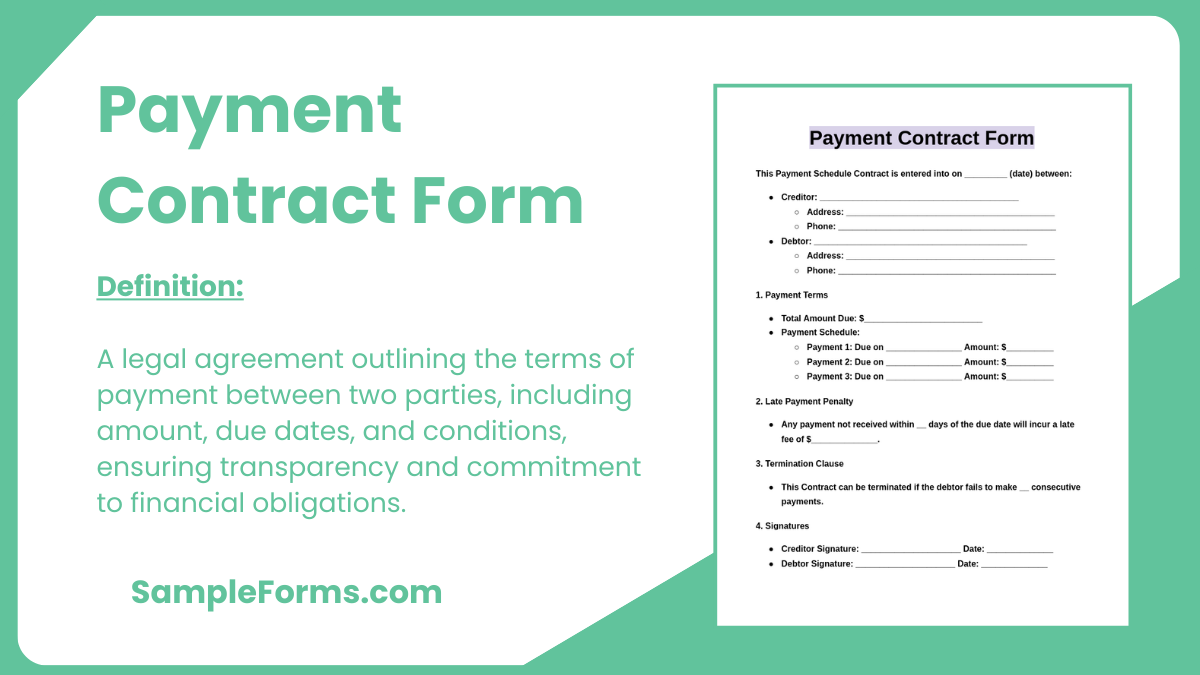

The Payment Contract Form is a crucial document used to define terms between a payer and a payee, ensuring smooth financial transactions. This guide explores different examples and templates to help you create clear and effective agreements. A Payment Form and Contract Form are essential tools for both businesses and individuals to maintain transparency and accountability.

Download Payment Contract Form Bundle

What is Payment Contract Form?

A Payment Contract Form is a legally binding document that outlines the agreement between two parties regarding payment terms. It includes details like payment amount, deadlines, and obligations, ensuring both sides fulfill their commitments. This form helps prevent misunderstandings and enforces accountability, protecting both the payer and the payee.

Payment Contract Format

Heading: Payment Agreement Terms

1. Contract Information

- Contract Number: Unique reference ID.

- Date of Agreement: Date of signing the contract.

2. Parties Involved

- Payer Information: Full name and contact details.

- Payee Information: Details of the payee.

3. Payment Terms

- Total Amount: Specify the amount.

- Payment Schedule: Define frequency (Monthly/Quarterly).

- Mode of Payment: Cash, cheque, or transfer.

4. Cancellation Clause

- Termination Conditions: Detail the cancellation policy.

5. Signatures

- Payer Signature: Sign and date.

- Payee Signature: Sign and date.

