An Operating Agreement Form is a crucial document for businesses, especially Limited Liability Companies (LLCs), to outline ownership, management, and financial arrangements. This agreement ensures all partners or members are clear on their roles, responsibilities, and profit-sharing, preventing future conflicts. By having a properly structured Agreement Form, businesses can establish a solid foundation for cooperation and smooth operations. Whether it’s a Cooperation Agreement Form or a single-member LLC, an operating agreement is vital for legal protection and organizational clarity. Make use of our complete guide to craft a customized agreement tailored to your business needs.

Download Operating Agreement Form Bundle

What is Operating Agreement Form?

An Operating Agreement Form is a legal document that outlines the internal structure, ownership, and operational procedures of an LLC or partnership. It defines each member’s responsibilities, decision-making processes, and profit distribution. This document is crucial for protecting the members’ personal assets from liabilities and ensuring smooth business operations. Having a detailed operating agreement helps prevent disputes and aligns all parties on shared goals.

Operating Agreement Format

Heading: Operating Agreement for [LLC Name]

Introduction & Background

- Provide an introduction outlining the purpose of the LLC, the date of formation, and its registered state.

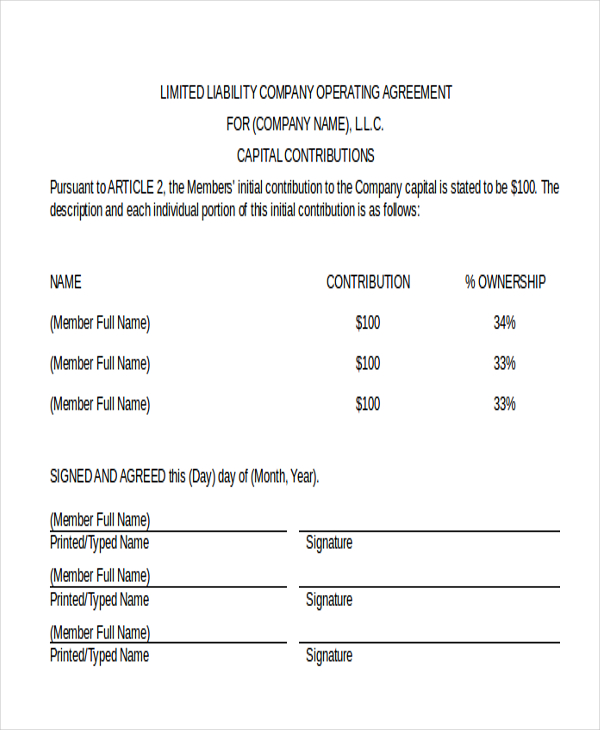

Ownership Structure & Capital Contributions

- Include the names of members, ownership percentages, and initial capital contributions.

- Detail additional contributions that may be required in the future.

Management Structure

- Define whether the LLC is member-managed or manager-managed. Outline the roles, responsibilities, and authority of managers.

Profit & Loss Distribution

- Describe how profits and losses will be allocated among members. Include any provisions for reinvestment or distribution of dividends.

Voting Rights & Decision-Making

- Detail voting procedures, quorum requirements, and the number of votes needed for major decisions.

Dispute Resolution & Exit Strategy

- Outline procedures for resolving disputes, including mediation and arbitration options.

- Include provisions for buyout options, dissolution, or sale of the business.

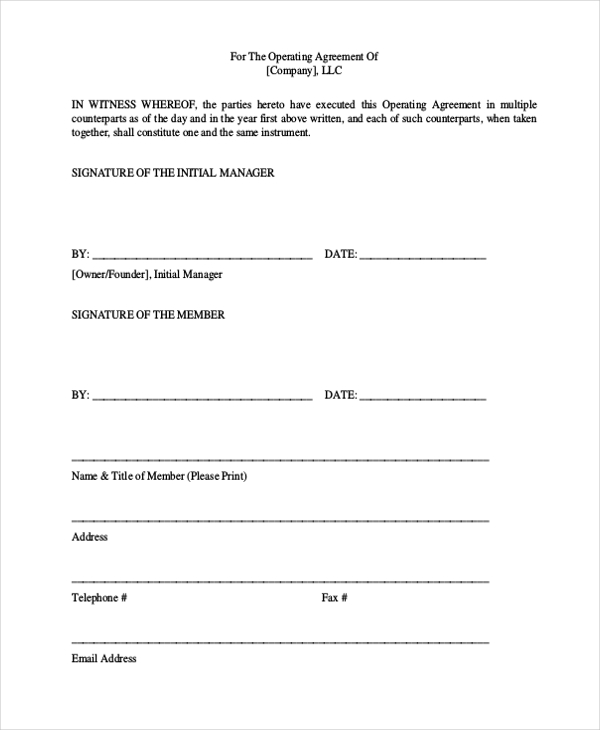

Signatures & Notarization

- Space for all members to sign, along with notarization if required.

