A Payment Requisition Form is essential for streamlining financial processes in organizations. It serves as an official document to request payments for various needs, ensuring accuracy and compliance. From salaries to vendor invoices, this guide provides detailed instructions, real-world examples, and tips for creating an efficient form. By incorporating the Requisition Form structure, organizations can reduce processing time, improve transparency, and simplify approvals. Additionally, this form helps track expenses and maintain financial records. Whether you’re a manager or an employee, understanding the importance of a Payment Form is crucial for effective financial management.

Download Payment Requisition Form Bundle

What is Payment Requisition Form?

A Payment Requisition Form is a formal document used to request payment for goods, services, or reimbursements. It ensures financial transparency and serves as a record for authorized payments. Typically, it includes details such as the payee’s name, purpose of payment, amount, and approval signatures. By organizing payment requests, it prevents errors and facilitates seamless financial operations. This tool is widely used across industries to standardize payment processes and maintain accountability.

Payment Requisition Format

Requestor’s Name: _____________________________

Department: _____________________________

Request Date: _____________________________

Purpose of Payment:

Provide detailed justification for the requested funds. _____________________________

Amount Requested: _____________________________

Payee Information:

Payee Name: _____________________________

Contact Information: _____________________________

Supporting Documents:

- List or attach required documentation (e.g., invoices, receipts).

Approval Section:

Supervisor’s Name: _____________________________

Approval Signature: _____________________________

Date: _____________________________

Disbursement Details:

Date Funds Issued: _____________________________

Issued By: _____________________________

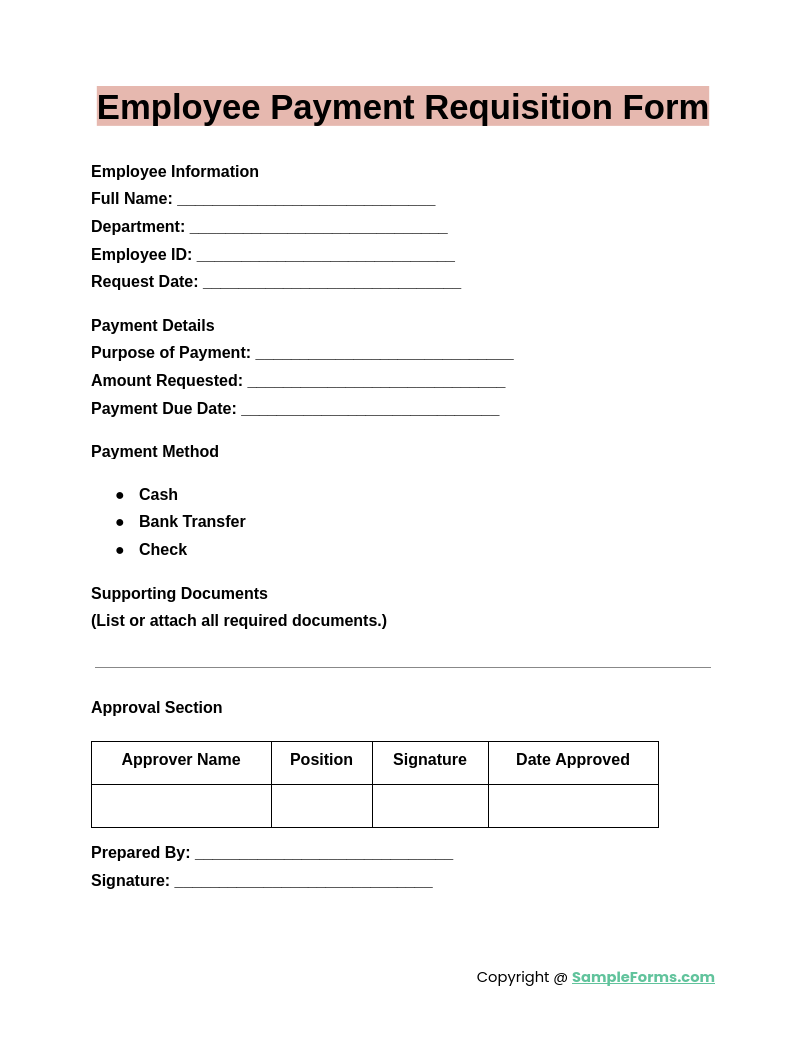

Employee Payment Requisition Form

An Employee Payment Requisition Form ensures employees request payments efficiently, documenting details like purpose and amount. Similar to a Payment Confirmation Form, it maintains clear records for smooth payroll management and accountability within the organization.

