Mortgage Application Form is a crucial document required when applying for a mortgage loan. It collects key financial details, employment history, credit information, and property details to assess loan eligibility. Lenders use this form to evaluate your ability to repay the loan based on income, assets, and liabilities. Completing an Application Form accurately improves the chances of approval and ensures a smooth loan processing experience. Whether you’re a first-time homebuyer or refinancing, this guide will help you understand each section of the form, ensuring a successful mortgage application.

Download Mortgage Application Form Bundle

What is Mortgage Application Form?

A Mortgage Application Form is an official document used to apply for a home loan. It includes personal information, financial statements, employment history, and property details to help lenders assess creditworthiness. The form allows financial institutions to determine eligibility based on income, debts, and assets. Borrowers must provide accurate details, as any discrepancies can delay approval. Lenders use the information to evaluate risks and decide on loan approval terms. This form is a vital part of the home-buying process, ensuring responsible lending and informed financial decisions.

Mortgage Application Format

Applicant Information

Full Name: [Insert Name]

Date of Birth: [MM/DD/YYYY]

Social Security Number: [XXX-XX-XXXX]

Property Details

- Address of Property: [Insert Address]

- Property Type: [House/Condo/Commercial]

Loan Information

- Mortgage Amount Requested: [$Amount]

- Down Payment: [$Amount]

Employment & Income Details

- Employer Name: [Company Name]

- Annual Income: [$Amount]

- Other Sources of Income: [Specify if Any]

Liabilities & Expenses

- Existing Loans: [List Details]

- Credit Card Debt: [$Amount]

Declaration & Consent

I certify that the above information is accurate.

Signature: [Signature]

Date: [MM/DD/YYYY]