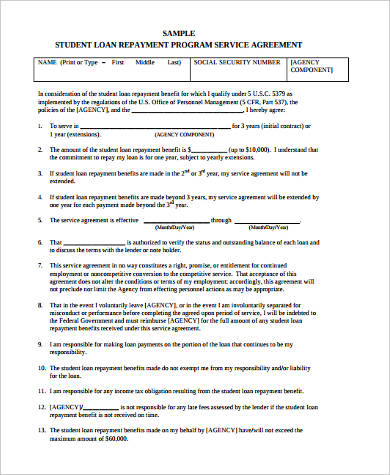

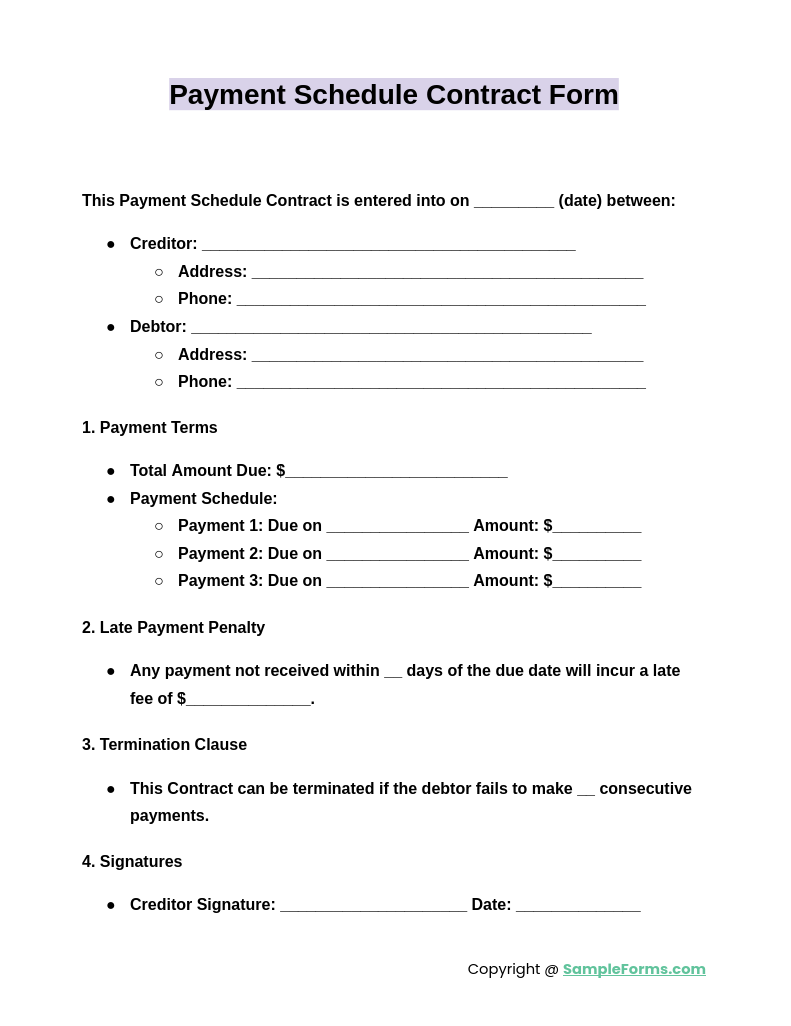

Payment Schedule Contract Form

A Payment Schedule Contract Form is designed to outline specific payment dates and amounts, ensuring timely financial obligations. This form is particularly useful for installment payments in agreements such as loans, services, or construction projects. By setting clear deadlines, it minimizes payment delays. The form can also include details like penalties for late payments, ensuring accountability. Additionally, a Payment Authorization Form is often required to authorize these scheduled transactions.

