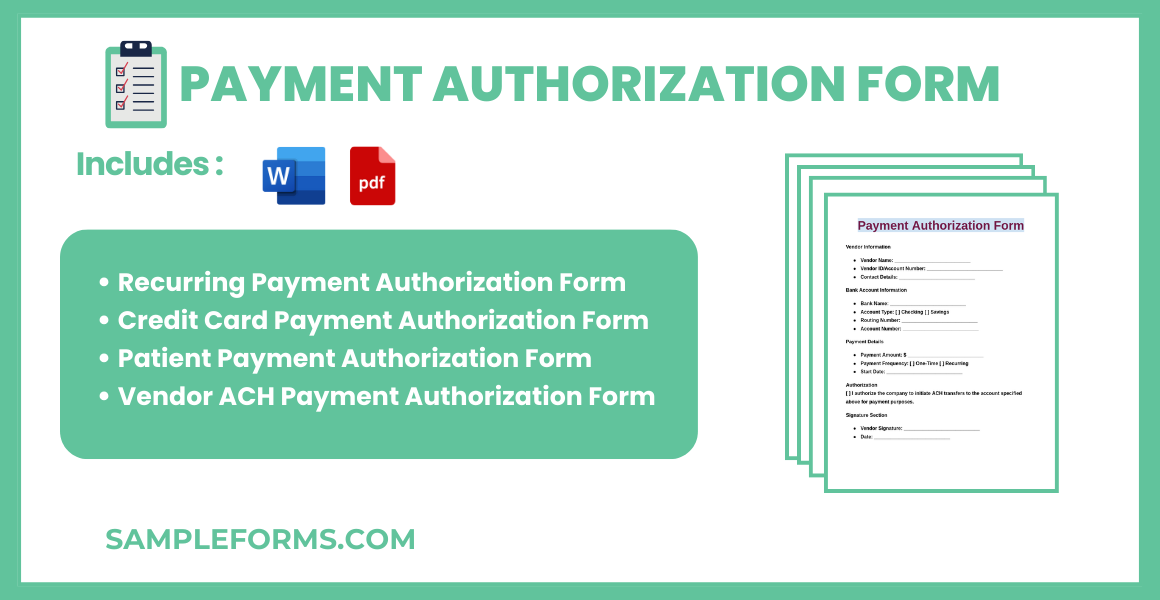

A Payment Authorization Form is an essential tool for businesses to secure customer consent for transactions. Our complete guide offers examples, explanations, and tips to simplify the payment process. Whether it’s a recurring transaction or a one-time payment, understanding the role of authorization forms ensures smooth operations. Explore how a well-structured Authorization Form or Payment Form can safeguard both businesses and customers while maintaining compliance with financial protocols.

