A LIC Proposal Form is the foundation of your LIC insurance application. It collects detailed personal and financial information to determine eligibility and customize policy terms. This guide simplifies understanding and completing a Proposal Form effectively. Learn what details are required, why accuracy is crucial, and how to avoid common mistakes. Whether for a new policy or modifications to an existing one, mastering the form process ensures smooth approval. From step-by-step instructions to real-world examples, this comprehensive guide empowers you to handle your LIC application confidently and efficiently.

Download LIC Proposal Form Bundle

What is LIC Proposal Form?

A LIC Proposal Form is a document used to apply for life insurance with LIC. It gathers critical information about the applicant, such as personal details, health history, and financial data, to assess eligibility and customize the policy. It is the first step in securing life insurance, ensuring accurate details are submitted for seamless processing.

LIC Proposal Format

Personal Details

Full Name: __________________________

Date of Birth: __________________________

Address: __________________________

Contact Number: __________________________

Email Address: __________________________

Policy Information

Policy Type: __________________________

Sum Assured: __________________________

Policy Term: __________________________

Premium Payment Mode: __________________________

Nominee Details

Nominee Name: __________________________

Relationship with Proposer: __________________________

Nominee Contact Information: __________________________

Health Details

Do you have any pre-existing medical conditions? (Yes/No): __________________________

Details of any past major surgeries or illnesses: __________________________

Are you currently on medication? __________________________

Declaration and Signature

I hereby declare that the information provided is true to the best of my knowledge.

Proposer’s Signature: __________________________

Date: __________________________

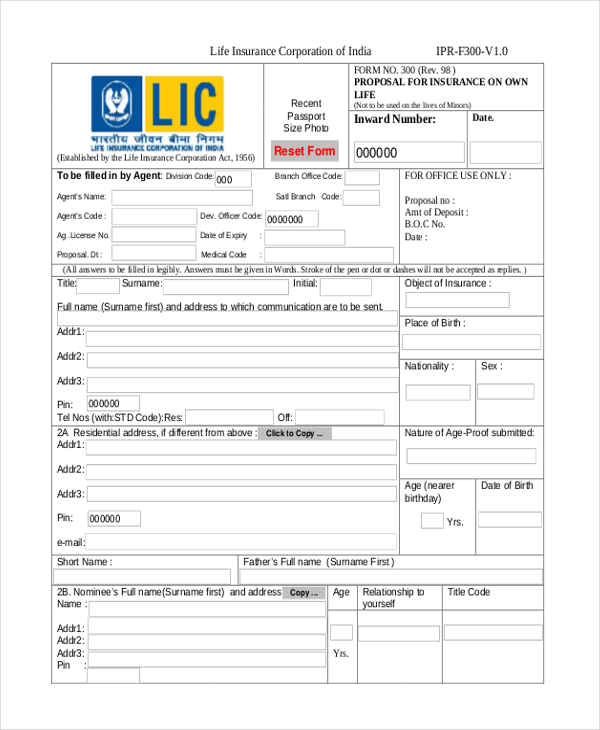

LIC Proposal Form 300

An LIC Proposal Form 300 is a key document for initiating an insurance policy. Similar to a Business Proposal Form, it collects detailed personal, financial, and health data to assess eligibility and determine policy terms.

LIC Proposal Form 360 Age Limit

The LIC Proposal Form 360 is designed for policies with specific age restrictions. Like a Grant Proposal Form, it ensures applicants meet the required criteria while documenting vital information for customized policy issuance and approval.

New LIC Proposal Form

A New LIC Proposal Form is used for applying for updated insurance plans. Similar to a Catering Proposal Form, it simplifies collecting and organizing key details, streamlining the approval process for modernized policy structures.

LIC Proposal Form Online

The LIC Proposal Form Online provides a digital solution for policy applications. Like a Project Proposal Form, it ensures easy data submission, allowing seamless updates and remote access for faster and more convenient processing.

