Embark on a journey of legal empowerment with our New Hampshire Power of Attorney (POA) Form guide. Tailored for New Hampshire residents, this resource simplifies the process of delegating decision-making authority. Learn to select a reliable agent, understand state-specific legal nuances, and effectively utilize POA forms. Our expert tips ensure a smooth, legally sound experience, safeguarding your interests. Ideal for those seeking clarity and confidence in managing personal or financial affairs with ease.

What is the New Hampshire Power of Attorney Form?

The New Hampshire Power of Attorney Form is a legal document that allows you to appoint someone else, known as an agent, to make decisions and take actions on your behalf. This can include managing your finances, property, or making healthcare decisions. The person you choose will have the authority to handle your affairs as specified in the form, which is particularly useful if you’re unable to manage your own affairs for any reason.

What is the Best Sample New Hampshire Power of Attorney Form?

Below is a sample template for a New Hampshire Power of Attorney Form with fillable blanks. Please note that this is a basic template and might need to be customized to fit specific legal requirements or personal circumstances. It’s always recommended to consult with a legal professional for advice and customization.

NEW HAMPSHIRE POWER OF ATTORNEY FORM

Principal’s Information:

- Name: [___________]

- Address: [___________]

- Phone Number: [___________]

Agent’s Information:

- Name: [___________]

- Address: [___________]

- Phone Number: [___________]

Powers Granted:

- Financial Decisions

- Real Estate Transactions

- Personal and Family Maintenance

- Business Operations

- Health Care Decisions

- Other: [___________]

Special Instructions:

- [___________]

Effective Date:

- Immediately

- Upon Disability or Incapacity

- Date: [___________]

Duration:

- Indefinite

- Specific End Date: [___________]

Signatures:

- Principal’s Signature: [___________]

- Date: [___________]

- Agent’s Signature: [___________]

- Date: [___________]

Notarization (if required):

- State of New Hampshire, County of [___________]

- On [Date], before me, [Notary’s Name], personally appeared [Principal’s Name], known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

- In witness whereof, I hereunto set my hand and official seal.

- Notary Public: [___________]

- My Commission Expires: [___________]

This form should be tailored to fit your specific needs and must comply with New Hampshire state laws. Ensure that all information is accurate and the form is notarized if required.

