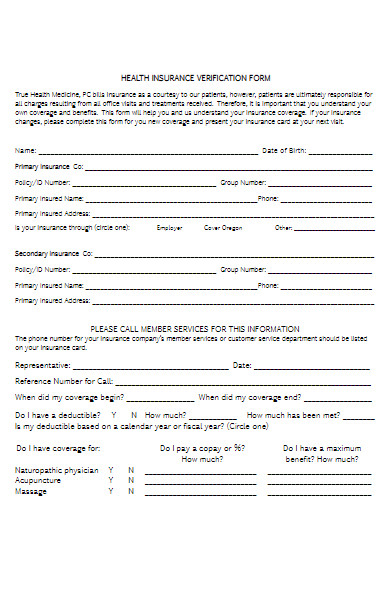

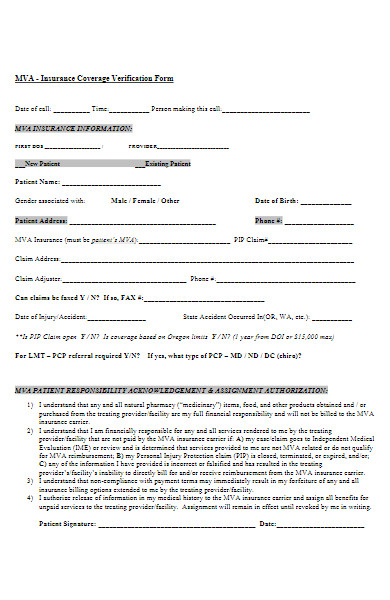

A Medical Insurance Verification Form stands as a vital bridge between healthcare providers and insurance entities, ensuring that patients receive their entitled benefits. This form verifies an individual’s insurance coverage details, thereby streamlining medical billing processes. With varying formats tailored to different healthcare environments, understanding its essence, nuances, and design is crucial. From its foundational meaning to creation tips, this guide delves into the complexities and significance of the Medical Insurance Verification Form in the healthcare realm. Dive in to explore its intricacies.

What is a Medical Insurance Verification Form ? – Definition

A Medical Insurance Verification Form is a standardized document utilized by healthcare providers to confirm a patient’s current health insurance coverage. The form typically seeks details about the insurance policy, its active dates, coverage benefits, and any limitations or restrictions. By verifying this information before medical services are rendered, healthcare providers can ensure they provide treatments that are covered and determine any out-of-pocket costs for the patient, thereby minimizing billing discrepancies and payment delays.

What is the Meaning of a Medical Insurance Verification Form?

The meaning of a Medical Insurance Verification Form centers around its role in the healthcare system as a tool to validate and ascertain the extent of a patient’s insurance coverage. It acts as a conduit for communication between healthcare providers and insurance companies. By using this form, providers can confirm if specific treatments, procedures, or medications are covered under the patient’s plan, determine the patient’s responsibility for co-pays or deductibles, and prevent unexpected expenses. Essentially, it safeguards both the patient’s interests by avoiding unforeseen medical bills and the provider’s interests by ensuring timely and accurate compensation.