Browse More LIC Proposal Forms

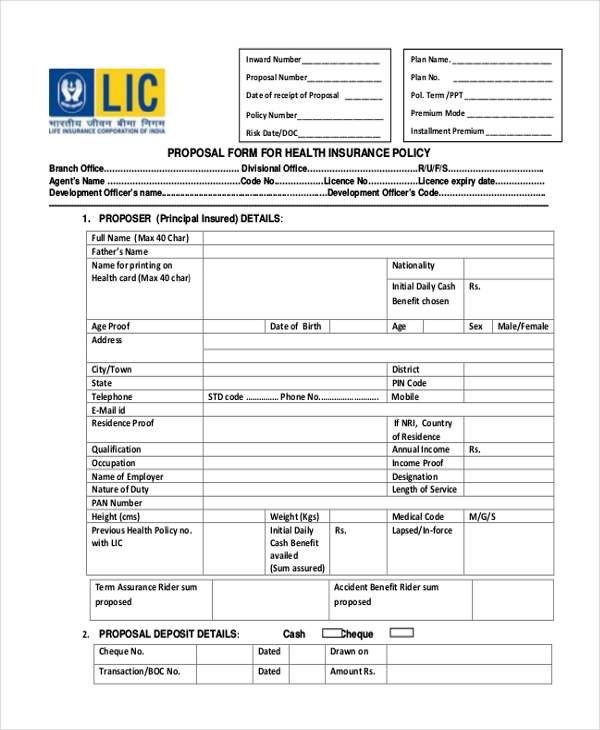

Sample Proposal Form for Health Insurance Policy

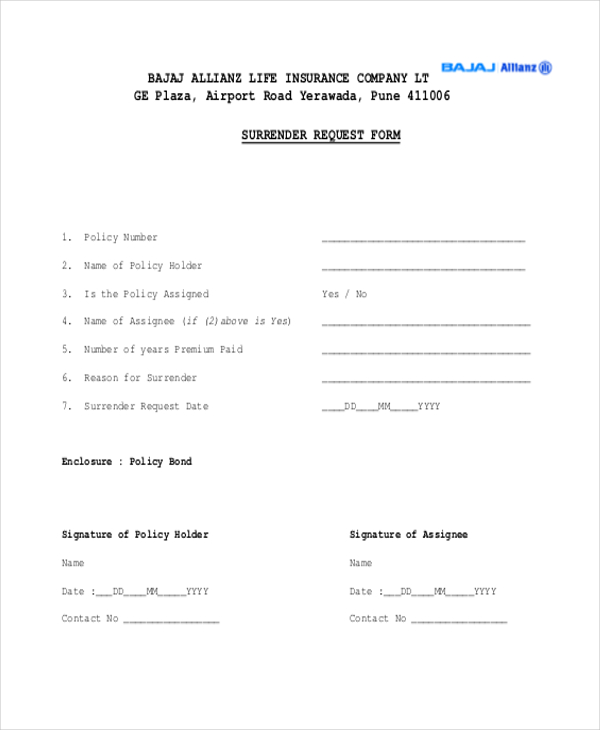

LIC Policy Surrender Proposal Form

Proposal for Insurance on Own Life

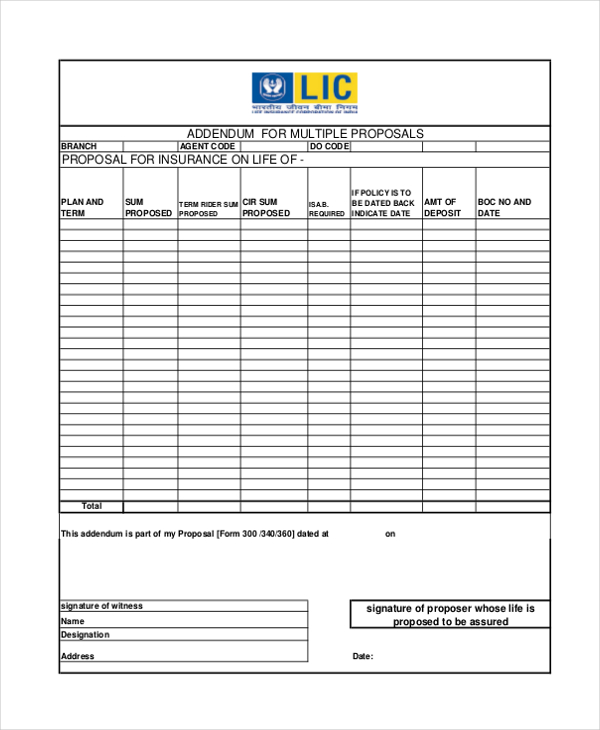

Sample Addendum for Multiple Proposals

LIC Bima Nivesh Proposal Form

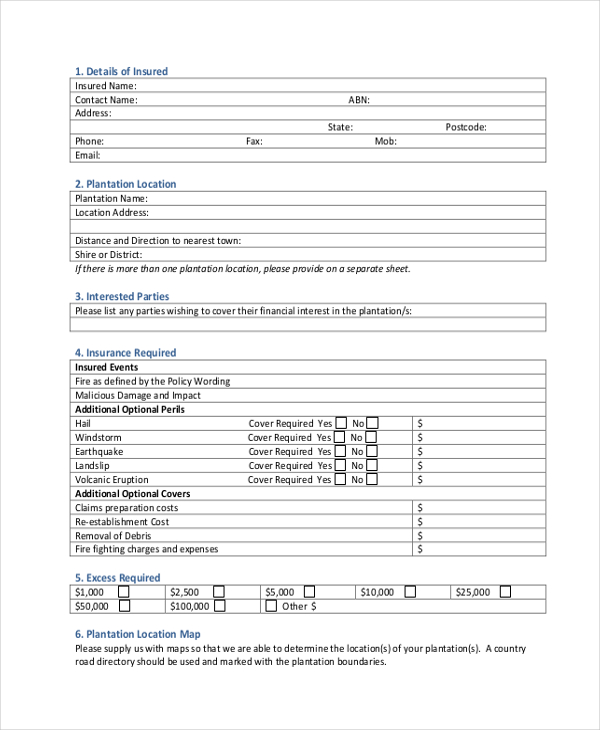

Forestry Insurance Proposal Form

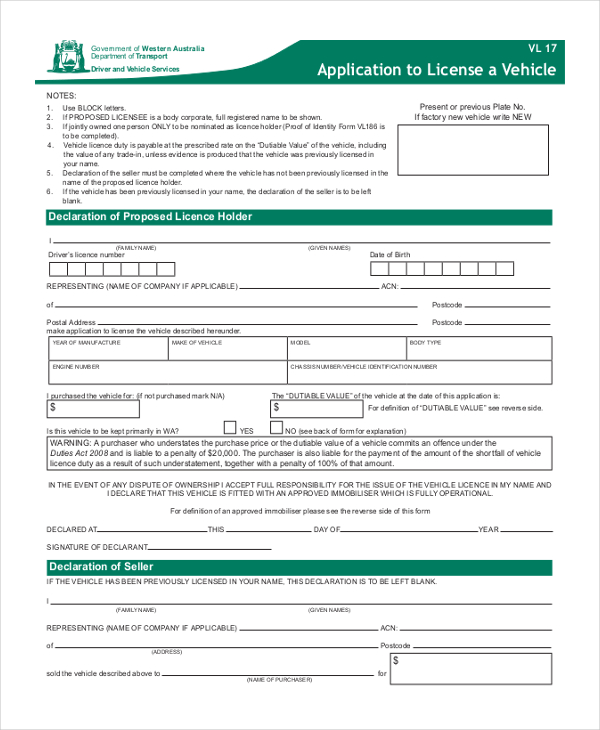

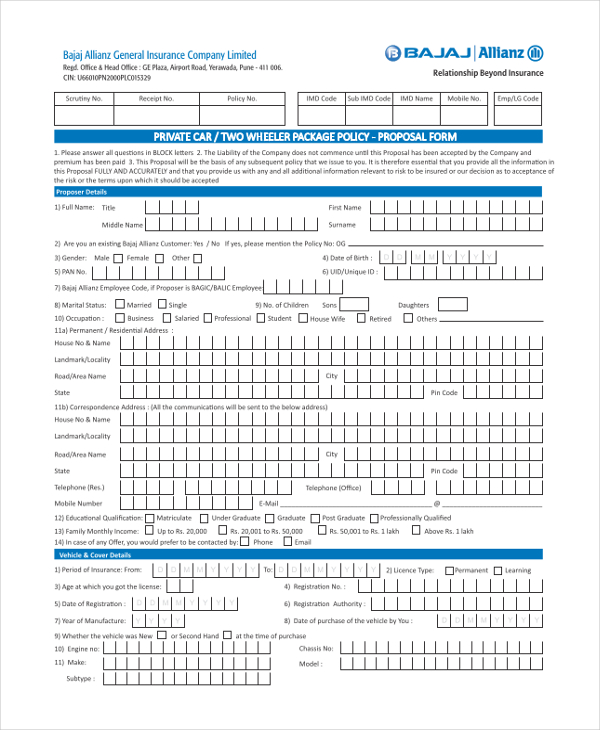

Sample Vehical Insurance Proposal Form

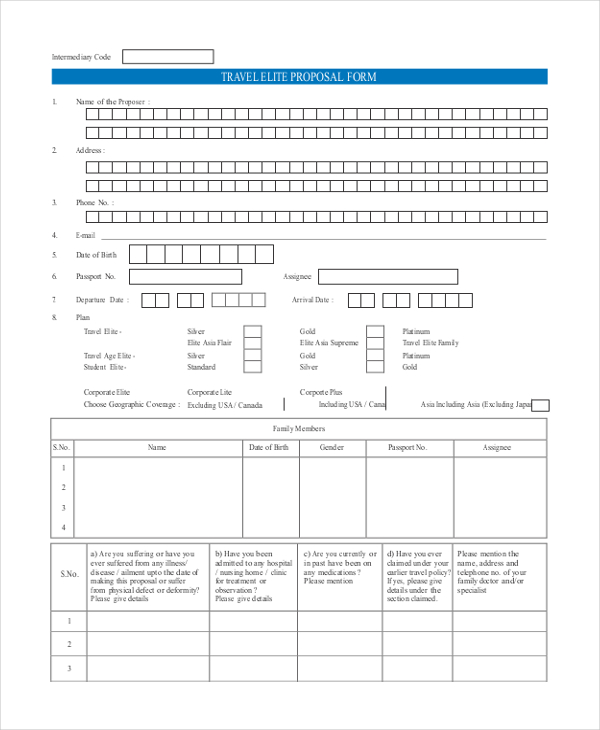

Travel Elite Proposal Form

General Insurance Proposal Form

Basic LIC Proposal Form

What is the purpose of a proposal for a life insurance policy?

The purpose of a life insurance proposal is to collect necessary information to assess eligibility and design a policy that fits individual needs.

Key purposes include:

- Policy Design: A Field Trip Proposal Form ensures a structured way to gather details, similar to how an insurance proposal outlines coverage options.

- Risk Assessment: Determines the applicant’s health and financial status to calculate premiums and coverage limits.

- Legal Compliance: Ensures adherence to regulations by documenting essential information.

- Transparency: Provides clarity about policy terms, ensuring both parties understand their obligations.

- Recordkeeping: Creates a formal document that serves as a reference for future claims or changes.

