A Notice of Exemption Form serves as a declaration to exempt a project or entity from specific legal obligations. This guide explores its purpose, benefits, and examples in diverse scenarios. Whether for businesses or individuals, a Notice Form ensures compliance and clarity in legal processes. From tax exemptions to business waivers, this guide explains critical steps to complete and file effectively. Stay informed on the importance of accuracy and discover best practices to avoid common mistakes in form submissions.

Download Notice of Exemption Form Bundle

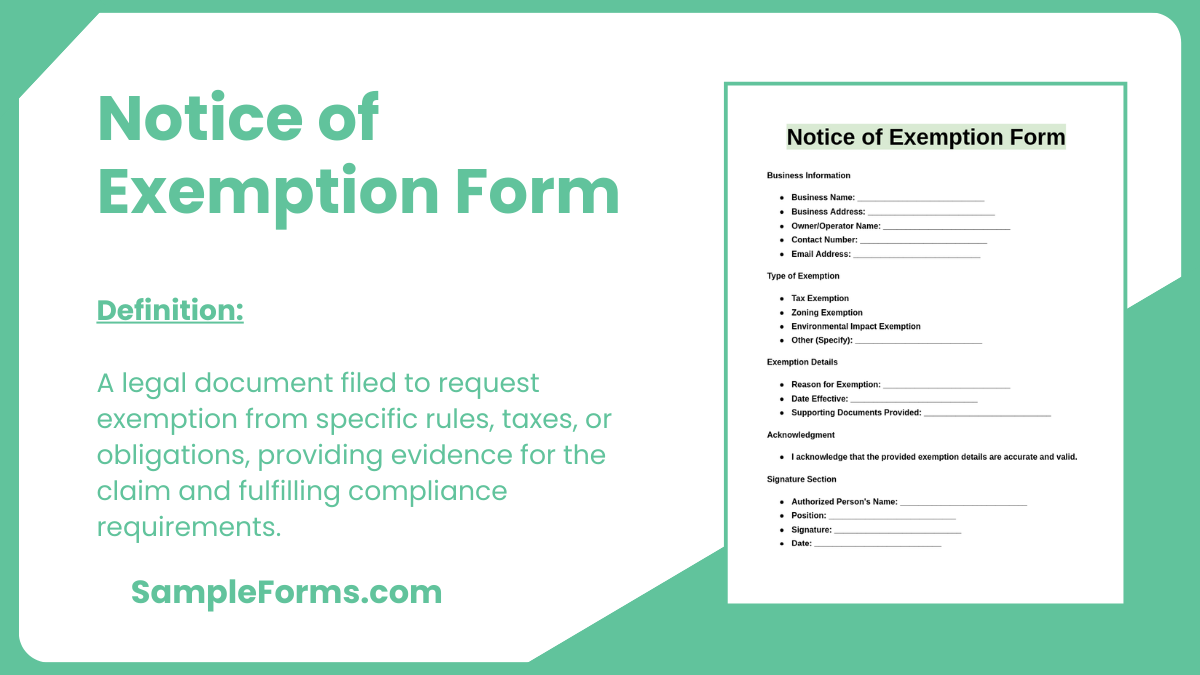

What is Notice of Exemption Form?

A Notice of Exemption Form is a legal document used to confirm an exemption from regulatory requirements. It is essential for businesses and individuals to clarify their exemption status for specific legal, tax, or procedural obligations. This document simplifies compliance while reducing unnecessary liabilities. A well-prepared Notice Form ensures that all relevant details are communicated to regulatory bodies, making it a critical tool in administrative processes. Accuracy, clarity, and proper filing are fundamental in ensuring its effectiveness.

