A Living Trust Form is a legal document used to manage and distribute your assets during your lifetime and after death. A Revocable Living Trust Form and Fillable Forms allows flexibility to amend or revoke the trust as your needs change. This guide provides a complete overview of living trusts, including how to create them, fillable forms for different jurisdictions like California or Florida, and examples to make the process easier. With this trust form, you ensure that your estate is managed in a way that aligns with your wishes, providing peace of mind for both you and your beneficiaries.

What is Living Trust Form?

A Living Trust Form is a legal document that places your assets into a trust during your lifetime and specifies how they will be managed and distributed after your death. It is a Living Trust Form, meaning you can modify or revoke it at any time. This trust form is designed to help you avoid probate, ensure privacy, and streamline the transfer of assets to your beneficiaries.

Living Trust Format

Grantor Information

- Full Name: _________________________

- Address: ___________________________

- Contact Information: _________________

Trustee Information

- Trustee Name: _______________________

- Trustee Address: _____________________

- Trustee Contact: ______________________

Beneficiary Information

- Beneficiary Name(s): ______________________

- Beneficiary Relationship: ___________________

Trust Terms

- Trust Start Date: _________________________

- Assets Included in Trust: ___________________

- Trust End Date or Conditions: _______________

Signatures

- Grantor Signature: ________________________

- Trustee Signature: ________________________

- Date: _________________________________

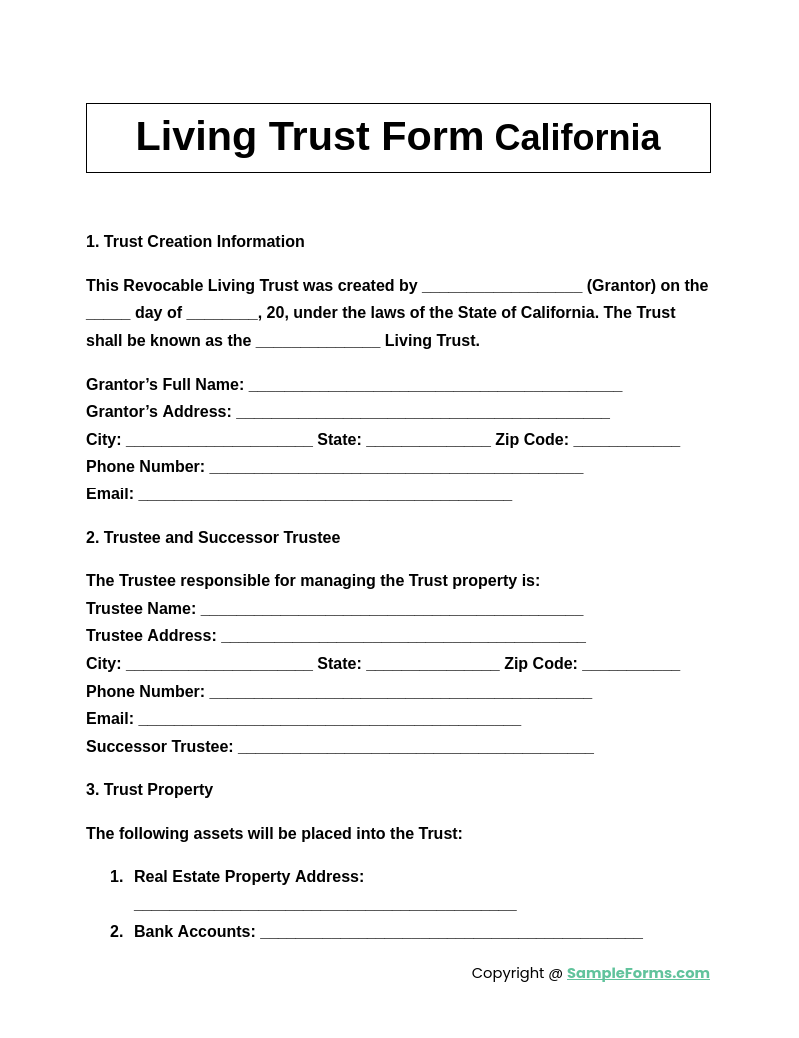

Living Trust Form California

A Living Trust Form California provides a state-specific solution for estate management and asset distribution. Similar to a Legal Petition Form, this trust form ensures compliance with California laws, streamlining asset transfers while avoiding probate complications.