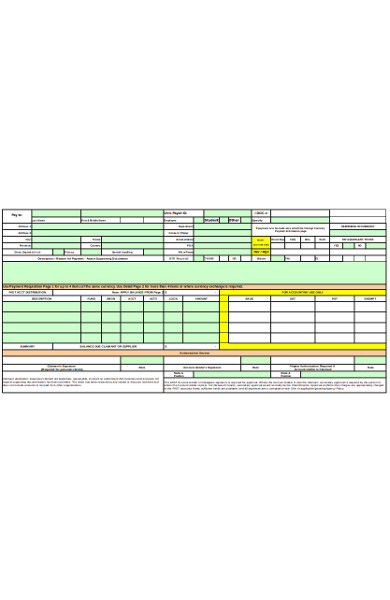

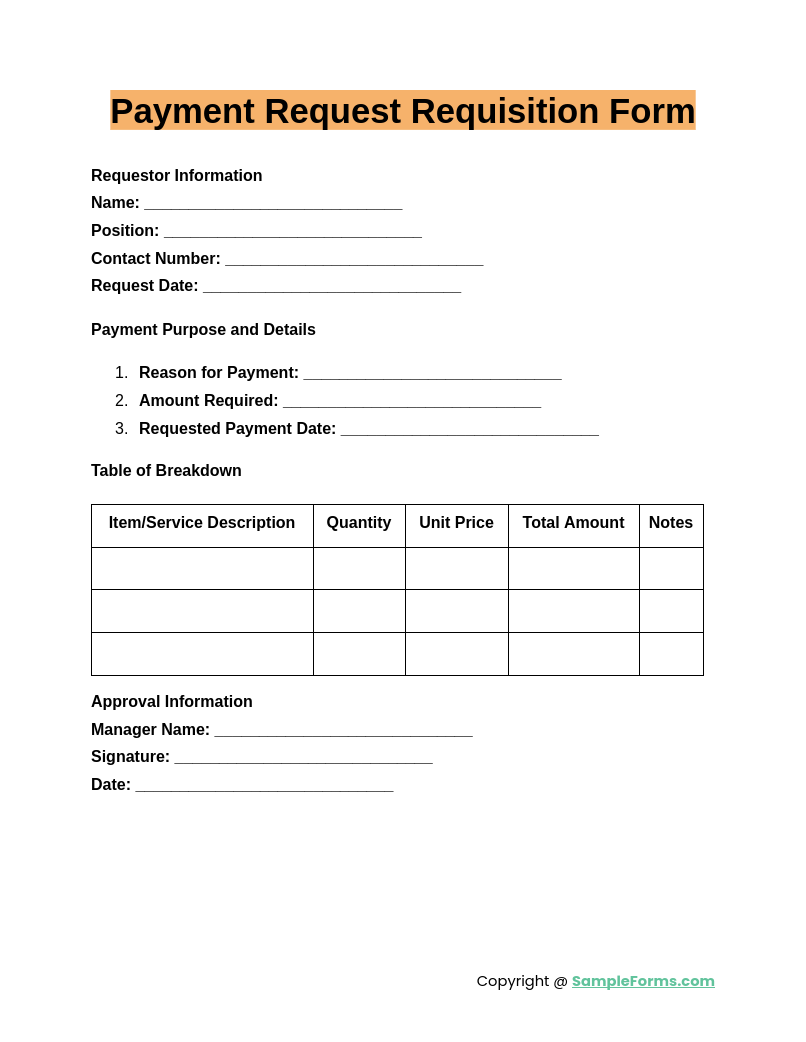

Payment Request Requisition Form

A Payment Request Requisition Form simplifies the process of requesting payments for goods or services. Much like a Contractor Payment Form, it ensures all payment details are recorded and approved before processing.

