A Lost Receipt Form is essential for documenting expenses when original receipts are unavailable. This comprehensive guide explains its purpose, structure, and uses in financial management. Learn how to create a professional form that ensures compliance and accountability. Featuring detailed Receipt Form, this resource covers everything from listing expense details to including approver signatures for transparency. Whether for reimbursements, business expenses, or audit trails, a properly structured Lost Receipt Form simplifies processes and ensures accurate records.

Download Lost Receipt Form Bundle

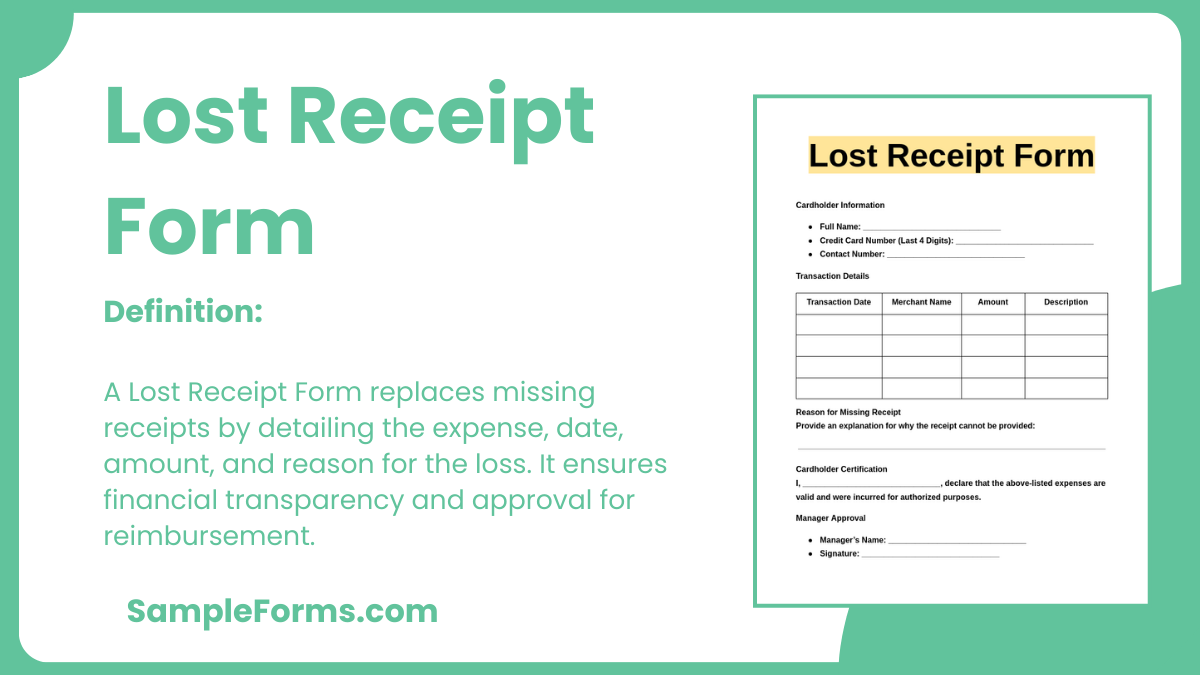

What is Lost Receipt Form?

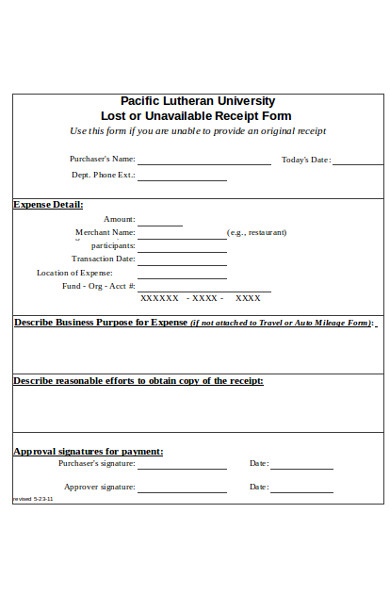

A Lost Receipt Form is a formal document used to report and validate expenses when an original receipt is lost or unavailable. It ensures accountability by capturing details such as the expense amount, date, vendor, and purpose. By including necessary approvals, the form serves as a substitute for the missing receipt, allowing for reimbursement or record-keeping. Simple yet vital, this form is widely used in corporate and financial settings to maintain transparency and facilitate expense management.

