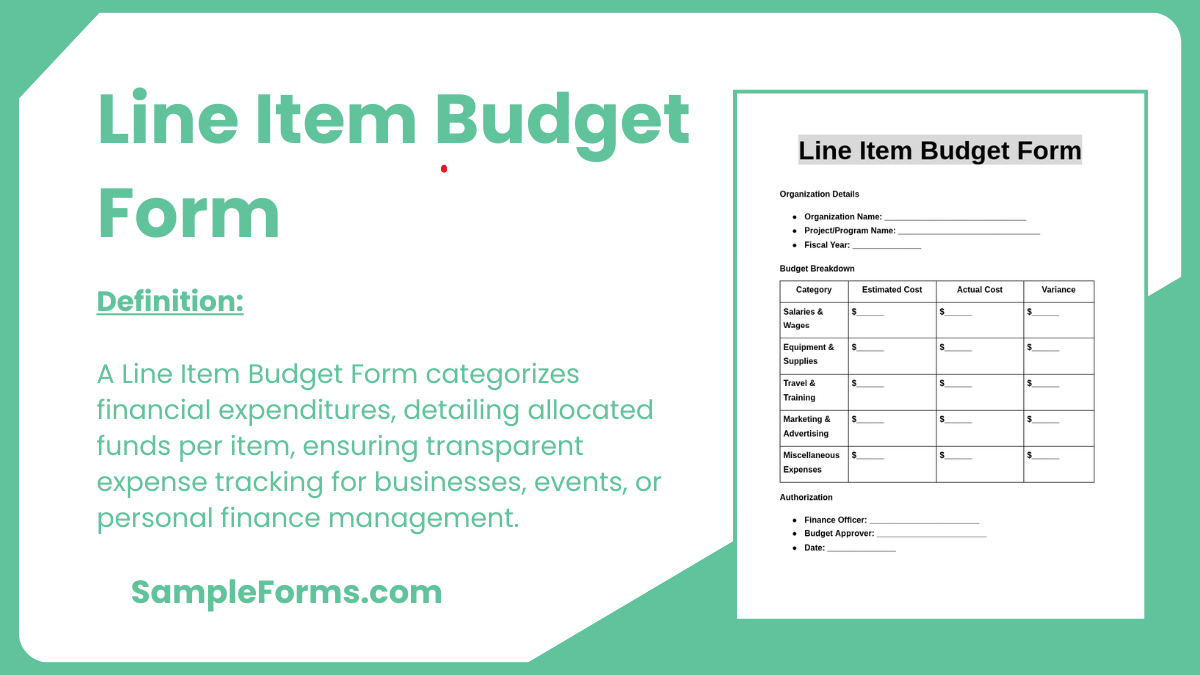

A Line Item Budget Form is a structured financial tool that categorizes expenses into detailed sections, helping organizations and individuals track spending efficiently. Whether for business, personal use, or project management, this Budget Form ensures transparency and accountability in financial planning. By listing each expense separately, it provides a clear overview of cost distribution, making it easier to control budgets and avoid overspending.

Download Line Item Budget Form Bundle

What is Line Item Budget Form?

A Line Item Budget Form is a financial document used to outline specific expenses under categorized sections. It helps track spending in detail, ensuring funds are allocated appropriately. This structured format improves transparency by clearly listing every expense, from salaries to operational costs. By using a Budget Form, businesses, nonprofits, and individuals can plan finances effectively, monitor variances, and make data-driven decisions. A well-prepared Line Item Budget Form supports better financial accountability, minimizes overspending, and enhances overall budget management for any project or organization.