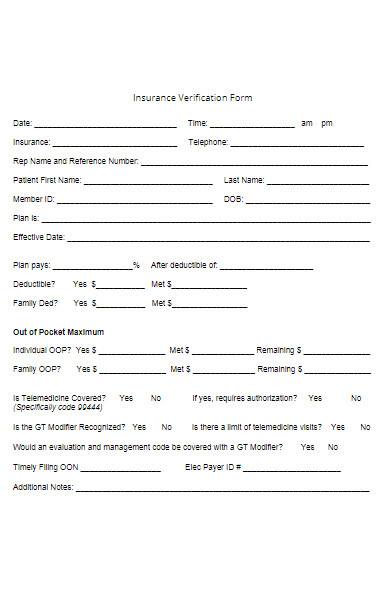

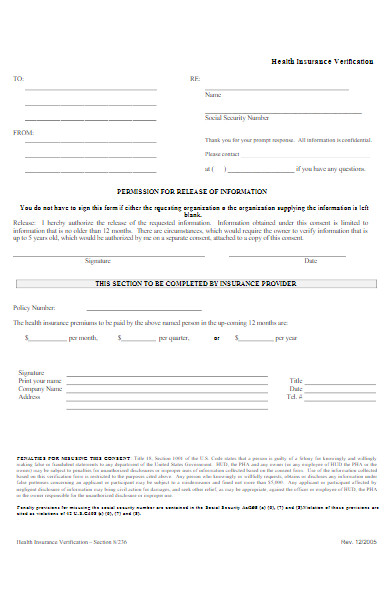

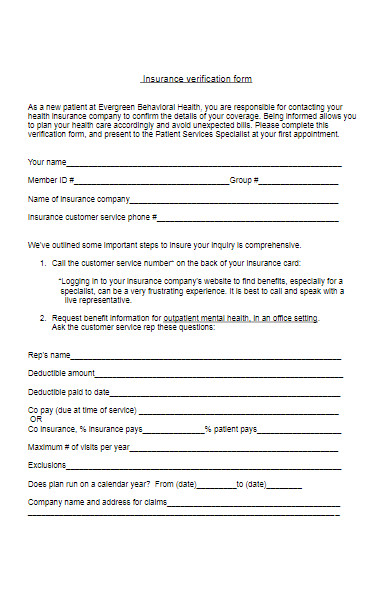

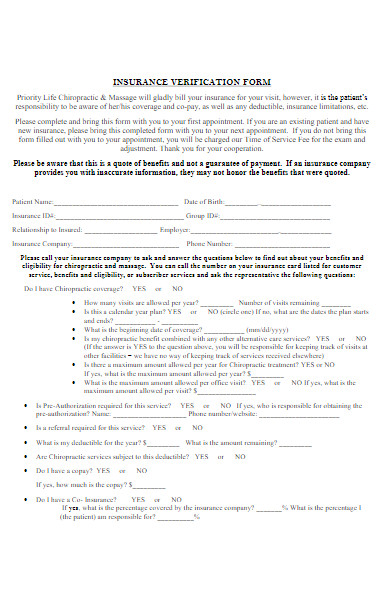

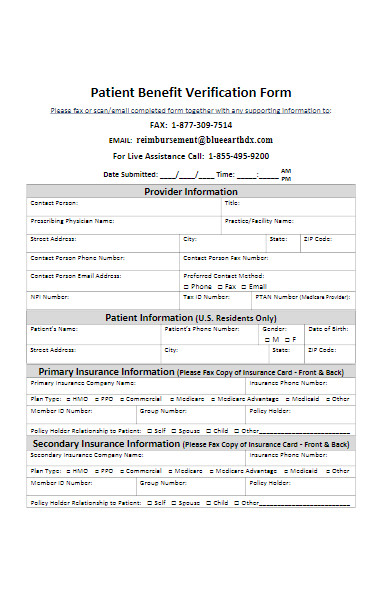

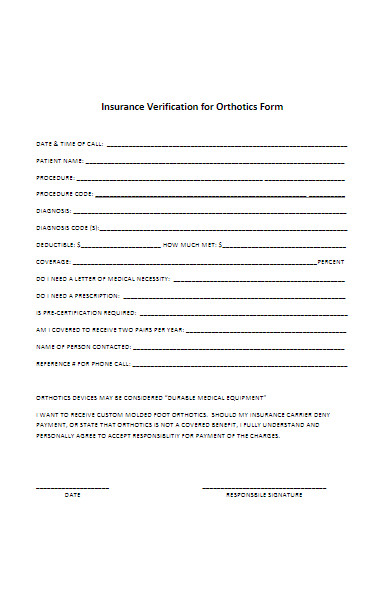

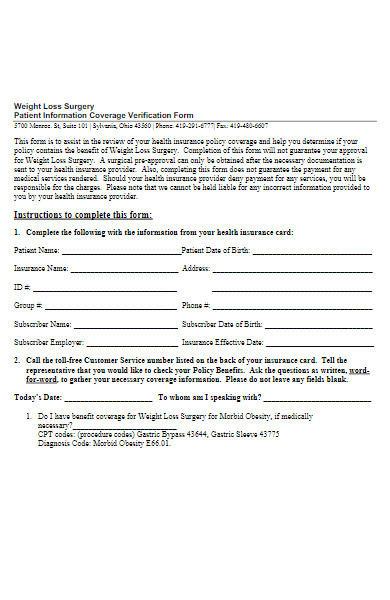

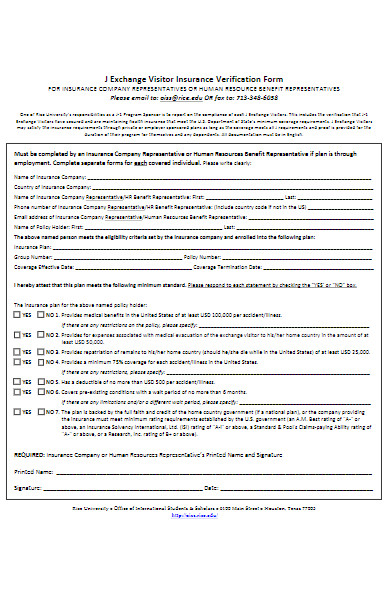

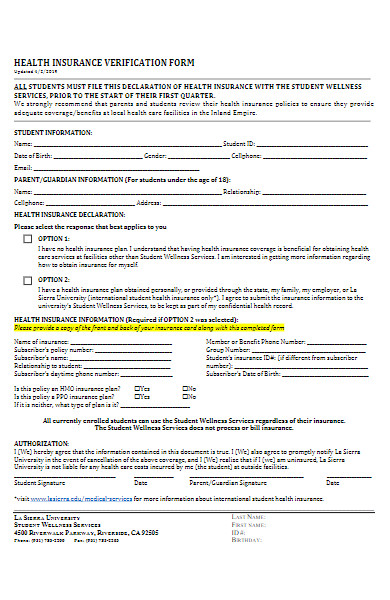

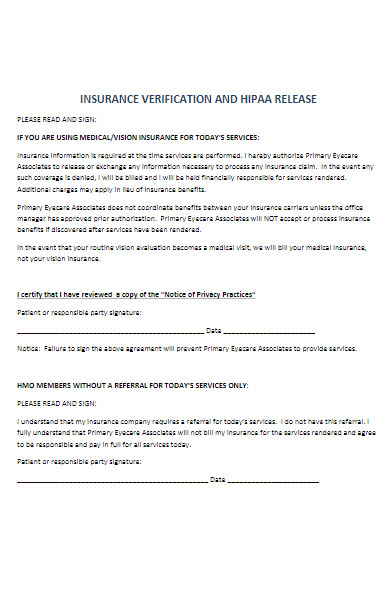

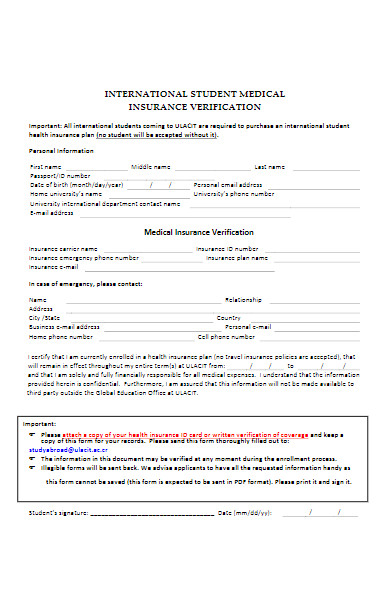

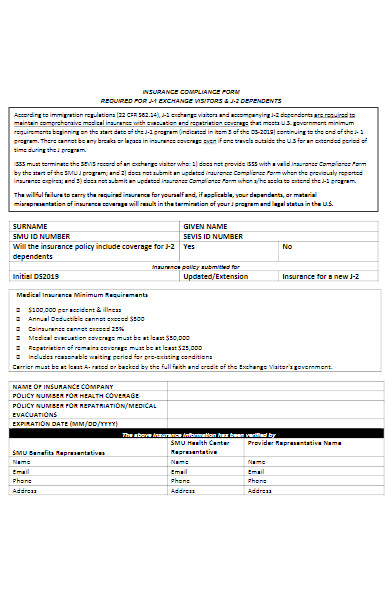

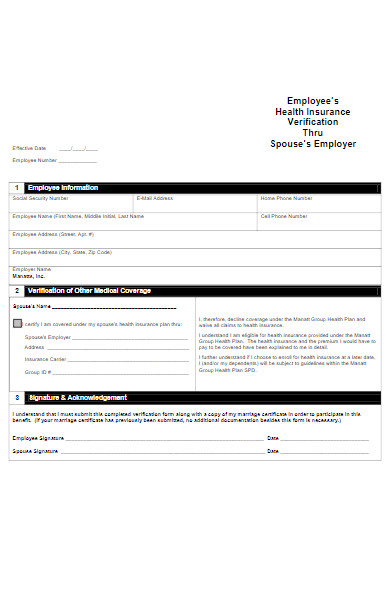

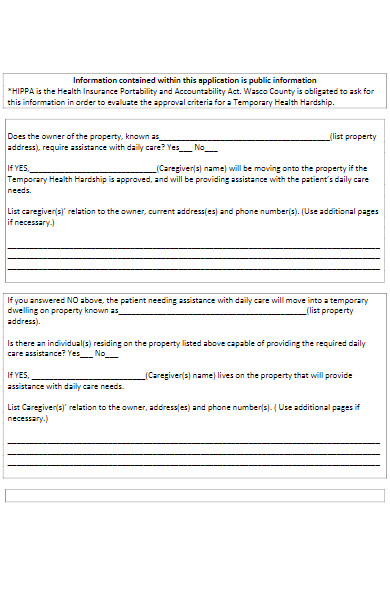

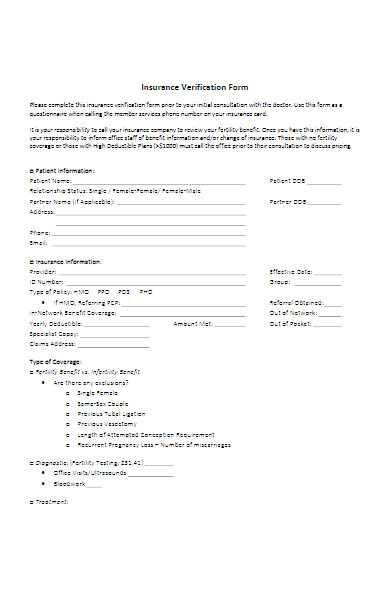

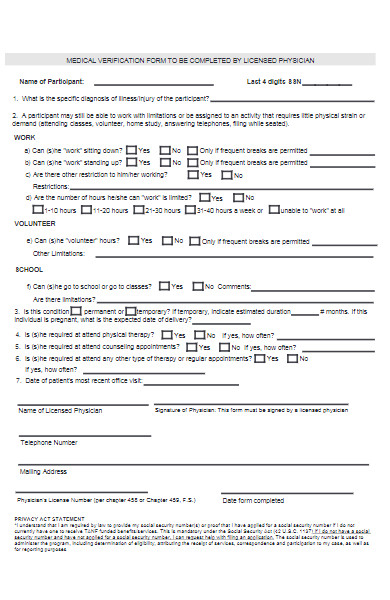

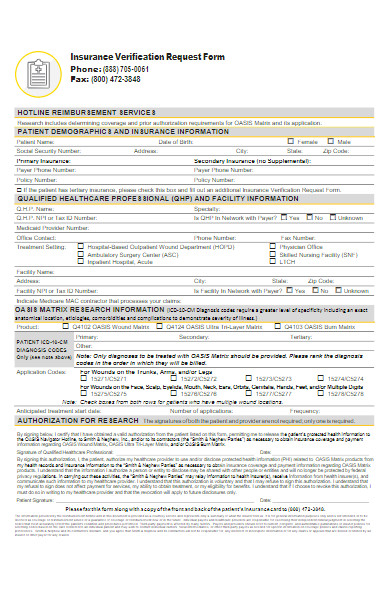

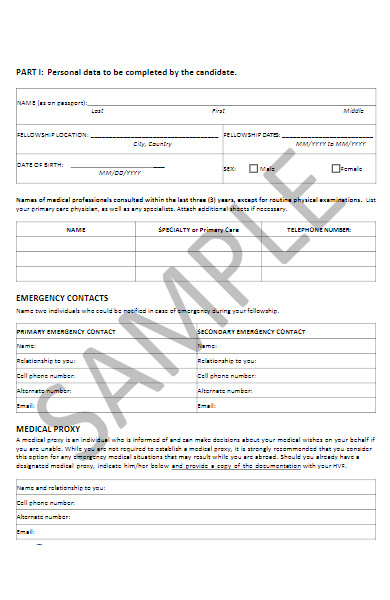

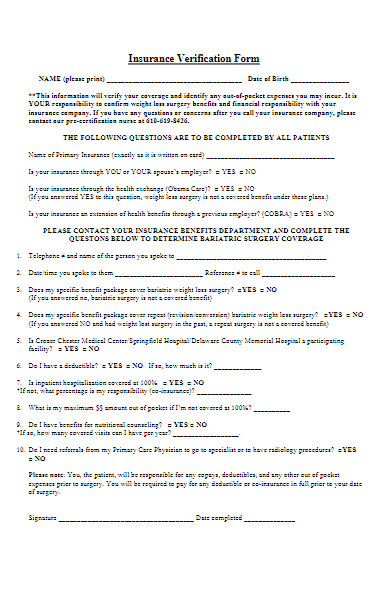

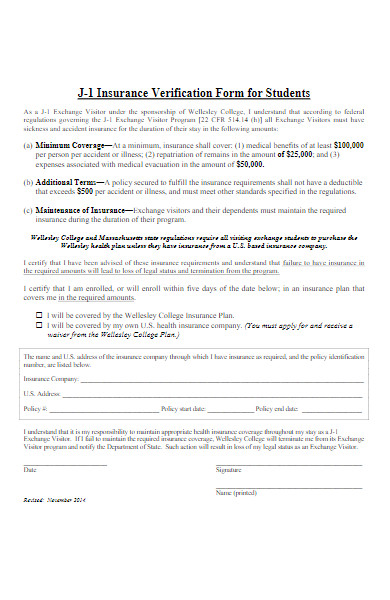

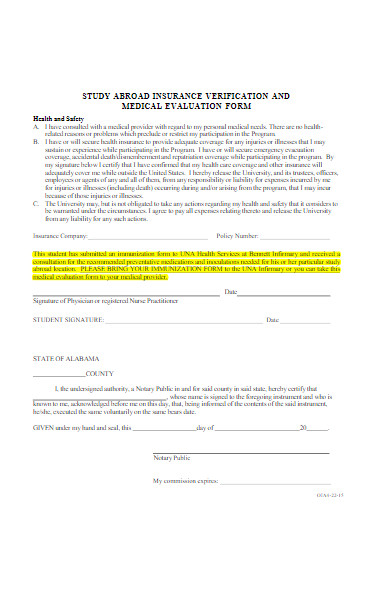

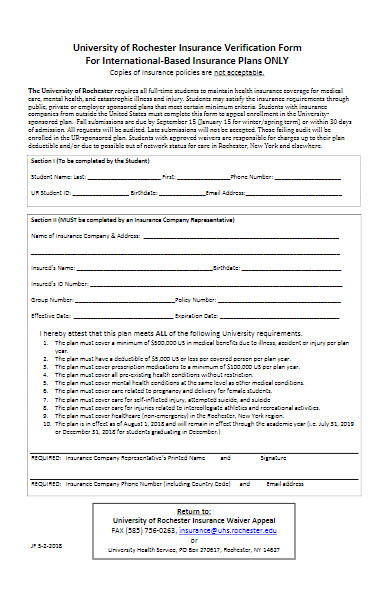

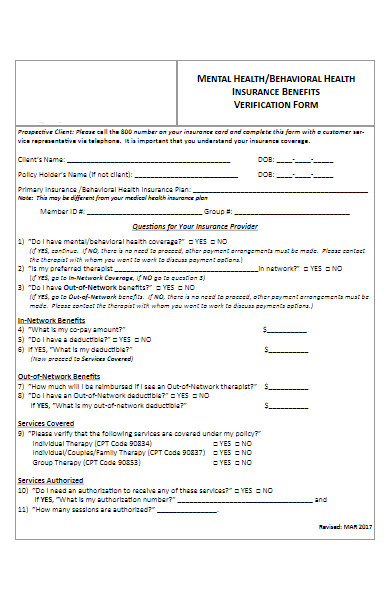

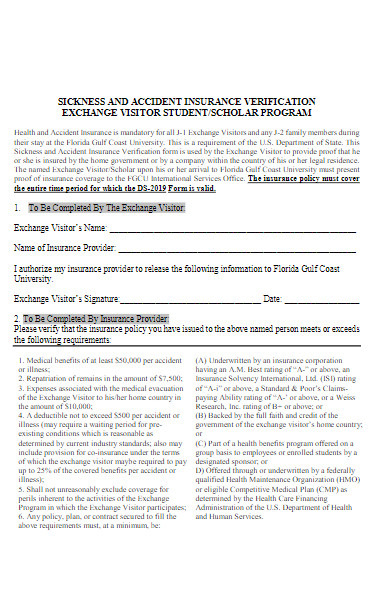

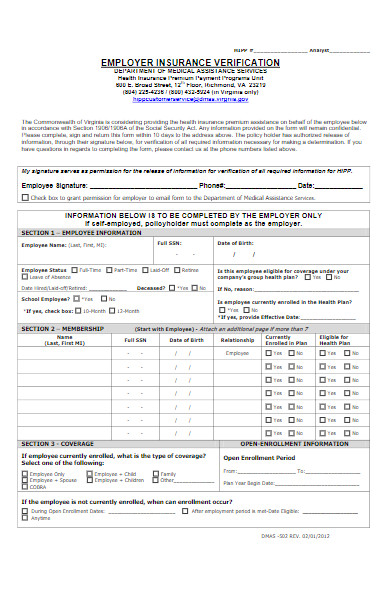

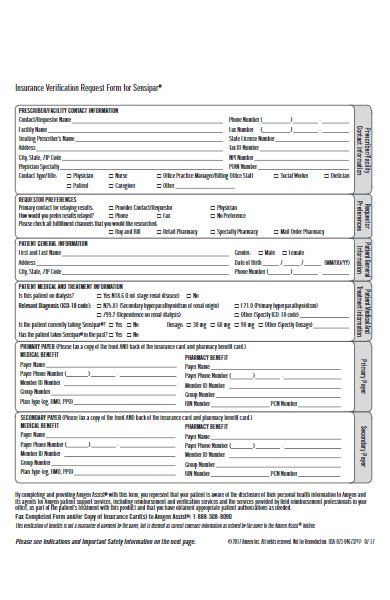