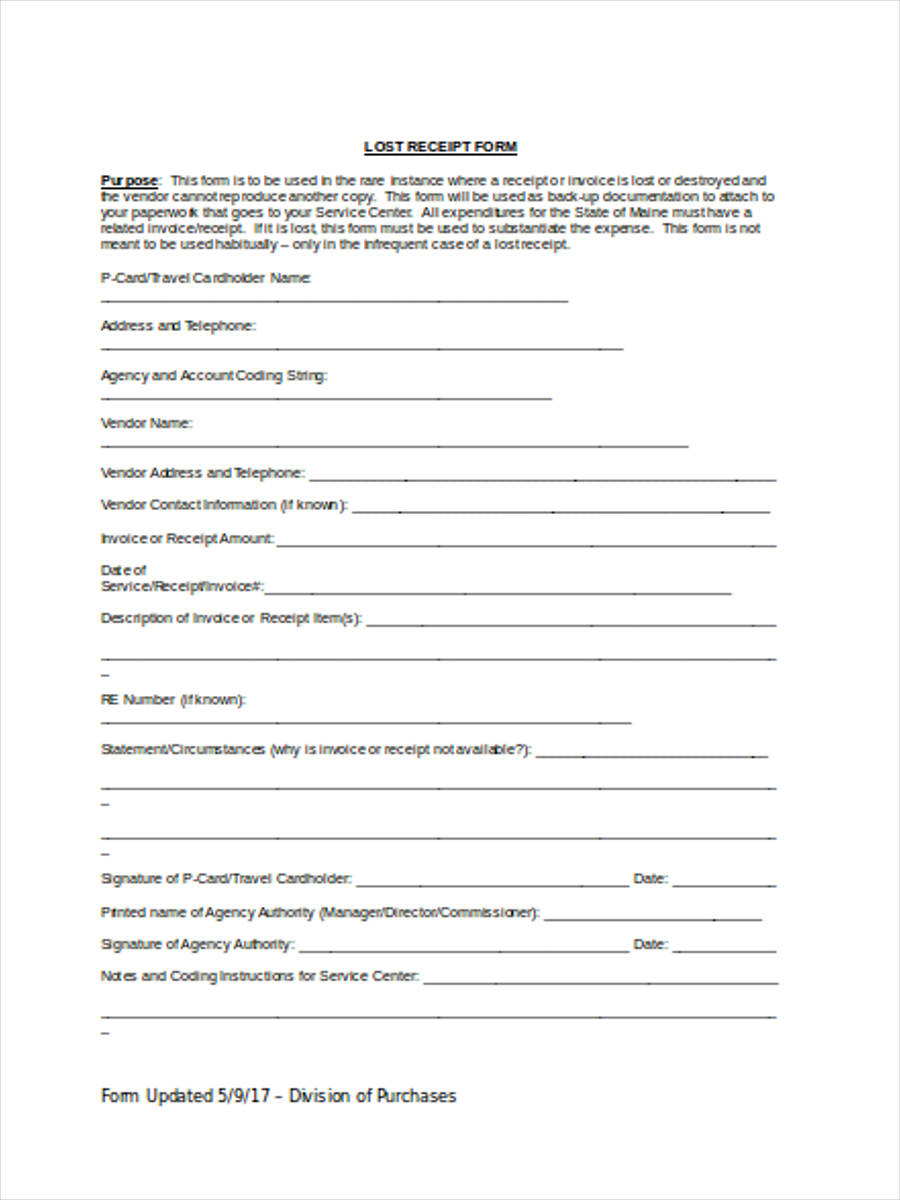

Lost Receipt Format

Employee Information

Full Name: _______________________________

Department: _______________________________

Contact Number: _______________________________

Date of Submission: _______________________________

Expense Details

Vendor Name: _______________________________

Date of Expense: _______________________________

Amount: _______________________________

Reason for Expense: _______________________________

Explanation of Lost Receipt

Details: _______________________________

Authorization

