Navigating through the creation of a Payment Agreement can be daunting. Our comprehensive guide simplifies this process, offering you step-by-step instructions on drafting effective Agreement Form and Payment Form. Whether you’re a business owner, a freelancer, or managing personal transactions, understanding the essentials of payment agreements ensures that your financial dealings are secured and clear, avoiding potential disputes and fostering trust between parties involved.

Download Payment Agreement Bundle

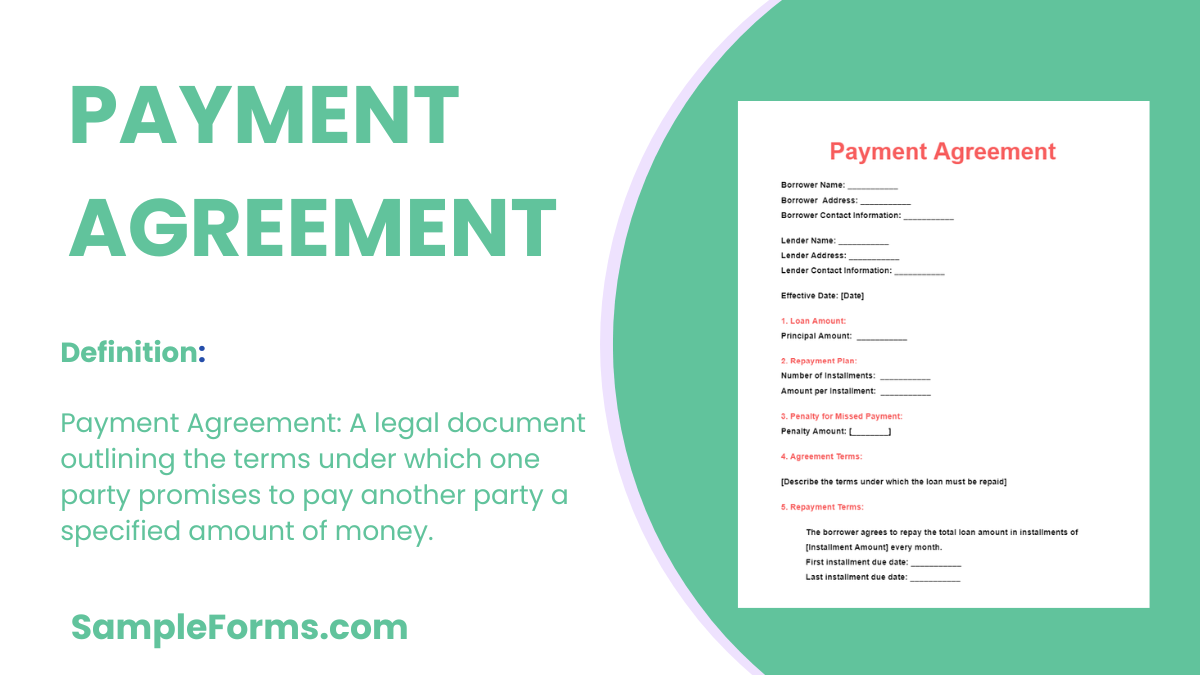

What is a Payment Agreement?

A Payment Agreement is a legally binding contract between two parties that outlines the terms under which payments are made from one party to another. This can include the total amount to be paid, the schedule of payments, and the responsibilities of each party. Such an agreement is crucial for clarifying financial obligations and providing a clear framework to prevent misunderstandings or legal disputes.

Payment Agreement Format

Payment Agreement

Parties Involved:

- Lender’s Name:

- Borrower’s Name:

Loan Details:

- Principal Amount:

- Interest Rate:

- Repayment Schedule:

- Due Dates:

Signatures:

- Lender’s Signature:

- Date:

- Borrower’s Signature:

- Date:

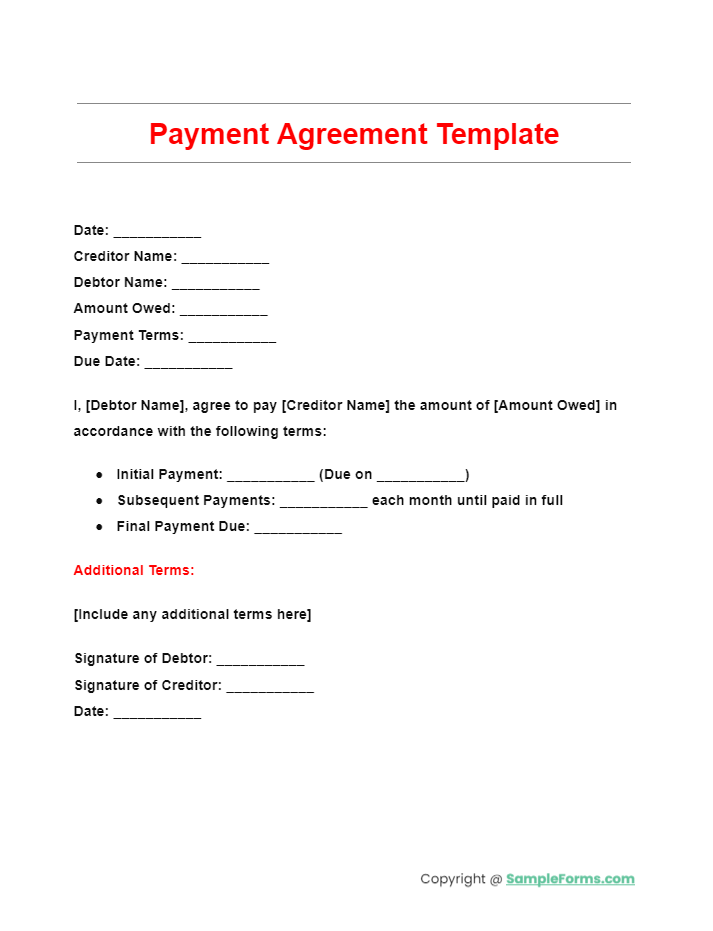

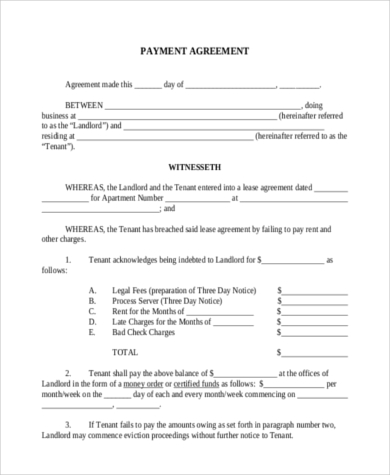

Payment Agreement Template

Find the perfect Payment Agreement Template that serves as a comprehensive Payment Request Form, tailored to ensure clarity and legal compliance in your transactions. You also browse our Guarantor Agreement Form

