Navigating the Massachusetts Power of Attorney (POA) Form can be straightforward with the right guidance. This legal document grants someone authority to act on your behalf in various matters. Understanding its use is crucial for effective decision-making. Our guide offers essential tips and insights on how to utilize this powerful tool effectively in Massachusetts. Whether for financial, healthcare, or general purposes, learn the key aspects to ensure your POA aligns with your needs and legal standards.

What is the Massachusetts Power of Attorney Form?

The Massachusetts Power of Attorney Form is a legal document allowing one person, known as the principal, to designate another individual, called the agent or attorney-in-fact, to make decisions and act on their behalf. This form can cover various areas, such as financial matters, healthcare decisions, or general personal affairs. It’s a crucial tool for delegating authority, especially in situations where the principal cannot make decisions due to illness or absence.

What is the Best Sample Massachusetts Power of Attorney Form?

A Power of Attorney (POA) form is a legal document that allows an individual (the Principal) to appoint someone else (the Agent or Attorney-in-Fact) to make decisions on their behalf. In Massachusetts, these forms are used for various purposes, including financial matters, healthcare decisions, and other personal affairs. This sample Massachusetts Power of Attorney form is designed to be comprehensive and easy to fill out.

Massachusetts Power of Attorney Form

Principal’s Information:

- Full Name: ___________________________

- Address: _____________________________

- City: ___________________ State: MA Zip: _______

Agent’s Information:

- Full Name: ___________________________

- Address: _____________________________

- City: ___________________ State: MA Zip: _______

Type of Power of Attorney:

- Durable (remains in effect even if the Principal becomes incapacitated)

- Non-Durable (ends if the Principal becomes incapacitated)

Powers Granted (check all that apply):

- Real Estate Transactions

- Financial and Banking Matters

- Business Operations

- Insurance and Annuity Transactions

- Tax Matters

- Personal and Family Maintenance

- Legal Affairs

- Healthcare Decisions (including HIPAA Release)

- Other: ________________________________________

Special Instructions:

Effective Date and Duration:

- Effective Date: _________________

- This Power of Attorney is effective immediately.

- This Power of Attorney shall become effective upon the occurrence of the following event: ________________________________________________________________________

- Duration:

- Indefinite

- Expires on: _________________

Third Party Reliance:

This document shall be fully binding upon the Principal, and all third parties are authorized to rely upon the representations and actions of the Agent as if taken directly by the Principal.

Signatures:

- Principal’s Signature: ___________________________ Date: _________________

- Agent’s Signature: _____________________________ Date: _________________

Notarization (if required):

This document was acknowledged before me on __________ (date) by ______________________ (name of Principal).

- Notary Public’s Signature: ________________________

- My Commission Expires: ________________________

This Massachusetts Power of Attorney form is designed to be comprehensive and adaptable to various needs. It is crucial to ensure that the form is filled out accurately and in compliance with Massachusetts law. It is advisable to consult with a legal professional to ensure that the document meets your specific requirements and is legally binding.