Employee’s Signature: _______________________________

Date: _______________________________

Supervisor’s Signature: _______________________________

Date: _______________________________

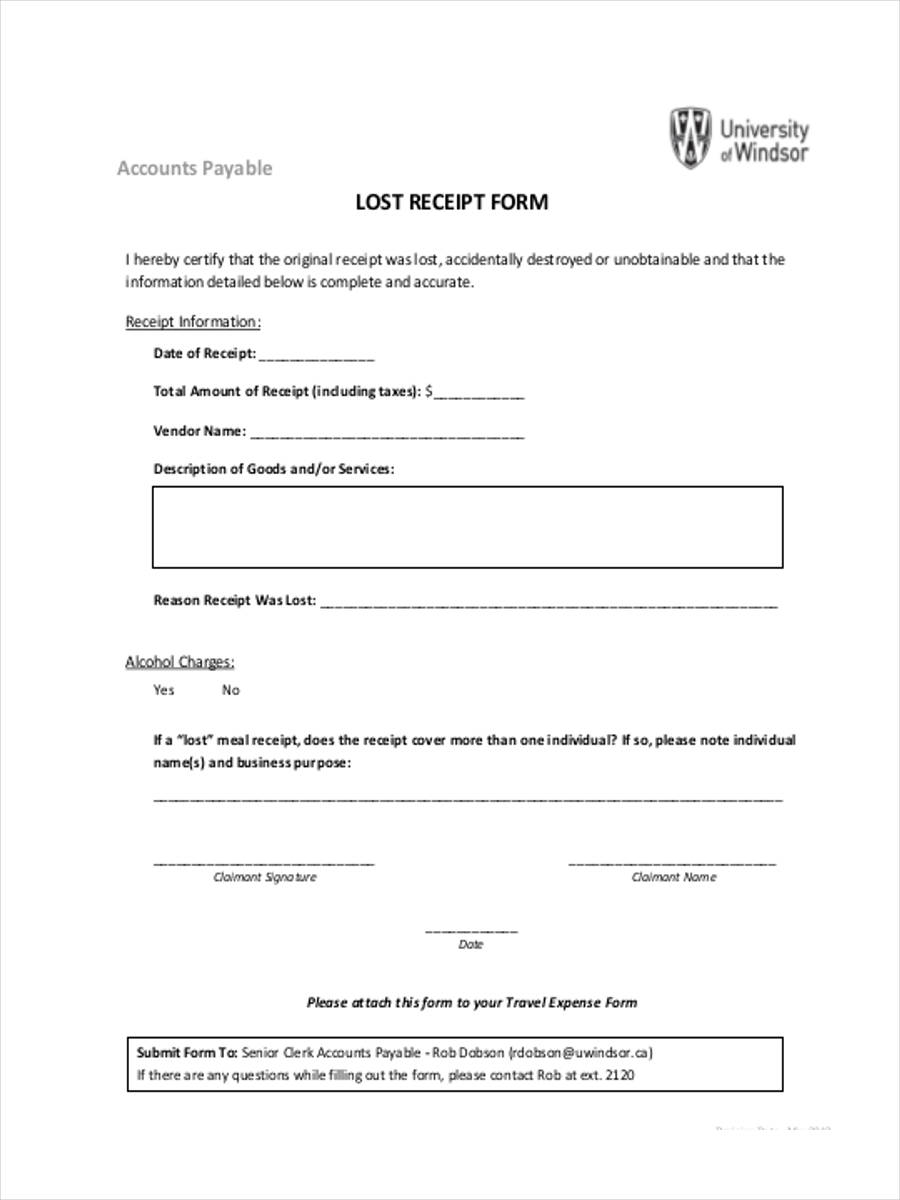

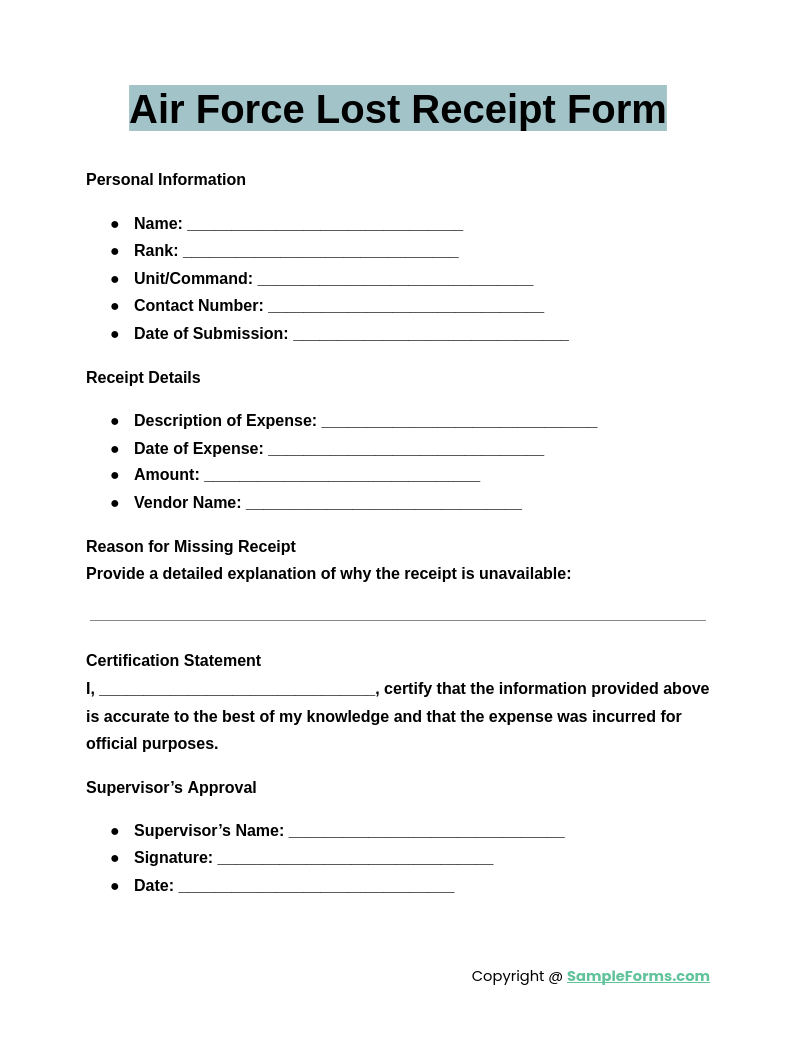

Air Force Lost Receipt Form

An Air Force Lost Receipt Form addresses missing official receipts for military-related expenses. Similar to a Payment Receipt Form, it documents expense details, ensures accountability, and facilitates reimbursements while adhering to organizational regulations.

