A Nonprofit Donation Form is a vital tool for nonprofits to collect contributions efficiently. It provides donors with a structured way to give, ensuring transparency and convenience. An optimized Donation Form includes key fields like donor details, payment options, and gift preferences. Whether for one-time or recurring donations, a well-designed form builds trust and encourages giving. This guide explores the best practices, must-have features, and real-world examples to enhance donation collection. Understanding the right format ensures seamless processing, boosting donor engagement and long-term support for nonprofit initiatives.

Download Nonprofit Donation Form Bundle

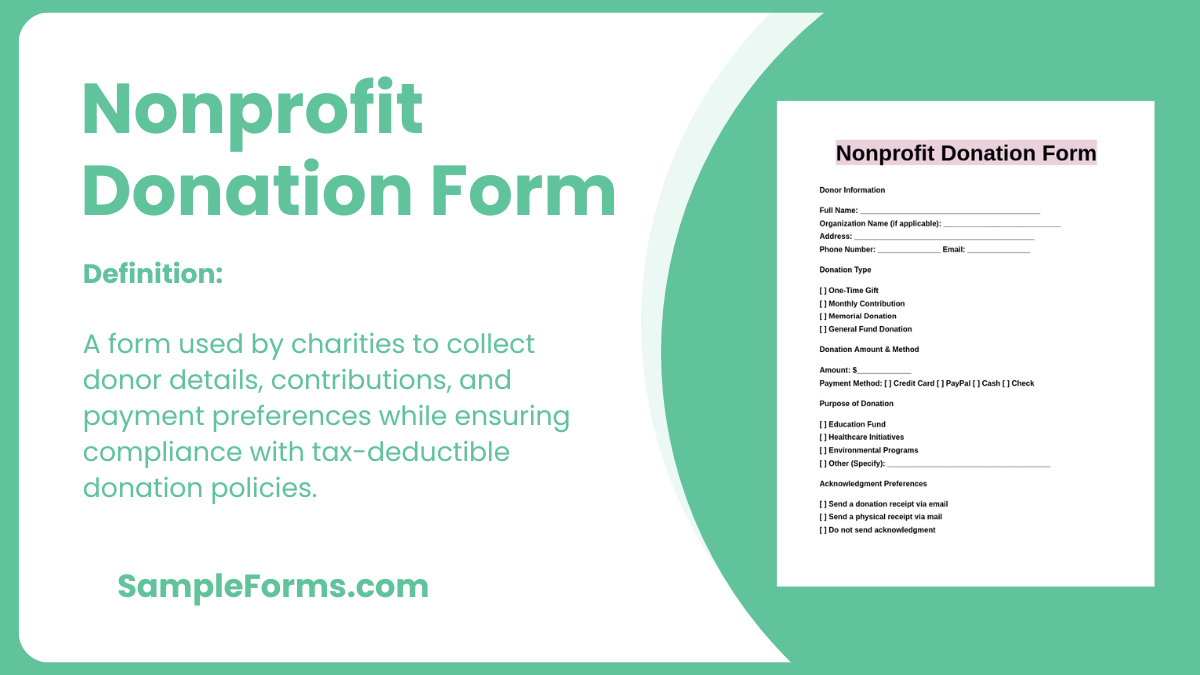

What is Nonprofit Donation Form?

A Nonprofit Donation Form is a document used by charities and nonprofit organizations to collect financial contributions from donors. It includes sections for donor information, donation amount, and preferred payment method. The form simplifies the giving process, making it easier for supporters to contribute securely. Nonprofits use this form to track donations, issue receipts, and maintain donor records. Whether digital or paper-based, a well-structured Nonprofit Donation Form enhances fundraising efforts, helping organizations receive and manage donations efficiently.

Nonprofit Donation Format

Donor Information

Full Name: [Insert Name]

Organization (If Applicable): [Insert Name]

Address: [Insert Address]

Donation Details

Donation Amount: [$Amount]

Type of Donation: [Monetary/In-Kind]

Donation Purpose: [Specify Program]

Payment Information

Mode of Payment: [Check/Credit Card/Online Transfer]

Transaction ID (If Applicable): [Insert Number]

Acknowledgment & Consent

I confirm this donation is voluntary and non-refundable.

Signature: [Signature]

Date: [MM/DD/YYYY]