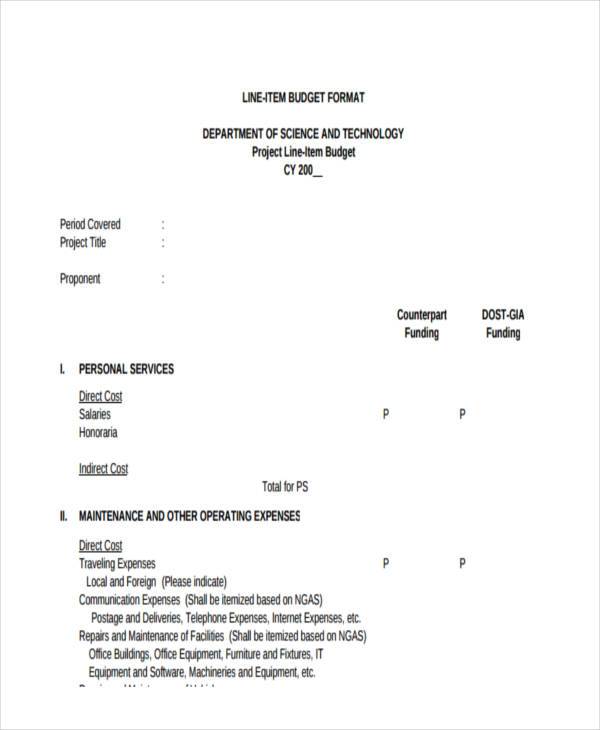

Line Item Budget Format

Budget Information

- Organization/Event Name: __________

- Budget Period: __________

- Total Budget Allocated: __________

Expense Breakdown

Category 1: __________

Allocated Amount: __________

Actual Expense: __________

Notes: __________

Category 2: __________

Allocated Amount: __________

Actual Expense: __________

Notes: __________

Approval

I confirm that the above budget allocation is accurate and aligns with the financial planning for the designated period.