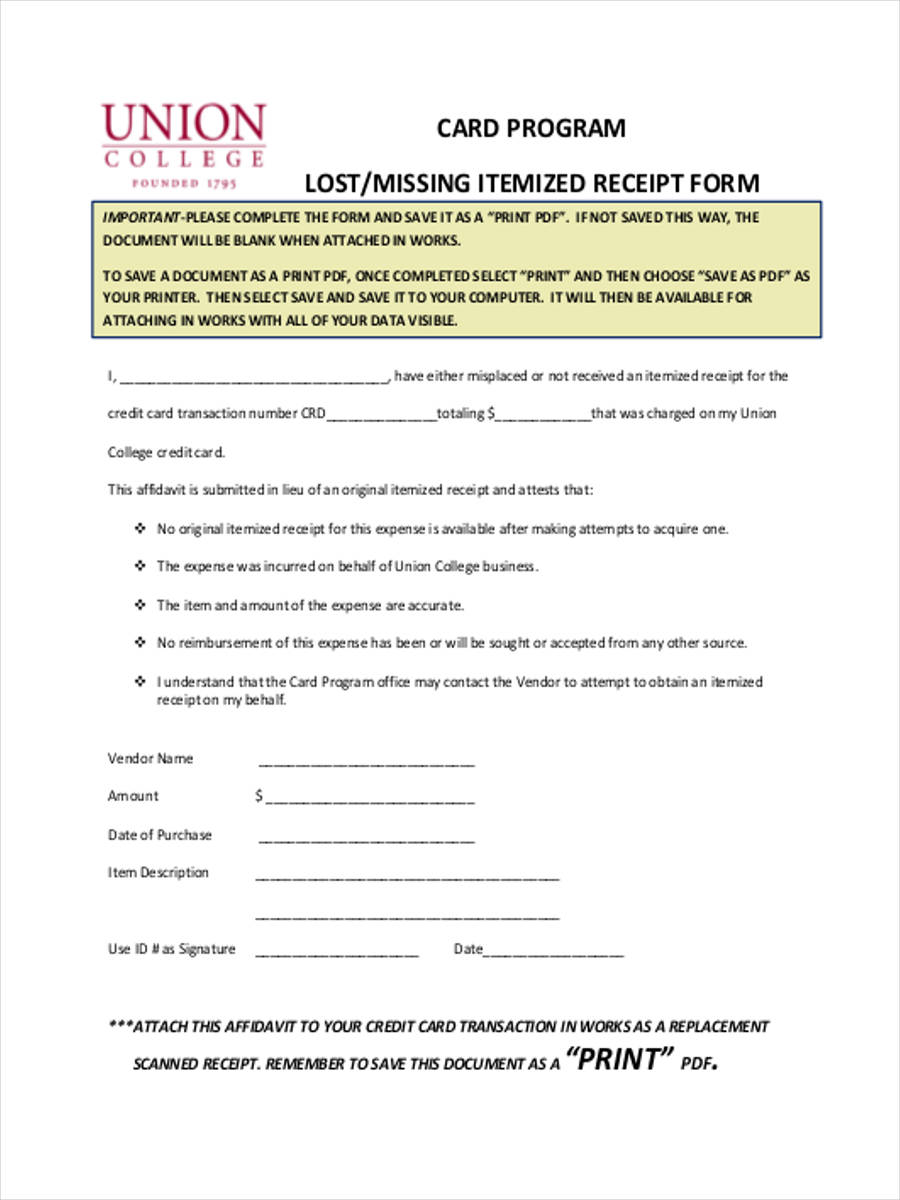

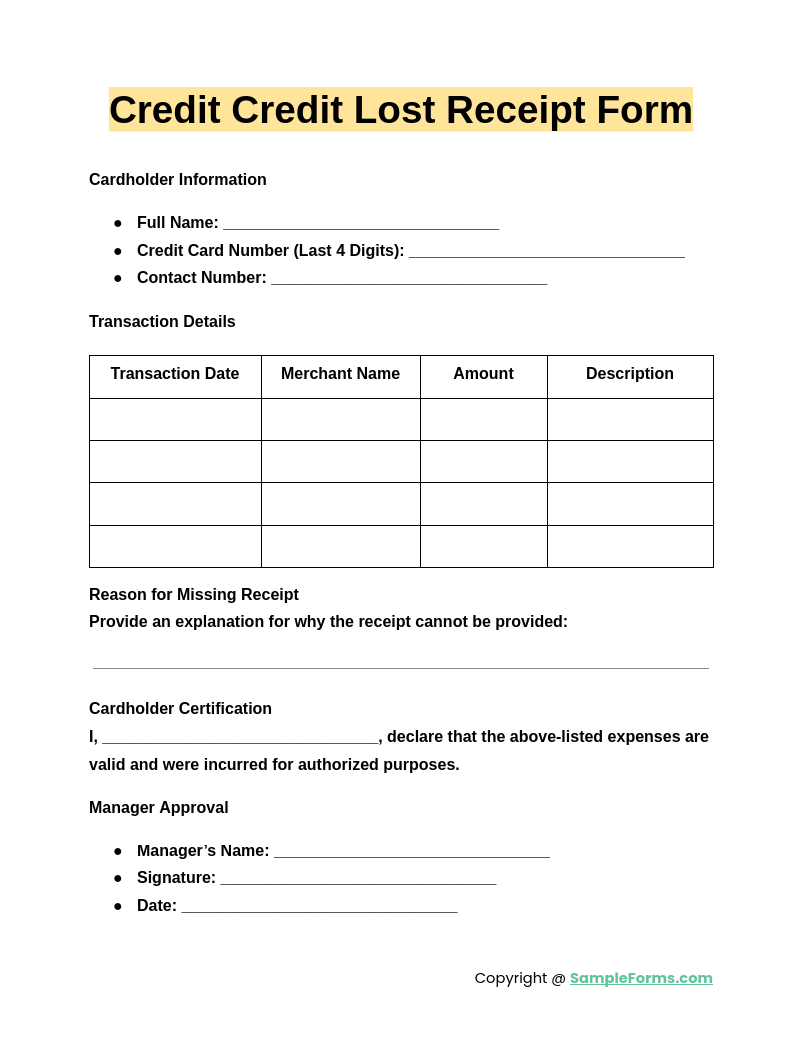

Credit Card Lost Receipt Form

A Credit Card Lost Receipt Form is used when credit card transaction receipts are unavailable. Much like a Restaurant Receipt Form, it requires transaction details to validate purchases for accurate record-keeping and expense management.