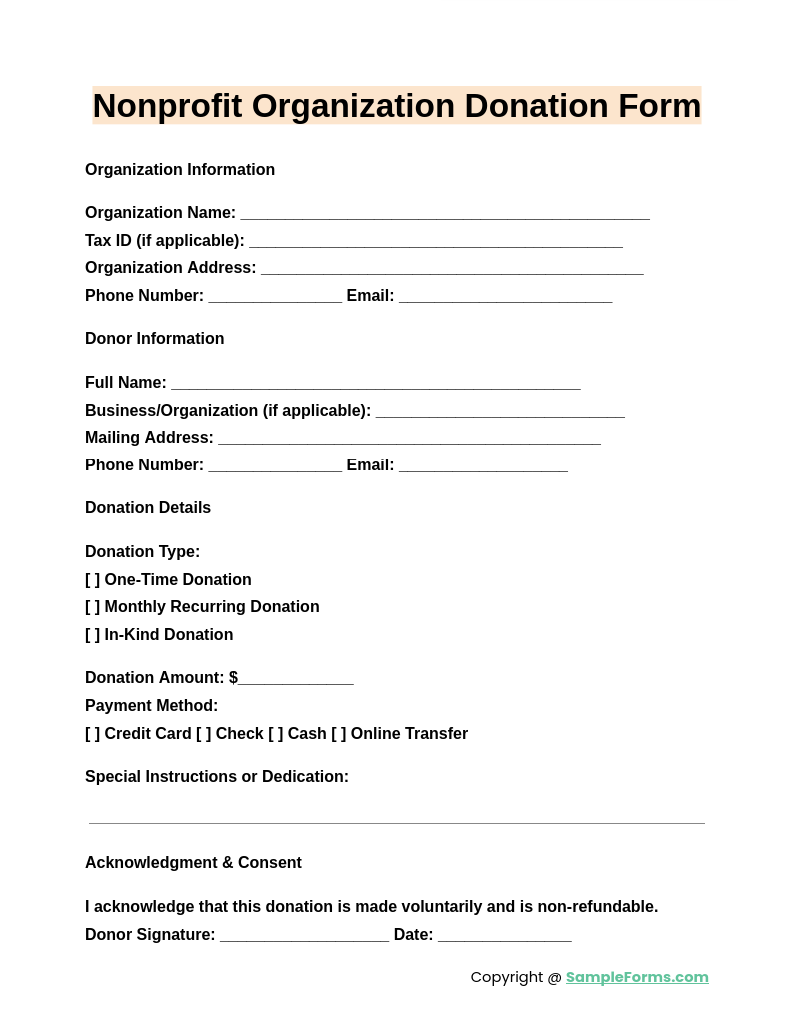

Nonprofit Organization Donation Form

A Nonprofit Organization Donation Form helps collect contributions efficiently. Similar to a Donation Receipt Form, it ensures transparency by recording donor details, payment information, and contribution amount for proper financial tracking and acknowledgment.

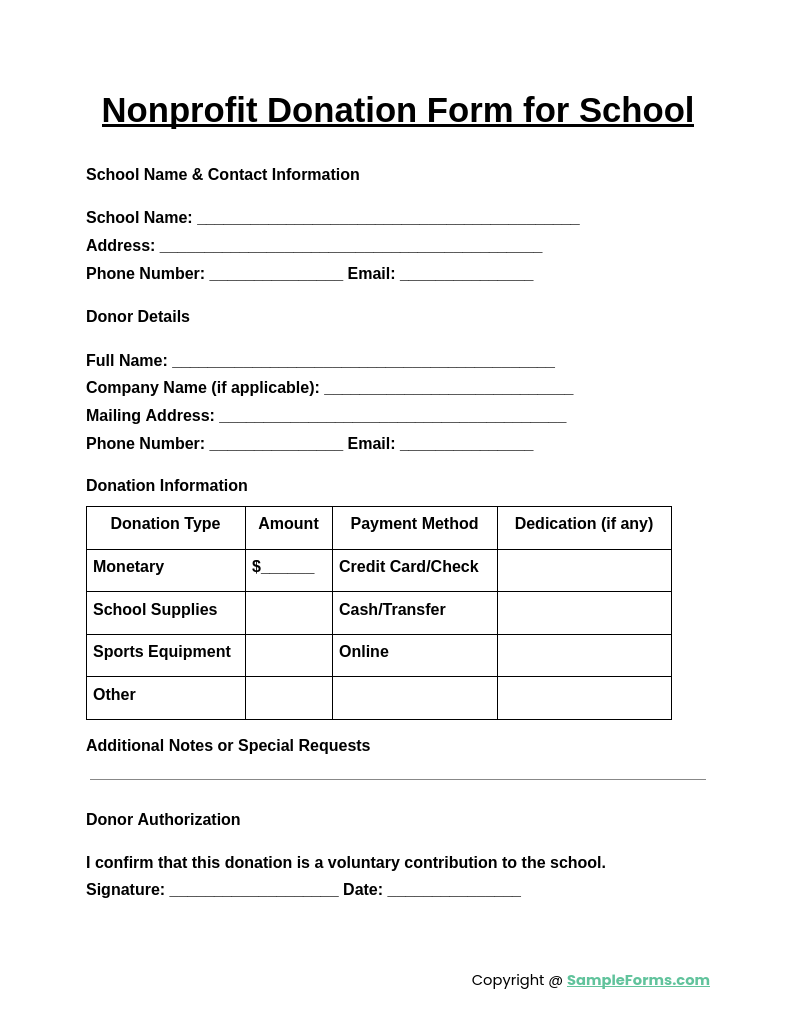

Nonprofit Donation Form for School

A Nonprofit Donation Form for School facilitates fundraising for educational initiatives. Similar to a Donation Request Form, it provides structured fields for donor details, donation amounts, and purpose, ensuring smooth financial contributions for school programs.