Download Payment Authorization Form Bundle

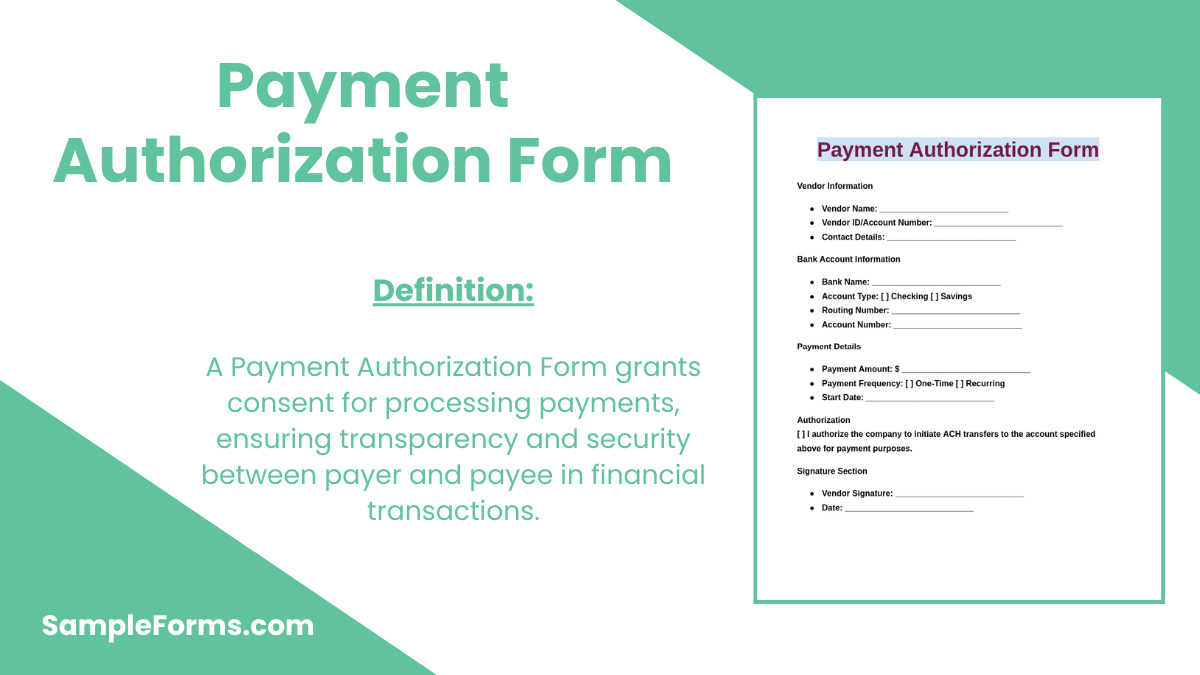

What is Payment Authorization Form?

A Payment Authorization Form is a document that gives permission to process a payment from an individual’s account. It serves as a legal agreement between the payer and payee, ensuring transparency and protection for both parties. By detailing the transaction terms, it helps avoid disputes and ensures a seamless financial exchange.

