A Mortgage Form is a pivotal document in the realm of property financing, serving as the foundation for one of the most significant financial commitments an individual might make. This document captures the terms, conditions, and intricate details binding both the borrower and lender in the property purchase process. From diverse types to nuanced creation methods, understanding these printable form is essential for a seamless home-buying journey. Delving into its meaning, types, and best practices ensures both clarity and informed decision-making in the mortgage world.

What is a Mortgage Form ? – Definition

A Mortgage Form is a legal document that establishes a secured loan agreement where real estate property is used as collateral. In this agreement, the borrower pledges the property to the lender as security for the loan. If the borrower fails to meet the repayment terms, the lender has the right to take possession of the property through a legal process known as foreclosure. The Mortgage Form outlines the terms and conditions of the loan, including the interest rate, repayment schedule, duration of the loan, and rights and responsibilities of both parties involved. It is a binding contract that ensures both the lender’s investment is protected and the borrower’s obligations are clearly defined.

What is the Meaning of a Mortgage Form?

The meaning of a Mortgage Form extends beyond just being a document; it symbolizes a mutual agreement between a borrower and a lender. At its core, a Mortgage Form represents a borrower’s promise to repay a loan under specified terms while using real estate as collateral. For the lender, it provides the legal right to claim the property if the borrower defaults on their payments. These fillable form details the loan amount, interest rate, payment structure, property specifics, and potential penalties, among other conditions. Essentially, it acts as a safety net for the lender while defining the borrower’s responsibilities, ensuring both parties are protected and informed.

