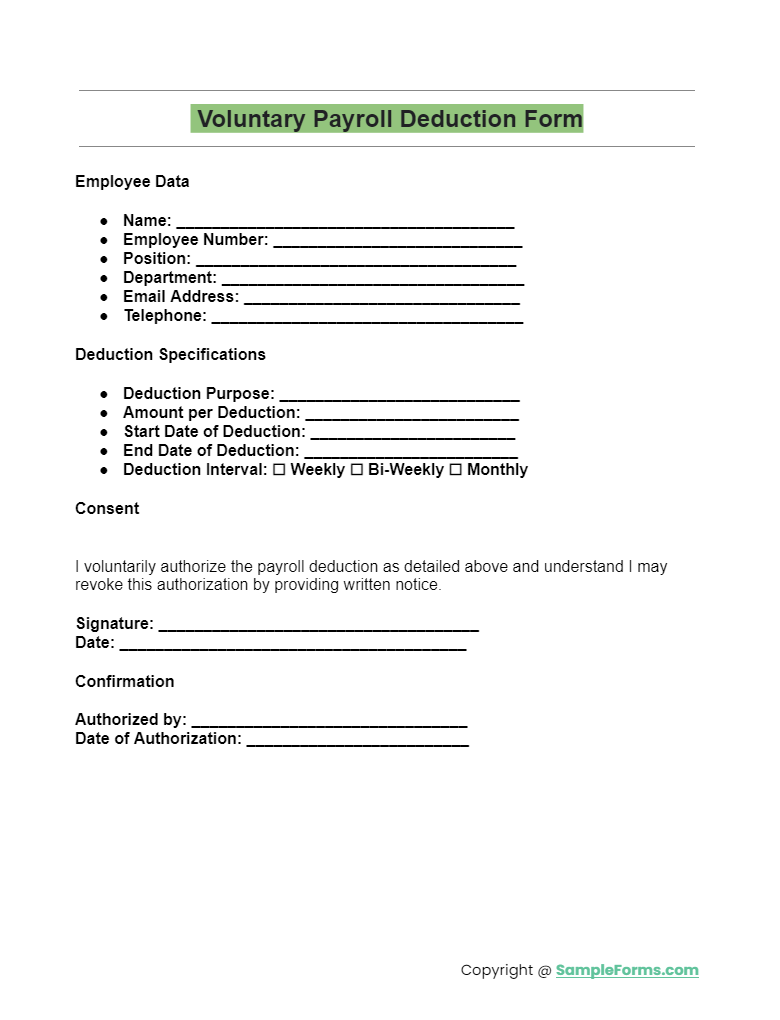

Voluntary Payroll Deduction Form

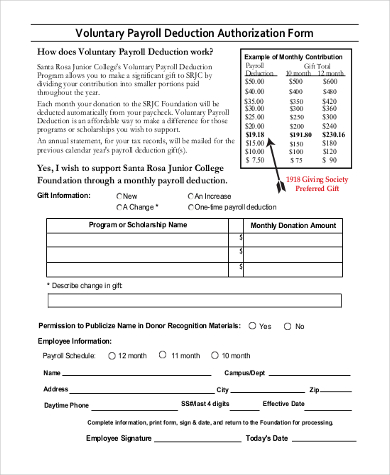

The Voluntary Payroll Deduction Form allows employees to voluntarily contribute to funds or pay for benefits, necessitating updates to the Payroll Form in Excel and Payroll Register Form, ensuring accurate payroll tracking and reporting.