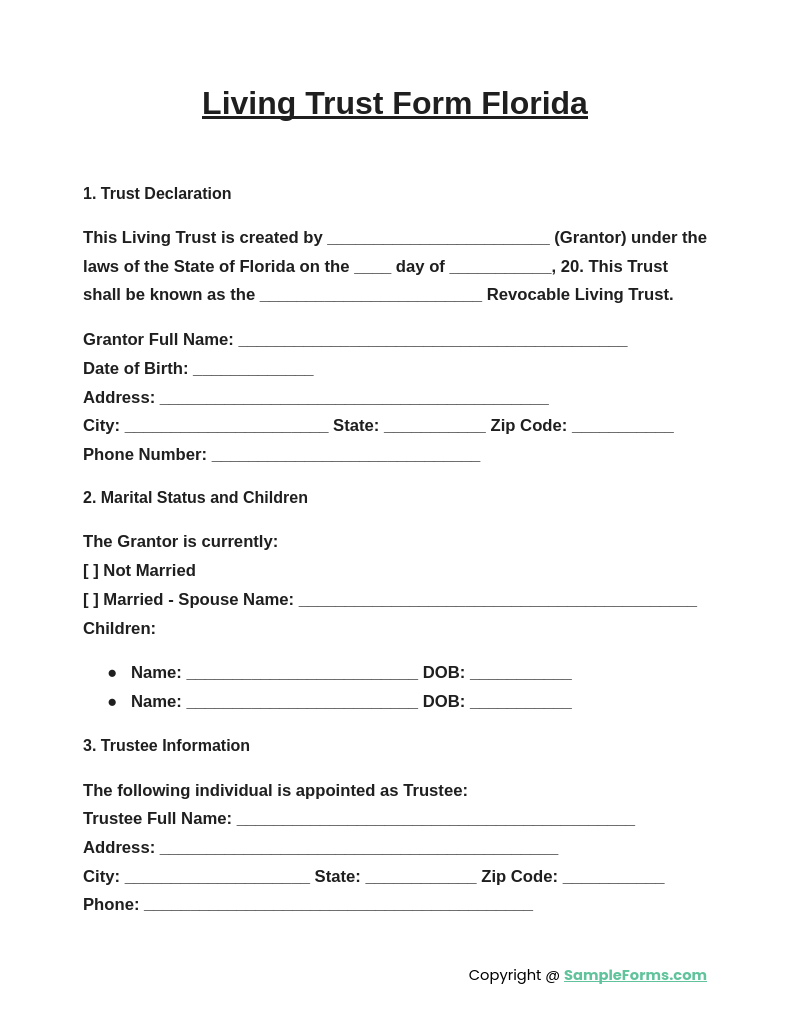

Living Trust Form Florida

A Living Trust Form Florida offers a flexible option for managing assets under Florida law. Like a Legal Guardian Form, this document helps protect beneficiaries, ensuring assets are distributed according to your wishes while bypassing probate.