Authorized Person’s Name: __________

Signature: __________

Date: __________

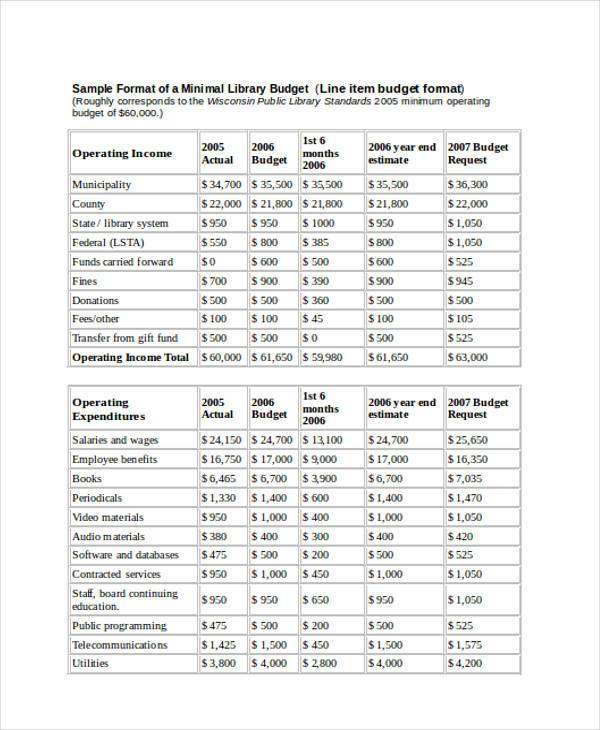

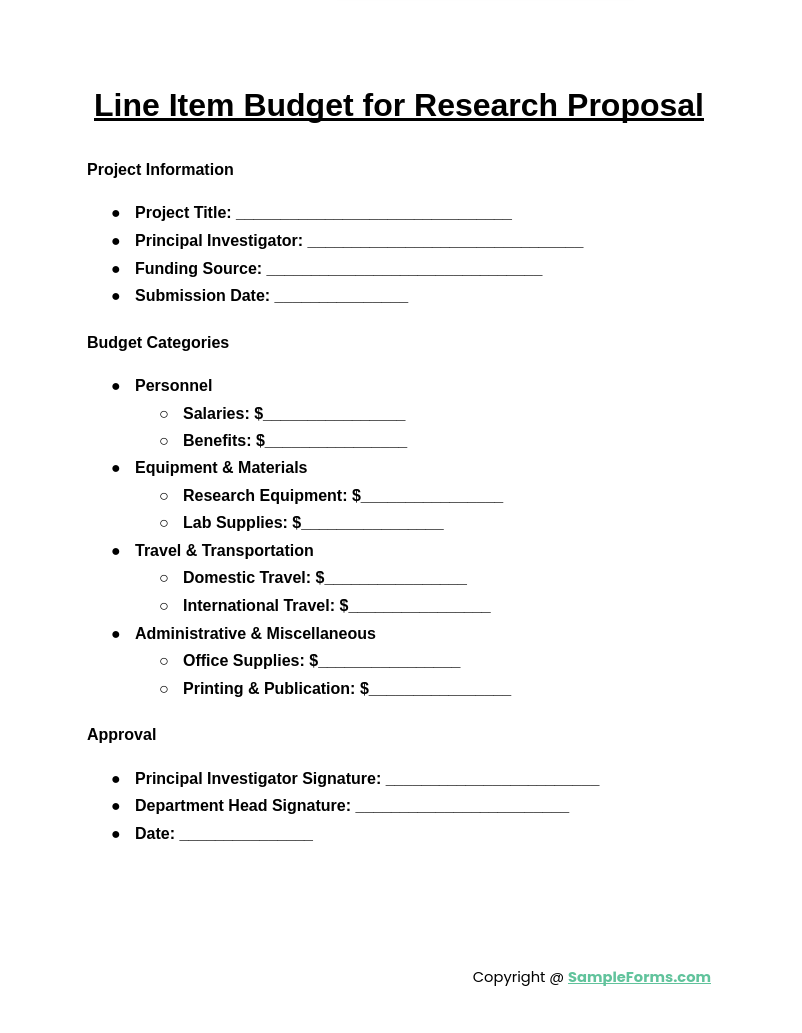

Line Item Budget for Research Proposal

A Line Item Budget for Research Proposal ensures proper allocation of funds for research expenses. Similar to an Event Budget Form, it categorizes costs such as salaries, materials, and travel, ensuring transparent financial planning and grant compliance.

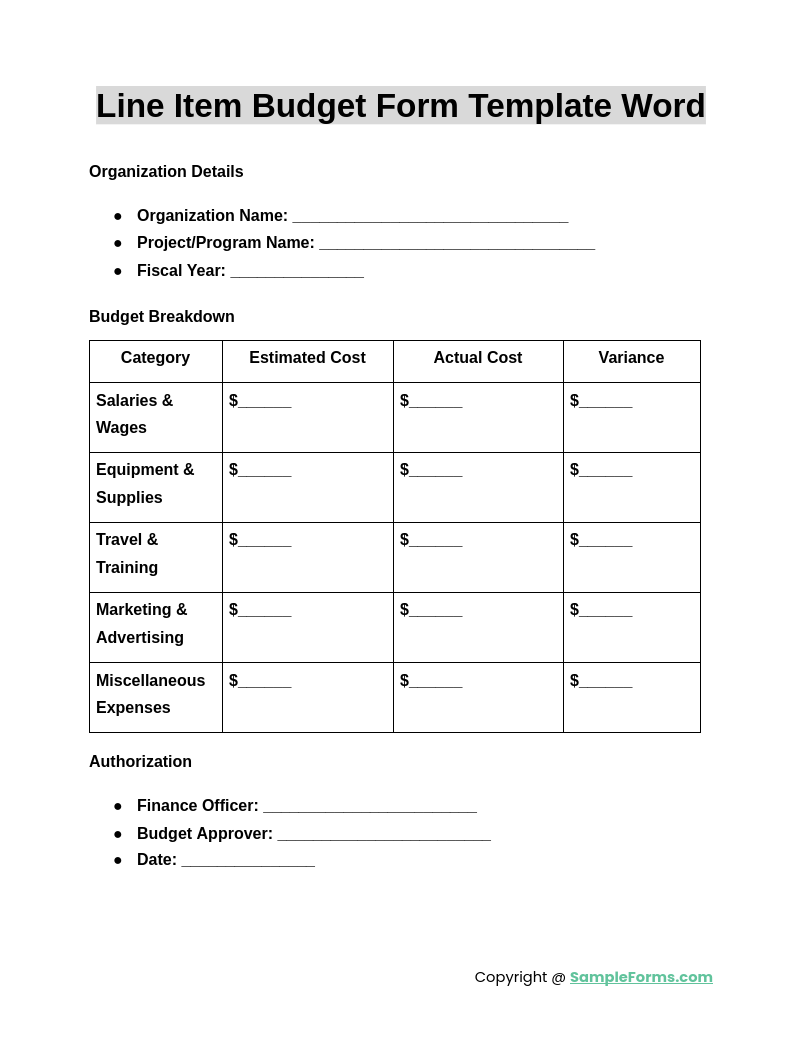

Line Item Budget Form Template Word

A Line Item Budget Form Template Word provides a structured format for listing expenses. Like a Construction Budget Form, it organizes costs by category, making financial tracking and reporting easier for businesses, nonprofits, and research projects.

