A Payroll Advance Form is a crucial tool for managing employee cash flow by providing advances on their salary. This complete guide covers everything you need to know about creating and using Payroll Form templates effectively. We include detailed instructions, examples, and tips to ensure your payroll processes are smooth and compliant with Certified Payroll regulations. Whether you’re handling occasional advances or setting up a formal system, this guide will help you navigate the process with confidence and efficiency.

Download Payroll Advance Form Bundle

What Is Payroll Advance Form?

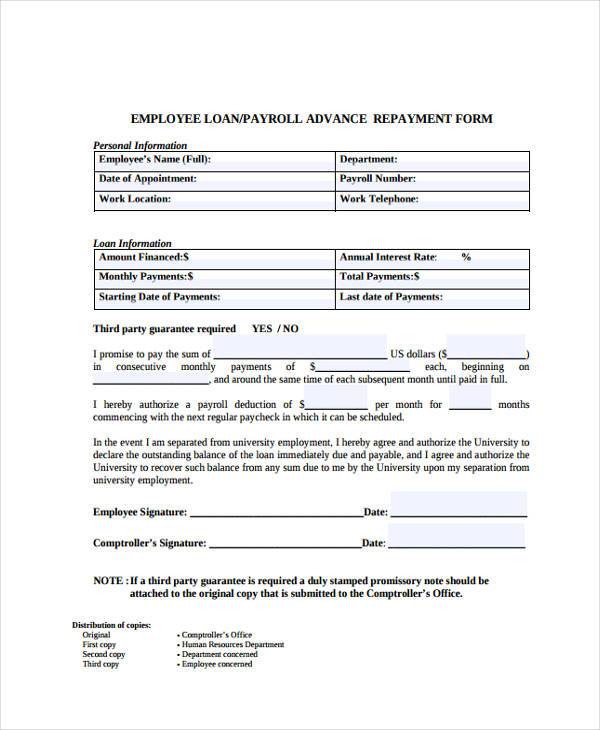

A Payroll Advance Form is a document used by employees to request an advance on their salary. This Payroll Form typically includes the amount requested, reason for the advance, and repayment terms. Understanding this form is essential for both employers and employees to manage short-term financial needs while maintaining accurate payroll records.

Payroll Advance Format

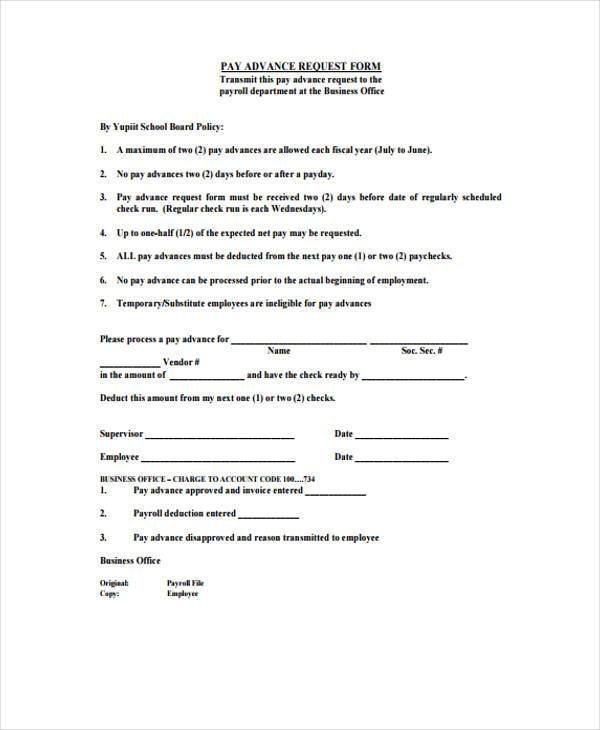

Title: Payroll Advance Request Form

Section 1: Employee Information

- Full Name:

- Employee ID:

- Department:

- Contact Number:

Section 2: Advance Details

- Amount Requested:

- Reason for Advance:

- Repayment Schedule:

Section 3: Authorization

- Supervisor’s Name:

- Supervisor’s Signature:

- Date:

Section 4: Employee Acknowledgment

- I understand the terms of this payroll advance and agree to repay as specified.