Payment Authorization Format

Authorization Details

Payment Request Number: ____________________________

Date of Request: ____________________________

Amount to be Paid: ____________________________

Payment Due Date: ____________________________

Payee Information

Payee Name: ____________________________

Payee Address: ____________________________

Payee Contact: ____________________________

Reason for Payment

Provide details for payment: ____________________________

Approval Section

Approver Name: ____________________________

Approver Signature: ____________________________ Date: _______________

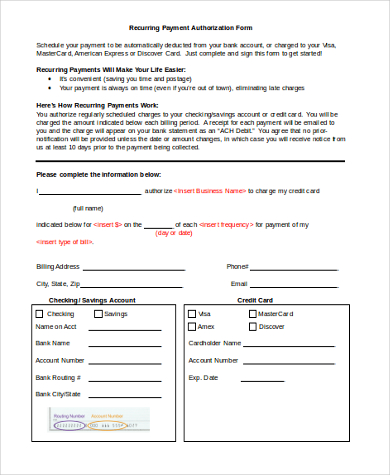

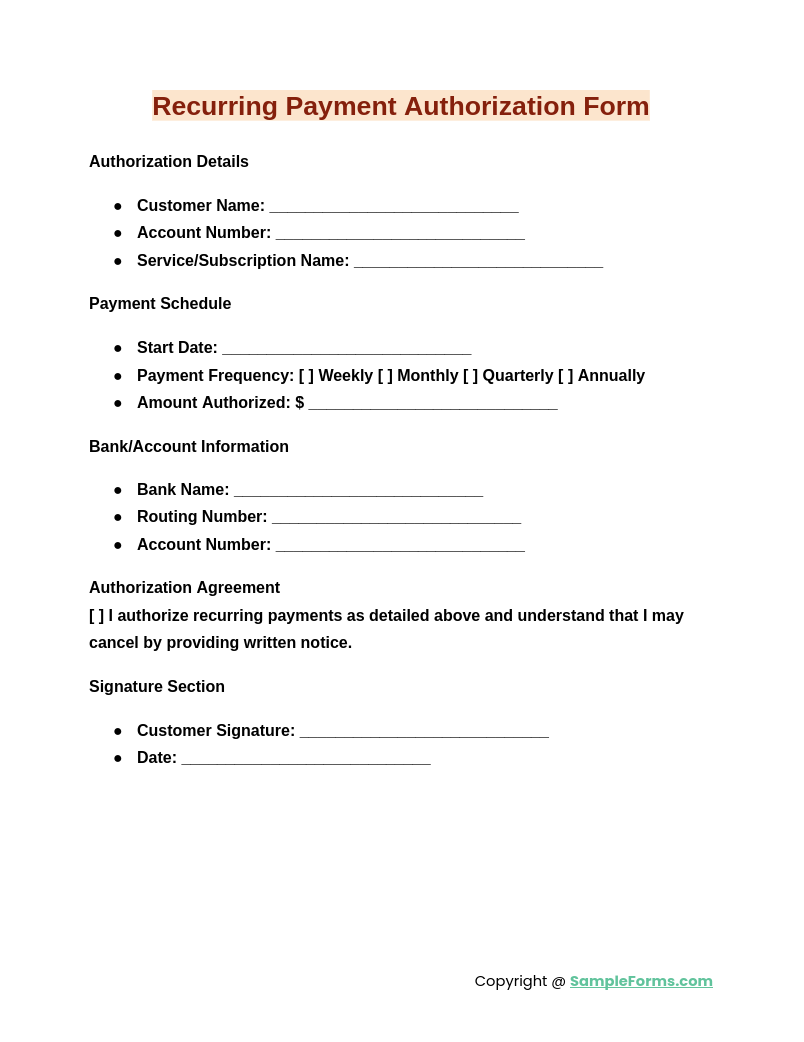

Recurring Payment Authorization Form

A Recurring Payment Authorization Form allows businesses to securely collect ongoing payments from customers. With this Release Authorization Form, automate billing, enhance cash flow, and provide customers with seamless transaction experiences. Ensure consent and compliance effortlessly.

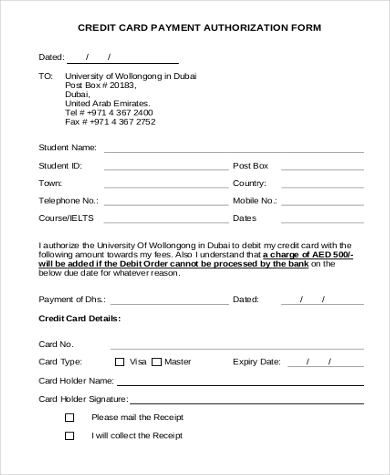

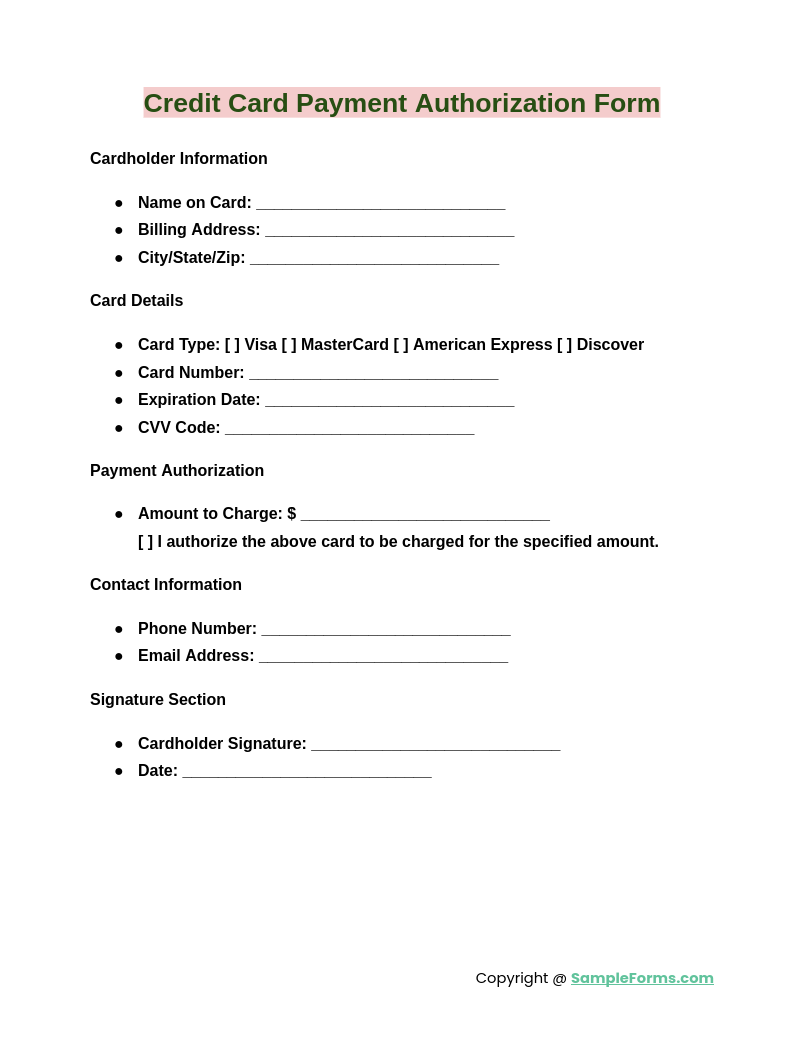

Credit Card Payment Authorization Form

A Credit Card Payment Authorization Form enables businesses to process card payments securely. Including details like cardholder consent and terms, this tool simplifies transactions, ensuring safety. Use it alongside a Hotel Credit Card Authorization Form for travel-related payments.