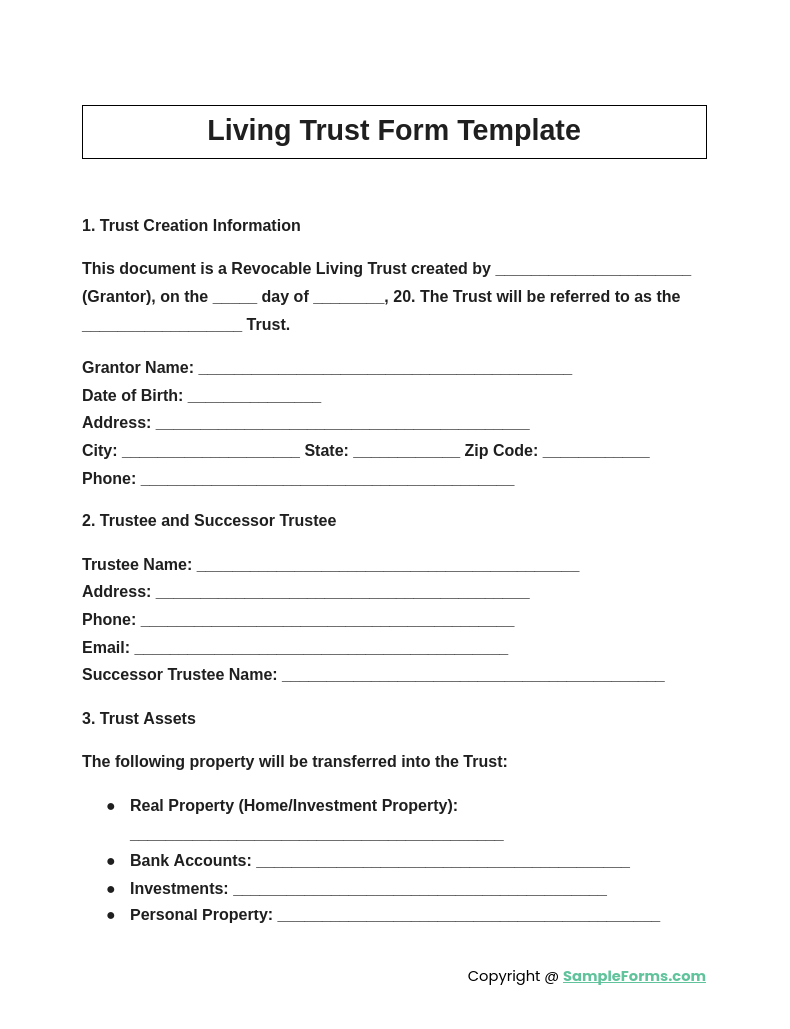

Living Trust Form Template

A Living Trust Form Template offers a customizable framework for individuals to create their own living trust. Much like a Legal Form, this template simplifies the process of managing assets and specifying how they will be distributed upon death.

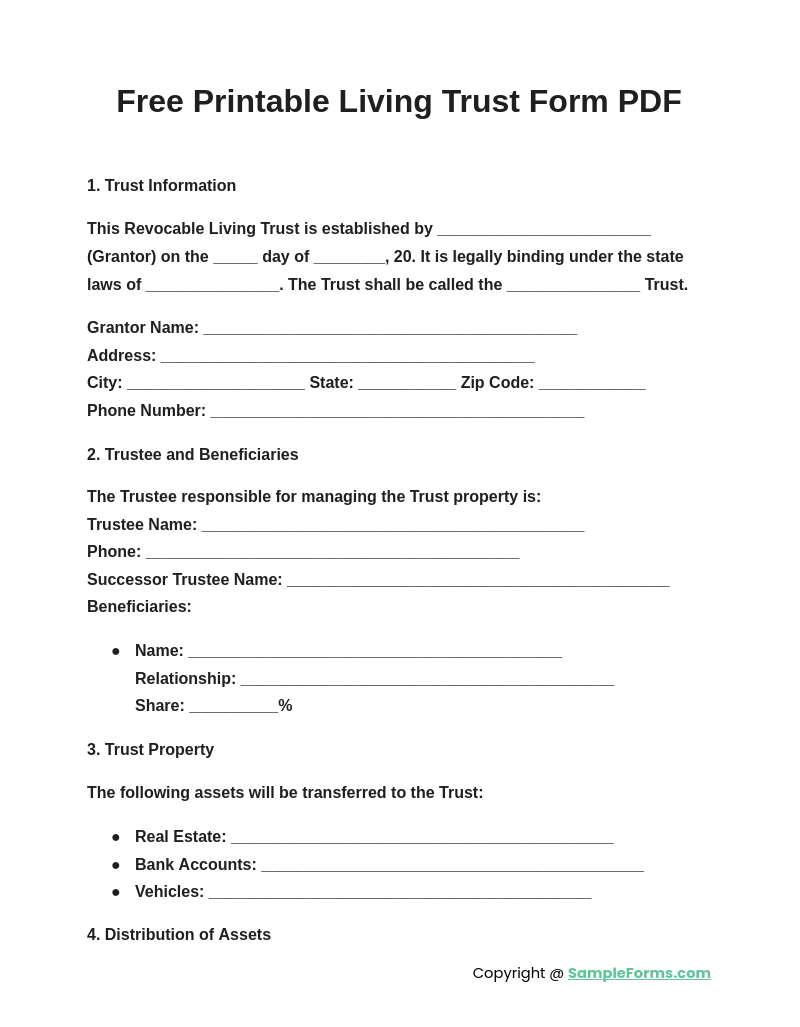

Free Printable Living Trust Form PDF

A Free Printable Living Trust Form PDF provides an easy, accessible way to create a living trust. Similar to a Legal Declaration Form, this document ensures legal protection for your assets while offering the flexibility to amend or revoke the trust as needed.