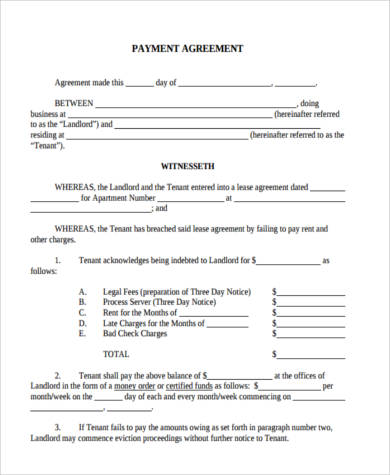

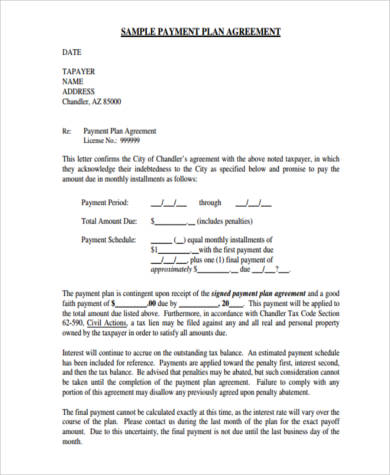

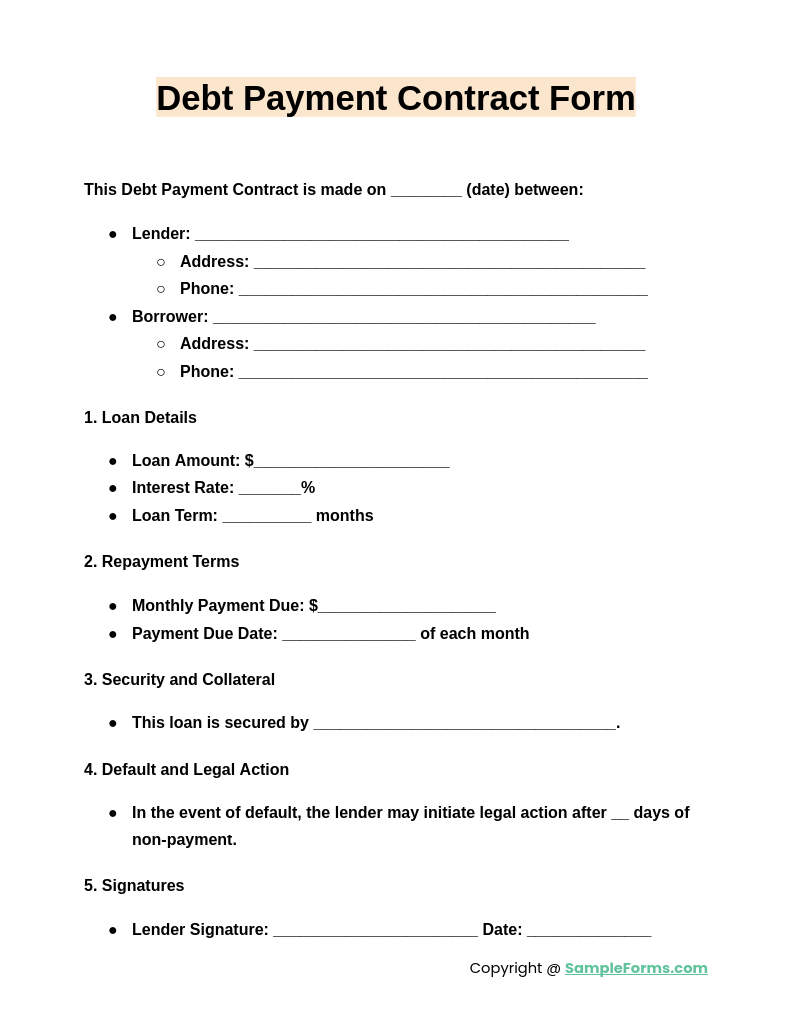

Debt Payment Contract Form

A Debt Payment Contract Form formalizes the repayment terms between a creditor and debtor. It specifies interest rates, due dates, and consequences of non-compliance. This form helps protect both parties by clearly documenting expectations and responsibilities. It also assists in maintaining accurate records, reducing disputes. For added assurance, a Payment Confirmation Form can be included to confirm that each installment has been received as agreed.