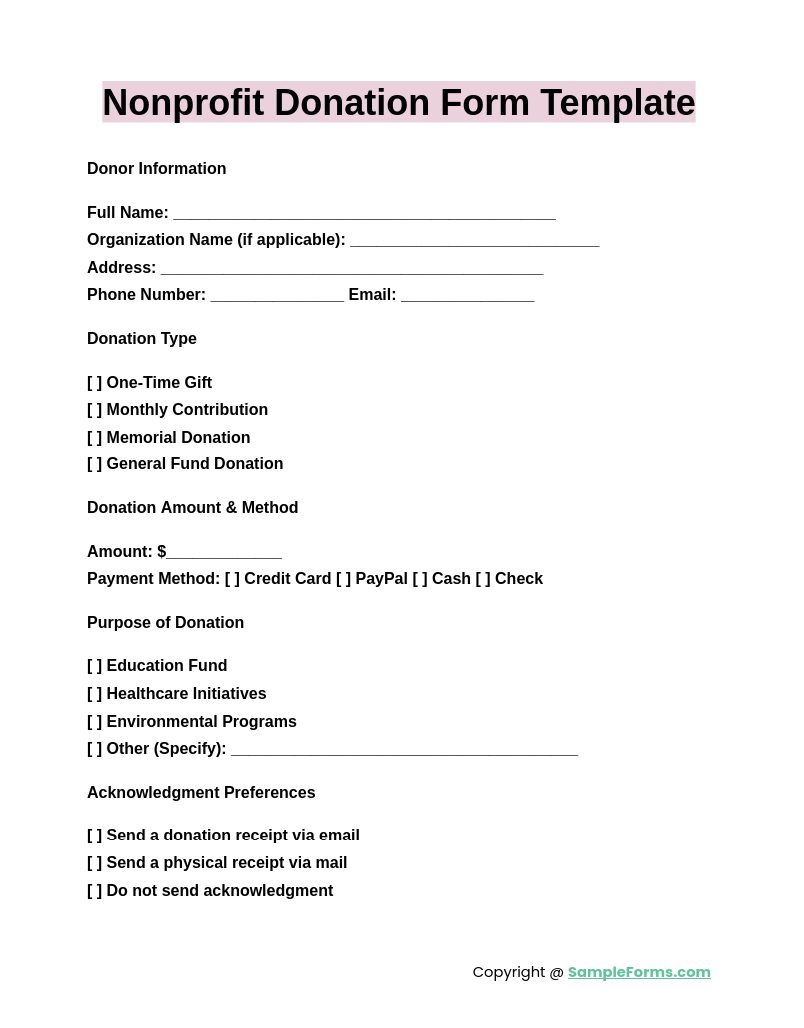

Nonprofit Donation Form Template

A Nonprofit Donation Form Template simplifies the donation process by offering a pre-structured layout. Similar to a Blood Donation Form, it collects necessary donor information, ensuring secure and systematic record-keeping for nonprofit organizations.

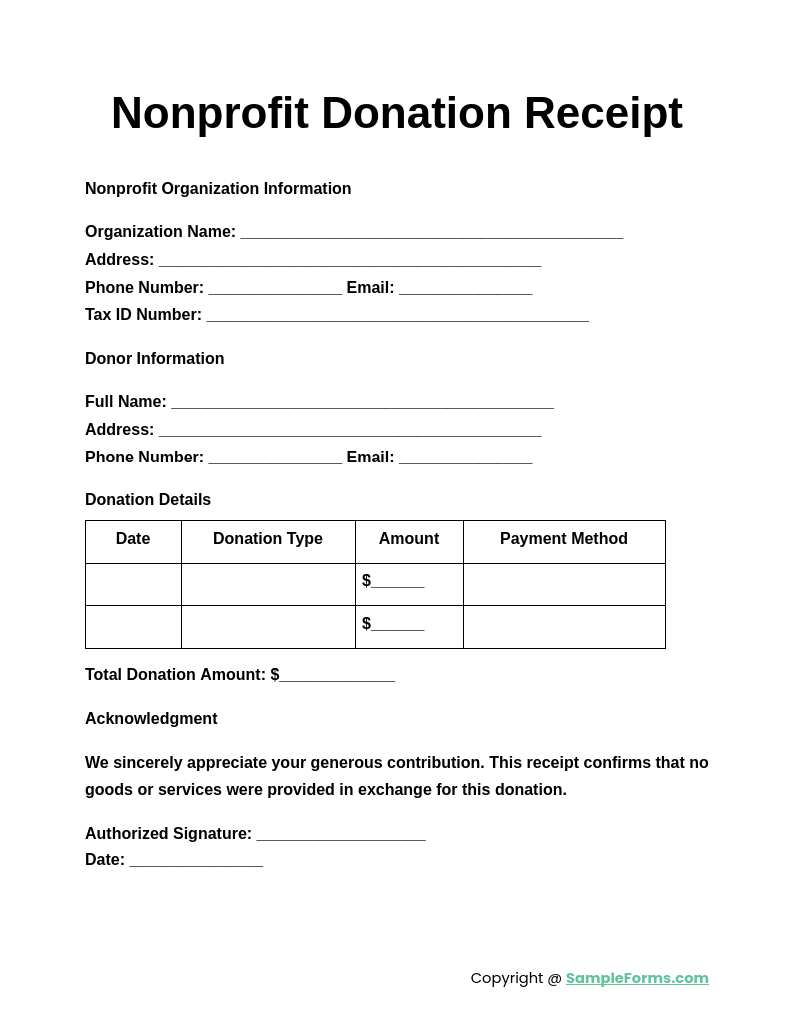

Nonprofit Donation Receipt

A Nonprofit Donation Receipt is essential for acknowledging contributions and tax deductions. Similar to a Church Donation Form, it confirms donation details, providing transparency and legal compliance for both donors and nonprofit organizations.