- Employee’s Signature:

- Date:

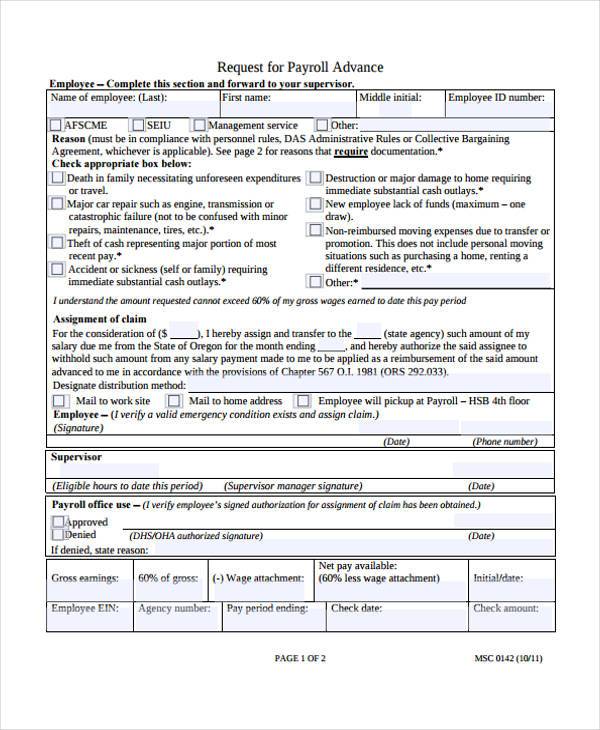

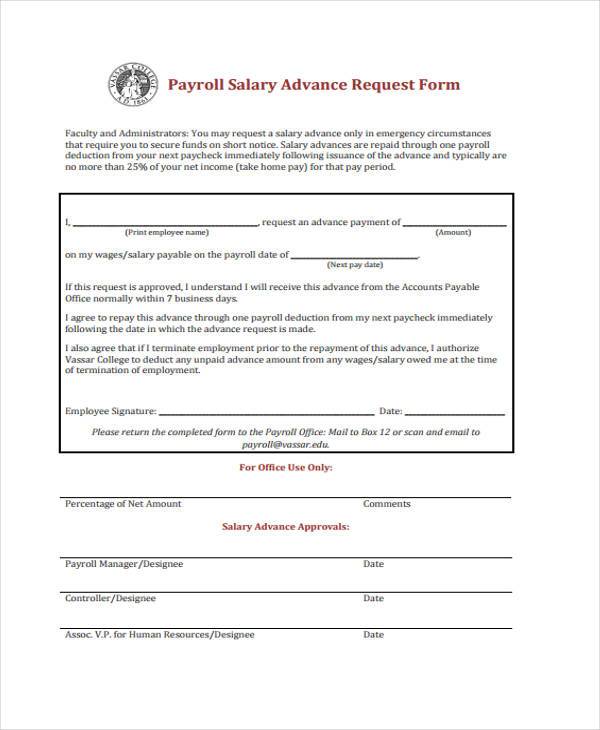

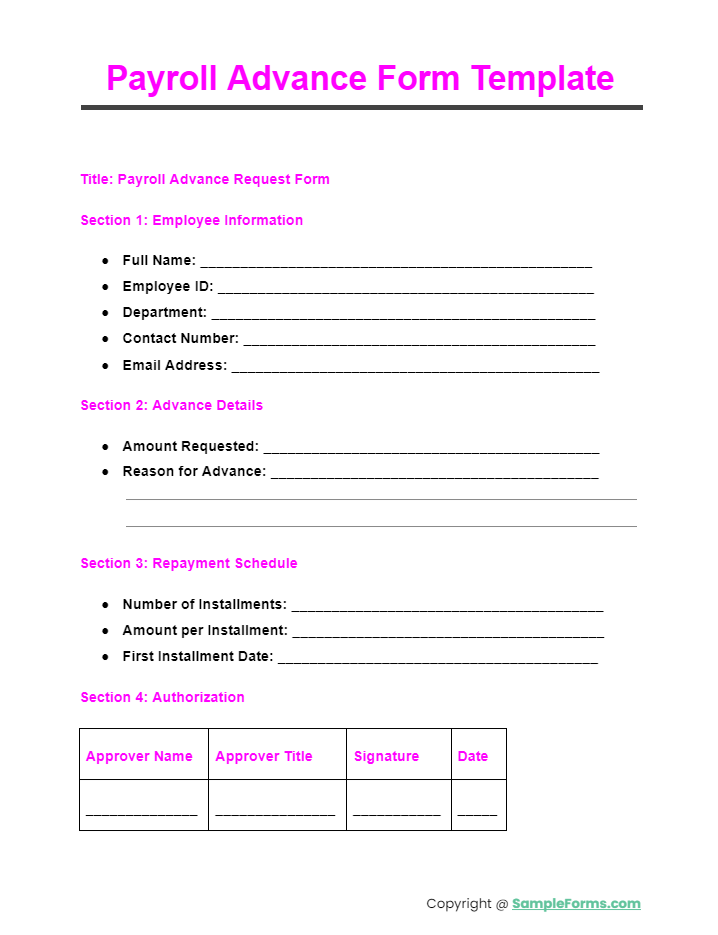

Payroll Advance Form Template

A Payroll Advance Form Template is essential for standardizing the process of requesting salary advances. This template ensures consistency and compliance, similar to a Payroll Deduction Form, by including