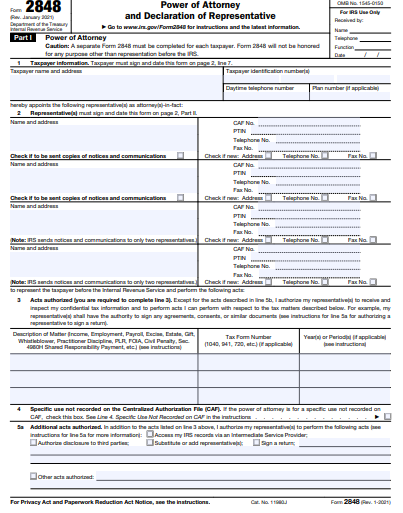

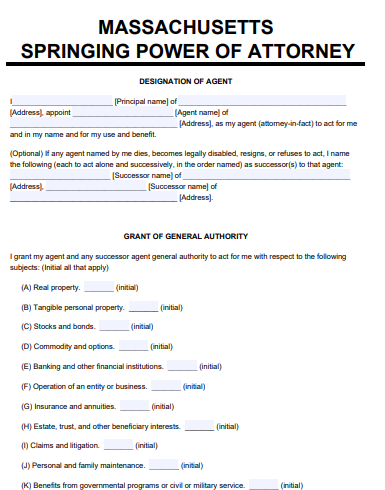

1. State of Massachusetts Power of Attorney Form

2. Massachusetts Special Power of Attorney Form

3. Massachusetts Simple Power of Attorney Form

4. Massachusetts Sample Power of Attorney Form

5. Massachusetts Printable Power of Attorney Form

6. Massachusetts Power of Attorney Form

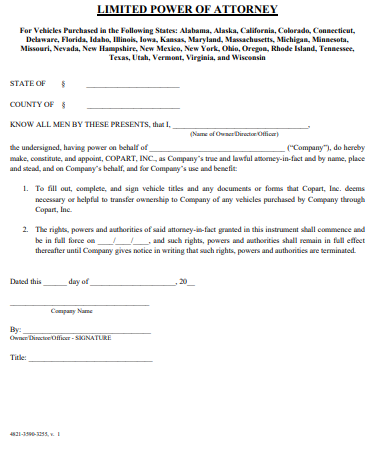

7. Massachusetts Limited Power of Attorney Form

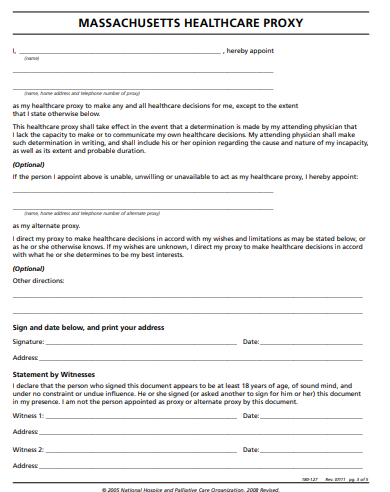

8. Massachusetts HealthCare Power of Attorney Form

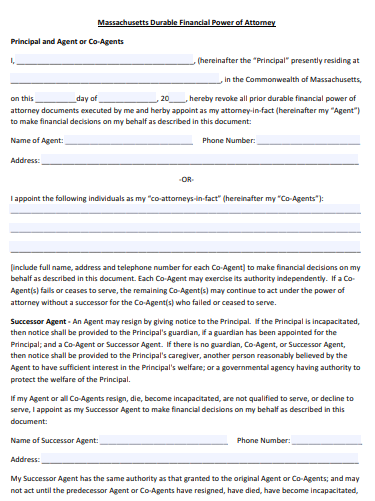

9. Massachusetts Durable Financial Power of Attorney Form

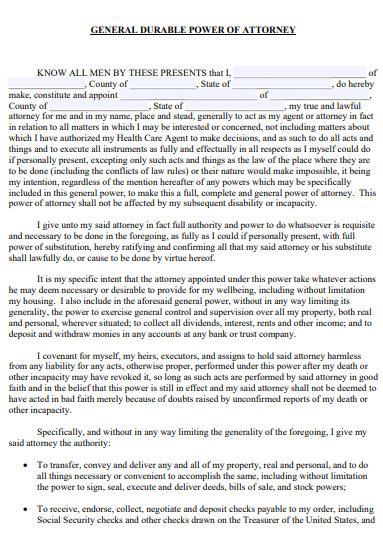

10. General Massachusetts Power of Attorney Form

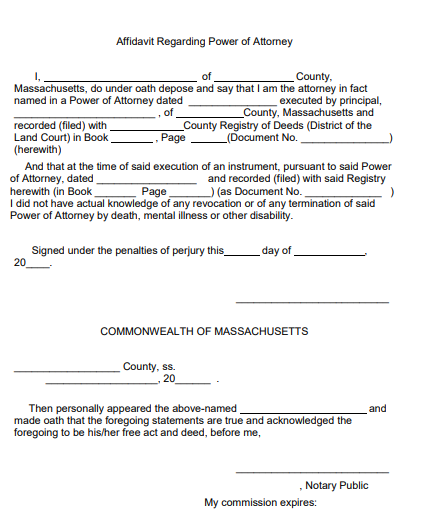

11. CommonWealth of Massachusetts Power of Attorney Form

How Do I Get Power of Attorney in Massachusetts?

1. Understanding the Process

To obtain a Power of Attorney in Massachusetts, select a trusted individual as your Agent. Complete a POA form, specifying the powers granted. Ensure the form adheres to Massachusetts laws, including signature requirements. It’s advisable to consult a legal expert for guidance.

2. Seeking Legal Advice

Consulting a lawyer can provide clarity on the POA process. They can help tailor the document to your specific needs, ensuring legal compliance and effectiveness.