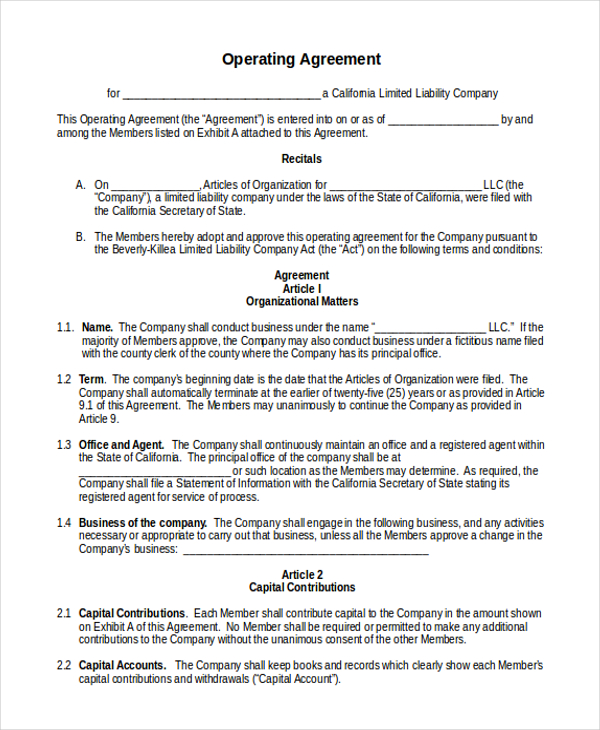

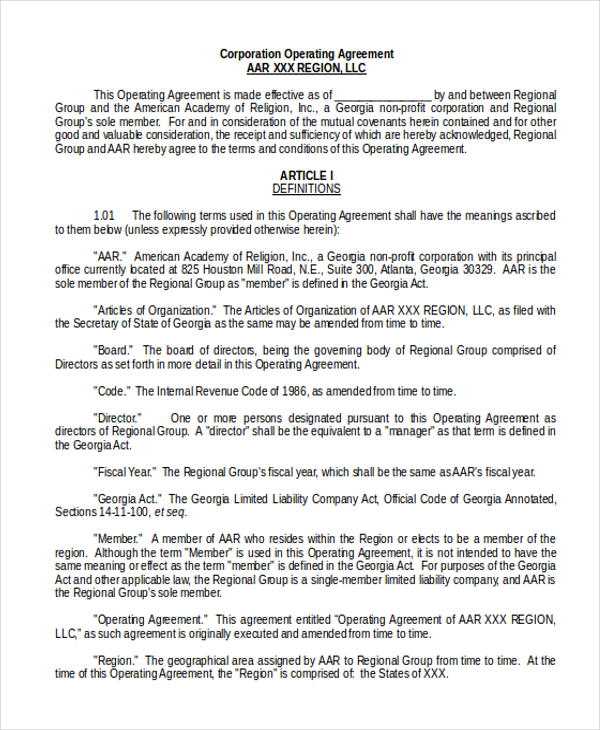

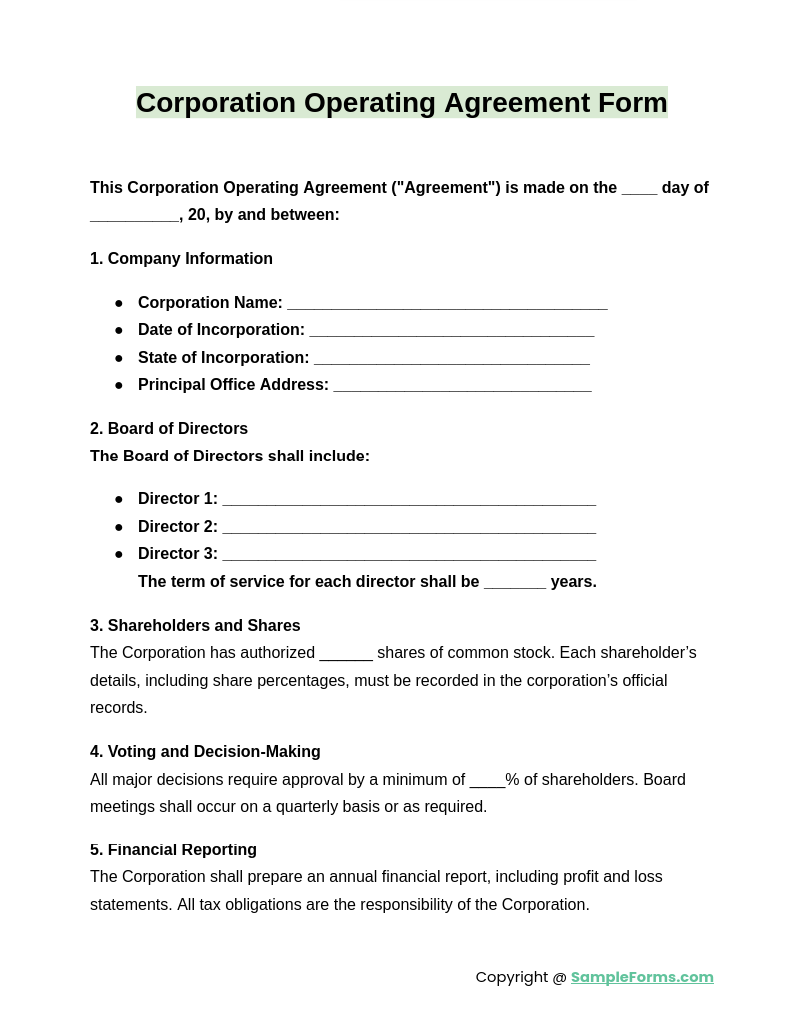

Corporation Operating Agreement Form

A Corporation Operating Agreement Form is designed to outline the ownership, responsibilities, and operational procedures of corporations. It defines the roles of directors, shareholders, and officers, ensuring a smooth corporate governance structure. This form is essential for managing business activities, especially when dealing with investors. Having a clear operating agreement minimizes disputes and fosters transparency. This document also complements a Buy Sell Agreement Form, protecting shareholders’ interests in case of ownership changes.