Browse More Nonprofit Donation Forms

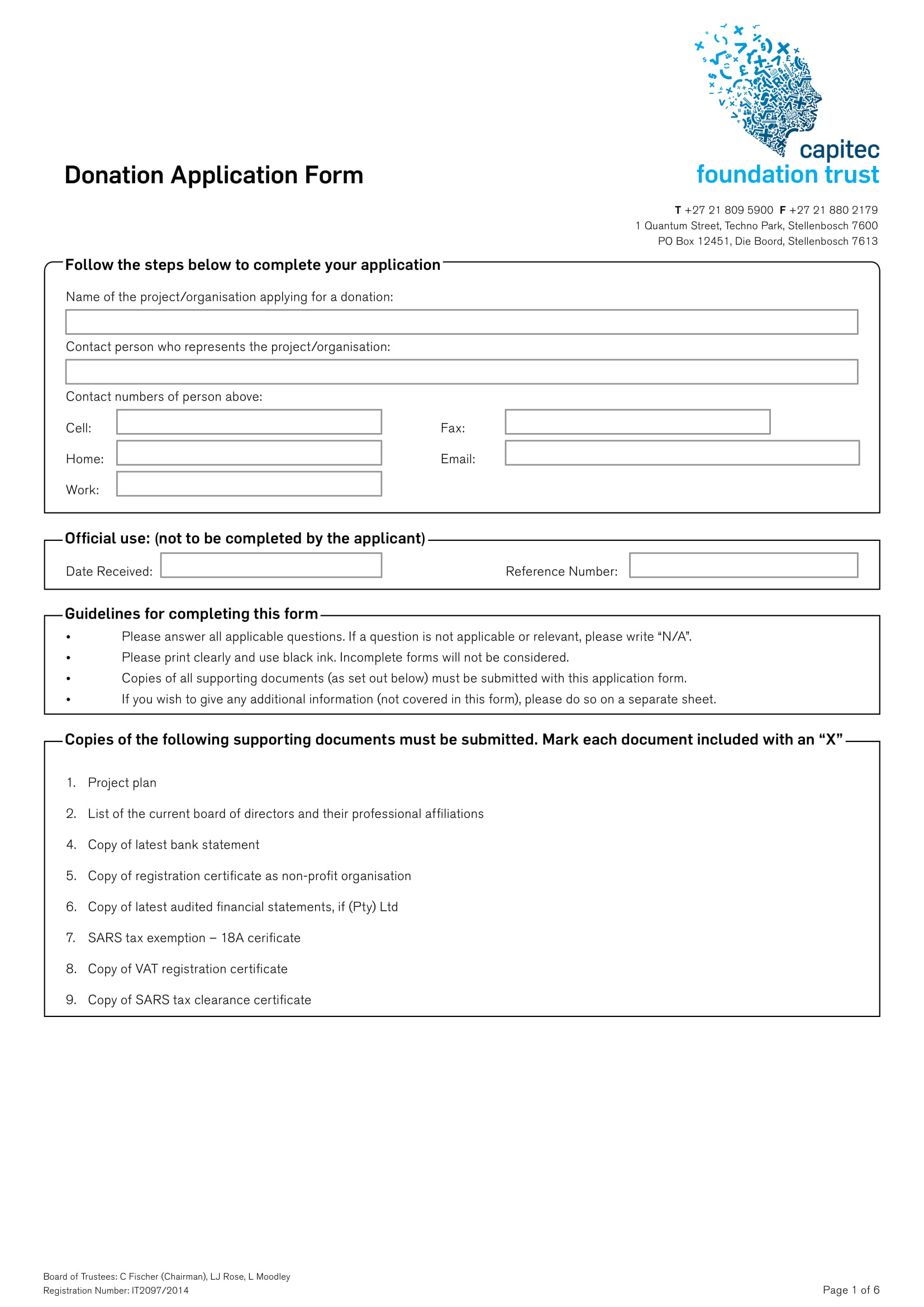

Nonprofit Donation Application Form

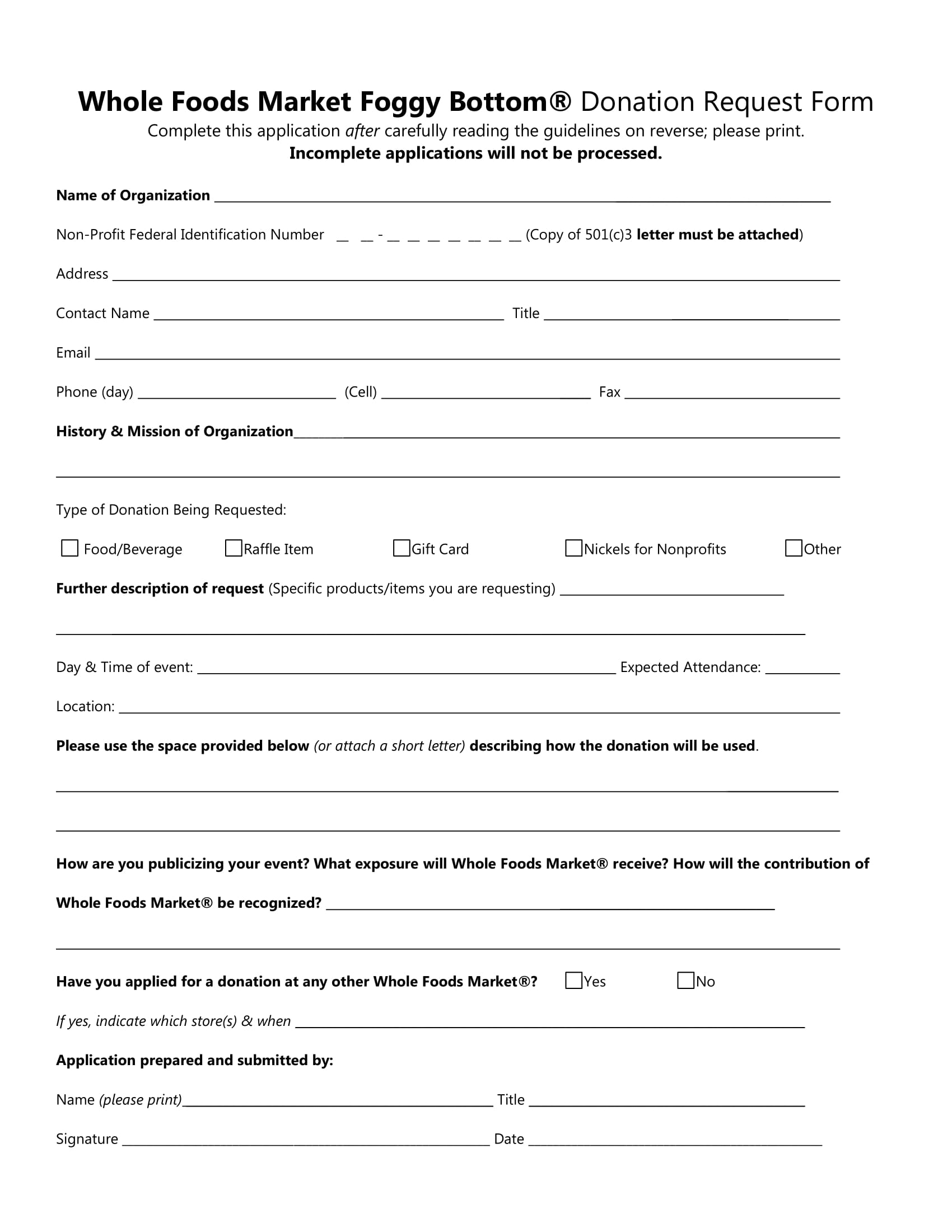

Nonprofit Donation Request Form

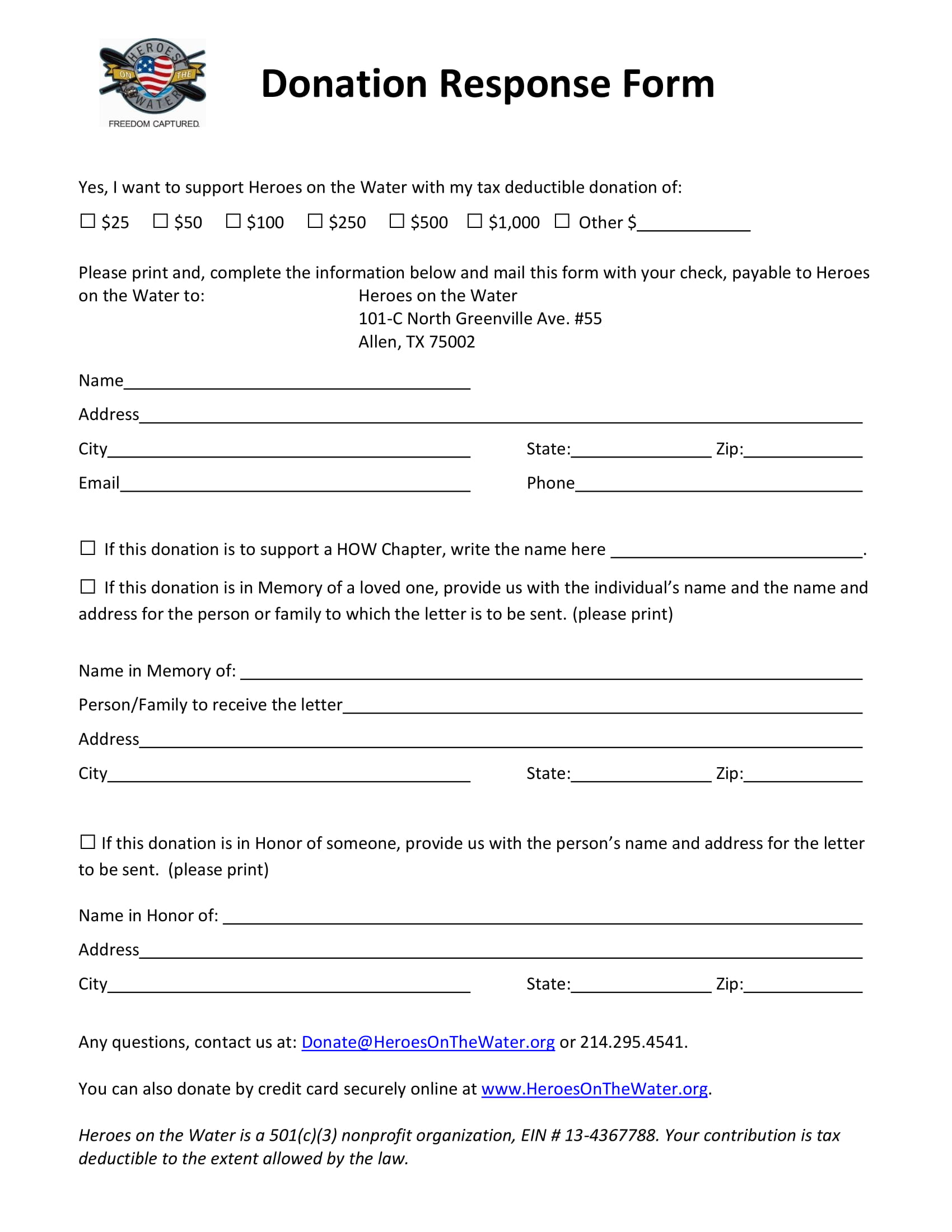

Nonprofit Donation Response Form

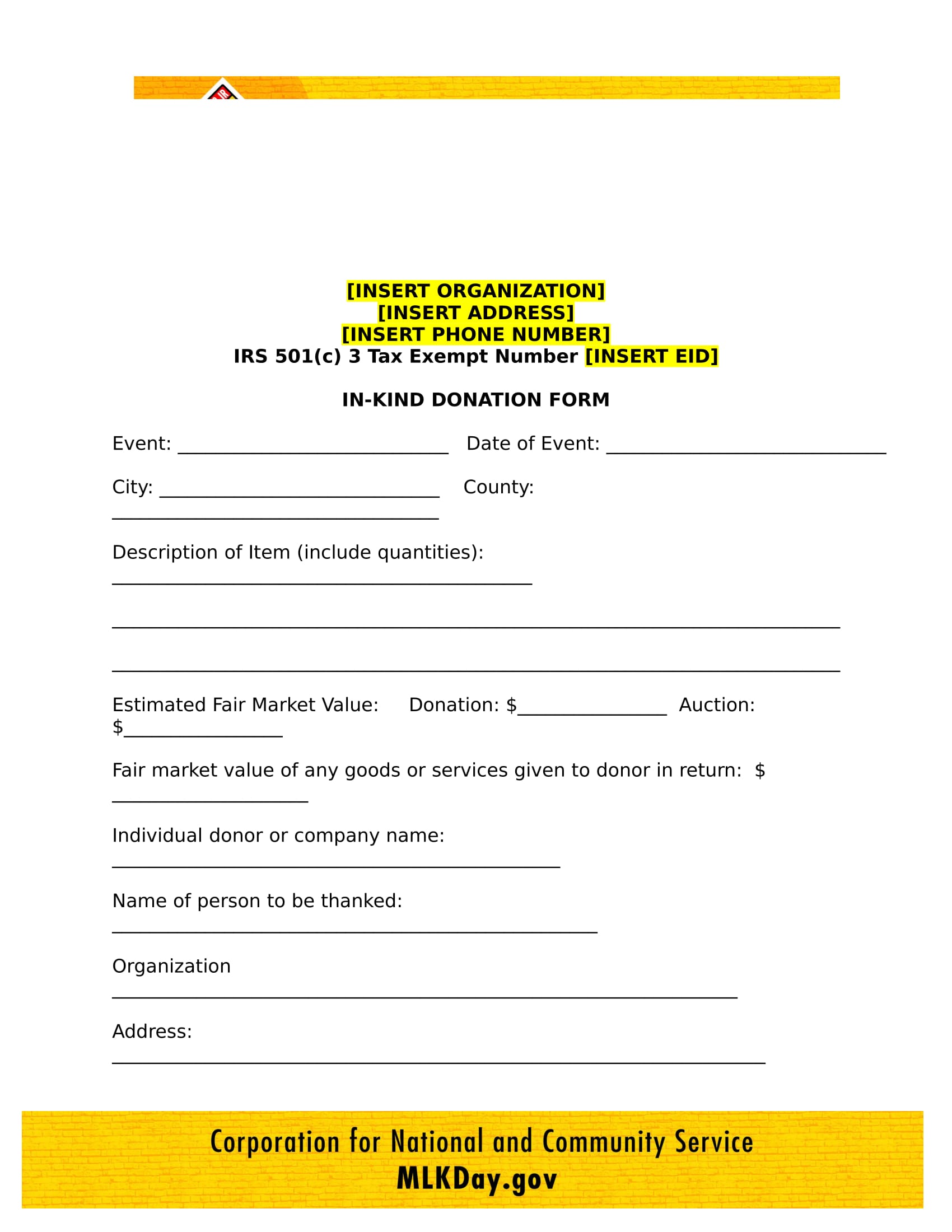