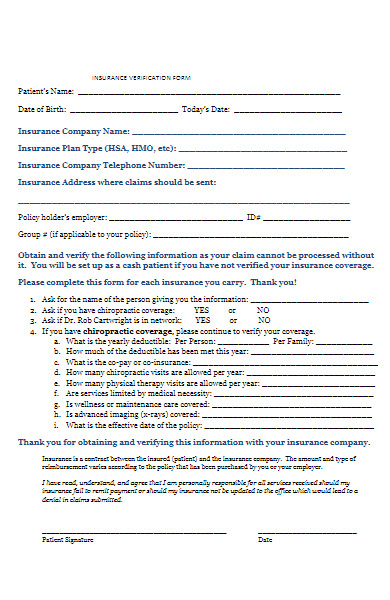

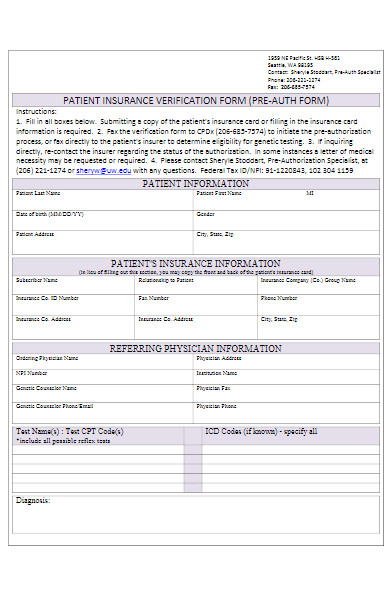

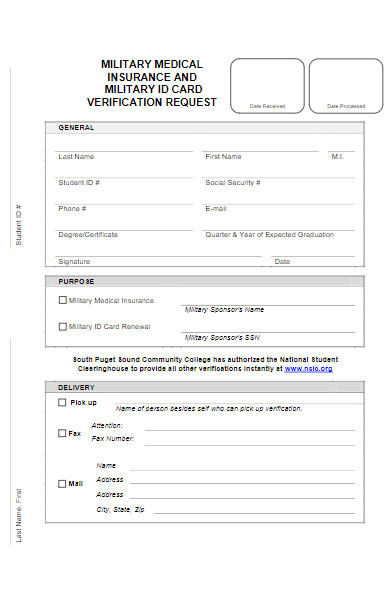

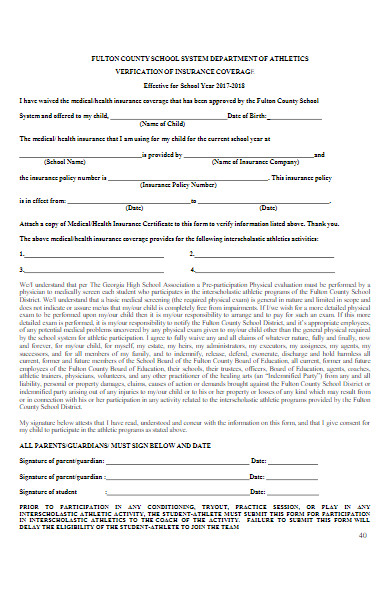

What is the Best Sample Medical Insurance Verification Form?

While the precise design and content of a Medical Insurance Verification Form may vary between healthcare facilities and insurance providers, here’s a basic sample to illustrate the general structure:

Patient Information:

- Full Name: __________________________

- Date of Birth: _________

- Address: __________________________

- Contact Number: __________________________

- Social Security Number (optional): _________

Insurance Information:

- Insurance Company: __________________________

- Policy/Group Number: __________________________

- Member ID: __________________________

- Policy Holder’s Name: __________________________

- Policy Holder’s Date of Birth: _________

Coverage Details (To be filled out by the insurance company):

- Effective Date: _________

- Expiration Date: _________

- Primary Care Physician: __________________________

- Coverage for Specific Services (if applicable):

- Laboratory: _____ (Covered/Not Covered)

- Surgery: _____ (Covered/Not Covered)

- Physical Therapy: _____ (Covered/Not Covered)

- [Other Services]

Financial Responsibility (Co-pays, Deductibles, etc.):

- Co-pay for Primary Care Visit: $_________

- Co-pay for Specialist Visit: $_________

- Annual Deductible: $_________

- Deductible Met (Y/N): _____

Insurance Company Verification:

- Verified by (Name): __________________________

- Date: _________

- Contact Number: __________________________

- Notes/Additional Information: __________________________

Healthcare Provider Use:

- Service(s) Inquired About: __________________________

- Estimated Cost: $_________

- Notes: __________________________

Please note that this is a generalized sample. Depending on the specific needs of the healthcare provider and the insurance company, additional or different fields might be required. It’s crucial to customize the form to cater to the specific operational requirements of the involved entities.