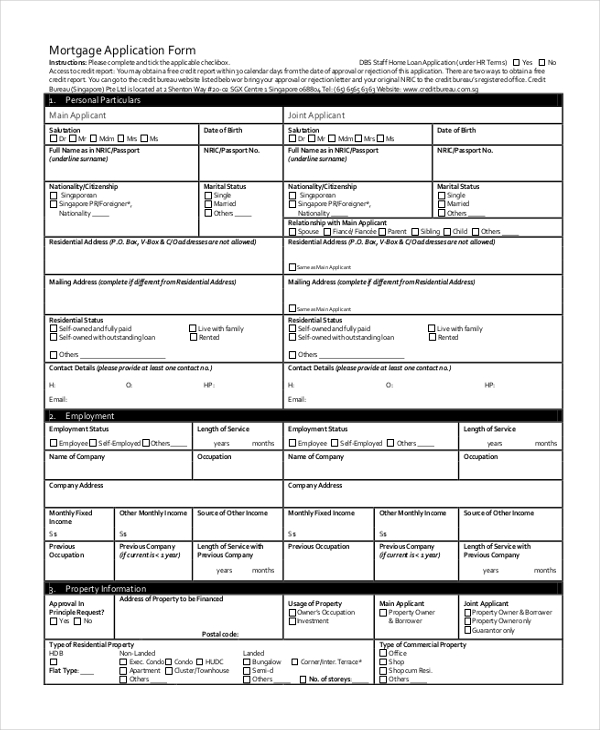

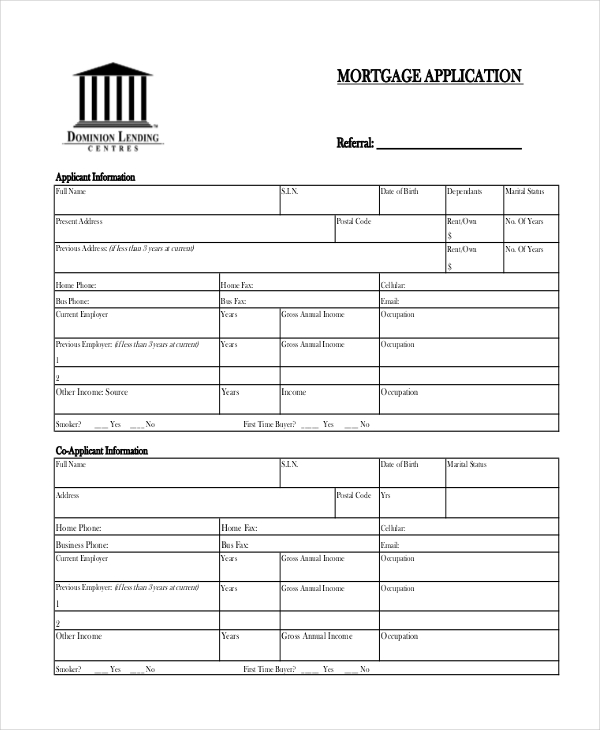

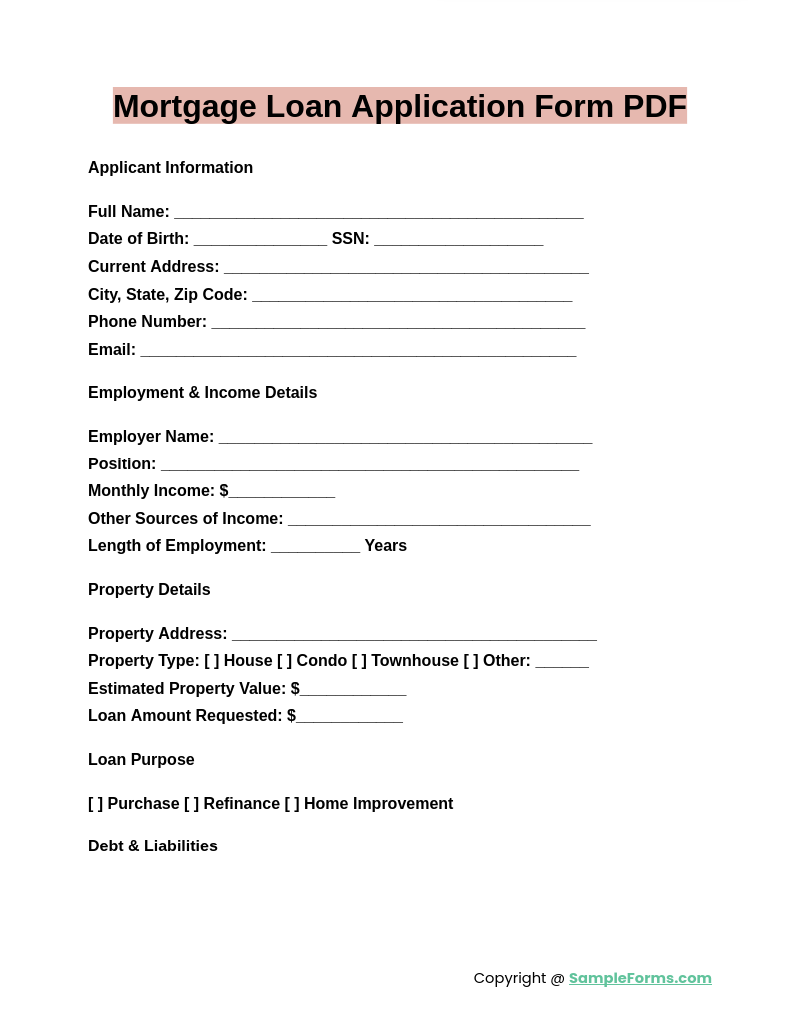

Mortgage Loan Application Form PDF

A Mortgage Loan Application Form PDF is a digital document for home loan applications. Similar to a Transfer Application Form, it ensures accurate financial details, income verification, and credit assessment for smooth mortgage approval.

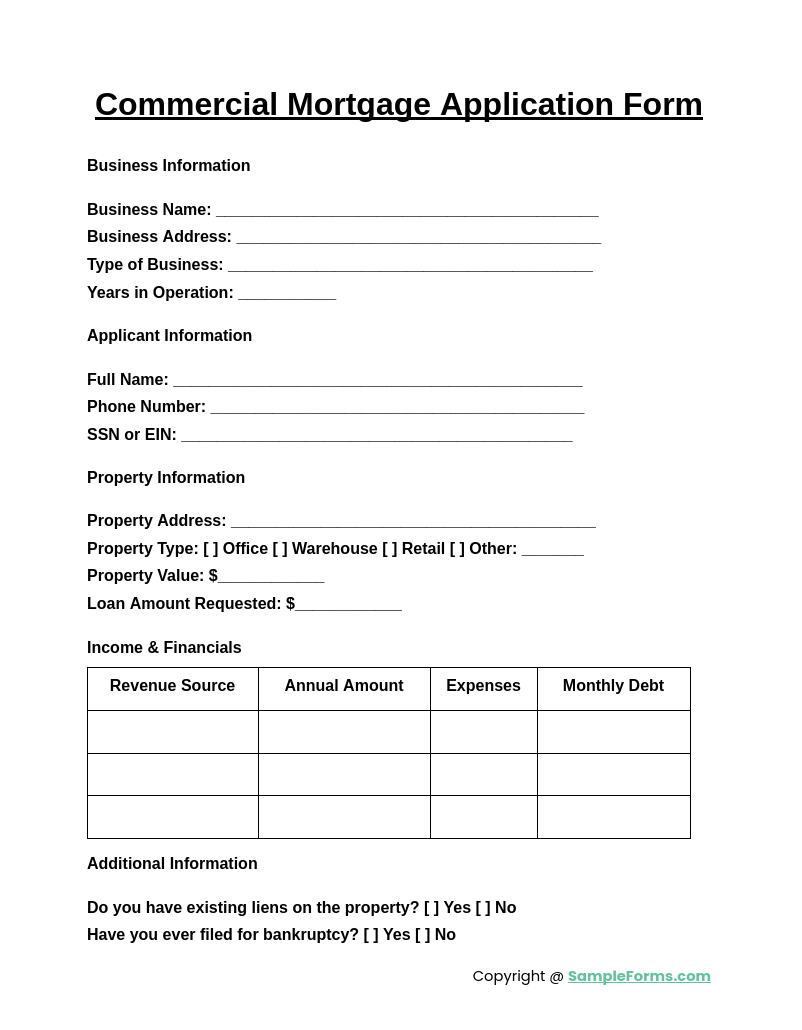

Commercial Mortgage Application Form

A Commercial Mortgage Application Form is used for financing business properties. Similar to a Safeway Application Form, it requires company financials, credit history, and loan purpose to assess borrower eligibility for commercial property loans.