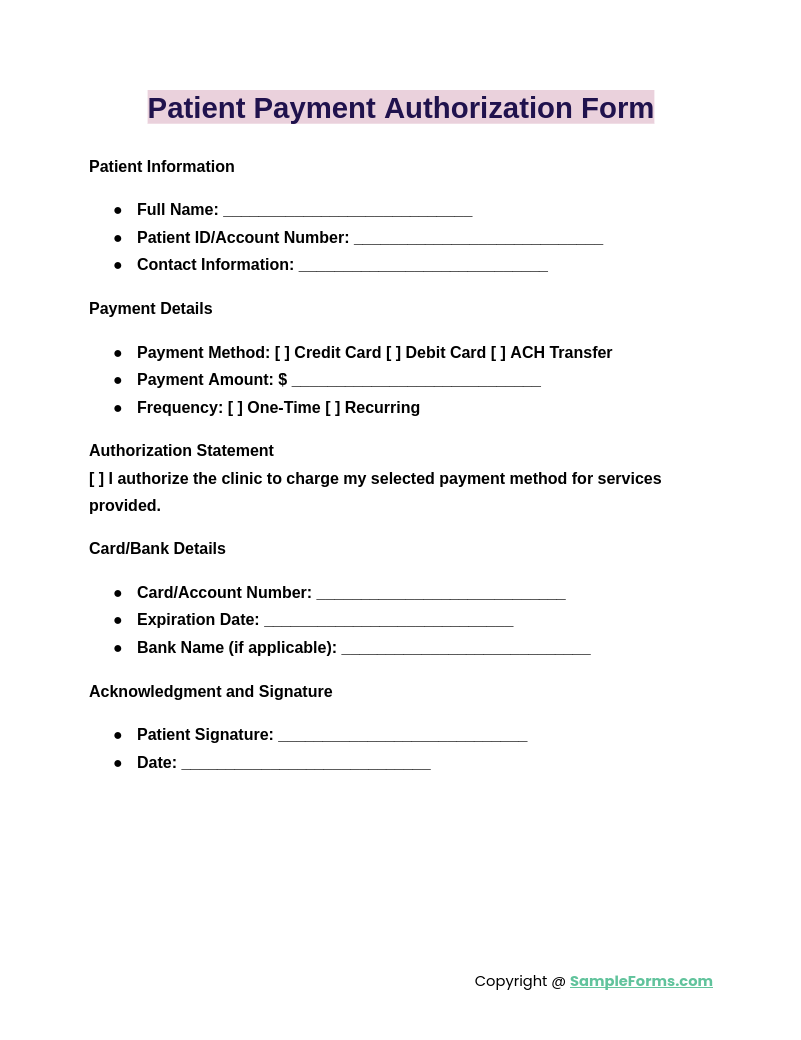

Patient Payment Authorization Form

A Patient Payment Authorization Form allows healthcare providers to securely process patient payments for medical services. Compliant with privacy laws like the HIPAA Authorization Form, it ensures seamless payment collection while maintaining confidentiality.