3. Completing the POA Form

Fill out the Massachusetts POA form with accurate details of the Principal and Agent. Clearly define the powers granted and any limitations.

4. Notarization and Witnesses

Massachusetts law may require notarization and/or witnesses for the POA to be valid. Ensure these steps are followed for legal enforceability.

5. Filing and Record Keeping

Once completed, the POA may need to be filed with certain institutions or agencies. Keep copies for your records and provide one to your Agent.

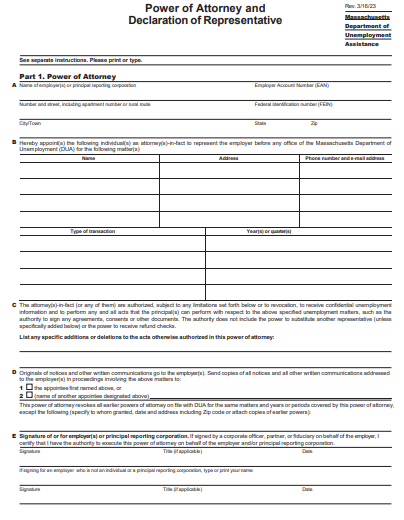

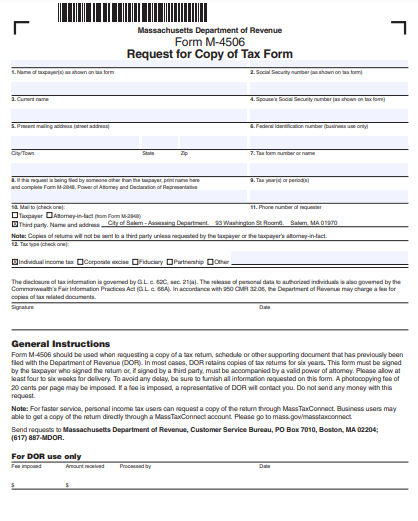

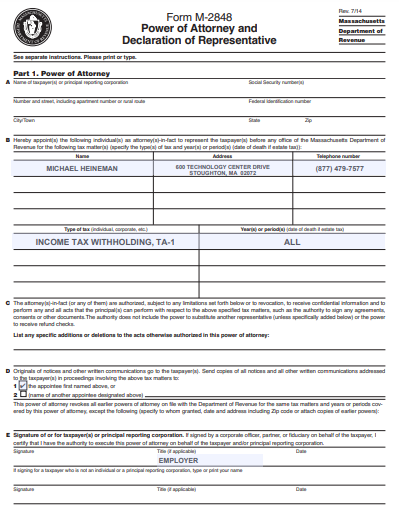

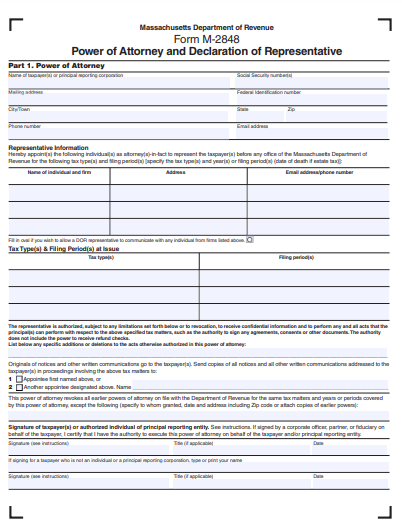

What is a Massachusetts Form M 2848?

1. Definition and Purpose

Form M 2848 is a Massachusetts tax power of attorney form, allowing individuals to appoint a representative for tax matters with the Department of Revenue.

2. Appointing a Tax Representative

This form enables taxpayers to designate a professional, like a CPA or attorney, to handle tax affairs, including communication with tax authorities.

3. Specific Tax Matters

Form M 2848 is used for specific tax-related tasks, such as filing returns, obtaining information, and representing in tax disputes.

4. Duration and Revocation

The form outlines the duration of the representative’s authority and includes provisions for revocation.

5. Filing Requirements

Understand the filing requirements with the Massachusetts Department of Revenue to ensure proper processing and acknowledgment.

How Much Does a Power of Attorney Cost in Massachusetts?

1. Basic Filing Fees

The cost of a POA in Massachusetts may involve nominal filing fees if the document needs to be recorded or registered with certain agencies.

2. Legal Consultation Fees

Hiring an attorney to draft a POA can incur additional costs, varying based on complexity and the lawyer’s rates.