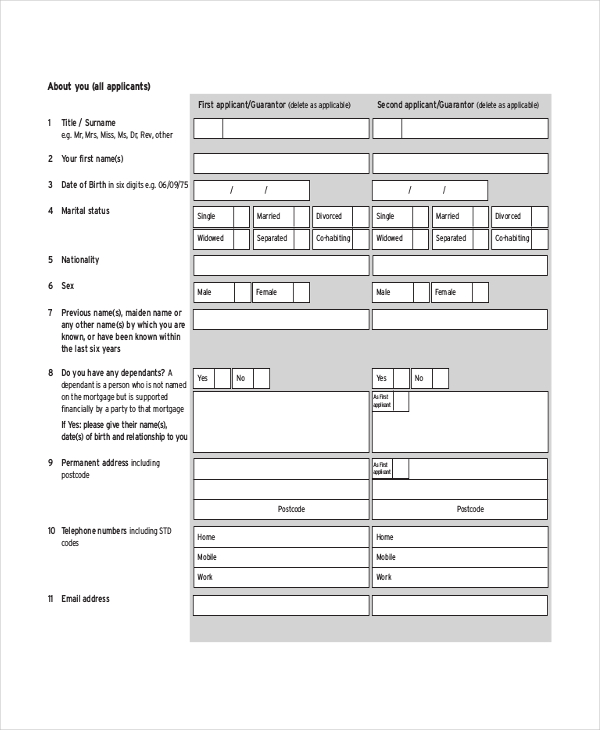

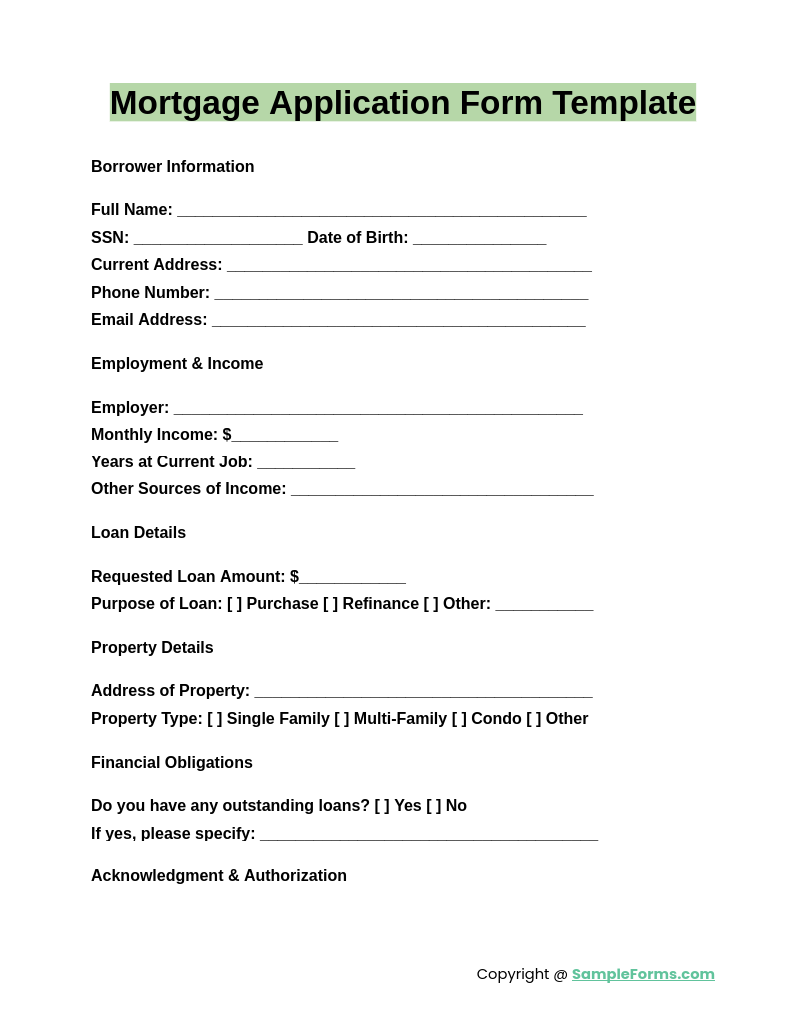

Mortgage Application Form Template

A Mortgage Application Form Template simplifies the loan process with a structured format. Similar to a Vendor Application Form, it collects necessary borrower details, financial records, and property information for lenders to evaluate mortgage eligibility.