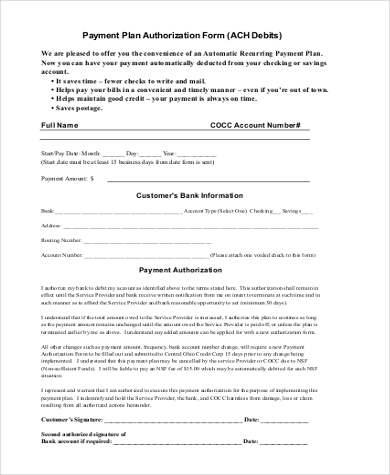

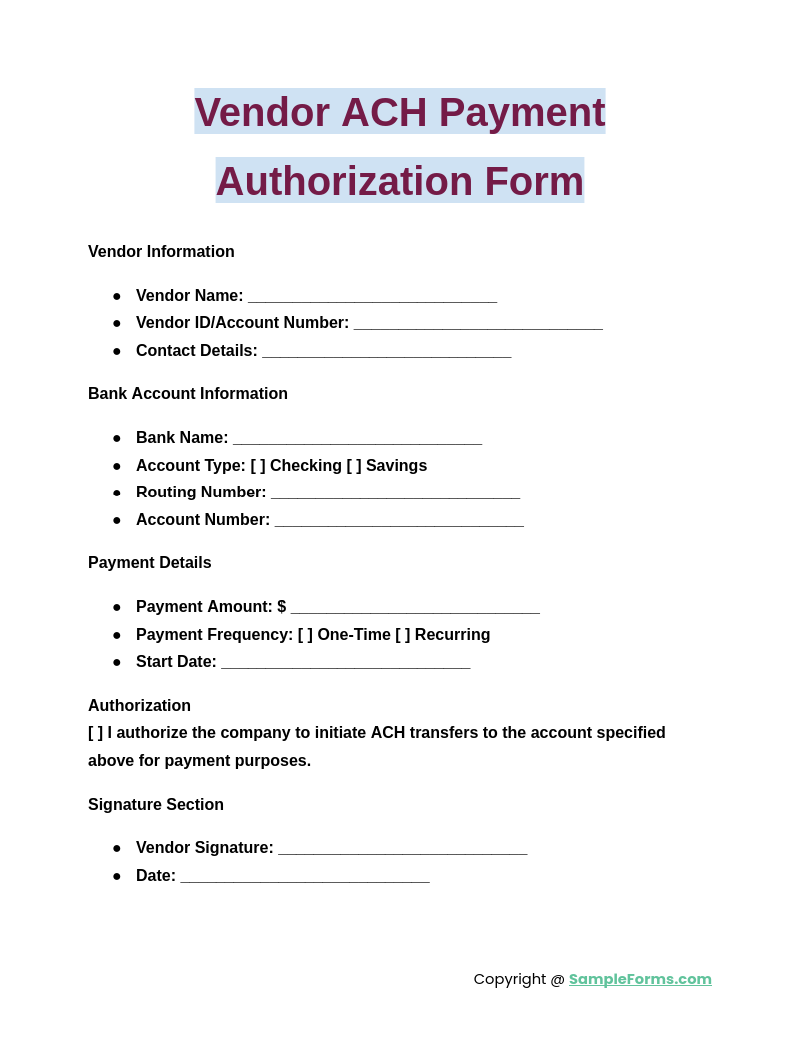

Vendor ACH Payment Authorization Form

A Vendor ACH Payment Authorization Form streamlines electronic transfers for vendor payments. Businesses use this form to simplify transactions, reduce processing time, and ensure accuracy. Pair it with a Paycheck Pickup Authorization Form for integrated financial processes.