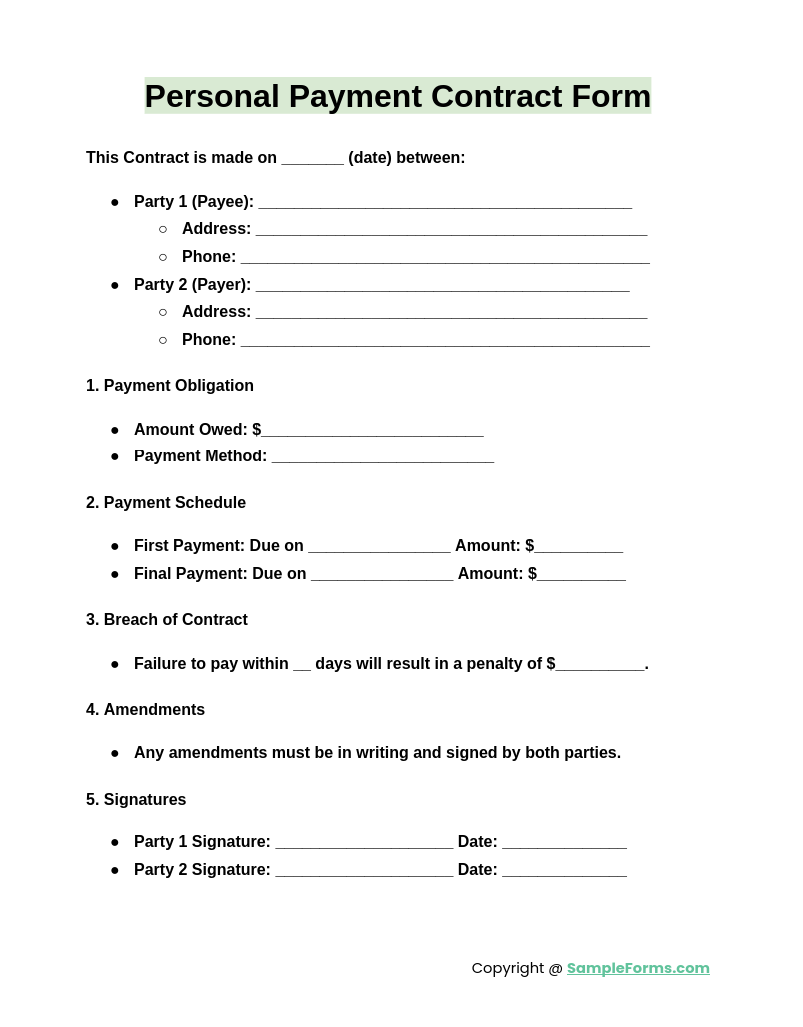

Personal Payment Contract Form

The Personal Payment Contract Form is a simple yet effective agreement used for personal loans or informal lending between friends or family members. It outlines the repayment terms, interest rates (if applicable), and consequences of default. By using this form, both parties can avoid misunderstandings. Additionally, incorporating a Payment Requisition Form can streamline requests for payments, ensuring all terms are honored.

