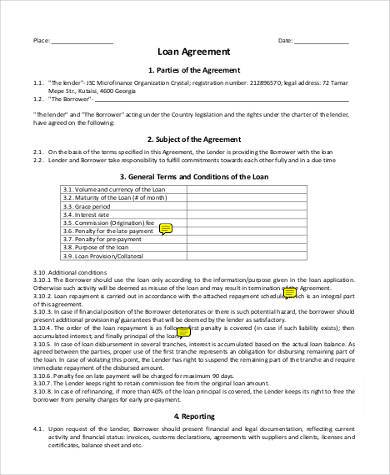

A Loan Agreement is a contract that is legally binding, formalizing the loan process of two or more parties. Loan Agreements can be varied depending on the type of loan being made and the negotiations between the borrower and the lender. Loan Agreements can come in the form of a detailed contract or a simple promissory note.

Loan Agreements typically include covenants, interest rate terms, length of time for repayment, and the collateral involved. Our Agreement Forms and Loan Agreement Forms cover the basic and general information that a Loan Agreement should include.

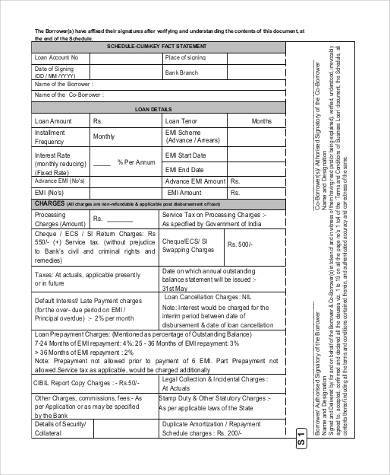

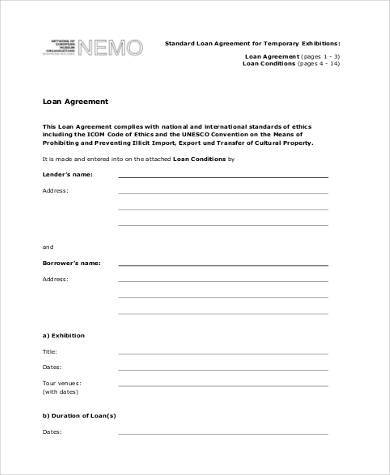

Personal Loan Agreement Form

Individual Loan Agreement Form

Loan Vehicle Agreement Form

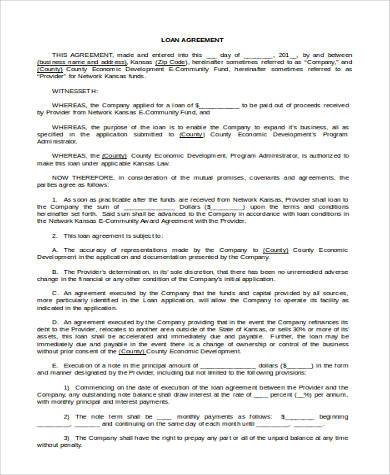

Business Loan Agreement Form

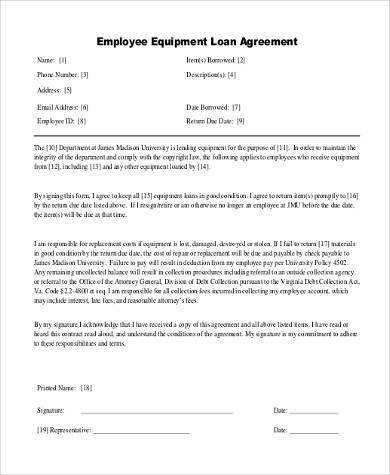

Employee Loan Agreement Form

Other Reasons Why a Loan Agreement Matters

Loaning money requires huge financial commitment and should not be taken lightly. Having a written Loan Agreement Form serves as tangible proof that indicates that the money given was borrowed. Loan Agreements also enable the lender to set certain terms and conditions which may be used as a point of reference when disputes or misunderstandings arise.

The Key Contents of a Loan Contract

-

The Loan and the Loaned Amount

The initial part of the Loan Agreement should indicate details about how the money is to be given by the lender to the borrower, the amount of money being loaned to the borrower, and the requirements or conditions that have to be met in order to obtain the amount of money being loaned.

-

Draw-down Date

The Draw-down Date generally refers to the date on which the amount being advanced or loaned is given by the lender to the borrower. This typically depends on the type of deal instigated by the lender. In some cases, the lender may opt to give out the principal or the loaned amount of money all at once; in other cases, the Draw-down Date may be given in several installments.

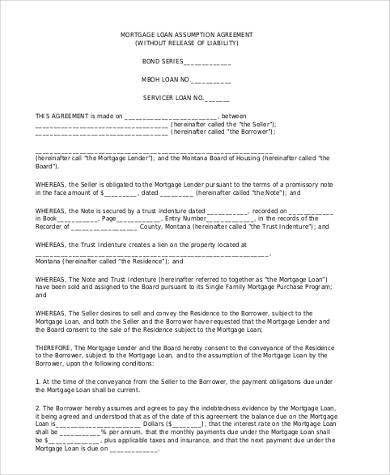

Loan Assumption Agreement Form

Loan Agreement Form in Word Format

Loan Agreement Blank Form

Free Loan Agreement Form

-

Purpose of the Loan

Loan Agreements will typically indicate the purpose for which the loan is being incurred, be it for a mortgage, a car loan, to pay of existing debt, and vice versa. The exact purpose of the loan is important because the assessment of its risk profile is based on the purpose of the loan to begin with.

-

Conditions Precedent

Conditions Precedent pertain to certain requirements or conditions that a borrower has to meet before he is able to obtain his principal or the loaned amount of money. The conditions imposed by the lender in the agreement will usually depend on the purpose of the loan, the amount of money being loaned, and the risk potential of the loan being made.

There are a lot of aspects that need to be considered and should be covered in a loan and in constructing a Loan Agreement. Loan Agreements have to be carefully written and should cover all the necessary details to make sure there is no room for doubt or loopholes. Our Personal Loan Agreement Contracts are guaranteed to cover all the necessary details and are within easy reach. Simply download them or print them out or tailor them according to your preferred format.

Related Posts

-

FREE 9+ Sample Release Agreement Forms in PDF | MS Word

-

FREE 29+ Sample Contract Agreement Forms in PDF | MS Word

-

FREE 30+ Sample Purchase Agreement Forms in MS Word | PDF

-

FREE 8+ Sample Joint Venture Agreement Forms in PDF | MS Word

-

FREE 9+ Sample Subordination Agreement Forms in PDF | MS Word

-

FREE 8+ Sample Shareholder Agreement Forms in PDF | MS Word

-

FREE 10+ Sample Transfer Agreement Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Cooperation Agreement Forms in PDF | MS Word

-

FREE 8+ Sample Reaffirmation Agreement Forms in PDF | MS Word

-

FREE 7+ Sample Asset Agreement Forms in PDF | MS Word

-

FREE 7+ Sample Investment Club Agreement Forms in PDF | MS Word

-

FREE 8+ Sample Patent Agreement Forms in PDF | MS Word

-

FREE 8+ Student Loan Agreement Forms in PDF | MS Word

-

FREE 34+ Loan Agreement Forms in PDF | MS Word

-

Personal Loan Agreement Form