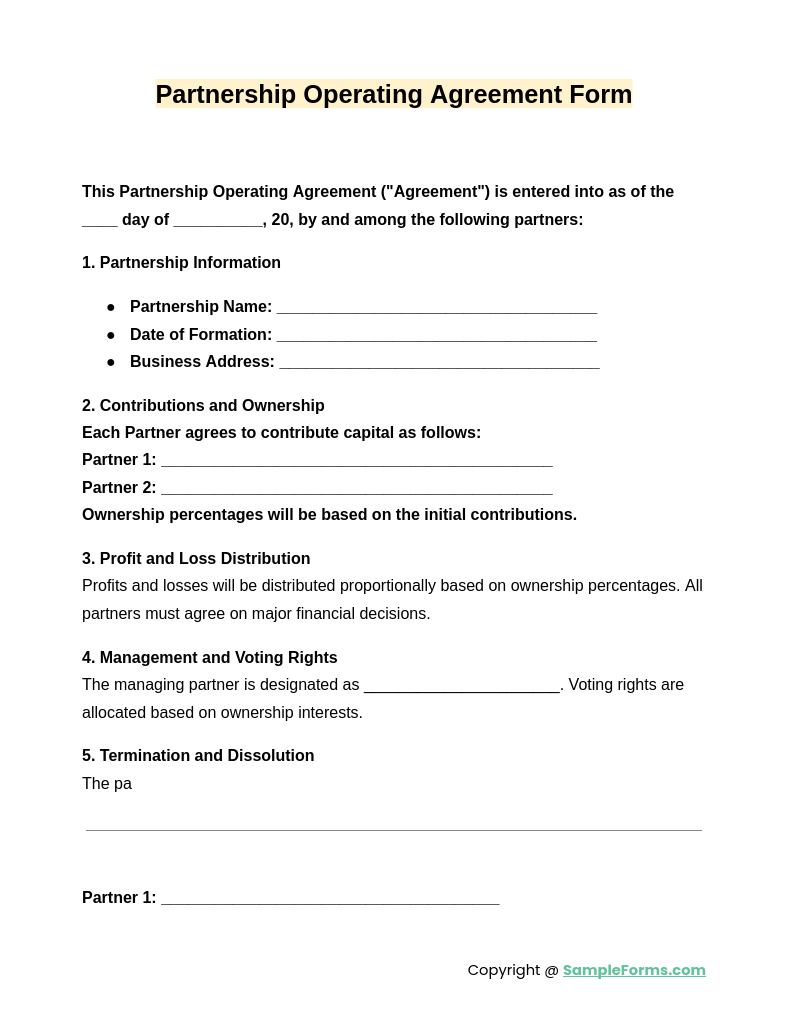

Partnership Operating Agreement Form

The Partnership Operating Agreement Form helps formalize the roles and profit-sharing arrangements between partners. It includes clauses related to capital contributions, decision-making, and dispute resolution, which are critical for partnership success. Properly structuring this agreement ensures mutual understanding and prevents conflicts. For commercial entities, combining it with a Commercial Rental Agreement Form can secure the use of shared assets and properties, enhancing business stability.