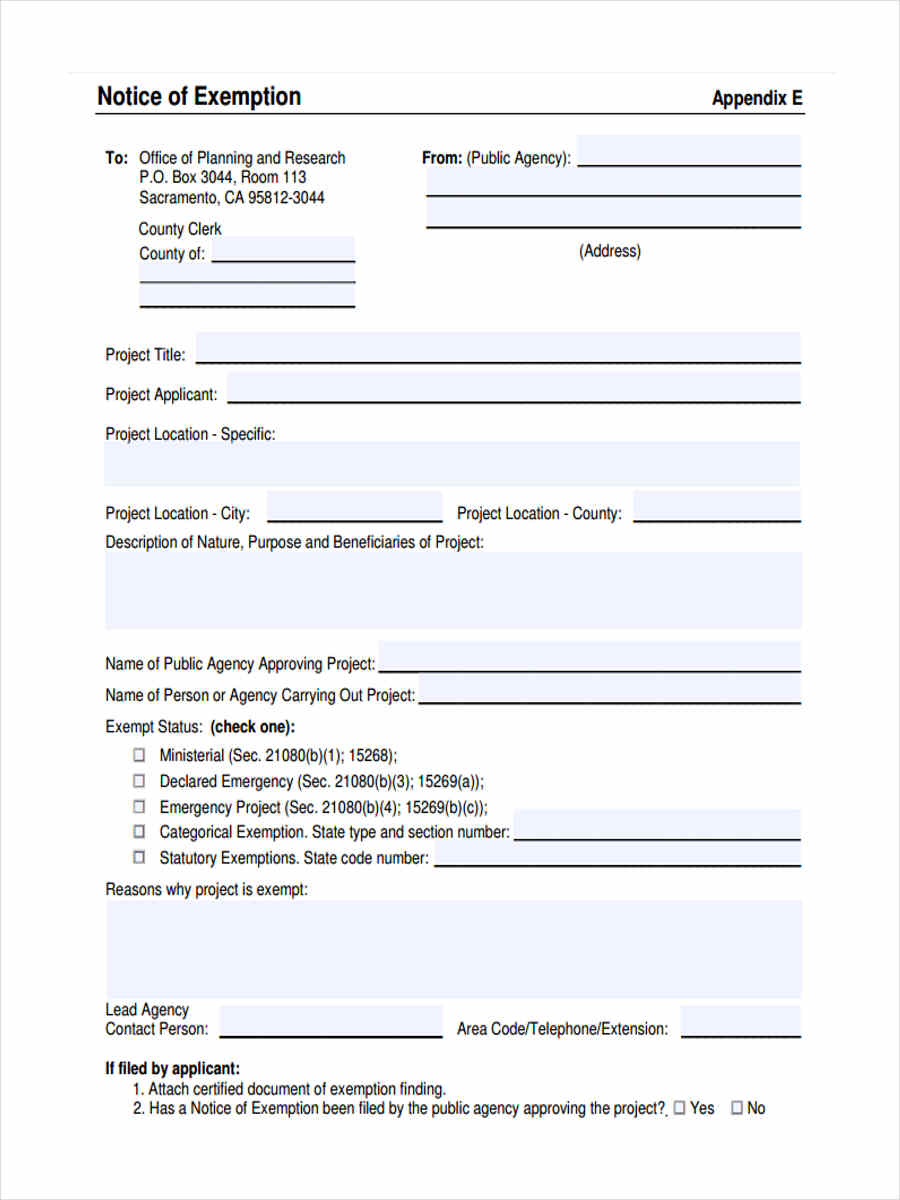

Notice of Exemption Format

Applicant Details

- Full Name: ____________________________

- Contact Information: ____________________________

- Identification Number: ____________________________

Reason for Exemption

- Description of Exemption Requested: ____________________________

- Supporting Documents Attached: ____________________________

- Relevant Law/Regulation for Exemption: ____________________________

Declaration

- I declare the above information is true and accurate.

- Applicant’s Signature: ____________________________

- Date: ____________________________

For Official Use

- Approval Status: ____________________________

- Authorized Officer’s Name: ____________________________

- Signature: ____________________________

- Date: ____________________________

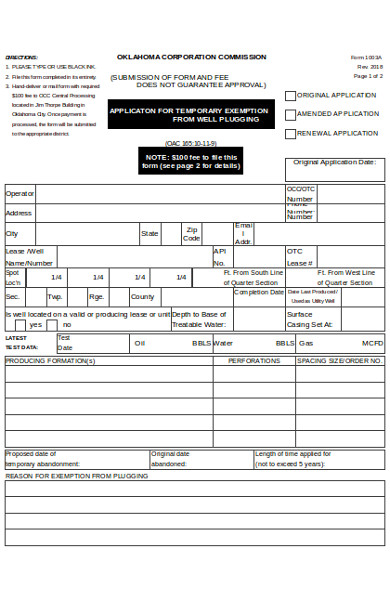

California AB 1482 Notice of Exemption Form

The California AB 1482 Notice of Exemption Form ensures compliance with rent control laws by exempting properties under specific conditions. Like a Tax Exemption Form, it clarifies legal responsibilities, providing protection for property owners and tenants.