Nonprofit In-Kind Donation Form

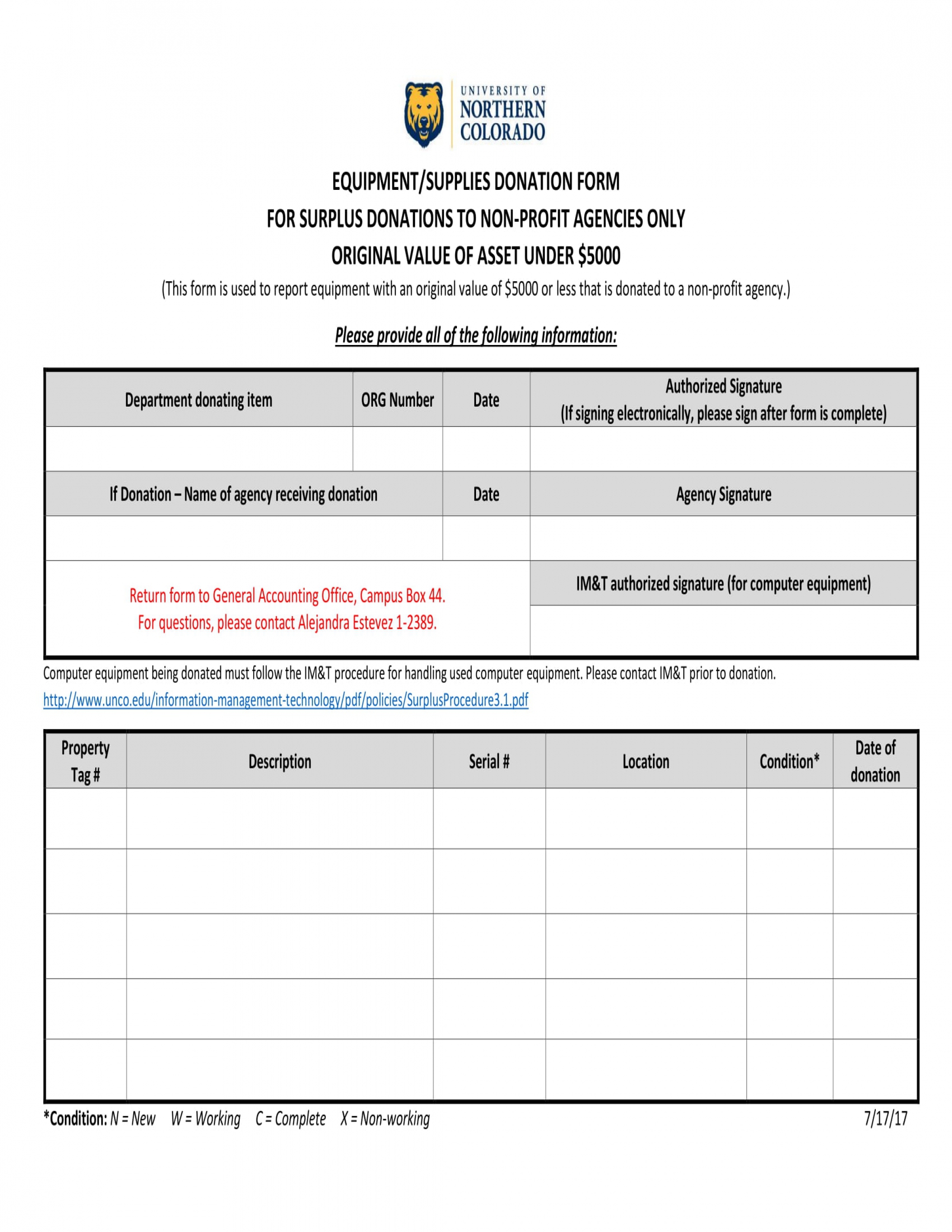

Nonprofit Equipment Donation Form

What Form Do I Need for Nonprofit Donation?

A Nonprofit Donation Form is required to collect and track charitable contributions, ensuring proper donor records and transparency in financial reporting.