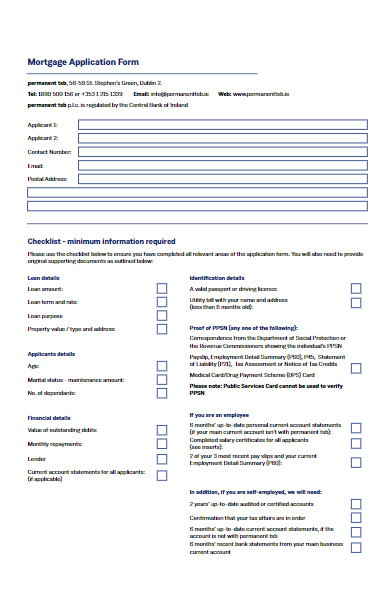

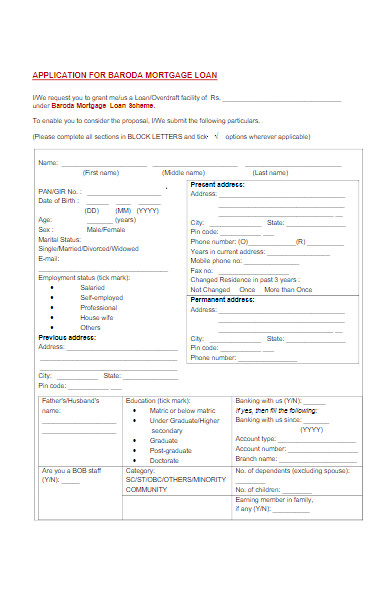

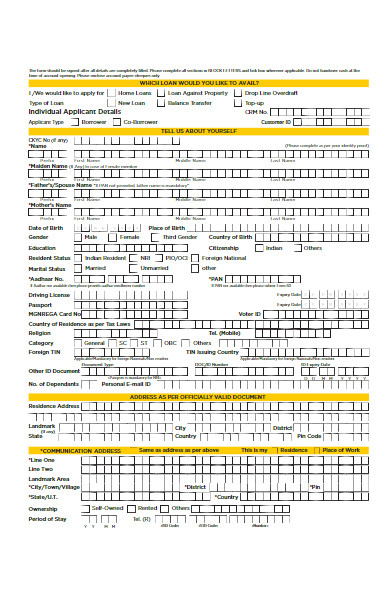

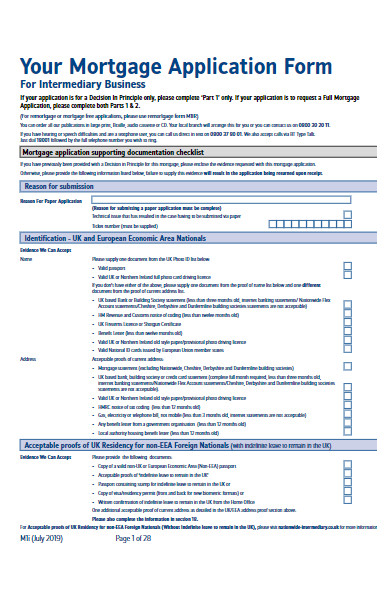

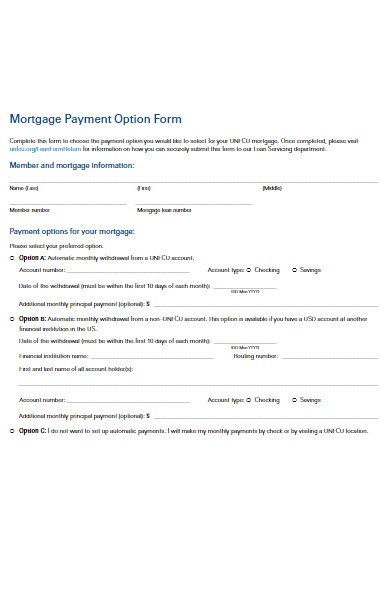

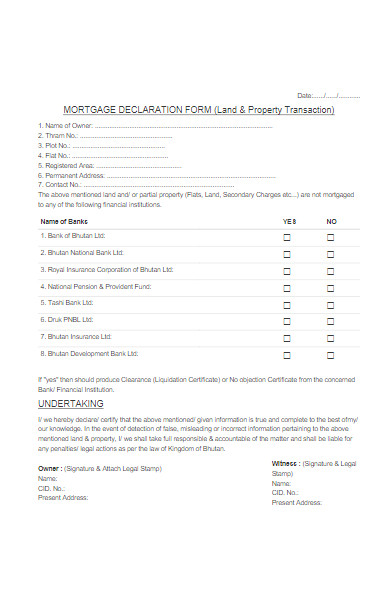

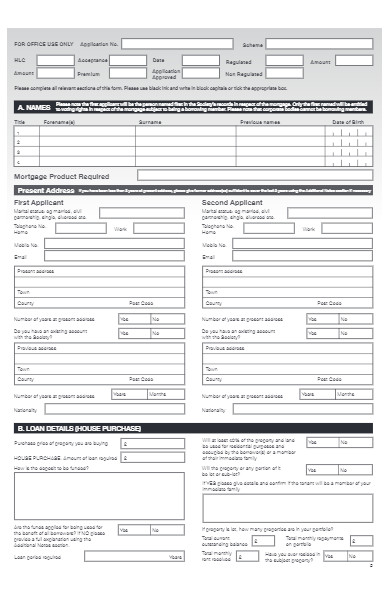

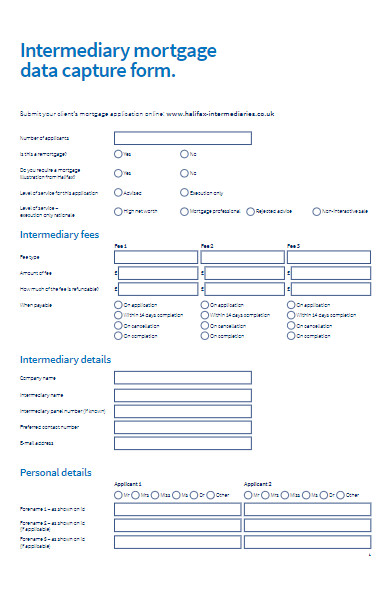

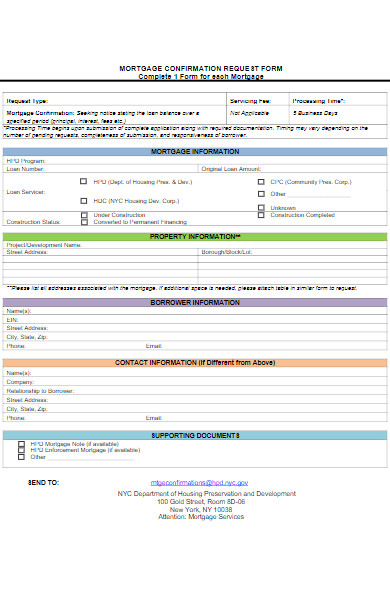

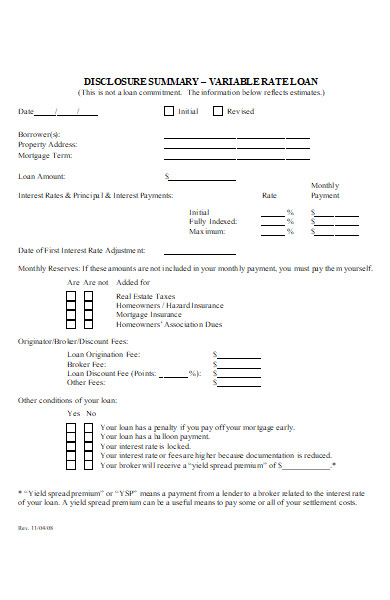

What is the Best Sample Mortgage Form?