Free Payroll Deduction Form Template

More Payroll Deduction Form Samples

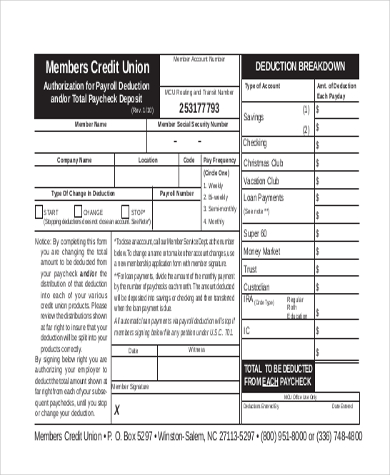

Payroll Deduction Authorization Form

Payroll Deduction Remittance Form

Payroll Tax Deduction Form

Employee Payroll Deduction Form

Basic Payroll Deduction Form

Blank Payroll Deduction Form

Loan Payroll Deduction Form

Printable Payroll Deduction Form

Voluntary Payroll Deduction Form

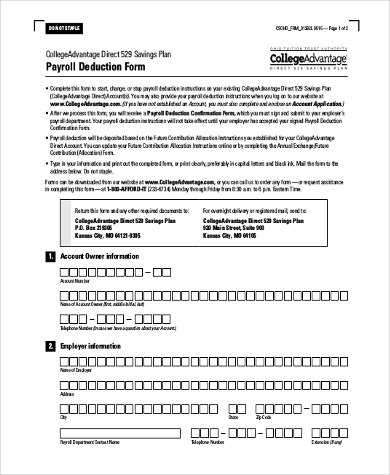

Automatic Payroll Deduction Form in PDF

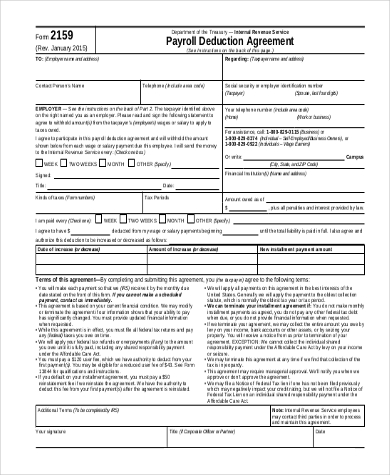

What is the IRS Form for Payroll Deductions?

- Identify the Correct Form: The primary IRS form for payroll deductions is the W-4 Form, also known as the Employee’s Withholding Certificate.

- Complete Employee Information: Employees must provide personal information and filing status to determine withholding amounts.

- Determine Withholding Amount: Use the IRS’s tax withholding estimator or tables provided in IRS publications to calculate the correct amount.

- Submit to Employer: After completion, the form should be submitted to the employer, who will adjust payroll deductions accordingly.

- Regular Updates: Update the W-4 form after major life events or yearly to ensure accurate Payroll Authorization Form compliance.

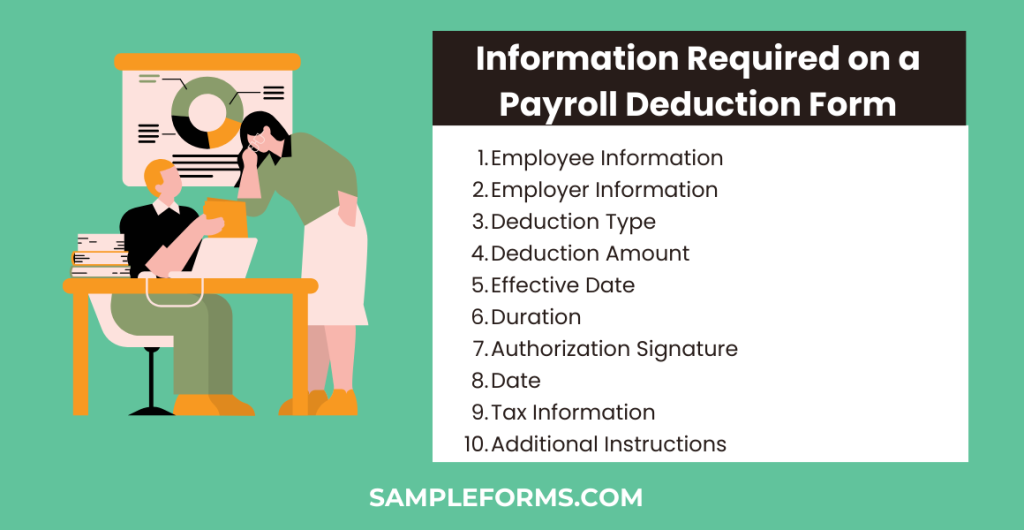

What Information is Required on a Payroll Deduction Form?