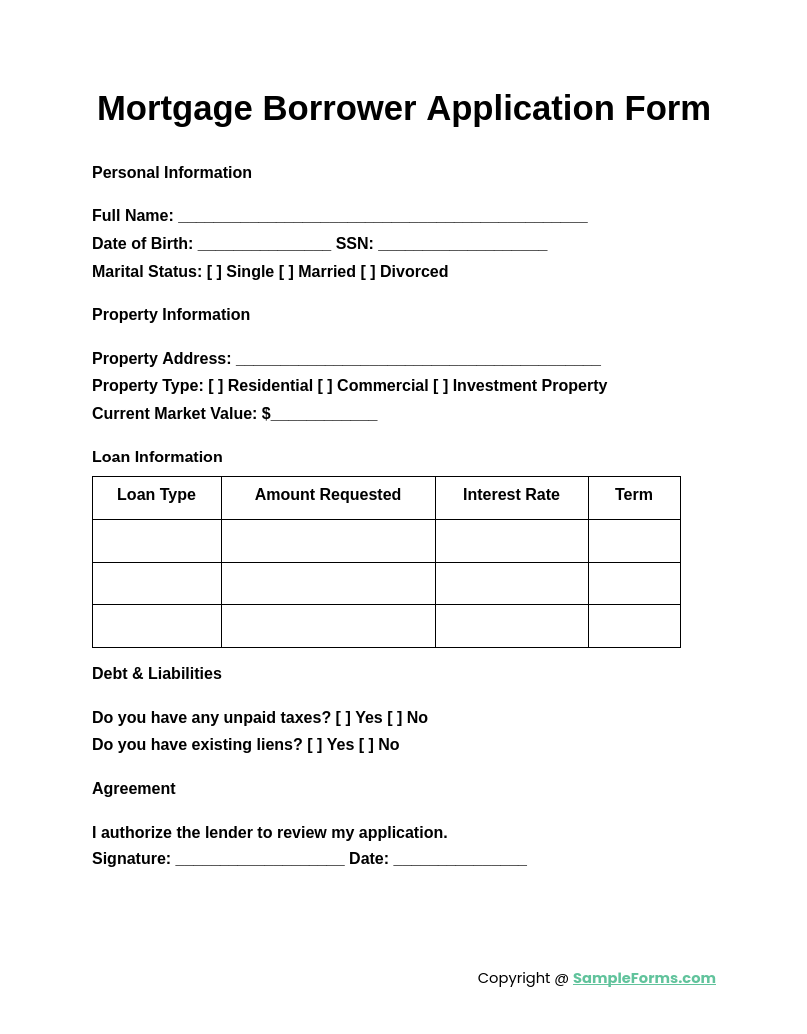

Mortgage Borrower Application Form

A Mortgage Borrower Application Form gathers personal and financial details for loan processing. Similar to a Work Application Form, it ensures lenders have accurate employment, income, and credit details for approving a mortgage loan.