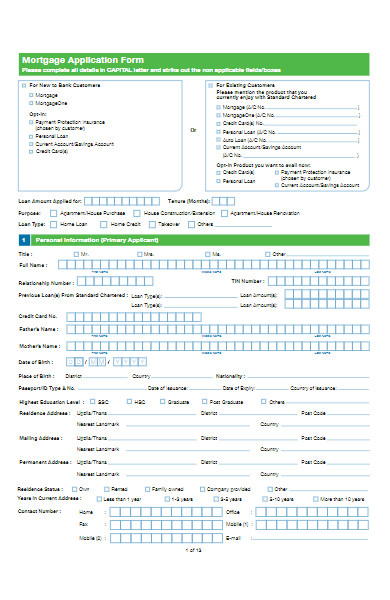

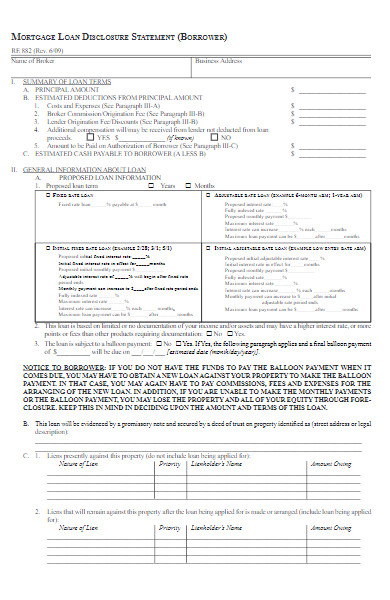

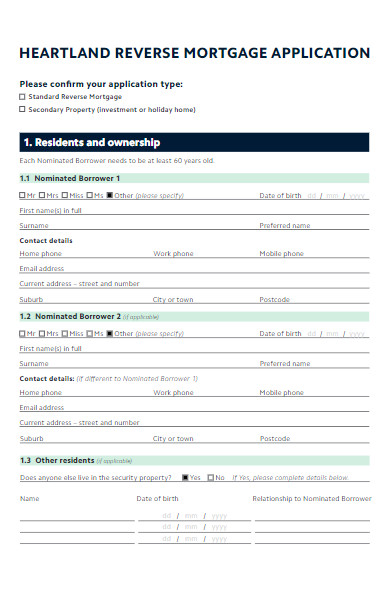

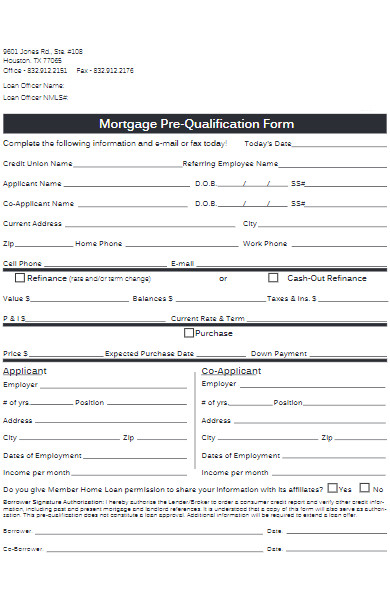

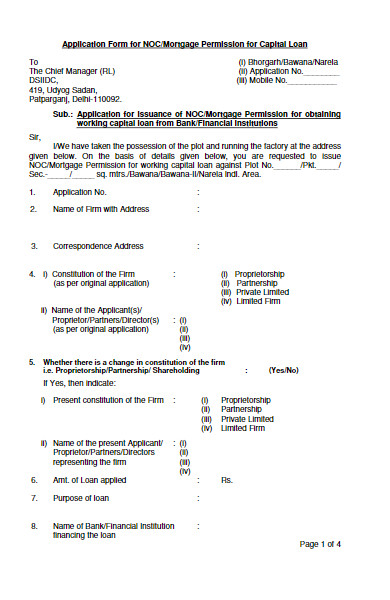

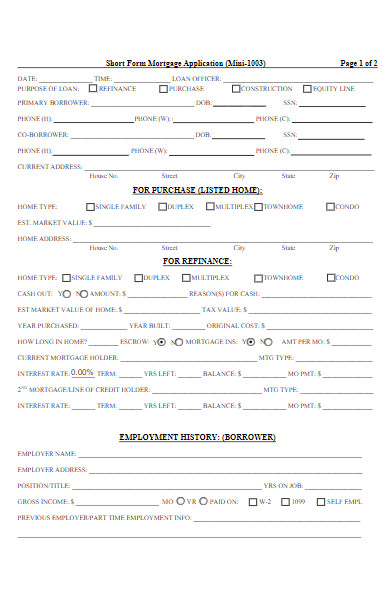

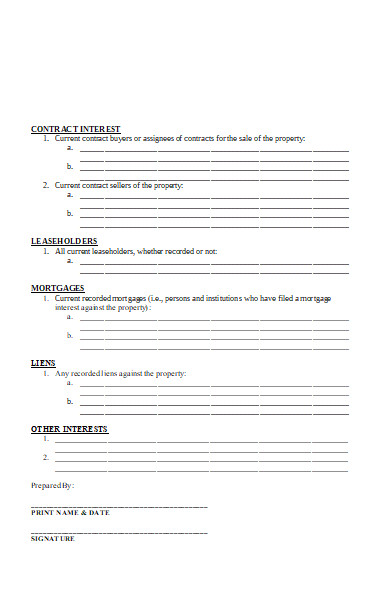

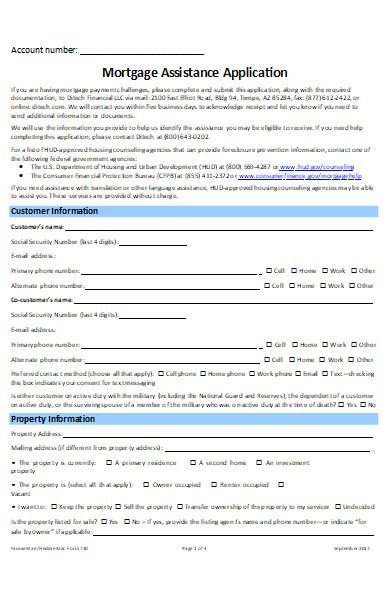

The best sample Mortgage Form would be contingent on various factors like the jurisdiction, type of property, loan specifics, and the unique requirements of both the lender and borrower. However, a standard Mortgage Form typically encompasses the following components:

-

Parties Involved:

- Borrower’s name and contact details.

- Lender’s name and contact details.

-

Property Information:

- Legal description of the property.

- Property address.

- Any pertinent identifiers or registration numbers.

-

Loan Details:

- Principal loan amount.

- Interest rate (fixed or adjustable).

- Loan term (e.g., 15 years, 30 years).

- Monthly payment amount.

- Start and end dates of the loan.

-

Default and Penalties:

- Specifics of what constitutes a default.

- Details about penalties or fees in case of late payments or defaults.

- Terms concerning the lender’s right to initiate foreclosure proceedings.

-

Additional Provisions:

- Rights to sell or transfer the mortgage.

- Insurance requirements.

- Tax obligations related to the property.

-

Signatures:

- Signature spaces for both the borrower and lender (or their representatives).

- Date of the agreement.

-

Notary Acknowledgment:

- Space for a notary public to verify and stamp the document, attesting to the identities of the signatories.

Remember, the above is a general outline, and the exact format and content can vary based on local laws, regulations, and individual agreement terms. If you’re looking for a specific Mortgage Form tailored to your needs, it’s essential to consult with a legal professional or specialist in the real estate field in your jurisdiction. They can provide or recommend the most appropriate and comprehensive forms. You should also take a look at our Sample Mortgage Application Forms.

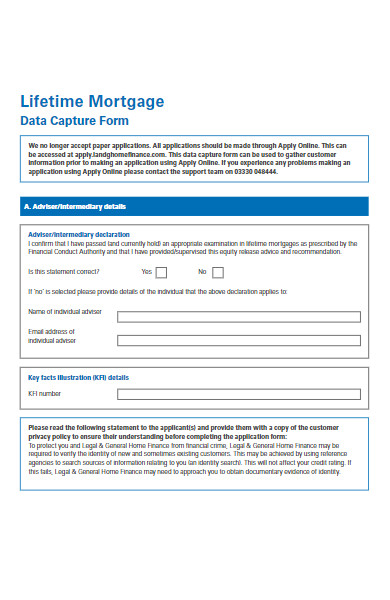

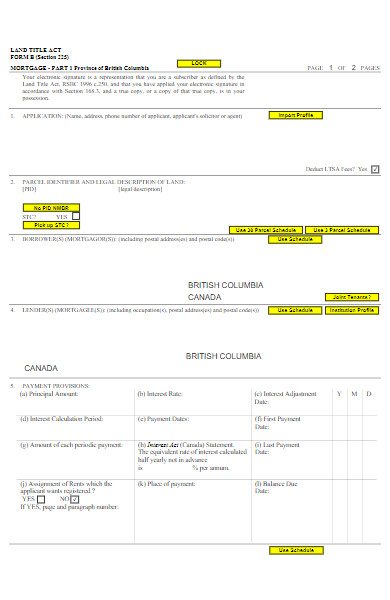

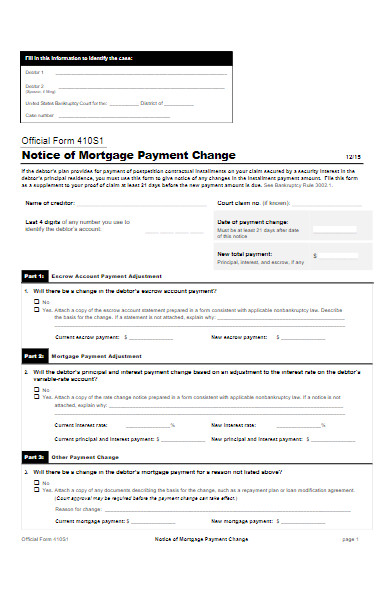

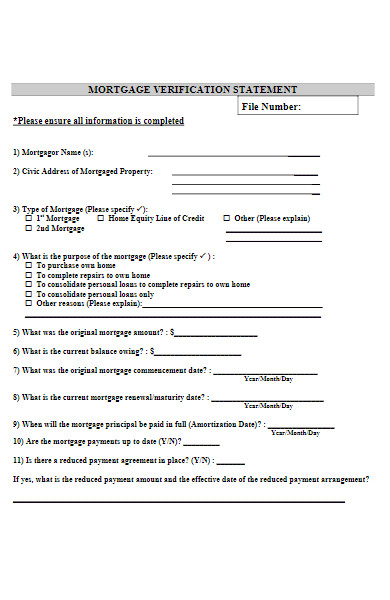

FREE 50+ Mortgage Forms

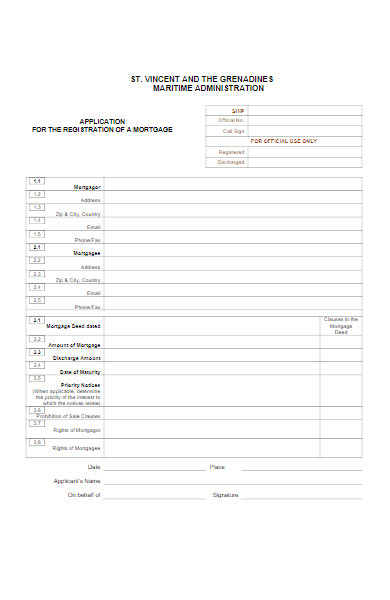

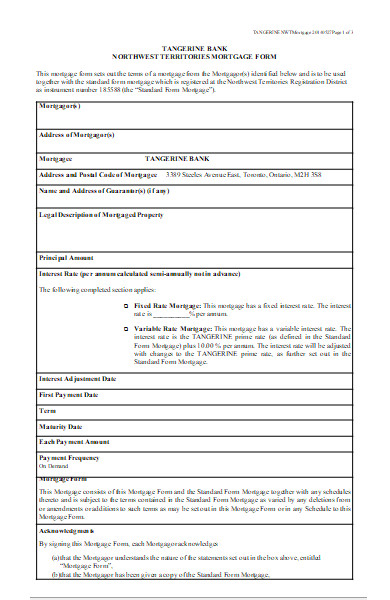

51. Territories Mortgage Form

What is a Mortgage Form and how does it work?