3. Notarization Costs

Notarization fees, if required, add to the overall cost of executing a POA in Massachusetts.

4. Self-Prepared POA

Creating a POA using online templates or forms can be more cost-effective but may lack personalized legal advice.

5. Ongoing Management Expenses

If the POA involves managing extensive assets or complex matters, there may be ongoing costs associated with its administration.

Do You Need a Lawyer for a Power of Attorney in MA?

1. Legal Expertise

While not mandatory, a lawyer can ensure your POA complies with Massachusetts laws and accurately reflects your intentions.

2. Complex Situations

In cases involving substantial assets or complicated family dynamics, legal guidance is beneficial for drafting a POA.

3. DIY Options

For straightforward situations, individuals may opt for self-prepared POA forms, available online or at legal document providers.

4. Risk Management

A lawyer can help mitigate risks, ensuring the POA is not only legally valid but also resistant to challenges.

5. Peace of Mind

Engaging a legal professional provides assurance that your POA is correctly executed and effective for its intended purpose.

What Does a Power of Attorney Do in Massachusetts?

1. Decision-Making Authority

A POA in Massachusetts grants an Agent authority to make decisions on behalf of the Principal, ranging from financial to healthcare matters.

2. Financial Management

It includes managing bank accounts, investments, and real estate transactions, ensuring financial affairs are handled as per the Principal’s wishes.

3. Healthcare Directives

A healthcare POA allows the Agent to make medical decisions if the Principal becomes incapacitated.

4. Legal Representation

The Agent can also handle legal matters, representing the Principal in various legal proceedings or negotiations.

5. Flexibility and Control

A POA provides flexibility, allowing Principals to tailor the extent of powers granted, ensuring their affairs are managed according to their preferences.

Does Massachusetts Have a Statutory Power of Attorney?

1. Standardized Form

Massachusetts offers a statutory POA form, providing a standardized template for creating a legally valid POA.

2. Broad Acceptance

This form is widely recognized and accepted by financial institutions, healthcare providers, and other entities within Massachusetts.

3. Customizable Options

While the statutory form covers general powers, it can be customized to suit specific needs and preferences.

4. Legal Compliance

Using the statutory form ensures compliance with Massachusetts laws, reducing the risk of disputes or rejection.

5. Ease of Use

The statutory POA form simplifies the process, making it accessible for individuals to create a POA without extensive legal knowledge.

Who Must File Massachusetts Form 3?

1. Business Entities

Massachusetts Form 3 is primarily filed by business entities, such as partnerships, reporting their income and losses.

2. Non-Resident Income Reporting

It’s also used by non-residents with income from Massachusetts sources, ensuring proper state tax compliance.

3. Partnership Tax Obligations

Partnerships use Form 3 to declare income distributed to partners, who then report this on their individual tax returns.

4. Filing Deadlines

Understanding the filing deadlines for Form 3 is crucial to avoid penalties and ensure timely compliance.

5. Record Keeping

Maintaining accurate financial records is essential for businesses and individuals filing Form 3, facilitating accurate and compliant reporting.

How to Prepare a Massachusetts Power of Attorney Form

Understanding the Basics

Before drafting a Massachusetts Power of Attorney (POA) form, understand its purpose. A POA allows you to appoint someone to manage your affairs, be it financial, legal, or health-related. Knowing the types of POAs – Durable, Non-Durable, Medical, or Limited – is crucial.

Selecting the Right Agent

Choose a trustworthy and competent individual as your Agent. This person should understand your values and be capable of making decisions that align with your interests.

Step 1: Gather Necessary Information

Prepare by collecting all relevant personal information, including full legal names, addresses, and contact details of both the Principal (you) and the Agent.

Step 2: Define the Scope

Clearly outline the powers you are granting. Be specific about what your Agent can and cannot do. This might include handling financial transactions, making healthcare decisions, or managing real estate.

Step 3: Draft the Document

Use a standard Massachusetts POA form or create one tailored to your needs. Ensure it meets state legal requirements. Online templates can be a starting point, but personalization is key.

Step 4: Legal Requirements

Understand and comply with Massachusetts laws regarding POAs. This includes signature requirements, the need for witnesses, and possibly notarization.

Step 5: Sign and Execute

Once the document is prepared, sign it in the presence of the required witnesses or a notary public. This step is crucial for the document’s legal validity.