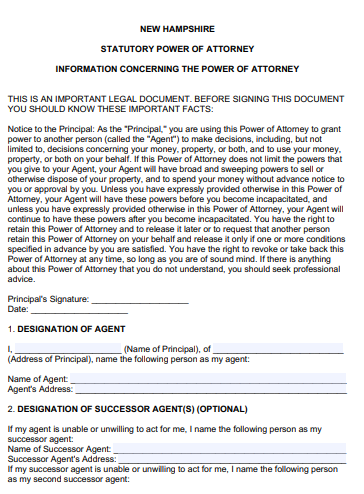

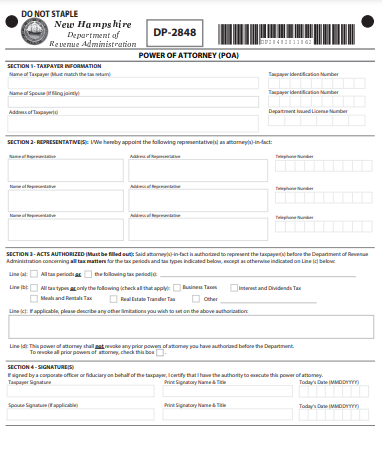

1. New Hampshire Statutory Power of Attorney Form

2. New Hampshire Simple Power of Attorney Form

3. New Hampshire Real Estate Power of Attorney Form

4. New Hampshire Printable Power of Attorney Form

5. New Hampshire Power of Attorney Form

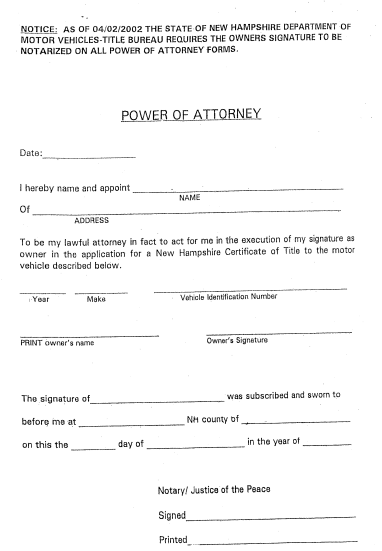

6. New Hampshire Motor Vehicle Power of Attorney Form

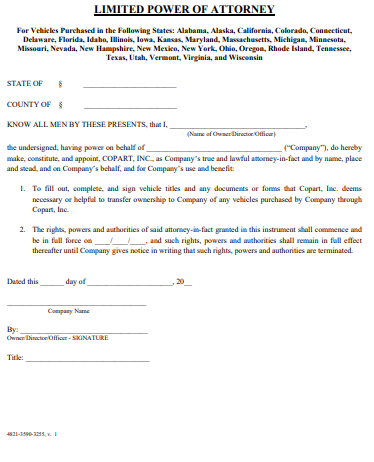

7. New Hampshire Limited Power of Attorney Form

8. New Hampshire Health Care Power of Attorney Form

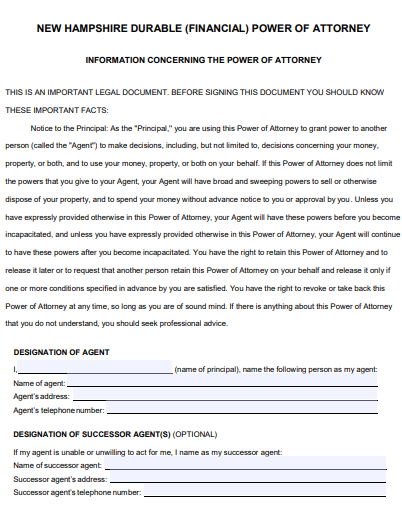

9. New Hampshire Financial Power of Attorney Form

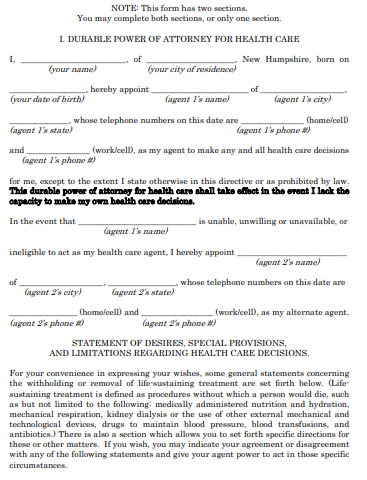

10. New Hampshire Durable Power of Attorney Form

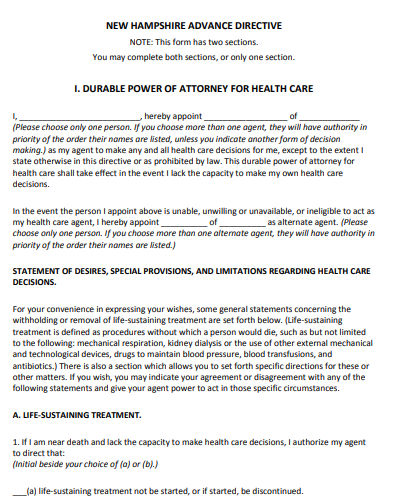

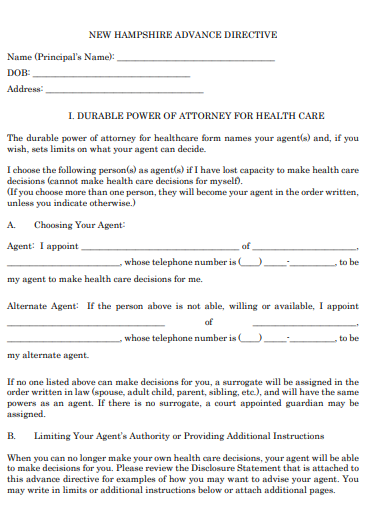

11. New Hampshire Advance Directives Power of Attorney Form

When to Use a New Hampshire Power of Attorney?

A New Hampshire Power of Attorney (POA) is crucial when you need someone to handle your affairs due to absence, illness, or incapacity. It’s a legal approach to ensure your financial, health, or legal matters are managed according to your wishes, providing peace of mind and continuity in decision-making.

Examples

- Health Incapacitation: If you’re unable to make healthcare decisions, a Healthcare POA allows an agent to decide on your behalf.

- Overseas Travel: Use a POA to manage financial or property matters while you’re abroad.

- Elderly Care: Seniors often use a POA for managing their affairs when they are no longer able to do so themselves.

- Business Management: Business owners may need a POA to delegate business decisions during their absence.

- Real Estate Transactions: Authorize someone to handle property sales or purchases if you’re unavailable or incapacitated.