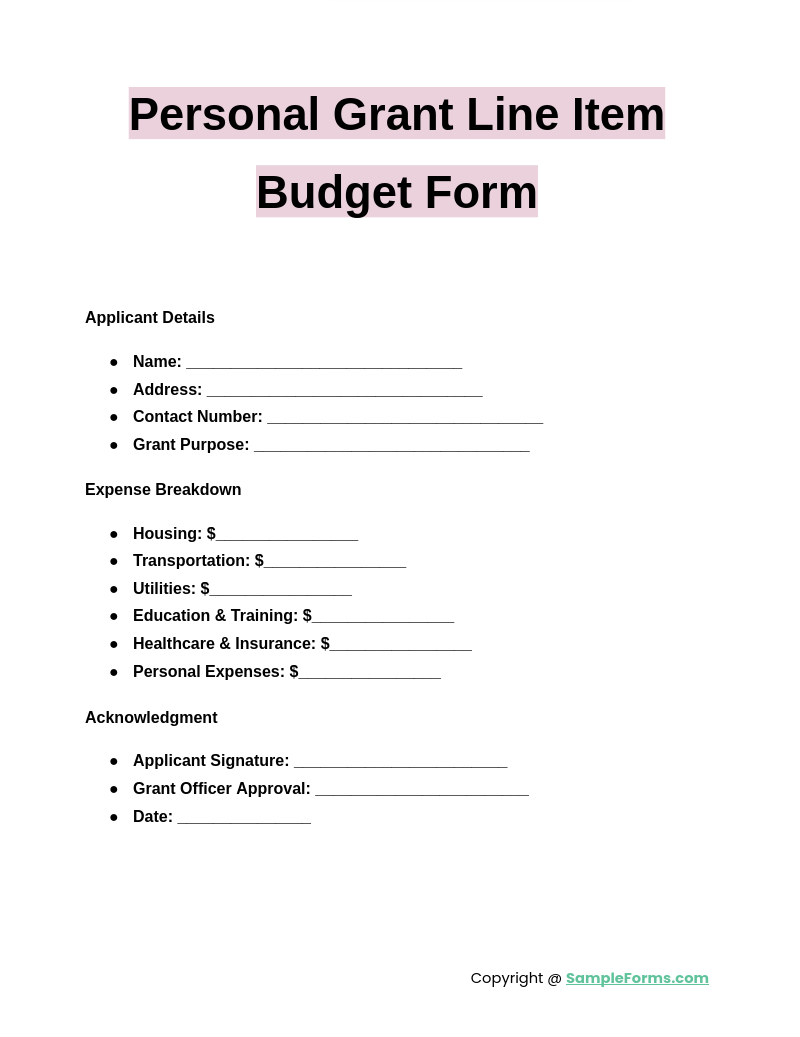

Personal Grant Line Item Budget Form

A Personal Grant Line Item Budget Form helps recipients outline spending for grant funds. Similar to a Family Budget Form, it details planned expenses, ensuring accountability, financial control, and proper fund utilization to meet grant requirements.