necessary fields like employee details, requested amount, and repayment terms.

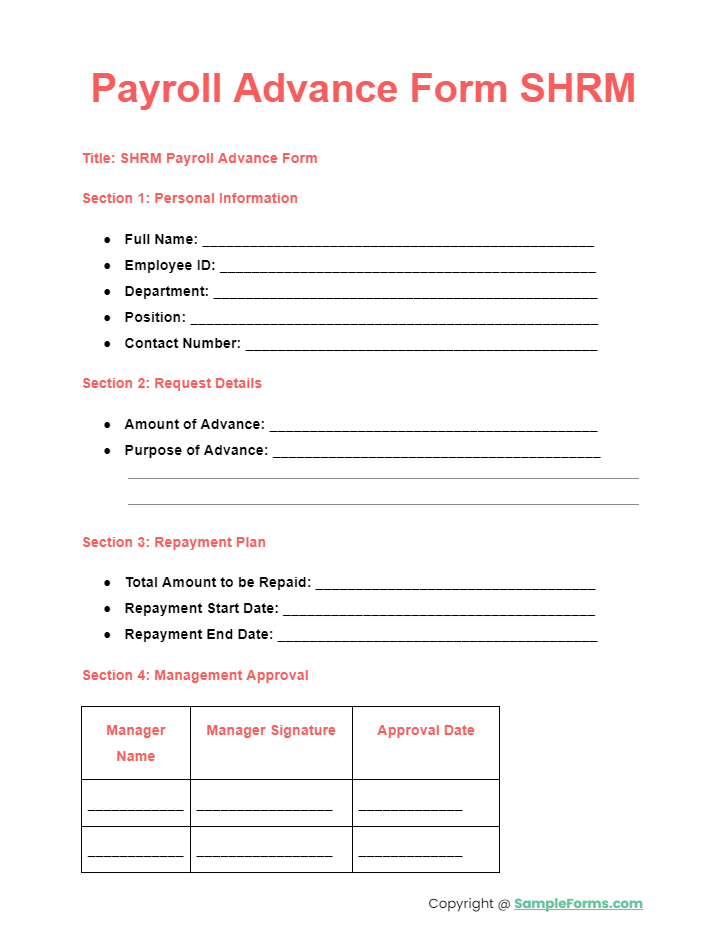

Payroll Advance Form SHRM

The Payroll Advance Form SHRM follows guidelines set by the Society for Human Resource Management. It helps HR professionals manage advance requests efficiently, ensuring all policies are met, much like handling a Payroll Remittance Form.