Browse More Mortgage Application Forms

Sample Mortgage Loan Application Form

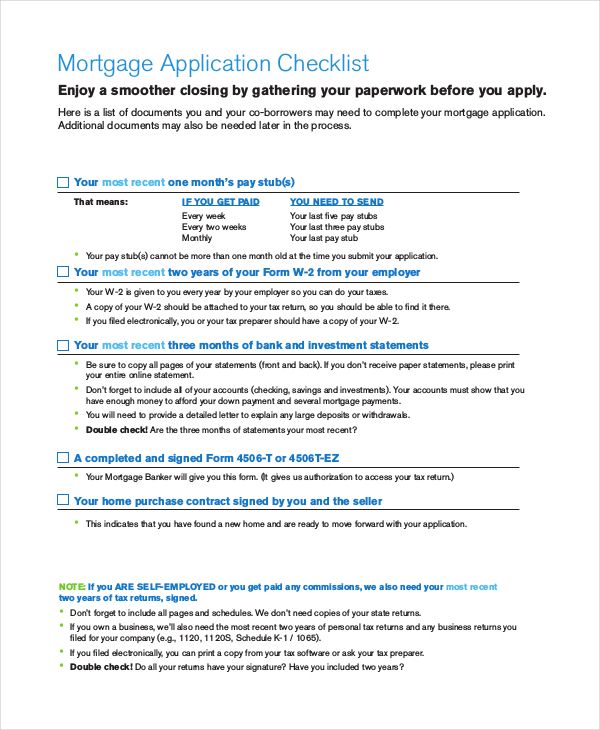

Mortgage Application Checklist

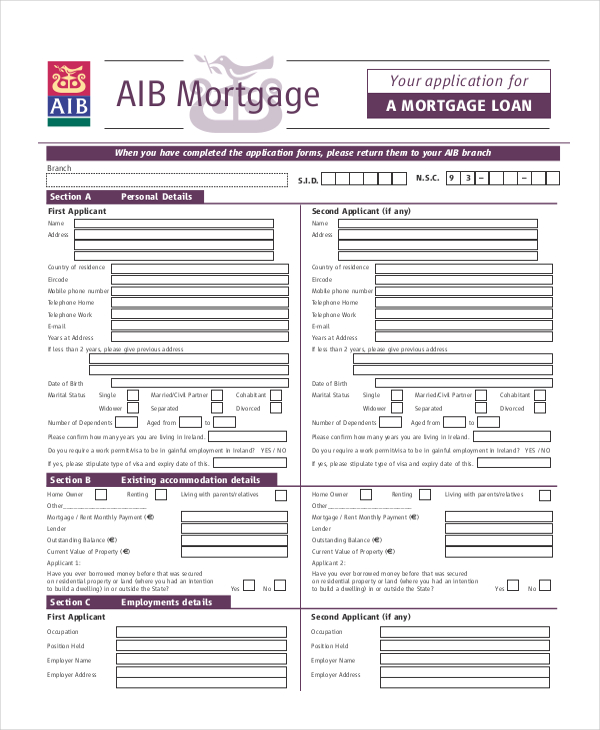

AIB Mortgages Application Form

Sample Mortgage Application for Buyers

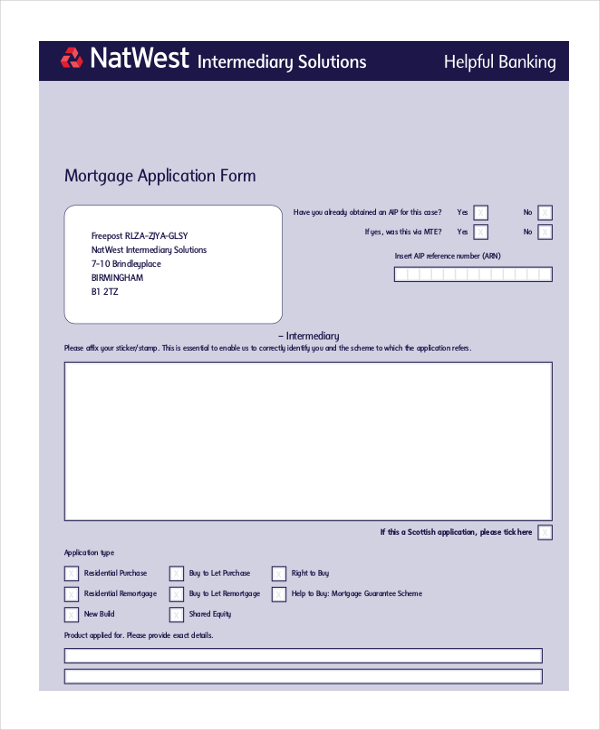

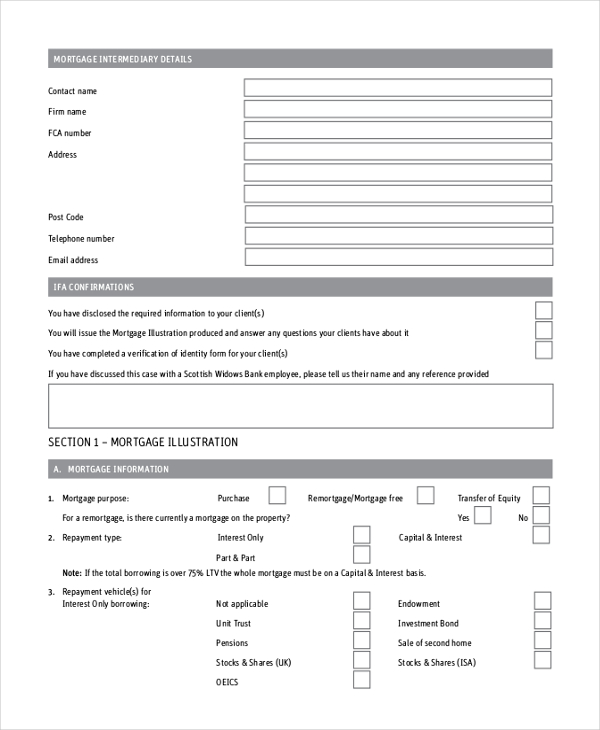

Mortgage Application Form for Intermediaries

Banking Mortgage Application Form

Sample Commercial Mortgage Application Form

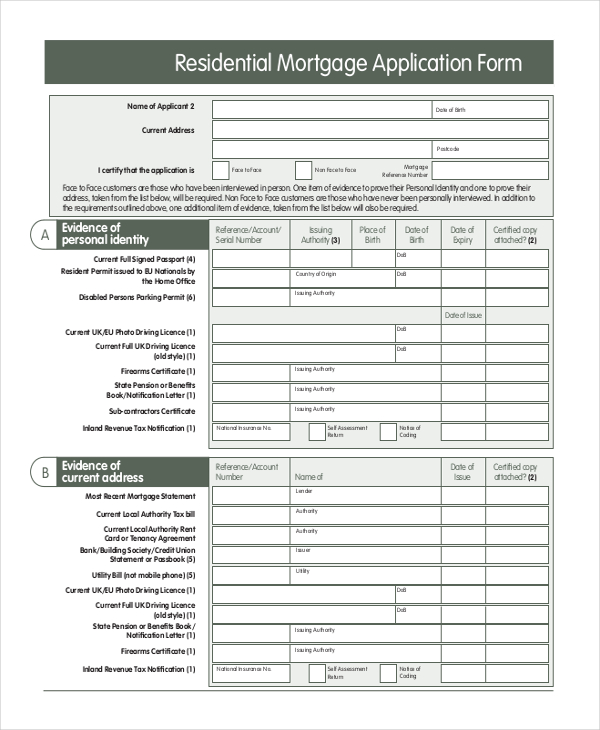

Residential Mortgage Application Form

SWB Mortgage Application Form

Sample Mortgage Application Form for Home Purchase

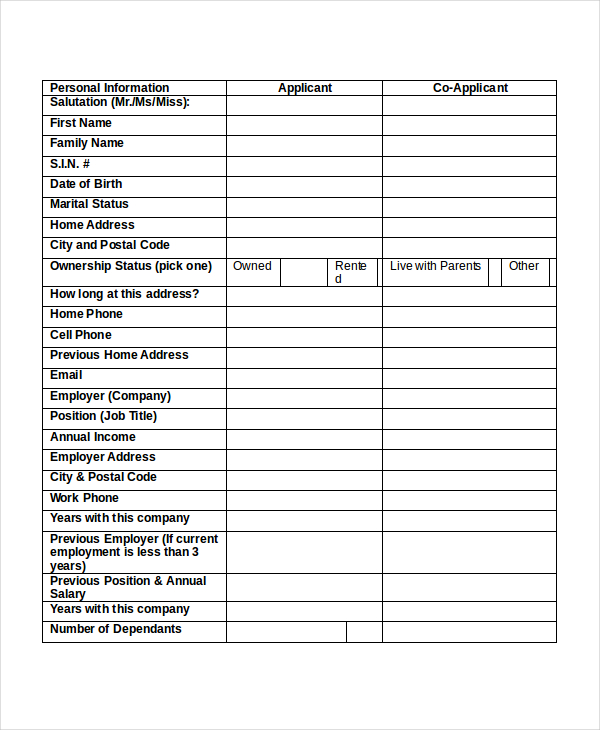

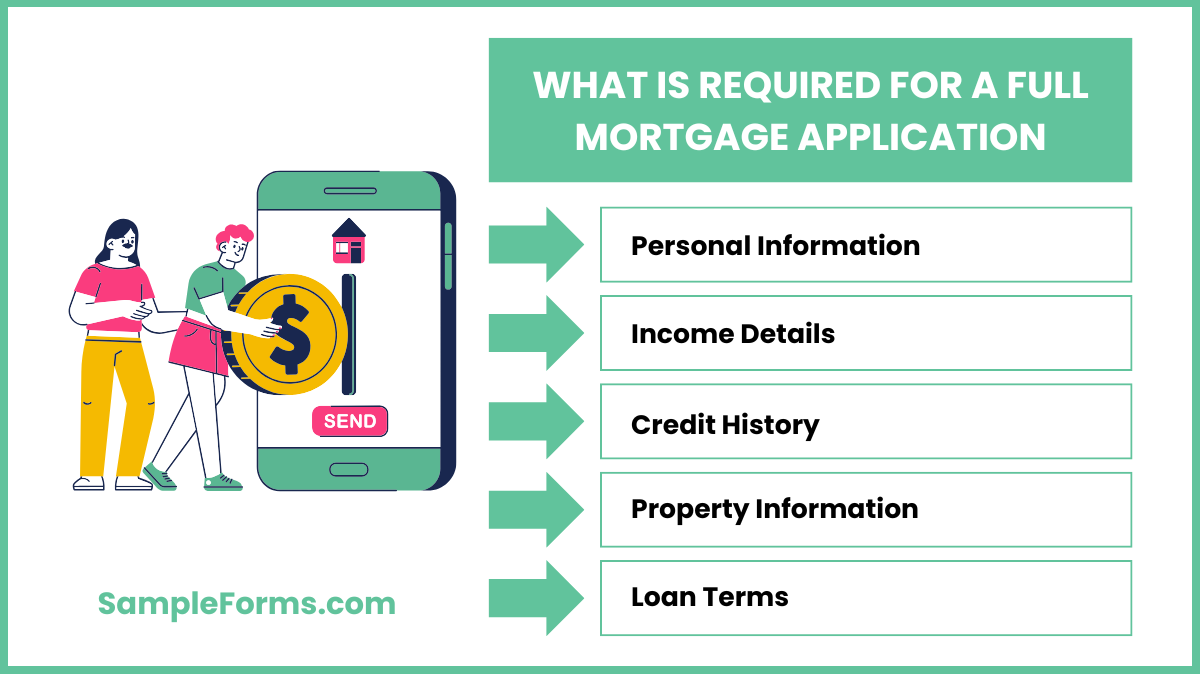

What is Required for a Full Mortgage Application?

A full mortgage application requires detailed financial and personal information to assess eligibility. Similar to a Training Application Form, it ensures all necessary details are provided for approval.

- Personal Information: Full name, contact details, Social Security number, and employment status.

- Income Details: Proof of income, tax returns, and pay stubs.

- Credit History: Credit score and outstanding debts to determine financial stability.

- Property Information: Details about the property being financed, including its value and condition.

- Loan Terms: Loan amount, interest rates, and repayment period.

What Forms Do I Need for Mortgage?