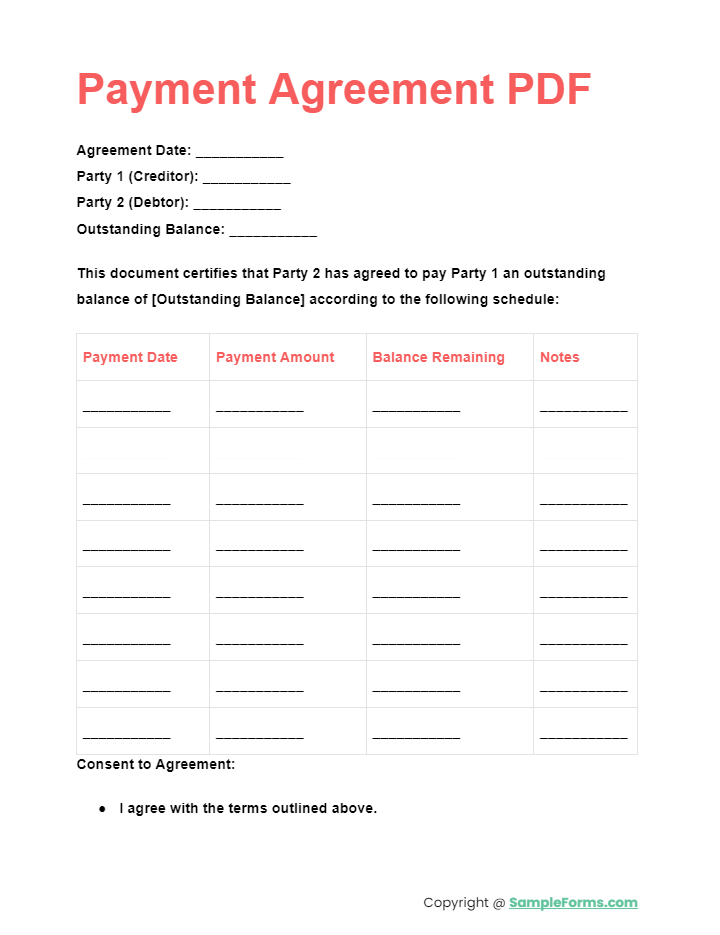

Payment Agreement PDF

Secure your financial dealings with a downloadable Payment Agreement PDF, designed as a robust Payment Contract Form to formalize payment terms effectively. You also browse our Purchase Agreement Form

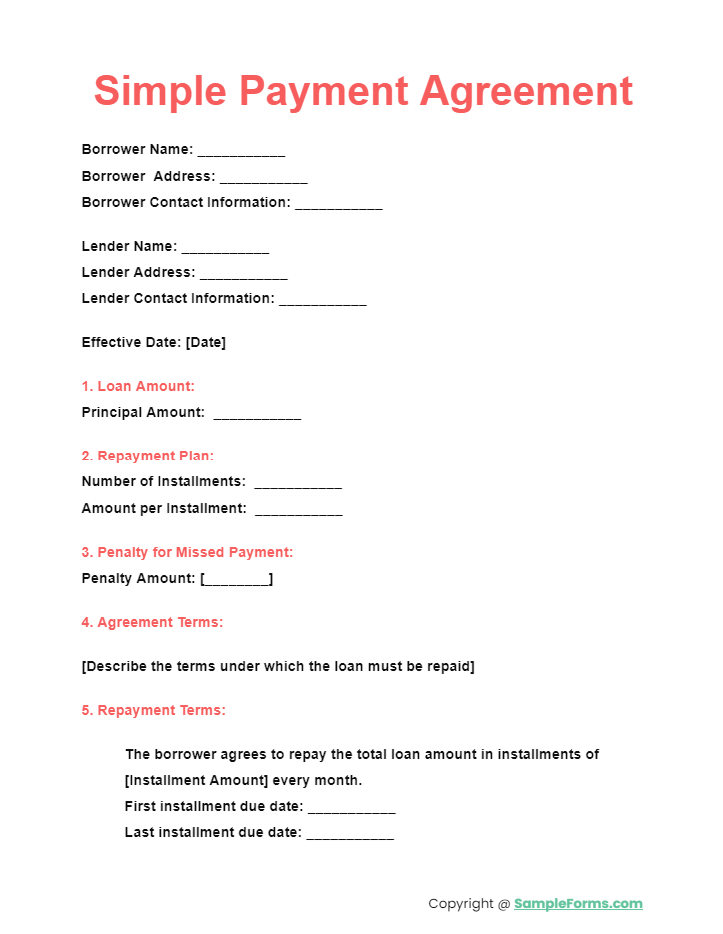

Simple Payment Agreement

Draft a straightforward Simple Payment Agreement that acts as a clear Receipt of Payment Form, ensuring all parties understand their obligations without complex legalese. You also browse our Investment Agreement Form