How to write a proposal step by step?

Writing a proposal requires clear and concise communication of details. A structured approach ensures all necessary elements are included.

- Start with an Introduction: Provide basic details such as the applicant’s name, contact information, and purpose of the proposal.

- List Essential Information: Like a School Proposal Form, include personal, financial, and medical details relevant to the policy.

- Detail the Requested Coverage: Specify the desired policy type, term, and sum assured.

- Include Supporting Documents: Attach identity proof, income statements, and medical records for accurate assessment.

- Finalize and Submit: Review for accuracy, sign the form, and submit it to the insurance provider.

How to write a life insurance proposal?

A life insurance proposal must comprehensively detail an applicant’s requirements and eligibility. It ensures smooth processing of the application.

Steps to write:

- Understand Policy Needs: Analyze your coverage requirements, similar to defining goals in an Investment Proposal Form.

- Collect Personal Information: Include age, occupation, and financial details for accurate risk evaluation.

- Provide Health Details: Disclose past and present medical conditions honestly to avoid claim issues later.

- Specify Policy Type: Mention whether it’s a term plan, endowment plan, or any other.

- Attach Required Documents: Submit identity proof, address proof, and income certificates along with the proposal.

Why is proposal form important in insurance?

A proposal form is the foundation of an insurance contract, documenting all relevant details to assess risks and determine premiums.

Reasons include:

- Legal Validity: A signed proposal, like a Video Proposal Form, formalizes the intent and agreement between insurer and insured.

- Accurate Risk Evaluation: Helps insurers assess potential liabilities based on the applicant’s information.

- Customizing Coverage: Ensures the policy is tailored to the applicant’s needs.

- Transparency: Clearly outlines terms and conditions, reducing the chances of disputes.

- Record Maintenance: Serves as an official reference for claims or disputes in the future.

Which of the following is not required for making a life insurance proposal?

Not all information is essential for a life insurance proposal. Unnecessary details can complicate the process unnecessarily.

Key non-required items:

- Unrelated Occupation Details: Unlike a Conference Proposal Form, job specifics unrelated to risk assessment may not be required.

- Non-Relevant Medical History: Minor illnesses without lasting effects may not need to be included.

- Extraneous Financial Data: Investments unrelated to premium payments may not be necessary.

- Personal Preferences: Non-essential lifestyle choices that do not impact risks are excluded.