Applying for a mortgage requires various documents to verify financial credibility. Similar to a Security Application Form, these forms ensure lenders assess eligibility properly.

- Loan Application Form: Standard mortgage application (Form 1003).

- Income Verification: W-2s, tax returns, and recent pay stubs.

- Credit Report Authorization: Permission for the lender to check credit history.

- Property Appraisal Report: Assessment of the home’s market value.

- Debt and Asset Documents: Bank statements and liabilities disclosure.

How Much Income is Required for a Mortgage?

Mortgage approval depends on income, debt, and loan amount. Similar to a Medical Application Form, proof of financial health is essential.

- Debt-to-Income Ratio (DTI): Should generally be below 43% for approval.

- Stable Employment: A steady income source over the past two years.

- Income Level: At least three times the monthly mortgage payment.

- Savings & Assets: Additional funds for down payment and reserves.

- Credit Score Impact: Higher income may offset lower credit scores.

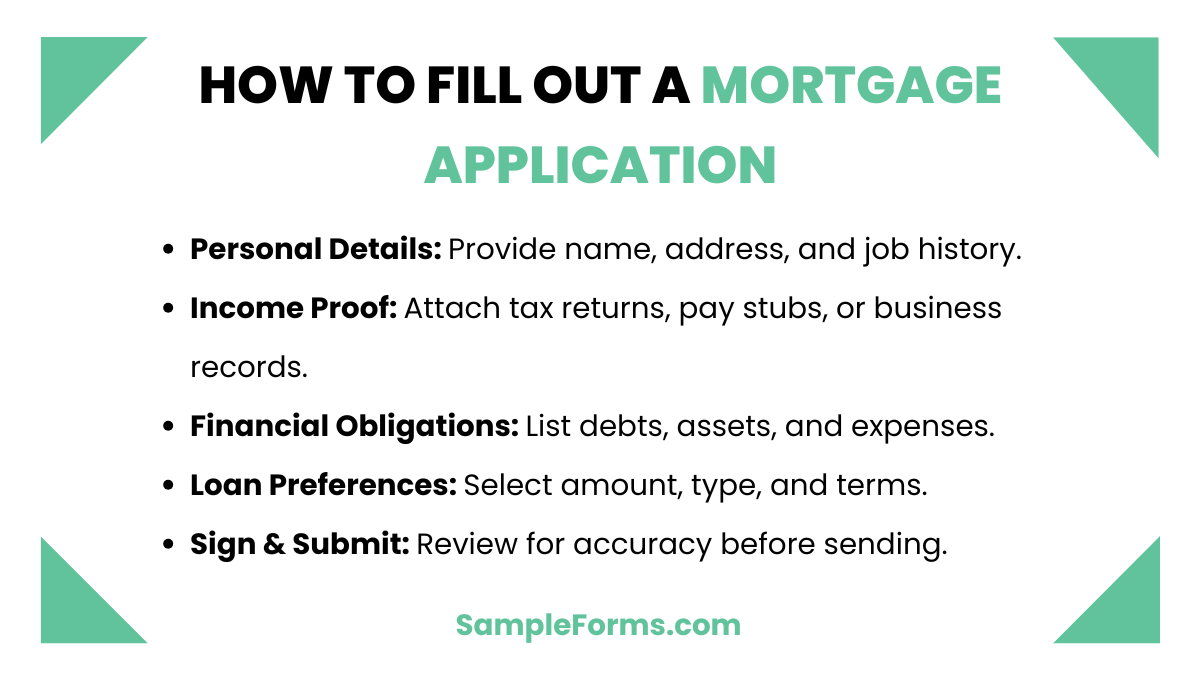

How to Fill Out a Mortgage Application?

A mortgage application must be completed accurately to avoid delays. Similar to a Citizen Application Form, it requires detailed and verified personal information.

- Provide Personal Details: Enter full name, address, and employment history.

- Submit Income Proof: Attach tax returns, pay stubs, or self-employment records.

- List Financial Obligations: Include debts, assets, and monthly expenses.

- Specify Loan Preferences: Choose loan amount, type, and repayment terms.

- Sign and Submit: Review for errors before submission to the lender.