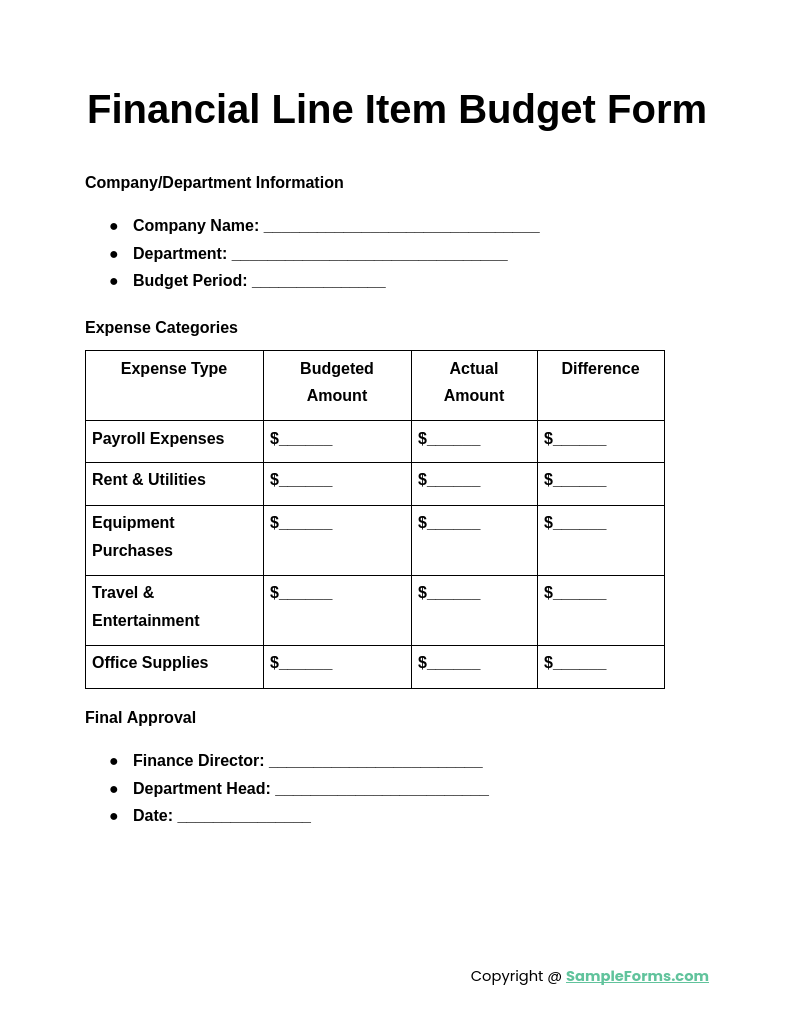

Financial Line Item Budget Form

A Financial Line Item Budget Form is essential for tracking and managing expenses within organizations. Like a School Budget Form, it ensures funds are properly allocated, monitored, and utilized for operational efficiency and financial transparency.