- Employee Information: Full name, employee ID, and contact details for identification.

- Employer Information: Company name and department to ensure proper processing.

- Deduction Type: Specific reason for the deduction, such as health insurance or retirement savings.

- Deduction Amount: Exact amount or percentage to be deducted from each paycheck.

- Effective Date: When the deductions should start, indicating the payroll period.

- Duration: If applicable, how long the deduction should continue (e.g., ongoing or specific end date).

- Authorization Signature: Employee’s signature to validate consent for the deductions.

- Date: When the form was completed and signed, for record-keeping purposes.

- Tax Information: Details relevant to tax withholdings, if applicable for the deduction.

- Additional Instructions: Any special instructions or conditions related to the deduction.

Are Payroll Deductions Mandatory?

- Understand Mandatory Deductions: Some payroll deductions are mandatory, including federal and state taxes, Social Security, and Medicare.

- Optional Deductions: Beyond mandatory deductions, employees may opt for Voluntary Deduction Agreement for benefits like health insurance or retirement plans.

- Employer Responsibilities: Employers must withhold mandatory taxes and forward them to the appropriate agencies.

- Employee’s Role: Employees decide on voluntary contributions and must complete relevant documentation, such as the Payroll Giving Form.

What is the Payroll Deduction on W2?

The payroll deduction on a W-2 form represents the total amount withheld from an employee’s wages for federal and state taxes, Social Security, and Medicare over the tax year. This information helps in filing an accurate tax return and reflects any Payment Receipt Form transactions.

What is the Difference Between Payroll Deductions and Withholdings?

| Feature | Payroll Deductions | Withholdings |

|---|---|---|

| Definition | Amounts taken from an employee’s total earnings for taxes, benefits, and other obligations. | Specifically refers to federal, state, and local taxes withheld from an employee’s paycheck. |

| Types | Includes taxes, retirement contributions, health insurance premiums, and Payment Agreement. | Primarily taxes such as income, Social Security, and Medicare taxes. |

| Voluntariness | Can be mandatory (taxes, Social Security) or voluntary(Voluntary Deduction Agreement). | Primarily mandatory, based on statutory rates. |

| Employee’s Control | Employees have some control over certain deductions, like retirement contributions or health plans. | Limited control, mainly through tax exemption claims on the Payroll Change Form in Excel. |

| Impact on Net Pay | Directly reduces the employee’s take-home pay. Includes a wider range of deductions beyond taxes. | Directly reduces take-home pay but is limited to tax obligations. |

| Documentation Required | May require specific forms like Payroll Action Form for authorization or changes to voluntary deductions. | Requires the W-4 form for setting up or adjusting tax withholdings. |

Incorporating these keywords and detailed explanations not only provides clarity but also enhances the content’s relevance and value for readers seeking comprehensive information on payroll deductions.