Step 6: Distribute Copies

Provide copies of the signed document to your Agent, relevant financial institutions, healthcare providers, and any other parties who may need it.

Step 7: Regular Review

Regularly review and update your POA to reflect any changes in your situation or preferences.

Tips for Using Effective Massachusetts Power of Attorney Form

Understanding the Scope of the Power of Attorney

1. Define the Powers Clearly: When drafting a Massachusetts Power of Attorney (POA) form, it’s crucial to specify the scope of authority granted to the Agent. This clarity prevents misunderstandings and ensures that the Agent acts within their designated powers, whether it’s managing finances, making healthcare decisions, or handling real estate transactions.

2. Choose the Right Type of POA: Massachusetts law recognizes different types of POAs, including Durable and Non-Durable. A Durable POA remains effective even if the Principal becomes incapacitated, making it a critical tool for long-term planning.

Selecting the Appropriate Agent

1. Trust and Reliability: Choose an Agent who is trustworthy and capable of handling the responsibilities. This person should have a good understanding of your wishes and be willing to act in your best interest.

2. Discuss Your Expectations: Before finalizing the POA, have a detailed conversation with your chosen Agent. Discuss your expectations, the extent of their powers, and any specific wishes you have regarding your affairs.

Legal Compliance and Execution

1. Adhere to Massachusetts Laws: Ensure that your POA form complies with the legal requirements in Massachusetts. This includes the necessary signatures, witnessing, and notarization, if required.

2. Seek Legal Advice: Consider consulting with a legal professional, especially for complex situations. They can provide valuable guidance on the legalities and help tailor the POA to your specific needs.

Effective Communication with Third Parties

1. Inform Relevant Parties: Once the POA is executed, inform any relevant parties, such as financial institutions, healthcare providers, or family members. This step ensures that they recognize the Agent’s authority.

2. Provide Necessary Documentation: The Agent should have access to the POA document and any other necessary paperwork to demonstrate their authority when required.

Regular Review and Updates

1. Update as Circumstances Change: Regularly review and update your POA to reflect any changes in your situation or wishes. This might include changing the Agent, modifying the powers granted, or revoking the POA entirely.

2. Keep Records Updated: Ensure that any updates to the POA are communicated to all relevant parties and that they have the most current version of the document.

Safeguarding Against Abuse

1. Monitor the Agent’s Actions: Set up a system to monitor the Agent’s actions. This could involve regular check-ins or having a third party review decisions made by the Agent.

2. Include Safeguards in the POA: Consider including safeguards in the POA document, such as requiring the Agent to provide regular accounting or limiting certain powers without additional consent.

By following these tips, you can ensure that your Massachusetts Power of Attorney Form is used effectively and in accordance with your wishes.

What are the Rules for Power of Attorney in Massachusetts?

In Massachusetts, a Power of Attorney must be in writing, signed by the principal, and witnessed by two adults. It should comply with state laws, including specific provisions for durability if required.

What are the Limitations of a Power of Attorney?

A Power of Attorney cannot override a principal’s wishes, make decisions after the principal’s death, vote on their behalf, or change their will. It’s limited to the scope defined in the document.

What is a POA for the State of Massachusetts?

A POA for Massachusetts is a legal document allowing an individual to appoint someone to make decisions on their behalf, covering financial, legal, or health matters, as per state law.

How Many Witnesses for a Power of Attorney in Massachusetts?

In Massachusetts, a Power of Attorney requires two adult witnesses to sign, ensuring the document’s validity and the principal’s capacity and willingness to grant the power.

Does Massachusetts Have a Statutory Power of Attorney?

Yes, Massachusetts provides a statutory form for Power of Attorney, offering a standardized template that complies with state laws, simplifying the process of granting authority.

What is a Limited Power of Attorney Form in Massachusetts?

A Limited Power of Attorney in Massachusetts allows the principal to grant specific, narrow powers to an agent, typically for a particular task or a limited time period.

The Massachusetts Power of Attorney Form is a vital legal tool, empowering individuals to appoint trusted agents for decision-making. Understanding its rules, limitations, and types, like the limited POA, ensures effective usage. With clear guidelines and tips, this guide simplifies the process, helping Massachusetts residents confidently navigate the complexities of creating a POA, ensuring their affairs are managed as per their wishes.

Related Posts

-

10+ Free New Hampshire (NH) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kentucky (KY) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Indiana (IN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Illinois (IL) Power of Attorney Form Download – How to Create Guide, Tips