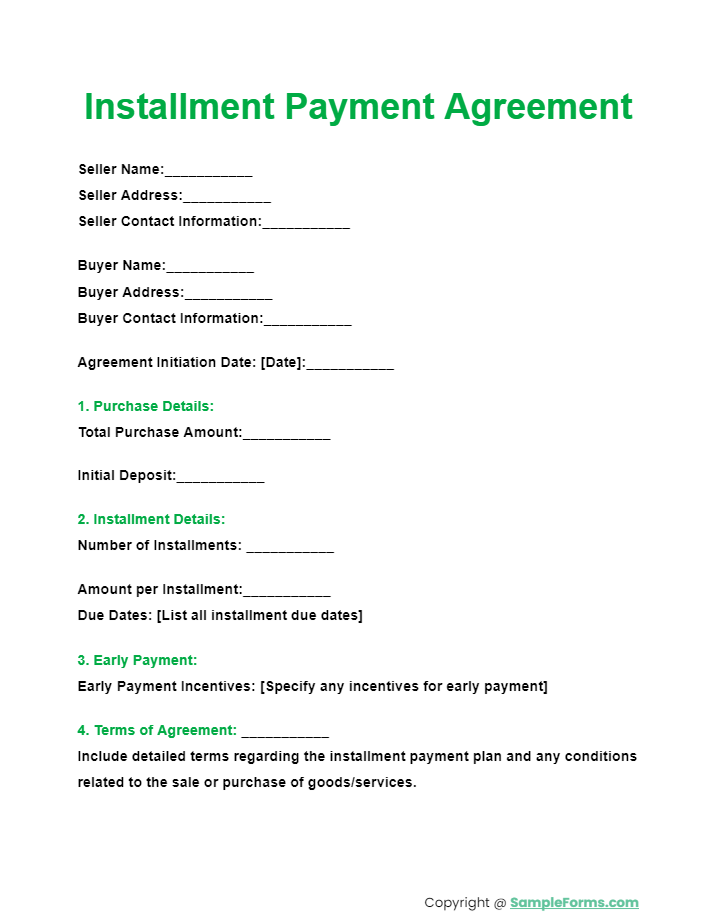

Installment Payment Agreement

More Payment Agreement Samples

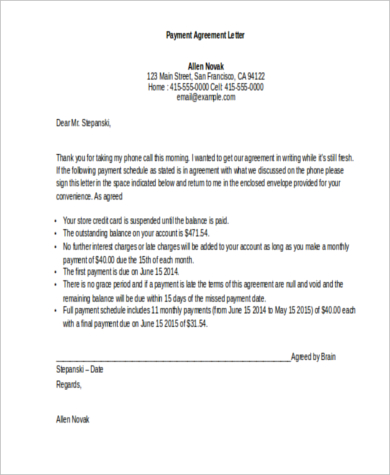

Payment Agreement Letter

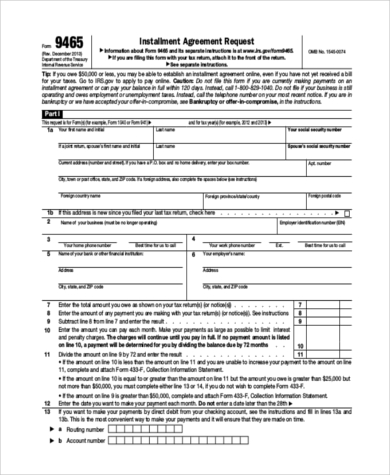

Installment Payment Agreement

Payment Agreement Form PDF

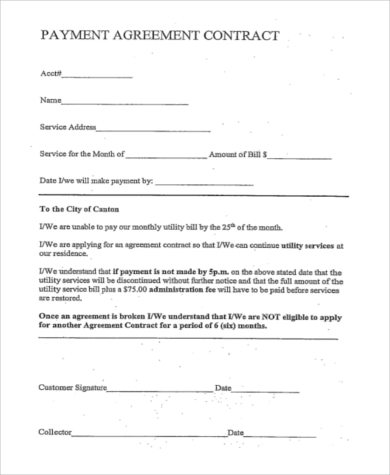

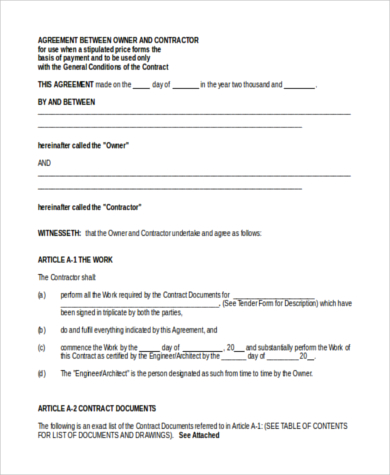

Payment Agreement Contract

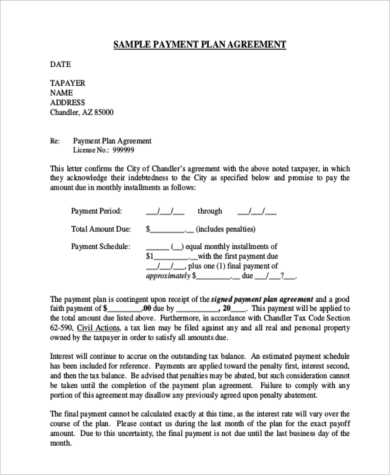

Payment Plan Agreement

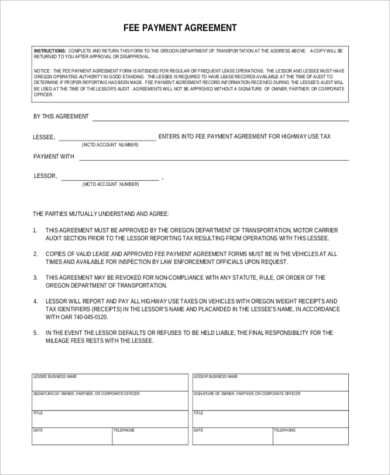

Free Payment Agreement Form

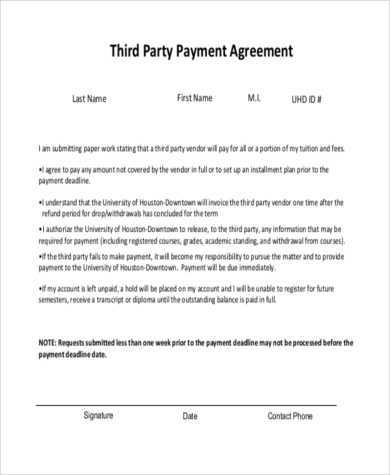

Third Party Payment Agreement

Payment Agreement Between Two Parties

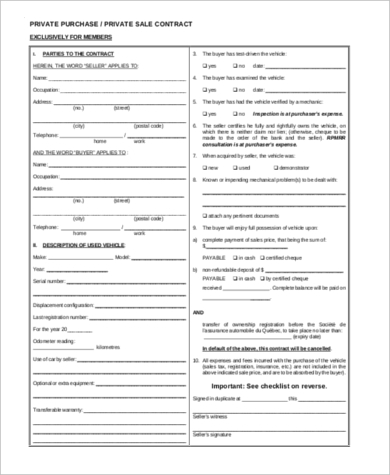

Private Vehicle Payment Agreement

How do I make a simple payment agreement?

- Identify the Parties: Clearly state the names and contact information of all parties involved in the agreement.

- Define the Payment Terms: Specify the total amount to be paid, payment deadlines, and acceptable payment methods. Include the Payment Authorization Form to confirm the agreement to charge a particular payment method.

- Outline the Services or Products: Describe in detail the services or goods involved in the transaction.

- Sign and Date: Ensure all parties sign and date the agreement to indicate understanding and acceptance of the terms. You also browse our Custody Agreement Form

How do I create a payment plan?

- Assess the Debt Amount: Determine the total amount owed that needs to be structured into a payment plan.

- Determine Installment Details: Decide on the amount of each installment, the frequency of payments, and the total duration of the plan using the Payment Requisition Form.

- Consider Interest or Fees: Include any interest or administrative fees applicable to the late payments.

- Document the Agreement: Create a formal document outlining all terms, and have it signed by all parties. You also browse our Sales Agreement Form

Is a payment agreement legally binding?

- Written Documentation: Ensure the agreement is documented in writing rather than agreed verbally.

- Inclusion of Essential Elements: Confirm the agreement includes all necessary details such as payment amounts, schedules, and parties’ information.

- Signatures: Have the document signed by all parties involved, making it a Payment Confirmation Form.

- Legality Check: Optionally, have the agreement reviewed by a legal professional to ensure it complies with local laws. You also browse our Rental Agreement Form

How do I make a payment agreement legally binding?

- Include Consideration: Ensure that there is something of value being exchanged between the parties.

- Legal Capacity: Verify that all parties are of legal age and mentally competent to enter into a contract.

- Voluntary Assent: Confirm that all parties agree to the terms freely without duress or coercion.