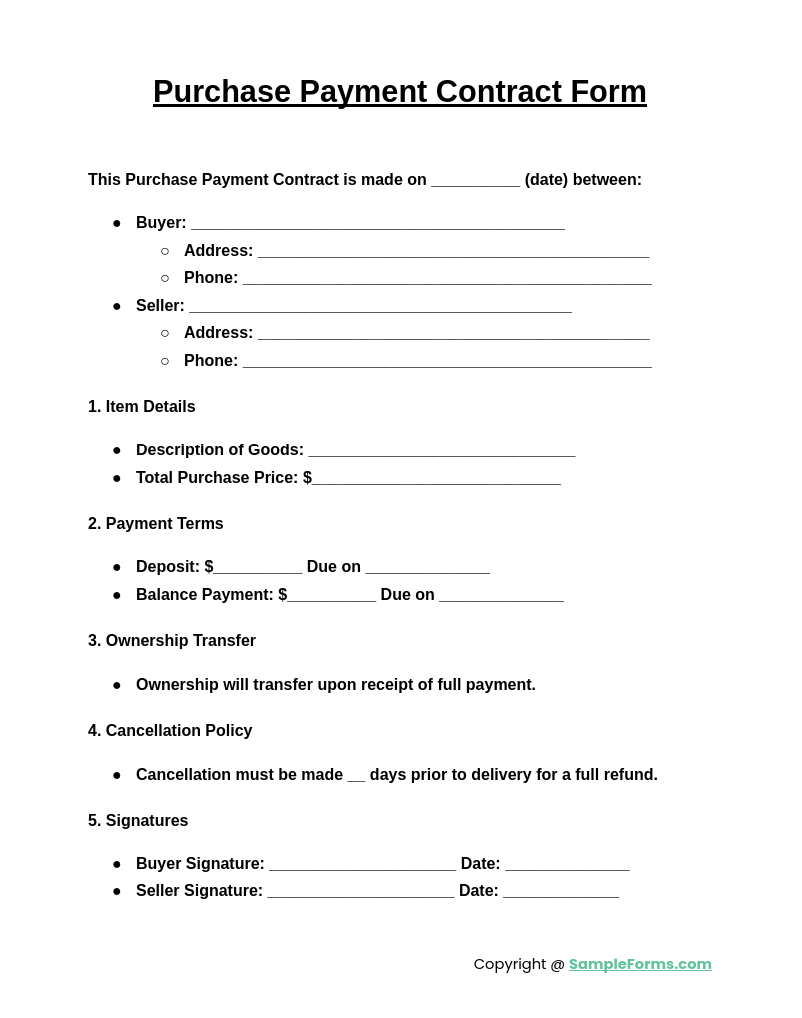

Purchase Payment Contract Form

A Purchase Payment Contract Form is used when purchasing goods or services, especially for larger transactions like real estate or high-value items. It clearly states payment terms, due dates, and itemized lists of goods or services provided. This contract ensures that both buyer and seller are protected by legally binding agreements. In cases involving contractors, using a Contractor Payment Form ensures transparency and compliance with agreed payment schedules.

Browse More Payment Contract Forms

Car Payment Contract Form

Monthly Payment Contract Form

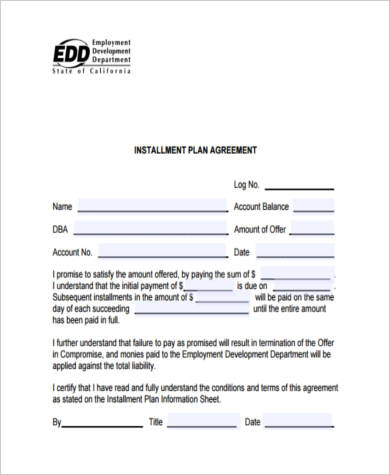

Installment Payment Contract Form

Contract Payment Agreement Form

Loan Payment Contract Form

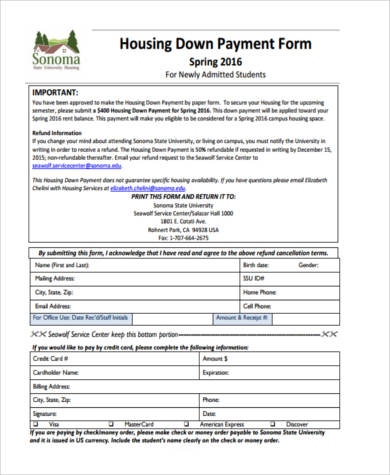

Down Payment Contract Form

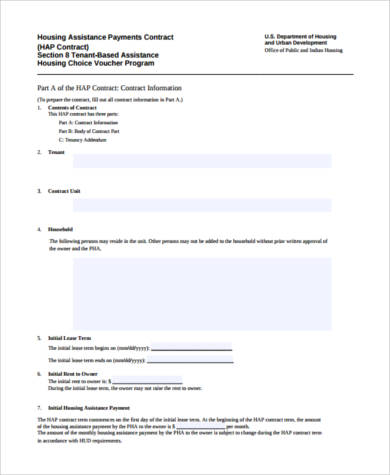

Housing Assistance Payments Contract Form

Payment Contract Form Free

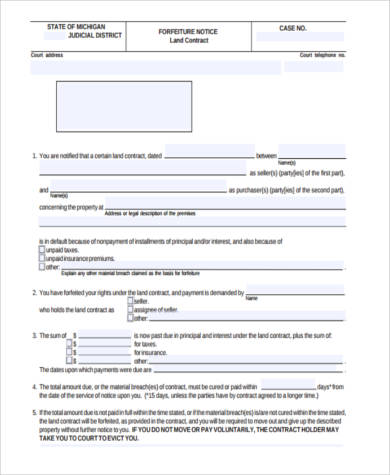

Land Contract Payment Schedule Form

General Payment Contract Form

How to write a contract for payment?