Browse More Living Trust Form

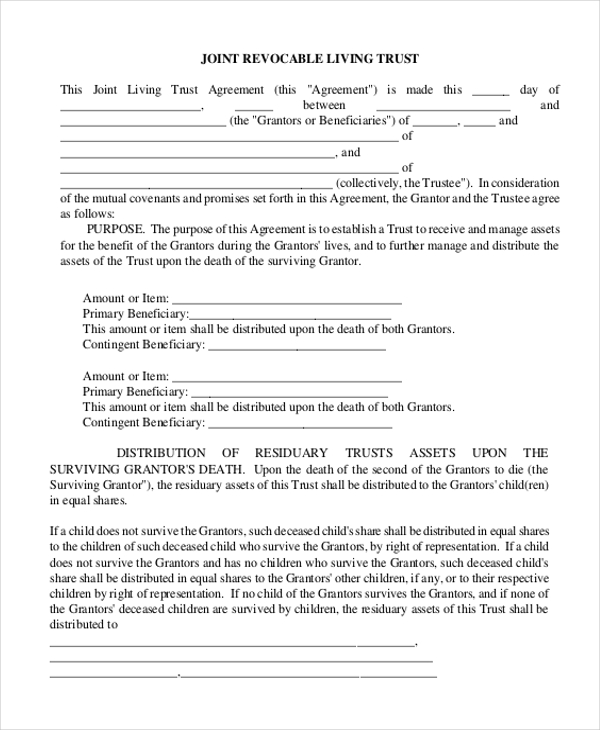

Sample Joint Revocable Living Trust Form

As the name suggests, this form is used by a person who wishes to draw a living trust agreement which can be revoked by him at any given time. This form comprises of all the essential clauses that should be included in such an agreement. You may also see Will Forms.

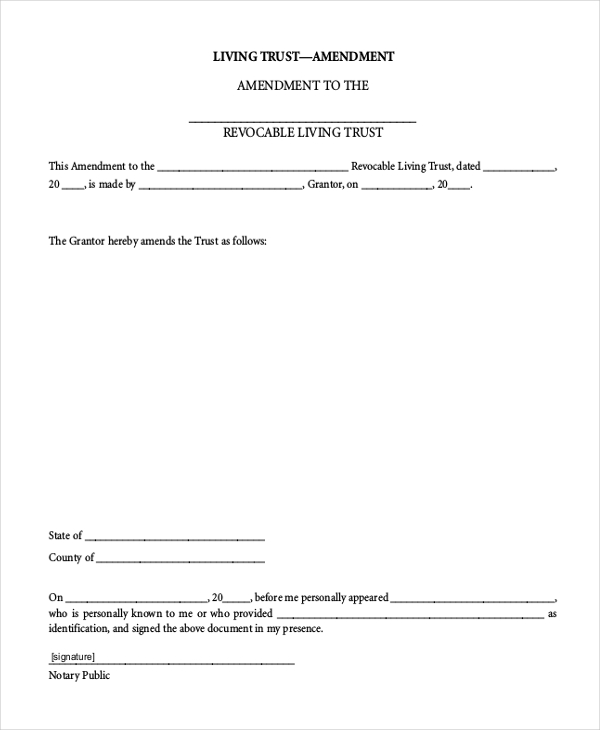

Free Living Trust Amendment Form

When a person wishes to make certain changes to the clauses and terms in the living trust agreement, he can use the aforesaid form for the purpose. This form gives him an idea of how the amendment can be carried out in the legal manner.