Browse More Line Item Budget Forms

Line Item Grant Budget Form

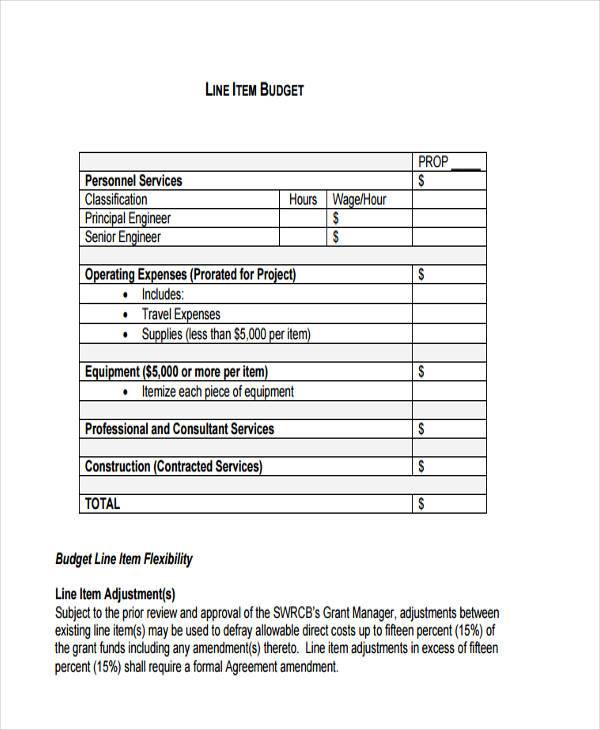

Line Item Budget Format

Line Item Budget Form in PDF

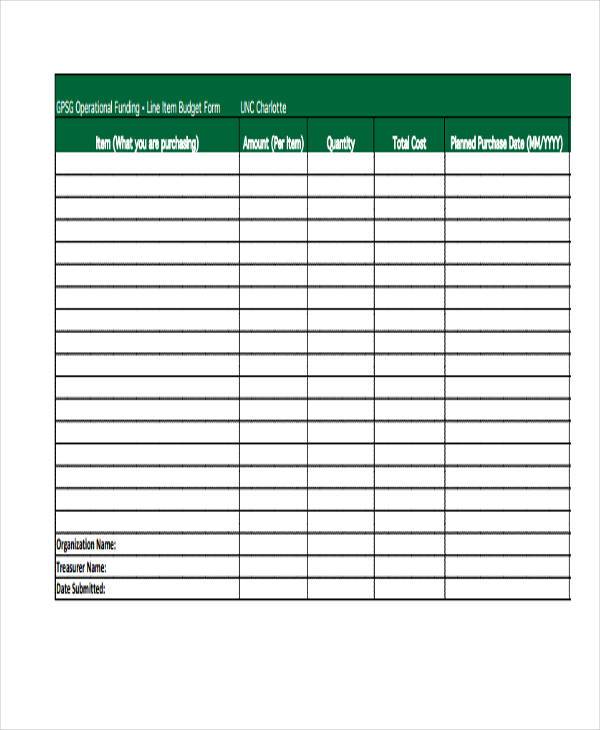

Operational Funding Line-Item Budget Form

Line Item Budget Form Example

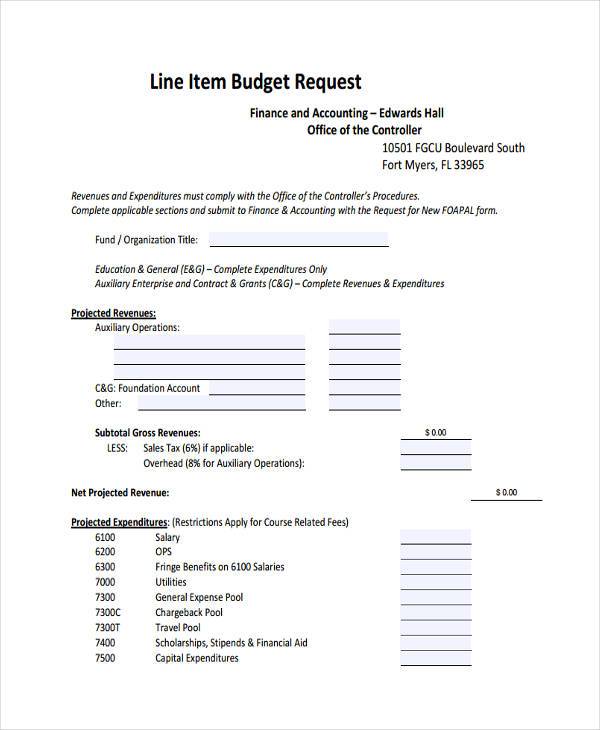

Line Item Budget Request Form

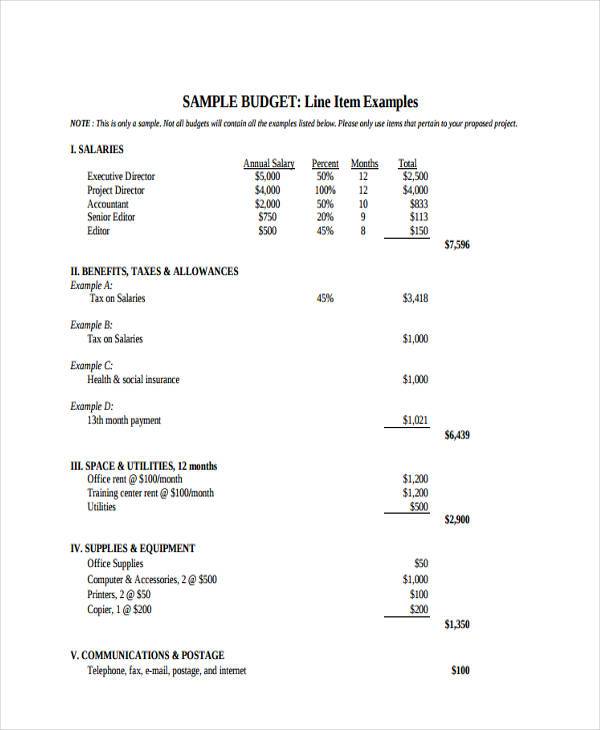

Free Line Item Sample Budget Form

Line Item Budget Form in Word Format

Line Item Budget Form Sample

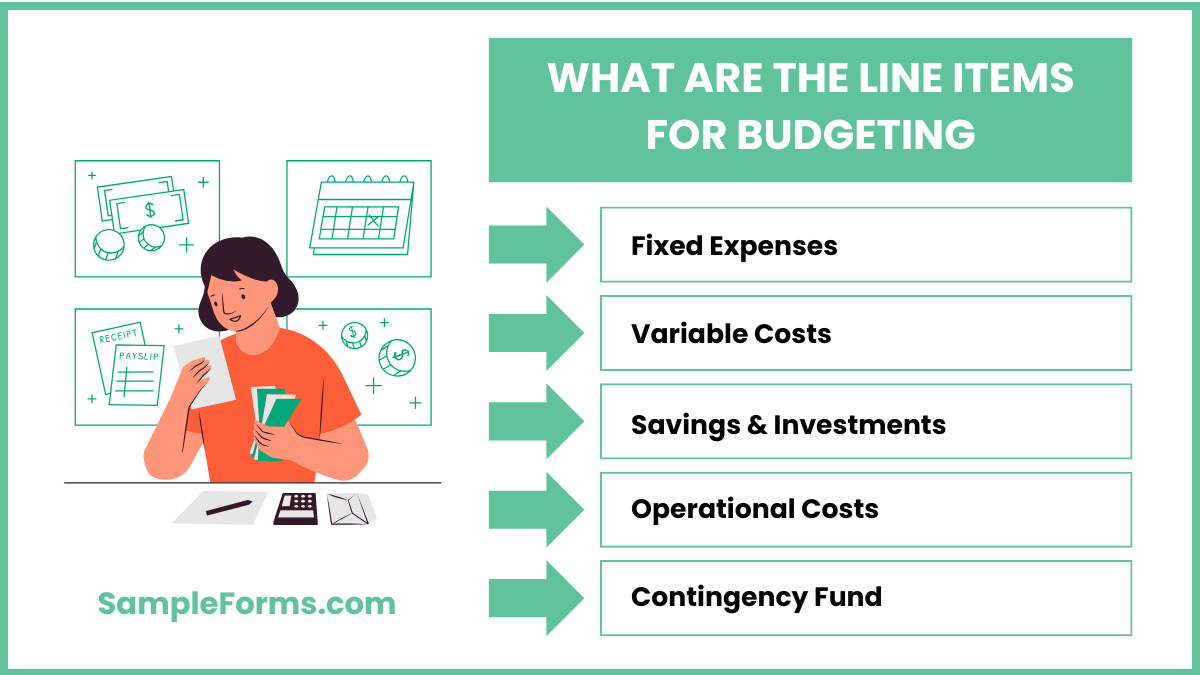

What are the line items for budgeting?

Line items in a Line Item Budget Form categorize expenses to ensure clear financial planning and accountability for individuals or organizations.

- Fixed Expenses: Recurring costs like rent, insurance, and salaries, similar to a Child Care Budget Form covering regular child care expenses.

- Variable Costs: Fluctuating expenses such as utilities, supplies, and transportation.

- Savings & Investments: Allocated funds for future needs, emergencies, or business growth.

- Operational Costs: Daily business or project-related expenses ensuring smooth functioning.

- Contingency Fund: Reserved money for unexpected costs or emergencies.

How to write a budget line?

A Line Item Budget Form requires precise financial documentation to track expenses and ensure accountability.

- Identify Categories: Divide expenses into fixed and variable costs, similar to a Budget Request Form detailing required funds.

- Specify Amounts: Allocate accurate cost estimates for each category.

- Justify Expenses: Explain why each budgeted item is necessary.

- Include Supporting Data: Use previous budgets or market research to support estimates.

- Ensure Clarity: Keep descriptions concise and easily understandable.

What describes a budget line?

A budget line visually represents income versus expenses in a Line Item Budget Form, helping in financial planning and control.

- Income vs. Expenses: Shows how total income is allocated across expenses, similar to an Annual Budget Form covering yearly financial planning.

- Spending Limits: Establishes how much can be spent in each category.

- Financial Priorities: Highlights essential vs. discretionary expenses.

- Adjustments & Forecasting: Helps in reallocating funds when needed.

- Accountability: Ensures financial transparency and prevents overspending.