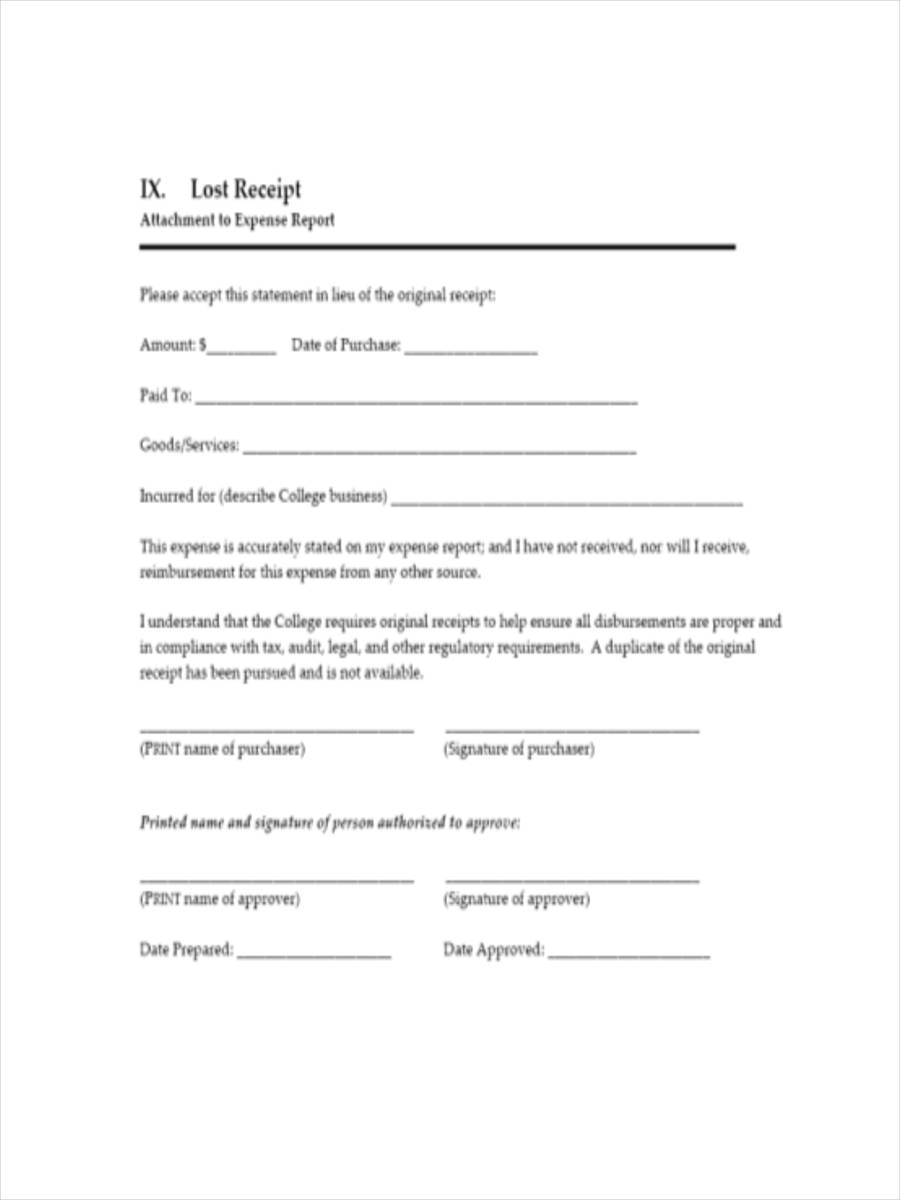

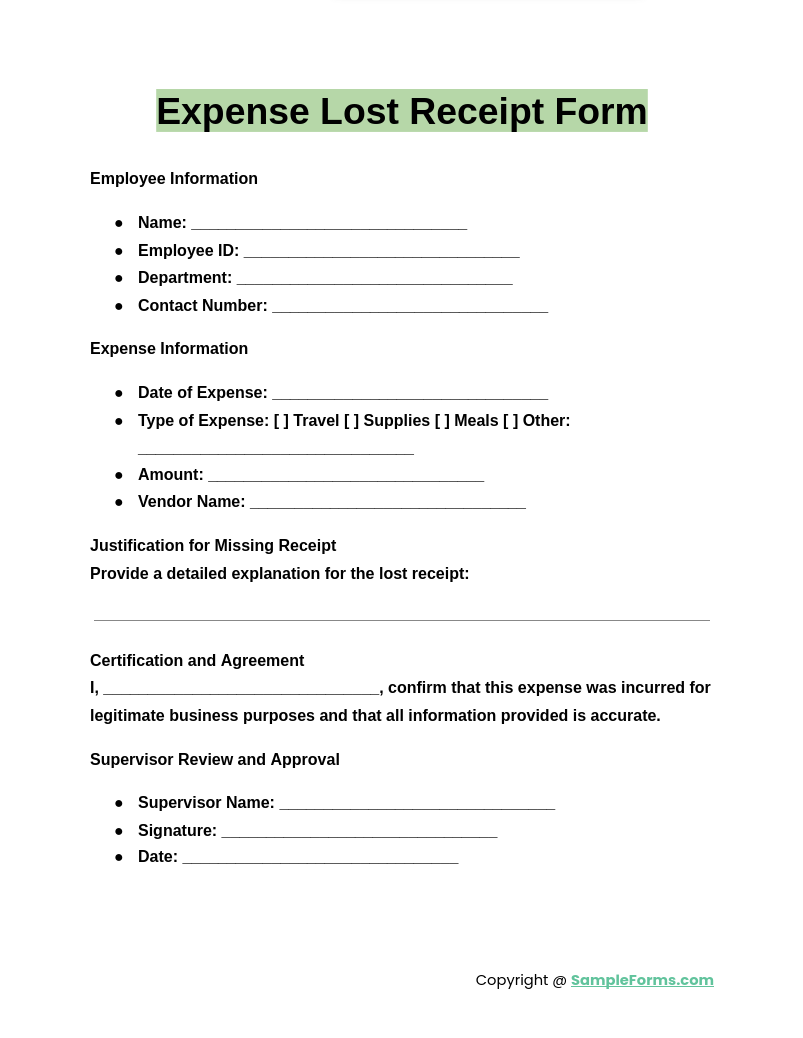

Expense Lost Receipt Form

An Expense Lost Receipt Form formalizes reporting of untraceable receipts for business expenditures. Similar to a Rent Receipt Form, it captures essential data like date, amount, and purpose, ensuring transparency and reimbursement eligibility.