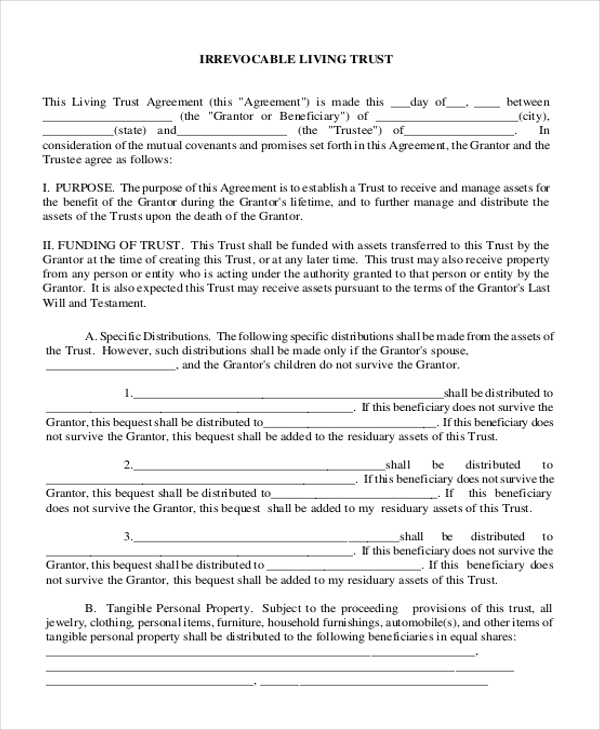

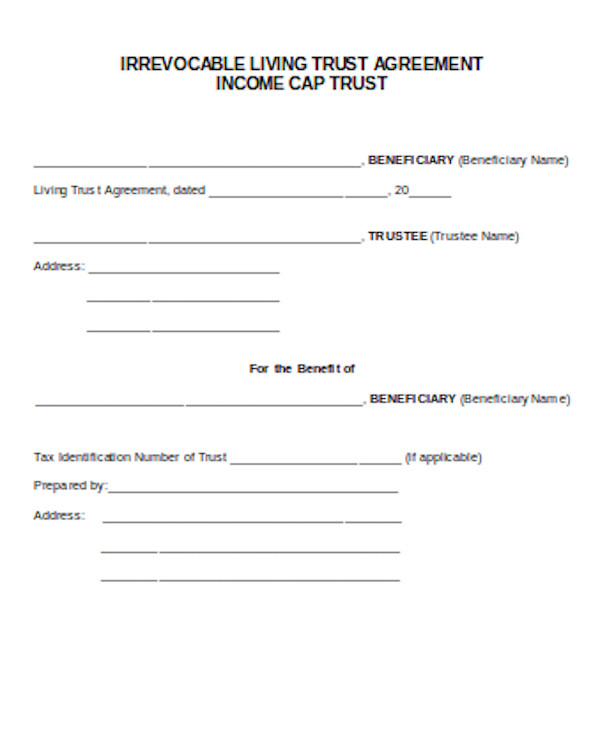

Example of Irrevocable Living Trust Form

When a person wishes to sign a living trust agreement which cannot be revoked later, he can use this form for the purpose. The form comprises of all the essential clauses and segments that should be included in such a document. You can also see Affidavit of Residence Forms.

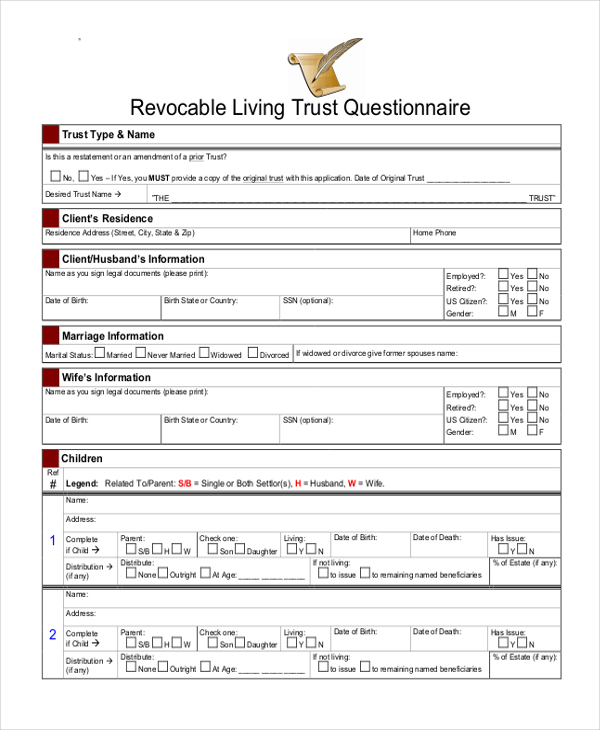

Living Trust Questionnaire Form Format

This form is used by a lawyer to collect all the relevant information from a person who may have approached him to draw a living trust agreement. This form contains a number of queries which the person needs to answer.