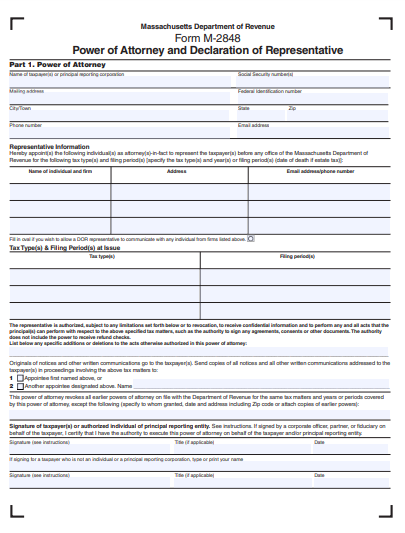

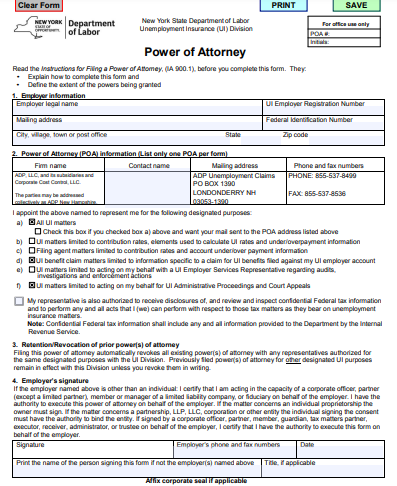

What is a Financial Power of Attorney (POA)?

A Financial Power of Attorney (POA) is a legal document that grants an appointed individual, known as an agent, the authority to manage your financial affairs. This may include handling bank transactions, managing investments, and dealing with property matters.

Examples

- Bank Transactions: Authorizing an agent to access and manage your bank accounts.

- Real Estate Management: Empowering an agent to sell, buy, or maintain property.

- Investment Decisions: Allowing an agent to handle stocks, bonds, and other investments.

- Bill Payments: Enabling an agent to pay your bills and manage expenses.

- Tax Matters: Authorizing an agent to file taxes and handle tax-related issues.

What Types of Power of Attorneys Are Available in New Hampshire?

New Hampshire offers various types of Power of Attorneys, including General, Durable, Medical, Limited, and Springing POAs, each serving different purposes and needs.

Examples

- General POA: Grants broad powers over financial and business matters.

- Durable POA: Remains effective even if the principal becomes incapacitated.

- Medical POA: Allows healthcare decisions on the principal’s behalf.

- Limited POA: Grants authority for specific tasks or limited time.

- Springing POA: Becomes effective upon a specified event or condition.

What Are the Legal Requirements of a Financial POA in New Hampshire?

In New Hampshire, a Financial POA must be in writing, signed by the principal, witnessed, and notarized. It should clearly state the powers granted and comply with state laws.

Examples

- Written Document: A formal, written POA agreement.

- Principal’s Signature: The principal must sign the document.

- Notarization: A notary public must notarize the document.

- Witnesses: Typically requires one or more witnesses.

- Clear Terms: Explicitly stated powers and limitations.

Who Can Be Named an Agent in New Hampshire?

In New Hampshire, an agent in a POA can be anyone the principal trusts, such as a family member, friend, attorney, or financial advisor, capable of handling responsibilities effectively.

Examples

- Family Member: A trusted relative like a spouse or adult child.

- Friend: A close, reliable friend.

- Attorney: A legal professional with expertise in financial matters.

- Financial Advisor: An expert in managing financial affairs.

- Trustee: Someone experienced in handling trust operations.

When Does My Durable Financial POA Take Effect?

A Durable Financial POA in New Hampshire takes effect as specified in the document. It can be immediate or upon the occurrence of a future event, like the principal’s incapacity.

Examples

- Immediate Effect: Becomes active as soon as it’s signed and notarized.

- Upon Incapacity: Activates when the principal is deemed incapacitated.

- Specific Date: Starts functioning from a predetermined date.

- Upon Specific Event: Triggered by a particular event, as defined in the POA.

- Revocation: Remains effective until explicitly revoked by the principal.

How to Prepare a New Hampshire Power of Attorney Form

Understanding the Purpose

Begin by recognizing the role of a Power of Attorney (POA) in New Hampshire. This legal document allows you to appoint an agent to make decisions on your behalf, covering areas like finance, health, or legal matters.

Selecting the Right Type of POA

Choose the appropriate POA form for your needs: General, Durable, Medical, Limited, or Springing. Each type serves different purposes, like a Durable POA, which remains effective if you become incapacitated.