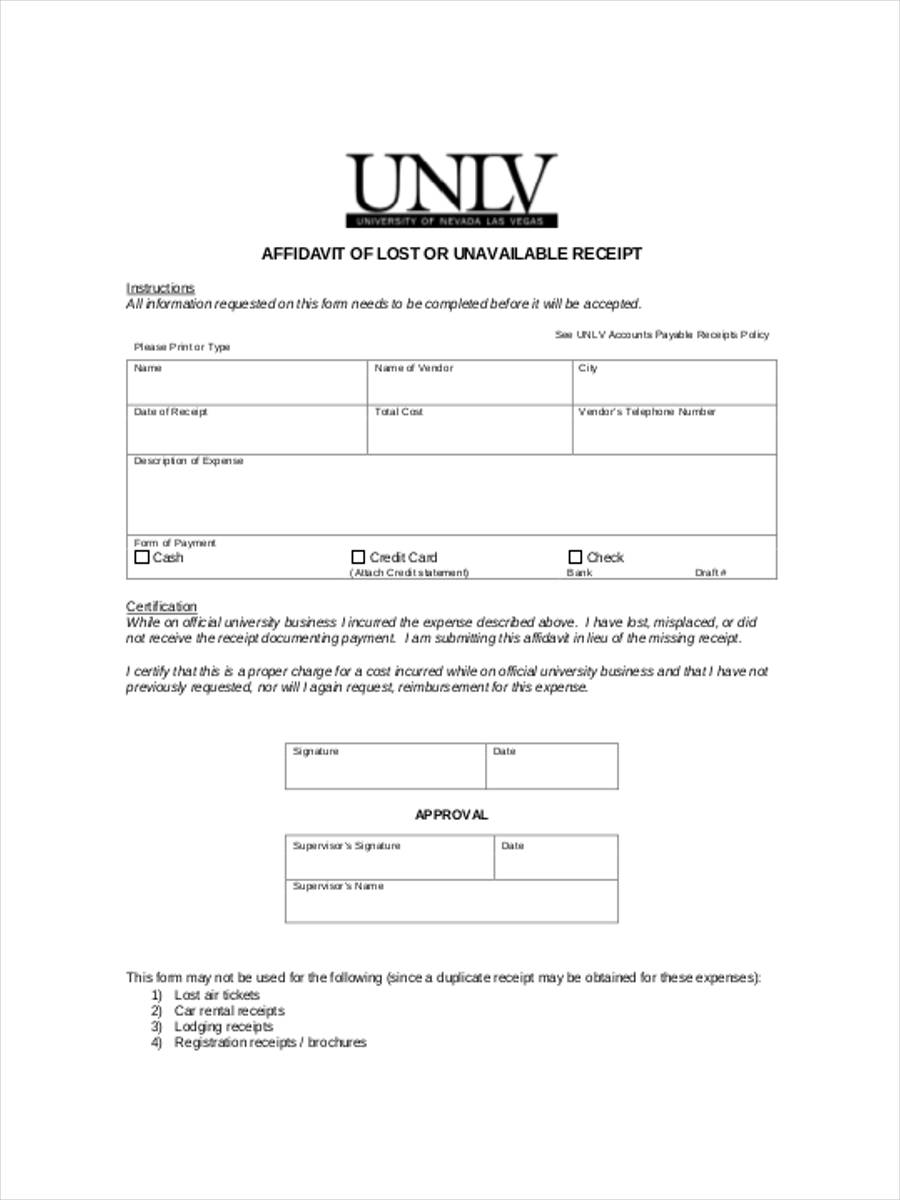

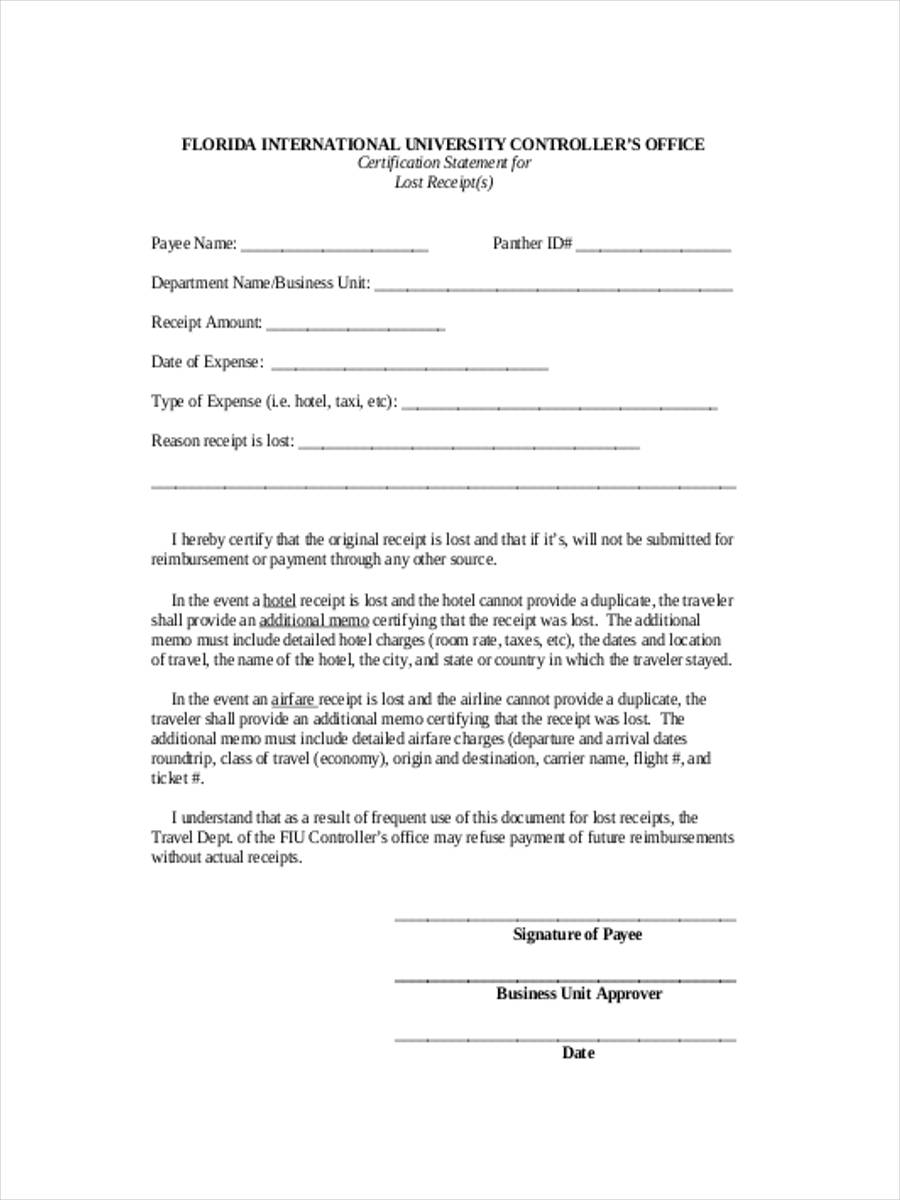

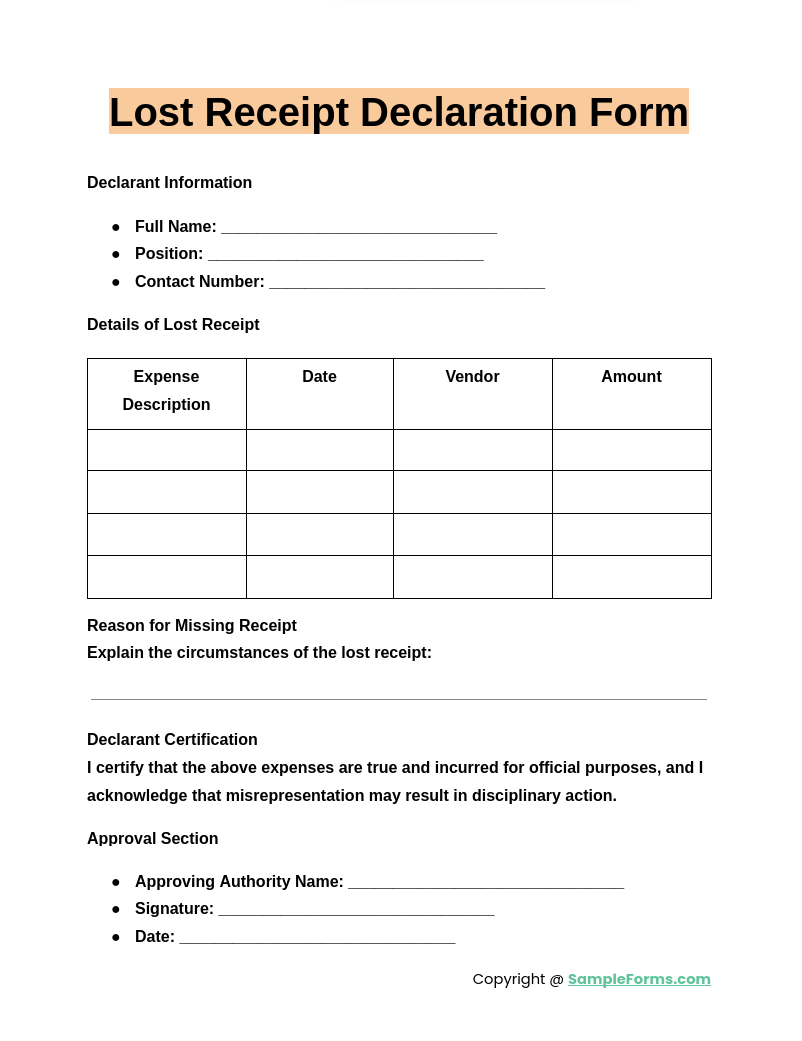

Lost Receipt Declaration Form

A Lost Receipt Declaration Form is a sworn statement for missing receipt verification. Comparable to a Hotel Receipt Form, it confirms transaction details, enabling financial tracking and compliance with reimbursement or audit policies.