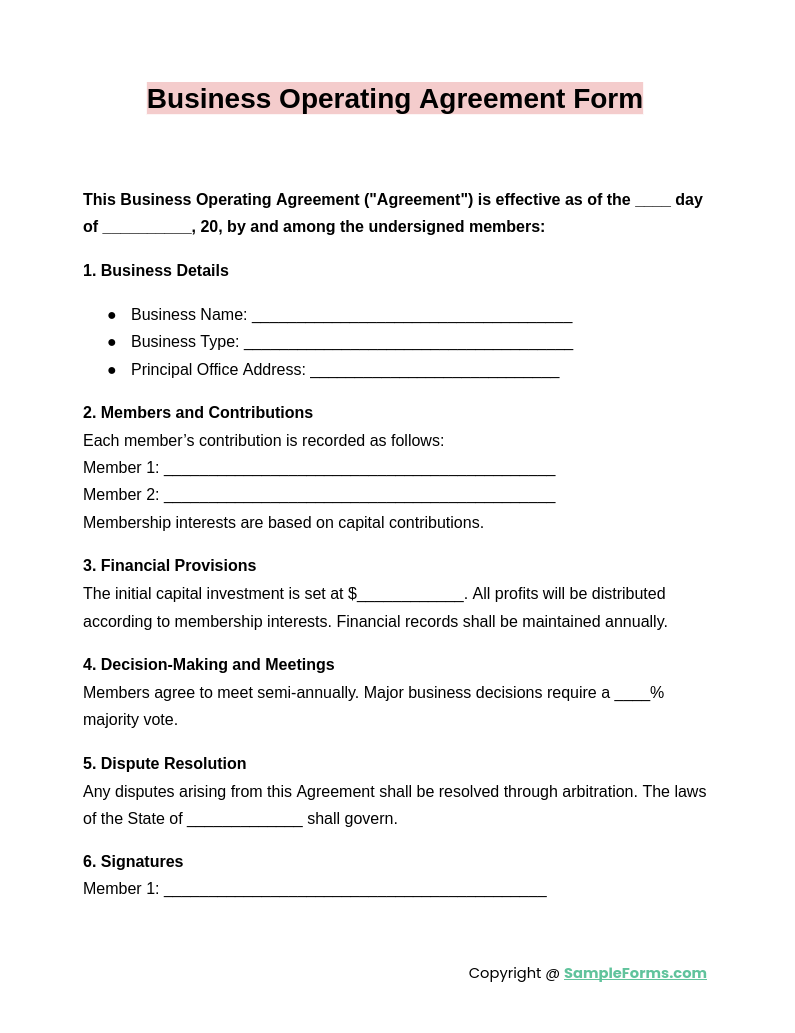

Business Operating Agreement Form

A Business Operating Agreement Form is crucial for setting up efficient management practices within a business. This form covers ownership distribution, voting rights, and operational guidelines. It’s essential for LLCs, ensuring that all members are aligned with business goals. The document also includes liability protection clauses, safeguarding members’ personal assets. For businesses dealing with settlements, a Settlement Agreement Form can be used in conjunction to resolve disputes efficiently.