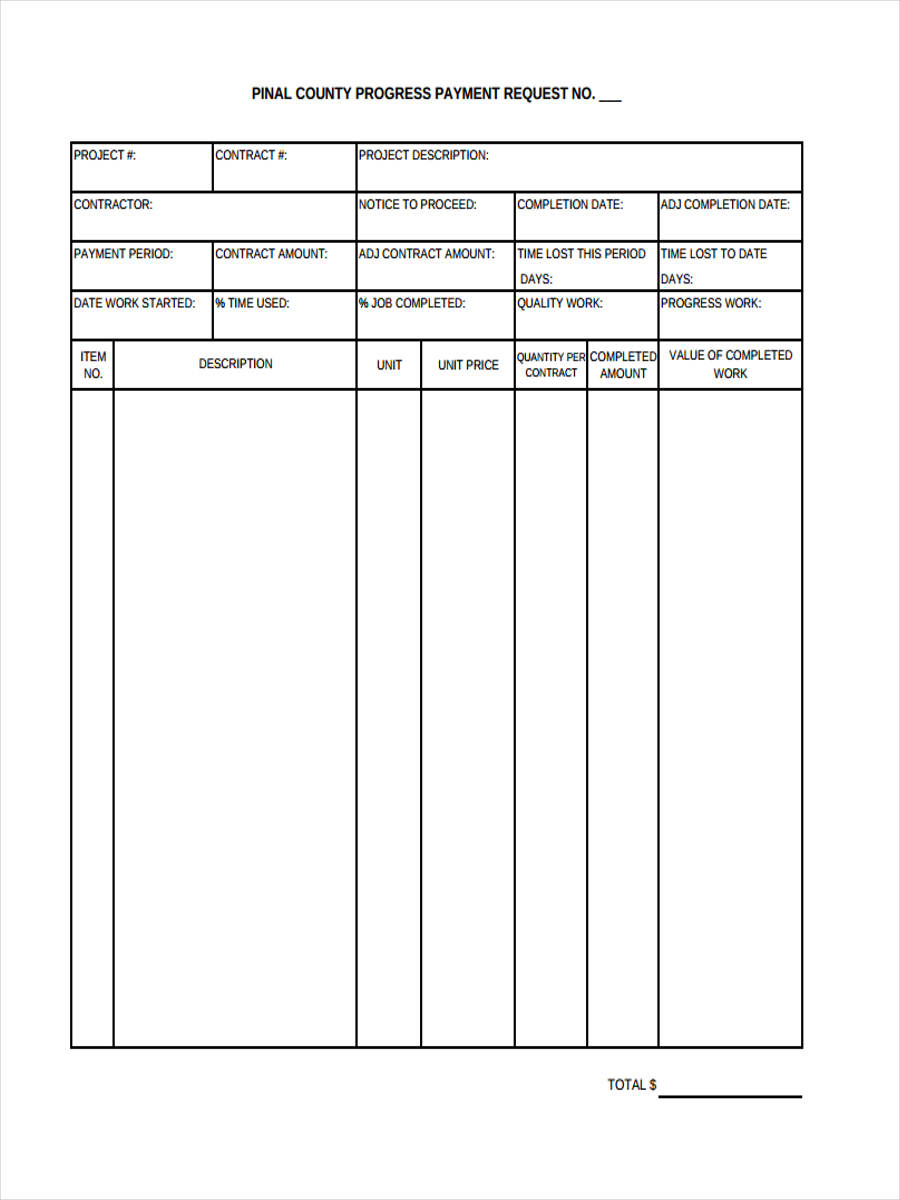

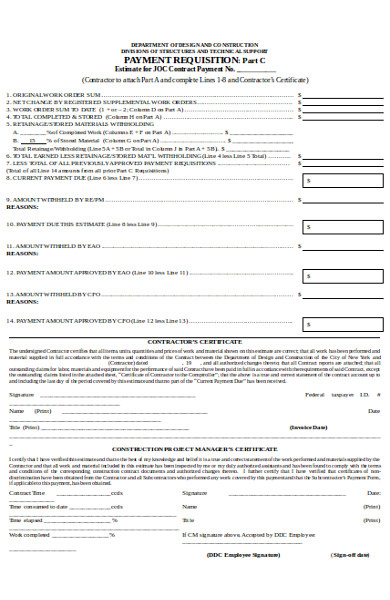

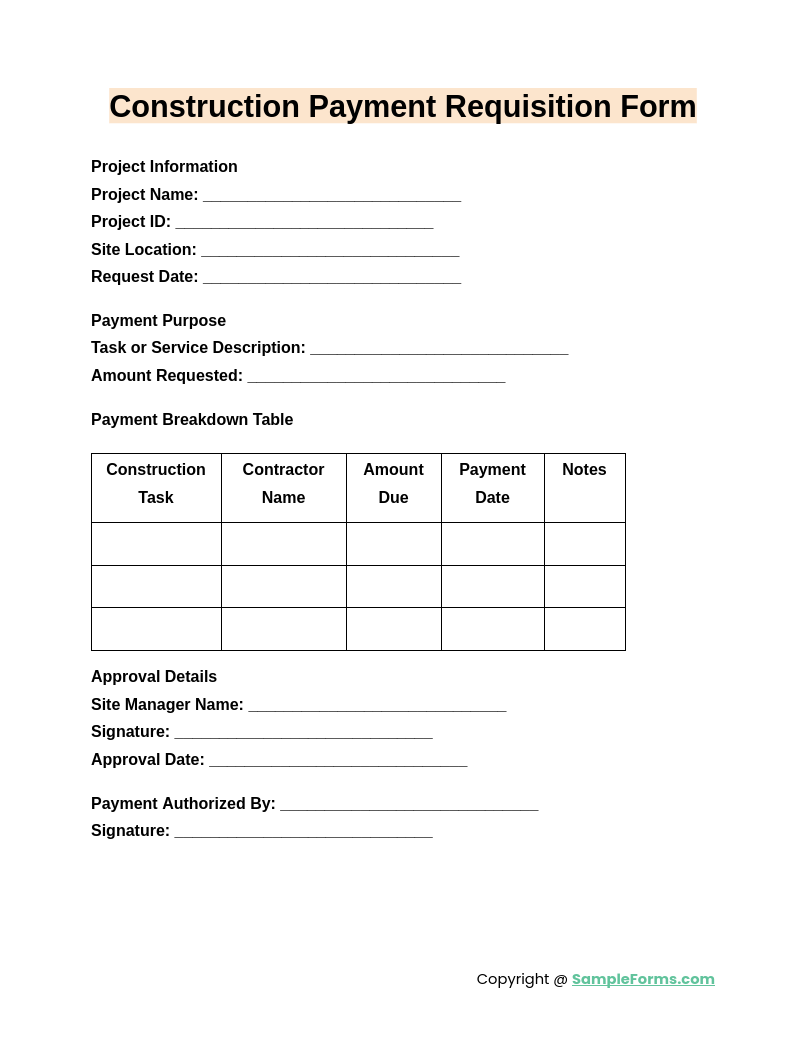

Construction Payment Requisition Form

The Construction Payment Requisition Form is tailored for construction projects, enabling contractors to request payments for completed work. Similar to a Payment Application Form, it includes work descriptions, amounts due, and required authorizations.

