The purpose of Payroll Action Forms is to request and approve payment of compensation for employees, and to record any change in employment, like the employee’s salary, job assignment or job title, promotions, address change, or the contract period for employees hired only for a specific period of time. The department handling payroll should make sure that these forms are completed accurately and in a timely manner. This is very critical because the information in these forms can affect an employee’s paycheck and benefits.

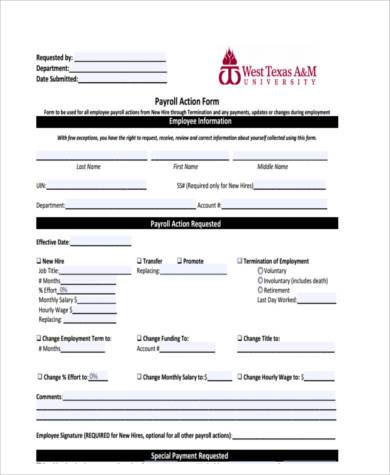

Employee Payroll Action Form

HR/Payroll Action Form

Business Payroll Action Form

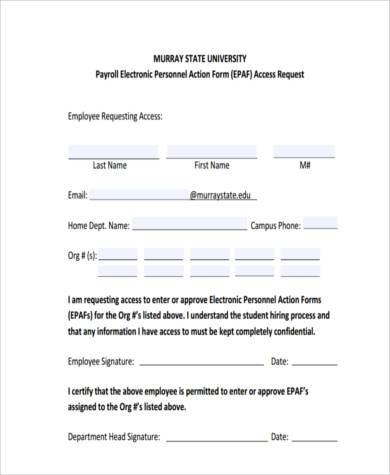

Electronic Payroll Action Form

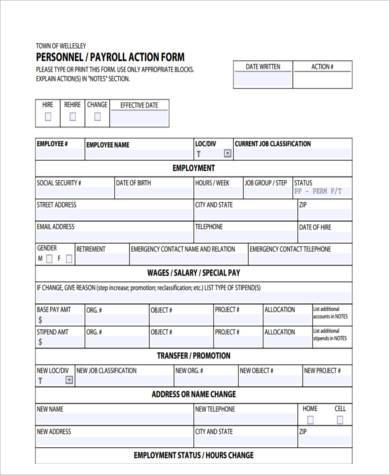

Personnel/Payroll Action Form

When do you need to fill out a Payroll Action Form?

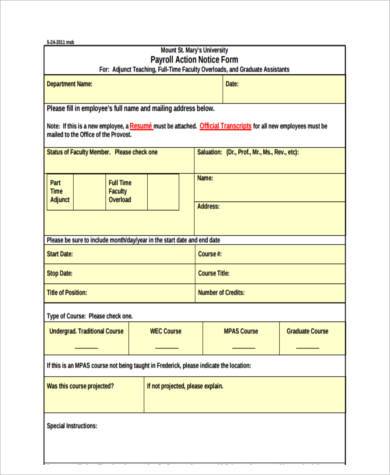

- New Hires or Rehires: For this purpose, you need to include employment information such as the employee’s name, hire date, department, job title, employee identification number, and other relevant information. You also need to include specifics regarding the employee’s compensation, like the monthly rate of the employee and the number of hours worked. For this, you may also see our Personnel Action Forms.

- Change to Current Status: This is used when there is a change in the information of an employee, like an address change, a promotion, a transfer to another department, or a raise in his pay. This is applicable for all other changes in status except for termination and leaves without pay. Information that should be changed are the only ones that need to be filled out to avoid confusion.

- Leave Without Pay or LWOP: This is appropriate for placing an employee on a leave without pay. You should include the type of leave, like personal leave or family medical leave, the reason for the leave, and the day the employee will resume work so he can be added to the payroll again.

- Termination: This is necessary to remove the employee from payroll after they have been terminated or have resigned. You should enter the last day which the employee will be paid. Also include the reason for termination, such as resignation, retirement, dismissal, layoff, death, or any other.

Payroll Action Notice Form

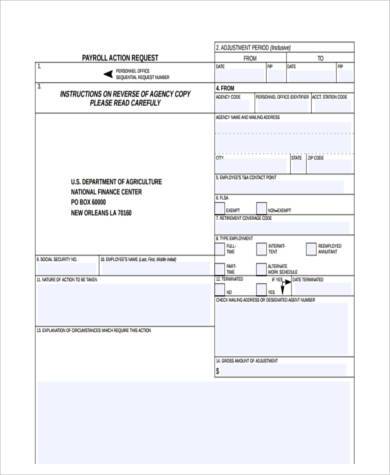

Payroll Action Request Form

Payroll Action Form in PDF

Payroll Action Form Example

Importance of Payroll Action Forms

- Payroll Action Forms help the payroll department keep track of any changes in the payroll. This way, it would be easier for them to compile information and sort them out. For this, you may also need to use Employee Action Forms.

- They assure that employees are properly compensated. This way, the employees are happy, and happy employees are productive employees and will most likely stay longer in your company. As a result, you will not have to constantly hire new employees to replace the ones who leave and you will not have to use your time and resources to train those replacement employees.

- They prevent any disputes and lawsuits. Because everything is in order and employees feel that they are properly compensated, they are less likely to file a complaint.

Given the importance of Payroll Action Forms, it is good to have trained supervisors and payroll department personnel to make sure that each employee is well-compensated and ensure the continuity of your business.

Related Posts

-

Types of Action Forms for Making Plans and Setting Goals [ With 10+ Samples ]

-

FREE 7+ Sample Administrative Action Forms in PDF | MS Word

-

FREE 7+ Sample Student Action Forms in PDF | MS Word

-

FREE 7+ Sample Goal Action Forms in MS Word | PDF

-

FREE 7+ Sample Recruitment Action Forms in MS Word | PDF

-

FREE 9+ Disciplinary Action Form Samples in PDF

-

FREE 20+ Sample Free Action Forms in MS Excel | PDF | MS Word

-

FREE 11+ Sample Action Request Forms in PDF | MS Word

-

FREE 9+ Employee Action Form Samples in PDF | MS Word | Excel

-

FREE 10+ Sample Affirmative Action Forms in PDF | MS Word

-

Corrective Action Procedures [ What is ]

-

Affirmative Action Policies [ What is ]

-

The Differences Between Corrective and Preventive Actions [ How to Formulate ]

-

FREE 5+ Maintenance Action Forms in MS Word | PDF

-

FREE 7+ Incident Action Forms in PDF | Ms Word