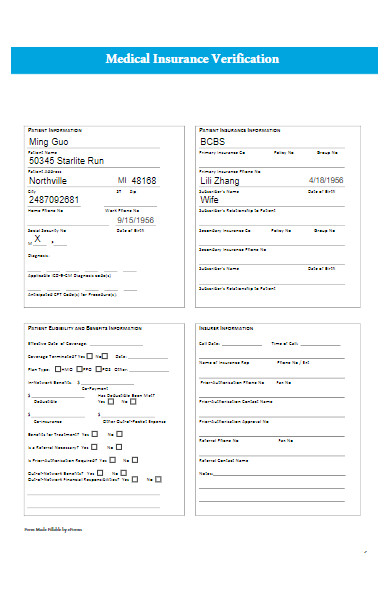

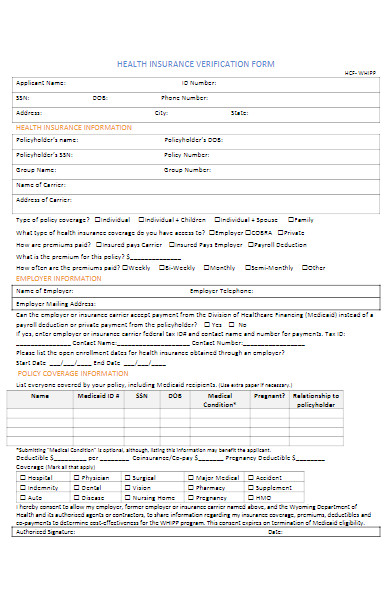

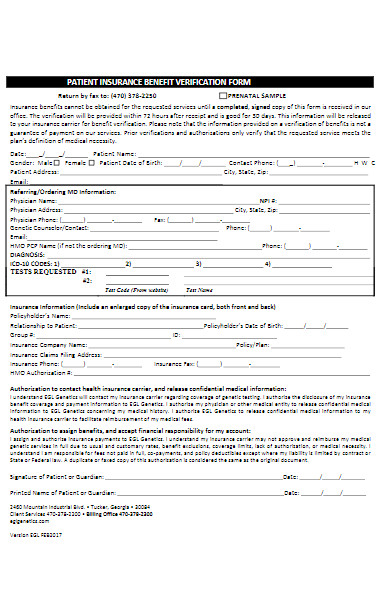

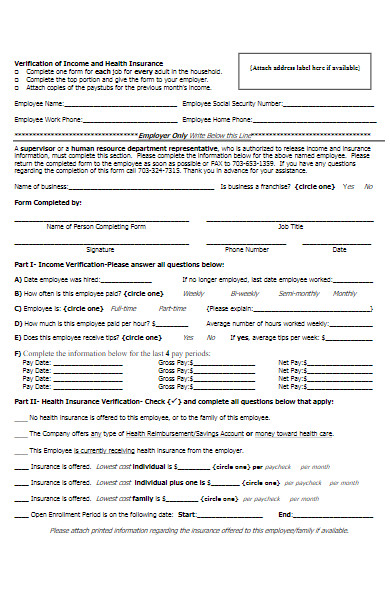

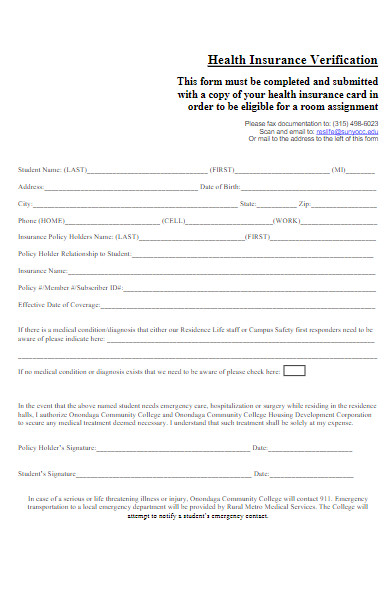

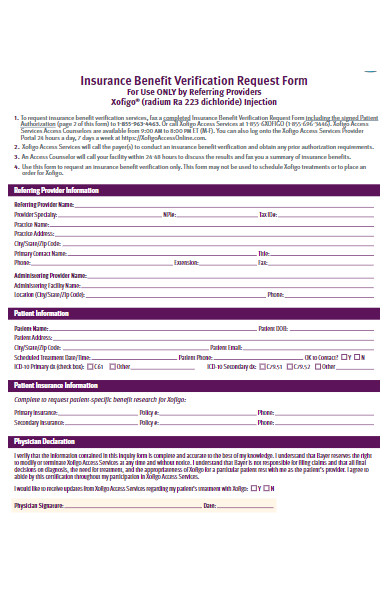

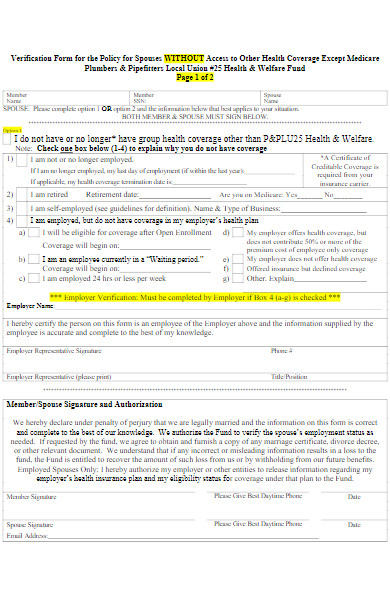

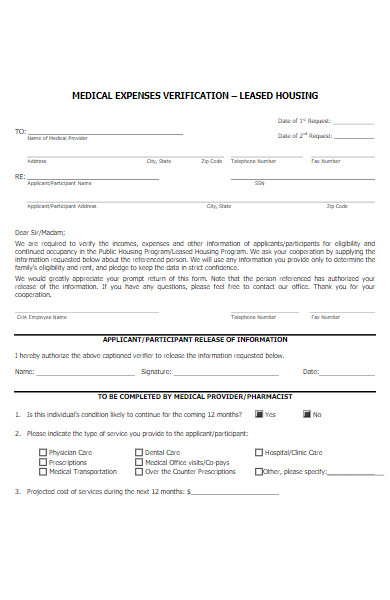

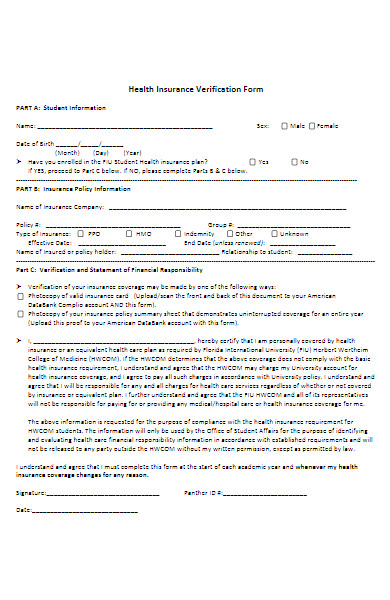

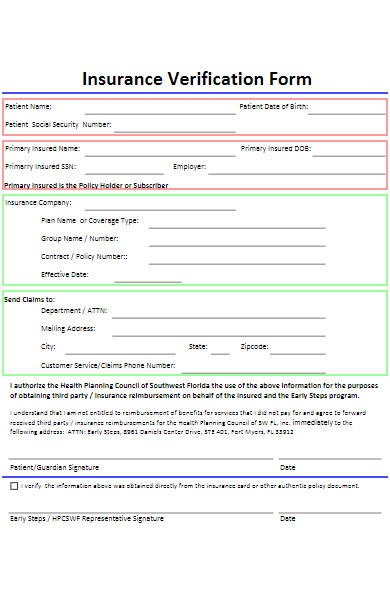

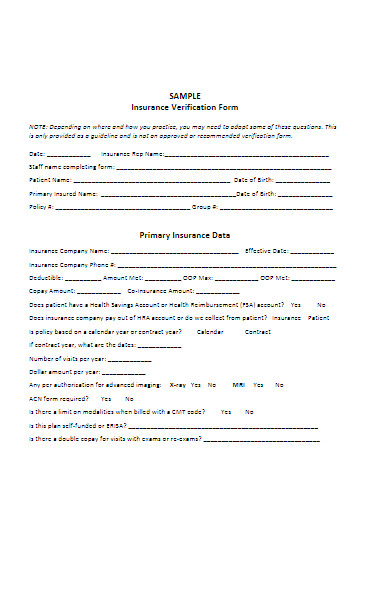

FREE 50+ Medical Insurance Verification Forms in PDF

51. Verification Form for Medical Insurance Coverage

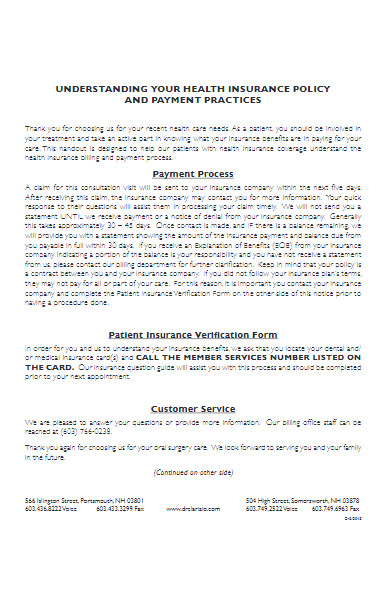

How do I fill out a Medical Insurance Verification Form?

Filling out a Medical Insurance Verification Form in PDF requires accurate and up-to-date information about the patient and their insurance coverage. Here’s a step-by-step guide on how to fill out such a form:

-

Patient Information:

- Full Name: Provide the patient’s legal name as it appears on their insurance card.

- Date of Birth: Enter the patient’s birth date.

- Address: Provide the current residential address of the patient.

- Contact Number: Enter a phone number where the patient can be reached.

- Social Security Number (if required): Some forms may ask for this for identification purposes.

-

Insurance Information:

- Insurance Company: Write down the name of the insurance provider.

- Policy/Group Number: Found on the insurance card, this identifies the specific policy.

- Member ID: This is the patient’s individual identification number with the insurance company.

- Policy Holder’s Name: If the patient isn’t the main policyholder (e.g., a dependent), provide the name of the person who holds the policy.