A Mortgage Form is a legal document that represents a secured loan agreement in which a borrower uses real estate property as collateral to obtain a loan from a lender. The form outlines the terms and conditions under which the loan is provided and specifies the borrower’s obligations for repayment.

Here’s how it works:

- Establishment of Collateral: By signing the Mortgage Form, the borrower pledges the property as security. This means if the borrower fails to repay the loan as agreed, the lender has the legal right to take possession of and sell the property, a process known as foreclosure, to recover the owed amount.

- Loan Terms: The Mortgage Form details the principal amount of the loan, the interest rate, the repayment schedule (e.g., monthly payments over 30 years), and other vital terms.

- Protection for the Lender: The form ensures the lender’s investment is protected. If a borrower defaults (fails to meet their repayment obligations), the mortgage provides the lender with a means to recover their funds.

- Rights and Responsibilities: The Mortgage Form clarifies the borrower’s responsibility to maintain the property, keep it insured, pay property taxes, and abide by other stipulated conditions. It also outlines the rights and responsibilities of the lender.

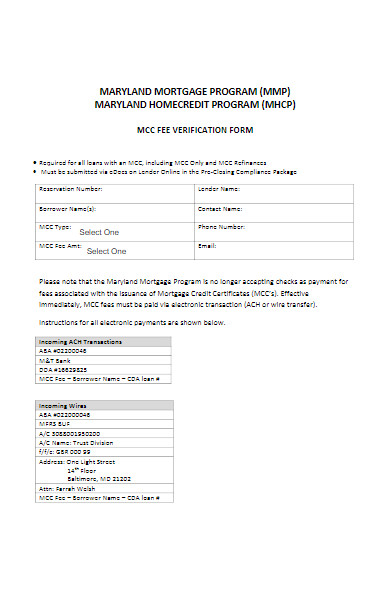

- Recordation: Once signed, the Mortgage Form is typically recorded in the local county or jurisdiction’s public records. This recordation serves as public notice that the property has been used as security for a loan and determines the priority of lenders in case of sale or subsequent mortgages.

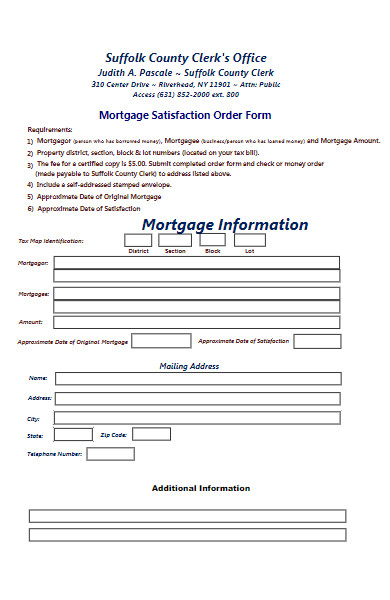

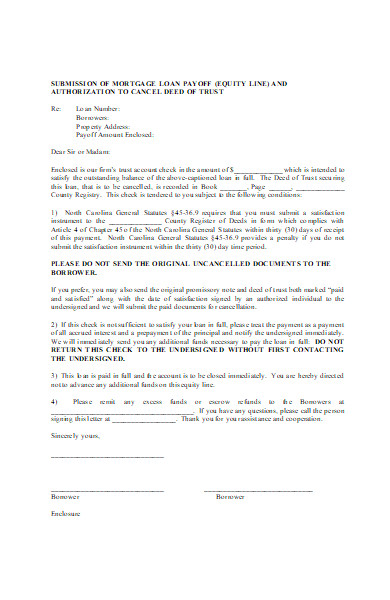

- Release or Satisfaction: Once the loan is fully repaid, the lender is obligated to release the mortgage, indicating that the debt has been satisfied and the property is no longer encumbered by the loan. This is usually done by filing a document, often called a “satisfaction” or “release,” in the public records.

In essence, the Mortgage Form serves as both a contract and a document that conveys an interest in property, ensuring both the borrower and lender’s interests are protected and the terms of the loan are clear and enforceable. Our Mortgage Questionnaire Forms is also worth a look at

Where can I find a sample Mortgage Form online?

Finding a sample Mortgage Form online is relatively straightforward, but it’s essential to ensure that the form you use is appropriate for your jurisdiction and circumstances. Here are some resources where you might find sample Mortgage Forms:

- Local Government Websites: Many county or state government websites provide sample forms or templates for various real estate transactions, including mortgages.

- Legal Document Providers: Websites like:

- LegalZoom

- Rocket Lawyer

- Nolo … offer various legal forms, including Mortgage Forms, often tailored to specific states or jurisdictions.

- Real Estate or Mortgage Associations: Organizations like the Mortgage Bankers Association or National Association of Realtors might offer resources, including sample forms, for industry professionals and consumers.

- Law Libraries: Some law schools or local bar associations have online libraries where you can access legal forms, including those related to real estate transactions.

- Online Platforms for Real Estate Professionals: Websites tailored for real estate agents, brokers, or other professionals sometimes provide sample forms and documents, including Mortgage Forms.

- Lenders’ Websites: Some banks or mortgage lenders might provide sample Mortgage Forms on their websites to give potential borrowers an idea of what to expect.

While there are many resources available online, it’s vital to consult with a real estate attorney or a mortgage professional to ensure that any form you intend to use is legally sound, compliant with local regulations, and appropriate for your specific needs. Different jurisdictions can have varying requirements and nuances in their Mortgage Forms, so always prioritize accuracy and legal compliance. In addition, you should review our Sample Mortgage Questionnaire Forms.