Browse More Payment Authorization Forms

Credit Card Payment Authorization Form

Payment Plan Authorization Form Sample

Recurring Payment Authorization Form in Word

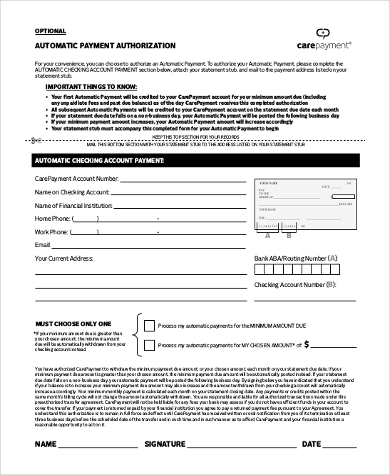

Automatic Payment Authorization Form

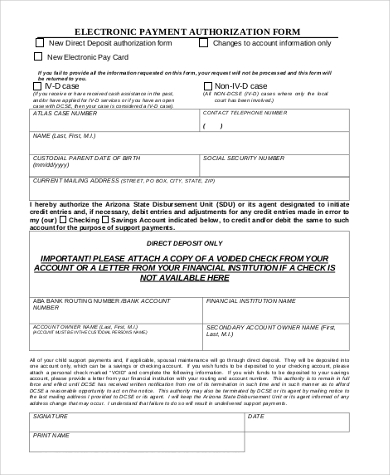

Electronic Payment Authorization Form Example

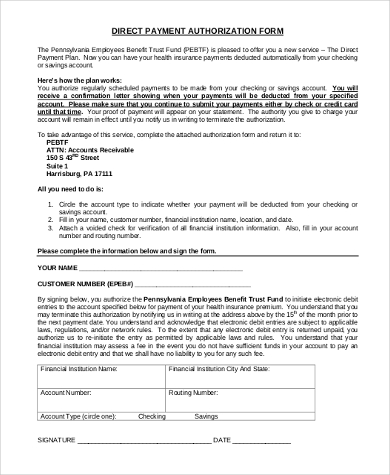

Direct Payment Authorization Form in PDF

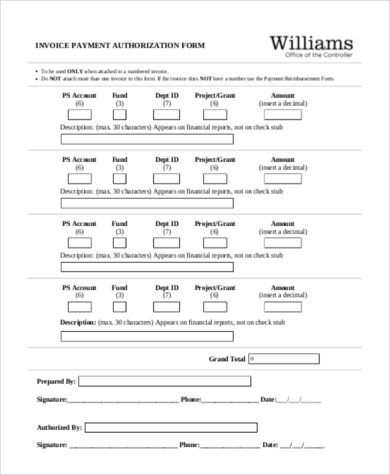

Invoice Payment Authorization Form Free

Customer Payment Authorization Form Printable

Child Care Payment Authorization Form

Payment Authorization Form Sample

How do I create an ACH authorization form?

Creating an ACH authorization form ensures secure electronic payments and compliance with regulations. Follow these steps to create one:

- Include Payer Information: Collect the payer’s name, contact details, and bank account information for secure transactions.

- Define Payment Terms: Specify transaction details like payment frequency, amount, and dates for clarity and accountability.

- Obtain Consent: Require the payer’s signature to authorize the transfer. Include a clause for revoking authorization.

- Comply with Regulations: Ensure the form adheres to applicable laws, like using a Vehicle Authorization Form format if needed.

- Provide a Copy: Give a copy of the form to the payer for their records and transparency.