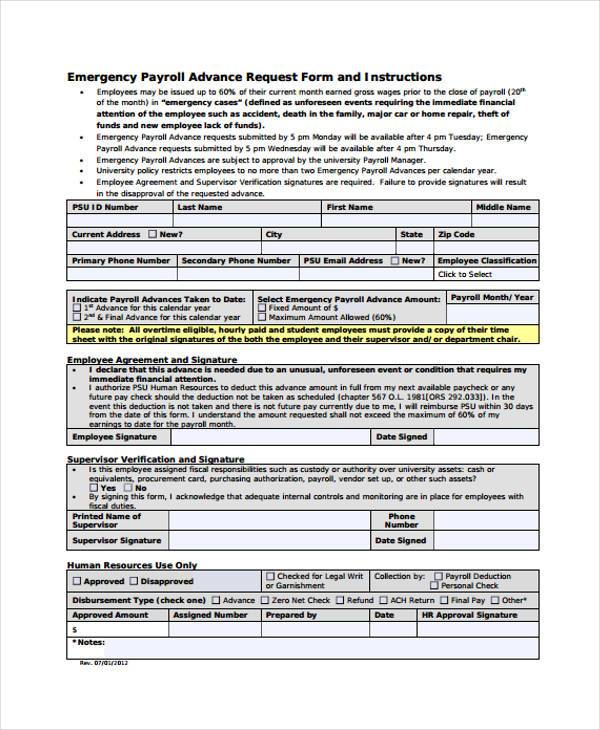

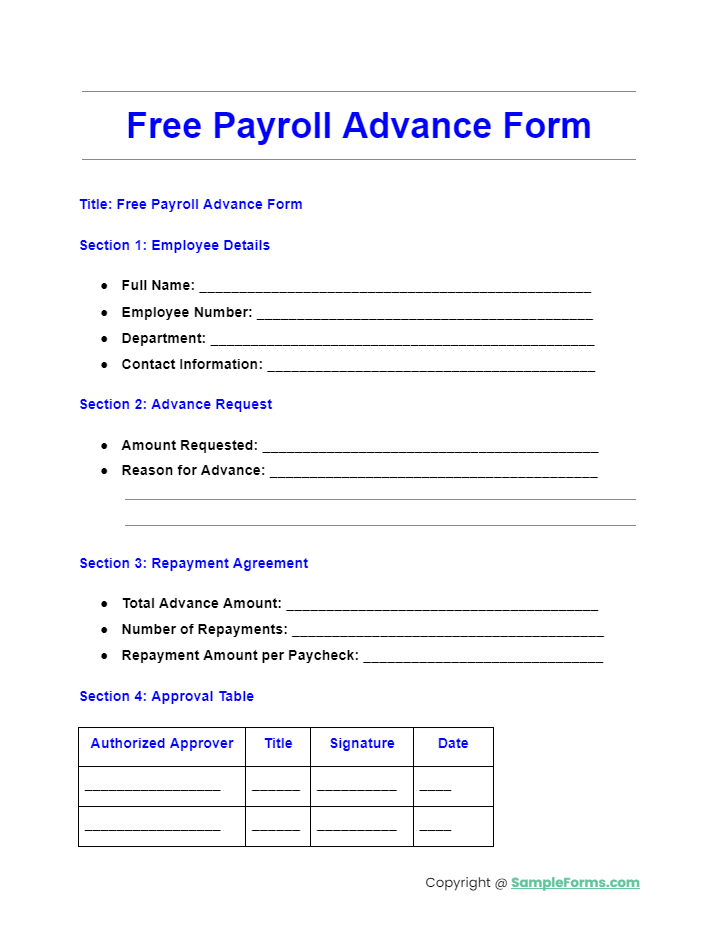

Free Payroll Advance Form

A Free Payroll Advance Form offers a cost-effective solution for businesses. Easily downloadable and customizable, it simplifies the advance request process for both employers and employees, akin to using a Payroll Change Form for updates.