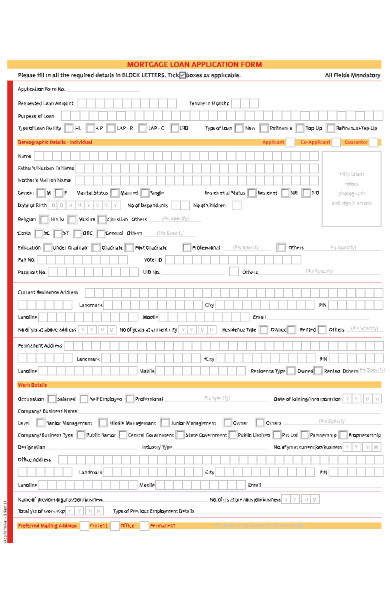

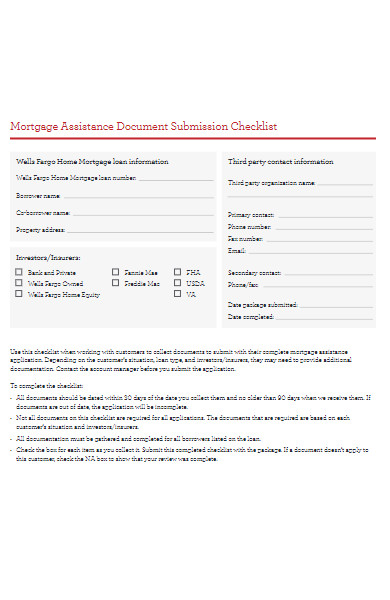

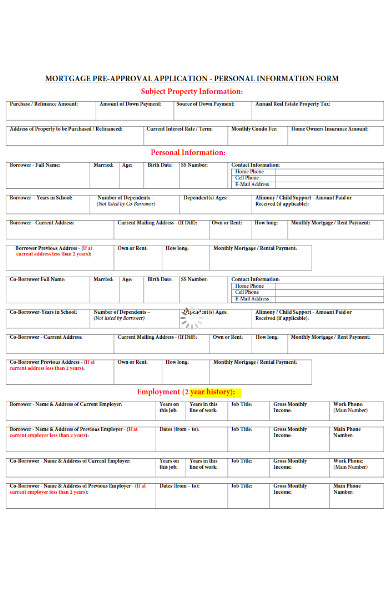

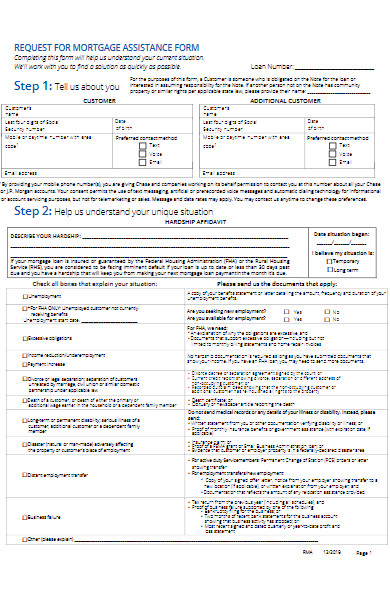

How to fill out a Mortgage Form correctly?

Filling out a Mortgage Form correctly is crucial to ensure the validity of the agreement and avoid potential legal disputes. Here’s a step-by-step guide to assist you:

-

Review the Form:

- Before filling it out, read the entire form to understand its structure and the information required.

-

Borrower and Lender Details:

- Enter the full legal name(s) of the borrower(s) and lender.

- Provide accurate contact information, including addresses.

-

Property Information:

- Fill in the complete address of the property being mortgaged.

- Provide the legal description of the property. This is a detailed and technical description, often referencing lot numbers, block numbers, and recorded plat maps. It might be found on a prior deed or title report.

-

Loan Details:

- Enter the principal loan amount, which is the total amount borrowed.

- Specify the interest rate and whether it’s fixed or adjustable.

- Detail the loan term (e.g., 30 years) and the repayment schedule.

- Include any details about loan origination fees, points, or other charges.

-

Default and Penalties:

- The form will define what constitutes a default (like missing a payment) and the penalties associated. Ensure these sections align with your loan agreement.

-

Additional Provisions and Riders:

- Some mortgages have riders or additional provisions attached, such as those for adjustable-rate mortgages or condos. Attach any applicable riders and fill them out as required.

-

Insurance and Taxes:

- The form might require information about property insurance and property taxes. Ensure you input accurate details regarding who pays them and how they’re escrowed.

-

Review for Accuracy:

- Before signing, review all entries for accuracy. Ensure there are no blank spaces and that all necessary attachments are included.

-

Signatures:

- The borrower (and potentially co-borrowers) must sign and date the form.

- In many jurisdictions, the lender or their representative also signs the form.

-

Notarization:

- Many Mortgage Forms require notarization. If so, do not sign the document until you’re in the presence of a notary public. The notary will verify your identity, witness your signature, and then sign and stamp the form.

-

Recording:

- Once completed and signed, the Mortgage Form is often recorded at the local county recorder’s office or similar entity to provide public notice of the mortgage.

Lastly, and importantly, consider seeking guidance from a real estate attorney or mortgage professional when filling out a Mortgage Form. They can provide expert advice, ensure compliance with local laws, and verify that all terms are in your best interest. You may also be interested in our Satisfaction of Mortgage Forms.

How long is a Mortgage Form valid for after signing?

A Mortgage Form’s validity is generally tied to the term of the loan it represents and the conditions stipulated within the form itself. Here are some points to consider:

- Duration of the Loan: Typically, a mortgage lasts for the duration of the loan it secures. For example, if you have a 30-year loan term, the mortgage would usually be in effect for those 30 years, unless the loan is paid off earlier or refinanced.

- Payoff or Refinance: If the loan is paid off before the end of its term (whether through regular payments, a lump sum, or refinancing), the mortgage becomes satisfied. At this point, the lender should provide a release or satisfaction of mortgage, which is recorded in public records to show that the loan has been paid and the mortgage is no longer in effect.

- Foreclosure: If a borrower defaults on their loan and doesn’t remedy the situation within the allowed timeframe, the lender can initiate foreclosure proceedings. If the property is sold in foreclosure, the proceeds go towards paying off the loan, and the mortgage is typically considered satisfied.

- Extensions or Modifications: In some situations, a borrower and lender might agree to extend or modify the loan terms. In such cases, they might execute a modification agreement, which could extend the validity of the original mortgage form.

- State Laws: The duration and validity of a mortgage can be influenced by state laws and regulations. Some jurisdictions have rules regarding the “dormancy” of a mortgage. For example, if no actions (like payments or notices of default) occur for a certain number of years, the mortgage might be considered dormant and could potentially be removed from public records.

- Expiration Provisions: While rare, some mortgages might have clauses that stipulate an expiration or end date separate from the loan’s payoff. Always check the specific terms of your Mortgage Form.

To determine the specific validity of a Mortgage Form, it’s essential to review the form itself, consider any subsequent loan modifications, and be aware of relevant local and state regulations. If in doubt, consulting with a real estate attorney or mortgage professional can provide clarity. You may also be interested to browse through our other Sample Loan Application Forms.

Do I need a notary for my Mortgage Form?

Yes, in most jurisdictions, a Mortgage Form requires notarization. The purpose of notarization is to verify the identity of the parties signing the document and to ensure that the signatures are provided willingly and without duress. Here’s why notarization is essential for a Mortgage Form:

- Validation and Authenticity: Notarization adds an extra layer of validation, confirming that the individuals signing the document are indeed who they claim to be.

- Fraud Prevention: By requiring the presence of a notary, it reduces the risk of fraudulent activities, such as forgery of signatures.

- Legal Requirement: In many areas, for a Mortgage Form to be recorded in the public records (which provides notice of the mortgage to any potential subsequent purchasers or lenders), it must be notarized.

- Evidence in Disputes: If ever there’s a dispute about the validity of a mortgage, a notarized document can serve as strong evidence in court because it has been verified by an impartial third party.

When having your Mortgage Form notarized:

- Do not sign it in advance. The notary must witness the signing.

- Ensure you have valid photo identification with you, as the notary will need to verify your identity.

- Be aware that there might be a fee associated with notarization unless the lending institution provides this service as part of the loan closing process.

Always check local and state regulations concerning notarization requirements for real estate documents, as these can vary. If in doubt, consult with a real estate attorney or professional in your jurisdiction.