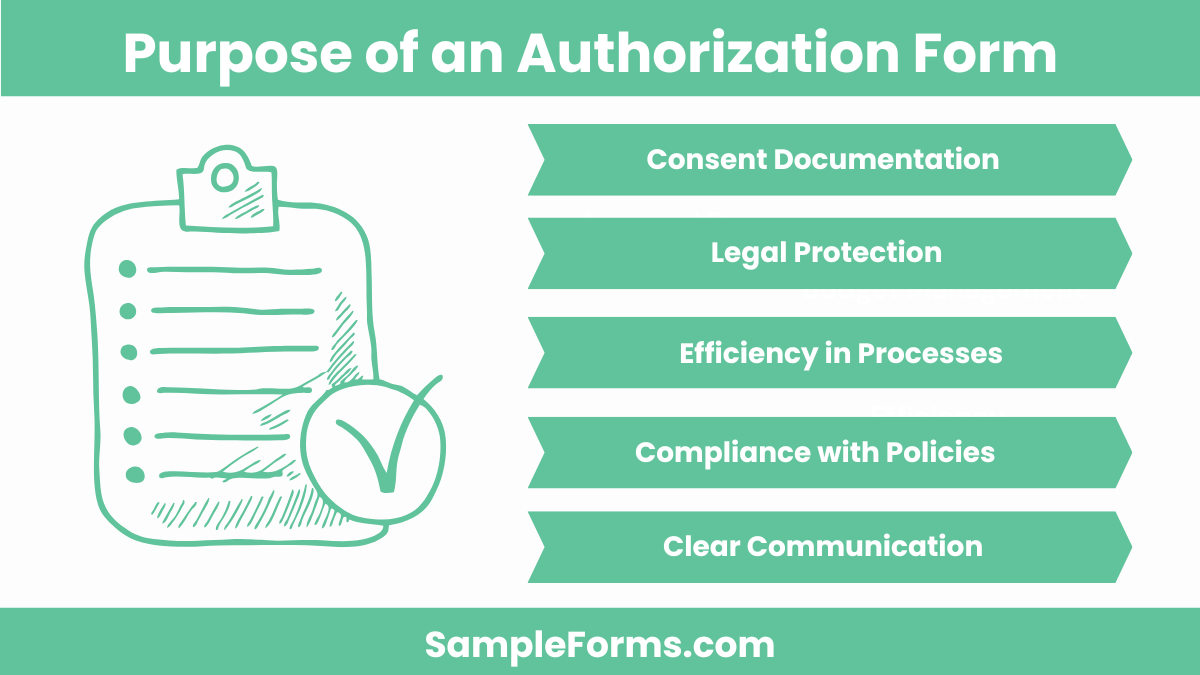

What is the purpose of an authorization form?

An authorization form secures consent for specific actions, protecting parties and ensuring transparency. Key purposes include:

- Consent Documentation: Clearly record authorization for payments, background checks, or any formal process.

- Legal Protection: Prevent disputes by defining terms, such as in a Background Check Authorization Form.

- Efficiency in Processes: Simplify recurring or one-time actions, like billing or information access.

- Compliance with Policies: Ensure alignment with organizational or legal policies for specific procedures.

- Clear Communication: Provide clear terms and conditions to all involved parties.

What is required for a payment authorization?

Payment authorizations need specific details for accuracy and security. Ensure the following elements are included:

- Payer and Payee Details: Names, addresses, and contact information of both parties for proper identification.

- Payment Terms: Specify the payment type, frequency, and amounts, as in an Overtime Authorization Form.

- Banking Information: Include account and routing numbers for ACH or card details for credit transactions.

- Consent and Signatures: Obtain written consent with a signature for legal validity.

- Retention of Records: Safeguard the form for compliance and reference.

What must a written authorization form include?

A written authorization form ensures legal clarity and protection. Include the following elements:

- Detailed Description: Define the purpose, such as payments or returns, as in a Return Authorization Form.

- Contact Information: Record accurate details of the individual or business authorizing the action.

- Terms of Authorization: Clearly state the scope, such as recurring or one-time actions.

- Signature Section: Provide a section for signatures and dates to confirm consent.

- Copy for Record: Offer a duplicate to the authorizing party for transparency.

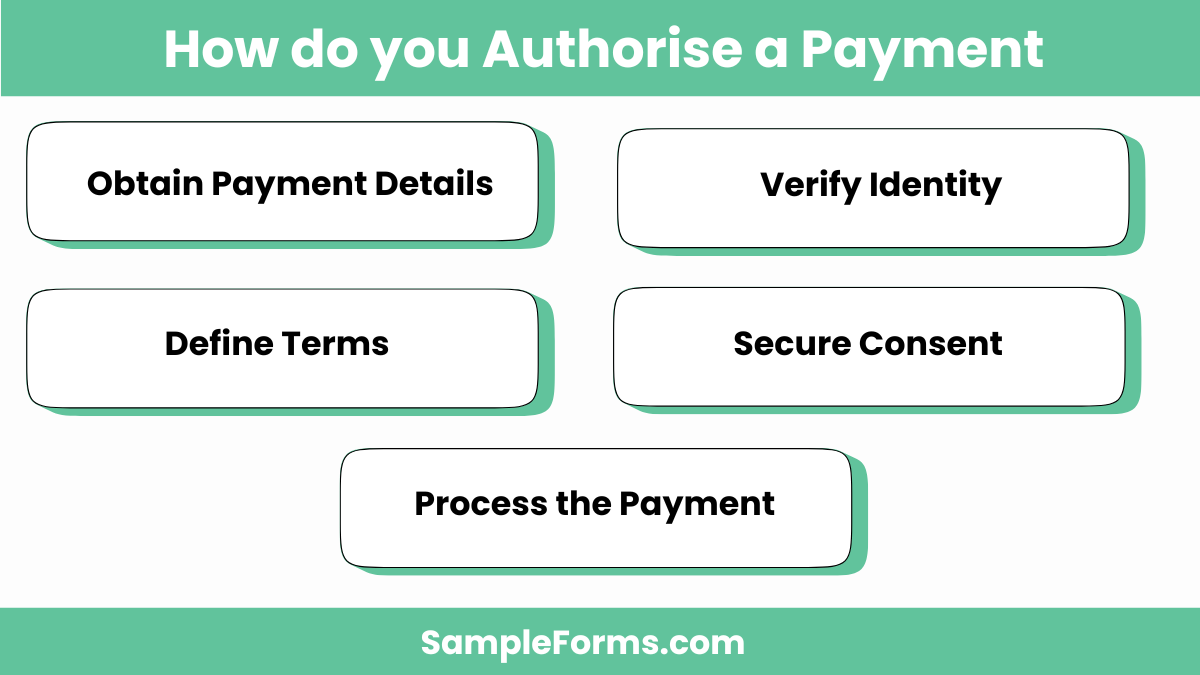

How do you authorise a payment?