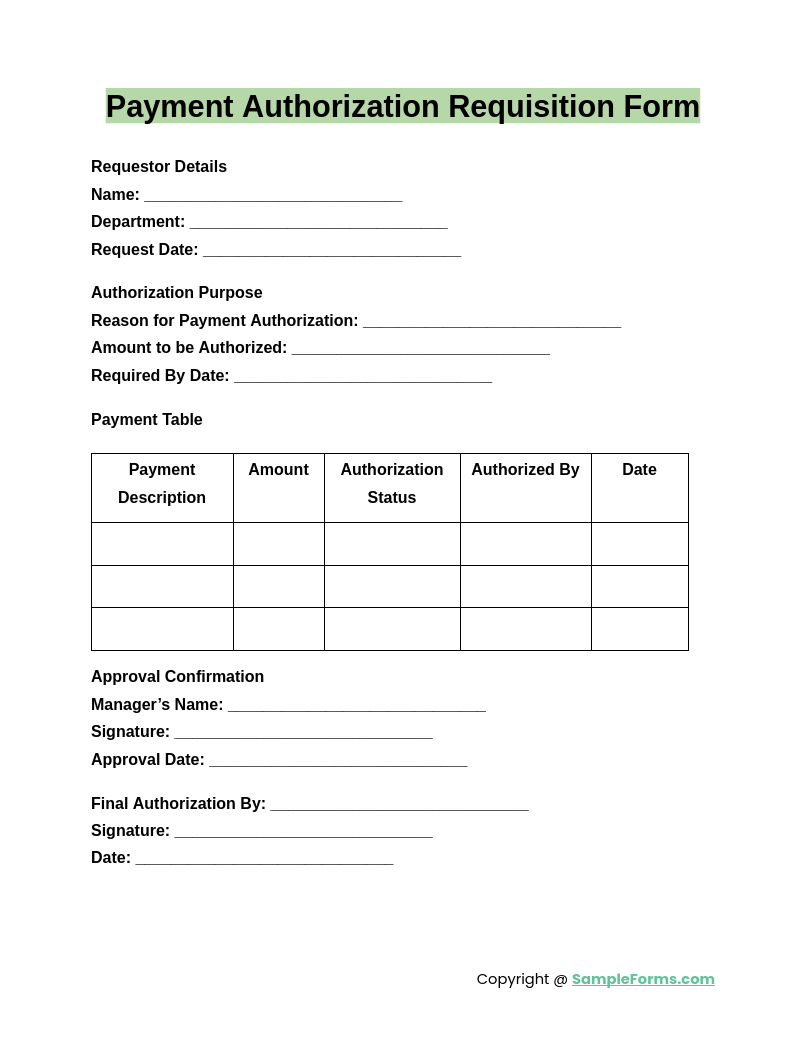

Payment Authorization Requisition Form

A Payment Authorization Requisition Form formalizes payment approvals for various purposes. Like a Payment Agreement Form, it ensures compliance by capturing necessary approvals before funds are released, enhancing financial transparency and control.