- Policy Holder’s Date of Birth: This is especially important if the patient is a dependent.

-

Coverage Details (if self-verifying):

- Refer to your insurance policy documents or contact your insurance provider to obtain specific coverage details for various medical services. It’s more common, however, for the medical provider or insurance company to fill out this section.

-

Financial Responsibility:

- Co-pays: Check your insurance card or documentation for co-payment amounts for visits or specific services.

- Annual Deductible: This is the amount you need to pay out-of-pocket before the insurance covers certain costs.

- Deductible Met: Indicate whether you’ve already met your deductible for the year.

-

Verification:

- If you’re filling out the form at a medical facility, the staff might handle verification with the insurance company. However, if you’re self-verifying, you may need to call your insurance company, verify the above details, and then document the name of the representative you spoke to, the date, and any additional information or notes provided.

-

Additional Sections:

- Some forms might have sections for prior authorizations, referrals, or specific service inquiries. Ensure you understand what is required and provide the necessary information.

-

Review:

- Before submitting, double-check all provided details for accuracy. Any discrepancies might delay the verification process or lead to billing issues.

-

Submission:

- Submit the completed form to the appropriate department or person, usually the billing or administrative department of the healthcare provider. Ensure you keep a copy for your records.

Remember, while this guide provides a general process, forms may vary. Always refer to any accompanying instructions or guidelines provided with the specific Medical Insurance Verification Form you’re working with.

Can I submit my Medical Insurance Verification Form online?

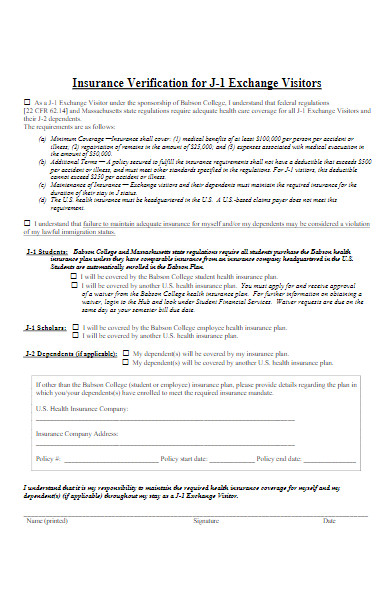

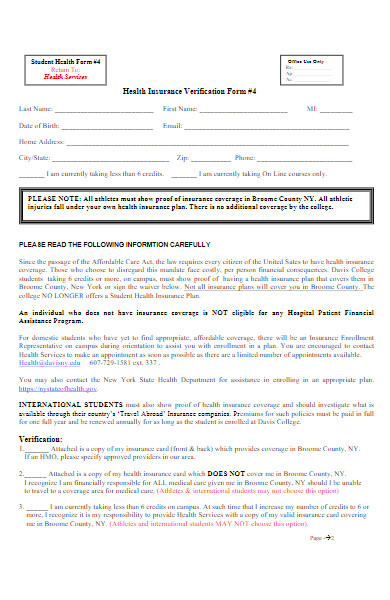

Yes, many healthcare providers and insurance companies allow for the online submission of the Medical Insurance Verification Form, especially as digital and telehealth services become more prevalent. However, the availability of online submission depends on the specific healthcare provider or insurance company in question. Here’s what you might expect if online submission is available:

- Portal Access: Many providers and insurance companies have secure online portals where patients can log in to manage their information. You might be asked to create an account if you don’t have one already.

- Digital Forms: Once logged in, you can access, fill out, and submit the Medical Insurance Verification Form digitally. Some systems might even pre-populate certain sections of the form based on the information they already have on file.

- Document Upload: If required, these portals often allow you to upload scanned copies or photos of supporting documents, such as a copy of your insurance card.

- E-Signatures: Many digital forms support electronic signatures, allowing you to “sign” the form online.

- Submission & Confirmation: After filling out and signing the form, you can submit it through the portal. Typically, you’ll receive a confirmation message or email verifying its successful submission.

- Data Security: These portals prioritize data security, using encryption and other security measures to protect your personal and medical information.

- Tracking: Some online systems allow you to track the status of your form, from submission to verification.

However, always verify with the specific healthcare provider or insurance company whether they accept online submissions of the Medical Insurance Verification Form. If they don’t, they will provide guidance on alternative submission methods, such as via fax, email, or in-person. You should also take a look at our medical health insurance verification forms.

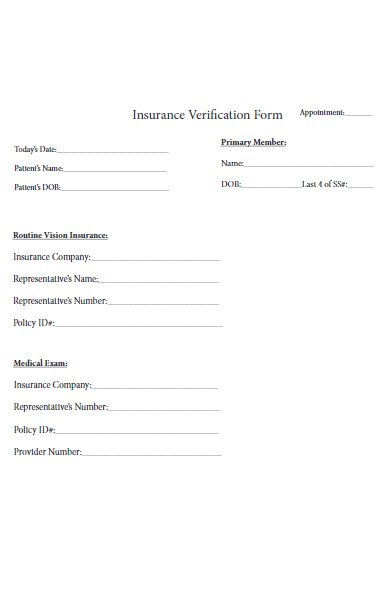

What details are required on the Medical Insurance Verification Form?

A Medical Insurance Verification Form is designed to gather all pertinent information regarding a patient’s health insurance coverage. While the specific details might vary depending on the healthcare provider or insurance company, here are the common details typically required:

-

Patient Information:

- Full Name: The patient’s legal name as it appears on the insurance card.

- Date of Birth: To verify age and policy specifics.

- Address: The patient’s current address.

- Contact Number: A primary phone number for the patient.

- Social Security Number (optional): Some institutions may request this for identification.

-

Insurance Information:

- Insurance Company: The name of the insurance company providing coverage.

- Policy/Group Number: An identifier for the patient’s insurance plan.

- Member ID: The patient’s unique identification number with the insurance company.

- Policy Holder’s Name: Useful if the patient is a dependent under someone else’s coverage.

- Policy Holder’s Date of Birth: Again, especially important for dependents.

-

Coverage Details:

- Effective Date: The start date of the insurance coverage.

- Expiration Date: The end date or renewal date.

- Coverage for Specific Services: This might include information on covered services like laboratory tests, surgeries, physical therapy, etc.

-

Financial Responsibility:

- Co-pay Amounts: Specific amounts required to be paid by the patient for services.

- Annual Deductible: The set amount a patient pays before insurance begins covering services.

- Deductible Met: Indication of whether the deductible has been met for the year.

-

Verification by Insurance Company (if filled by them or after communication):

- Verified by: Name of the insurance representative who verified the information.

- Date of Verification: When the information was confirmed.

- Notes/Additional Information: Any extra information or specifics about coverage, exclusions, or limitations.

-

Healthcare Provider Section (if applicable):

- Service(s) Inquired About: Specific medical services or treatments for which coverage verification is sought.

- Estimated Cost: Potential cost of the treatment or service.

- Notes: Any other relevant notes from the healthcare provider’s perspective.

-

Additional Sections (if applicable):

- Prior Authorizations: Information about treatments or procedures that need prior approval from the insurance company.

- Referrals: Details if a referral is required for seeing a specialist.

It’s essential for patients and healthcare providers to fill out the form accurately and completely, as any discrepancies or missing information can lead to issues with billing and coverage verification.

How often should I update my Medical Insurance Verification Form?

The frequency with which you should update your Medical Insurance Verification Form depends on various factors. Here are some general guidelines:

- Changes in Personal Information: Update the form whenever there’s a significant change in your personal details, such as a change in name (due to marriage, for example), address, or contact number.