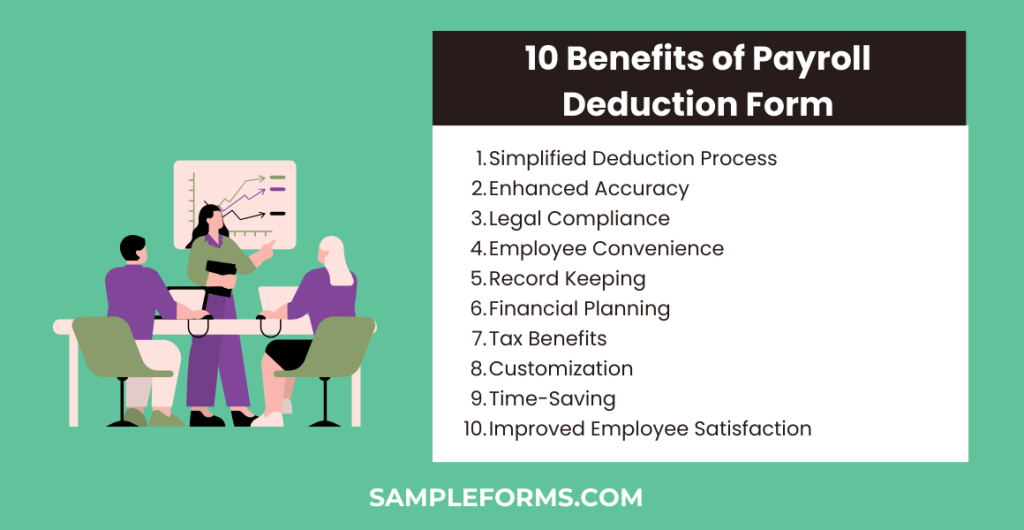

10 Benefits of Payroll Deduction Form

- Simplified Deduction Process: Automates and streamlines the deduction from employees’ paychecks for various purposes.

- Enhanced Accuracy: Reduces errors in payroll processing, ensuring accurate deduction amounts.

- Legal Compliance: Helps both employer and employee comply with tax laws and regulations.

- Employee Convenience: Offers a hassle-free way for employees to manage financial contributions and payments directly from their salary.

- Record Keeping: Facilitates better record keeping for both employees and employers regarding deductions made over time.

- Financial Planning: Assists employees in financial planning by automating savings and investment contributions.

- Tax Benefits: Enables pre-tax deductions, potentially lowering taxable income for employees.

- Customization: Allows employees to customize deductions according to their financial goals and needs.

- Time-Saving: Reduces the administrative burden and time spent on manual deduction processes.

- Improved Employee Satisfaction: Enhances employee satisfaction through efficient management of benefits and other deductions.

Who is Responsible for Processing Payroll Deduction Forms Within the Company?

The HR department or payroll team typically handles processing Payment Form submissions, ensuring accurate payroll deductions and compliance with legal requirements.

How Do You Record Payroll Deductions?

Payroll deductions are recorded in payroll software or spreadsheets, detailing each deduction type, such as taxes or benefits, and aligning with the Payment Confirmation Form procedures.

Are Payroll Deduction Forms Confidential?

Yes, Payroll Deduction Forms are confidential, protected under privacy laws and company policy, similar to the security around a Payment Agreement Form to safeguard employee information.

How Often Do Employees Need to Submit a Payroll Deduction Form?

Employees should submit a Contractor Payment Form only when initiating deductions or changing deduction amounts, usually at employment start or during annual benefits enrollment.

What Are the Consequences of Not Submitting a Payroll Deduction Form on Time?

Failing to submit a Payroll Deduction Form on time can lead to incorrect withholdings, affecting tax liabilities and benefits coverage, akin to delays in a Payment Application Form submission.

In the realm of payroll management, the Payroll Deduction Form stands out as an indispensable tool, ensuring that every deduction from an employee’s salary is accounted for and authorized. This documentation is essential for maintaining Certified Payroll Form compliance, offering a layer of security and transparency for both employers and employees. Master the use of these forms to uphold financial integrity and streamline your payroll operations.

Related Posts

-

FREE 6+ Voluntary Deduction Agreement Samples in PDF

-

FREE 10+ Sample Payroll Direct Deposit Forms in PDF | MS Word | Excel

-

FREE 10+ Sample Payroll Register Forms in PDF | Excel

-

FREE 8+ Sample HR Payroll Forms in PDF | Word | Excel

-

FREE 8+ Sample Payroll Tax Forms in PDF | Excel | MS Word

-

FREE 9+ Sample Certified Payroll Forms in PDF | Excel | Word

-

FREE 9+ Sample Payroll Remittance Forms in PDF | Excel