Choosing Your Agent

Select a trustworthy individual as your agent. This person should be reliable, understand your values, and capable of making decisions in your best interest. Consider their proximity, availability, and willingness to take on this responsibility.

Drafting the Document

Use a standard New Hampshire POA form or seek legal assistance for drafting. The form should include your name, the agent’s name, the powers granted, and the conditions under which the POA becomes effective.

Defining Powers and Limitations

Clearly outline the powers you are granting to your agent. Specify what they can and cannot do to avoid future misunderstandings or misuse of the POA.

Legal Requirements

Ensure that the POA complies with New Hampshire state laws. It typically needs to be signed by you and notarized. Some forms might have additional requirements, especially for a Medical POA.

Signing and Notarization

Sign the document in the presence of a notary. This step is essential for the legal standing of the POA in New Hampshire. The notary public will verify your identity and your intention to sign the document.

Distributing Copies

Provide a copy of the signed POA to your agent and keep one for your records. Inform relevant parties, such as your bank or healthcare provider, about the POA.

Regular Updates

Review and update your POA periodically. Changes in your life situation or New Hampshire law may necessitate adjustments to your POA.

Tips for Using Effective New Hampshire Power of Attorney Form

Choosing the Right Agent

Your agent should be someone who communicates effectively, understands your preferences, and respects your autonomy. Their ability to make informed decisions under pressure is crucial.

Specificity in Powers Granted

Define the scope of authority in clear terms. This precision in the POA document ensures that your agent acts within the boundaries you’ve set, leading to more effective decision-making.

Communicating Your Wishes

Have an open discussion with your agent about your expectations and wishes. Clear communication is key to ensuring that your agent makes decisions that align with your preferences.

Seeking Legal Advice

Consider consulting a lawyer who specializes in New Hampshire POA laws. They can provide guidance on drafting an effective POA and ensure it meets all legal requirements.

Regular Reviews

Life changes can affect the relevance of your POA. Regularly review and update the document to reflect your current wishes and circumstances, maintaining its effectiveness.

Educating Your Agent

Ensure your agent understands their responsibilities and the extent of their powers. Educating them about New Hampshire laws related to POA can lead to more informed and effective decision-making.

Accessibility of the Document

Keep the POA document accessible to your agent and relevant parties. In emergencies, quick access to the document is crucial for effective action.

Monitoring the Agent’s Actions

Regularly check in on your agent’s decisions. This oversight ensures they are acting in your best interest and according to your specified terms.

Planning for Contingencies

Include provisions for alternate agents in case your primary agent is unable or unwilling to serve. This foresight ensures continuous effective management of your affairs.

Respecting Your Wishes

Ensure your agent respects and adheres to your wishes. Effective communication and a mutual understanding of expectations are key to a successful POA arrangement in New Hampshire.

How Can I Get Power of Attorney in New Hampshire?

To obtain a Power of Attorney in New Hampshire, choose the right form, fill it out, have it signed and notarized, and distribute copies as needed.

Do I Need to Have a New Hampshire PoA?

Having a New Hampshire POA is essential for ensuring someone can legally manage your affairs if you’re unable to do so yourself.

Which Type of Power of Attorney Do I Need in New Hampshire?

The type of POA needed in New Hampshire depends on your specific needs: General, Durable, Medical, or Limited POA.

Do I Need a Lawyer for My New Hampshire PoA?

While not mandatory, consulting a lawyer for a New Hampshire POA ensures legal accuracy and alignment with your needs.

How Much Might I Typically Pay for a Lawyer to Help Me Get a Power of Attorney Form in New Hampshire?

Legal fees for a POA in New Hampshire vary, typically ranging from a few hundred to over a thousand dollars.

Are There Any Additional Steps That I Should Take After I Have Made a New Hampshire Power of Attorney?

After creating a New Hampshire POA, inform relevant parties, keep it accessible, and review it regularly for any necessary updates.

This comprehensive guide simplifies the process of creating a New Hampshire Power of Attorney Form. By carefully selecting an agent, understanding legal requirements, and utilizing our practical tips, you can ensure your affairs are managed effectively. Regular reviews and clear communication are key to maintaining a legally sound and functional Power of Attorney, providing peace of mind and security in managing your personal and financial matters.

Related Posts

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Massachusetts (MA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kentucky (KY) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Indiana (IN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Illinois (IL) Power of Attorney Form Download – How to Create Guide, Tips