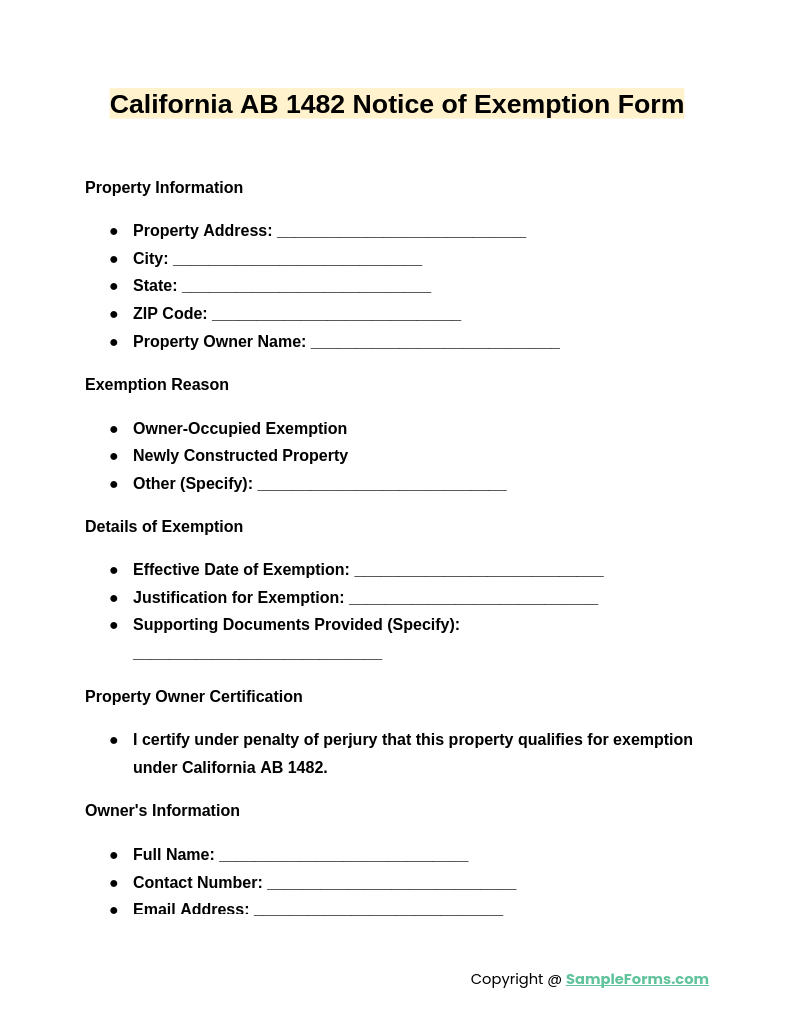

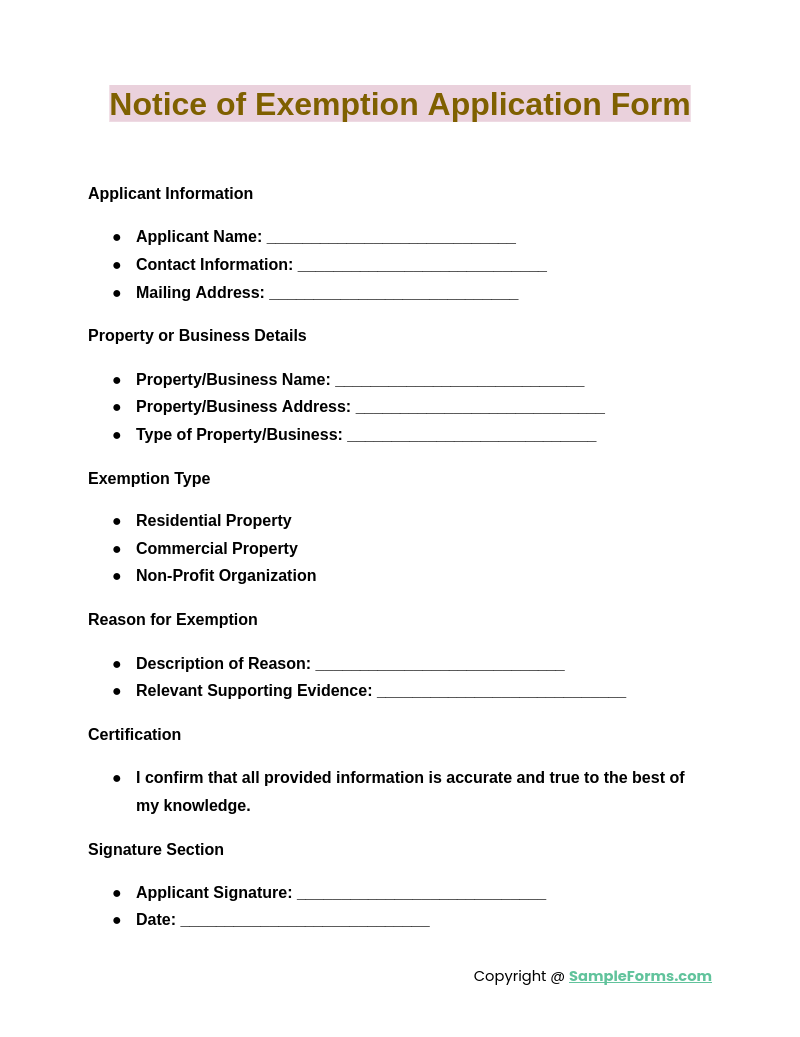

Notice of Exemption Application Form

A Notice of Exemption Application Form initiates the process for obtaining exemption status from applicable laws or regulations. Similar to a 30 Day Notice Form, it details necessary information to ensure compliance with application procedures.

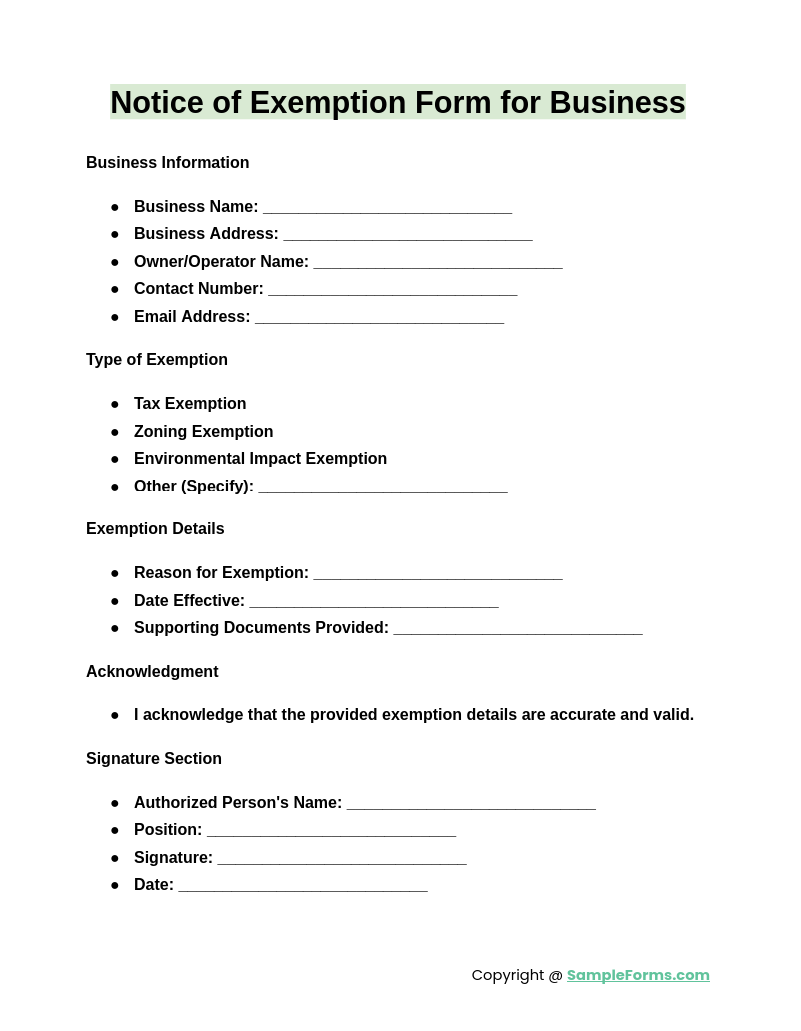

Notice of Exemption Form for Business

The Notice of Exemption Form for Business allows companies to declare exemption from regulatory or tax obligations. It functions like an Eviction Notice, ensuring clarity and legal adherence in corporate processes and filings.