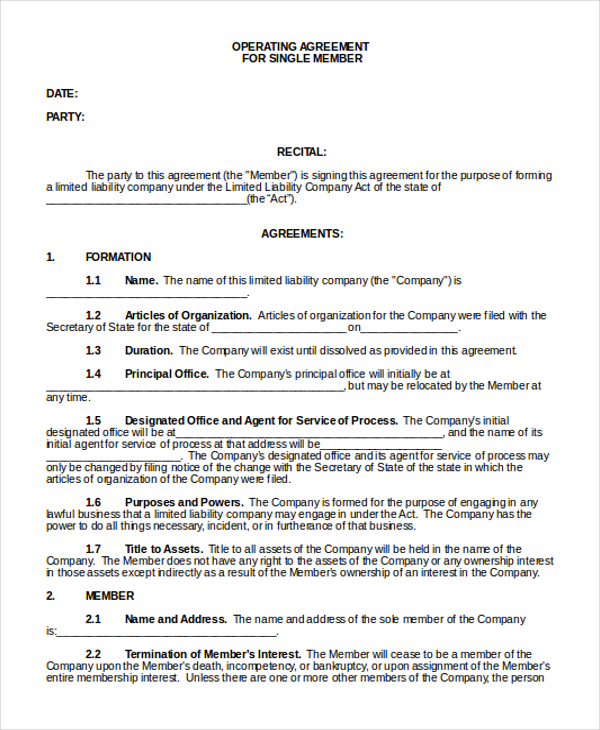

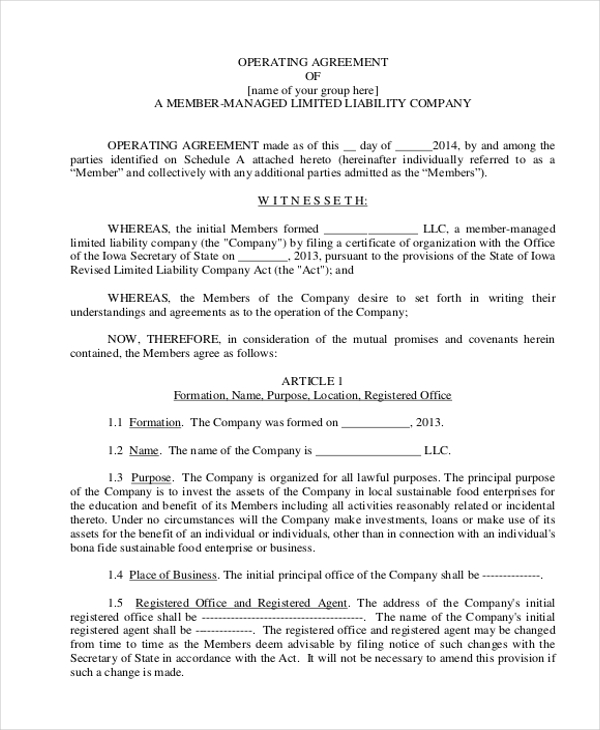

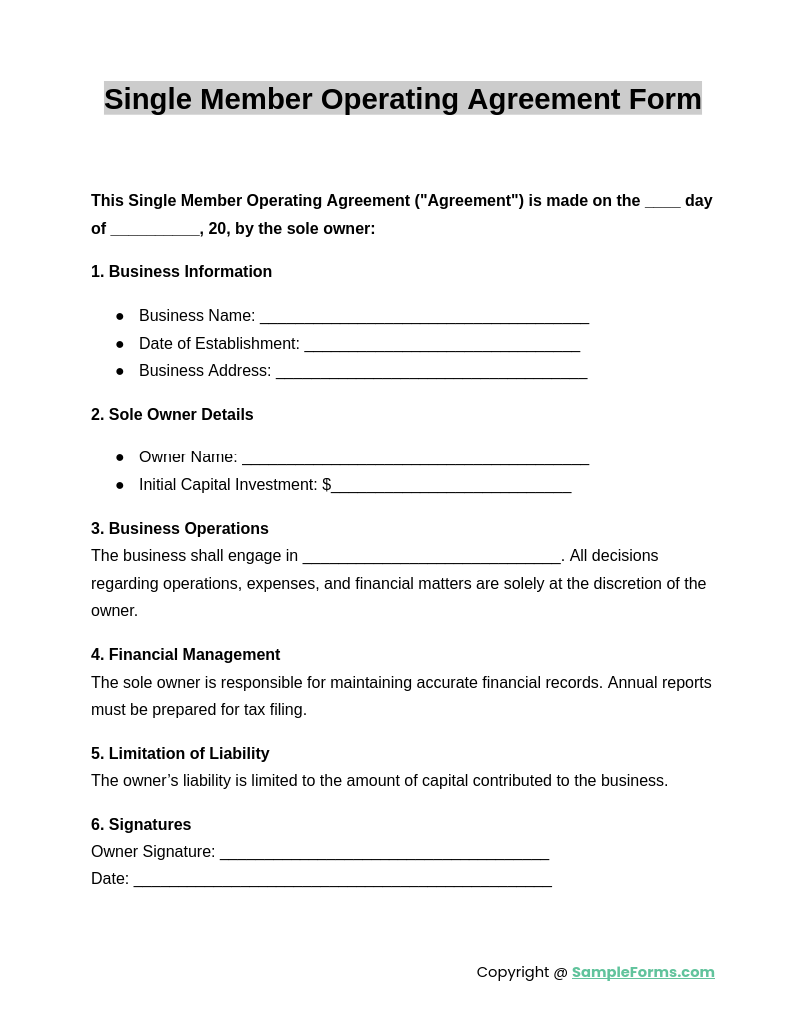

Single Member Operating Agreement Form

The Single Member Operating Agreement Form is tailored for solo entrepreneurs managing an LLC. It outlines ownership rights, operational procedures, and tax classifications, providing clarity despite having only one member. This form is necessary for legal protection and legitimizes the business entity. For rental properties managed by single-member LLCs, using it alongside a Rental Lease Agreement Form ensures streamlined property management and clear tenant agreements.

Browse More Operating Agreement Forms

Sample LLC Operating Agreement

When an LLC wishes to clearly define the power and the rights of its higher officials, it makes use of this agreement. The agreement contains the details of all the rules that these officials are expected to abide.