- Change in Insurance Provider or Plan: If you switch insurance companies or even just change your plan within the same company, it’s crucial to update the form. The new policy might have different coverage specifics, co-pays, or deductibles.

- Annually: Even if there haven’t been any major changes, it’s a good practice to review and, if necessary, update your Medical Insurance Verification Form annually. This ensures that your healthcare provider has the most up-to-date information, particularly if there are minor changes in the policy or if the plan renews with slightly different terms.

- Beginning of Treatment or Medical Procedures: Before starting any long-term treatment or undergoing significant medical procedures, ensure that the form is up-to-date. This ensures that both you and your healthcare provider are clear about what the insurance covers and what you might need to pay out-of-pocket.

- When Requested: Sometimes, medical service providers will request verification regularly, especially if you’re seeing a new doctor or specialist, or if you’re accessing a new medical service.

- Change in Employment: If your health insurance is provided by your employer and you change jobs, you’ll likely need to update the form. Even if you remain with the same employer, they might change insurance providers or policy details from time to time.

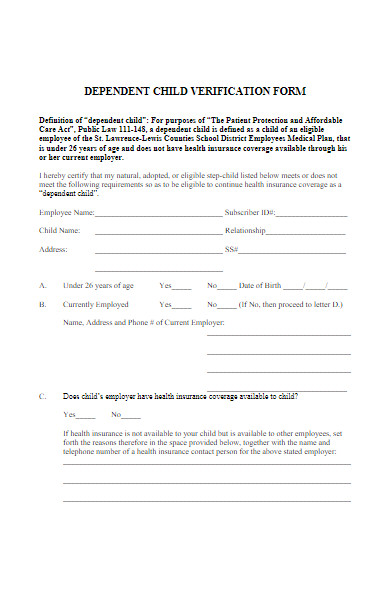

- Addition of Dependents: If you add a dependent to your insurance policy (like a newborn child or a new spouse), you should update the form to reflect this change.

Regularly updating your Medical Insurance Verification Form minimizes the risk of billing discrepancies, ensures you get the coverage you’re entitled to, and helps avoid unexpected out-of-pocket costs.

Who should I contact if I have issues with the Medical Insurance Verification Form?

If you encounter issues with the Medical Insurance Verification Form, the following are the most appropriate points of contact:

- Your Healthcare Provider’s Office: If the form was provided by a specific doctor’s office, clinic, or hospital, start by contacting their administrative or billing department. They can assist with questions related to how the form should be completed, what specific information they require, or any discrepancies between what they’ve recorded and what your insurance policy covers.

- Your Insurance Company: For questions about your coverage details, policy number, member ID, or any other insurance-specific information, reach out to your insurance company’s customer service department. They can clarify the coverage, co-pays, deductibles, and any other policy-related queries.

- Human Resources (if insurance is through your employer): If your insurance is provided as a benefit through your employer, your HR department can be a valuable resource. They often handle enrollment and might be familiar with common questions or issues regarding the insurance plan.

- Online Portals: If you’re using an online portal to submit or manage your Medical Insurance Verification Form, there’s usually a help section or customer support option available. This might include FAQs, live chat support, or contact details for technical support.

- Insurance Broker or Agent: If you purchased your insurance policy through a broker or agent, they could provide assistance, especially if you’re unsure about specific coverage details or if you’re considering changing your policy.

- Health Insurance Assistance Programs: Some regions have non-profit organizations or government programs designed to help individuals understand and navigate their health insurance. They can be especially helpful if you’re struggling to understand policy details or if you believe your insurance company isn’t providing the coverage you’re entitled to.

- Legal Counsel: In rare situations, if you believe there’s a significant discrepancy or unfair denial of coverage, and you’ve exhausted other avenues, you might consider seeking legal advice.

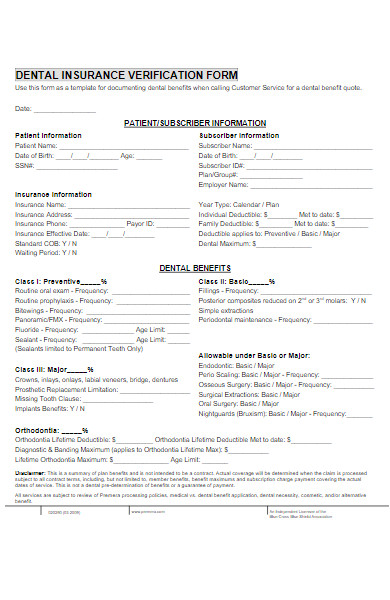

Always remember to keep copies of all communications regarding the form, especially if there are issues or disputes. This documentation can be invaluable in resolving misunderstandings or challenges. Our Dental Insurance Verification Forms is also worth a look at

How secure is my information on the Medical Insurance Verification Form?

The security of your information on the Medical Insurance Verification Form depends on multiple factors, including how the form is stored, transmitted, and accessed. Here are some general points to consider:

-

Physical Forms:

- Storage: Paper forms should be kept in secure locations, such as locked filing cabinets, within medical facilities.

- Access: Only authorized personnel, like administrative staff and healthcare providers, should have access to these forms.

- Disposal: Shredding is the best way to dispose of paper documents containing sensitive information once they’re no longer needed.

-

Digital Forms:

- Encryption: Digital forms should be encrypted both in storage (at rest) and when being transmitted (in transit). This ensures that unauthorized individuals cannot easily access the data.

- Secure Portals: Many healthcare providers and insurance companies use secure online portals for form submission. These portals typically require strong passwords and may employ two-factor authentication for added security.

- Firewalls and Anti-Malware: Healthcare institutions should have robust firewalls and anti-malware programs in place to prevent unauthorized access or cyberattacks.

- Regular Backups: Data should be backed up regularly to prevent loss and to facilitate recovery in the event of any breaches.

-

Regulations and Compliance:

- In many countries, there are strict regulations regarding the protection of personal health information. For example, in the U.S., the Health Insurance Portability and Accountability Act (HIPAA) sets forth standards to protect sensitive patient data. Healthcare providers and insurance companies must adhere to these regulations, which include ensuring the security of personal health information.

-

Sharing Information:

Your information should only be shared with entities that require it for medical or billing purposes. There should be established protocols for sharing this information securely, whether it’s faxed, emailed, or sent through other means.

-

Employee Training:

Staff members who handle sensitive information should be trained in maintaining data privacy and security. This includes understanding best practices and being aware of potential threats like phishing attempts.

-

Audits and Monitoring:

Regular audits and monitoring can identify potential security vulnerabilities and ensure compliance with security protocols.

To ensure the security of your information on the Medical Insurance Verification Form:

- Ask your healthcare provider or insurance company about their data protection measures.

- Only provide personal information through recognized, official channels.

- Be cautious about sharing your information, especially over the phone or through email, unless you’re certain about the legitimacy of the request.

Remember that while medical institutions and insurance companies typically have robust security measures in place, no system is entirely immune from potential breaches. Being informed and cautious can help protect your sensitive information.

Can I request a copy of my submitted Medical Insurance Verification Form?

Yes, you generally have the right to request a copy of your submitted Medical Insurance Verification Form. Here’s how you can go about it:

- Contact the Provider: Start by contacting the doctor’s office, clinic, or hospital where you submitted the form. They should have a process in place to provide patients with copies of their records.

- Written Request: Some institutions may require a written request to release medical or administrative records. Ensure that you provide all necessary details in your request, such as your full name, date of birth, the approximate date of submission, and any other relevant details that can help locate the form.

- HIPAA Rights (U.S. Specific): If you’re in the United States, the Health Insurance Portability and Accountability Act (HIPAA) grants patients the right to access their medical records, which includes administrative forms like the Medical Insurance Verification Form. Providers are required to comply with such requests within a reasonable time frame.