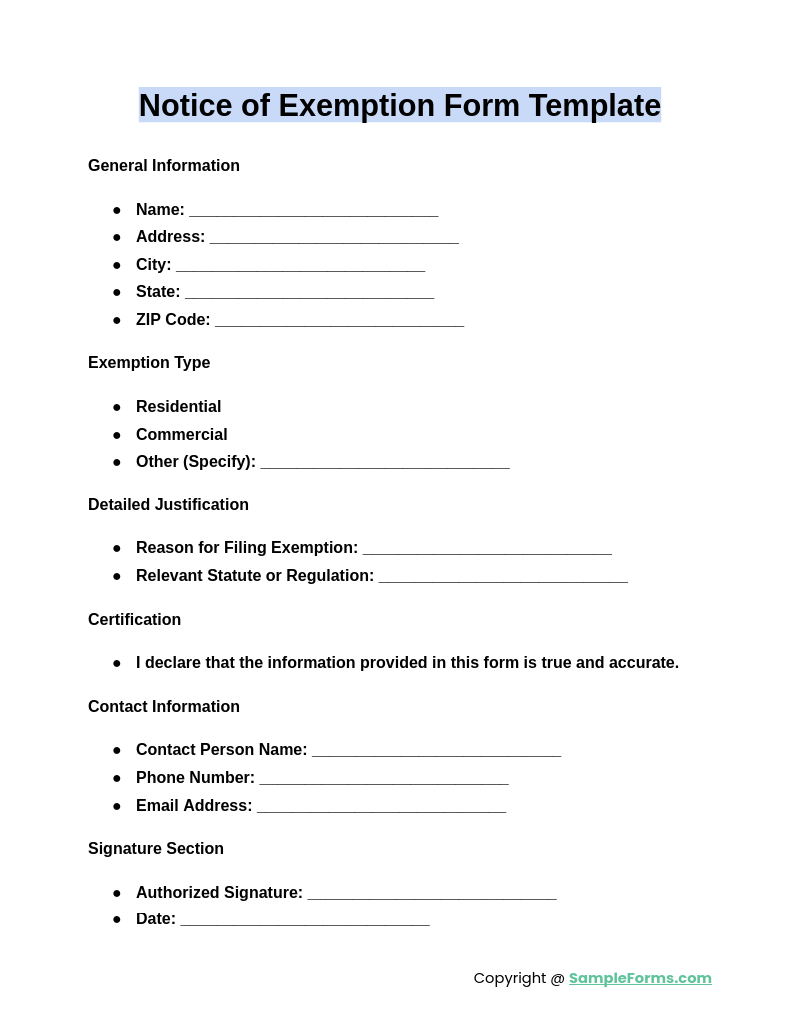

Notice of Exemption Form Template

A Notice of Exemption Form Template offers a pre-designed structure for filing exemptions. Similar to an Employee Warning Notice, it provides a standardized, efficient format for communicating critical information while maintaining compliance with regulatory requirements.