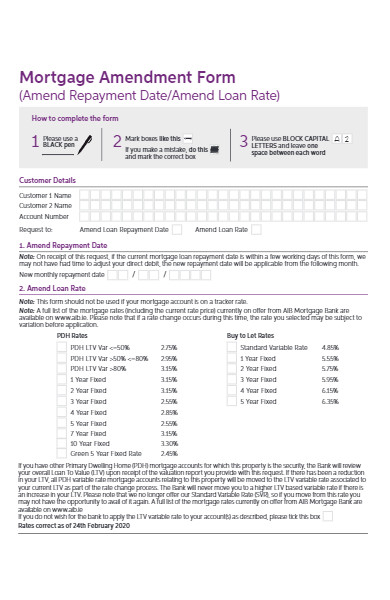

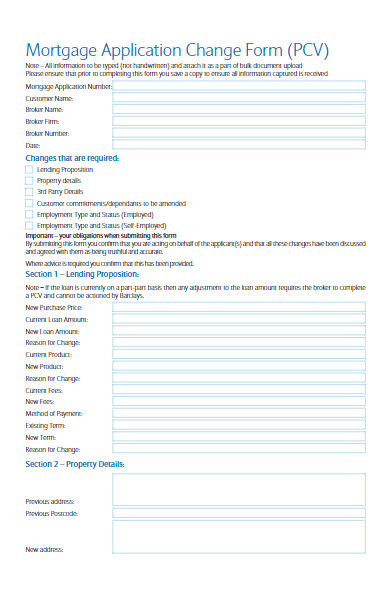

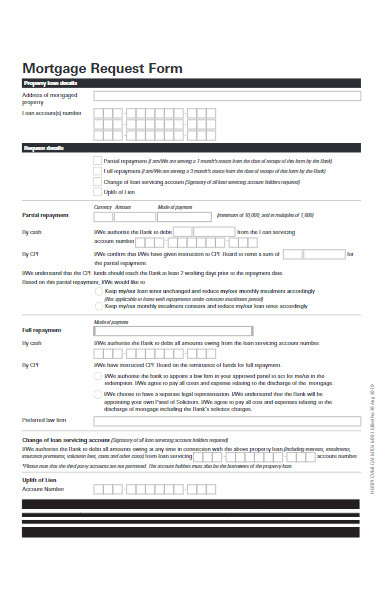

Can I modify the terms on a standard Mortgage Form?

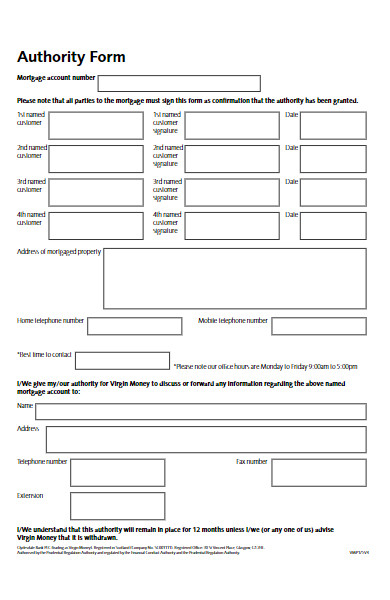

Yes, you can modify the terms on a standard Mortgage Form, but both parties—the borrower and the lender—must agree to the changes. Any modification should reflect the mutual consent of both parties involved. Here are some considerations and steps when modifying a standard Mortgage Form:

- Negotiation: Discuss and negotiate the desired changes with the lender. Remember that any changes should be mutually beneficial or address specific concerns that both parties recognize.

- Documenting Changes: Any modifications to the original Mortgage Form should be documented clearly. You might draft a separate “Modification Agreement” to capture these changes, or in some cases, the changes can be made directly to the original form and initialed by both parties.

- Legal Review: Before finalizing any modifications, consider having the revised document reviewed by a real estate attorney to ensure that all changes are legally sound and that there are no unintended consequences.

- Notarization: Depending on the jurisdiction, the modified Mortgage Form or the Modification Agreement might need to be notarized.

- Recording: Just as with the original Mortgage Form, any modifications should be recorded in the local county recorder’s office or similar entity to provide public notice of the changes.

- Maintain Original Terms: Ensure that the modifications explicitly state which terms of the original mortgage are being changed, and that all other terms and conditions remain in effect.

- Clarity: Ensure that any modifications are clear and unambiguous to prevent future disputes or misunderstandings.

- Fees: Be aware that modifying a mortgage may involve fees, especially if you’re formally refinancing or if there are charges associated with recording the modification.

- Interest Rate and Loan Duration: If you’re considering changes to the interest rate or the length of the loan, understand the long-term implications of these changes on your total payment and the overall cost of the loan.

- Lender’s Willingness: Remember that while borrowers often desire modifications (especially if facing financial hardship), lenders are not always obliged to agree unless contractually bound or incentivized by external factors, like government modification programs.

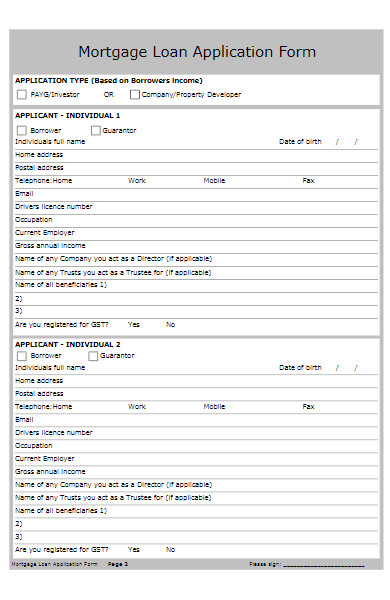

In all cases, open communication with the lender and seeking professional advice can facilitate a smoother modification process and ensure that both parties’ interests are protected. You should also take a look at our Mortgage Loan Application Forms.