Single Member LLC Operating Agreement

Limited Liability Company Operating Agreement

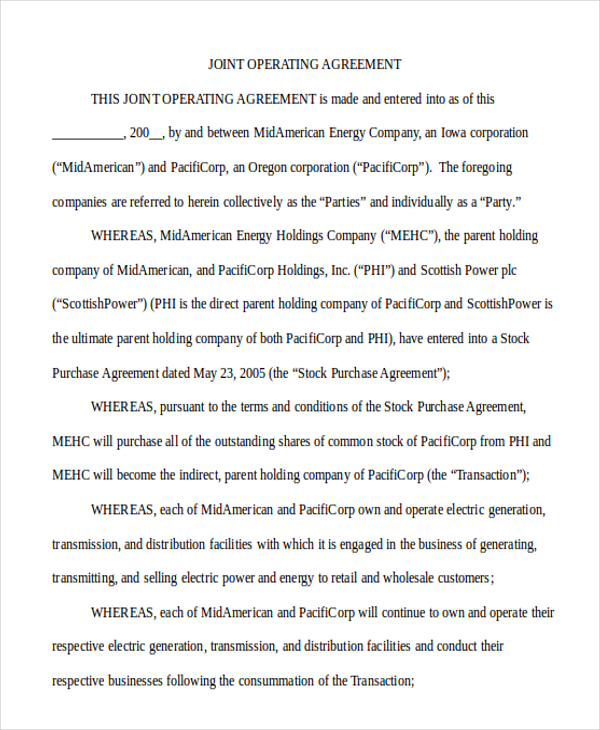

Joint Operating Agreement

Blank Operating Agreement

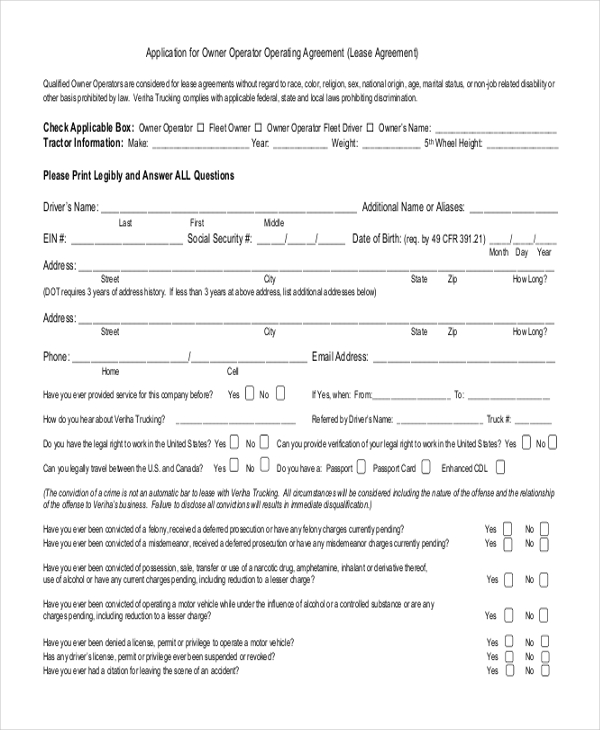

Sample Owner Operator Lease Agreement

Generic Operating Agreement

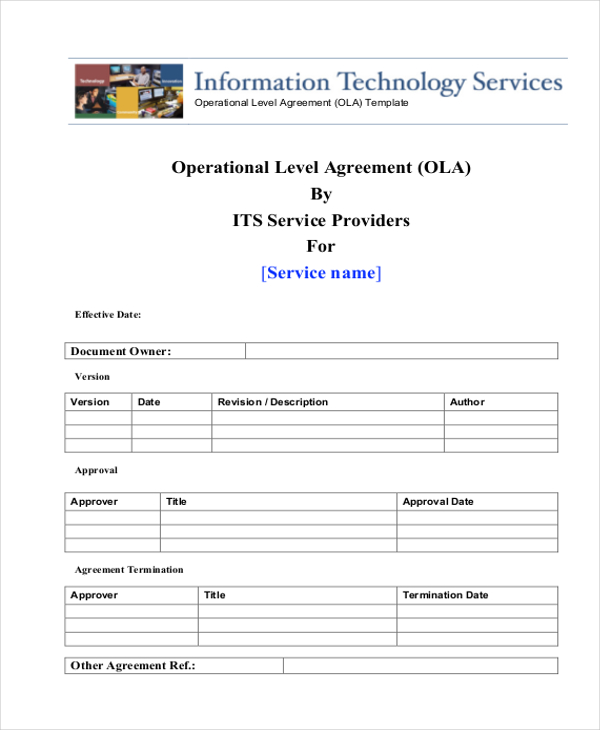

Operating Level Agreement

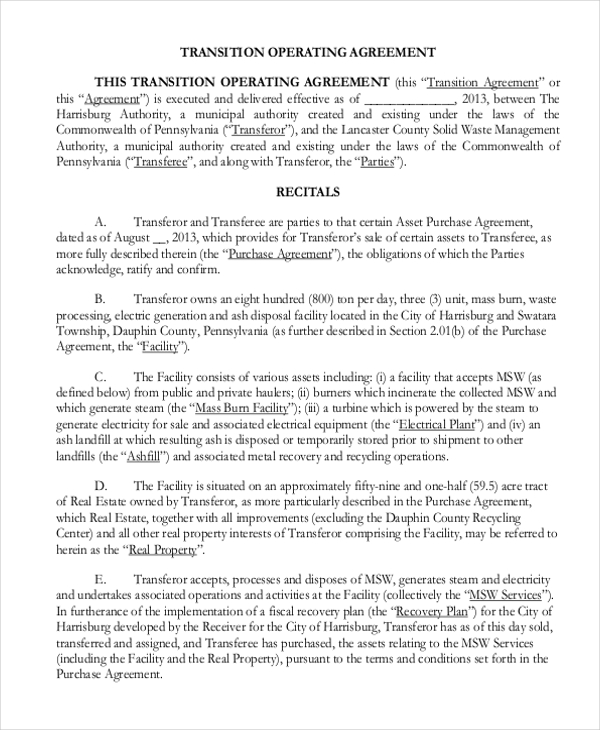

Transition Operating Agreement

Sample Corporation Operating Agreement

How to write an operating agreement form?

Creating a comprehensive operating agreement form involves including essential details like ownership structure, management roles, and profit distribution. This document should clearly outline operational guidelines to prevent misunderstandings.

Adhering to specific rules ensures an effective operating agreement:

- Identify Members’ Roles: Clearly define each member’s responsibilities using a Business Purchase Agreement Form for clarity on ownership.

- Financial Contributions: Detail the capital contributions of each member, ensuring transparent financial commitments.

- Profit and Loss Allocation: Specify how profits and losses will be shared among members.

- Management Structure: Establish decision-making processes to streamline business operations.

- Exit Strategy: Include provisions for member withdrawal, dissolution, or transferring ownership.

What are the pitfalls of LLC operating agreements?

LLC operating agreements can have pitfalls if not drafted carefully. Overlooking details or using a generic template can lead to legal issues and conflicts between members.

Key rules include:

- Incomplete Terms: Using a generic Electrical Subcontractor Agreement Form may leave critical details missing, causing disputes.

- Unclear Member Roles: Vague role definitions can lead to conflicts and misunderstandings.

- Lack of Legal Review: Not consulting a legal expert may result in unenforceable terms.

- Omitting Dispute Resolution: Absence of a clear dispute resolution process can complicate conflicts.

- Ignoring State Laws: Not adhering to state regulations can invalidate the agreement.

What makes an operating agreement invalid?

An operating agreement becomes invalid if it lacks essential legal elements, such as clear terms, signatures, or adherence to state laws. Ensure that the agreement is legally enforceable.

Key rules include:

- Missing Signatures: An unsigned agreement, like a Non Compete Agreement Form, lacks legal validity.

- Ambiguous Terms: Vague or conflicting clauses can invalidate the document.

- Non-Compliance with State Laws: Not following local regulations can render the agreement unenforceable.