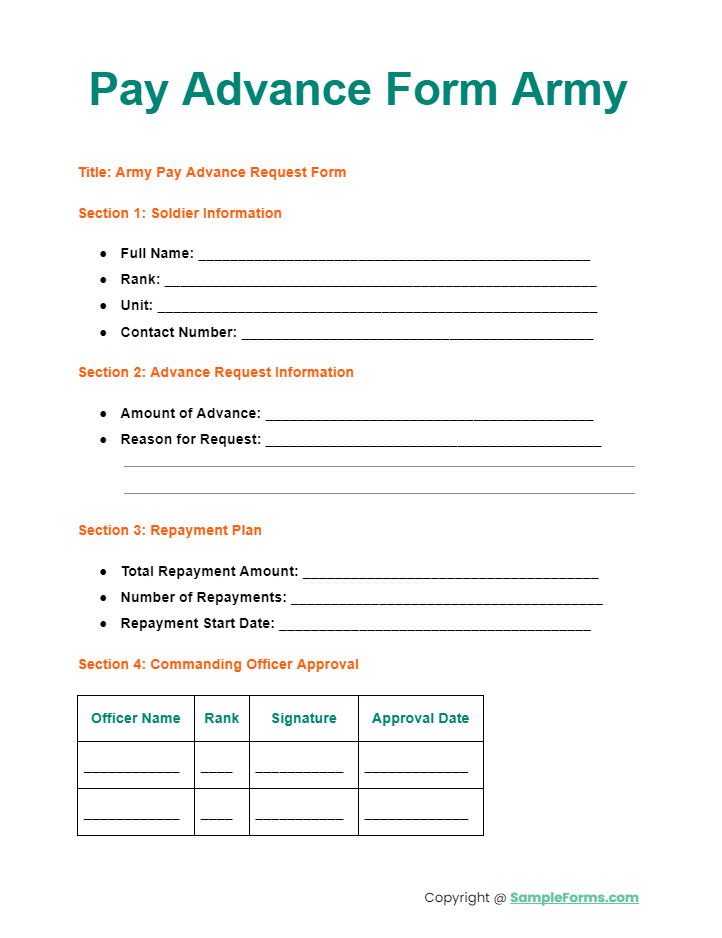

Pay Advance Form Army

The Pay Advance Form Army is designed specifically for military personnel needing salary advances. This form adheres to military regulations and ensures timely processing, similar to how an Employee Payroll Form facilitates regular payroll management.