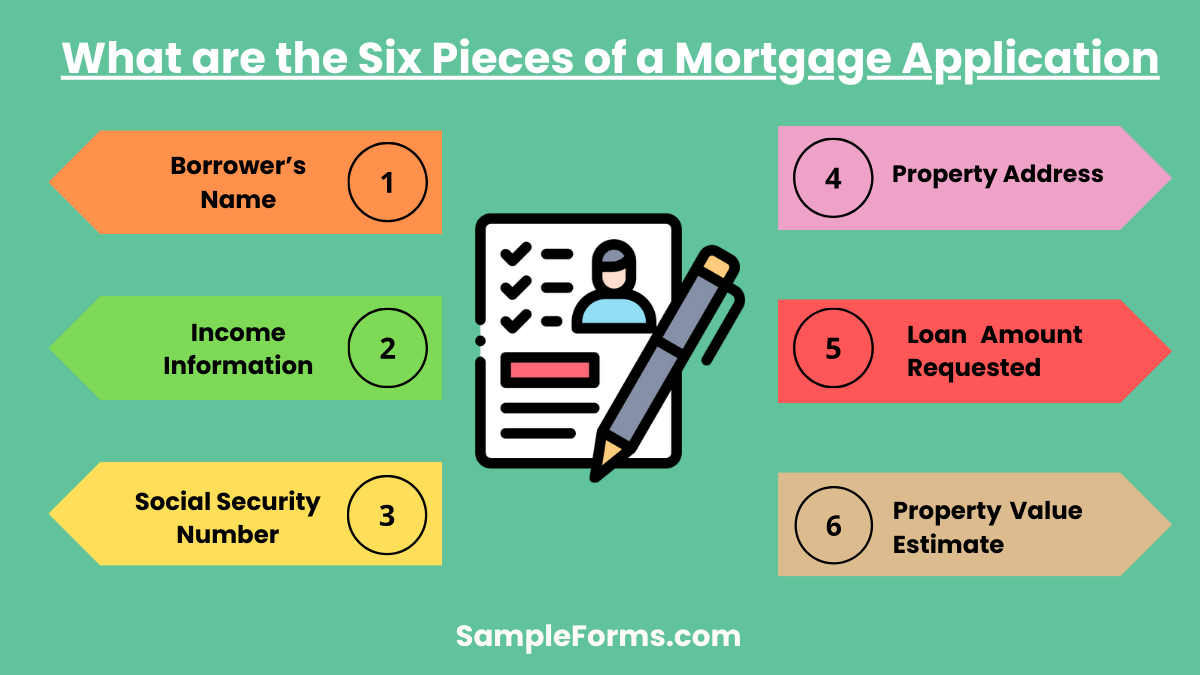

What are the Six Pieces of a Mortgage Application?

A mortgage application requires six essential components for processing. Similar to a Car Loan Application Form, these details determine eligibility.

- Borrower’s Name: Full legal name for identification.

- Income Information: Verification of earnings and financial stability.

- Social Security Number: Used for credit history checks.

- Property Address: Location of the home being financed.

- Loan Amount Requested: Exact mortgage amount applied for.

- Property Value Estimate: Appraised worth of the home.

What is a 1025 form in mortgage?

A 1025 form is a small residential income property appraisal report. Similar to a Housing Application Form, it assesses multi-unit property value for mortgage approval.

What is a 1009 form mortgage?

A 1009 form is used for farm and rural housing loans. Similar to a Summer Camp Application Form, it evaluates eligibility for specialized mortgage programs.

Where to start when applying for a mortgage?

Start by checking credit, gathering documents, and pre-qualifying. Similar to a Credit Application Form, financial history determines loan approval chances.

Which mortgage lender is the best?

The best lender depends on interest rates, customer service, and loan options. Similar to a Leave Application Form, choosing the right one requires careful evaluation.

What is the best mortgage lender right now?

Top lenders vary based on rates and terms. Similar to a Construction Application Form, selecting the best lender depends on current financial needs and goals.

How long does it take to get approved for a mortgage?

Mortgage approval takes days to weeks based on documents and credit. Similar to a Renewal Application Form, processing time depends on lender verification.

Do you need a cosigner for a mortgage?

A cosigner helps if credit or income is insufficient. Similar to a Puppy Application Form, extra approval steps may be required for financial security.

Who is offering the lowest mortgage rates right now?

Rates change frequently, so checking multiple lenders is best. Similar to a Legal Application Form, thorough research ensures choosing the best mortgage deal.

What’s the easiest mortgage to get?

FHA loans are the easiest due to lower credit requirements. Similar to a Disability Application Form, they assist individuals with specific financial needs.

Is it better to use a mortgage lender or bank?

Banks offer stability, while lenders provide flexible options. Similar to a Health Care Application Form, the choice depends on personal financial goals and needs.

A properly filled Mortgage Application Form increases approval chances and simplifies mortgage processing. Additionally, understanding required documents, such as a Talent Application Form, helps in other financial or professional applications, ensuring a well-prepared and seamless experience.

Related Posts

-

FREE 8+ Commercial Property Application Forms in PDF

-

FREE 18+ Leave Cancellation Forms Download – How to Create Guide, Tips

-

FREE 6+ Business Credit Checklist Forms in PDF

-

FREE 6+ Background Check Application Forms in PDF | MS Word

-

FREE 6+ Leasing Application Forms in PDF | MS Word

-

FREE 10+ New Job Application Forms in PDF | MS Word | Excel

-

FREE 9+ Articles Of Organization Forms in PDF

-

FREE 10+ Commercial Rental Application Sample Forms in PDF | MS Word

-

FREE 5+ HR Reclassification Application Forms in PDF | MS Word

-

FREE 8+ Clearance Application Forms in PDF | MS Word

-

FREE 6+ Talent Application Forms in PDF | MS Word

-

FREE 6+ House Rental Application Forms in PDF | MS Word | Excel

-

FREE 10+ Sponsor Application Forms in PDF | MS Word | Excel

-

Security Guard Application Form

-

FREE 4+ Retail Job Application Forms in PDF | MS Word