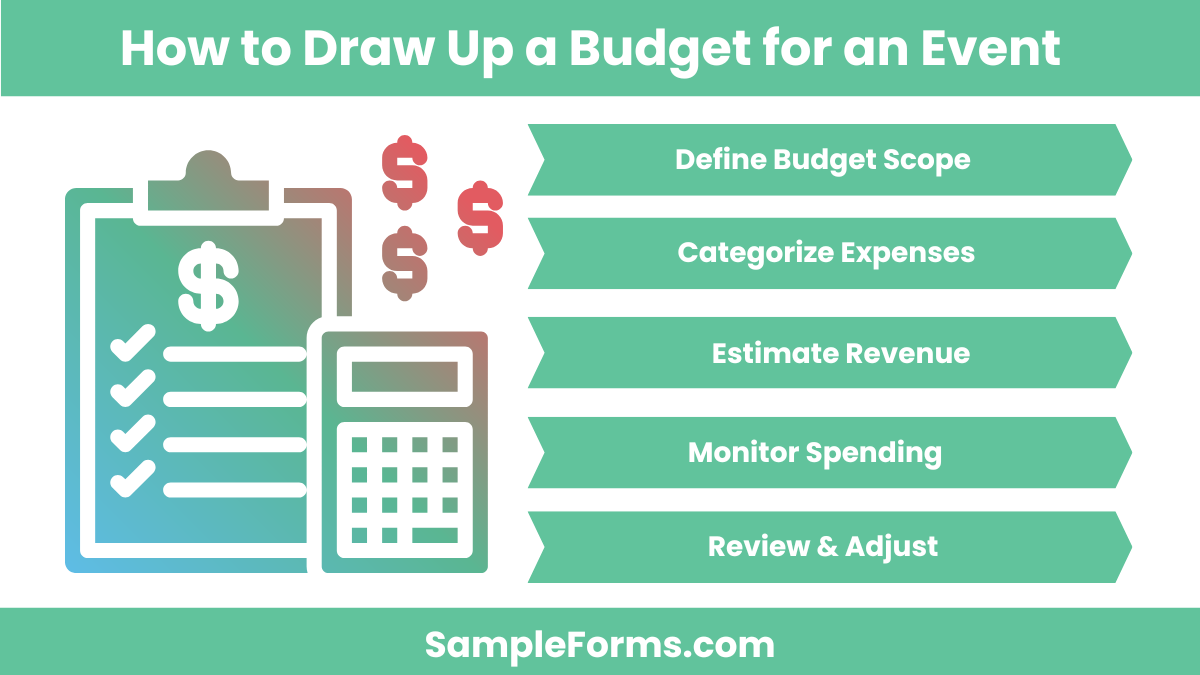

How to draw up a budget for an event?

Creating an Event Budget Form involves outlining expenses and revenue sources to manage costs effectively.

- Define Budget Scope: List all expected costs, similar to a Film Budget Form covering production expenses.

- Categorize Expenses: Separate venue, catering, marketing, and logistics costs.

- Estimate Revenue: Include sponsorships, ticket sales, and donations.

- Monitor Spending: Track all payments and keep receipts for accuracy.

- Review & Adjust: Update the budget as new expenses arise.

What is the zero-based budgeting method?

Zero-based budgeting ensures every expense is justified rather than automatically carried over in a Line Item Budget Form.

- Start from Zero: Unlike a Project Budget Form, previous budgets are not referenced.

- Justify Every Expense: All costs must be explained and necessary.

- Prioritize Spending: Essential expenses are ranked higher.

- Reduce Waste: Eliminates unnecessary costs by questioning each expense.

- Increase Efficiency: Allocates funds based on actual need rather than assumptions.

What is a budget with example?

A budget outlines income and expenses to manage finances effectively. A Household Budget Form helps track rent, utilities, groceries, and savings for better financial control.

What is the budget set formula?

The budget set formula is Income ≥ Expenses, ensuring spending stays within earnings. A Monthly Budget Form helps individuals plan accordingly and prevent overspending.

What states allow line items veto?

Many U.S. states allow governors to veto specific budget items, similar to how a Capital Budget Form prioritizes financial allocations for major projects.

Which President had line-item veto?

President Bill Clinton briefly had line-item veto power, allowing selective budget cuts, much like a Marketing Budget Form adjusts spending for various campaigns.

Who got rid of the line-item veto?

The U.S. Supreme Court struck down the line-item veto in 1998, reinforcing budgeting processes similar to a Student Budget Form for financial planning.

Which budget rule is best?

The 50/30/20 Rule is widely used, allocating income to needs, wants, and savings, similar to a Weekly Budget Form that ensures balanced spending.

What is the standard budget line?

A standard budget line represents income versus expenses, ensuring financial balance, much like a Travel Budget Form structures trip expenses for better planning.

What are considered line items?

Line items are categorized expenses such as salaries, utilities, and materials, similar to a Budget Transfer Form reallocating funds within a financial plan.

What is a lump sum budget?

A lump sum budget allocates a fixed amount for a project or department, just like a Church Budget Form manages building expenses efficiently.

What is rolling budgeting?

Rolling budgeting continuously updates financial plans based on changing needs, similar to a Financial Form that tracks real-time financial performance for adjustments.

A well-structured Line Item Budget Form is essential for tracking and managing financial resources effectively. It ensures that every expense is accounted for, helping organizations maintain fiscal responsibility. Whether for business, government agencies, or personal finance, this form simplifies budgeting and prevents mismanagement of funds. Similar to a Restaurant Budget Form, it helps streamline cost tracking, optimize resource allocation, and improve financial planning.

Related Posts

-

Check Register Form

-

FREE 5+ Income Statement Spreadsheet Forms in PDF

-

FREE 46+ Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Project Budget Form Samples in PDF | MS Word | Excel

-

FREE 9+ Sample Proposal Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Construction Budget Forms in PDF | MS Word | Excel

-

FREE 7+ Sample Wedding Budget Forms in PDF | MS Word

-

FREE 7+ Sample Child Care Budget Forms in PDF | MS Word

-

FREE 8+ Sample College Budget Forms in PDF | MS Word | Excel

-

FREE 9+ Sample Annual Budget Forms in PDF | MS Word | Excel

-

FREE 6+ Sample Marketing Budget Forms in MS Word | PDF

-

FREE 7+ Sample Travel Budget Forms in PDF | MS Word

-

Daily Cash Log

-

FREE 9+ Sample School Budget Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Personal Budget Forms in MS Word | PDF | MS Excel