More Payroll Advance Form Samples

Payroll Advance Request Form

Employee Payroll Advance Form

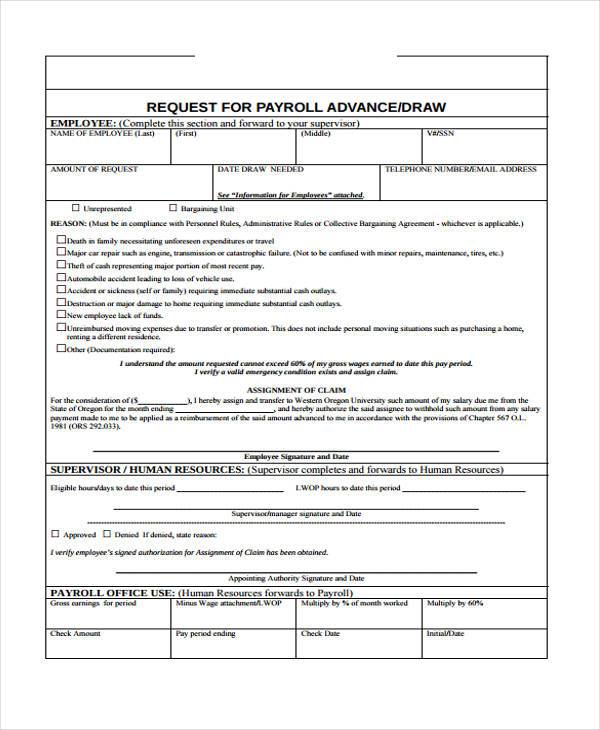

Request for Payroll Advance Form in PDF

Free Payroll Advance Request Form

Payroll Advance Authorization Form

Payroll Advance Request Form Example

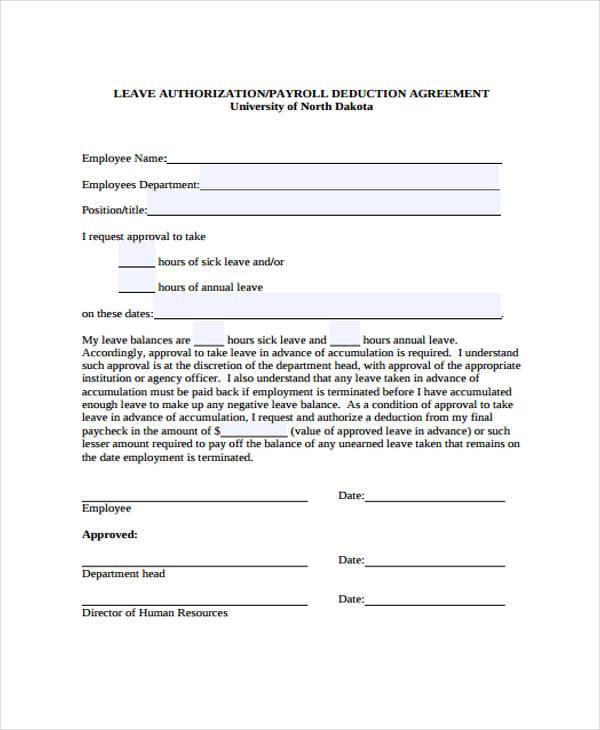

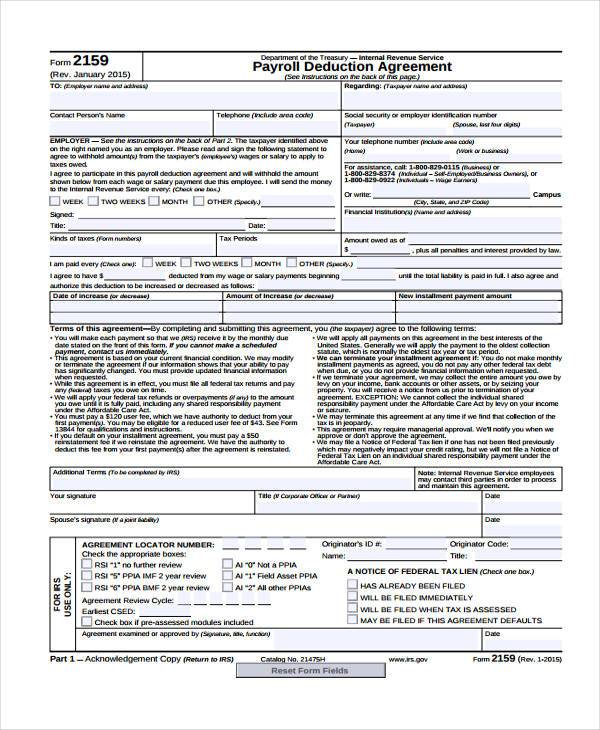

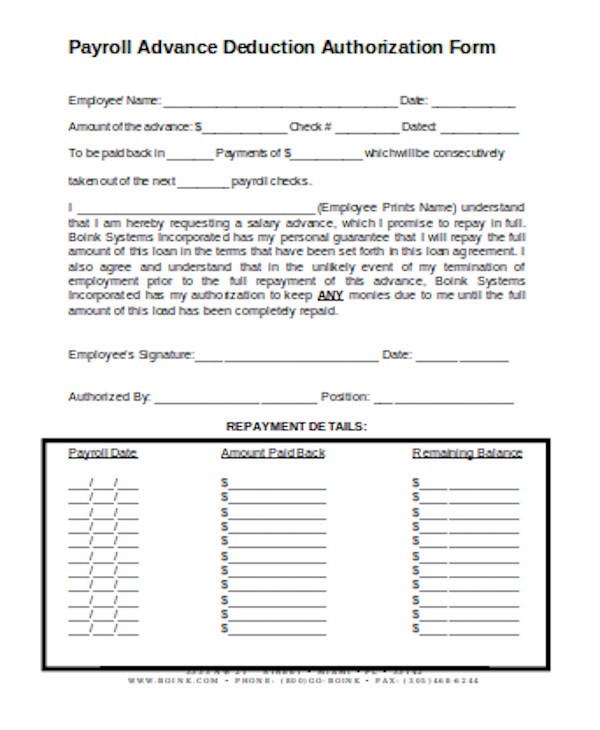

Payroll Deduction Agreement Form

Payroll Salary Advance Request Form

Printable Payroll Advance Request Form

Payroll Advance Deduction Authorization Form

All employees look forward to payday. In order to boost the morale and motivation of the employees in the company, it is important to give them the proper amount they are promised through payroll. Here, they will be able to review the deductions or bonus breakdown into a simplified format. These Employee Advance Request Form will guarantee you the information you need and indicate the official deductions of important payments like taxes.

There are ten different formats you can use for your company or edit it in accordance with what information you need to gather. It also helps you check the growth of the company and understand the standards of the payment agreed upon on. This will also help you decide if you need to alter the salaries of your employees by carefully reviewing the raise in the budget. Aside from transparency purposes, it also helps them decide if they need to contribute a portion of their salary to altruistic purposes. You may also see Payment Requisition Form

This form helps the employees understand the certain deductions made from their payment and see the complete breakdown of their salary. It promotes fairness and trustworthiness in the workplace. You may also see Payment Confirmation Form

How Do I Record a Payroll Advance?

Recording a payroll advance accurately ensures proper tracking and repayment. Key steps include:

- Create Advance Account: Set up a separate payroll advance account in your accounting system.