Browse More Notice of Exemption Forms

Notice of Exemption in PDF

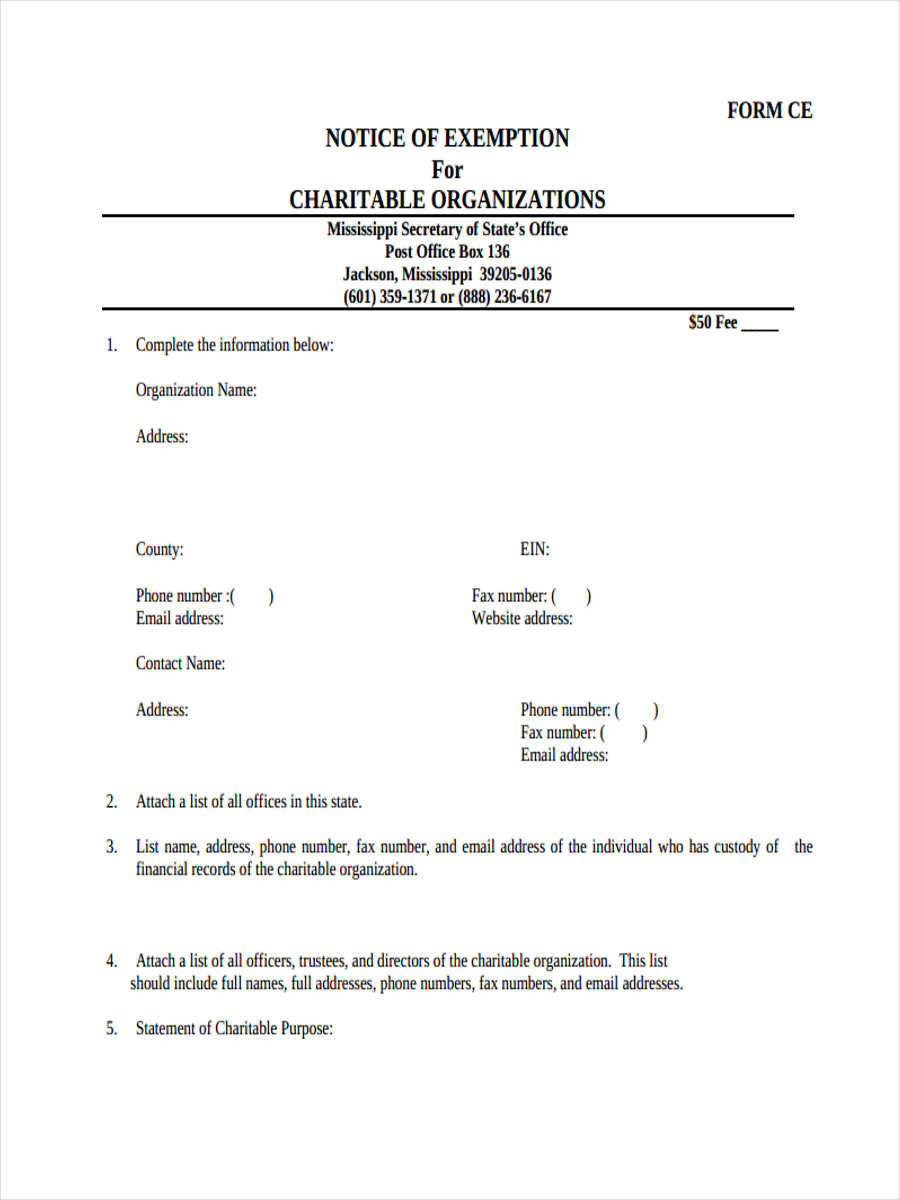

Charitable Exemption Notice Form

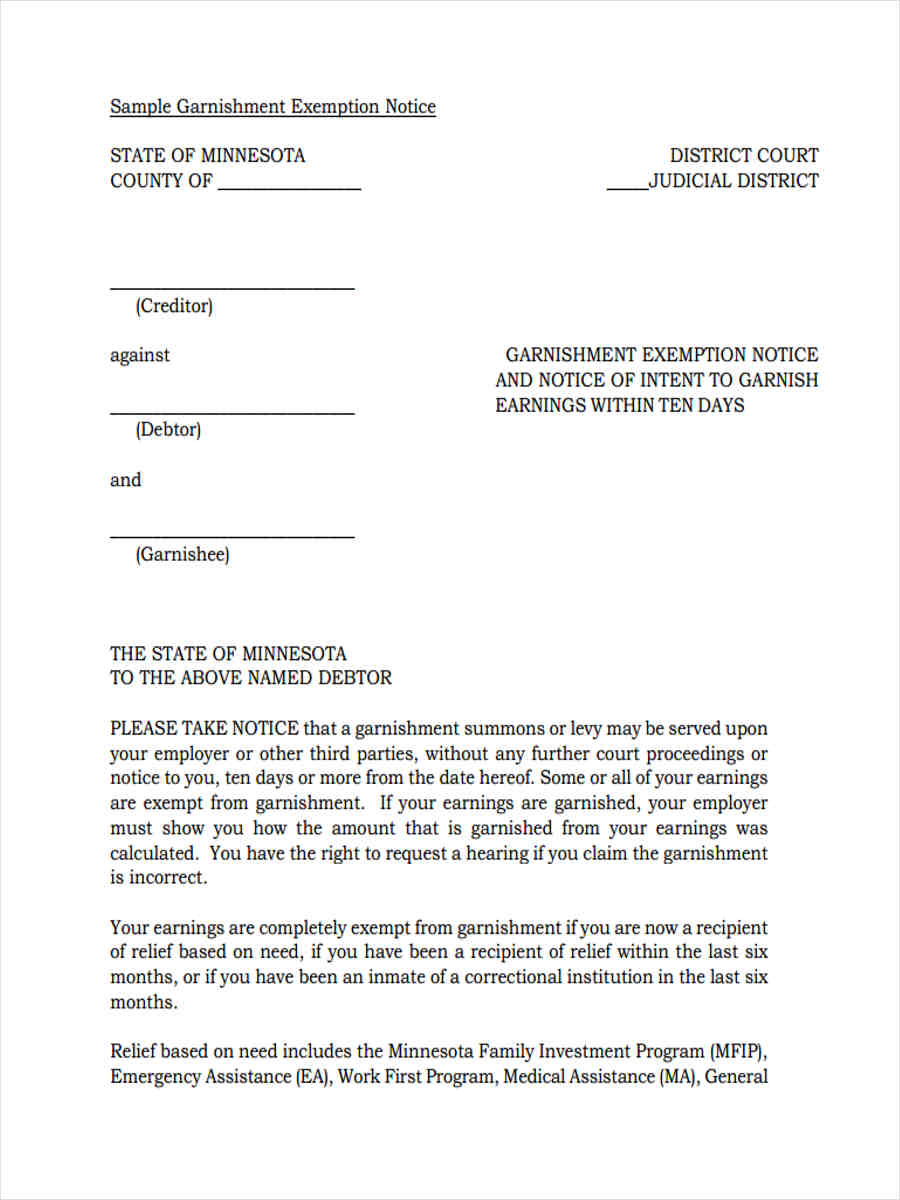

Notice of Garnishment Exemption

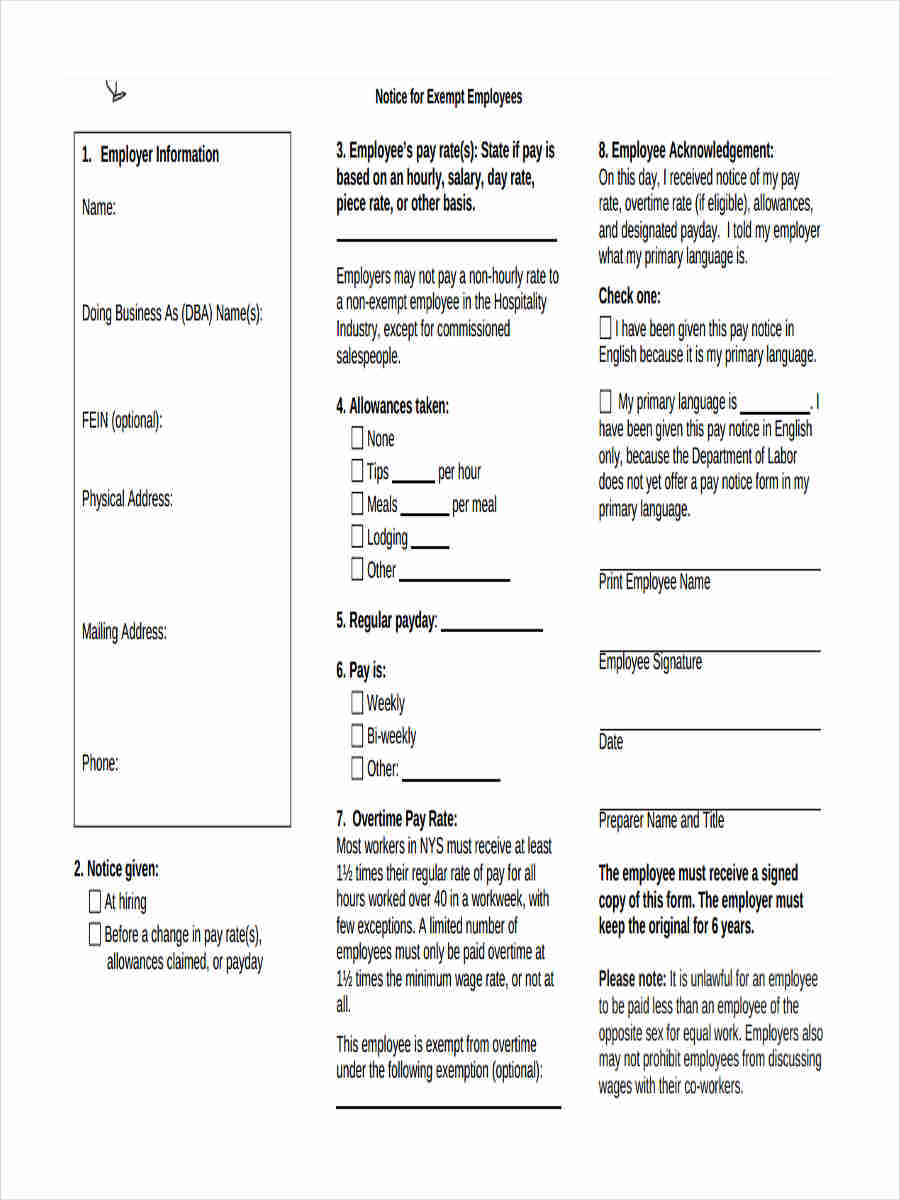

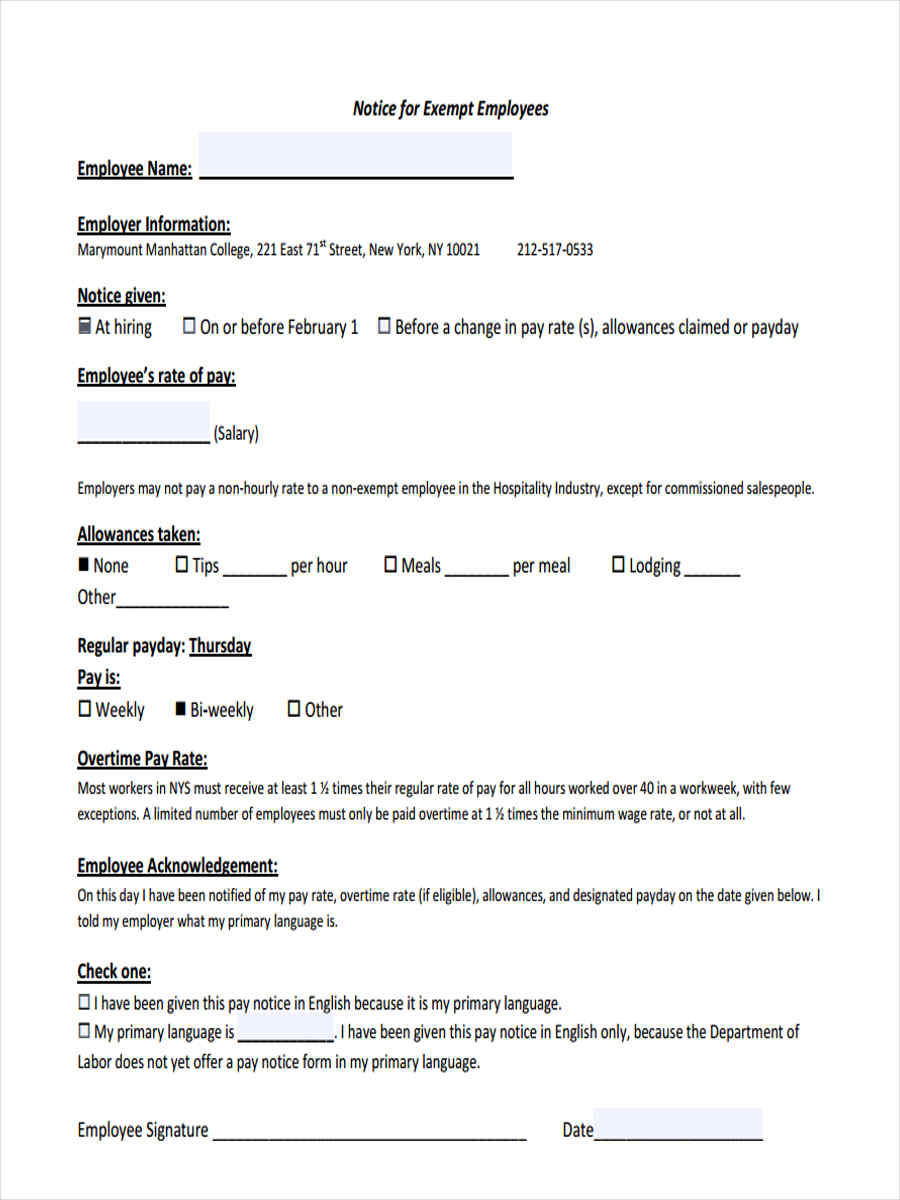

Notice for Exempt Employees

Sample Notice of Exemption

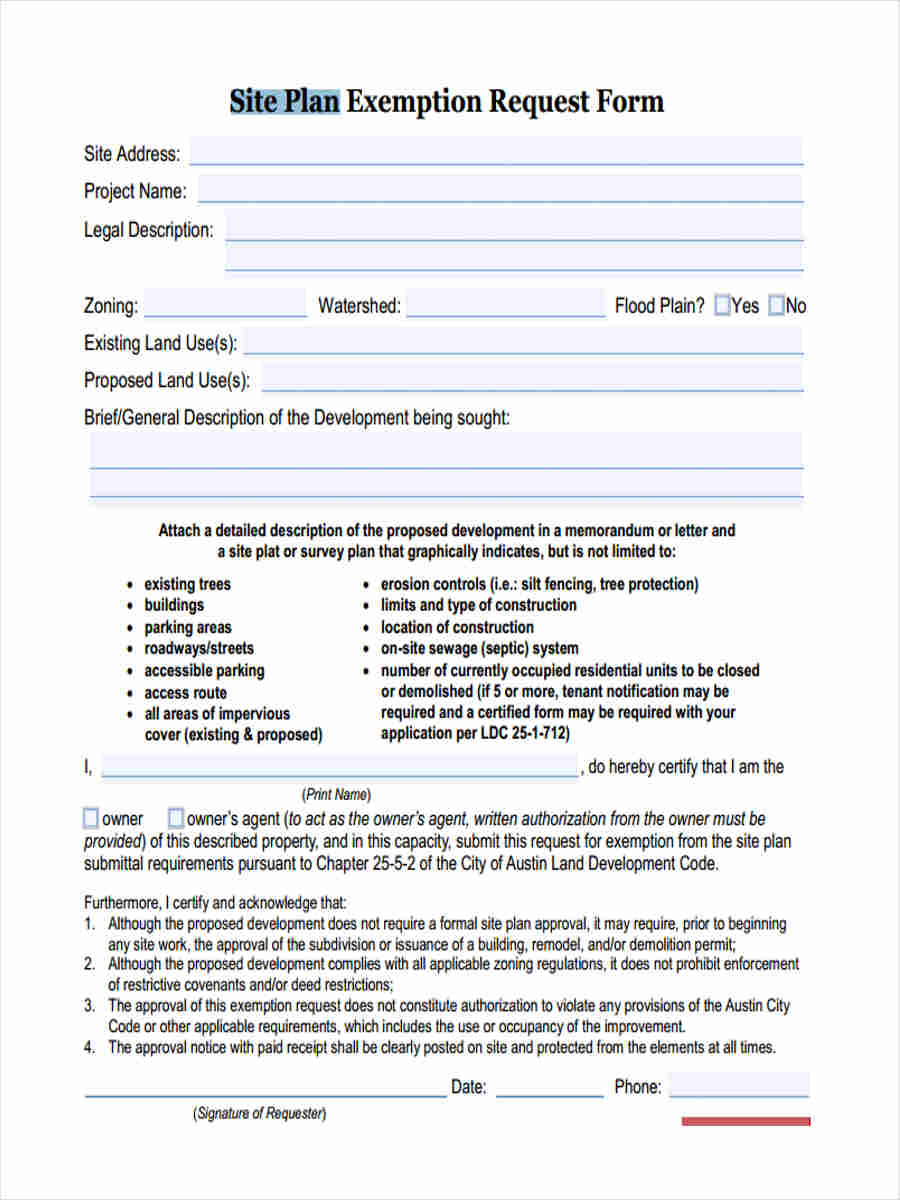

Notice of Site Plan Exemption Request

Sample Notice of Exemption Form

How do I get proof of exemption?

Obtaining proof of exemption involves following specific processes defined by relevant authorities. This ensures eligibility and validity for various exemption benefits.

- Eligibility Verification: Confirm your eligibility based on applicable rules and regulations for the specific exemption.

- Application Submission: Submit a formal application, similar to a Notice of Election Form, to the relevant department or organization.

- Document Collection: Collect required documents such as identification, tax records, or other supporting evidence.

- Approval Process: Await approval from the concerned authorities after submitting your complete application.