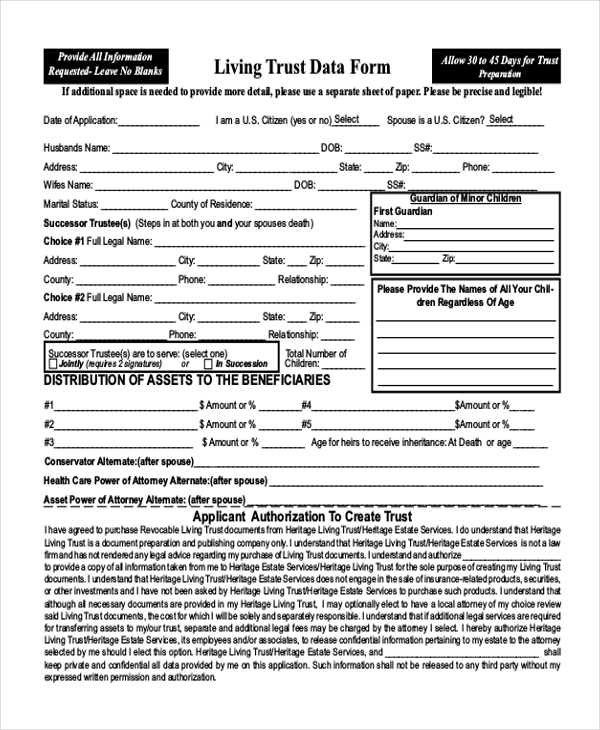

Living Trust Data Form in PDF

As the name indicates, this form can be used to record all the relevant data of a living trust in an organized manner. It is used to record the name and age of beneficiaries, details of the assets, whom these would be transferred to etc.

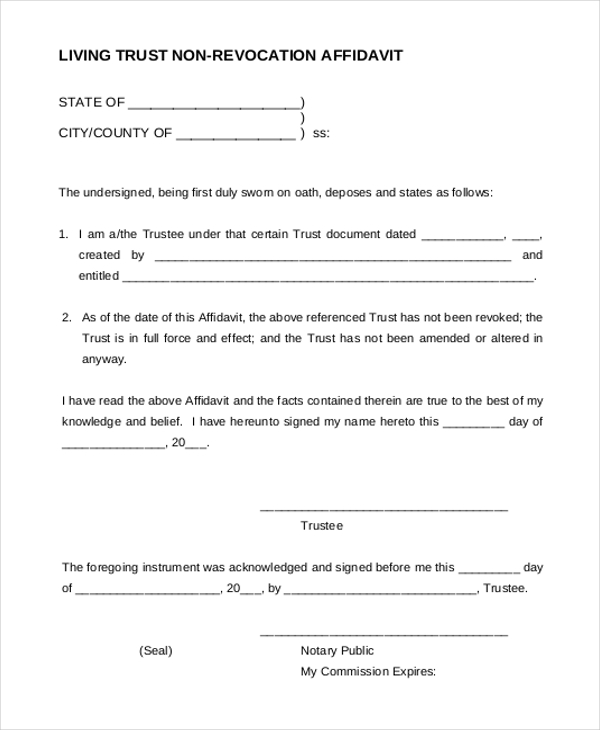

Living Trust Non Revocation Affidavit Form

This form can be used by a person to design an affidavit which may be required to prove that a certain living trust has not been revoked. The form comprises of all the essential segments that should be included in such an affidavit. You can also see Sample Small Estate Affidavit Forms.