- Document Transaction: Record the advance in the payroll system using a Payroll Adjustment Form.

- Track Repayments: Monitor repayments through payroll deductions.

- Update Financial Records: Ensure financial records reflect the advance and repayments.

- Review Regularly: Periodically review the payroll advance account for accuracy. You may also see Payment Agreement Form

How Do I Ask for an Advance on My Paycheck?

Requesting an advance on your paycheck requires clear communication and understanding of company policies. Key steps include:

- Review Company Policy: Check if your company allows payroll advances.

- Prepare Request: Draft a formal request explaining the reason for the advance.

- Submit Form: Fill out and submit a Payroll Verification Form.

- Discuss with HR: Have a discussion with HR to understand repayment terms.

- Follow Up: Confirm the request has been processed and keep records. You may also see Contractor Payment Form

What Type of Account Is Payroll Advance?

A payroll advance is typically recorded as a current asset account in accounting. Key steps to set it up include:

- Account Creation: Create a “Payroll Advance” account in your chart of accounts.

- Document Advances: Record advances issued to employees.

- Track Repayments: Monitor repayments through deductions in a Receipt of Payment Form.

- Reconcile Monthly: Regularly reconcile the payroll advance account.

- Review Policies: Ensure policies align with the accounting practices. You may also see Payment Application Form

How Far in Advance Do Companies Submit Payroll?

Companies usually submit payroll a few days before payday to ensure timely processing. Key steps include:

- Set Schedule: Establish a payroll processing schedule.

- Prepare Documents: Gather necessary documents, such as a Payroll Correction Form.

- Review Entries: Verify all payroll entries for accuracy.

- Submit to Processor: Submit payroll data to the payroll processor.