- Legal Purpose: The agreement must be for a lawful purpose and include an Consignment Agreement Form to solidify its legality. You also browse our Commercial Lease Agreement Form

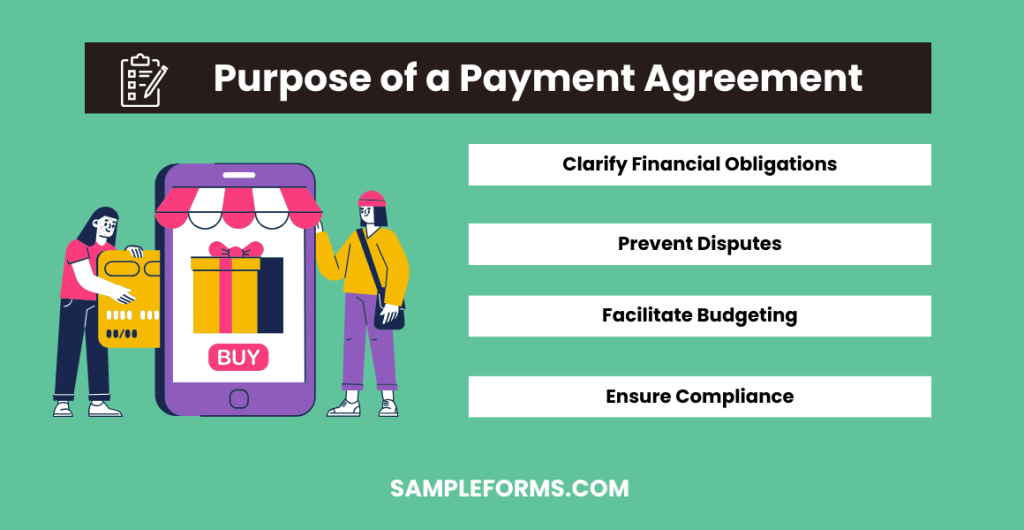

What is the purpose of a payment agreement?

- Clarify Financial Obligations: Establish clear financial responsibilities between the involved parties.

- Prevent Disputes: Help avoid misunderstandings and disputes over payment issues.

- Facilitate Budgeting: Assist parties in budgeting by setting clear payment schedules.

- Ensure Compliance: Include a Contractor Payment Form to ensure all legal and contractual obligations are met. You also browse our Restaurant Agreement Form

What is the reason for payment agreement?

- Secure Payments: Ensure that all financial transactions are secured and agreed upon by all parties.

- Formalize Informal Agreements: Transform verbal or informal agreements into formal commitments. You also browse our License Agreement Form

- Create a Payment Record: Provide a documented history of agreed payments and terms.

- Protect Rights: Protect the rights of all parties involved using a Payment Application Form.

What should be stated in the payment agreement?

- Parties’ Information: List the full names and contact details of all involved parties.

- Payment Details: Outline the payment amounts, due dates, and conditions for payment. You also browse our Distribution Agreement Form

- Terms of Agreement: Define the terms and conditions related to the agreement.

- Miscellaneous Provisions: Include any additional terms such as confidentiality clauses and penalties for late payments.

- Signature Section: Conclude with a place for all parties to sign and date, turning the document into a formal Cash Payment Receipt Form.

What is the minimum payment agreement?

The minimum payment agreement often involves structured minimum amounts over time, typically outlined in a Tenancy Agreement Form to ensure regular payment compliance. You also browse our Vehicle Sales Agreement Contract Form

What is the most common payment plan?

The most common payment plan is monthly installments, frequently used in Business Agreement Form to manage financial transactions smoothly. You also browse our Maintenance Agreement Form

What is another word for payment arrangement?

Another term commonly used for payment arrangement is “payment schedule,” typically formalized through a Promissory Note Agreement Form. You also browse our Prenuptial Agreement Form

What happens if I miss payment arrangement?

Missing a payment arrangement can lead to penalties, affecting credit ratings and potentially invoking clauses from a Personal Loan Agreement Form. You also browse our Apartment Rental Agreement Form

What is the payment agreement between buyer and seller?

The payment agreement between buyer and seller stipulates payment terms, responsibilities, and timelines, documented in a Lease Agreement Form for clarity and enforcement. You also browse our Contractor Agreement Form

What is a payment agreement between three parties?

A payment agreement involving three parties often includes intermediary facilitation, structured via a Hold Harmless Agreement Form to protect all involved parties’ interests. You also browse our Advertising Agreement Form

End your search for the perfect template with our Investment Club Agreement Form. This tool not only simplifies the drafting of payment agreements but also ensures that all involved parties are well-informed and compliant with the agreed terms. Ideal for use in various settings, including businesses, personal transactions, and more, it serves as a fundamental resource for managing your financial engagements efficiently.