- Proof Issuance: Once approved, the exemption certificate or letter will serve as proof of your exemption status.

What is the purpose of an exemption?

Exemptions serve to alleviate obligations or restrictions for qualifying individuals, organizations, or entities, such as taxes, fees, or other requirements.

- Financial Relief: Reduces financial burden by waiving or minimizing specific costs.

- Encouragement of Actions: Incentivizes activities like education or business setup, akin to a Pull Notice Form.

- Compliance with Laws: Aligns practices with regulatory frameworks offering specific exemptions.

- Support for Vulnerable Groups: Assists individuals or entities needing additional support.

- Encouraging Contributions: Facilitates charitable or societal contributions by easing operational constraints.

What is the benefit of exemption?

Exemptions offer numerous benefits, including economic, legal, and operational advantages, making processes smoother and more accessible.

- Cost Reduction: Decreases expenses for eligible entities.

- Simplified Processes: Streamlines procedures like those in a Notice to Enter Form, ensuring efficiency.

- Compliance Advantages: Provides lawful privileges for specific actions.

- Encourages Participation: Motivates entities to engage in societal or economic activities.

- Improves Resource Allocation: Directs saved resources to other productive areas.

Why do you apply for exemption?

Applying for exemption ensures formal recognition of your eligibility, granting privileges such as financial relief or access to exclusive resources.

- Formal Recognition: Secures lawful acknowledgment of your exempt status.

- Eligibility Confirmation: Validates your qualifications for specific exemptions.

- Legal Protection: Protects against penalties, akin to a Warning Notice Form, by complying with regulations.

- Financial Savings: Reduces obligations, making operations or activities more viable.

- Access to Benefits: Unlocks exclusive benefits aligned with your exemption criteria.

Why would you claim an exemption?

Claiming an exemption can provide financial and operational relief, enhancing efficiency while meeting legal or professional obligations.

- Tax Benefits: Reduces taxable income or eliminates tax liabilities.

- Legal Compliance: Meets specific regulatory exemptions, as outlined in a Notice of Job Opening Form.

- Operational Savings: Eases business or personal costs related to specific activities.

- Enhanced Accessibility: Facilitates access to services or resources otherwise limited.

- Encouraging Growth: Supports educational, personal, or business growth through reduced obligations.

What is the document of exemption?

A document of exemption certifies eligibility for relief from certain obligations or charges, such as taxes or regulations, ensuring compliance and benefits. Includes Layoff Notice Form if applicable.

Am I exempt from prescription charges?

Exemptions from prescription charges apply to specific groups based on age, income, or medical conditions. Verify eligibility with a Preliminary Notice Form for accuracy.

What are the conditions for exemption?

Exemptions are granted based on criteria such as financial need, age, or compliance with regulations. Submission of a Notice of Objection Form is required for verification.

What does request an exemption mean?

Requesting an exemption involves applying for relief from obligations like fees or compliance, backed by valid reasons. Often requires a Notice of Disposal Form submission.

Is personal exemption good or bad?

Personal exemptions reduce taxable income, offering financial benefits. However, over-reliance might impact tax deductions. Evaluate with a Notice of Claim Form for suitability.

Is it better to claim no exemptions?

Claiming no exemptions increases withholdings, potentially resulting in larger tax refunds. Assess benefits using a Compliance Notice Form for accuracy in financial planning.

What is reasonable notice of an exemption clause?

A reasonable notice of exemption clause specifies the time frame required to claim or dispute an exemption. Often includes a Notice of Cancellation Form.

What is the exemption period?

The exemption period is the duration during which the exemption is valid. Ensure proper documentation with a Notice of Removal Form to track timelines.

Is it better to be exempt or non-exempt?

Being exempt allows for fewer obligations, such as overtime pay in employment. Confirm status using a Notice to Owner Form for clarity.

What is a notice of exempt offering?

A notice of exempt offering notifies authorities about securities exempt from registration. It requires submission of a Payroll Change Notice Form for legal compliance.

The Notice of Exemption Form is vital in legal, financial, and administrative contexts, ensuring streamlined compliance with applicable regulations. Whether filing for tax relief, project waivers, or business exemptions, it simplifies processes effectively. Clear documentation is critical, as inaccuracies may lead to delays or rejection. Utilizing a Notice of Transfer Form helps establish accountability while fostering transparency with governing entities. Embrace these insights to maximize the utility of exemption forms in various scenarios. Always consult guidelines to avoid common errors and enhance the effectiveness of your submission.

Related Posts

-

FREE 7+ Change in Custodian Forms in MS Word | PDF | Excel

-

FREE 4+ Uniform Commercial Code Forms in PDF

-

FREE 5+ Formal Resignation Letters in PDF | MS Word

-

FREE 6+ Compliance Notice Forms in PDF | MS Word

-

FREE 5+ Notice to Enter Forms in PDF | MS Word

-

FREE 5+ Parent Handbook Acknowledgement Forms in PDF | MS Word

-

FREE 3+ Advance Beneficiary Notice Forms in PDF | MS Word

-

FREE 7+ 10-Day Notice Forms in PDF | MS Word

-

FREE 3+ Payroll Change Notice Forms in PDF

-

60 Day Notice Form

-

FREE 6+ Sample Notice of Election Forms in MS Word | PDF | Excel

-

FREE 5+ Sample Pull Notice Forms in MS Word | PDF

-

FREE 7+ Sample Notice of Removal Forms in MS Word | PDF

-

FREE 5+ Notice to Owner Forms in PDF | Ms Word

-

FREE 6+ Sample Preliminary Notice Forms in MS Word | PDF