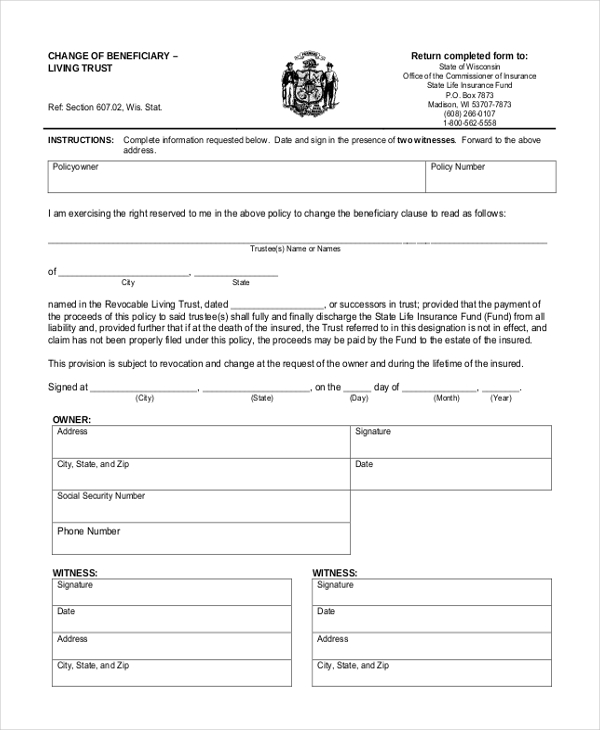

Downloadable Change of Beneficiary Living Trust Form

When a person wishes to change a beneficiary of his living trust, he can use the aforesaid form for the purpose. In this form, he needs to mention the name and details of the beneficiary he wishes to change and the details of the new beneficiary.

Simple Living Trust Form

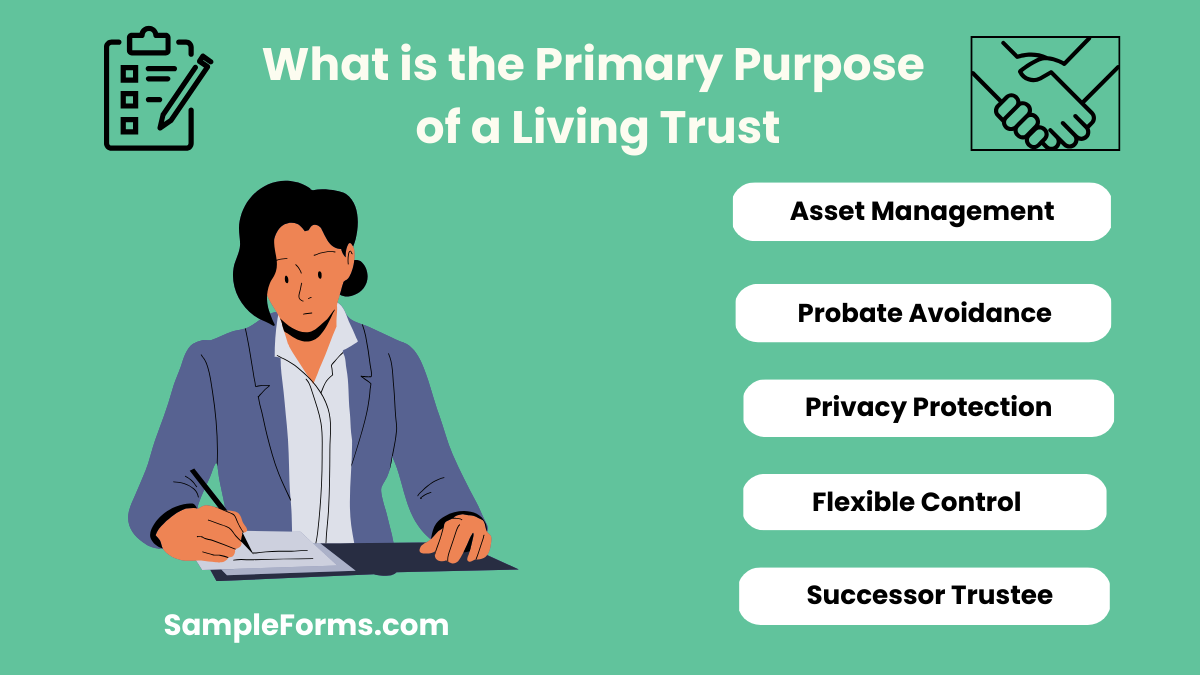

What is the primary purpose of a living trust?

The primary purpose of a Living Trust is to manage and distribute assets during your lifetime and after death, avoiding probate and ensuring privacy.

1. Asset Management: A living trust allows for proper management of assets during the grantor’s lifetime.

2. Probate Avoidance: Assets in a trust do not go through probate, simplifying the process for beneficiaries.

3. Privacy Protection: Unlike wills, living trusts are private documents, keeping asset distribution confidential.

4. Flexible Control: The grantor can maintain control and amend the trust as needed.

5. Successor Trustee: A trustee can manage assets if the grantor becomes incapacitated, as outlined in a Legal Ownership Form.

What is the downside of a living trust?

A major downside of a living trust is the initial cost and complexity of setting it up, requiring careful legal documentation.