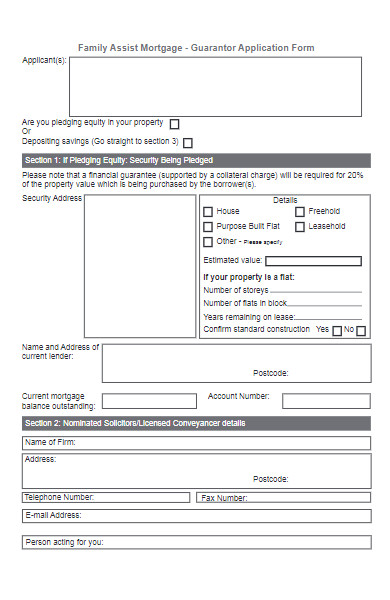

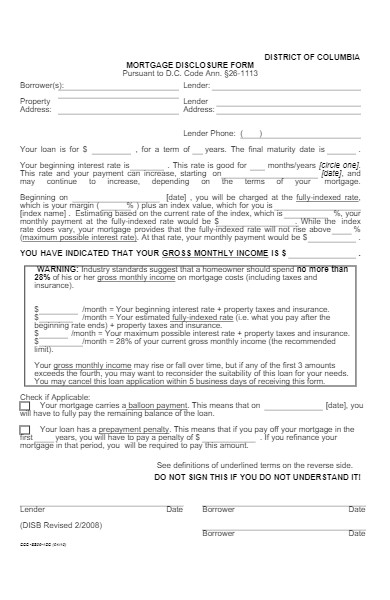

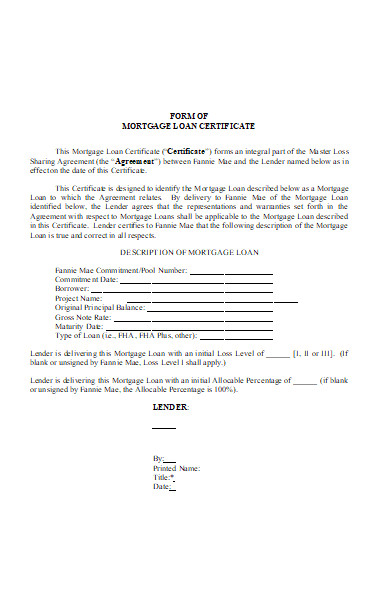

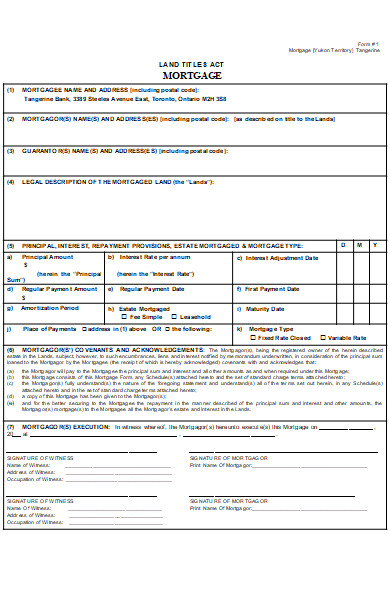

What sections are mandatory in a Mortgage Form?

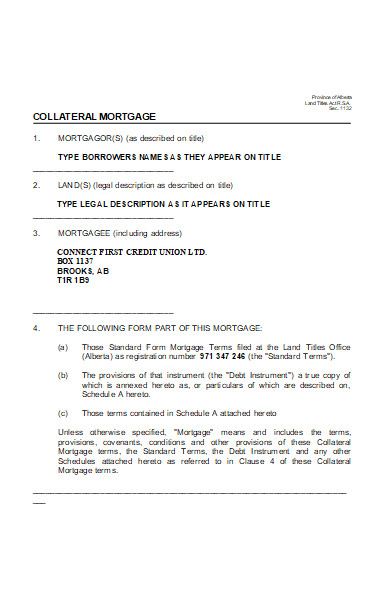

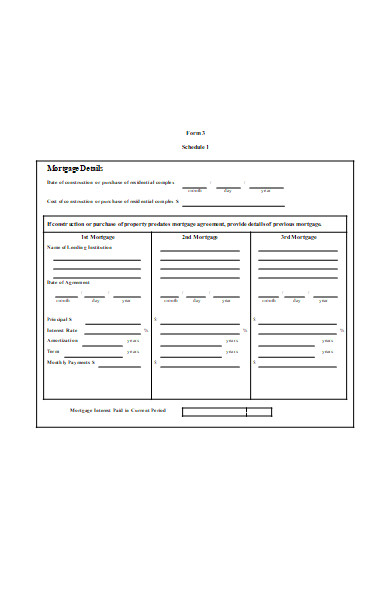

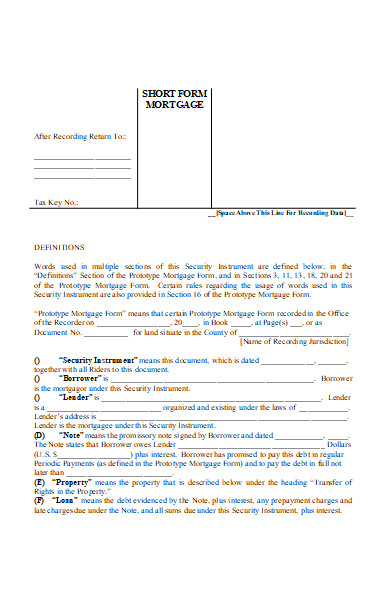

A Mortgage Form serves as a legal document that secures the borrower’s obligation to repay a debt, typically a home loan, to the lender. While the exact sections and details might vary by jurisdiction and the type of mortgage, there are several fundamental sections that are typically found in a standard Mortgage Form:

- Parties Involved: This section identifies the borrower (mortgagor) and the lender (mortgagee). It usually includes their full names and addresses.

- Recitals: This provides a brief explanation of the purpose of the mortgage, which is to secure a particular debt.

- Description of the Property: A detailed legal description of the property being mortgaged. This is not just the street address but usually references lot numbers, block numbers, and plat book pages or other recorded instruments.

- Loan Amount and Terms: This section lays out the principal amount of the loan, the interest rate, the term (length) of the loan, and details about the repayment schedule.

- Default and Remedies: Explanation of what constitutes a default (like missing payments) and the lender’s remedies if a default occurs, which could include foreclosure.

- Covenants and Agreements: These can be wide-ranging but often include:

- Insurance: The borrower’s obligation to maintain property insurance.

- Taxes: The borrower’s obligation to pay all property taxes.

- Preservation of Property: The borrower’s obligation to maintain the property in good condition.

- Right of Acceleration: This clause allows the lender to demand immediate payment of the entire loan balance upon default.

- Due on Sale Clause: A provision stating that if the borrower sells or transfers the property, the entire loan balance will become due immediately.

- Escrow: Details about any escrow arrangements for property taxes, insurance, or other costs.

- Release or Satisfaction: A section that outlines the conditions under which the mortgage will be considered satisfied or released, typically when the loan is paid in full.

- Miscellaneous Provisions: These could include clauses related to jurisdiction, notices, amendments, or other general administrative details.

- Signatures: The borrower’s signature is essential, and in some cases, the lender might also sign. The signatures acknowledge the terms and the intent to abide by them.

- Acknowledgment/Notarization: Typically, a Mortgage Form will have a space for a notary public to acknowledge that the borrower appeared before them and signed the document. This section is vital for recording the mortgage in public records.

Remember, the exact sections and the comprehensive details required can vary based on jurisdiction, the type of property, the nature of the loan, and specific lender requirements. It’s always a good idea to consult with a real estate attorney or professional when drafting or reviewing a Mortgage Form. In addition, you should review our Loan Proposal Forms.