Browse More Payment Requisition Forms

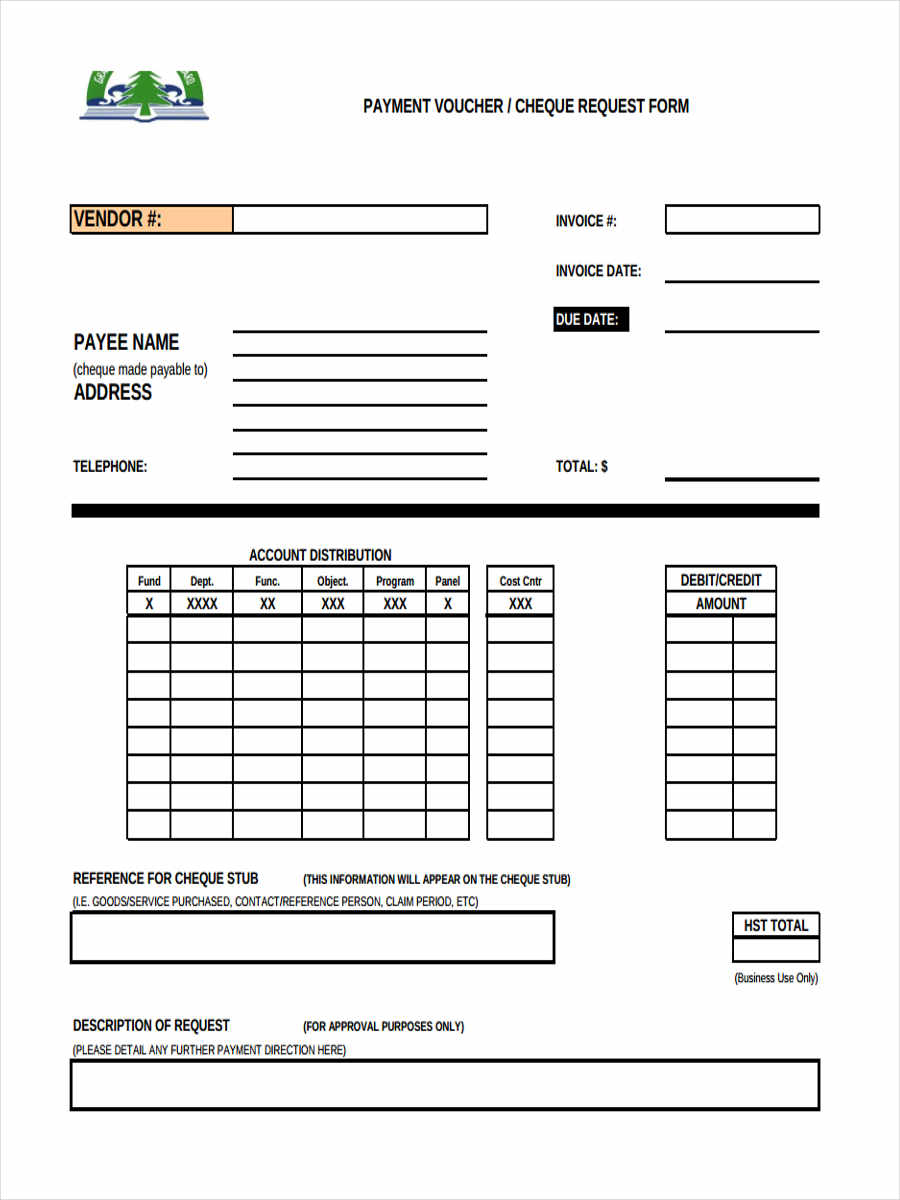

Cheque Payment Requisition

Construction Payment Form

Simple Payment in PDF

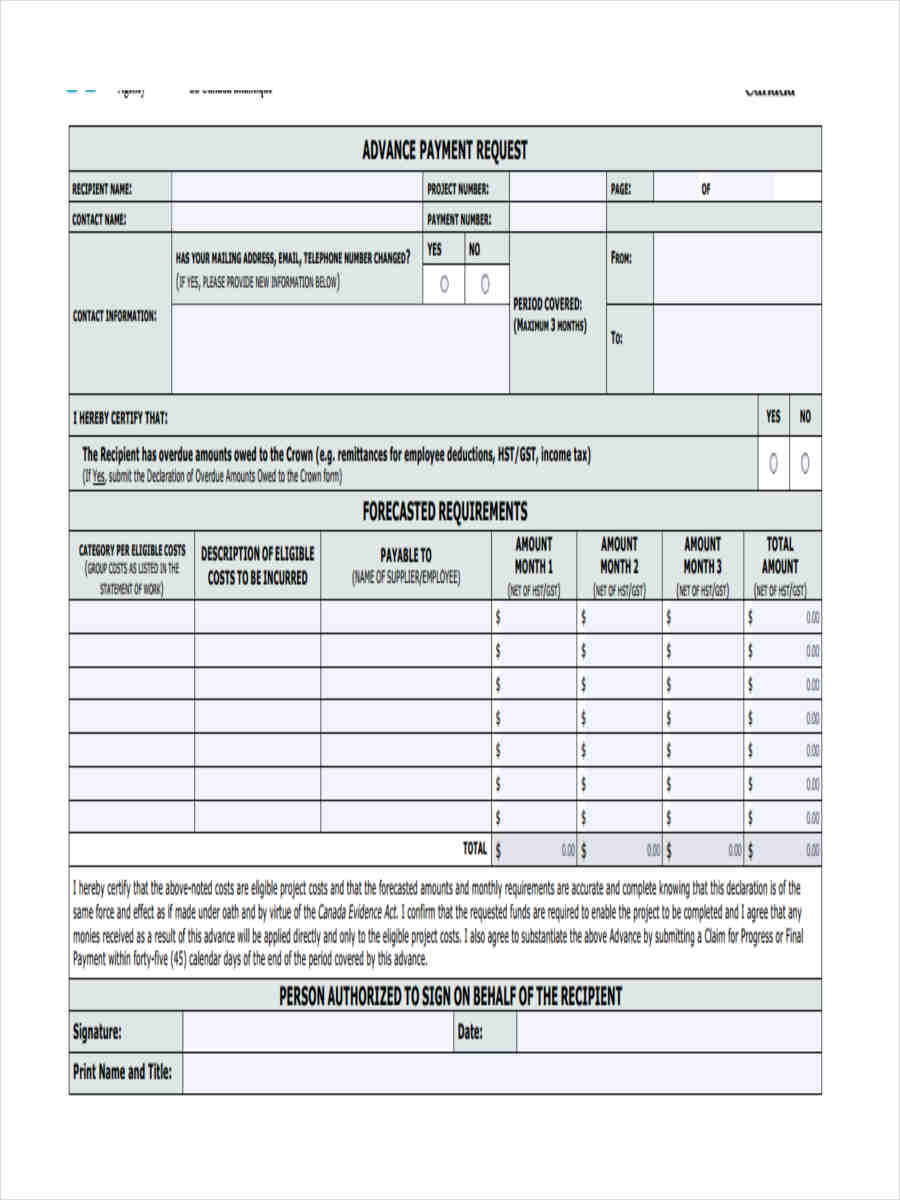

Advance Payment Form

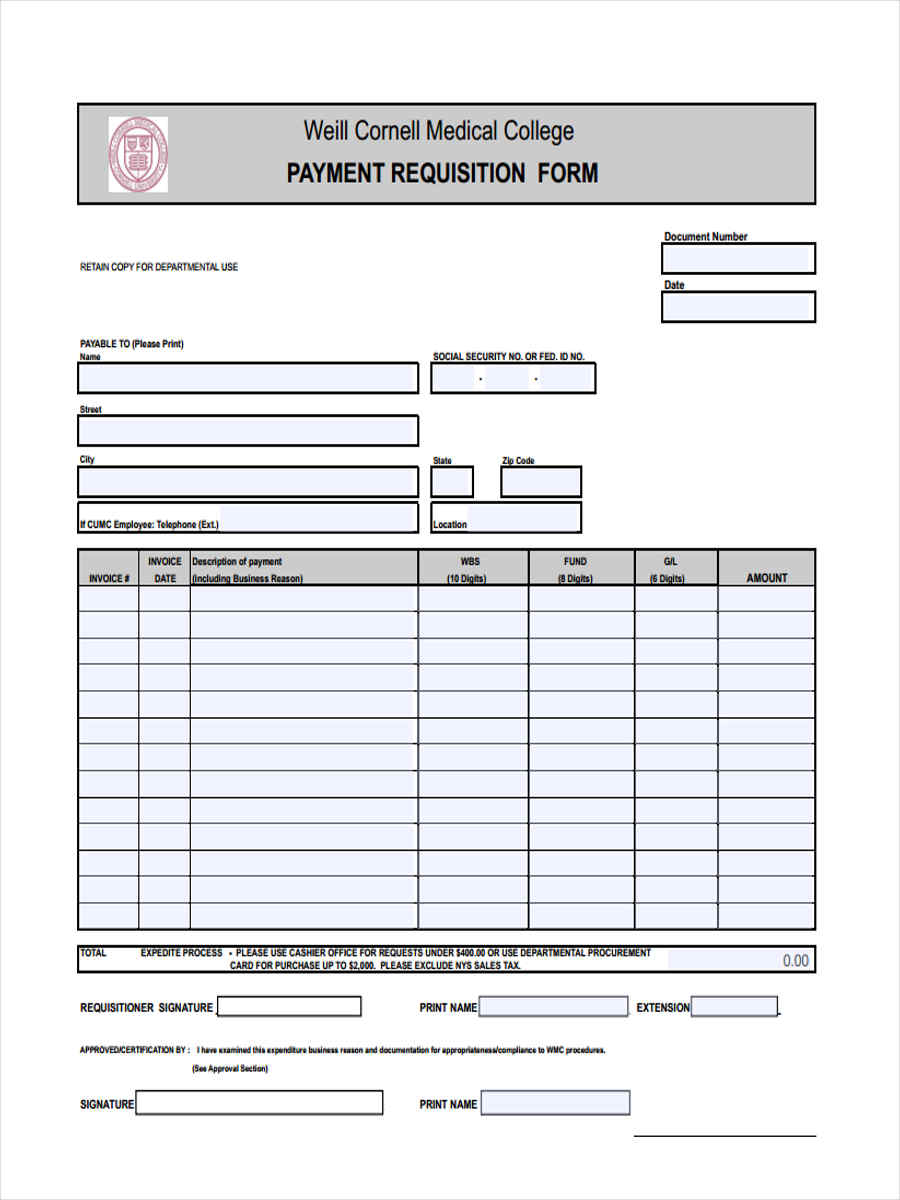

Medical College Payment

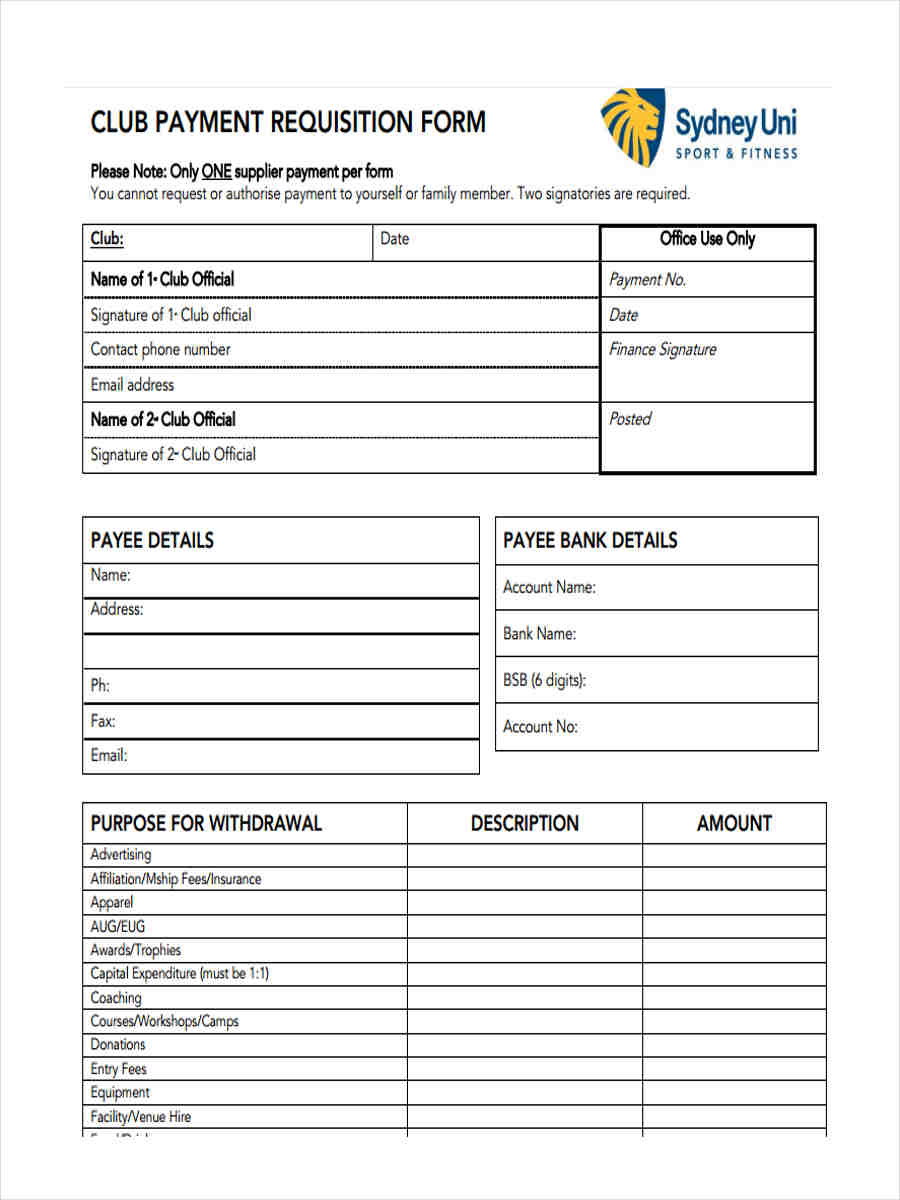

Club Payment Requisition

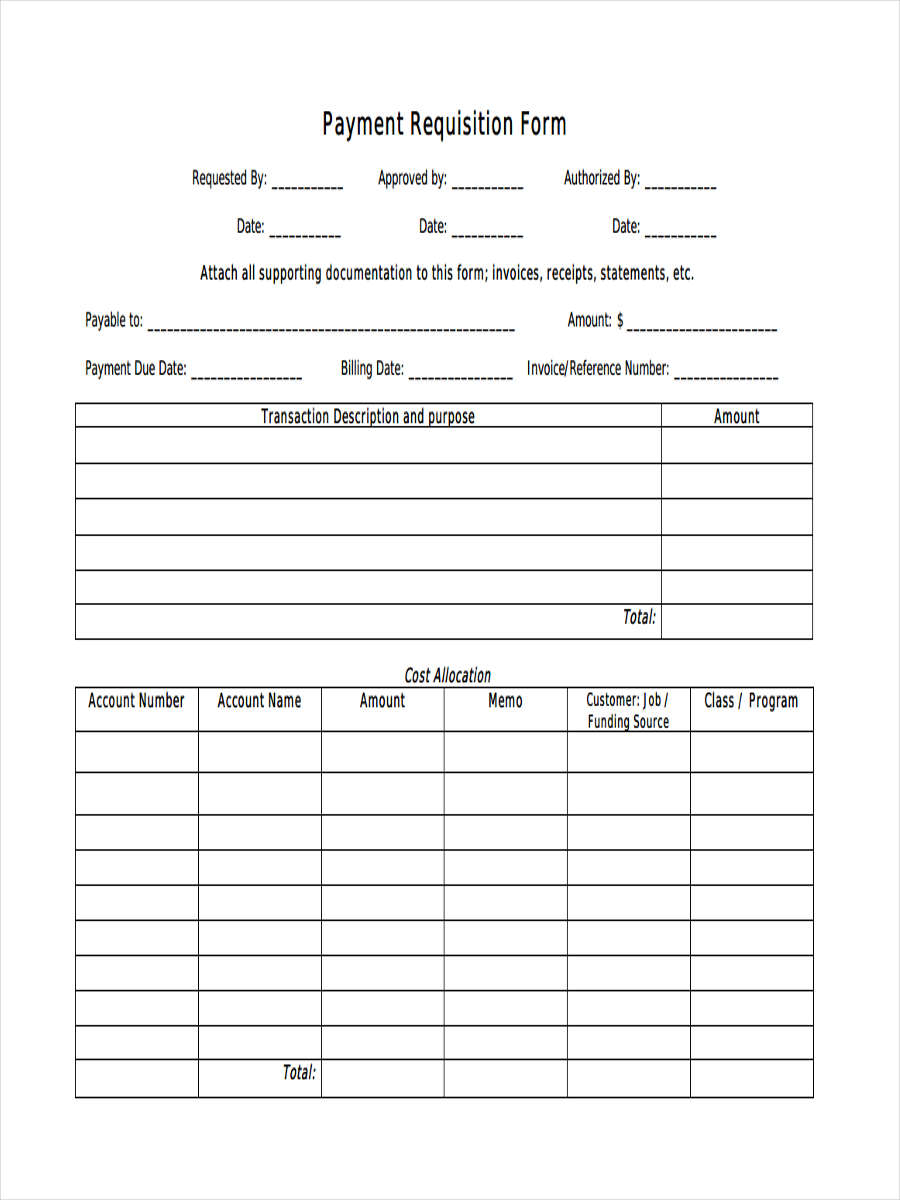

Basic Payment Requisition Form

Simple Payment Requisition Form

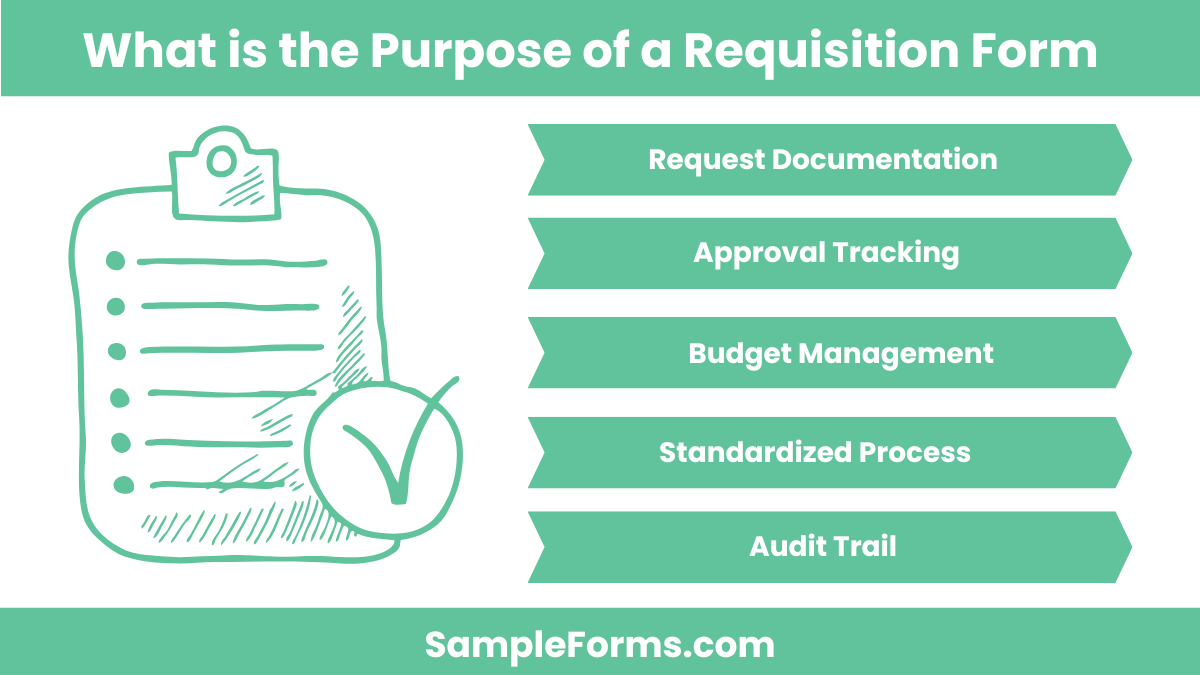

What is the purpose of a requisition form?

A requisition form documents requests for goods, services, or payments, ensuring an organized approval process and accurate record-keeping for accountability.

- Request Documentation: Capture details of required items or payments.