- Donor Information: Collects name, contact details, and donation amount.

- Payment Details: Specifies the mode of payment and transaction information.

- Donation Purpose: Clarifies if the contribution supports a specific program or general fund.

- Tax Deduction Statement: Indicates if the donation is tax-deductible.

- Acknowledgment Section: Provides space for the nonprofit to confirm receipt. You may see our Financial Aid Form

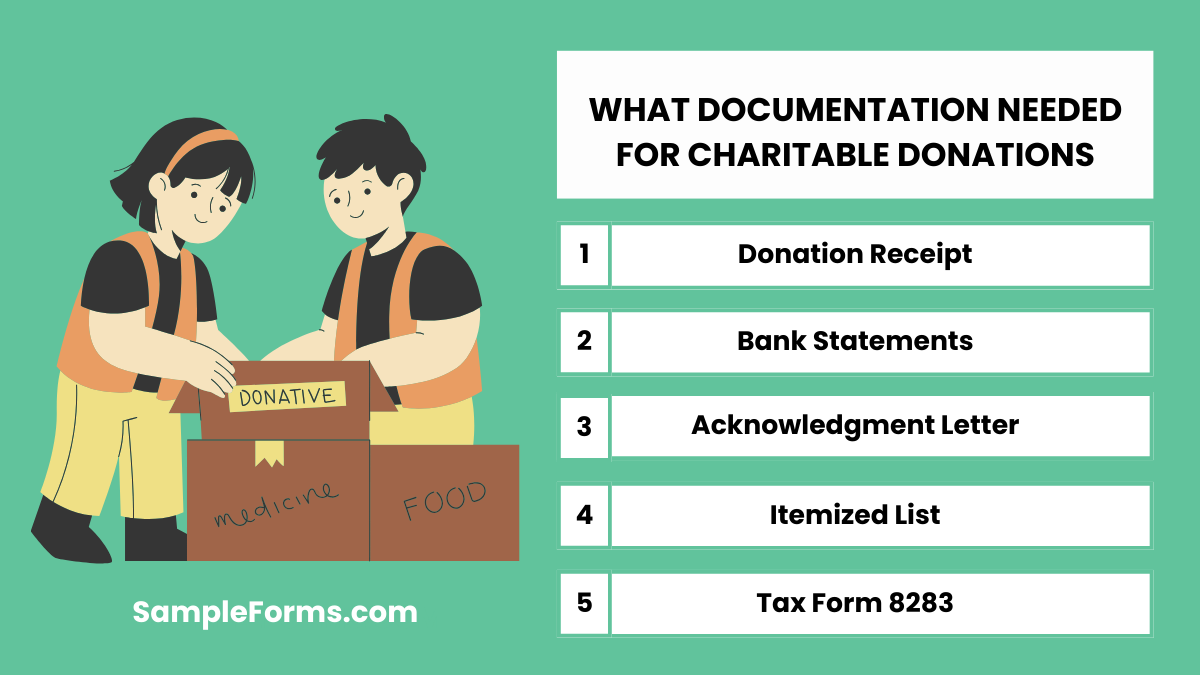

What Documentation Do I Need for Charitable Donations?