- Fraudulent Information: False statements can nullify the entire agreement.

- No Updates: Failing to update the agreement as the business evolves can cause issues.

What if an operating agreement was never signed?

If an operating agreement was never signed, it may not be legally enforceable. Without signatures, proving member consent becomes difficult, especially during disputes.

Key rules include:

- Document Approval: Ensure all parties sign, similar to a Room Agreement Form, to confirm acceptance.

- Legal Consultation: Seek legal advice to validate unsigned agreements.

- Implied Agreements: Sometimes, actions by members can imply agreement, but this is not legally robust.

- Written Amendments: Have members sign any changes to the agreement to maintain its enforceability.

- Formalization: Regularly review and formalize agreements to avoid disputes.

How to write a standard operating procedure?

A standard operating procedure (SOP) clearly outlines the steps for business operations to ensure consistency. It’s essential for effective management and efficiency.

Key rules include:

- Define Objectives: Start by specifying the purpose of the procedure using a Parking Agreement Form for clarity.

- Step-by-Step Instructions: Provide detailed, sequential steps for completing tasks.

- Assign Responsibilities: Clearly indicate who is responsible for each step.

- Review and Update: Regularly review the SOP to keep it current and effective.

- Documentation: Maintain proper documentation to ensure compliance and reference.

How many pages is a standard operating agreement?

A standard operating agreement typically ranges from 5 to 20 pages, depending on business complexity. A well-drafted agreement, like a Commercial Agreement Form, ensures clarity for all involved parties.

Can I write my own operating agreement for my LLC?

Yes, you can write your own operating agreement using resources like a House Agreement Form. However, consulting a legal expert ensures its validity and compliance with state regulations.

Can you create an operating agreement for free?

Yes, free templates are available online, but using a customized Roommate Agreement Form can be more effective to suit your business’s unique needs.

How long does an operating agreement last for an LLC?

An operating agreement remains valid as long as the LLC exists unless formally amended or terminated, similar to a Joint Venture Agreement Form.

How will the LLC be classified for tax purposes?

LLCs can be classified as sole proprietorships, partnerships, or corporations for tax purposes. Proper classification may require a Financial Agreement Form for clarity.

Is an LLC operating agreement the same as articles of organization?

No, an operating agreement differs from the Assignment Agreement Form. Articles of organization are filed with the state, while operating agreements define internal management.

Do I need an EIN for my LLC in Colorado?

Yes, obtaining an EIN is essential for hiring employees and opening a bank account. An Investment Agreement Form may also be needed for financial dealings.

Does an LLC need a business license in Colorado?

Yes, an LLC must obtain the necessary licenses to operate legally, just as you would with a Deposit Agreement Form for financial security.

What states require an operating agreement for LLC?

States like California, New York, and Missouri mandate operating agreements. A Holding Deposit Agreement Form can offer additional security for LLC dealings.

Do I need an operating agreement to open a bank account?

Yes, banks require an operating agreement to verify business structure and authority, akin to presenting a Investment Club Agreement Form during financial negotiations.

In conclusion, an Operating Agreement Form is an indispensable tool for businesses, especially when forming LLCs or partnerships. It provides a clear framework that covers ownership, responsibilities, and profit-sharing, helping avoid misunderstandings among members. Use a Trademark License Agreement Form to protect intellectual property and business interests effectively. Proper documentation not only ensures compliance but also secures long-term business success.

Related Posts

-

FREE 50+ Mortgage Forms Download – How to Create Guide, Tips

-

FREE 4+ Real Estate Listing Information Forms in PDF | MS Word

-

FREE 7+ Garage (Parking) Rental Agreement Forms in PDF | MS Word

-

FREE 7+ Office Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Salon Booth Rental Agreement Forms in PDF | MS Word

-

FREE 5+ Roommate Rental Agreement Forms in PDF | MS Word

-

Electrical Subcontractor Agreement Form

-

FREE 10+Non-Disclosure Forms in PDF | MS Word

-

FREE 5+ Construction Subcontractor Agreement Forms in PDF | MS Word

-

FREE 5+ Real Estate Lease Guarantee Co-Signer Agreement Forms in PDF | MS Word

-

FREE 5+ Lease with an Option to Purchase Agreement Forms in PDF | MS Word

-

FREE 7+ Realtors Lease Agreement Forms in PDF

-

FREE 10+ Subordination Agreement Forms in PDF | MS Word

-

FREE 10+ Condominium Lease Agreement Forms in PDF | MS Word

-

FREE 5+ Lottery Agreement Forms in PDF | MS Word