- Approval Tracking: Record authorization signatures for accountability.

- Budget Management: Ensure expenses align with allocated funds.

- Standardized Process: Streamline communication between departments.

- Audit Trail: Maintain a record for transparency, like a Requisition Slip Form.

What are the parts of requisition form?

A requisition form typically includes essential sections to document and approve requests for goods or services.

- Requester Information: Name, department, and contact details.

- Request Details: Description, quantity, and purpose of the request.

- Authorization: Signatures and approvals, akin to a Material Requisition Form.

- Delivery Instructions: Specify timelines and delivery locations.

- Tracking Reference: Unique form number for record-keeping.

How to prepare a requisition form?

Preparing a requisition form requires clarity and accuracy to ensure smooth processing and approval of the requested items or payments.

- Gather Information: Identify items or services required.

- Use a Template: Standardize entries like in a Purchase Requisition Form.

- Fill Details: Include item descriptions, quantities, and costs.

- Submit for Approval: Forward to the relevant authority.

- File Copies: Retain a copy for future reference.

What is the requisition to pay process?

The requisition-to-pay process manages purchase requests to final payment, ensuring efficiency and compliance in financial operations.

- Requisition Creation: Submit a request for items or services.

- Approval Workflow: Gain necessary authorizations.

- Purchase Order Generation: Convert approved requests into orders.