Browse More Lost Receipt Forms

Lost Credit Card Receipt

Affidavit of Lost Receipt Form

Generic Lost Receipt

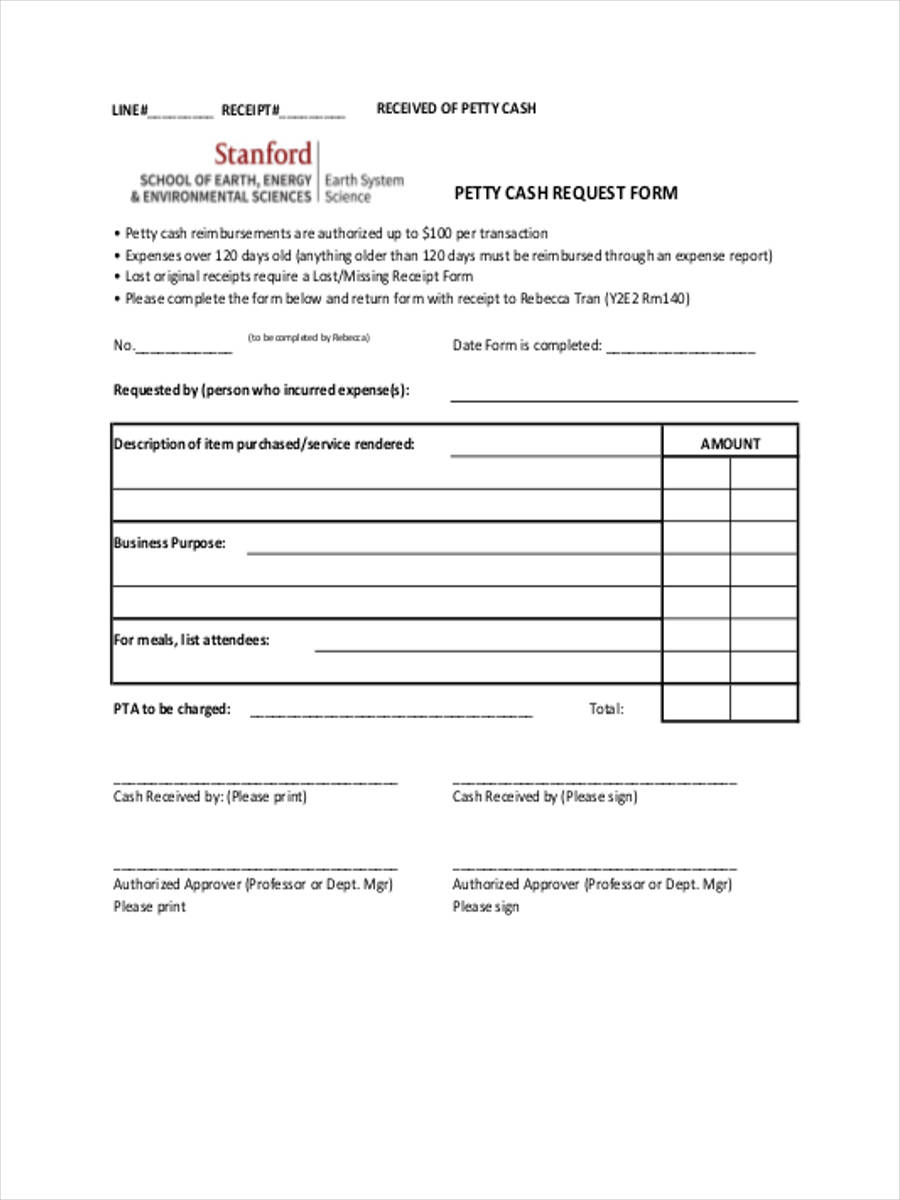

Petty Cash Lost Receipt

Travel Lost Receipt

Lost Receipt Example

Lost Receipt Sample

Sample Lost Receipt Form

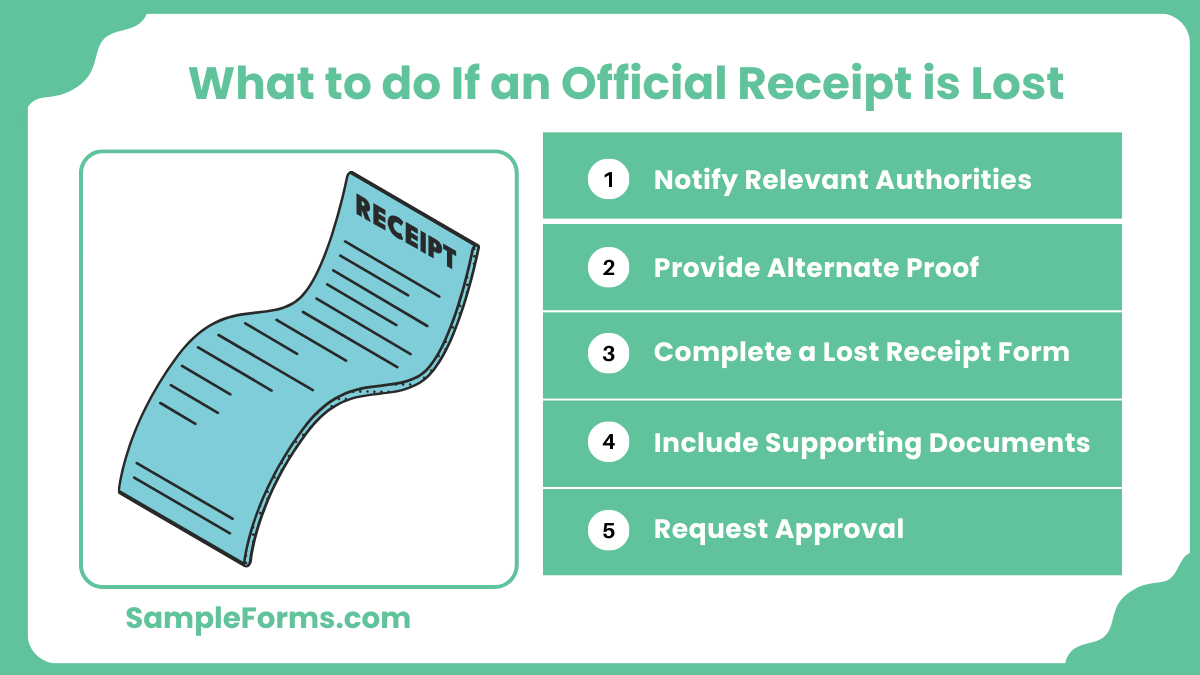

What to do if an official receipt is lost?