1. Initial Cost: Setting up a living trust can be expensive, involving attorney fees.

2. Complexity: It requires careful transfer of assets into the trust, which can be time-consuming.

3. No Creditor Protection: A revocable trust does not protect assets from creditors during the grantor’s lifetime.

4. Maintenance: Regular updates are needed to ensure the trust reflects current assets.

5. Complex Legal Requirements: Documents like a Legal Guardianship Form may need to be included for minor beneficiaries.

What is the major disadvantage of a trust?

The major disadvantage of a trust is its complexity and the continuous management required to ensure assets are properly handled and beneficiaries are protected.

1. Costly to Administer: Ongoing legal and administrative fees can be high.

2. Complex Asset Transfer: All assets must be properly titled in the name of the trust.

3. Limited Creditor Protection: Revocable trusts do not shield assets from creditors.

4. Not Suitable for Small Estates: For smaller estates, the cost may outweigh the benefits.

5. Legal Documentation: Forms like a Legal Application Form may be needed to ensure legal compliance.

What is the biggest mistake parents make when setting up a trust fund?

The biggest mistake parents make is not clearly specifying the terms of distribution, which can lead to disputes or mismanagement of assets.

1. Vague Distribution Terms: Failing to provide clear guidelines for distributing assets can cause confusion.

2. Inadequate Trustee Selection: Choosing a trustee without proper financial management skills.

3. Lack of Updates: Not updating the trust to reflect changes in the family or assets.

4. Not Funding the Trust: Forgetting to transfer all necessary assets into the trust.

5. Legal Oversights: Not including important documents like a Legal Statement Form for specific instructions.

Why would someone want a living trust?

Someone may want a living trust to manage their assets efficiently, bypass probate, maintain privacy, and provide for smooth distribution to beneficiaries.

1. Probate Avoidance: Assets in the trust avoid the lengthy and costly probate process.

2. Incapacity Protection: A successor trustee can manage the assets if the grantor becomes incapacitated.

3. Privacy: Unlike wills, a trust is not made public upon death.

4. Flexibility: The trust can be amended or revoked during the grantor’s lifetime.

5. Protection for Beneficiaries: Special provisions for minors or dependents can be added, such as a Legal Services Contract Form

Should I put all my bank accounts into my trust?

Yes, placing bank accounts in your Living Trust ensures assets avoid probate, streamlining the transfer to beneficiaries. Use a Direct Deposit Form to update account information.

Can I make my own living trust in California?

Yes, you can create a Living Trust in California, but using a lawyer for legal advice is recommended. A Consent Form may be needed for specific terms.

How many witnesses are needed for a living trust in California?

Typically, no witnesses are required to sign a Living Trust in California, but a Personal Information Form can ensure proper notarization for added security.

What are reasons to not have a trust?

A Living Trust may not be necessary for small estates, involves upfront costs, and requires ongoing maintenance, unlike a Certificate Form which is simpler.

At what net worth should you consider a trust?

Consider a Living Trust if your estate exceeds $100,000 in California or includes complex assets, ensuring smooth transfer with a Claim Form.

What happens to a trust bank account when someone dies?

When a trust owner dies, assets in a trust account are distributed to beneficiaries without probate. Use a Self Evaluation Form for trust asset updates.

What is the average cost to set up a living trust in California?

Setting up a Living Trust in California costs between $1,500 and $3,000. Some firms also provide lower-cost options for completing an Enrollment Form.

What documents do I need for living trust in California?

Documents include a Living Trust form, asset list, and deed transfers. An Application Form may be required for specific assets or beneficiary information.

Why have a trust instead of a will?

A Living Trust avoids probate, provides privacy, and allows asset management during incapacitation, unlike a will that requires court approval, similar to an Inspection Form.

Is a trust worth the money?

Yes, a Living Trust is worth the investment if you have substantial assets, ensuring privacy and bypassing probate, supported by a Testimonial Form from legal advisors.

A Living Trust Form is an essential estate planning tool to manage and transfer your assets. It simplifies the process of estate distribution by avoiding probate and maintaining privacy. Whether you’re setting up a revocable living trust or finalizing your estate plan, using Relationship Affidavit Form in conjunction with a living trust can help ensure all your assets are protected. By utilizing sample forms, letters, and templates, you can tailor the trust to meet your specific needs and ensure a smooth transfer of wealth to your beneficiaries.