To write a contract for payment, clearly define the payment schedule, amounts, and deadlines to protect both parties. It ensures transparency and legal security.

- Specify Payment Details: Use a Payment Agreement Form to outline the payment schedule.

- Legal Documentation: Include terms to ensure enforceability.

- Confirmation of Receipt: Acknowledge payments formally to avoid disputes.

- Define Consequences: Detail what happens if payments are late.

- Signatures: Both parties must sign to validate the agreement.

What is the legal document for payments?

A legal document for payments formalizes an agreement between parties, ensuring all terms are clear. It includes essential details such as amounts, deadlines, and conditions.

- Outline the Agreement: Use a Payment Application Form for milestone-based payments.

- Terms of Payment: Include specific payment dates.

- Verification: Keep records of all transactions.

- Documentation: Ensure everything is written to avoid misunderstandings.

- Signatures: A legal signature finalizes the agreement.

How do you write payment terms in a contract?

Payment terms in a contract should detail due dates, amounts, and late fees. Clearly written terms reduce misunderstandings and ensure smooth transactions.

- Detailed Breakdown: Utilize a Cash Payment Receipt Form for accurate records.

- Due Dates: Clearly state when payments are expected.

- Penalties: Outline any late fees.

- Installment Plans: If applicable, include structured payments.

- Approval: Ensure all parties agree to the terms.

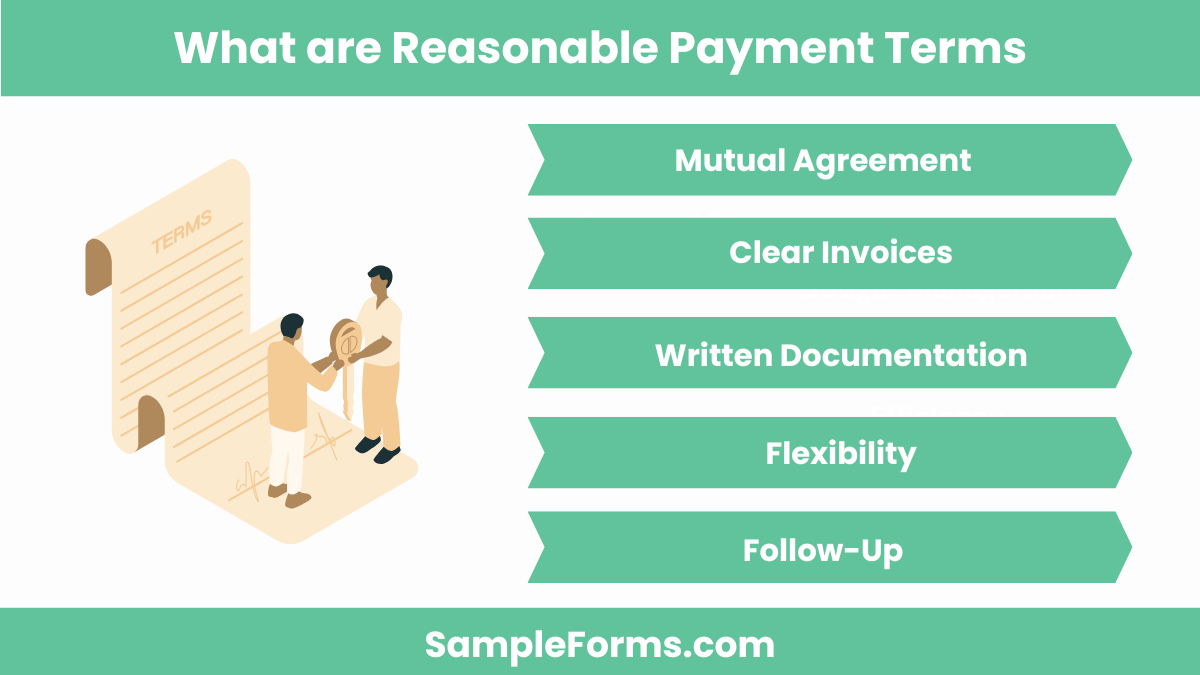

What are reasonable payment terms?