Proper documentation ensures compliance and transparency in charitable giving, much like an Organ Donation Form, which records consent for donation.

- Donation Receipt: Confirms the amount and recipient of the donation.

- Bank Statements: Provides proof of electronic or check donations.

- Acknowledgment Letter: Issued by the nonprofit for tax records.

- Itemized List: Details in-kind donations, such as goods or services.

- Tax Form 8283: Used for donations exceeding $500 in value.

What is the Proof for Donation?

Proof of donation ensures accountability and tax benefits, similar to a Refuse Organ Donation Form, which records an individual’s decision on donation.

- Official Receipt: Issued by the nonprofit acknowledging the contribution.

- Email Confirmation: Digital verification of online donations.

- Bank Transaction Record: Verifies direct deposits or electronic payments.

- Check Image: Provides physical proof of a written donation.

- Letter of Thanks: Acts as an acknowledgment and appreciation from the nonprofit.

How Do You Record Donations for a Nonprofit?

Accurate donation recording ensures proper financial management, just like a Car Donation Form documents vehicle donations for tax and ownership transfer.

- Use Donation Software: Automates tracking and financial reporting.

- Maintain Donor Database: Records donor details and contribution history.

- Generate Receipts: Provides official acknowledgment for each donation.

- Categorize Funds: Allocates donations to specific programs or general funds.

- Audit Transactions: Regularly review donation records for accuracy.

How Do Nonprofits Keep Track of Donations?

Tracking donations ensures financial transparency and donor trust, similar to a Charity Form, which helps manage fundraising and philanthropic contributions.

- Use Accounting Software: Tracks contributions and generates reports.

- Issue Donation Receipts: Provides proof for tax and financial records.

- Maintain Financial Logs: Documents every incoming donation systematically.

- Assign Unique Donor IDs: Helps track repeat contributions easily.

- Conduct Regular Audits: Ensures compliance with financial regulations.

Does the IRS need proof of charitable donations?

Yes, the IRS requires proof for tax deductions. Similar to a Real Estate Offer Form, documentation must include receipts, bank statements, or written acknowledgments from the nonprofit.

Do you have to be a 501c3 to accept donations?

No, but 501(c)(3) status ensures tax-exempt benefits. Similar to an Offer to Purchase Real Estate Form, official recognition provides credibility and incentives for donors seeking tax deductions.

What does a 501c3 donation receipt look like?

A donation receipt includes donor details, contribution amount, and tax exemption status. Similar to a Purchase Offer Form, it serves as legal proof of the transaction.

How to set up a nonprofit donation page?

Create a secure donation page with payment options. Similar to a Grant Proposal Form, it must clearly present the nonprofit’s mission and funding needs to attract contributions.

Are nonprofits required to give receipts?

Yes, nonprofits must issue receipts for tax purposes. Similar to a Grant Application Form, documentation ensures compliance with financial regulations and donor transparency.

Can I make donations to my own nonprofit?

Yes, but proper documentation is required. Similar to a Grant Deed Form, transactions must follow legal guidelines to avoid conflicts of interest and maintain tax-exempt status.

What is the safest way to make a donation?

Use verified platforms, secure payment methods, or direct bank transfers. Similar to a Grant Review Form, due diligence ensures funds reach the intended nonprofit securely.

What can non-profits get for free?

Nonprofits may receive free software, advertising, and grants. Similar to a Grant Evaluation Form, eligibility depends on meeting specific application criteria set by funding organizations.

What is the IRS donation form for nonprofits?

Nonprofits use IRS Form 990 to report donations. Similar to a Contribution Margin Form, it tracks financial records and ensures compliance with tax regulations.

Do donations need to be reported to the IRS?

Yes, donations above $250 require reporting. Similar to a Gift Affidavit Form, nonprofits must provide acknowledgment letters and maintain transparent records for tax purposes.

A Nonprofit Donation Form is essential for effective fundraising. It streamlines the donation process, ensuring accuracy and security in financial transactions. A well-crafted form improves donor experience, increasing contribution rates for nonprofit organizations. Digital forms offer seamless integration with payment gateways, while physical forms provide a personal touch at events and fundraisers.

Related Posts Here

-

Contest Registration Form

-

Waiting List Form

-

Restaurant Schedule Form

-

Mobile Home Bill of Sale

-

Landlord Consent Form

-

60-Day Notice to Vacate Form

-

Financial Statement Form

-

Product Evaluation Form

-

Construction Contract

-

School Receipt Form

-

Restaurant Training Form

-

Daily Cash Log

-

Volleyball Evaluation Form

-

Holding Deposit Agreement Form

-

License Agreement Short Form