Authorizing a payment involves clear steps to ensure security and accuracy. Follow these:

- Obtain Payment Details: Collect account or card information for processing. Use secure methods for data collection.

- Verify Identity: Confirm the payer’s identity, leveraging forms like a Credit Card Authorization Form if needed.

- Define Terms: Ensure both parties agree on payment terms, including amounts and dates.

- Secure Consent: Obtain written or electronic consent to proceed with the transaction.

- Process the Payment: Use compliant systems to execute the payment, ensuring records are kept for reference.

Who usually authorizes a payment?

Typically, the payer or account holder authorizes payments. Businesses may also require a Leave Authorization Form to ensure compliance with internal policies before processing payments.

How do I authorize an ACH transfer?

Authorize an ACH transfer by completing a valid form, including payer details and consent. Use formats like a Compensatory Time Authorization Form for structured documentation.

What authorizes a purchase transaction?

A purchase transaction is authorized through the payer’s consent, typically via signed agreements or PINs. For businesses, a Third Party Authorization Form may ensure proper permissions.

Is it safe to send a credit card authorization form?

Sending a Credit Authorization Form is safe when encrypted methods are used. Always ensure the recipient is trusted and follows data protection laws.

What does a valid authorization require?

A valid authorization requires payer information, consent, transaction details, and legal adherence. Formats like a Payroll Authorization Form simplify and validate the process.

What are the different types of authorization forms?

Authorization forms vary by purpose, including Travel Authorization Form, medical, or payment forms. Each serves to document consent and streamline specific processes.

Who is responsible for obtaining an authorization?

The requesting party, such as a business or employer, is responsible for obtaining the payer’s or employee’s consent. For instance, an Expense Authorization Form is typically employer-driven.

What is the point of authorization?

Authorization validates consent, ensuring secure and compliant transactions or activities. Tools like a Direct Deposit Authorization Form enhance clarity and reduce disputes.

What is a bank authorization form?

A bank authorization form allows customers to consent to transactions, such as automated payments. Similar to a Security Authorization Form, it ensures accuracy and legal compliance.

Can someone charge my credit card without authorization?

Charging a credit card without consent is illegal. A Work Authorization Form equivalent ensures documented permission to avoid unauthorized charges.

In conclusion, the Payment Authorization Form: Sample, Forms, Letters, Use is a vital resource for ensuring secure transactions. From recurring payments to one-time authorizations, these forms simplify and streamline financial processes. Coupled with tools like the Cash Payment Receipt Form, businesses can maintain accuracy and build trust in their financial dealings.

Related Posts

-

FREE 11+ Bank Authorization Forms in PDF | MS Word

-

FREE 5+ Daycare Authorization Forms in PDF

-

FREE 10+ Paycheck Pickup Authorization Forms in PDF

-

FREE 10+ Compensatory Time Authorization Forms in PDF | MS Word

-

FREE 14+ Release Authorization Forms in PDF | MS Word | Excel

-

FREE 13+ Prior Authorization Forms in PDF | MS Word

-

FREE 12+ Security Authorization Forms in PDF | MS Word

-

Vehicle Authorization Form

-

FREE 8+ Sample Third Party Authorization Forms in PDF | MS Word

-

FREE 13+ Check Authorization Forms in PDF | MS Word

-

FREE 10+ Leave Authorization Forms in PDF | MS Word

-

FREE 9+ Sample Pre Authorization Forms in PDF | Excel

-

FREE 7+ Sample Parental Authorization Forms in PDF | MS Word

-

FREE 6+ Voluntary Deduction Agreement Samples in PDF

-

FREE 9+ Sample Authorization Release Forms in PDF | MS Word