- Confirm Processing: Ensure payroll has been processed and funds are available. You may also see

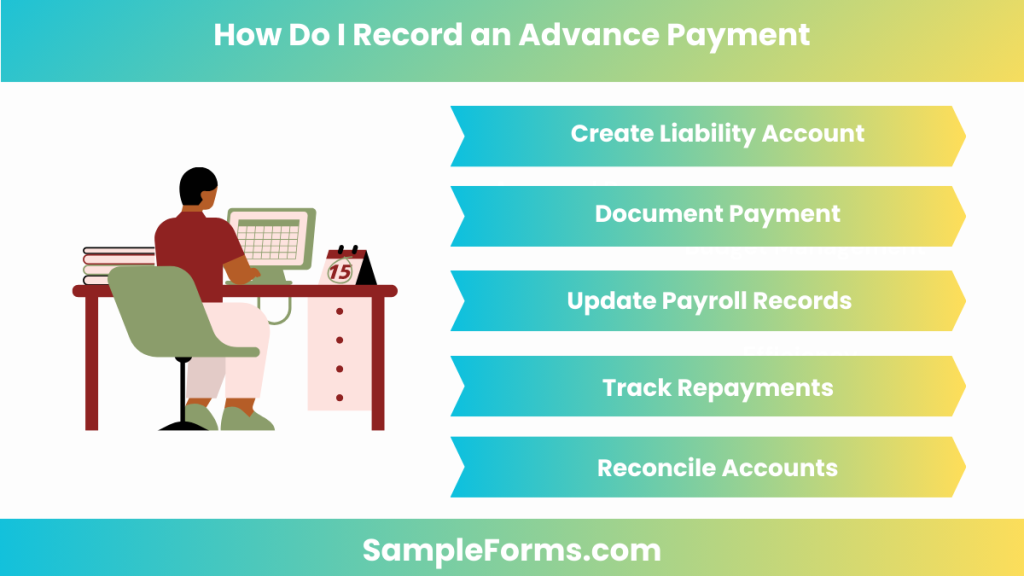

How Do I Record an Advance Payment?

Recording an advance payment requires precise accounting entries. Key steps include:

- Create Liability Account: Set up an advance payment liability account.

- Document Payment: Record the advance payment in the accounting system.

- Update Payroll Records: Reflect the advance in payroll records using a Payroll Register Form.

- Track Repayments: Monitor repayments through payroll deductions.

- Reconcile Accounts: Regularly reconcile the advance payment account to ensure accuracy. You may also see Payment Form

Can I Process Payroll in Advance?

Yes, you can process payroll in advance by following company policies and using a Payroll Change Notice Form to document the adjustment.

Is a Payroll Advance a Liability?

Yes, a payroll advance is considered a liability on the company’s balance sheet until it is repaid by the employee, similar to a Payment Agreement.

Is a Payroll Advance Taxable?

Yes, a payroll advance is taxable income and should be reported on the employee’s W-2 form, just like regular earnings processed through a Payroll Direct Deposit Form.

Can I Ask for My Paycheck in Advance?

Yes, you can request your paycheck in advance by submitting a formal request and completing a Payment Request Form with your employer’s HR department.

How Does a Paycheck Advance Work?

A paycheck advance allows employees to receive a portion of their future earnings early. It’s repaid through deductions, documented via a Payroll Authorization Form.

What Is the Process of Advance Payment?

The advance payment process involves submitting a request, approval from management, and processing through payroll. This is typically documented using a Payroll Giving Form.

What Is a Cash Advance on Payroll?

A cash advance on payroll is a short-term loan against future earnings, documented in a Payroll Giving Form, and repaid through subsequent payroll deductions. You may also see Travel Advance Form

What Makes You Eligible for an Advance Payment?

Eligibility for an advance payment depends on company policy, tenure, and financial need. Employees may need to complete a Payment Contract Form to formalize the agreement.

Related Posts

-

FREE 10+ Sample Payroll Direct Deposit Forms in PDF | MS Word | Excel

-

FREE 10+ Sample Payroll Register Forms in PDF | Excel

-

FREE 8+ Sample HR Payroll Forms in PDF | Word | Excel

-

FREE 8+ Sample Payroll Tax Forms in PDF | Excel | MS Word

-

FREE 9+ Sample Certified Payroll Forms in PDF | Excel | Word

-

FREE 9+ Sample Payroll Remittance Forms in PDF | Excel

-

FREE 6+ Voluntary Deduction Agreement Samples in PDF