- Potential Fees: While you have the right to request your records, some institutions may charge a nominal fee for making copies or for the administrative labor associated with retrieving and providing the form. These fees vary by institution and region.

- Digital Access: If the healthcare provider uses an online patient portal, you might be able to access and download copies of submitted forms directly from the portal.

- Insurance Company: If for some reason the healthcare provider cannot furnish a copy, you can also contact your insurance company. They may have received a copy when verifying coverage and can provide you with the details they have on file.

- Privacy Concerns: When requesting copies, the provider might verify your identity to ensure they’re releasing information to the correct individual. This is a standard procedure meant to protect your privacy.

It’s a good practice to keep personal copies of important forms and medical records, as they can be useful for future reference, especially if there are any disputes or if you switch healthcare providers.

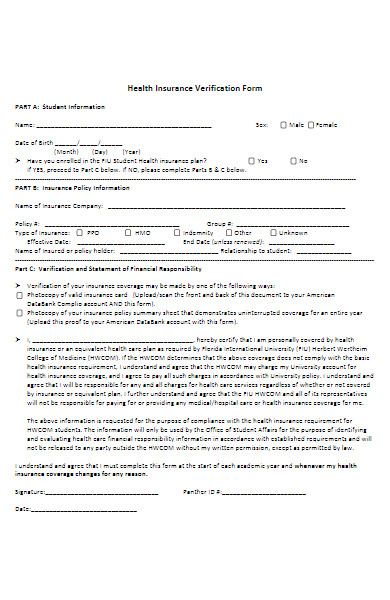

How to Create a Medical Insurance Verification Form?

Creating a Medical Insurance Verification Form requires careful consideration to ensure it gathers all necessary information for the verification process. Here’s a step-by-step guide to creating one:

-

Determine the Purpose:

- Understand the need for the form. Typically, it’s to verify insurance coverage before a medical service is provided.

-

Choose a Format:

- Decide whether the form will be paper-based, digital, or available in both formats.

- Use software like Microsoft Word, Google Docs, or specialized form creation tools for digital versions.

-

Header:

- Place the name and logo of your medical practice or institution at the top.

- Mention the title “Medical Insurance Verification Form” prominently.

-

Patient Details:

- Full name

- Date of birth

- Address

- Phone number

- Email (optional)

-

Insurance Information:

- Insurance company name

- Policy number

- Group number (if applicable)

- Name of the policyholder (if different from the patient)

- Policyholder’s date of birth

- Relationship of patient to policyholder (e.g., self, spouse, child)

-

Type of Service:

- List or space to describe the expected service or treatment. This helps the insurance company verify coverage specifics.

-

Date of Service:

- The expected date when the medical service will be provided.

-

Consent Clause:

- A statement where the patient or guardian gives consent to verify the insurance details.

- Example: “I hereby authorize [Medical Institution Name] to verify my insurance coverage details with the mentioned insurance company.”

-

Privacy Statement:

- A brief note ensuring that the patient’s details will remain confidential and will be used only for the verification purpose.

-

Signature and Date:

- Space for the patient (or guardian, if applicable) to sign and date the form, confirming the accuracy of the information and the given consents.

-

Footer (optional):

- Include contact details of the medical institution or clinic for any queries.

-

Feedback and Review:

- Before finalizing the form, have it reviewed by relevant stakeholders, such as administrative staff, healthcare providers, or legal teams, to ensure it meets all necessary criteria.

-

Distribution and Storage:

- Determine how the form will be distributed to patients and how completed forms will be securely stored, whether physically or digitally.

-

Stay Updated:

- Periodically review and update the form as insurance norms and requirements change.

-

Train Staff:

- Ensure that front office and administrative staff are well-trained on the form’s purpose, how to assist patients in filling it out, and the subsequent steps in the verification process.

By following this guide, you can create an effective and comprehensive Medical Insurance Verification Form that simplifies the insurance verification process for both patients and healthcare providers.

Tips for creating an Effective Medical Insurance Verification Form

Creating an effective Medical Insurance Verification Form requires a blend of simplicity, comprehensiveness, and clarity. Here are some tips to guide you in making your form both efficient and user-friendly:

-

Keep it Simple:

- Use clear, concise language. Avoid medical jargon or complex terms unless absolutely necessary.

-

Logical Flow:

- Organize the form in a logical sequence, starting with patient details, followed by insurance information, the service details, and finally, consent and signatures.

-

Use Clear Headings:

- Divide the form into sections with bold headings to make it easier for patients to fill out.

-

Provide Adequate Space:

- Ensure there’s enough space for patients to write or type information, especially in sections where they might need to provide detailed answers.

-

Include Help Icons or Tooltips (for digital forms):

- If your form is digital, consider adding help icons or tooltips for fields that might require additional explanation.

-

Mandatory vs. Optional Fields:

- Clearly mark which fields are mandatory and which are optional. This ensures that patients provide all essential information.

-

Use Checkboxes or Dropdowns:

- For sections with standard answers, like “Relationship to Policyholder”, use checkboxes or dropdown options to speed up the process.

-

Add a Privacy Assurance:

- Reassure patients that their information will be kept confidential and used only for the intended purpose.

-

Include a Contact Point:

- Should patients have questions while filling out the form, provide a contact number or email for assistance.

-

Consent Section:

- Ensure the consent section is clear about what the patient is authorizing and who will access the information.

-

Provide Instructions:

- Offer clear instructions at the beginning or within relevant sections, especially if specific details or document numbers are needed.

-

Ensure Legibility:

- If using a paper form, use a font size and style that’s easy to read. If digital, ensure the form is mobile-responsive.

-

Regularly Update:

- Insurance norms and requirements can change. Review and update your form periodically to stay compliant and relevant.

-

Test and Get Feedback:

- Before finalizing the form, test it with a small group of patients or staff. Gather feedback to make any necessary adjustments.

-

Security for Digital Forms:

- If the form is online, ensure it’s secure, uses encryption, and complies with relevant data protection regulations.

-

Include a Submission Confirmation (for digital forms):

- Once submitted, users should receive a confirmation message or email. This assures them that the process was successful.

By following these tips, you’ll create a Medical Insurance Verification Form that’s efficient, user-friendly, and aids in the smooth verification of insurance coverage for healthcare services.

The Medical Insurance Verification Form is a crucial tool for healthcare providers, ensuring patients’ insurance coverage for specific services. It simplifies the verification process, providing clarity and efficiency. Properly crafted, it can streamline administrative tasks and enhance patient-provider communication. Regular updates and a user-friendly design are essential for its effectiveness in navigating the intricate world of medical insurance. In addition, you should review our Employee Verification Form.

Related Posts

What Is a Birth Verification Form? [ Definition, Importance, Purpose ]

FREE 41+ Printable Medical Forms in PDF Excel | MS Word

What Is a Signature Verification Form? [ What Is, Importance, Tips ]

FREE 9+ Sample Medical Verification Forms in PDF MS Word

FREE 23+ Insurance Verification Forms in PDF

FREE 23+ Insurance Verification Forms in PDF MS Word

FREE 9+ Education Verification Forms in PDF Ms Word

FREE 5+ Medical Bill Forms in PDF

FREE 7+ Medical Intake Forms in PDF

What Is a Disability Verification? [ Definition, Importance, Uses ...

FREE 25+ Insurance Forms in PDF MS Word

FREE 8+ Sample Education Verification Forms in PDF MS Word

FREE 50+ Medical Forms in PDF XLS

FREE 9+ Sample Dental Claim Forms in PDF MS Word

FREE 4+ Health Insurance Quote Forms in PDF Excel