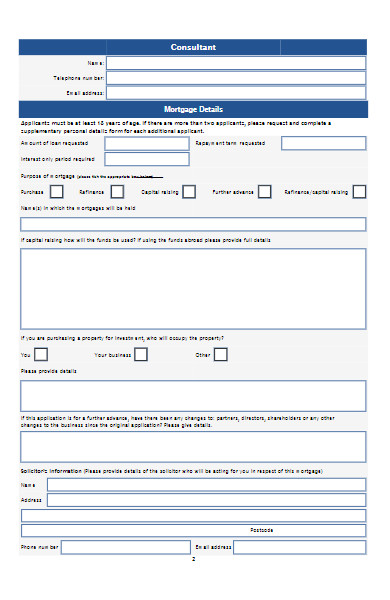

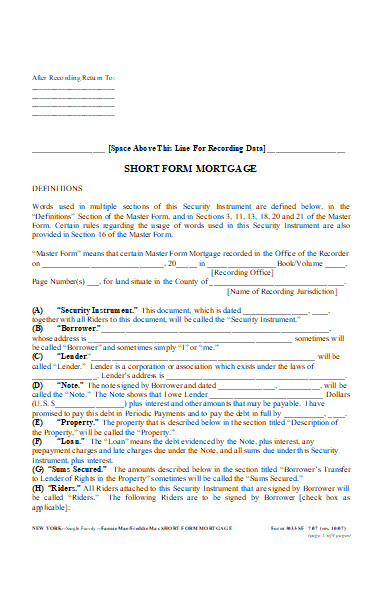

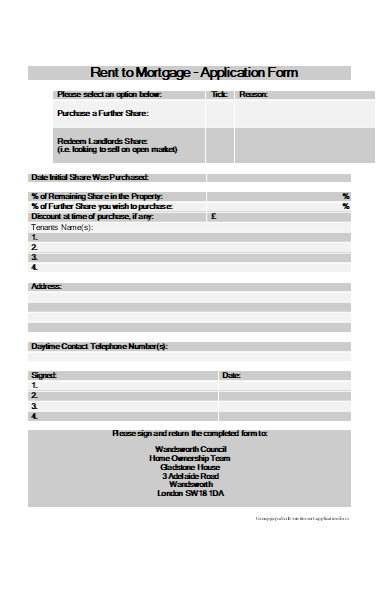

How to Create a Mortgage Form?

Creating a Mortgage Form involves careful consideration of both legal requirements and the specific terms agreed upon between the borrower and lender. Here’s a step-by-step guide to help you draft an effective Mortgage Form:

- Research Local Regulations:

- Start by understanding local and state regulations concerning mortgages. These regulations can dictate certain mandatory clauses and formatting requirements.

- Identify Parties Involved:

- Clearly list the full legal names and addresses of both the borrower (mortgagor) and the lender (mortgagee).

- Provide a Property Description:

- Include a detailed legal description of the property being mortgaged, not just the street address. This can often be sourced from a previous deed or title report.

- Outline Loan Details:

- Specify the principal loan amount.

- Indicate the interest rate, specifying if it’s fixed or adjustable.

- Detail the term (e.g., 15 years, 30 years) and the repayment schedule.

- Mention any prepayment penalties or other fees.

- Default and Remedies:

- Define what constitutes a default (e.g., missed payments, failure to maintain insurance).

- Explain the lender’s remedies in case of default, typically culminating in foreclosure.

- Include Covenants:

- Discuss the borrower’s obligation to maintain property insurance and pay property taxes.

- Include a clause about the borrower maintaining the property in good condition.

- Right of Acceleration:

- Include a provision that allows the lender to demand full payment of the loan if the borrower defaults.

- Due on Sale Clause:

- A clause indicating that if the borrower sells the property, the entire loan becomes due immediately.

- Address Escrow:

- If escrow accounts will be used for taxes or insurance, provide details here.

- State Release Conditions:

- Outline when and how the mortgage will be released, typically upon full payment of the loan.

- Add Miscellaneous Provisions:

- Clauses related to jurisdiction, amendments, notices, and any other specifics relevant to your mortgage agreement.

- Include Signature Lines:

- Provide space for the borrower (and potentially co-borrowers) to sign and date. In some instances, the lender might also sign.

- Notarization Section:

- Reserve space for notarization, where a notary public will verify the borrower’s identity, witness the signing, and affix their seal.

- Review and Legal Counsel:

- Before finalizing, review the document for accuracy and completeness.

- Strongly consider consulting with a real estate attorney to ensure the Mortgage Form is legally sound and adheres to local regulations.

- Finalize and Record:

- Once the Mortgage Form is signed and notarized, ensure it’s recorded with the appropriate local entity (usually the county recorder’s office). Recording provides public notice of the mortgage.

Remember, while this guide offers a general overview, specific requirements can vary greatly based on jurisdiction, property type, and individual circumstances. Always tailor your Mortgage Form to your specific situation and consult professionals as needed.

Tips for creating an Effective Mortgage Form

Creating an effective Mortgage Form requires precision, clarity, and attention to legal requirements. Here are some tips to ensure your Mortgage Form serves its purpose effectively:

- Be Clear and Concise: Avoid ambiguous language. Every term and provision should be clear to both parties, minimizing the chance of misunderstandings.

- Use Standard Terminology: Stick to commonly accepted terms and phrases in the real estate industry. This can help reduce confusion and ensure the document’s legality.

- Research Local Laws: Every jurisdiction may have specific laws and regulations regarding mortgages. Familiarize yourself with these to ensure the form’s compliance.

- Detail Property Description: The property description should be detailed enough to uniquely identify it, often referencing official land or plot numbers.

- Specify All Financial Terms: Clearly outline all financial aspects, including the loan amount, interest rate (and if it can change), repayment schedule, late fees, and any other charges.

- Include Essential Clauses: Ensure the form has necessary clauses like the ‘Default and Remedies’ clause, ‘Right of Acceleration’, and ‘Due on Sale’ clause.

- Avoid Jargon: Unless it’s standard legal terminology, avoid using jargon. If a layperson can’t understand the document, there’s a greater chance for misunderstandings.

- Outline Borrower’s Responsibilities: Clearly detail the borrower’s responsibilities, like maintaining insurance, paying property taxes, and keeping the property in good condition.

- Include a Notary Section: Since many jurisdictions require Mortgage Forms to be notarized, ensure there’s a section for notarization.

- Consider Prepayment and Penalties: If there are provisions for early repayment or penalties associated with it, clearly mention them.

- Consistency is Key: Ensure that terms, conditions, and definitions are consistent throughout the document. If you define a term at the beginning, use it consistently in the same context.

- Add a Governing Law Clause: Mention which state’s or country’s laws will govern the mortgage agreement. This is especially important if parties are from different jurisdictions.

- Consult Professionals: Even if you draft the form yourself, it’s wise to have a real estate attorney review it to ensure its legality and completeness.

- Keep Multiple Copies: Once finalized, both the borrower and the lender should have signed copies for their records. Additionally, ensure the document is recorded with the appropriate local authority.

- Stay Updated: Real estate laws and regulations can change. Regularly review and update your Mortgage Form template to align with current laws.

An effective Mortgage Form not only secures the loan but also provides clear guidelines and expectations for both the borrower and the lender, reducing potential disputes and misunderstandings.

A Mortgage Form is a pivotal legal document in real estate, detailing the agreement between borrower and lender. It solidifies the terms, obligations, and protections related to a property loan. While it’s essential to understand its significance, structure, and types, creating an effective form requires precision, clarity, and adherence to local regulations. Consulting professionals ensures its validity and effectiveness in safeguarding both parties’ interests. You may also be interested in our Loan Contract Forms.

Related Posts Here

-

Separation Agreement Form

-

Business Partnership Agreement Form

-

Settlement Agreement Form

-

Employee Loan Agreement

-

Equipment Lease Agreement Form

-

Commercial Rental Agreement Form

-

Lottery Syndicate Agreement Form

-

Buy-Sell Agreement Form

-

Truck Lease Agreement

-

Lease Termination Agreement Form

-

Agreement Form

-

Driveway Easement Agreement Form

-

Month-to-Month Rental Agreement Form

-

Distribution Agreement Form

-

Land Agreement Form