- Future Intentions: Plans not directly linked to the insurance coverage are typically irrelevant.

What is proposal form in life insurance?

A proposal form in life insurance is a formal document providing personal, medical, and financial details required to assess policy eligibility, like a Finance Proposal Form for evaluating financial plans.

Who fills up proposal form?

The proposer, typically the person seeking life insurance coverage, completes the form. It is akin to submitting a Loan Proposal Form to initiate an approval process.

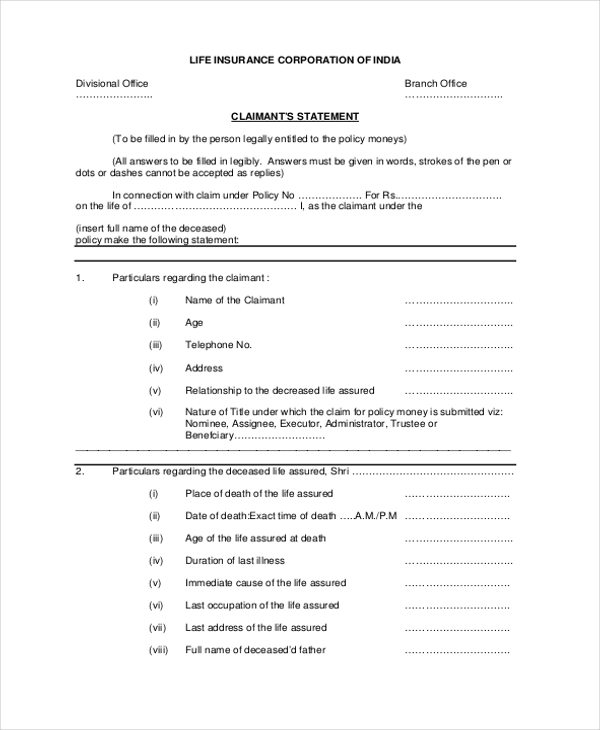

How to claim LIC after death?

Submit a death claim form, policy documents, and proof of death to the LIC office. Similar to a Funding Proposal Form, accuracy ensures smooth processing.

What is Form 3801 used for?

Form 3801 is used for notifying changes in nominee or beneficiary details in an LIC policy, ensuring updates are seamless, like a Bid Proposal Form for contract amendments.

What is the LIC death claim form 3783?

Form 3783 is used to file death claims with LIC, requiring policyholder details, proof of death, and claimant identification, much like a Job Proposal Form establishes eligibility.

How to fill LIC assignment form 3848?

Complete Form 3848 by providing policy details, assignor and assignee information, and a valid reason for assignment, similar to filling a Book Proposal Form for clarity.

What is option F in LIC policy?

Option F refers to a specific rider or additional benefit in an LIC policy, tailored for coverage enhancements, like customizing a Science Fair Proposal Form for specific projects.

What should a policy proposal include?

A policy proposal includes personal details, financial data, health history, and desired coverage, ensuring completeness, akin to a Taxi Proposal Form outlining services and terms.

Who is the proposal in life insurance?

The proposal is the person submitting the application for insurance coverage, like the initiator of a Travel Proposal Form outlining journey specifics.

What is a proposal approval form?

A proposal approval form documents formal consent for a proposal submission, ensuring compliance, similar to a Restaurant Proposal Form confirming operational agreements.

The Cleaning Proposal Form simplifies processes by offering a structured format to provide accurate details. Whether you’re exploring policy options, submitting proposals, or clarifying terms, understanding how forms work ensures better outcomes for all stakeholders.

Related Posts

-

Proposal Form

-

FREE 14+ Travel Proposal Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Service Proposal Forms in PDF | MS Word

-

Seminar Proposal Form

-

FREE 9+ Conference Proposal Forms in PDF | MS Word

-

FREE 9+ Catering Proposal Forms in PDF | MS Word | Excel

-

FREE 9+ Health Proposal Forms in PDF | MS Word

-

FREE 8+ Science Fair Proposal Forms in PDF | MS Word

-

FREE 10+ Taxi Proposal Forms in PDF | MS Word

-

Field Trip Proposal Form

-

FREE 9+ Course Proposal Forms in PDF

-

FREE 8+ Video Proposal Forms in PDF | MS Word

-

FREE 9+ Book Proposals Forms in PDF | MS Word

-

FREE 9+ Bid Proposal Forms in PDF | MS Word

-

Proposal Evaluation Form