Losing an official receipt can disrupt records, but alternative documentation can help. Similar to a Cash Receipt Form, accurate replacement is essential.

- Notify Relevant Authorities: Inform your organization or financial department immediately to log the missing receipt.

- Provide Alternate Proof: Use credit card statements or bank transactions to support your claim.

- Complete a Lost Receipt Form: Fill out a detailed form to account for the missing documentation.

- Include Supporting Documents: Attach any related documents, such as purchase orders or invoices.

- Request Approval: Submit the replacement form for validation and reimbursement processing.

How to get proof of purchase without receipt?

Securing proof of purchase without a receipt requires creativity and documentation. Like a Donation Receipt Form, alternate evidence supports your claim.

- Request from the Vendor: Contact the retailer for transaction records or duplicate receipts.

- Check Digital Records: Use online accounts or apps linked to the purchase.

- Bank Statements: Provide transaction details from your credit card or bank statement.

- Invoice Copies: Retrieve any emailed invoices or confirmations related to the transaction.

- Use Warranty or Delivery Notes: Supplement your claim with related product or service documentation.

What happens if you lost receipts?

Losing receipts complicates reimbursements and records but can be resolved with proper steps. Like a Sales Receipt Form, details matter.

- Inform Management: Immediately notify your department or finance team.

- Complete a Lost Receipt Form: Provide detailed information about the missing expense.

- Attach Supporting Evidence: Include bank statements or invoices as substitutes.

- Explain the Situation: Clearly state the reasons for the lost receipt in your form.

- Follow Up: Regularly check the status of your reimbursement request.

How can I prove my expenses without receipts?

Proving expenses without receipts relies on alternative documentation and clear explanations. Much like a Purchase Receipt Form, accuracy ensures credibility.

- Use Bank Statements: Highlight relevant transactions for verification.

- Provide Vendor Invoices: Request replacement invoices from suppliers.

- Offer Email Confirmations: Attach any email correspondence confirming the purchase.

- File a Declaration Form: Use a lost receipt declaration for official reporting.

- Include Photographic Evidence: Provide pictures of the purchased items, if applicable.

What happens if you lose a receipt for expenses?

Losing a receipt may delay reimbursements but can be managed effectively. Similar to a Delivery Receipt Form, proper documentation substitutes the original.

- Inform Your Finance Team: Report the lost receipt promptly.

- Submit a Lost Receipt Form: Detail the expense for tracking and processing.

- Attach Transaction Records: Provide alternative proof, such as credit card or bank statements.

- Explain the Circumstances: Include a note explaining why the receipt was lost.

- Request Managerial Approval: Ensure your supervisor validates the expense to complete the process.

Is it illegal to not send a receipt?

Not issuing a receipt for transactions is often against regulations. Like a Cash Receipt Journal Form, it ensures accountability and transparency in financial dealings.

What can I do if I have no receipt?

Use alternate proofs like bank statements or invoices. Completing a Lost Receipt Form can formalize and validate missing transaction records for reimbursement.

How do I get a lost receipt?

Request a duplicate from the vendor or use details from a Receipt Book Form to regenerate the receipt accurately for official use.

How do I prove a payment without a receipt?

Provide bank or card statements, emails, or signed acknowledgment, much like a Car Receipt Form, to confirm transaction validity.

Is there a way to recover a lost receipt?

Yes, contact the vendor or check digital platforms. Refer to transaction logs like a School Receipt Form for accurate retrieval.

How to make an affidavit of loss receipt?

An affidavit of loss is a sworn statement detailing the lost receipt, similar to a Contractor Receipt Form, ensuring legal acknowledgment of missing documentation.

Who keeps the original copy of a receipt?

The purchaser typically retains the original receipt, while sellers may keep duplicates, similar to handling a Missing Receipt Form for internal records.

Is a photo of a receipt proof of purchase?

Yes, a clear photo of a receipt can serve as proof of purchase, akin to verifying ownership through an Asset Receipt Form.

How much is an affidavit of loss receipt?

The cost varies by region but typically includes notarization fees, similar to processing fees for a Petty Cash Receipt Form.

How do I make a copy of a receipt?

Photocopy or scan the original receipt, similar to creating duplicates of an Event Receipt Form, for secure and accessible record-keeping.

A Lost Receipt Form ensures financial accuracy and accountability when receipts go missing. From creating sample, forms, letters, use to understanding its importance, this guide offers comprehensive insights. Like a Receipt of Agreement, it formalizes expense declarations and ensures proper documentation. By including detailed fields for expenses, approver details, and certifications, these forms streamline the reimbursement process while maintaining transparency. Whether for personal or business use, a well-designed Lost Receipt Form simplifies financial workflows and minimizes discrepancies.

Related Posts

-

How to Write a Receipt Form? [ Types, Includes ]

-

FREE 6+ Asset Receipt Forms in MS Word | PDF

-

Cash Receipt Form

-

Donation Receipt Form

-

FREE 6+ Contractor Receipt Forms in PDF | MS Word

-

Delivery Receipt Form

-

FREE 7+ Service Receipt Forms in PDF | MS Word

-

What is Delivery Receipt Form? [ Definition, Policy and Procedures, Tips ]

-

What is Receipt Form? [ How to Fill, Uses ]

-

Deposit Receipt Form

-

Receipt Form

-

FREE 9+ Sample Receipt Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Payment Receipt Forms in PDF | MS Word | MS Excel

-

Rental Receipt Form

-

FREE 8+ Sample Donation Receipt Forms in PDF | Excel