Reasonable payment terms typically range from net 15 to net 45 days, balancing the needs of both parties. It promotes timely payments and strong business relationships.

- Mutual Agreement: Ensure all parties agree to the payment terms.

- Clear Invoices: Issue invoices promptly.

- Written Documentation: Use a Employment Contract Form for clarity.

- Flexibility: Allow reasonable time for payments.

- Follow-Up: Regularly check on overdue payments.

How to write payment terms in a contract?

Payment terms in a contract should be explicit, including deadlines and penalties. They ensure both parties are aware of obligations, reducing potential conflicts.

- Document Terms: Include a Construction Contract Form for clarity.

- Clear Deadlines: State exact payment dates.

- Penalties for Delays: Specify late fees.

- Payment Methods: Detail acceptable forms of payment.

- Finalize Agreement: Ensure both parties sign to confirm.

Can I write a contract myself?

Yes, you can write a contract yourself as long as it includes all legally required elements. Use a Land Contract Form to ensure clarity and completeness.

Can you make a contract without a lawyer?

Yes, contracts can be made without a lawyer if all essential terms are clear. A Supply Contract Form can help organize the necessary details effectively.

Are handwritten contracts legal?

Handwritten contracts are legal if they meet all contractual elements, such as offer, acceptance, and consideration. Using a Performance Contract Form ensures proper structure.

What is a payment document called?

A payment document is often referred to as an invoice or receipt. For formal agreements, an Agency Contract Form may be used for documentation.

What is required for proof of payment?

Proof of payment includes receipts, bank statements, or signed documents like a House Contract Form detailing transaction details, amounts, and signatures.

What is an example of a form of payment?

Forms of payment include cash, credit cards, checks, or online transfers. A Business Contract Form can outline the specific payment methods accepted.

What is a legal document for payment?

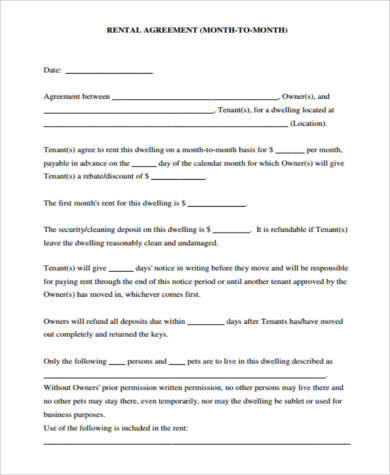

A legal document for payment, like a Rental Contract Form, defines terms, amounts, and deadlines to secure mutual agreements between parties.

How do I make my own agreement?

To create your own agreement, outline terms, obligations, and signatures. Use a Sale Contract Form as a guide to ensure all legal elements are covered.

What is the most common payment term?

The most common payment terms are Net 30 or Net 45 days. These can be formalized using a Loan Contract Form to clearly outline deadlines.

How do I make a payment agreement legally binding?

For a legally binding payment agreement, include clear terms, signatures, and consideration. An Equipment Contract Form can serve as a template to cover essential clauses.

The Payment Contract Form is an indispensable tool for securing financial agreements. By defining clear terms and conditions, it reduces disputes and fosters trust between involved parties. Whether you’re handling personal loans, business transactions, or purchases, a well-drafted Purchase Contract Form can protect your interests, ensuring payments are made on time and as agreed.

Related Posts

-

FREE 5+ Mutual Release Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Merger Agreement Contract Forms in PDF | MS Word

-

FREE 3+ Limited Partnership Agreement Contract Forms in PDF | MS Word

-

FREE 4+ Medical Release Agreement Contract Forms in PDF

-

FREE 5+ Office Lease Agreement Contract Forms in PDF

-

FREE 6+ Pledge Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Medicaid Agreement Contract Forms in PDF

-

FREE 8+ Non-Competition Agreement Contract Forms in PDF | MS Word

-

FREE 4+ Limited Liability Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Joint Venture Contract Forms in PDF | MS Word

-

Indemnity Agreement Form

-

FREE 3+ Sale of Goods Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Home Sales Agreement Contract Forms in PDF | MS Word

-

FREE 10+ Easement Agreement Contract Forms in PDF

-

FREE 8+ Consulting Contract Forms in PDF | MS Word