- Receipt of Goods: Verify delivery against the order, similar to a Stationery Requisition Form.

- Payment Processing: Issue payment after invoice verification.

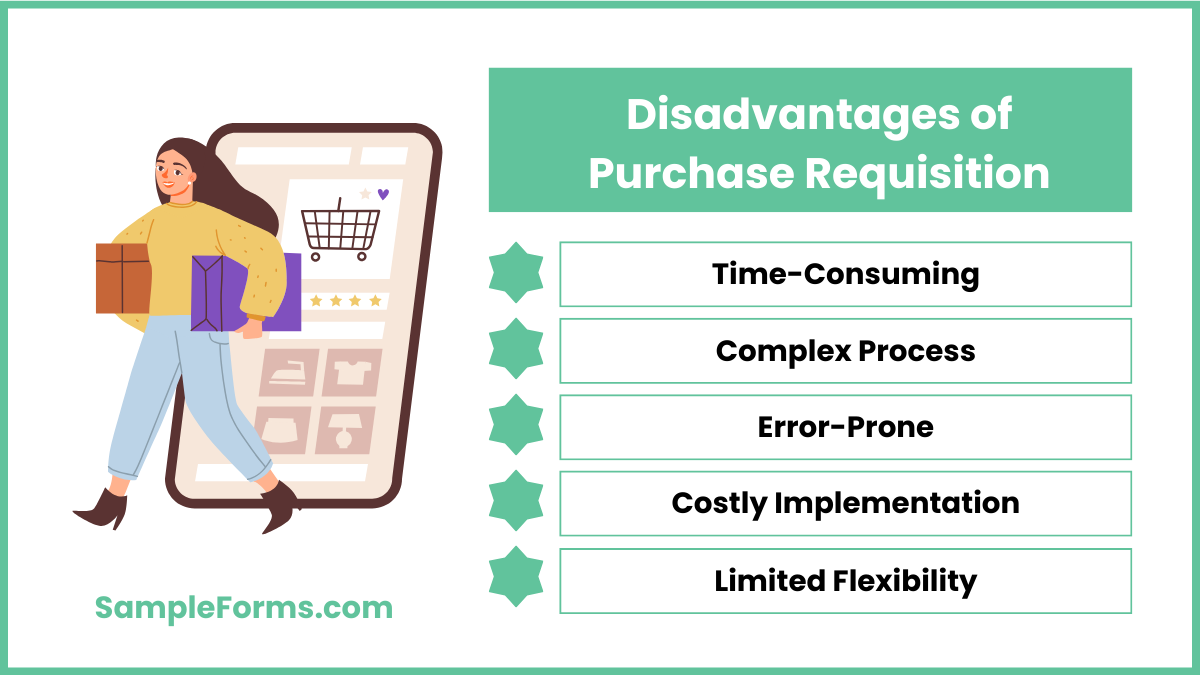

What are the disadvantages of purchase requisition?

While purchase requisitions ensure control, they can introduce delays, administrative overhead, and miscommunication if not managed effectively.

- Time-Consuming: Approval workflows may slow urgent requests.

- Complex Process: Involves multiple stakeholders, increasing workload.

- Error-Prone: Mistakes in forms can cause delays.

- Costly Implementation: Requires resources for setup and training.

- Limited Flexibility: Not ideal for immediate needs, unlike a Test Requisition Form.

Who generates a purchase requisition?

A purchase requisition is typically generated by the requesting department or employee to notify the procurement team, similar to a Job Requisition Form for specific needs.

Who fills the requisition form?

The requisition form is filled by the individual or department requesting goods or services, akin to a Stock Requisition Form used for inventory purposes.

What comes first, PO or invoice?

A purchase order (PO) is issued before the invoice to formalize the order, much like the sequence in a Recruitment Requisition Form.

What is a cash requisition form?

A cash requisition form is used to request petty cash or funds for immediate expenses, similar in purpose to an Equipment Requisition Form.

What is PR in billing?

PR, or Purchase Requisition, initiates the procurement process by documenting the need for goods or services, akin to an Employee Requisition Form for staffing.

Who is responsible for preparing a requisition?

The individual or team requesting goods or services prepares the requisition, similar to how a Lab Requisition Form is handled in labs.

Who usually prepares the purchase requisition form?

The department or employee requiring the item typically prepares the form, mirroring processes in an Office Requisition Form.

Who fills the requisition form?

The requester or department in need completes the requisition form, much like a Supply Requisition Form for office materials.

Who initiates purchase requisition?

A purchase requisition is initiated by the requesting party, such as an employee or team, similar to an Employment Requisition Form for hiring needs.

Who usually authorizes a purchase requisition?

Purchase requisitions are usually authorized by a manager or supervisor, reflecting the process in a Restaurant Requisition Form for supplies.

The Payment Requisition Form is a vital financial tool that ensures clarity, compliance, and efficient payment processing. From routine reimbursements to significant vendor payments, this form standardizes the approval process, reducing delays and errors. By integrating templates and practical examples, this guide highlights the form’s versatility in managing financial transactions. The Cash Payment Receipt Form provides a complementary tool for record-keeping, ensuring end-to-end transparency. Whether for business or personal use, adopting this form can enhance financial efficiency and accountability.

Related Posts

-

FREE 6+ Personnel Requisition Forms in MS Word | PDF

-

FREE 5+ Staff Requisition Forms in MS Word | PDF

-

Employee Requisition Form

-

FREE 8+ Supply Requisition Forms in PDF | Excel

-

FREE 6+ Lab Requisition Forms in PDF | MS Word | Pages

-

Stationery Requisition Form

-

Equipment Requisition Form

-

FREE 10+ Service Requisition Forms in PDF | Ms Word

-

FREE 27+ Requisition Forms in Excel

-

Material Requisition Form

-

FREE 9+ Employment Requisition Forms in PDF | Excel | MS Word